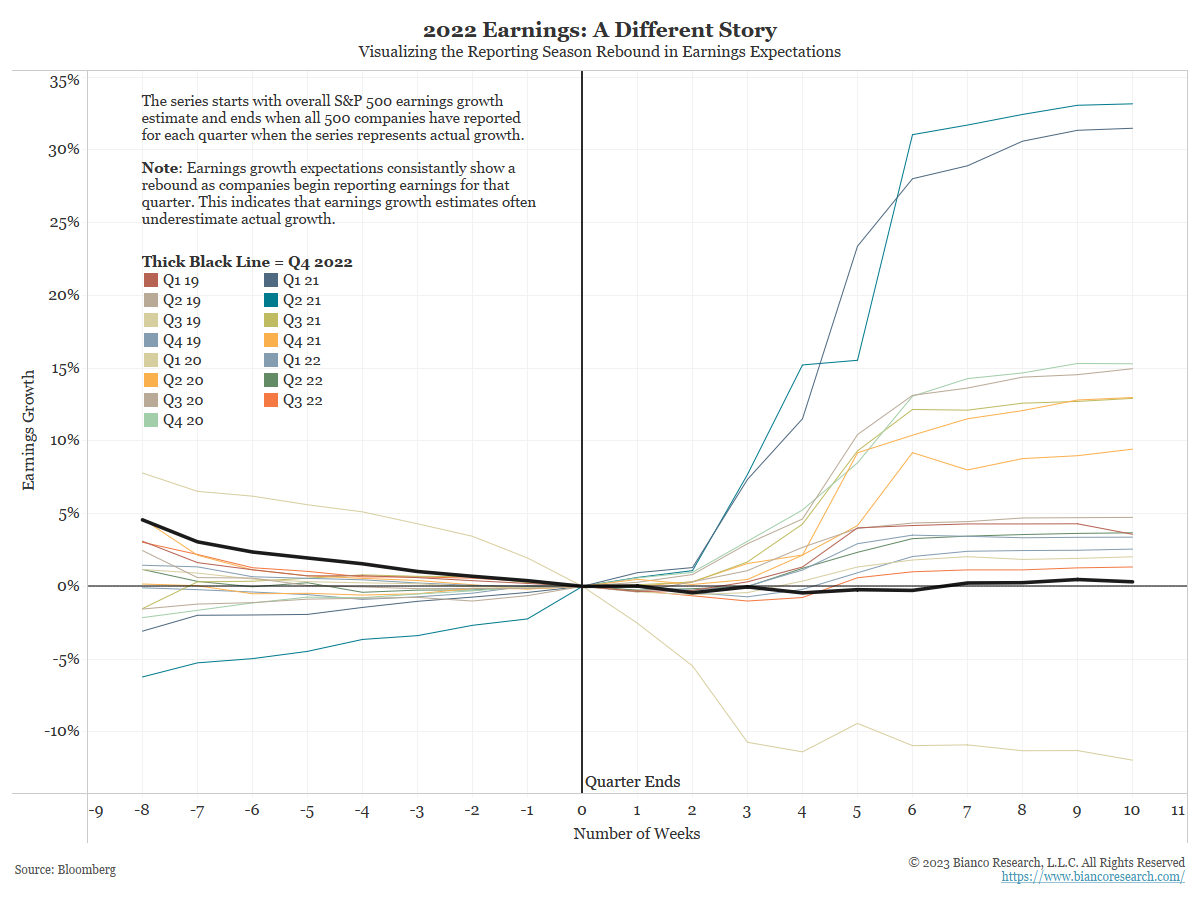

Notice the lack of a big uptick in Q4 2022 earnings growth as earnings season got underway. This is also a disappointment.

As companies report during periods of economic strength, Wall Street tends to underestimate growth, leading to a “bounce” in growth forecasts as results start trickling in.

The chart below shows the same earnings growth measures as the chart above; however, this chart is standardized by weeks before and after the calendar quarter end (0). So, in the case of Q4 2022, the zero line starts December 31, 2022, before earnings reports start coming in.

It is common to see the ‘bounce’ in expected growth starting about two weeks after the end of the calendar quarter, just as companies start reporting. The thick black line (Q4 2022) has not bounced as in previous quarters (note the gold line that collapsed after the end of the calendar quarter was Q1 2020, the lockdown quarter).

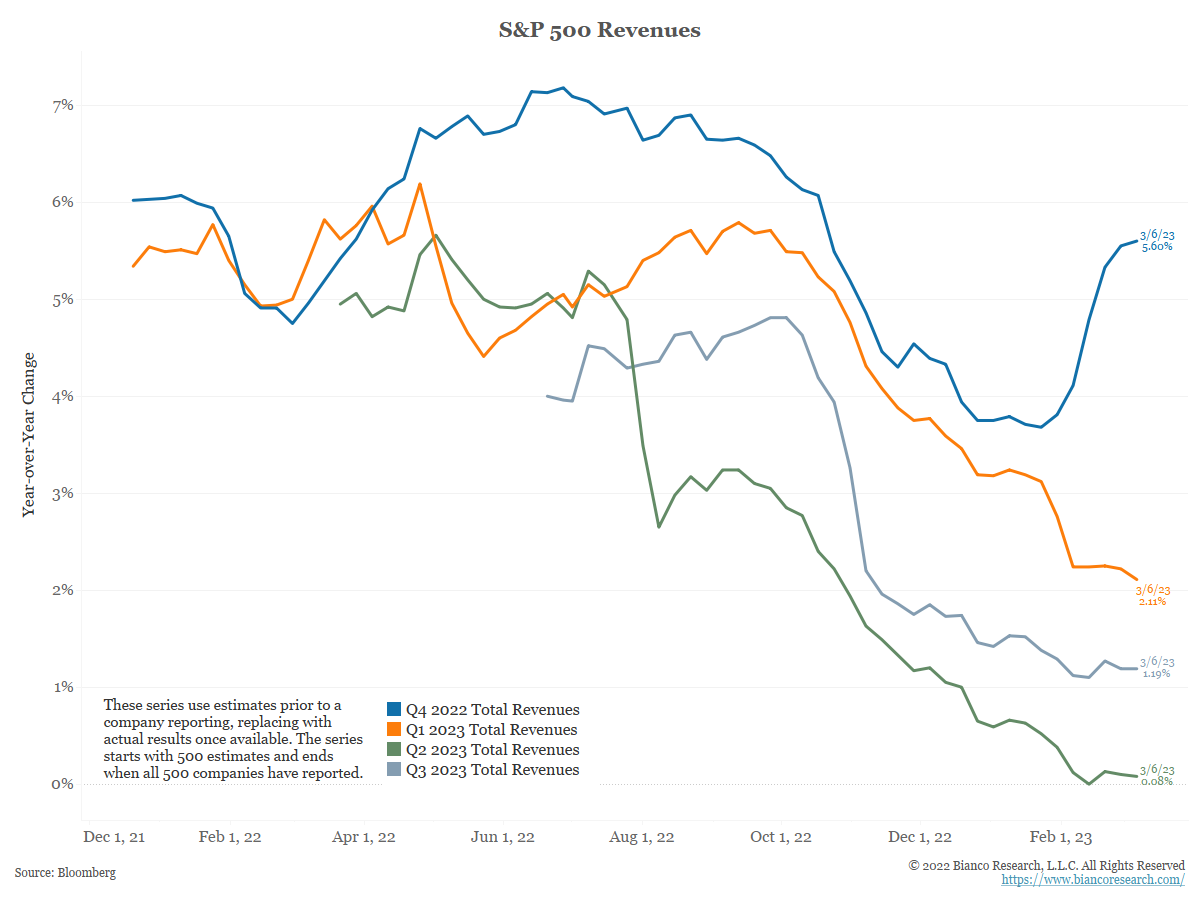

The next chart is the same format as the first but for S&P 500 revenues/sales.

These are nominal growth numbers, so the inflation rate is a big part of this growth rate. Q4 2022 expectations (blue) have come down significantly since mid-year but are rebounding fast as companies report more positive top-line results than expected.

All these estimates are less than expected inflation over the next few quarters. So, revenues/sales are negative on a real or after-inflation basis.

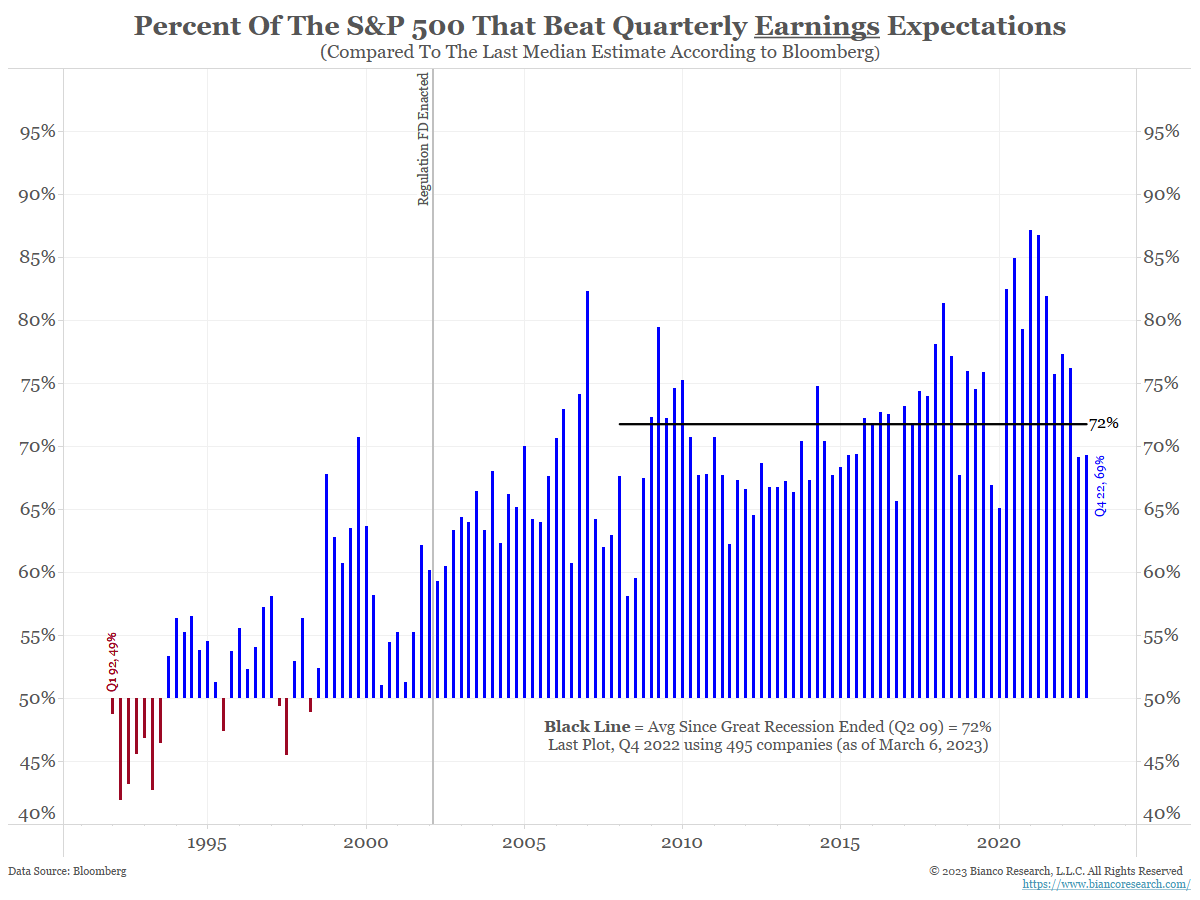

Beat Rate Continues to Disappoint

495 companies have reported, with 69% beating the median earnings estimate on Wall Street. This is slightly below the 72% average beat rate since the end of the Great Recession (black line).

What Management Is Communicating

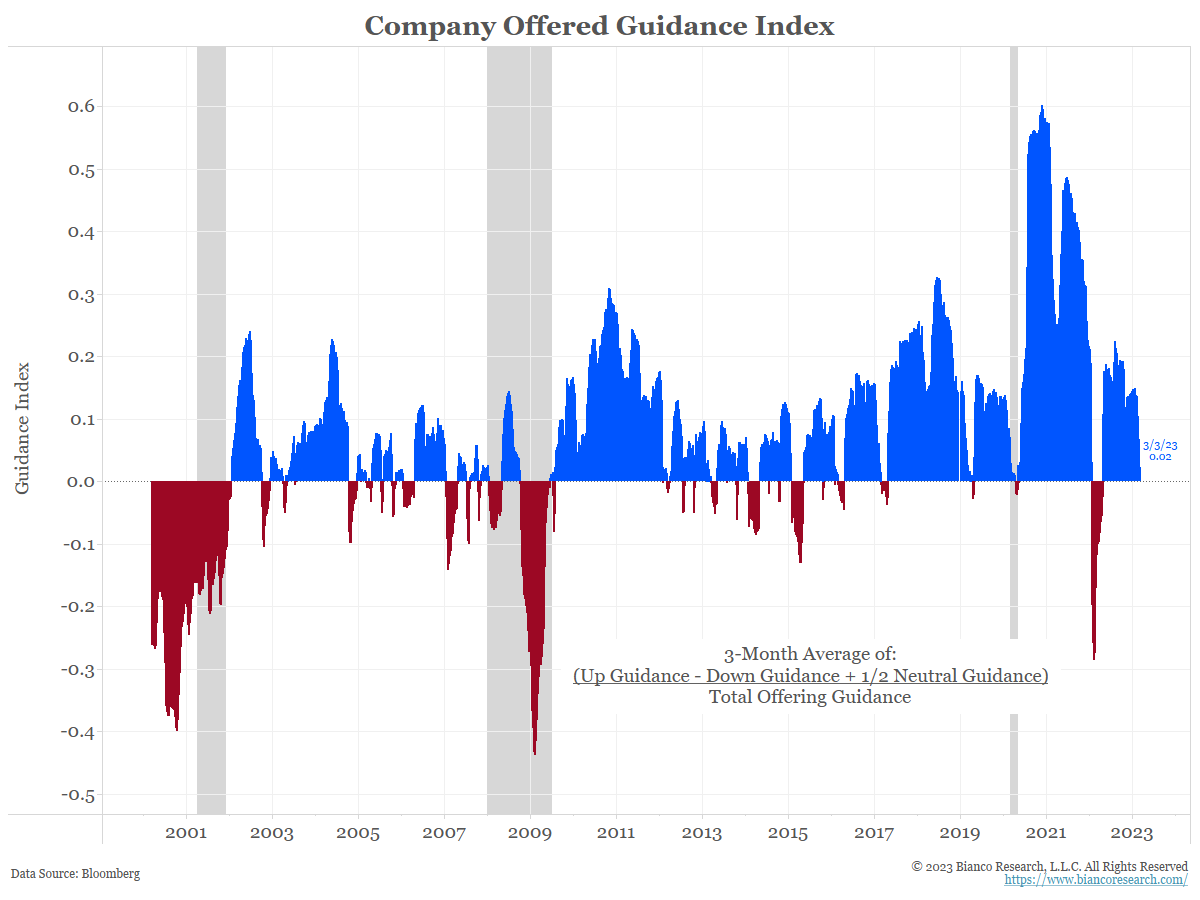

The next chart shows the Guidance Index, which essentially shows the net percentage of companies either raising or lowering guidance.

In early 2022, many companies warned analysts that earnings would struggle. Now companies have shifted to more positive guidance, again at odds with expectations of an impending recession.

Global Earnings Cuts

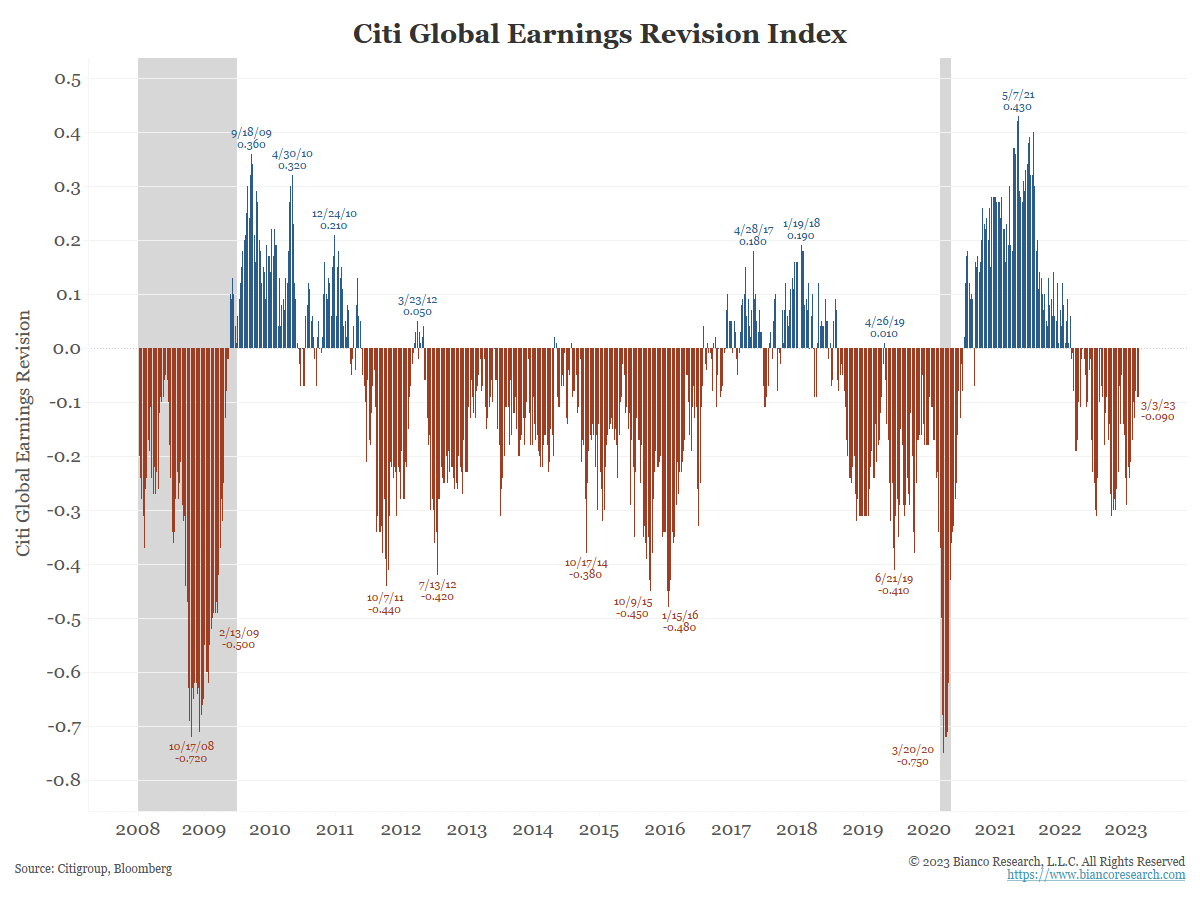

While analysts covering S&P 500 companies have not cut their earnings estimates, the picture looks slightly different globally.

The chart below shows Citi’s Global Earnings Revisions Index. According to this measure, financial analysts continue to cut their estimates.

So companies are more upbeat than the financial analysts that cover the companies.

Summary

As the Q4 2022 reporting season winds down, earnings have been a disappointment. The beat rate is less than expected and the reporting “bounce” is among the smallest ever seen.

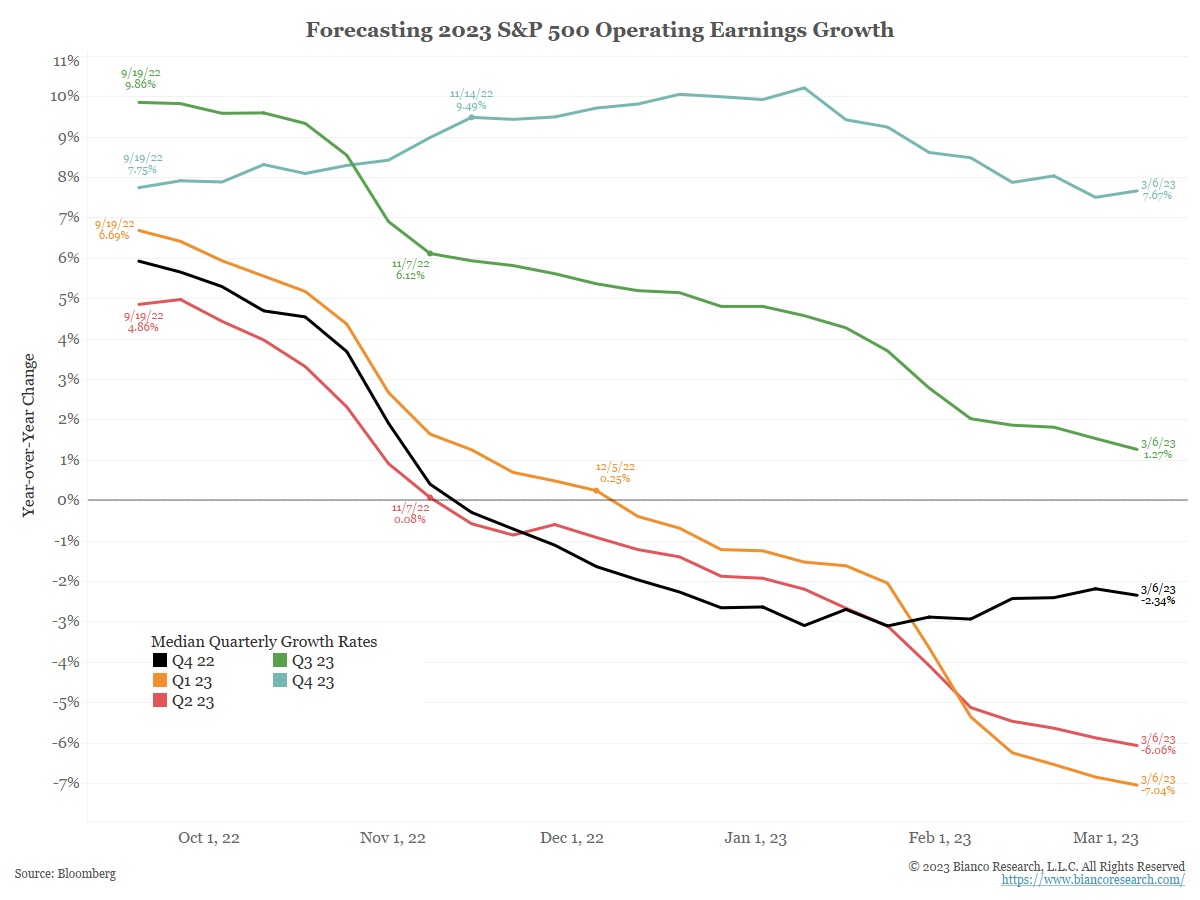

Earnings Expectations

The chart below shows weekly updates of year-over-year S&P 500 forecasted earnings growth by quarter. These series use “bottom-up” Wall Street analysts’ median estimates before a company reports, replacing them with actual results once available. The series starts with 500 estimates and ends when all 500 companies have reported.

The black line is Q4 2022. It consists of 495 actual results and the median Wall Street estimate for the 31 companies that still have to report.

Many expect a recession in 2023, which explains why earnings expectations for Q4 2022 through Q2 2023 (red) are negative.