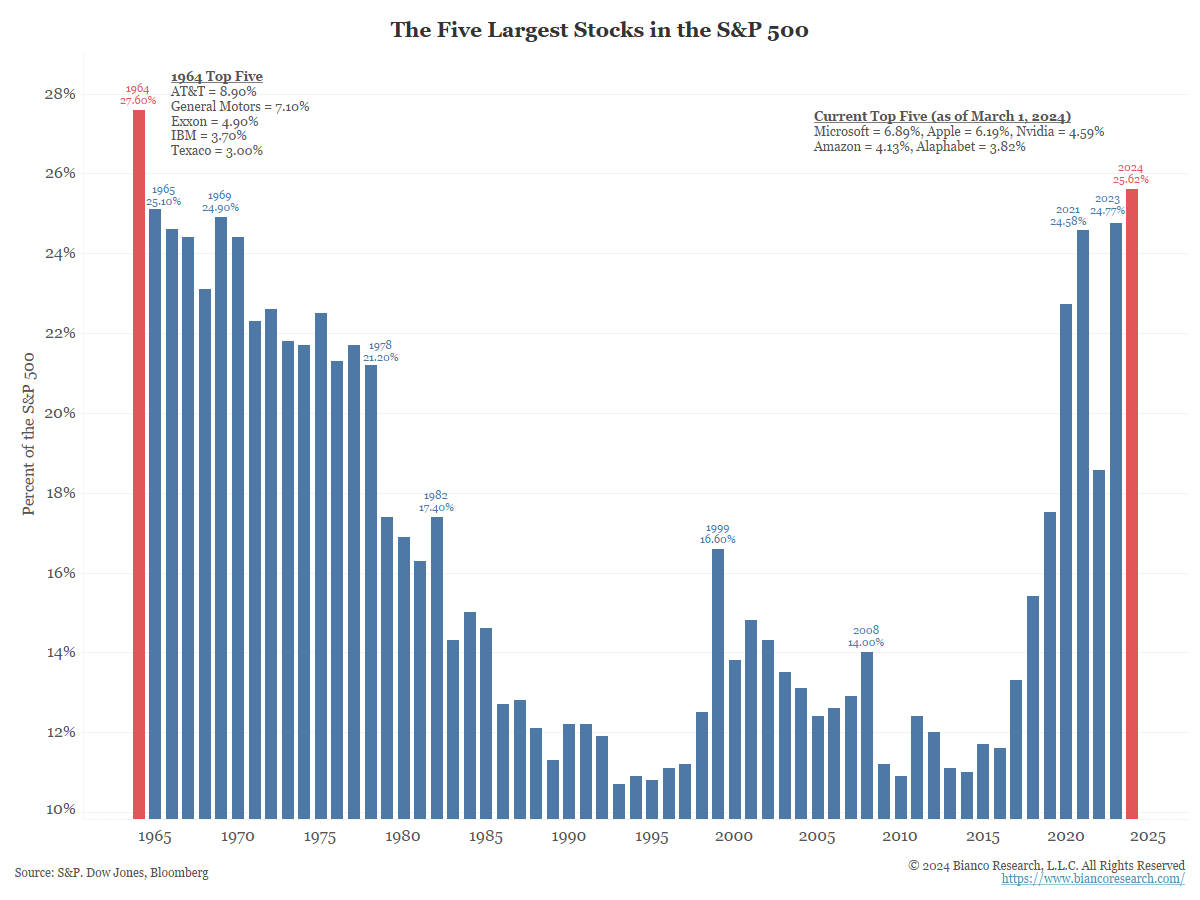

What Does It Mean That the Stock Market Is Down to the Fabulous Four?

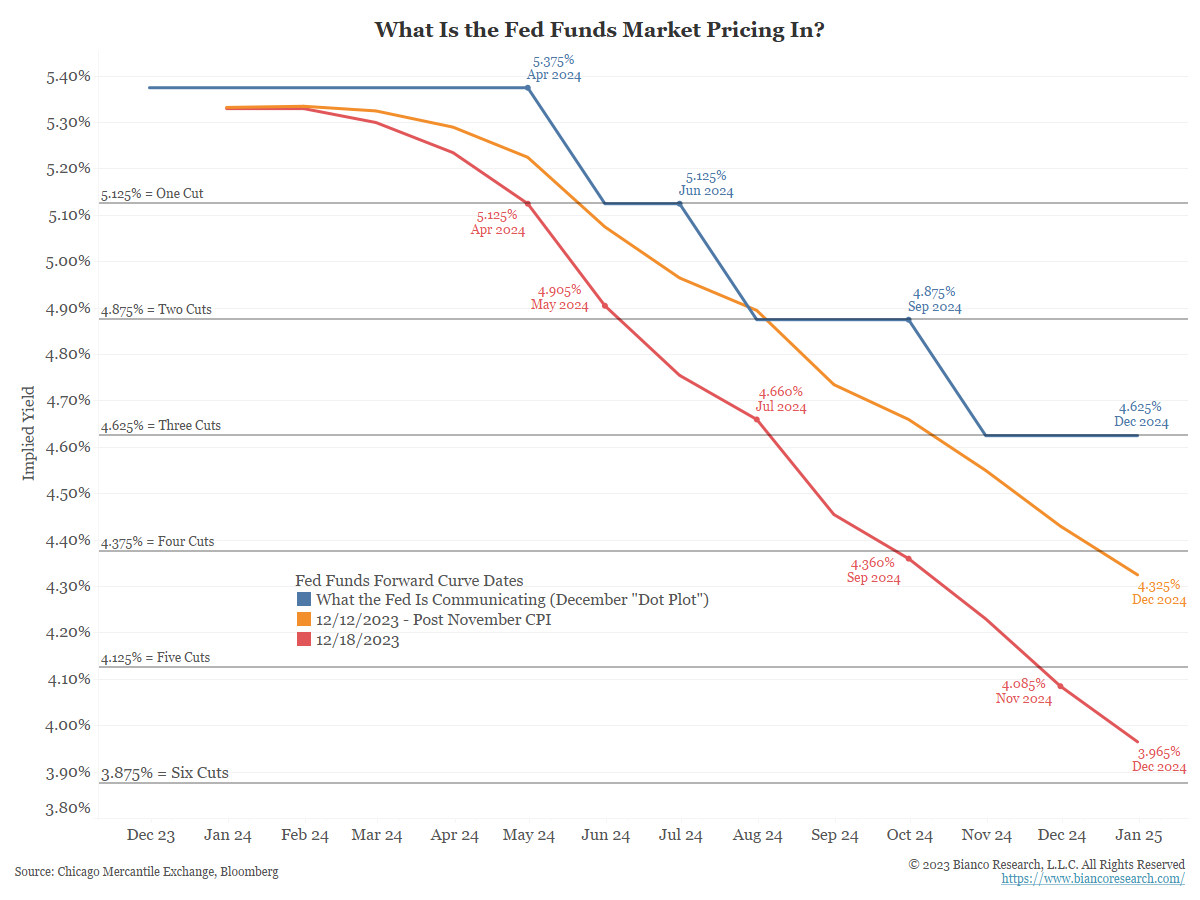

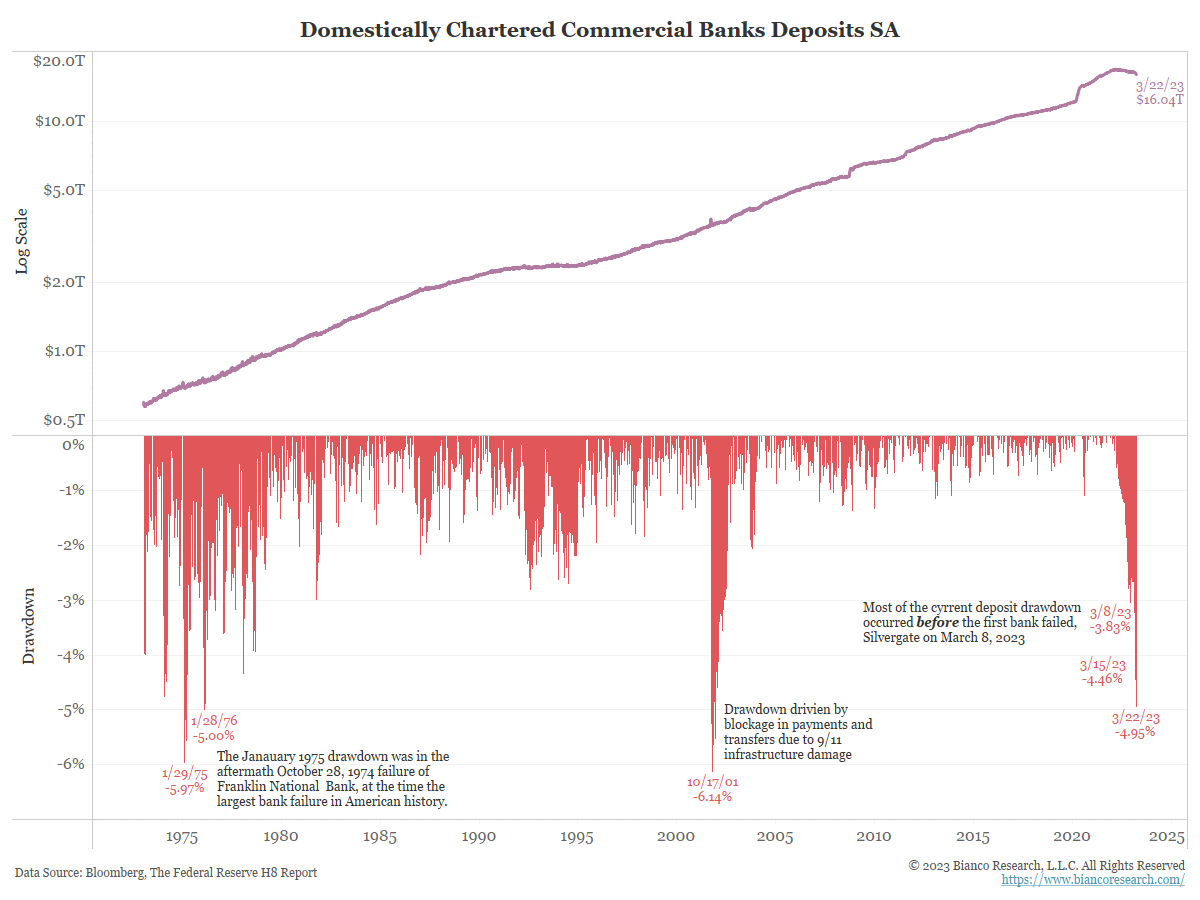

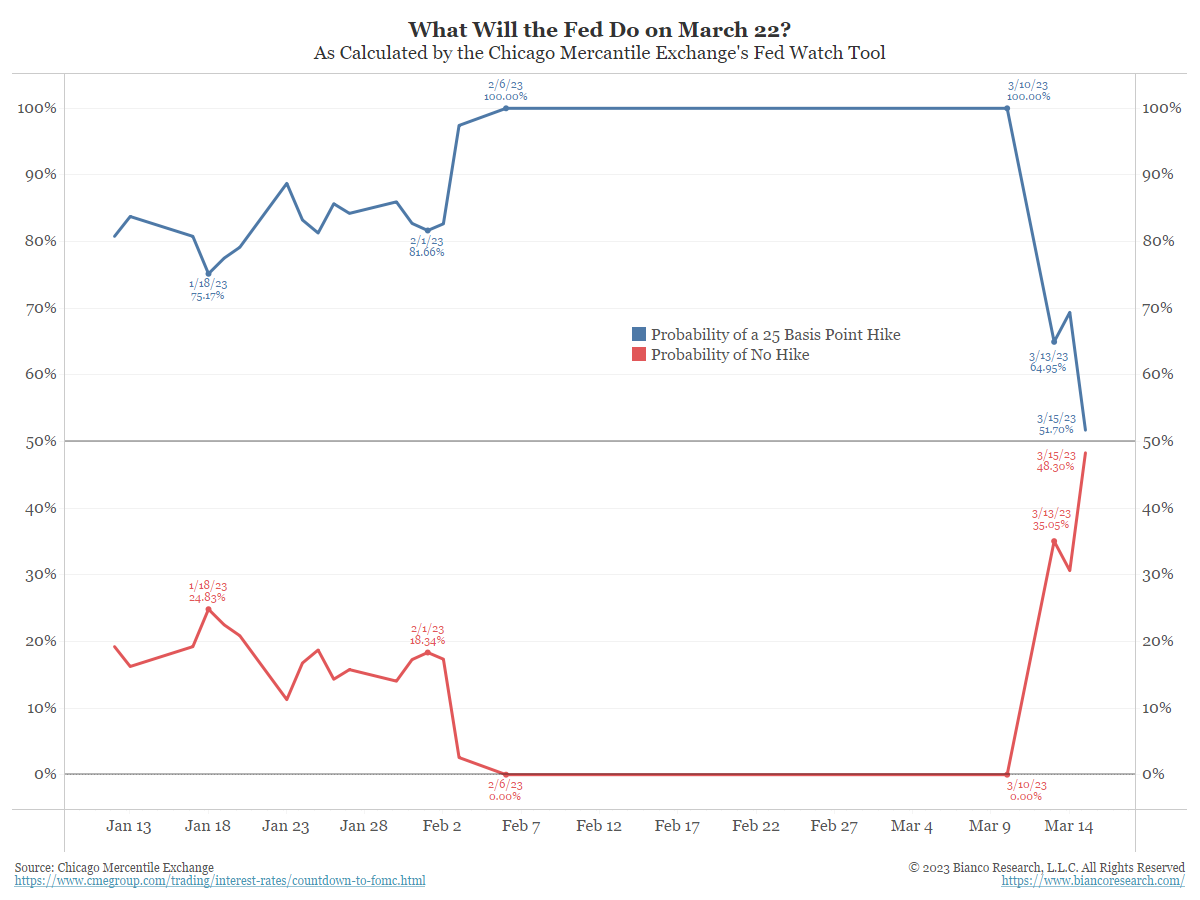

The stock market's year-to-date gains are more concentrated than just about any historical period. Wall Street is desperately looking for money to keep the rally going, but sources of liquidity are drying up.... Read More