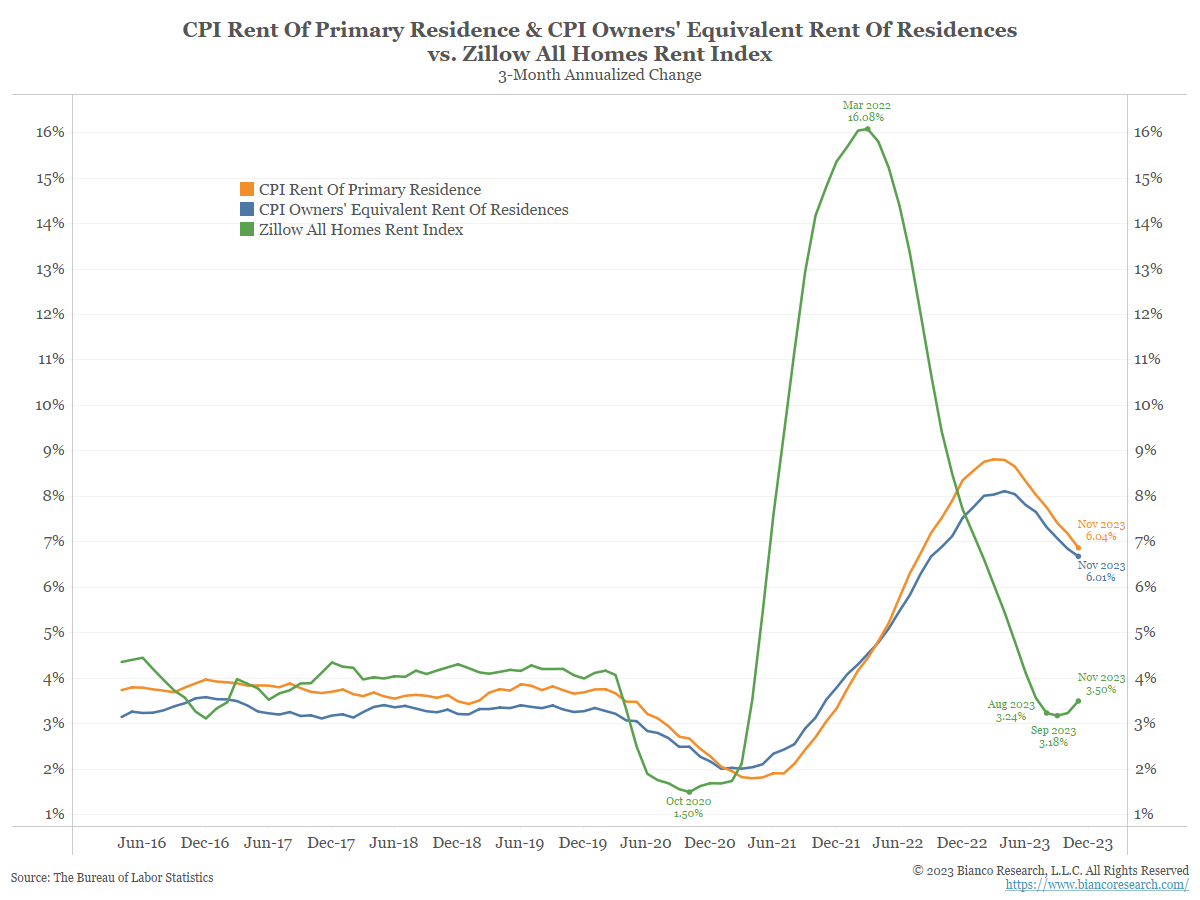

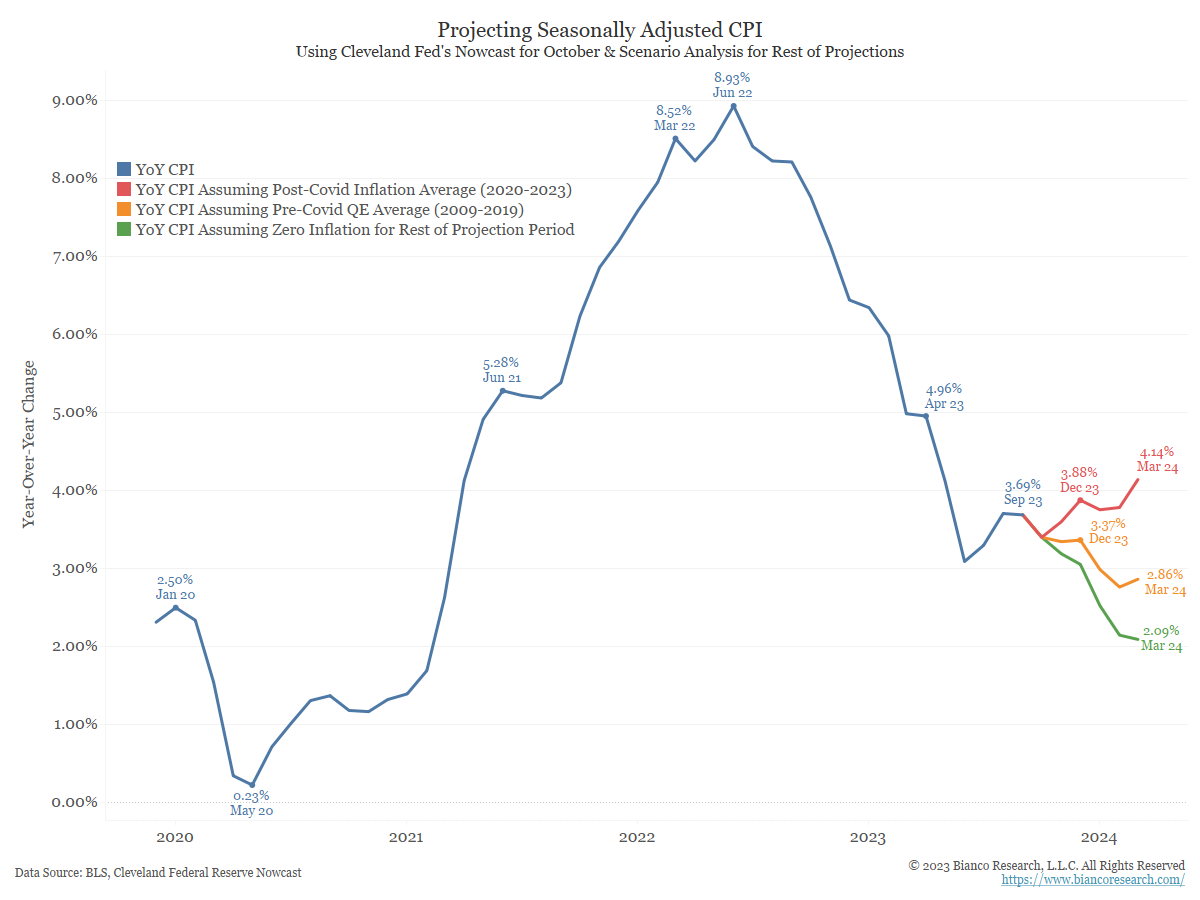

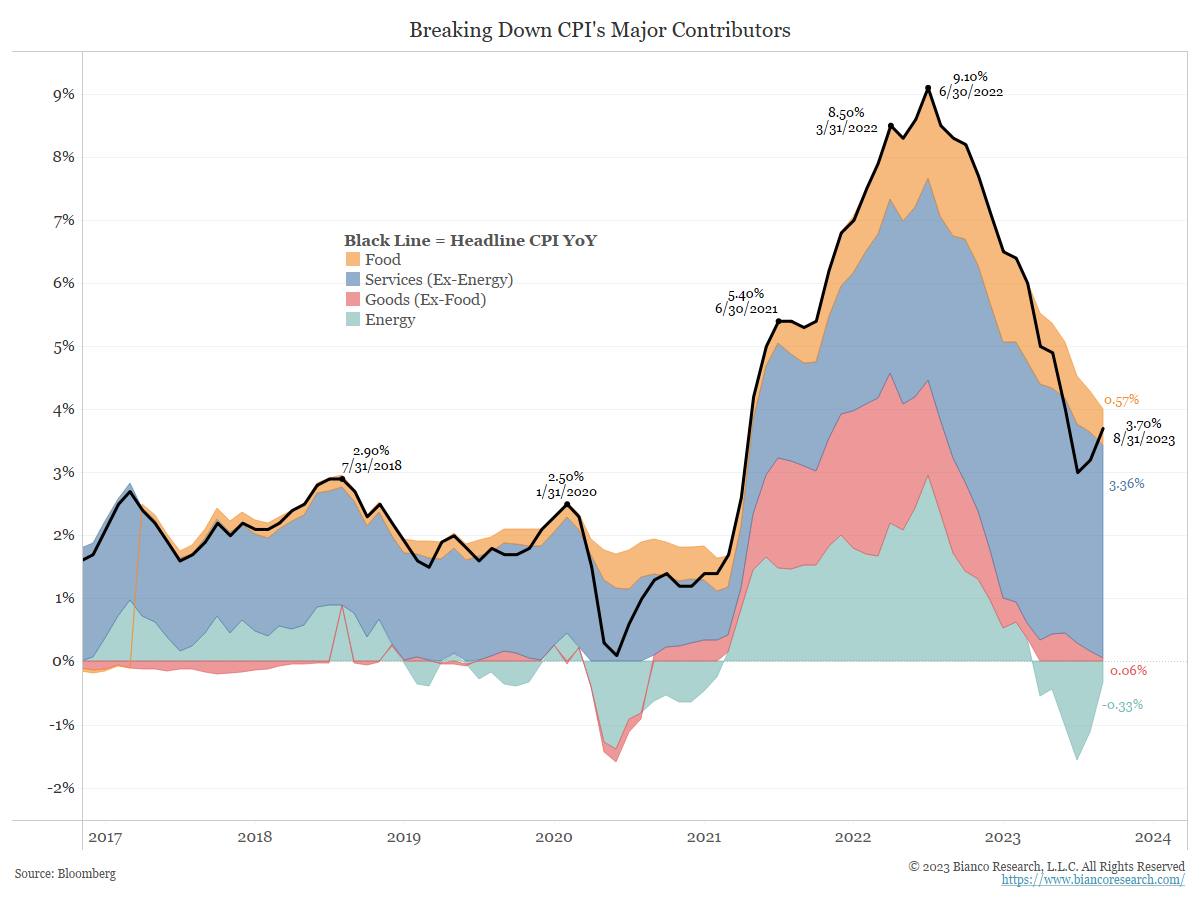

Inflation Watch – Still All About Housing

Posted By Greg Blaha

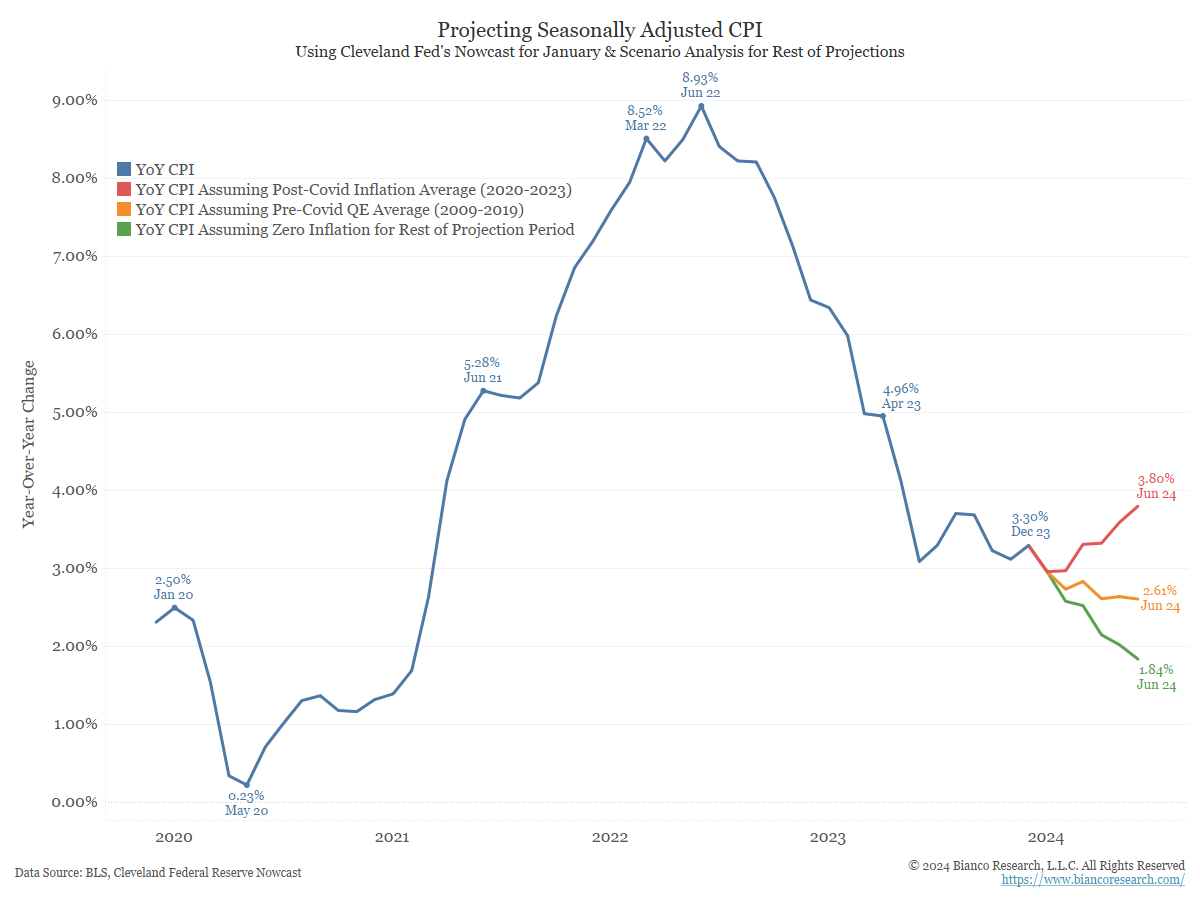

Inflation came in slightly above expectations in December. With the easy part of the fight against inflation now over, shelter prices will have to continue lower if the Fed hopes to hit its 2% target.... Read More