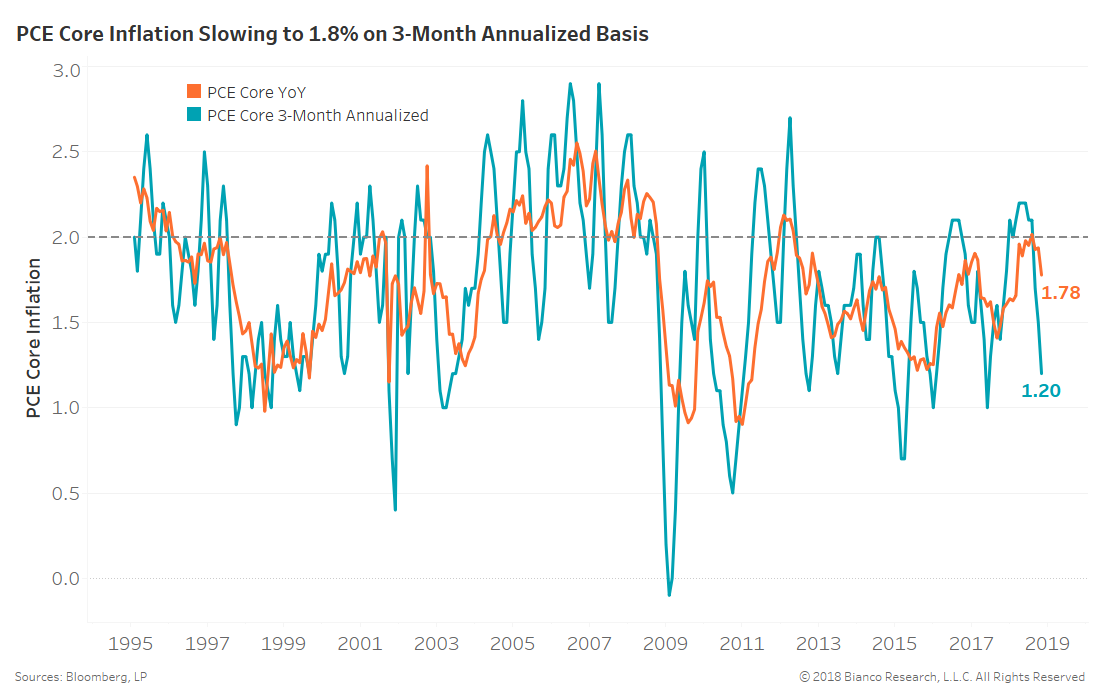

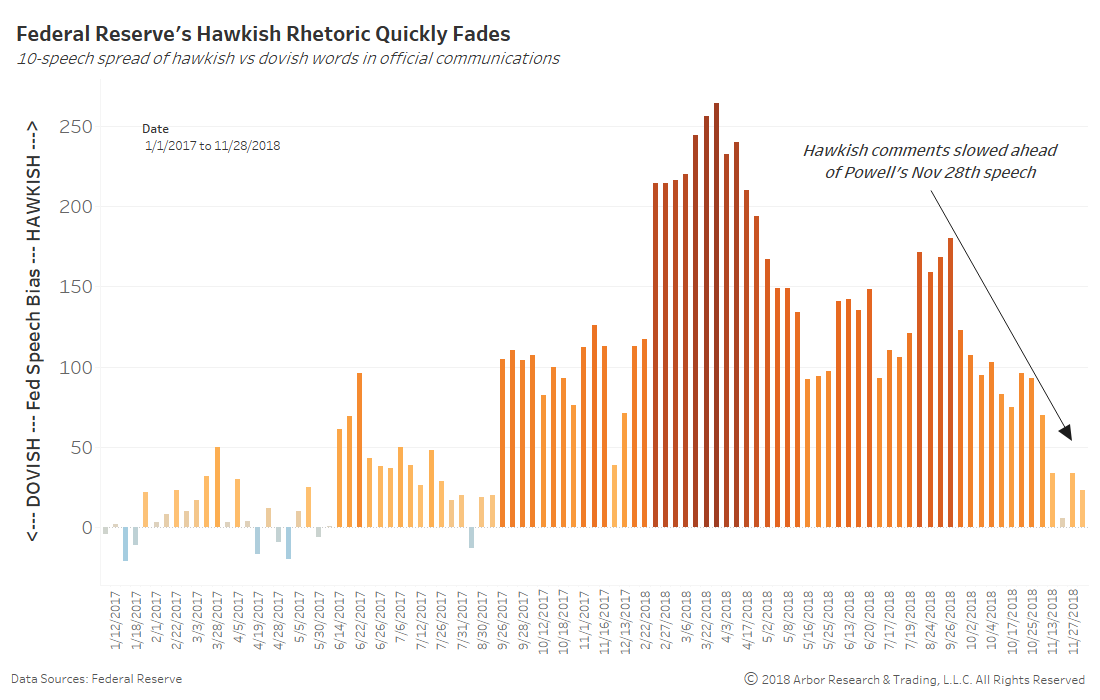

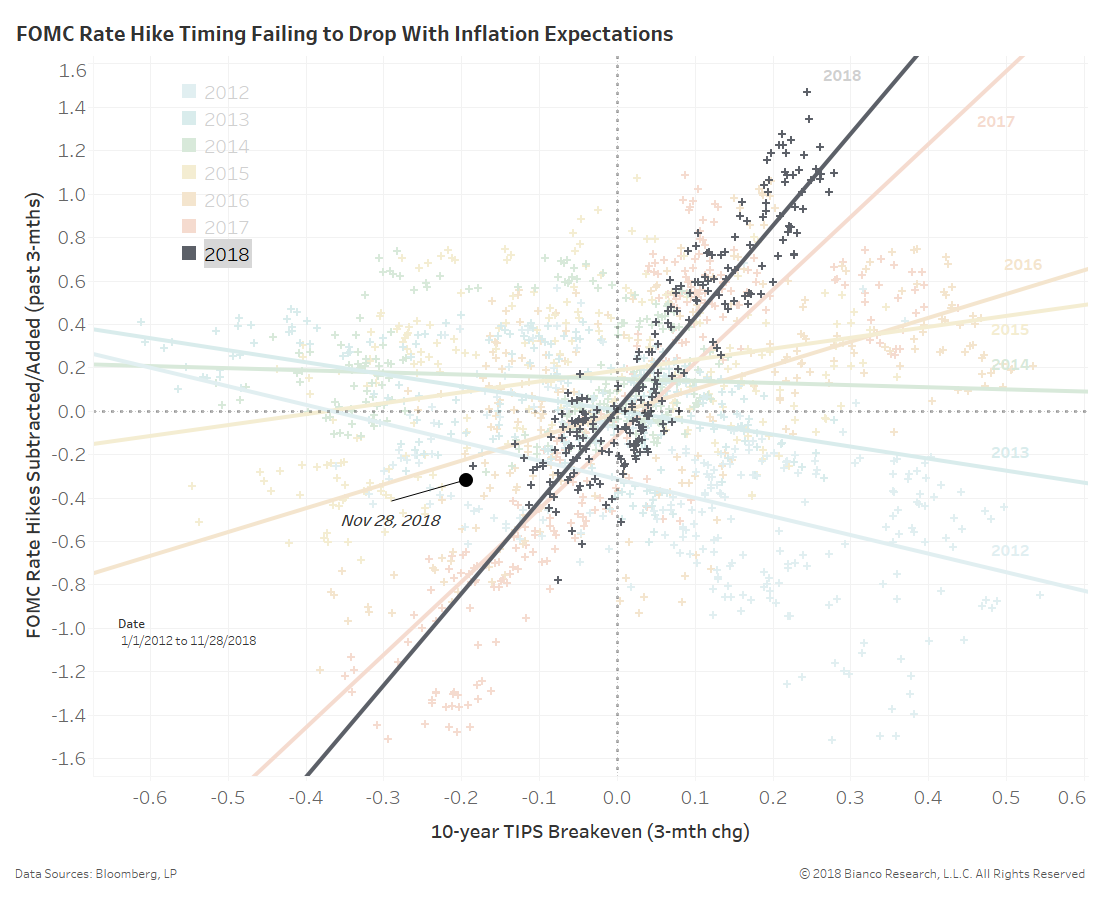

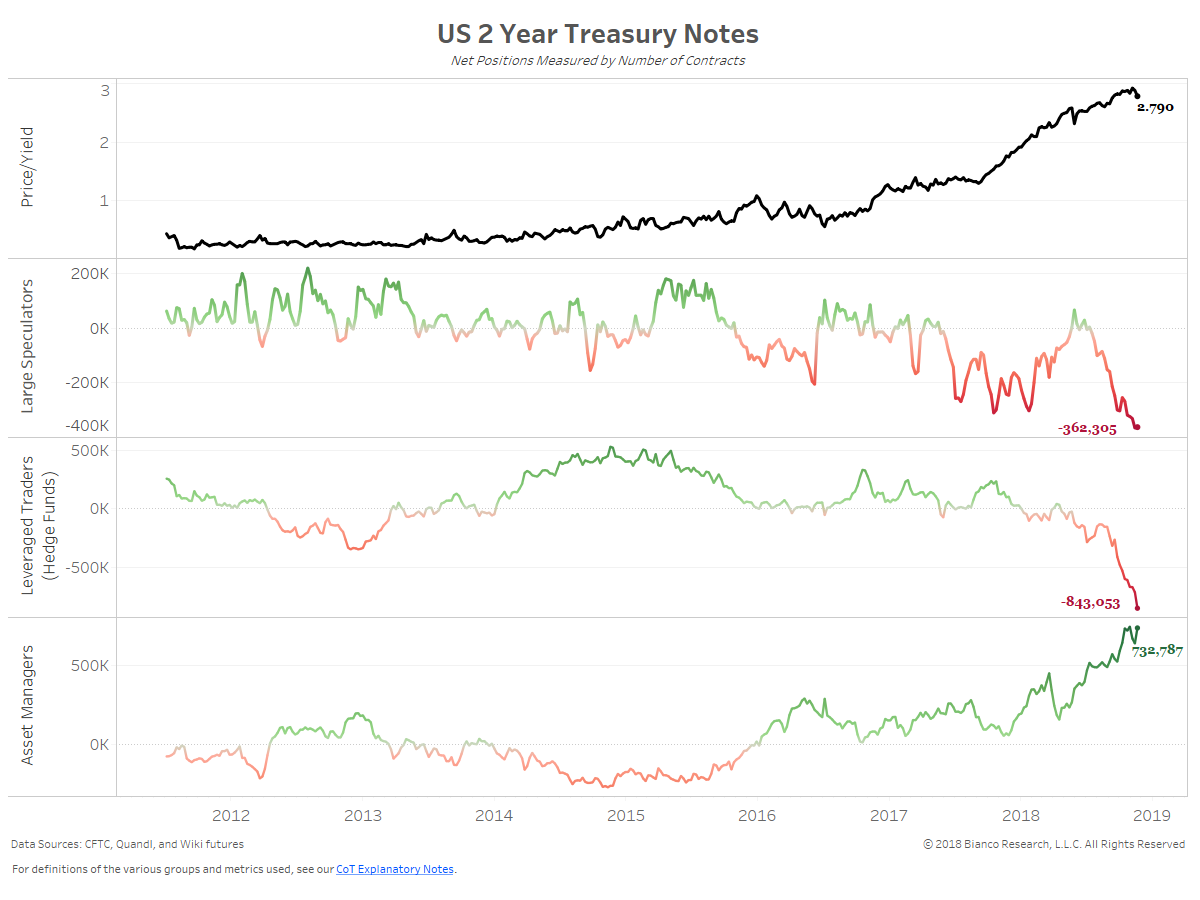

Bond Investors Say “Bah Humbug” to Inflation and Tightening Outlooks

Posted By Ben Breitholtz

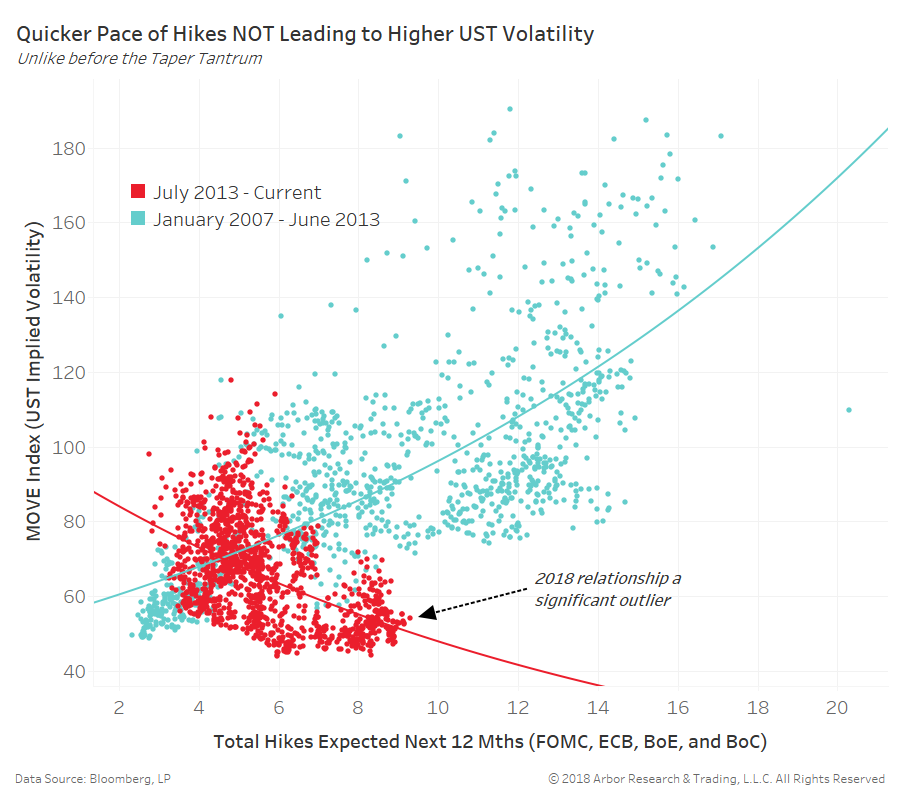

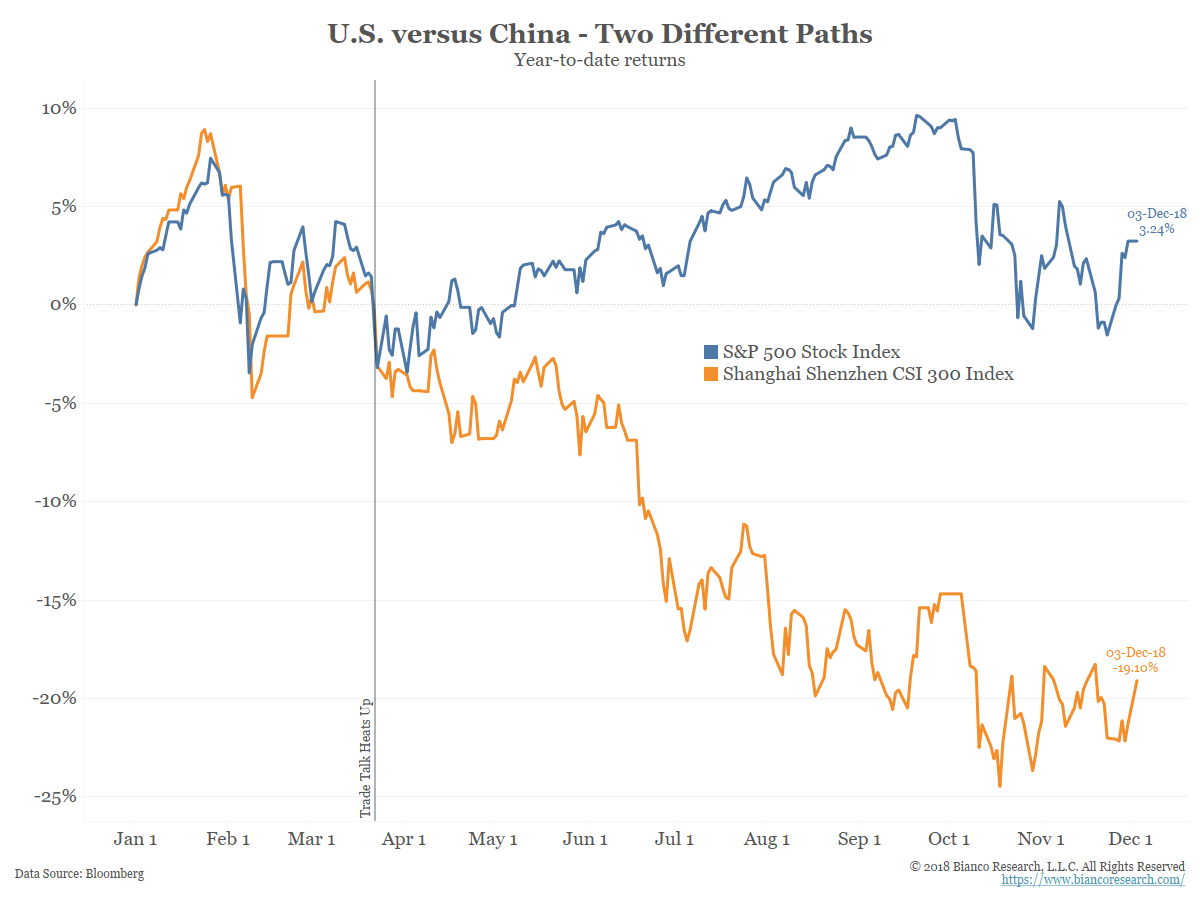

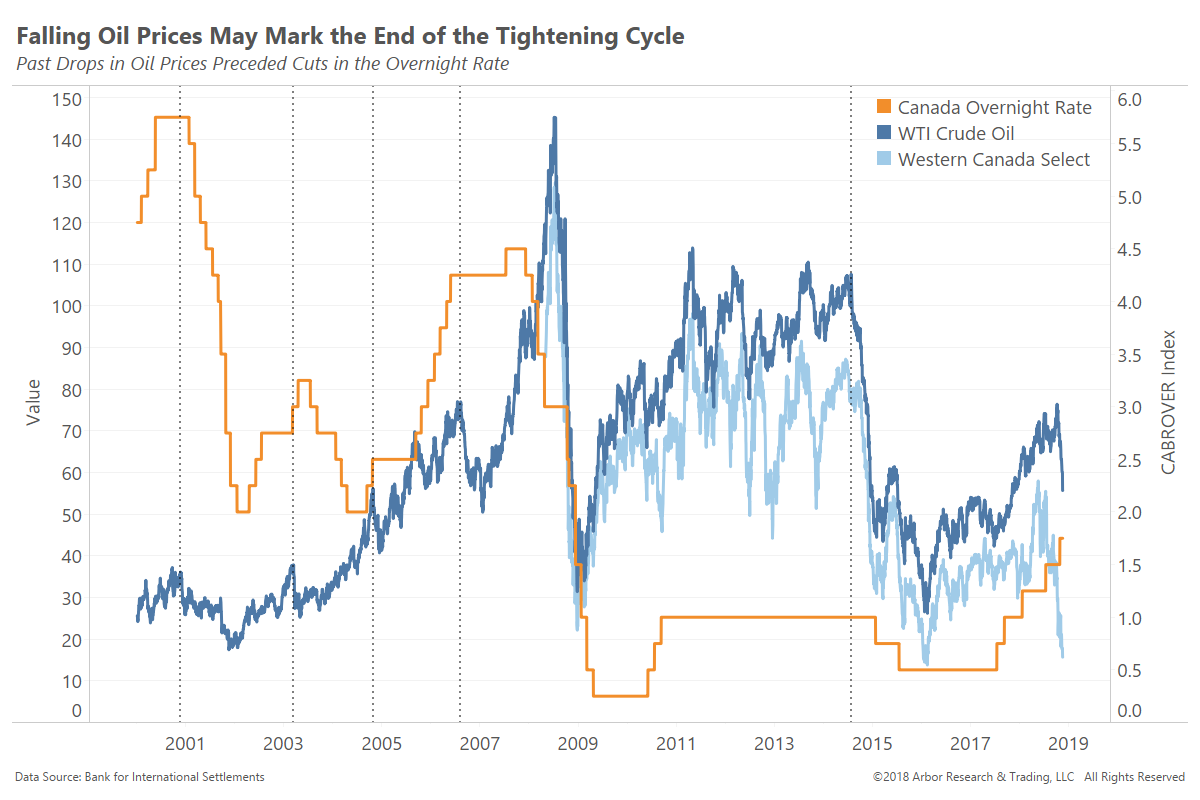

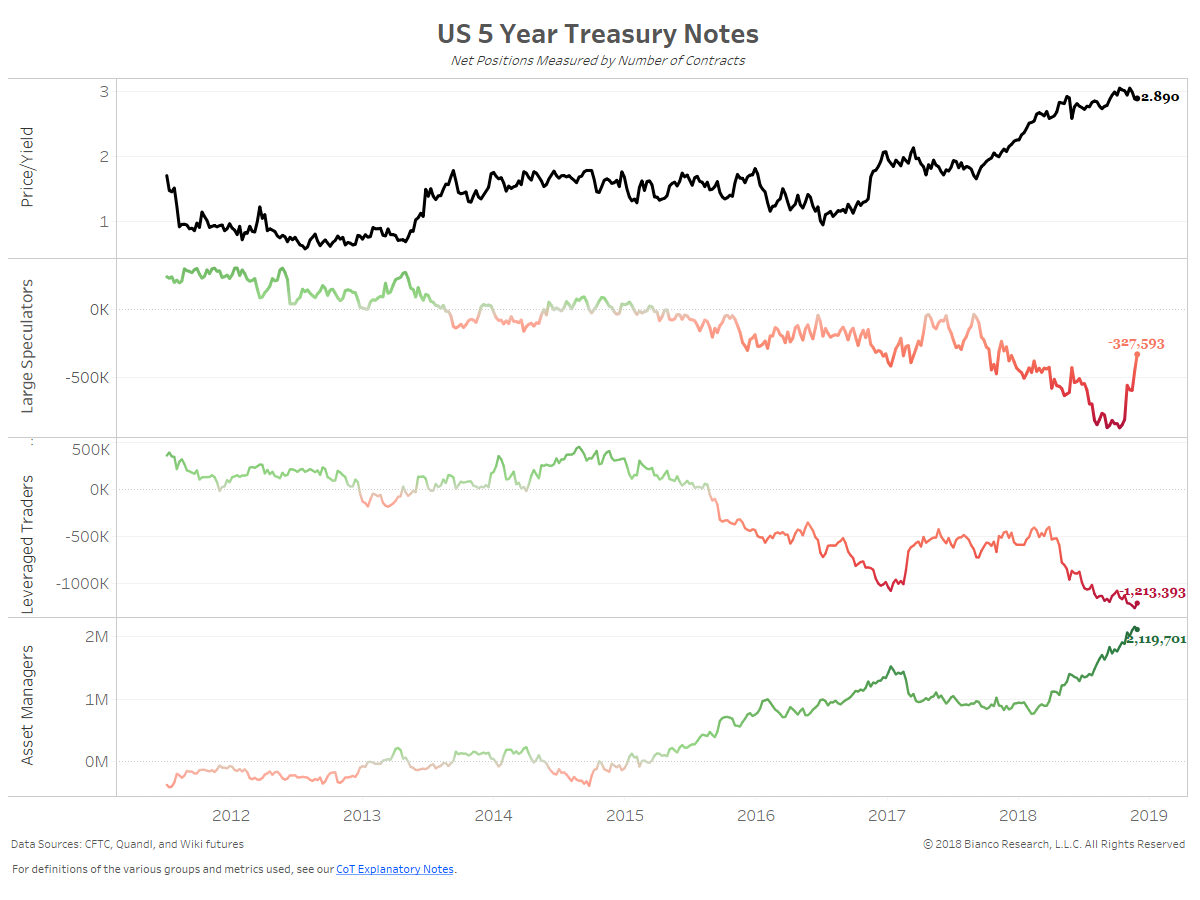

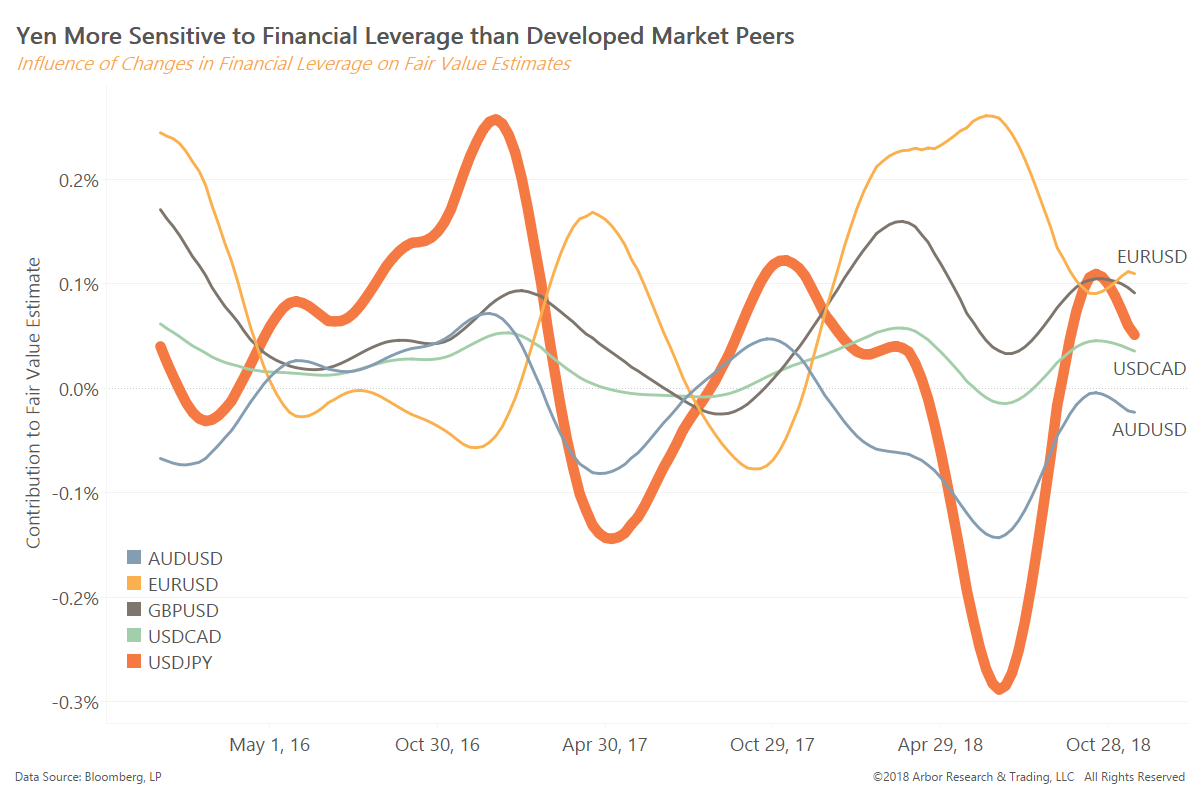

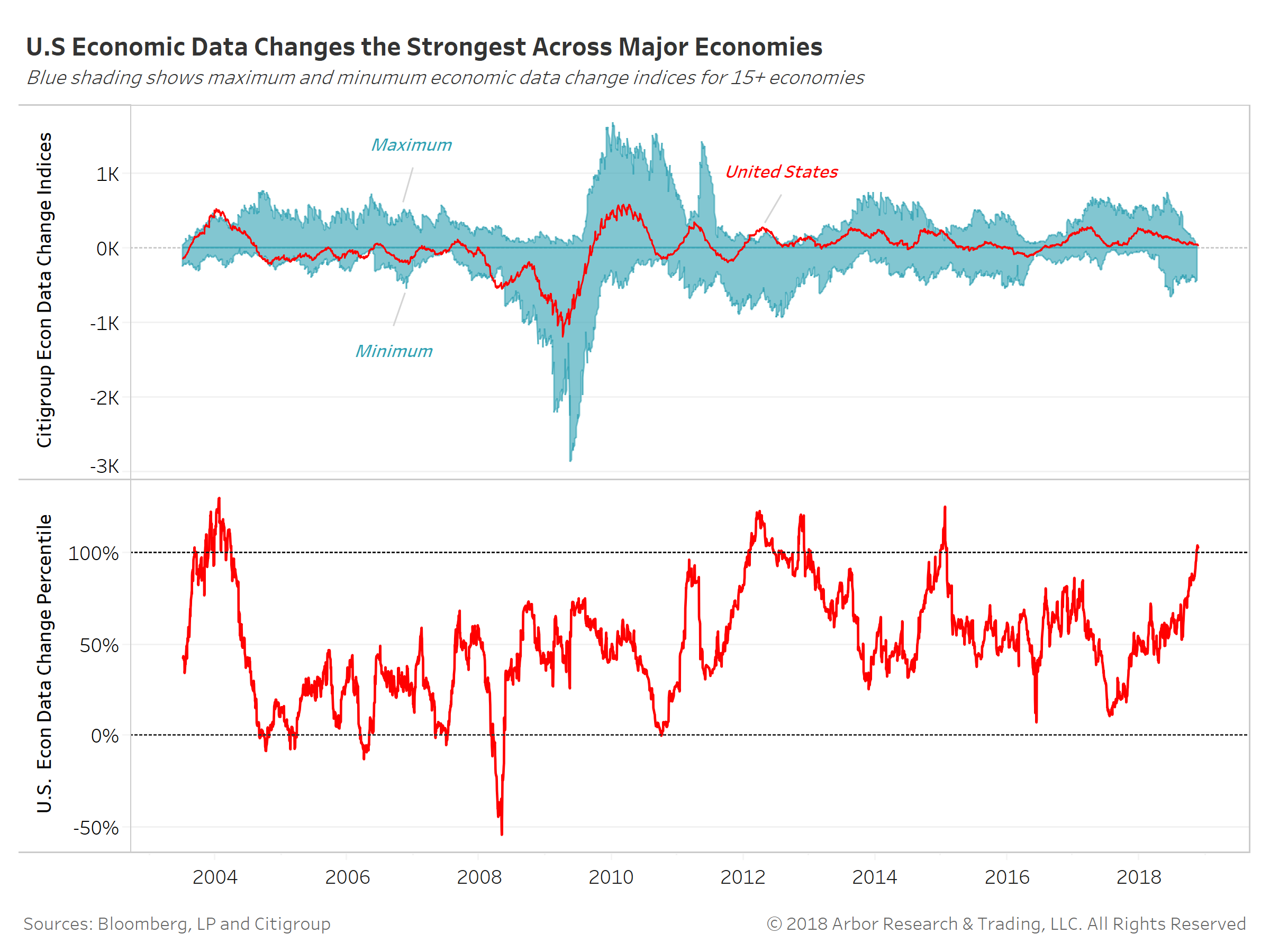

U.S. inflation has lost momentum on the heels of slowing global growth, dampening the Fed's hawkish bias. Bond investors refuse to become concerned a rash of inflation or tightening can occur as evidenced by low U.S. Treasury volatility.... Read More