Newsclips

Updating the Market’s Signal to Central Banks

As we noted above, short rates continue to send a signal that central banks are behind the curve. Even though the following short rates have pulled back more than those above, we still see them as being in an uptrend.

Election Day: All Eyes on Virginia

Wall Street is focused on two things, assessing how much fiscal stimulus the economy will get in 2022 and whether the December 3 debt ceiling will be messy. The Virginia gubernatorial election today could be a key factor in assessing these outlooks.

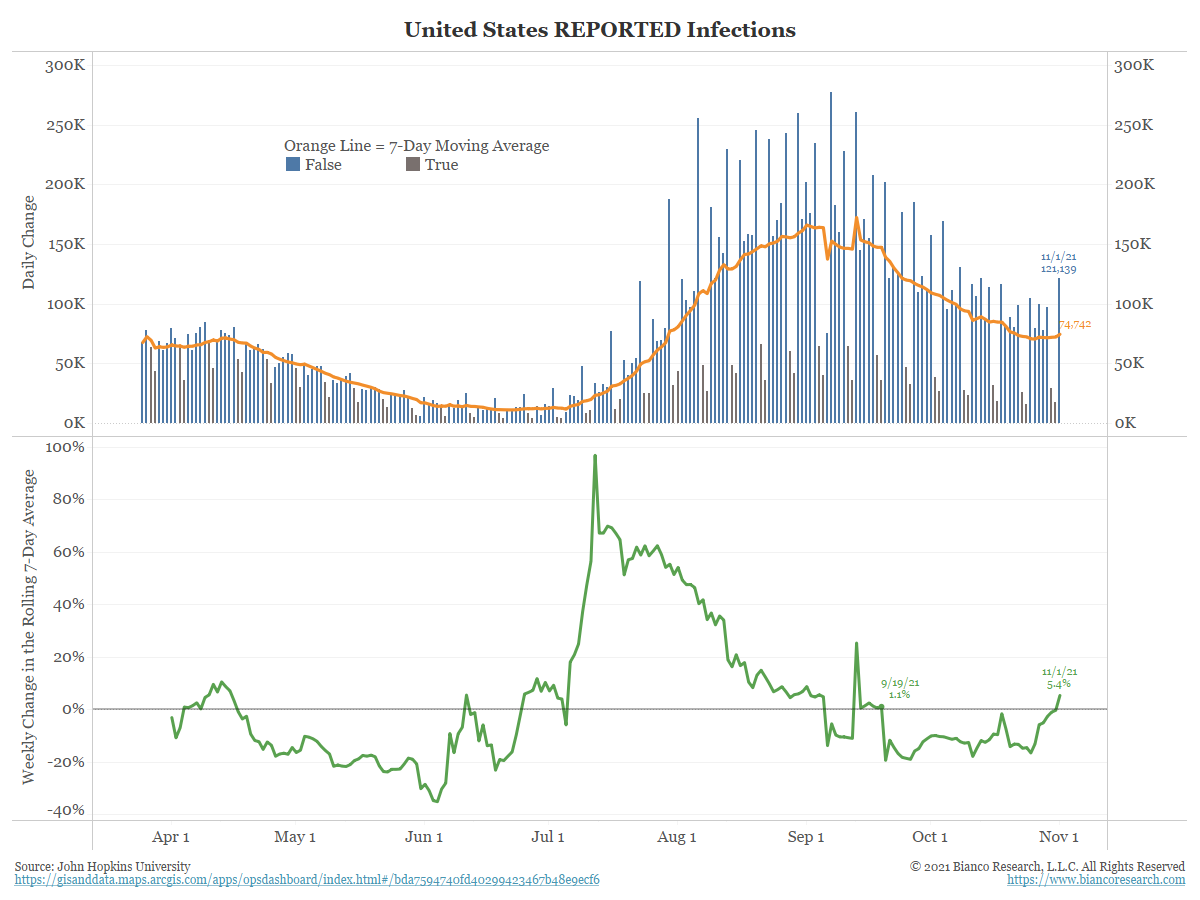

Are COVID Cases Bottoming?

The top panel of the chart below shows the number of daily COVID cases in the U.S. (blue) and their rolling 7-day average (orange). The bottom panel shows the percentage change in the rolling 7-day average. For the first time since September 19, case counts turned higher.

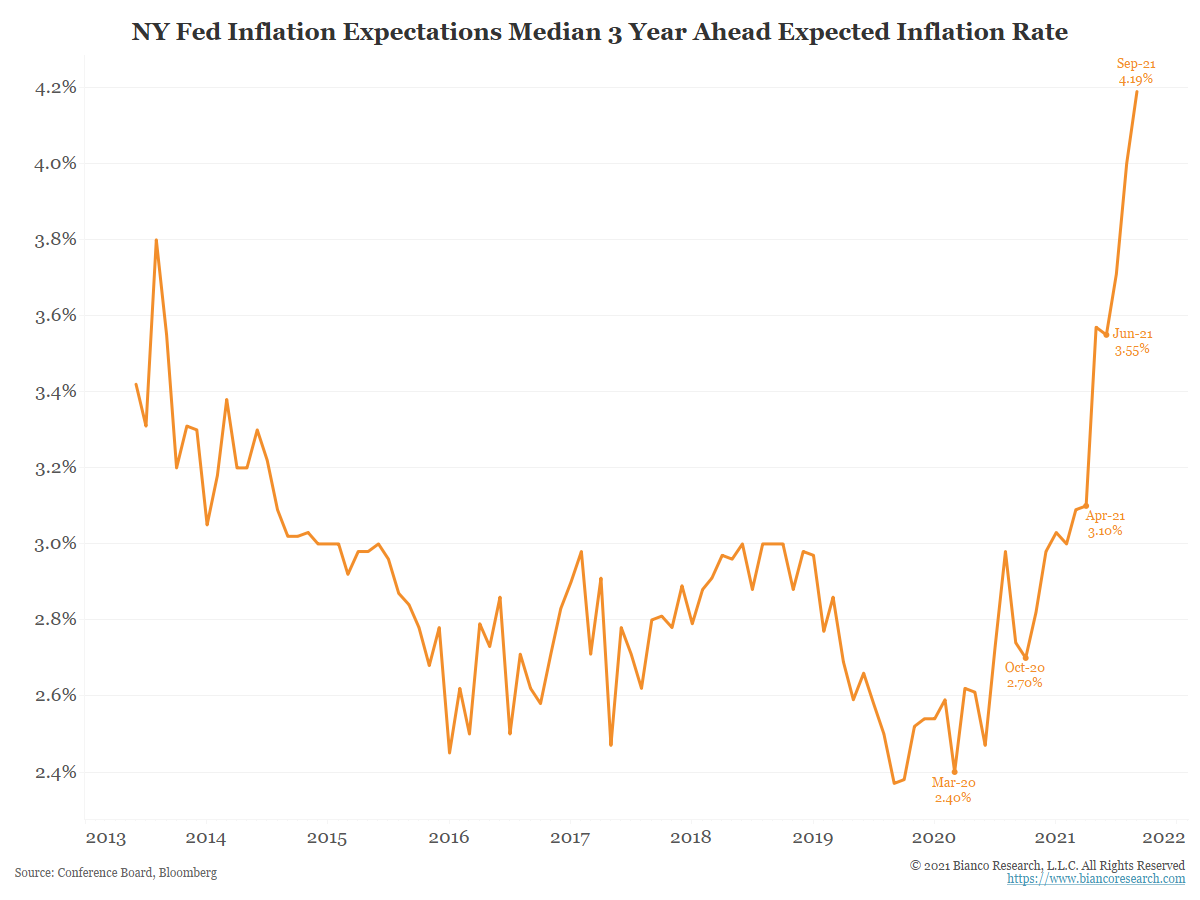

The Week Transitory Inflation Ended

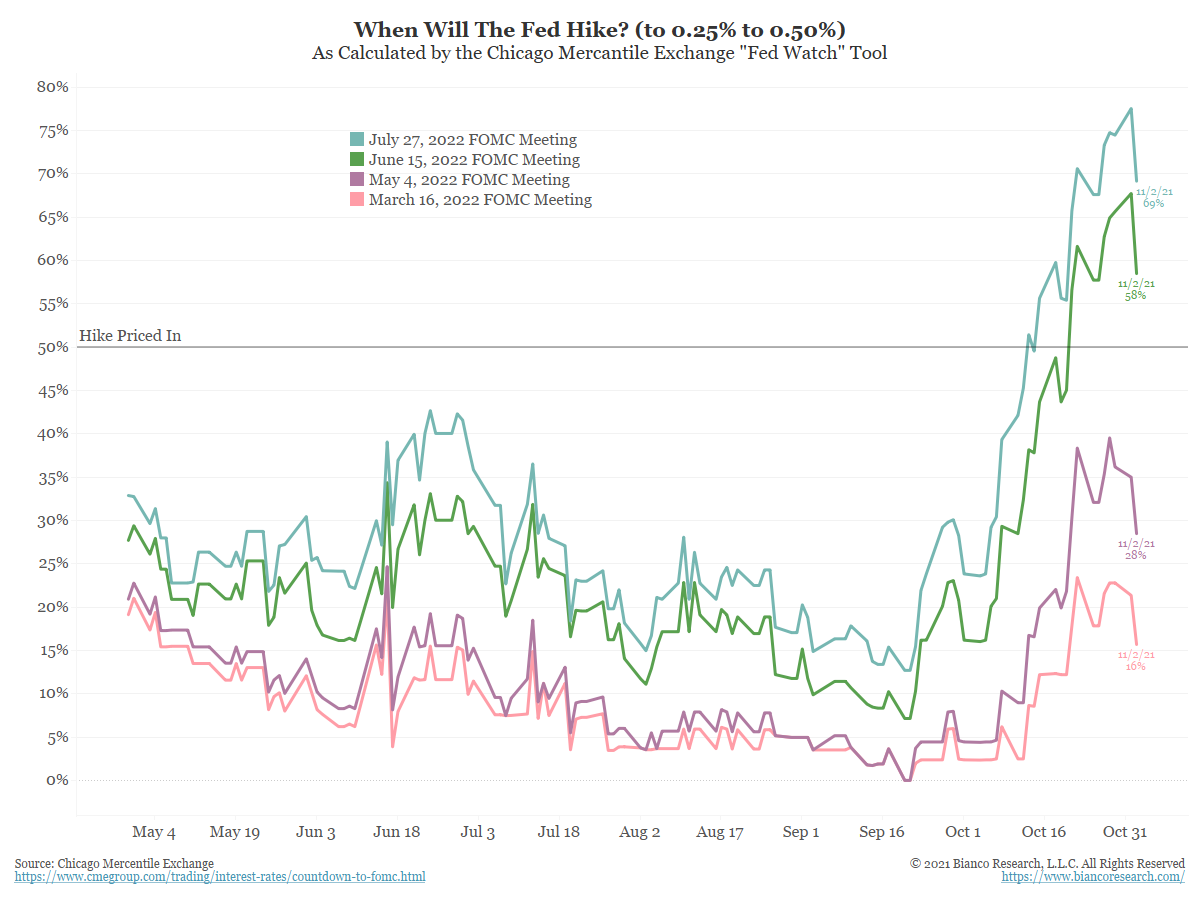

In the last month, markets are pricing in more aggressive tightening monetary policy across the globe, sending short rates higher. This move accelerated in the last week. Is this signaling the end of the “transitory” inflation era?

Conference Calls

What Does The Fed Do Now?

Now that the word transitory has been retired, what does the Fed do next? Do they fight inflation or worry about risk assets? They can’t do both at the same time.

Charts of the Week

October 22nd, 2021

Topics Include:

– Housing Affordability

– The Fed’s Footprint as the Taper Nears

– DeFi Total Value Locked Back at All-Time Highs

– Measuring Regulatory Activity in 2021

– The Fed’s Repo Facility Continues to Attract More Dollars

– An Update on Negative-Yielding Bonds

– LT Outlook: A Look at PE Ratio and Rates

– Weekly Research Roundup

Talking Data Podcast

What If We Get Inflation?

In today’s installment of Talking Data, Jim and Ben discuss whether inflation is becoming persistent, what happens if economic growth moderates, and how the Fed and market might react.