-

-

Bloomberg – US Payrolls Top Estimates While Jobless Rate Rises, Wages Cool

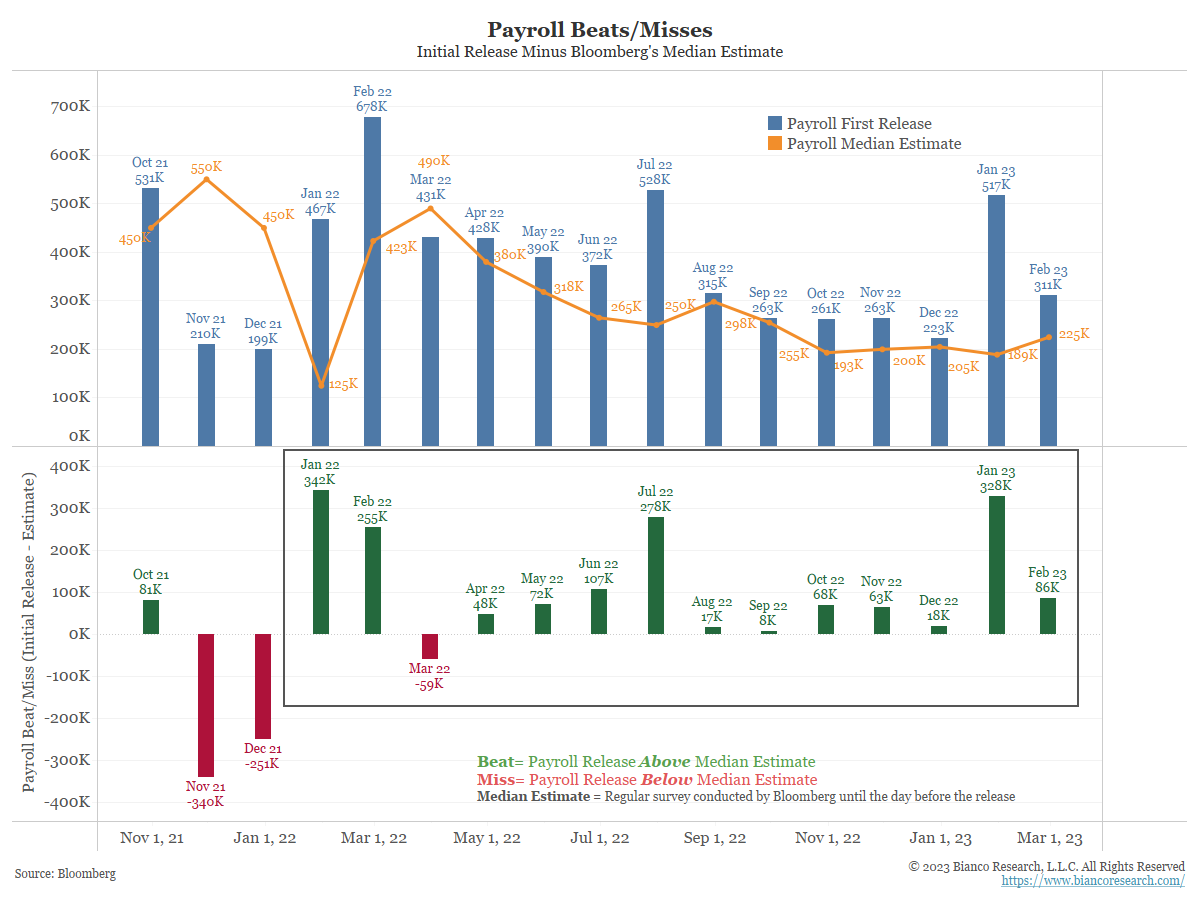

US payrolls in February rose by more than expected while a broad measure of monthly wage growth slowed, offering a mixed picture as the Federal Reserve decides whether to step up the pace of interest-rate hikes. Nonfarm payrolls increased 311,000 after a 504,000 advance in January, a Bureau of Labor Statistics report showed Friday. The unemployment rate ticked up to 3.6% as the labor force grew, and monthly wages rose at the slowest pace in a year.

-

Comment

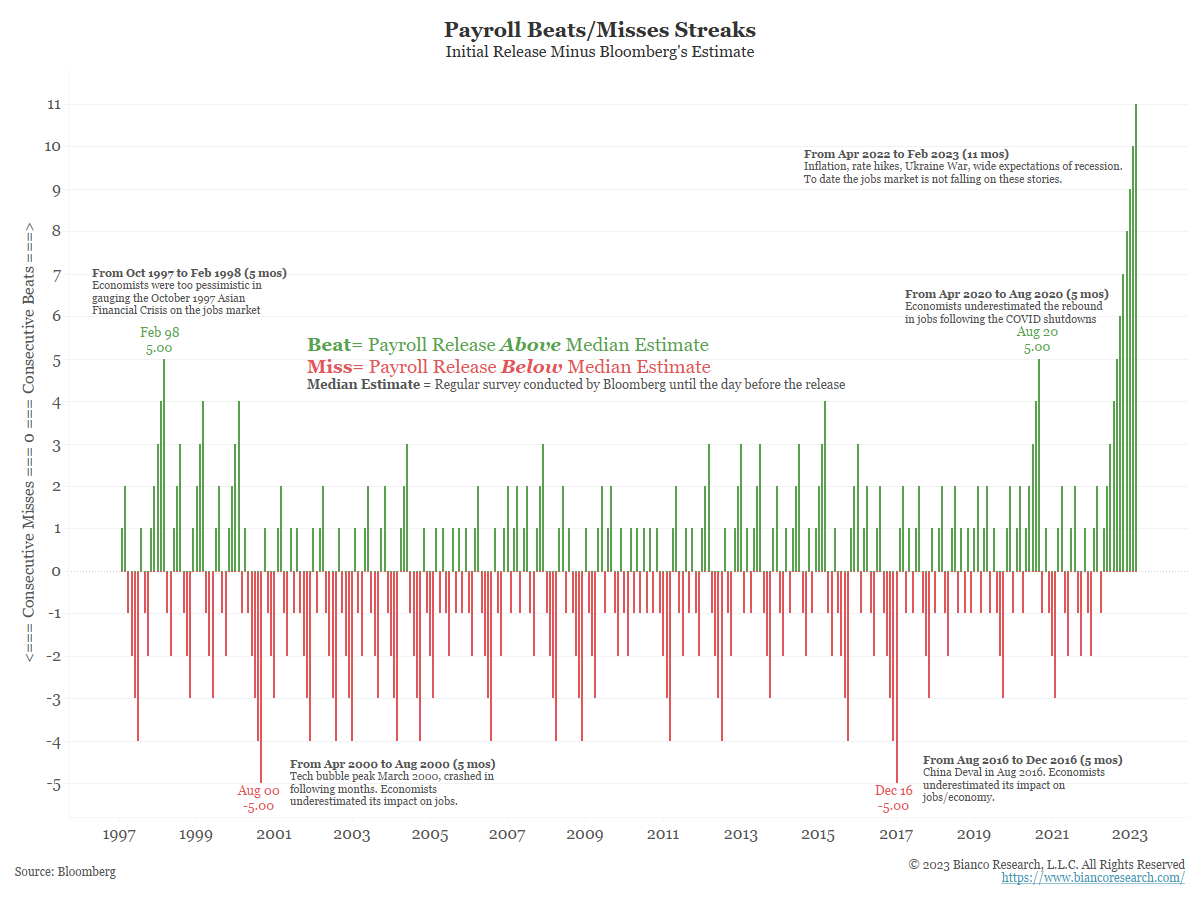

Today’s upside beat was the eleventh straight month that economists underestimated the actual release. In 2022, the payroll number only fell short of economists’ expectations once, in March 2022.

Since Bloomberg began collecting estimates in 1997, such a streak has never occurred before.

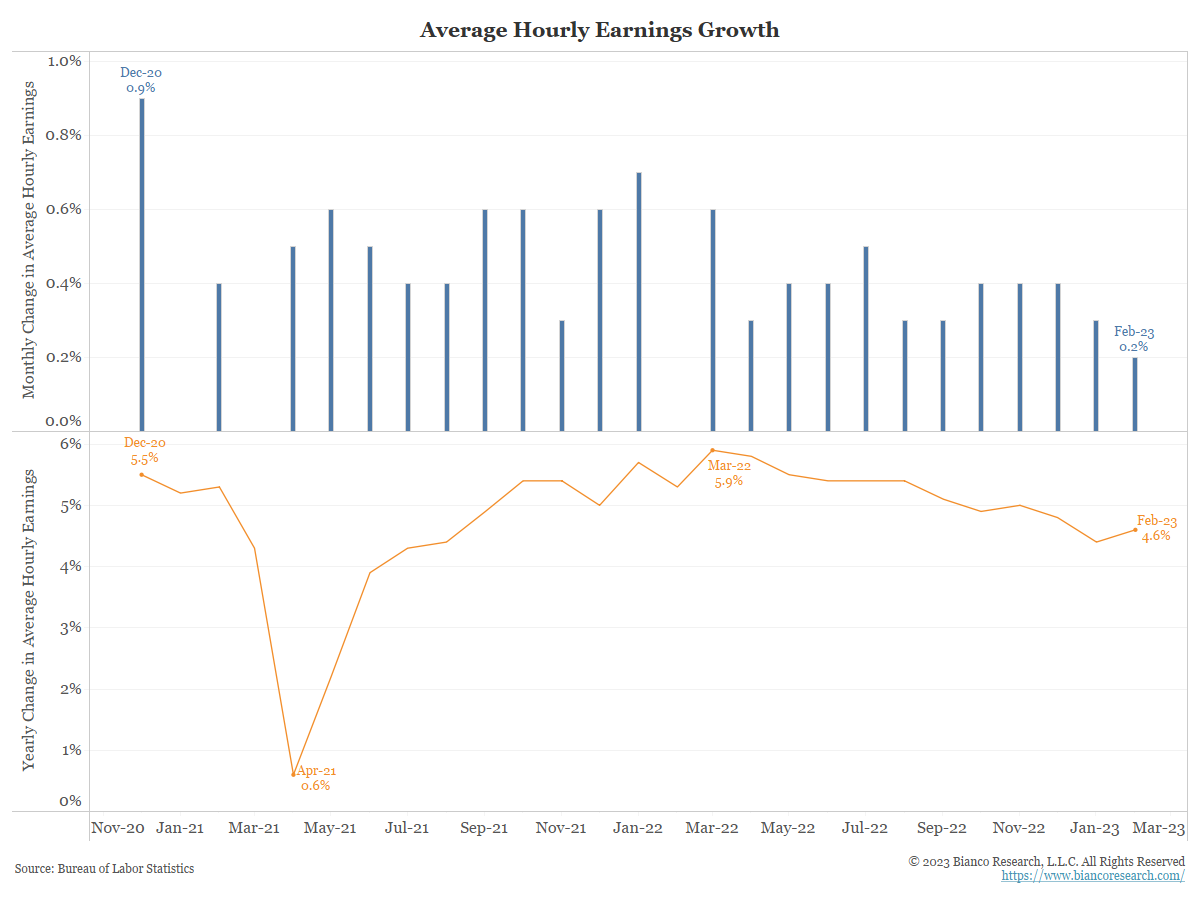

For those concerned about wage growth seeping into sustained higher inflation, the February data was encouraging. As the chart below shows, average hourly earnings grew by 0.2% in February, its lowest monthly rate of change in a year. That being said, the year-over-year number ticked slightly higher.

So where does this all leave the Fed for its March 22 meeting? In the wake of the payrolls release, the fed funds market is suggesting the odds are split 50/50 between a 25 or 50 basis point hike. In other words, the market is not interpreting this morning’s beat to be strong enough to definitively warrant the larger hike. With CPI still looming next week, the market is punting until February’s inflation data is released.

The interactive charts below break down the labor market in a number of categories. Each tab defaults to show what we consider some of the more interesting series, but additional options are available in the drop-down menu.

Over the past year, inflation statistics have garnered most of the Fed’s attention in its dual mandate of price stability and maximum employment. With CPI expected to continue falling for the next several months, the payrolls report has taken on increased importance. By all measures, the jobs market remains extremely hot. This would typically be a good problem for the Fed, but it is now viewed as a concern. Would the Fed have to keep its foot on the brakes if wage growth keeps inflation elevated?