A Look at the Stock Pickers’ Environment

Posted By Greg Blaha

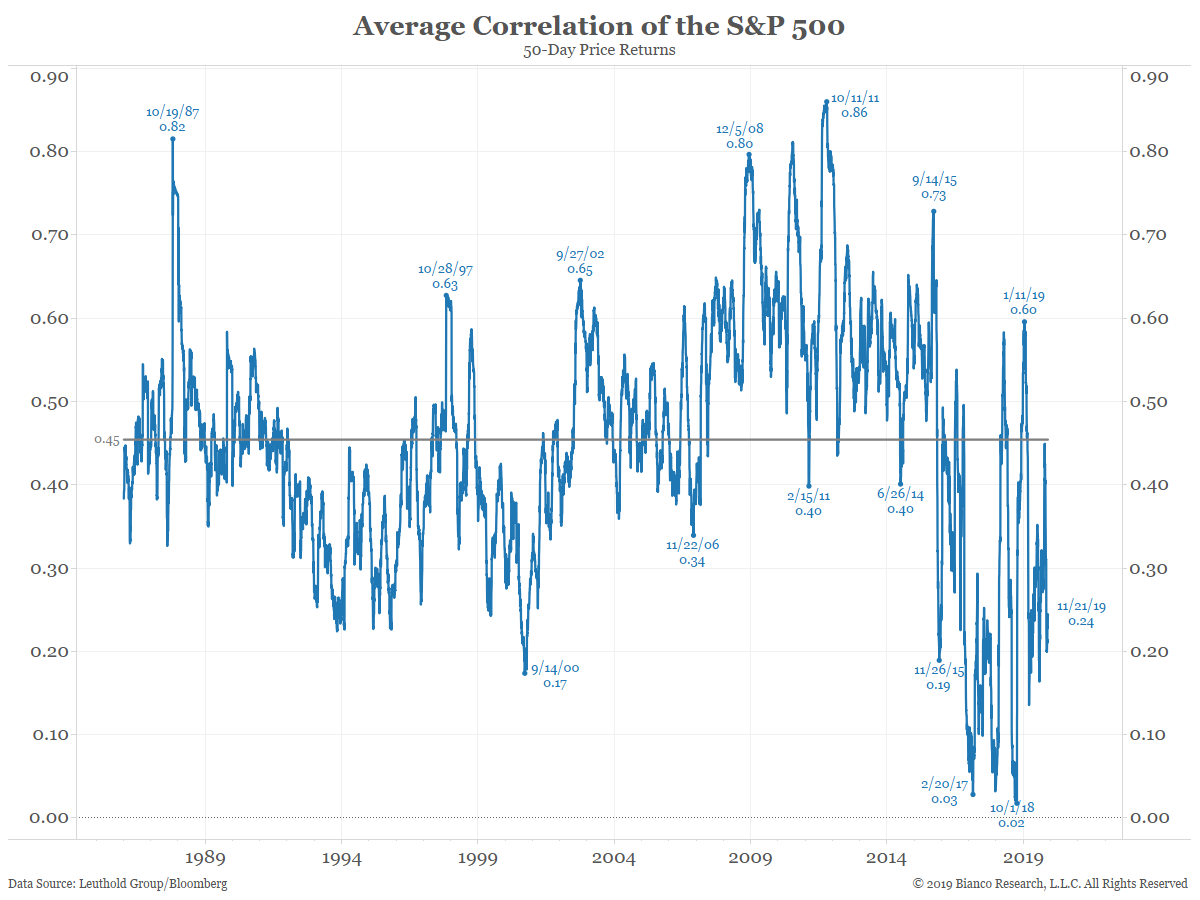

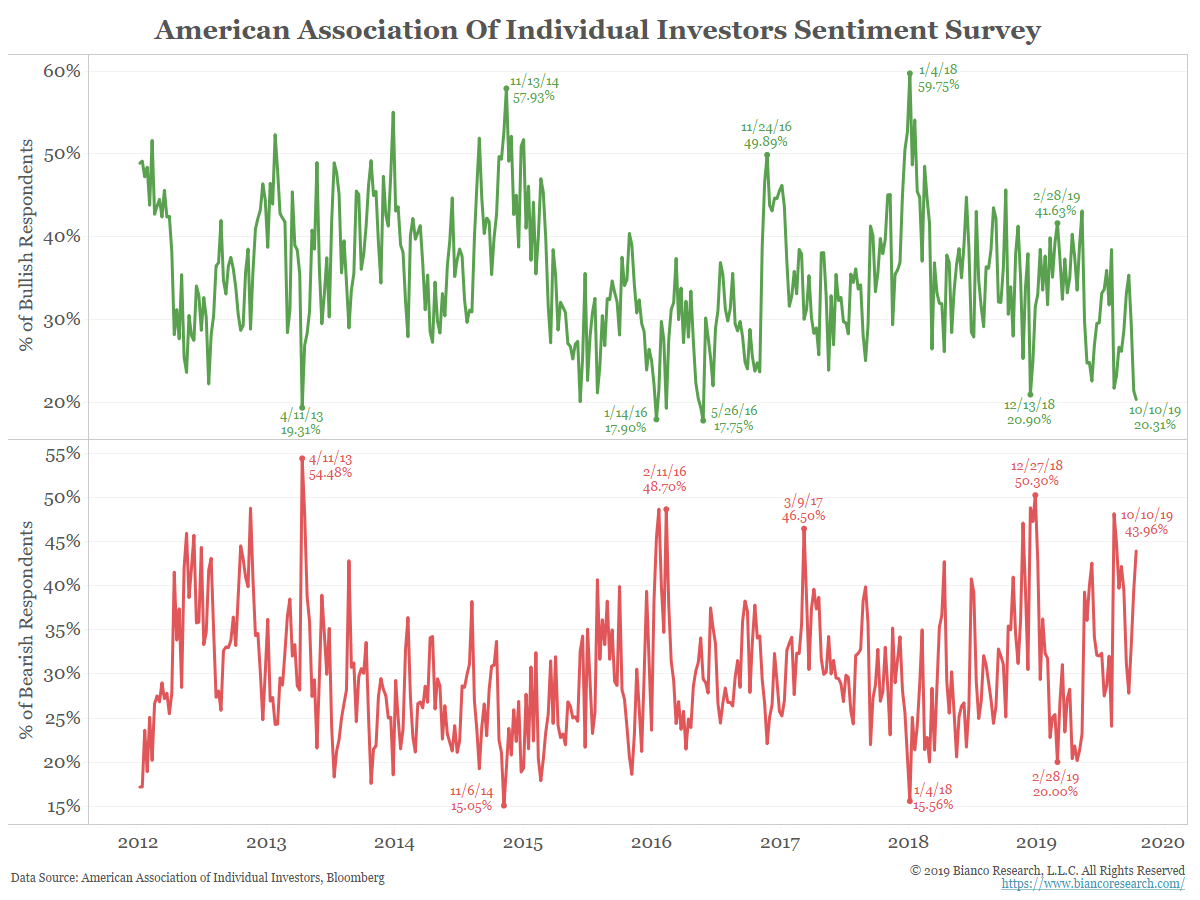

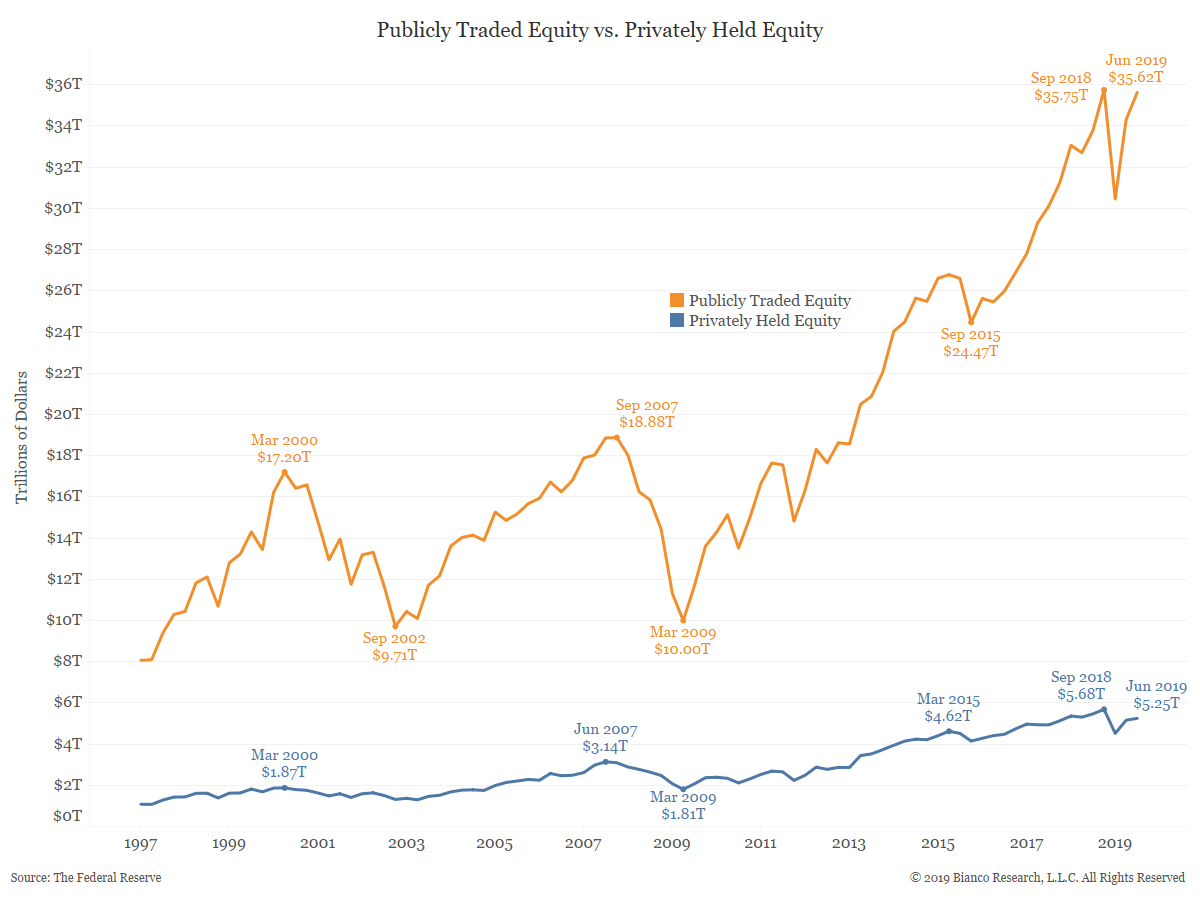

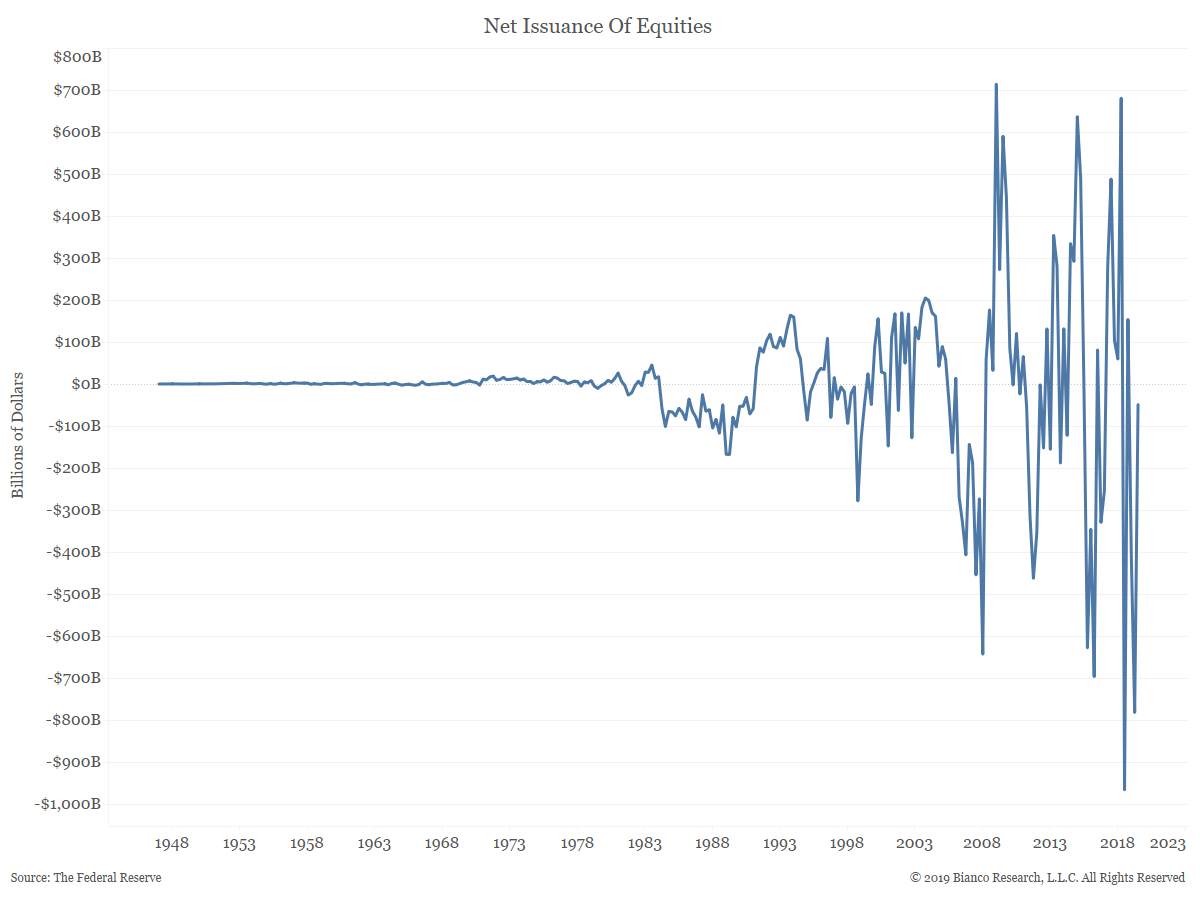

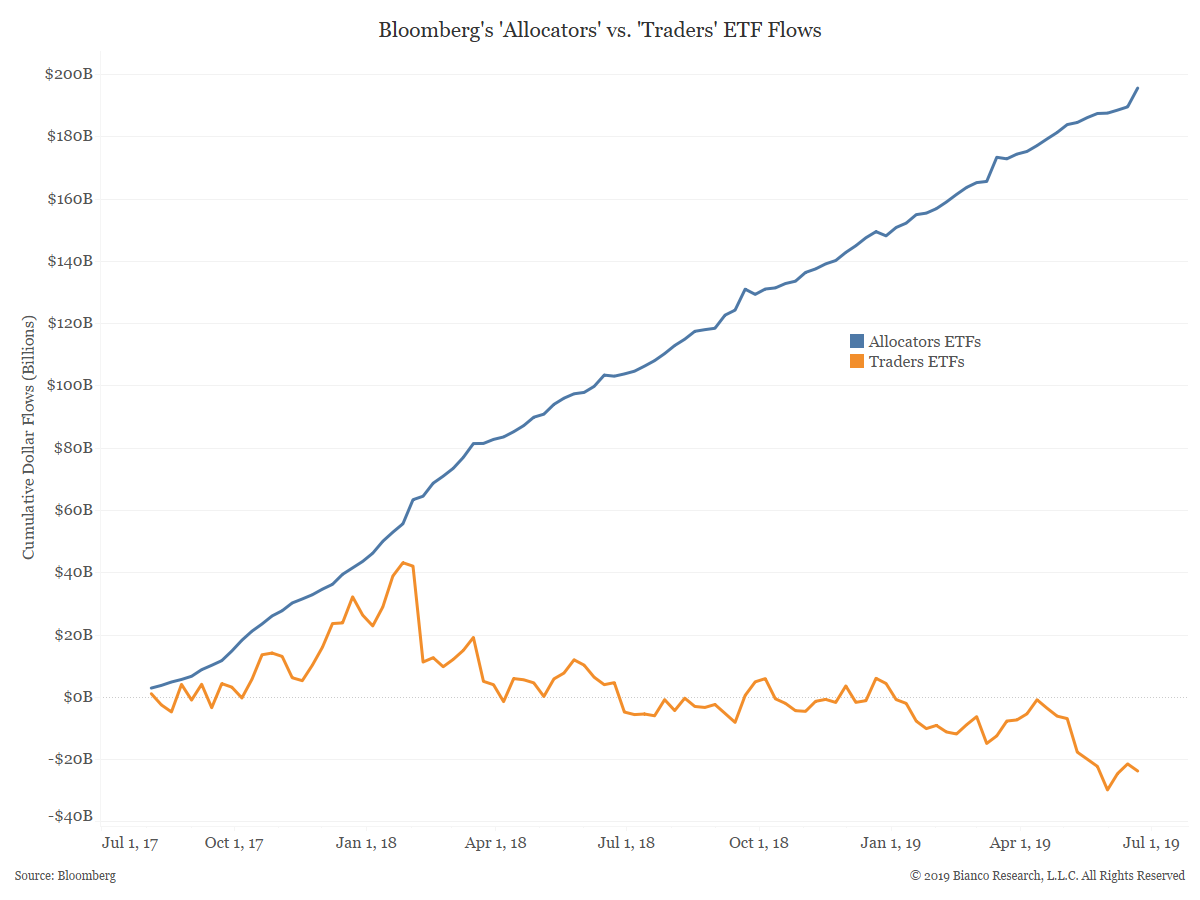

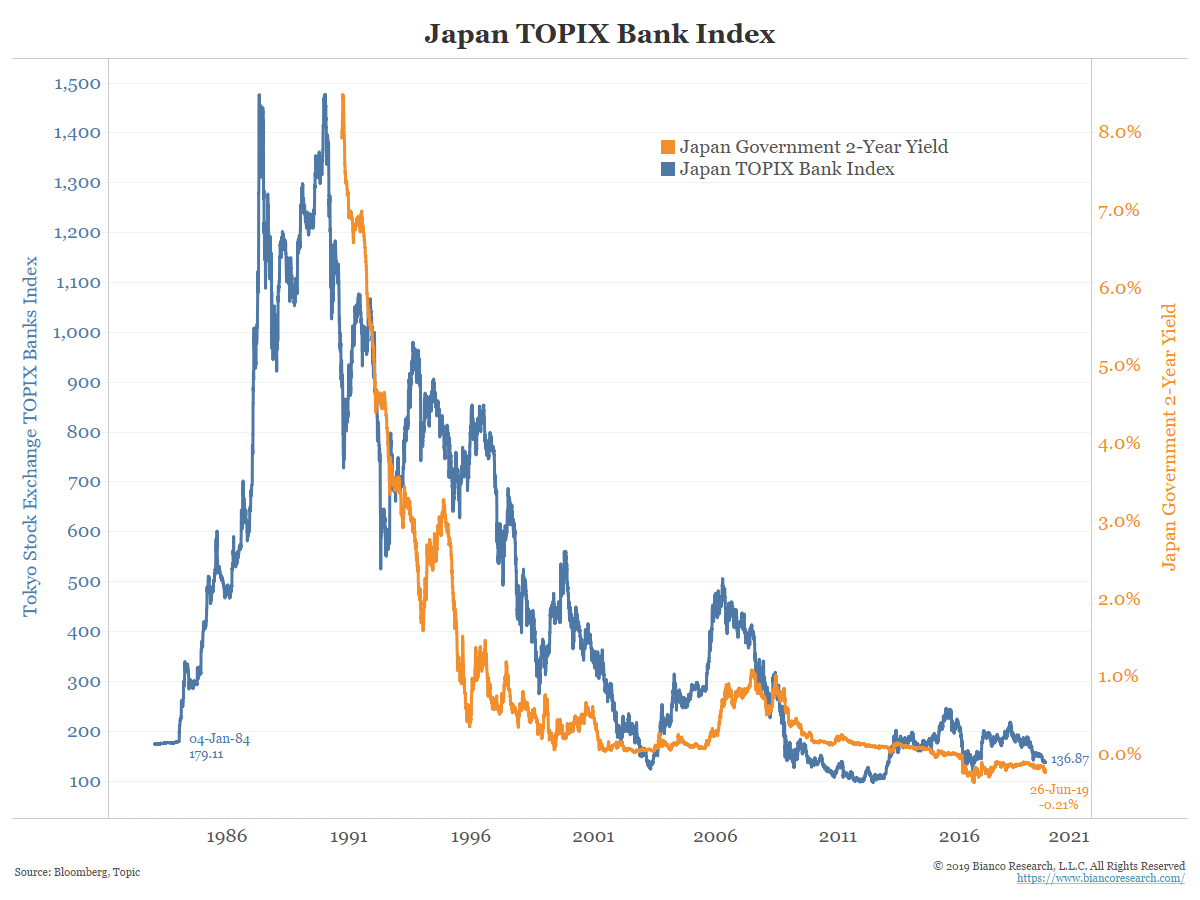

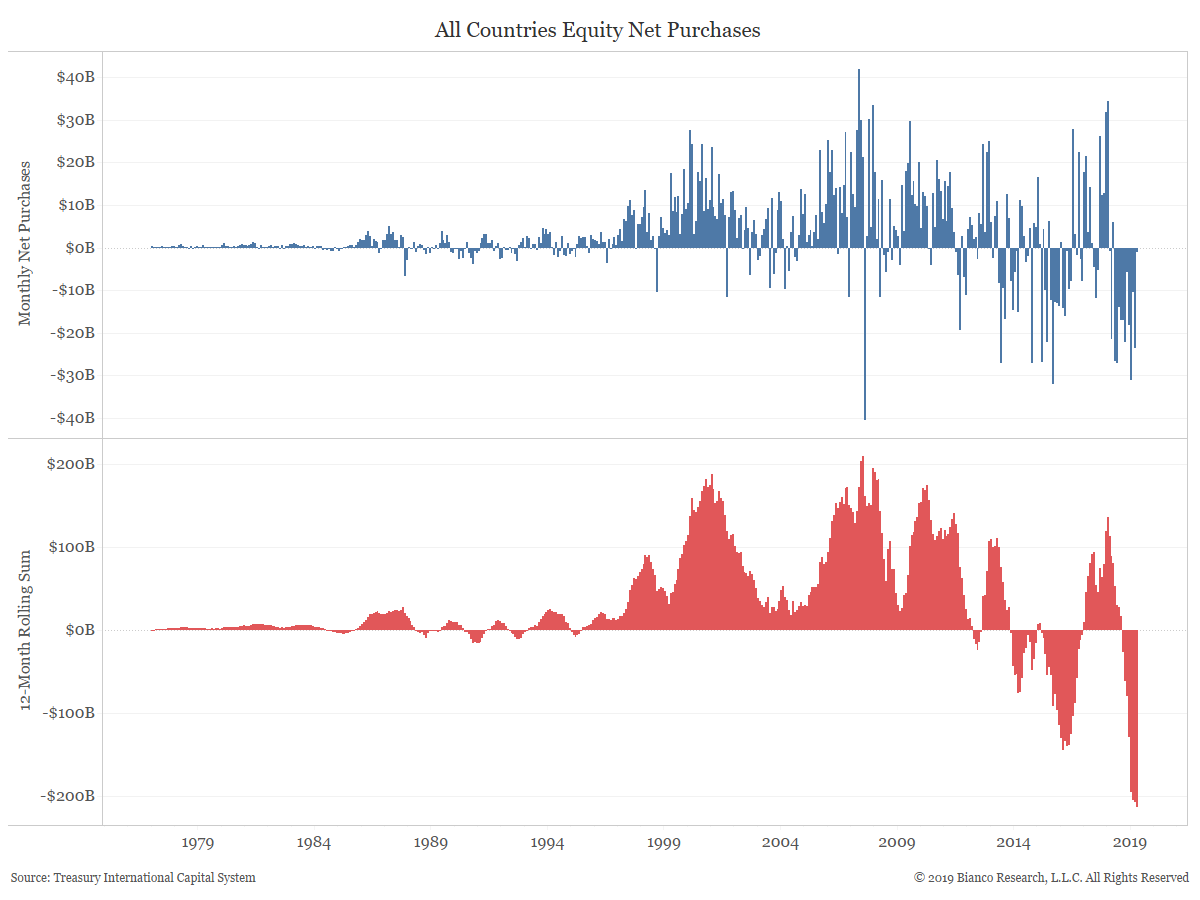

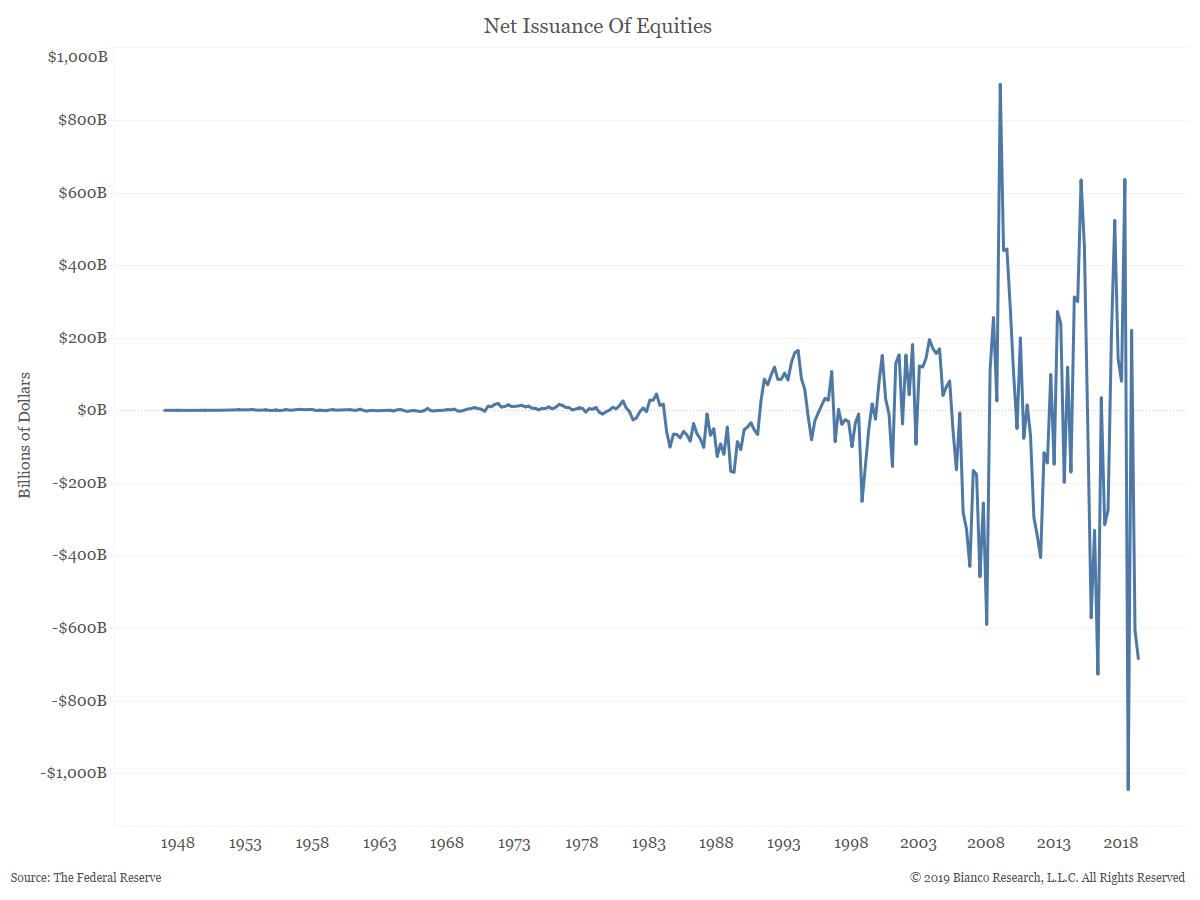

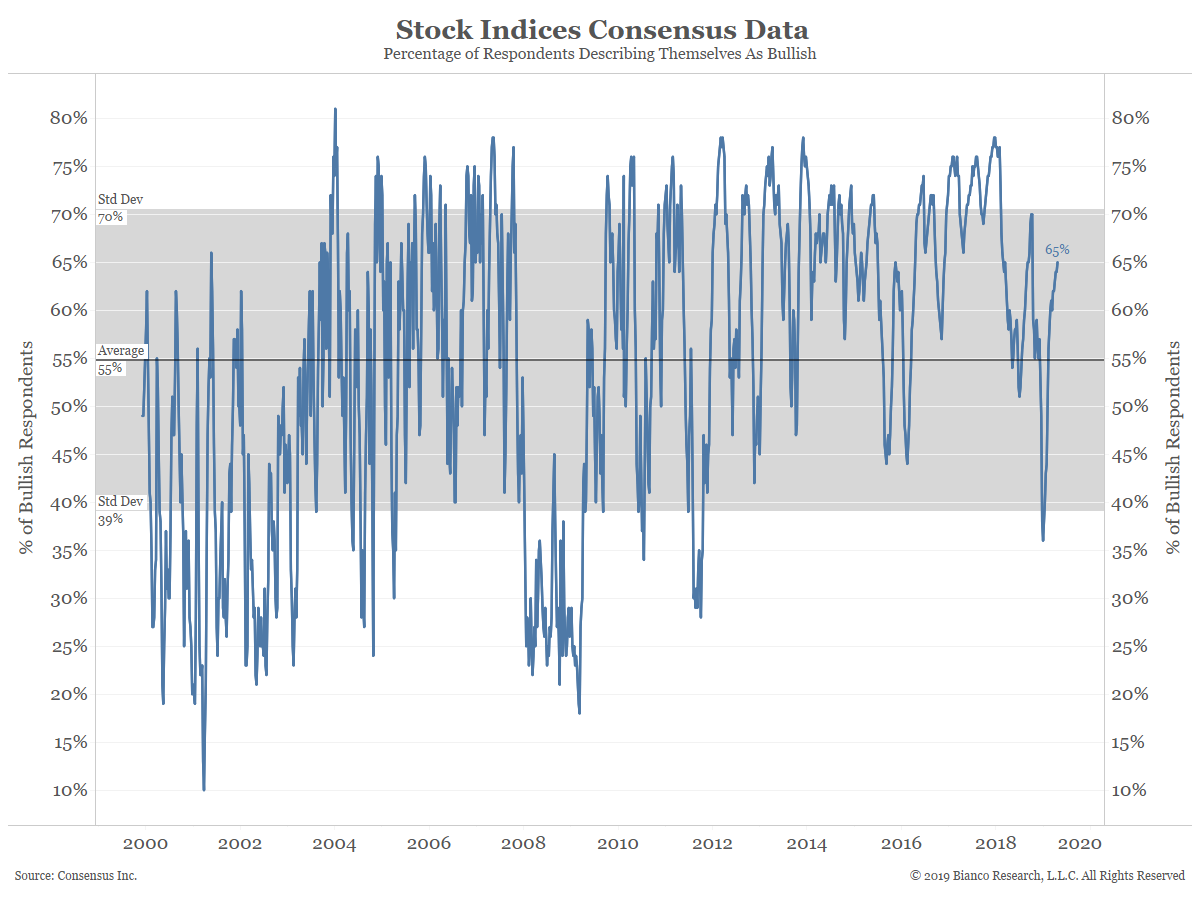

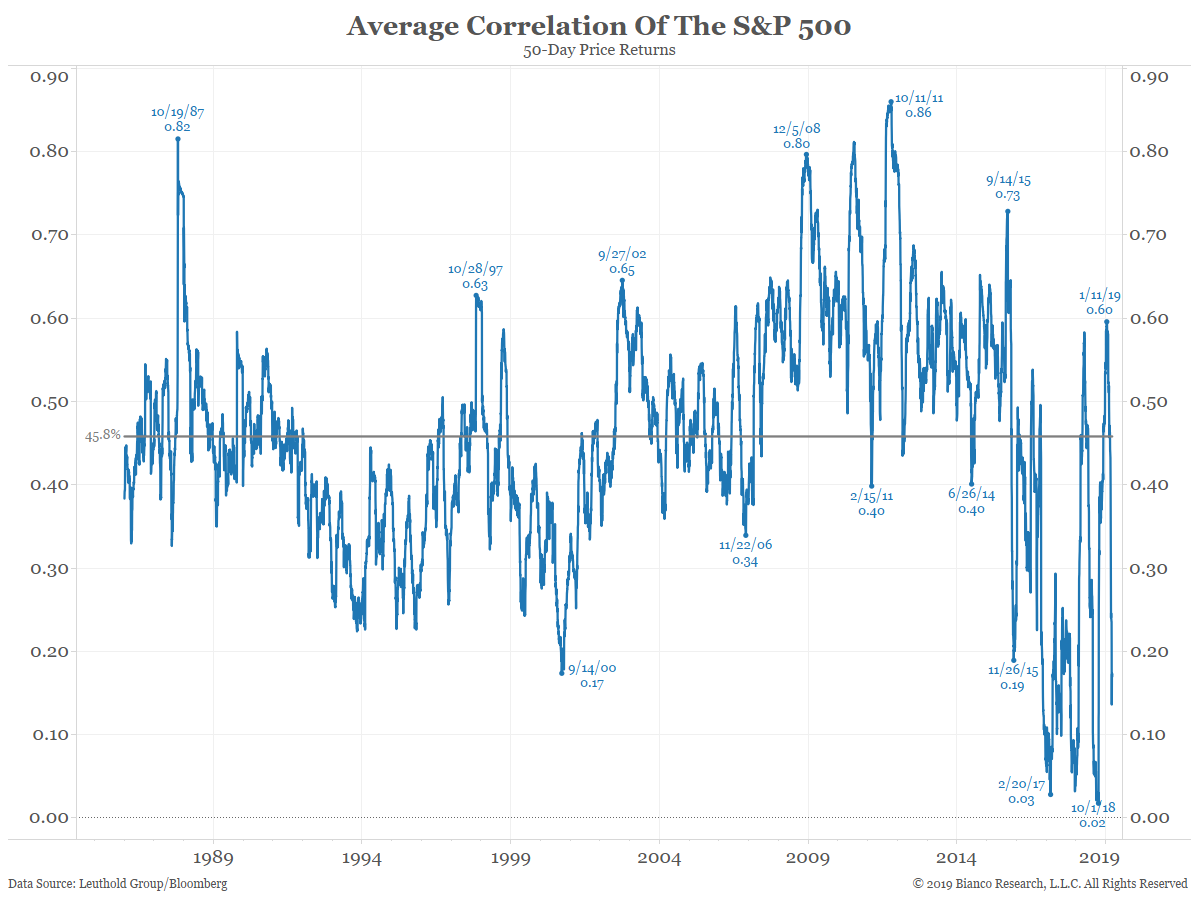

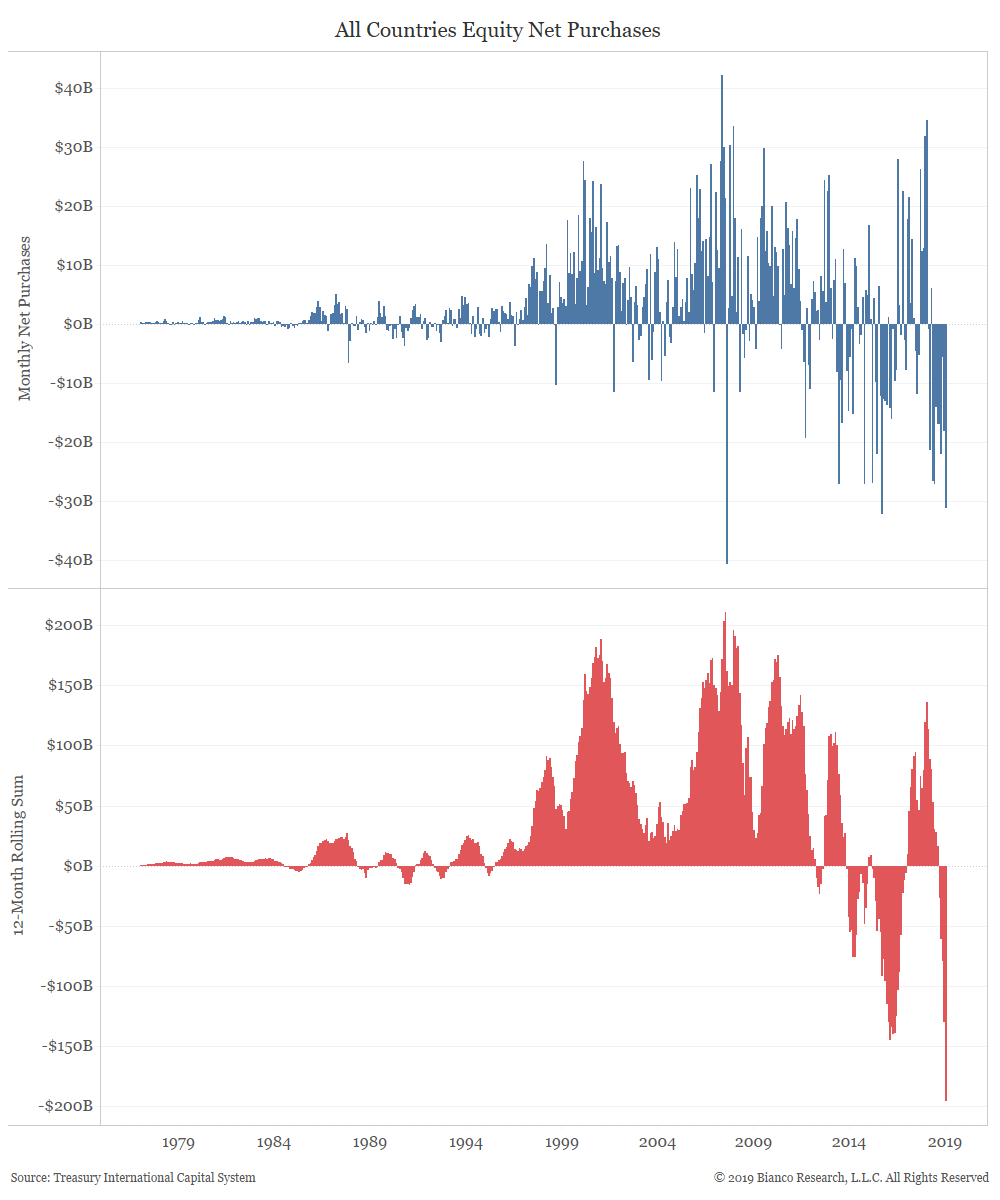

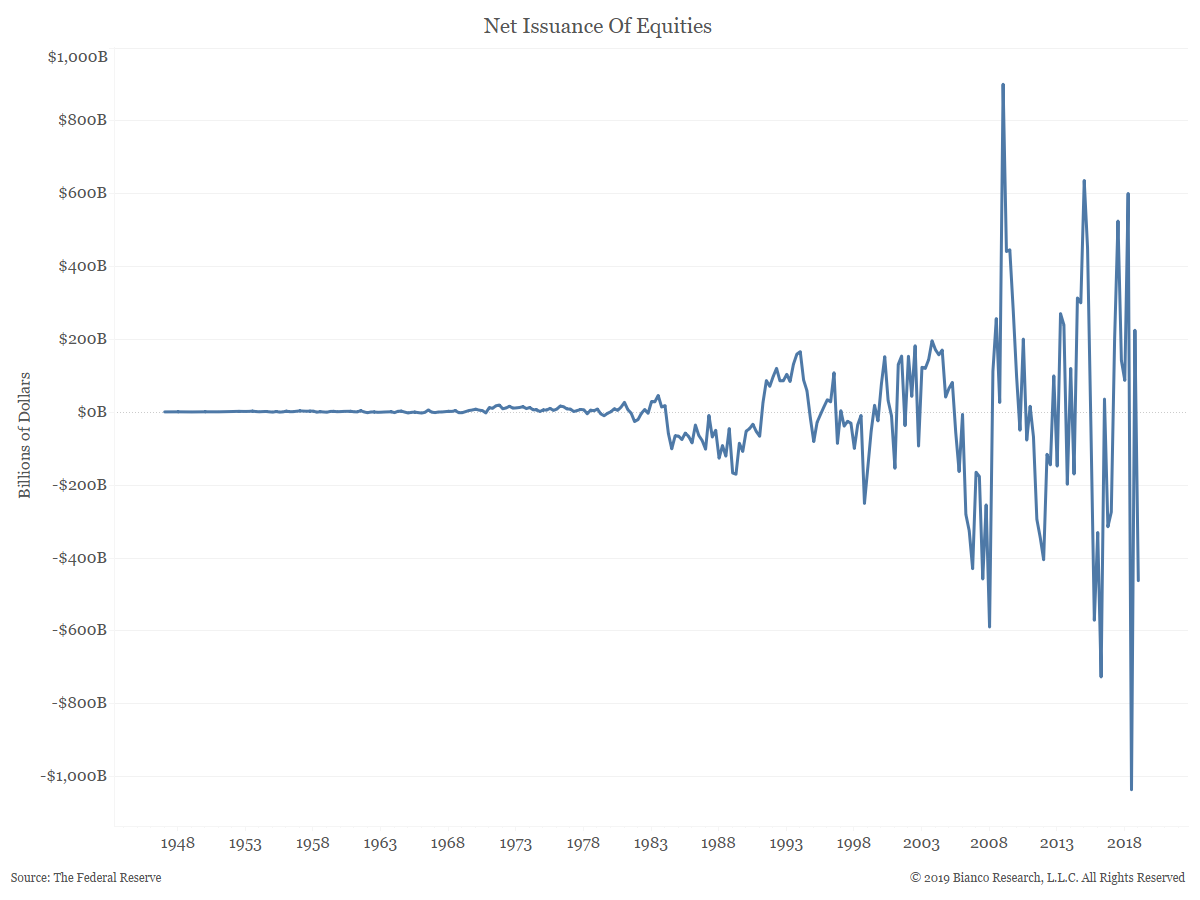

As equities have rallied in 2019, traders have been afforded a better stock picking environment.... Read More