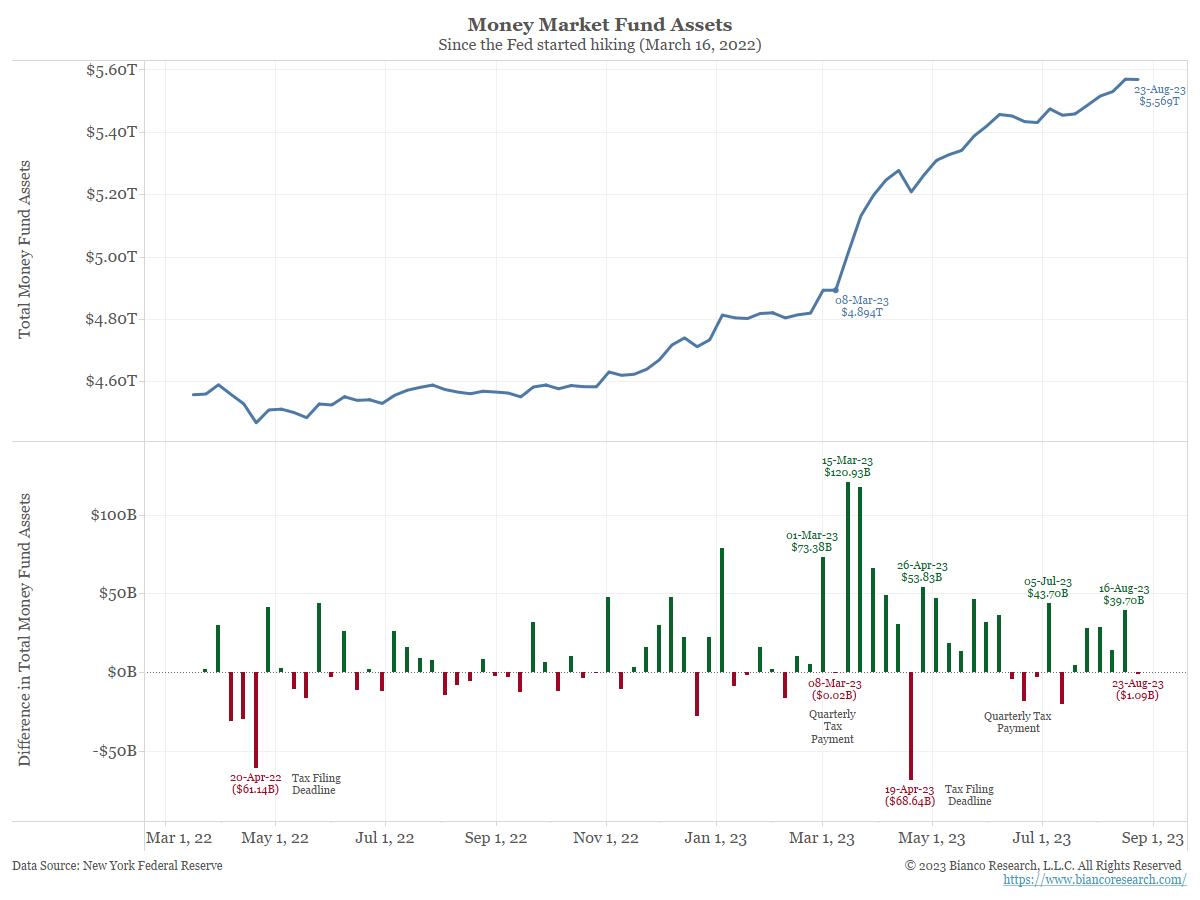

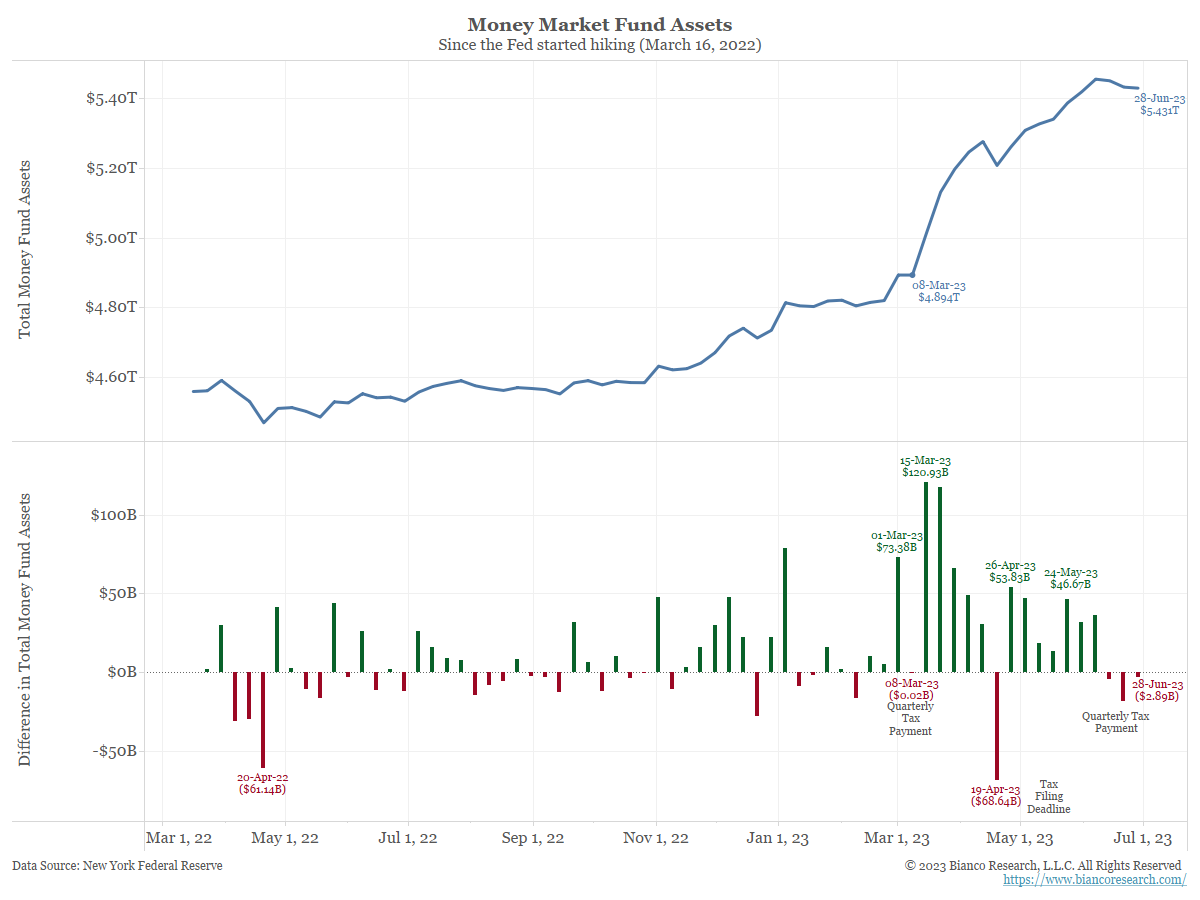

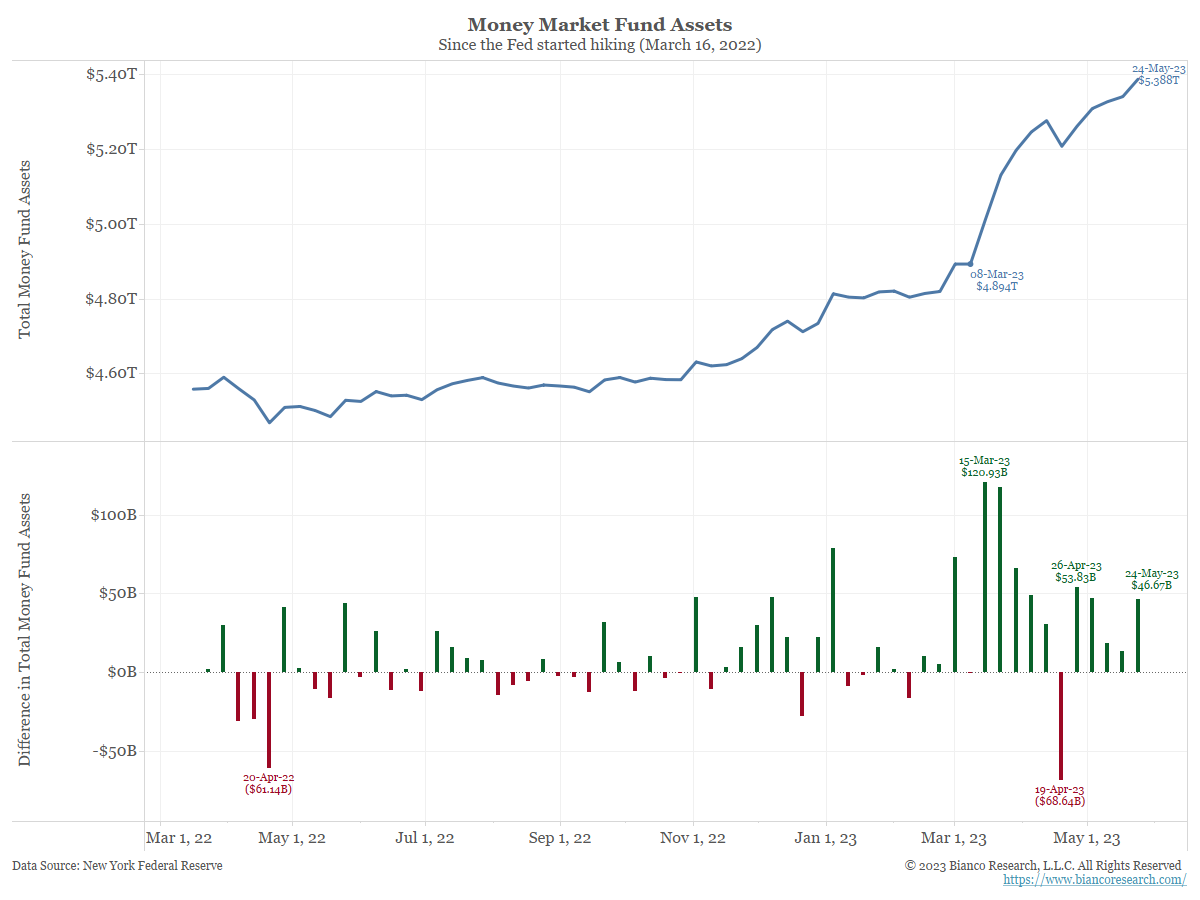

Monthly Fund Flows – Money Market Inflows Resume

Posted By Greg Blaha

Flows into money market funds resumed in August, which points to squeezed profitability for banks.... Read More