Playing the Earnings Game

Posted By Greg Blaha

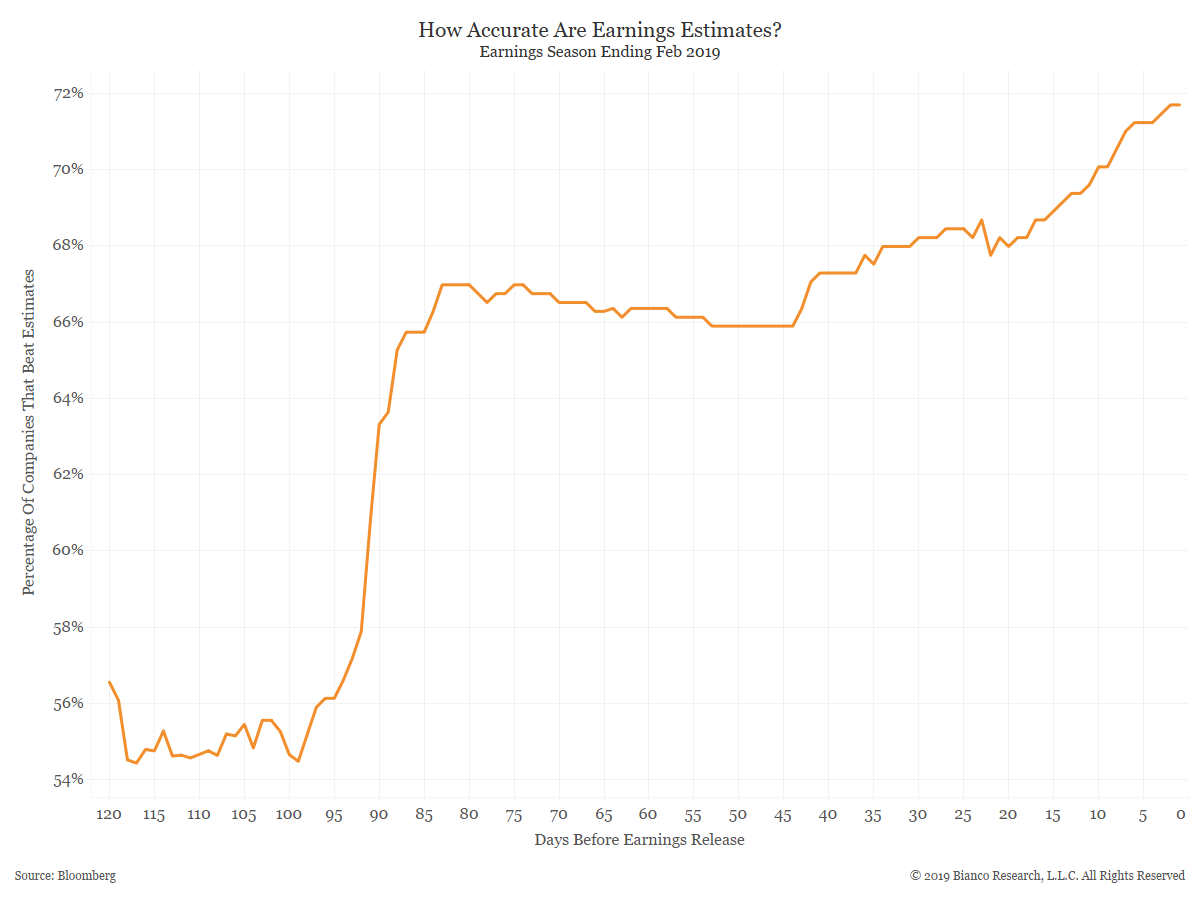

As another earnings season comes to a close, companies have once again successfully guided analysts' expectations low enough to ensure positive results. This is a game that has been perfected over the past decade.... Read More