The Era of Stocks Splits Is Ending

Posted By Alex Malitas

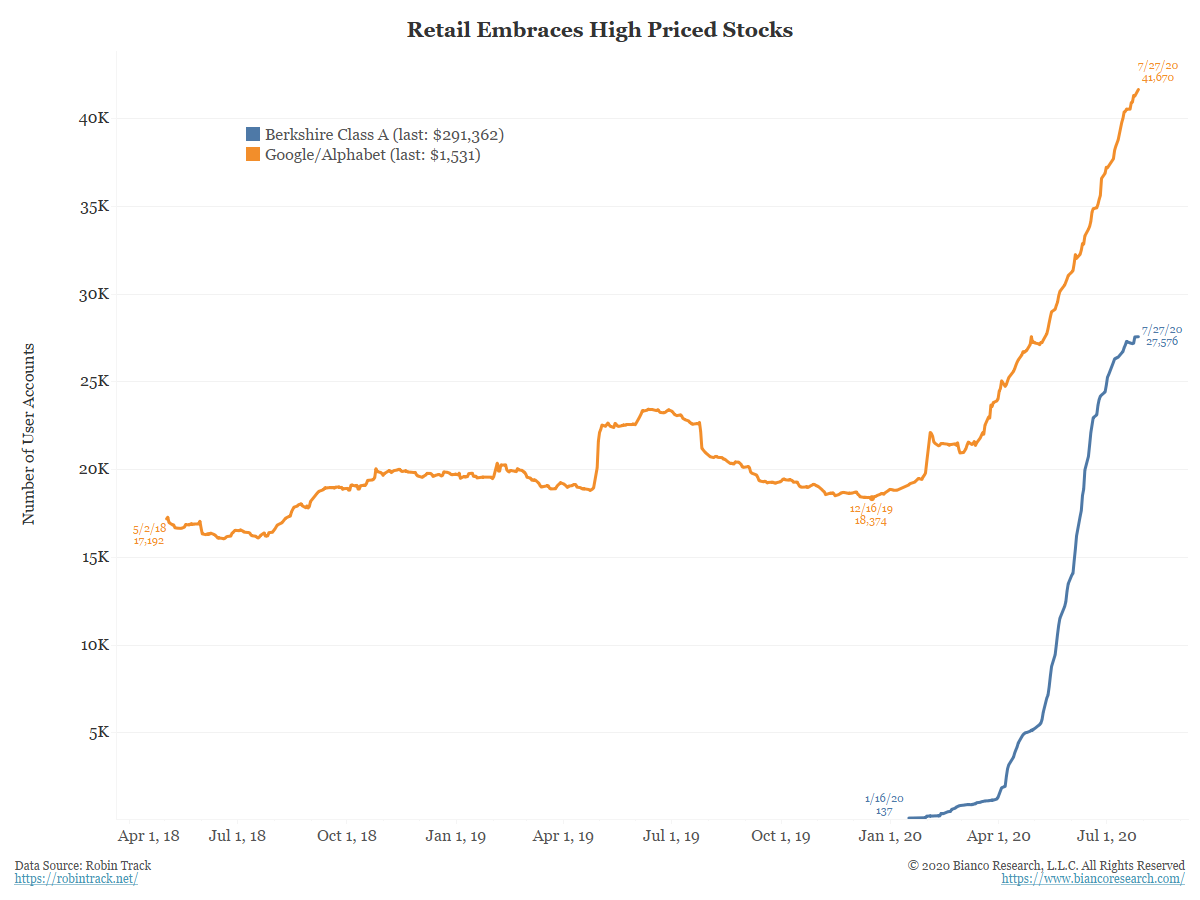

Yesterday Apple announced something rare, a stock split. In an era of zero commissions and fractional share purchases, stock splits are disappearing.... Read More