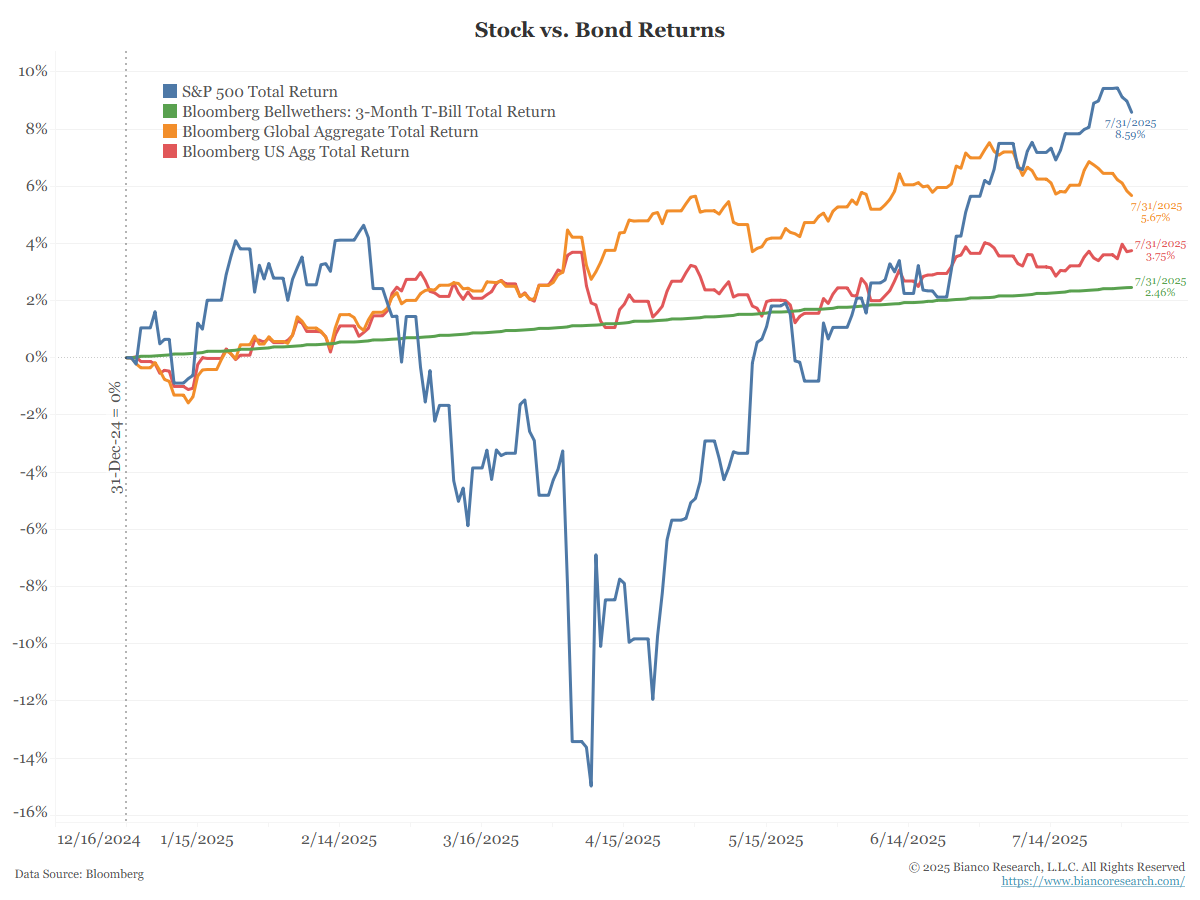

Total Return Review – Updating Markets’ Reactions to Inflation & Fiscal Concerns

Posted By Greg Blaha

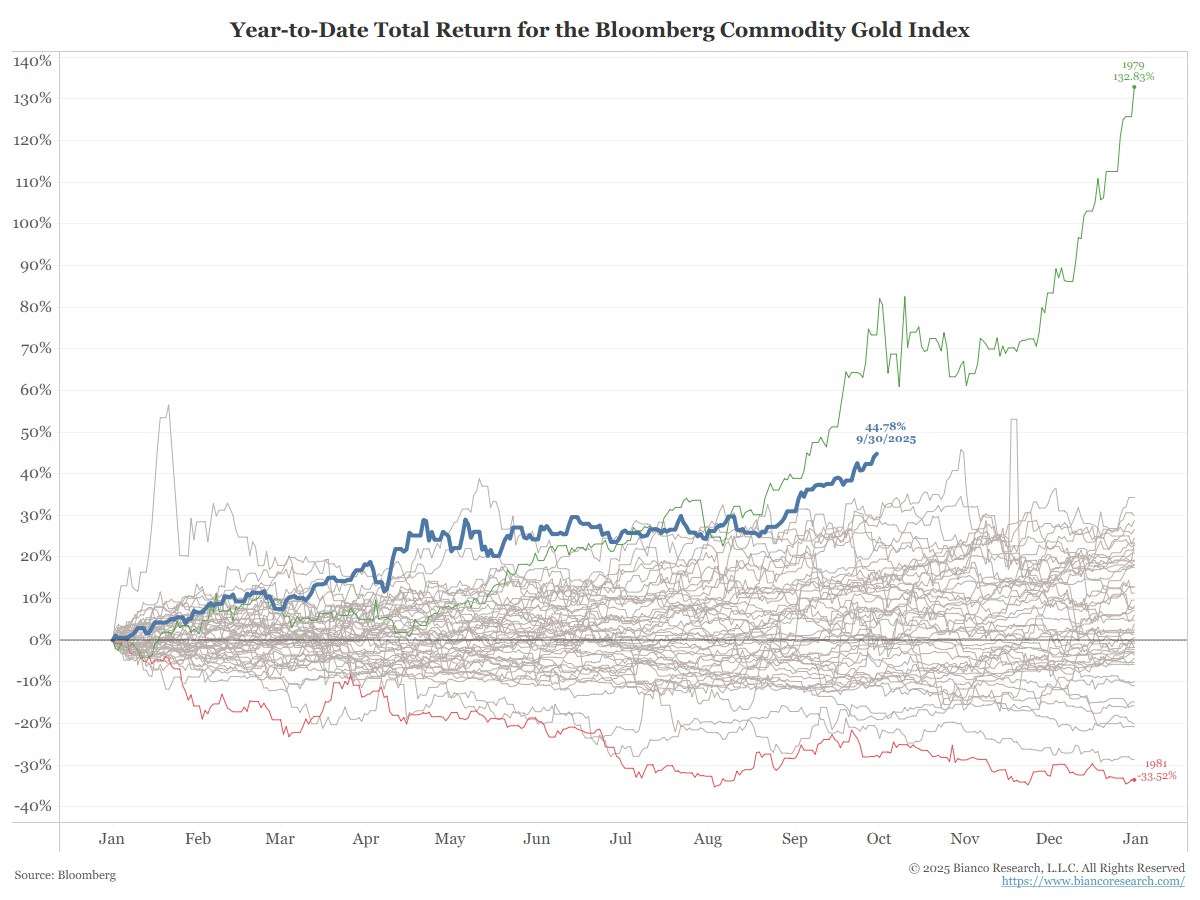

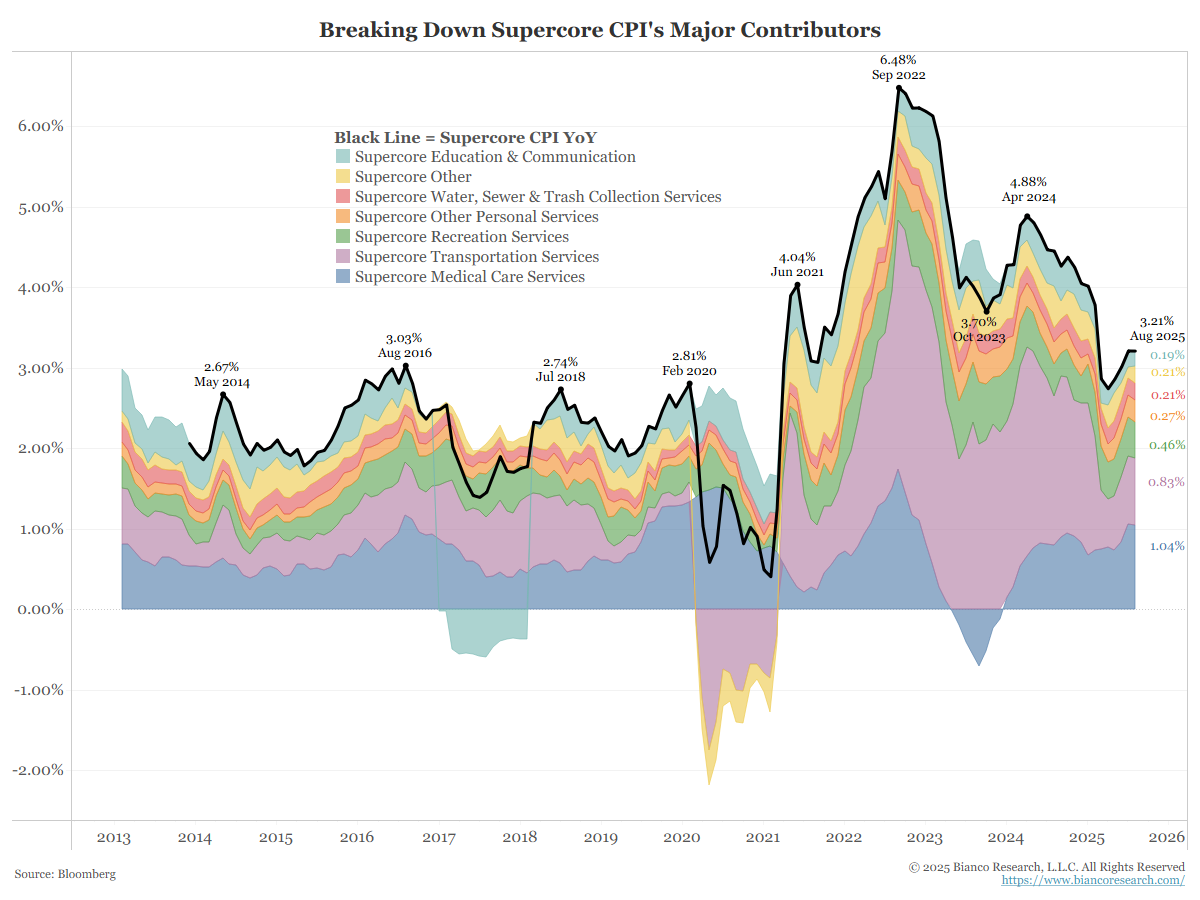

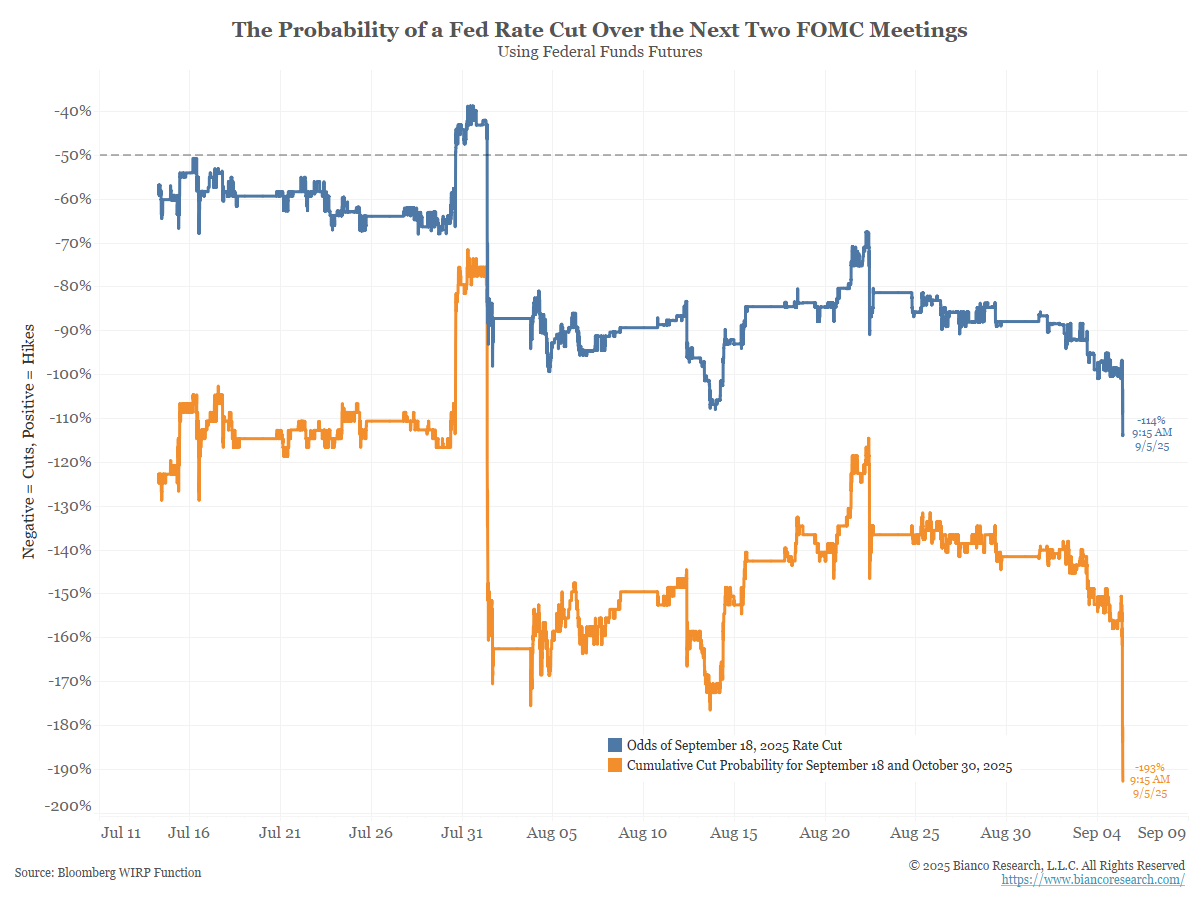

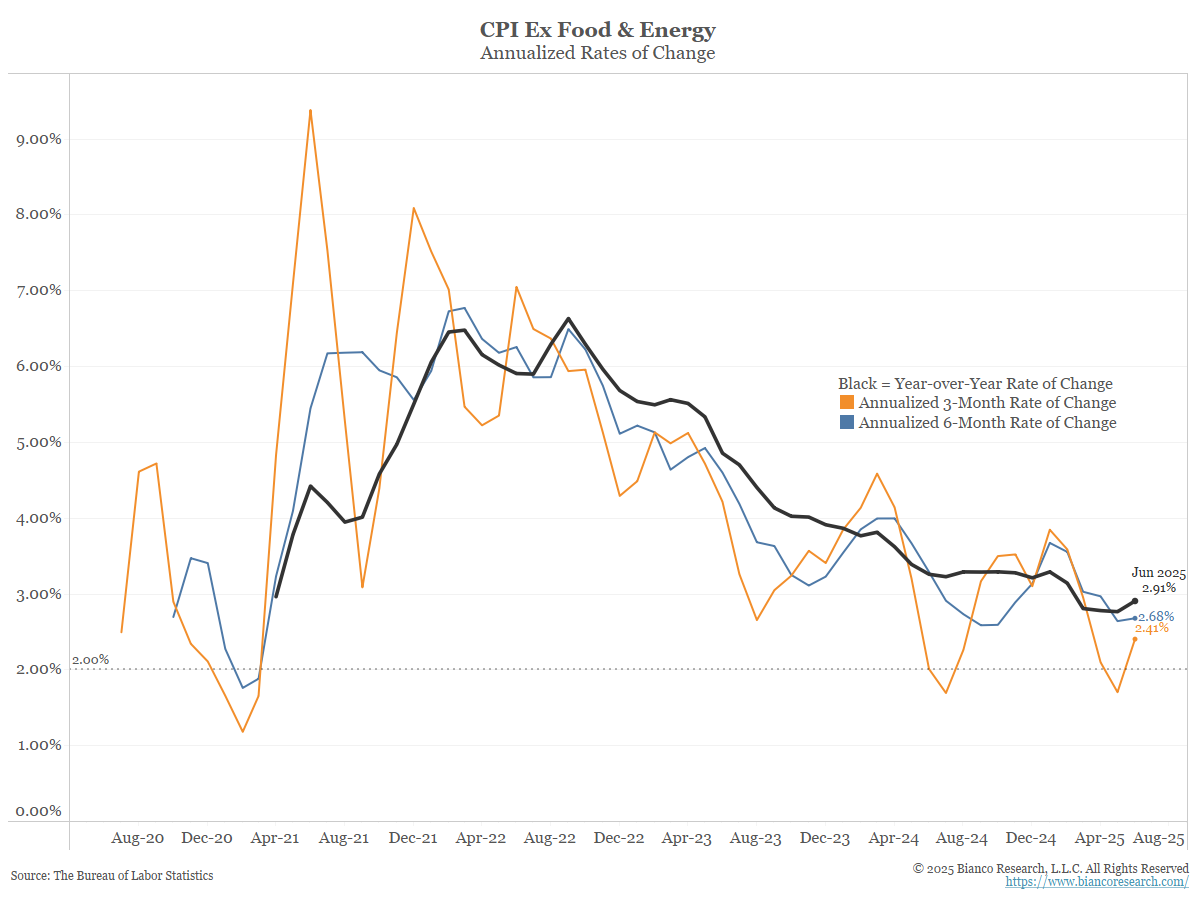

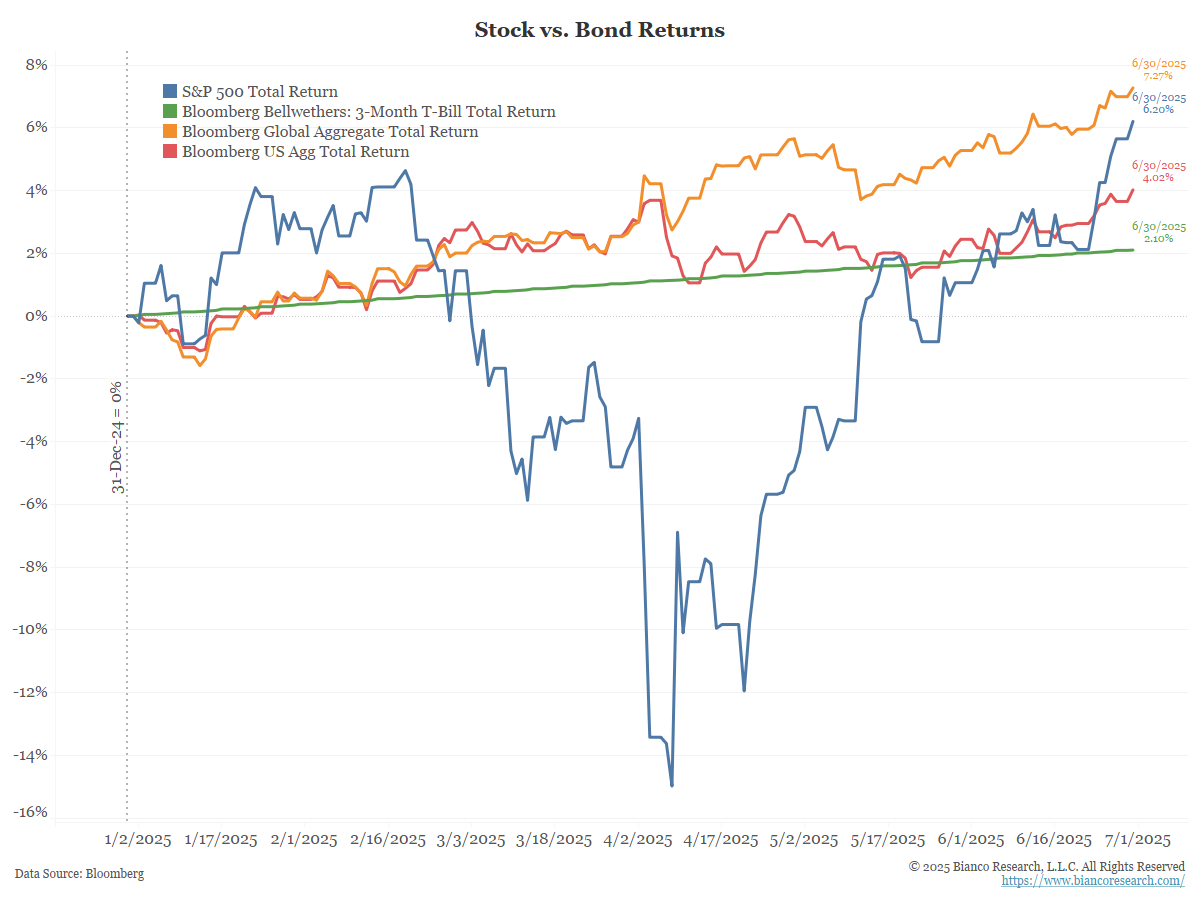

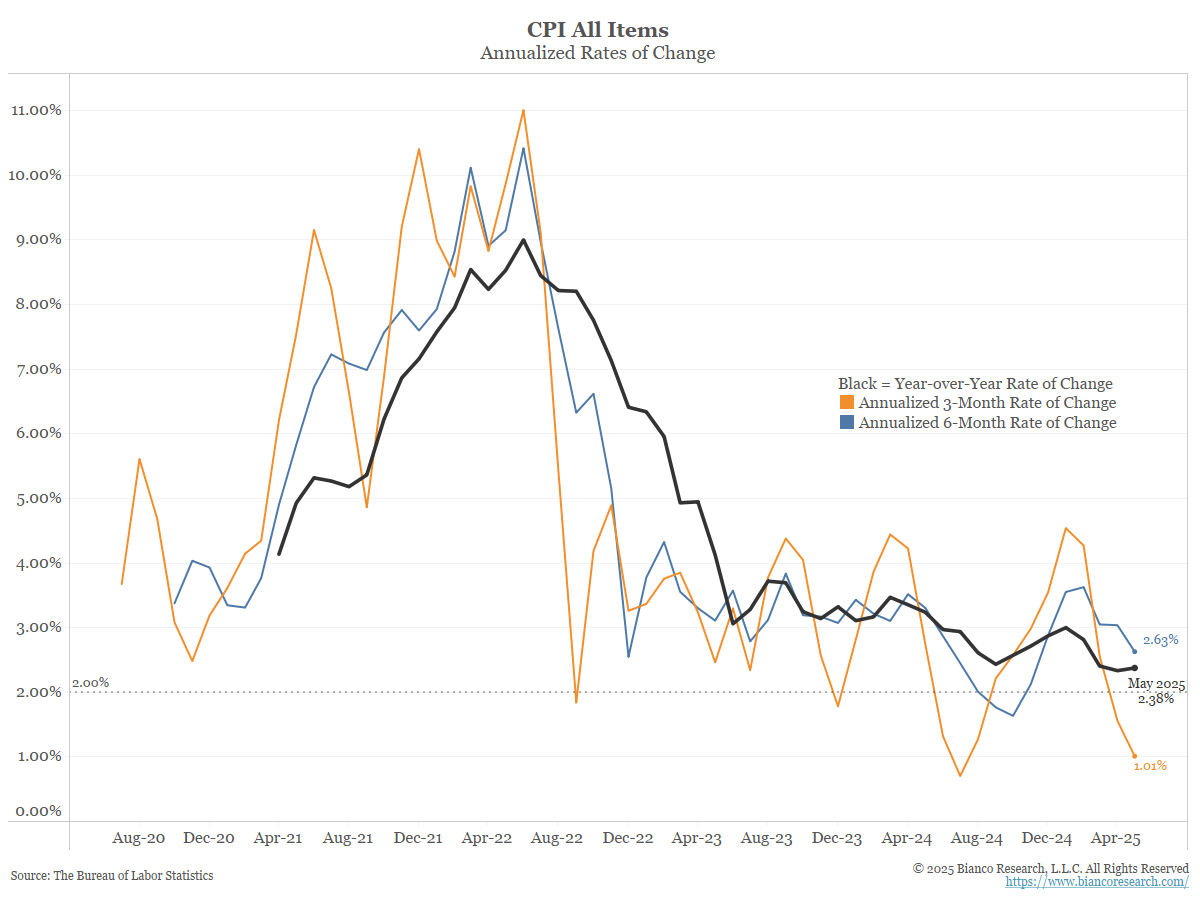

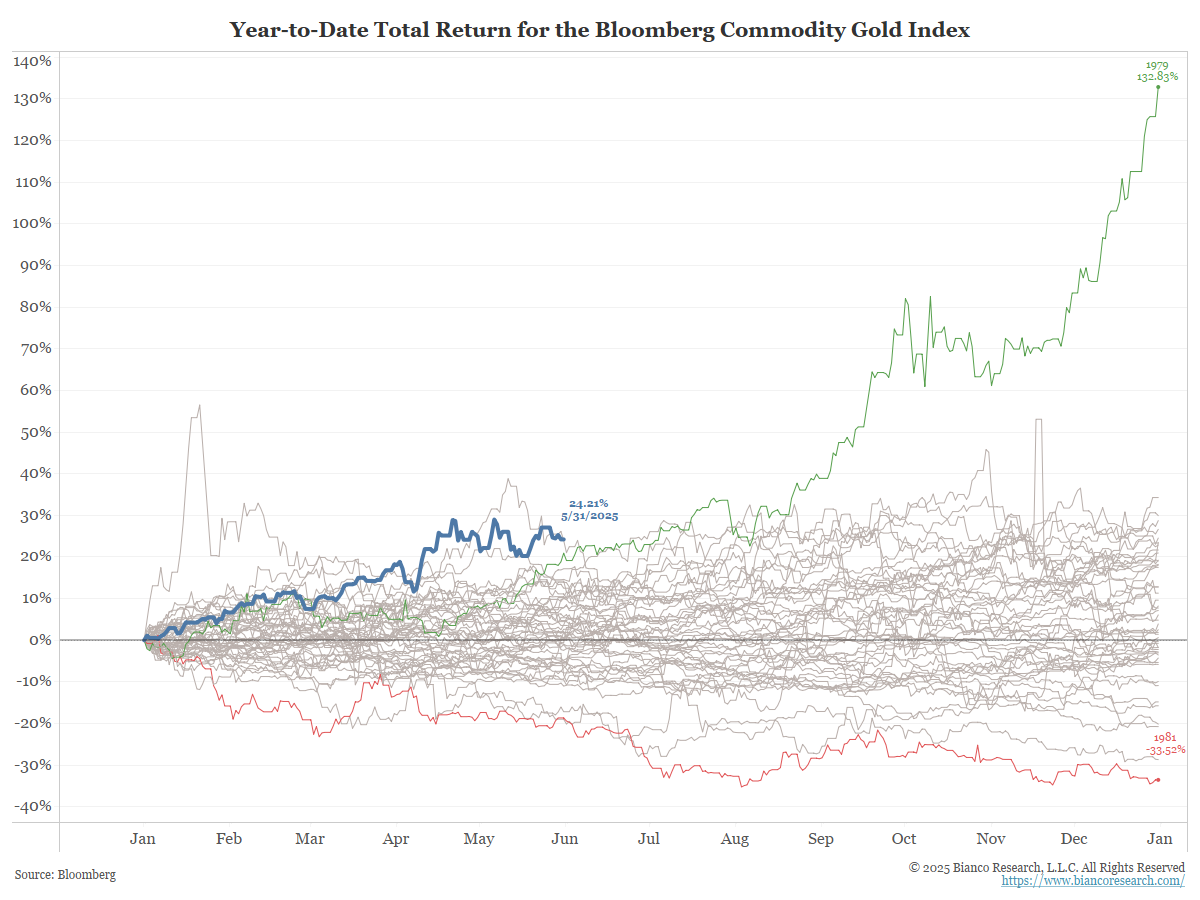

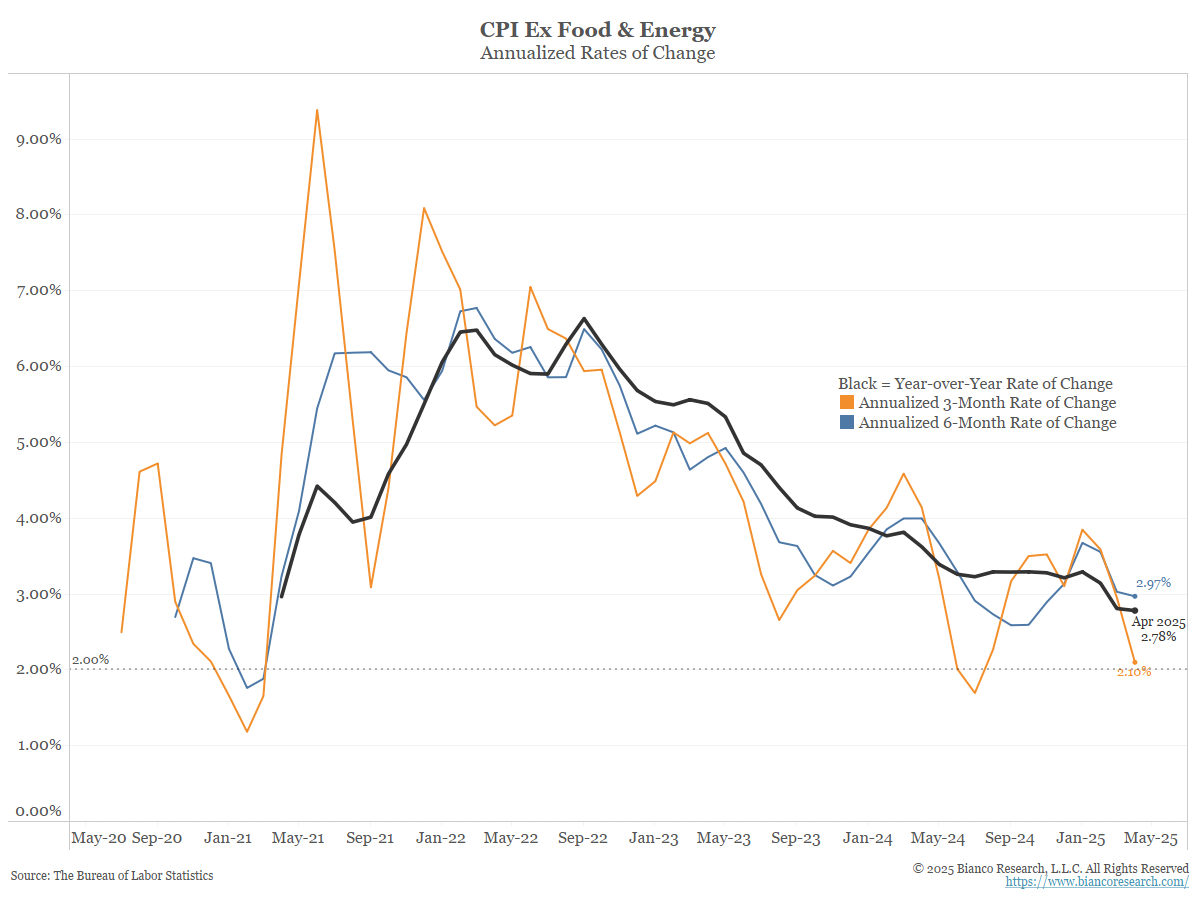

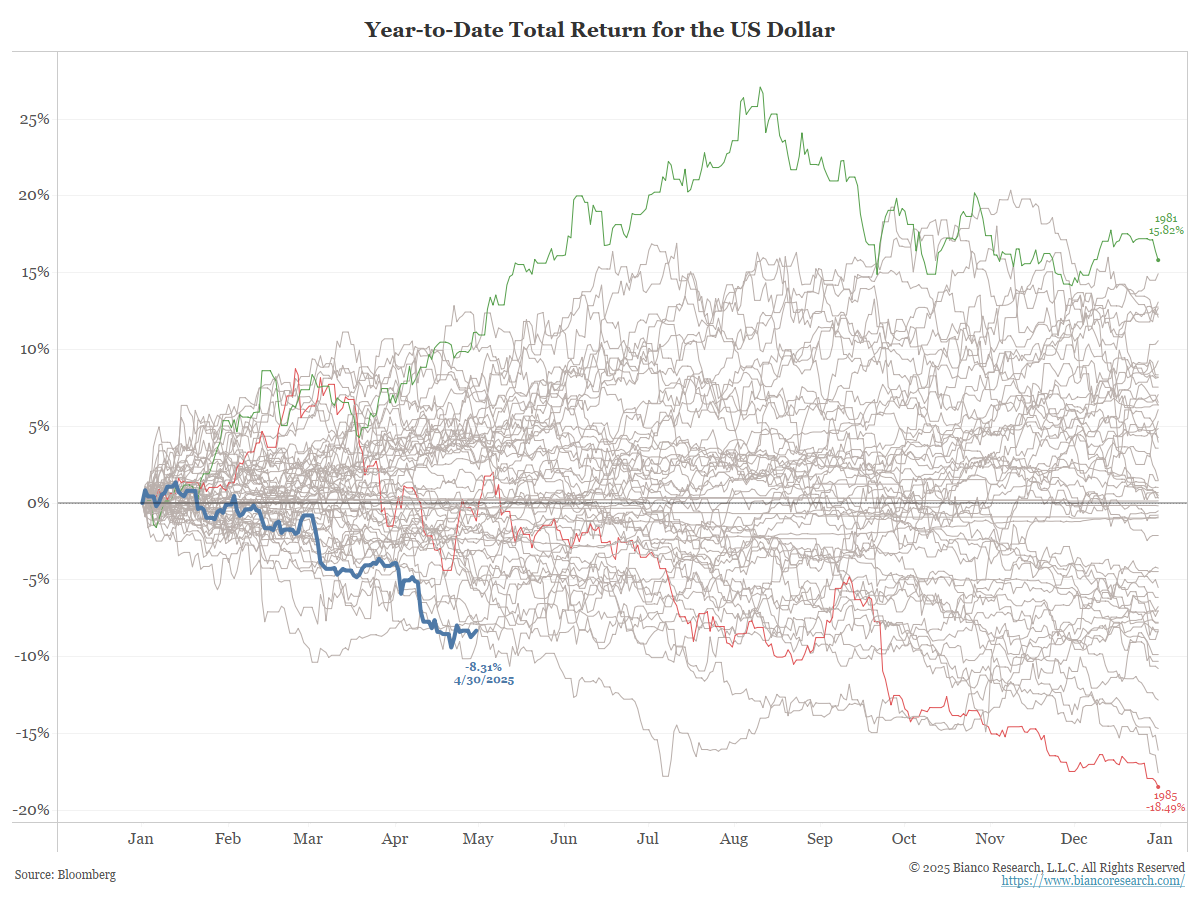

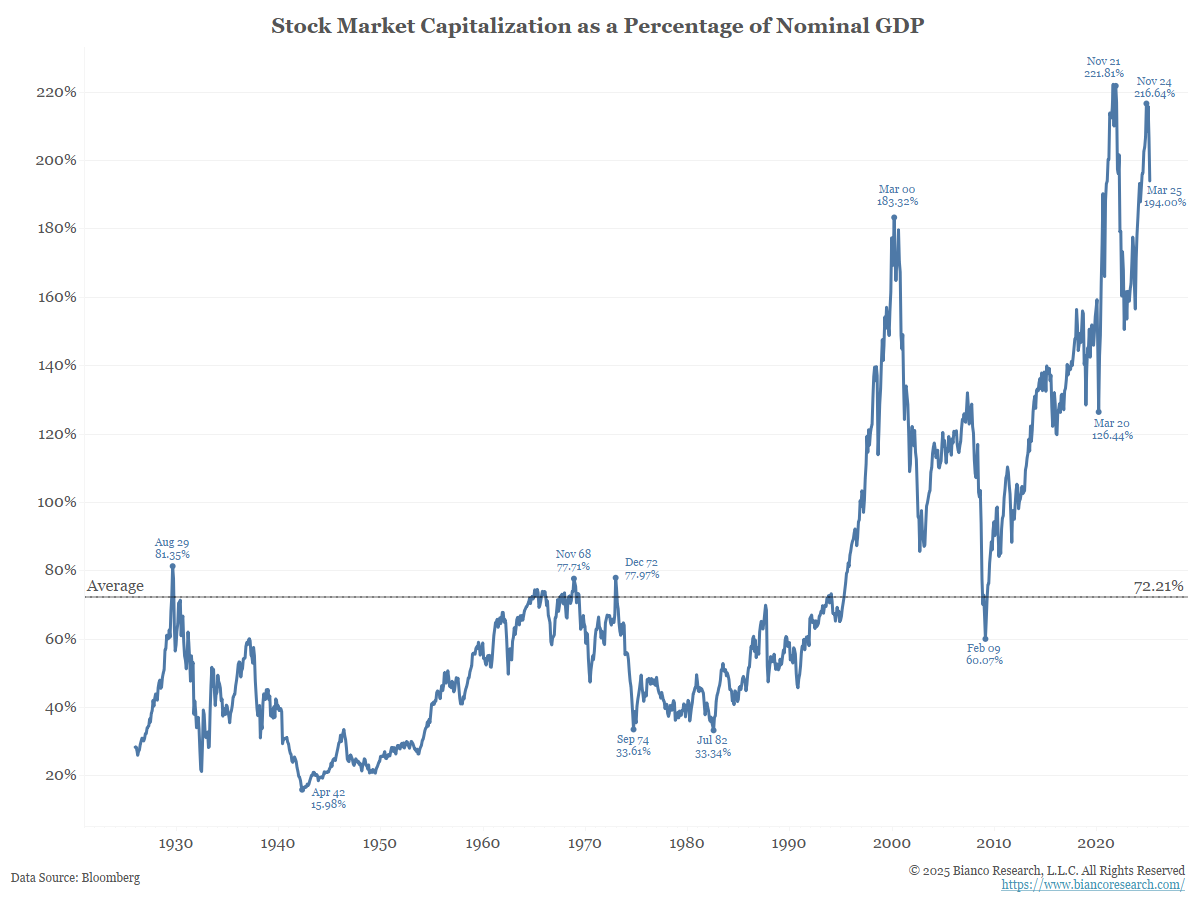

Gold has trended higher this year as inflation remains above the Fed's 2% target. The dollar has depreciated as fiscal concerns grow.... Read More