Risks Growing as Investors Rush Back into Brazil

Posted By Peter Forbes

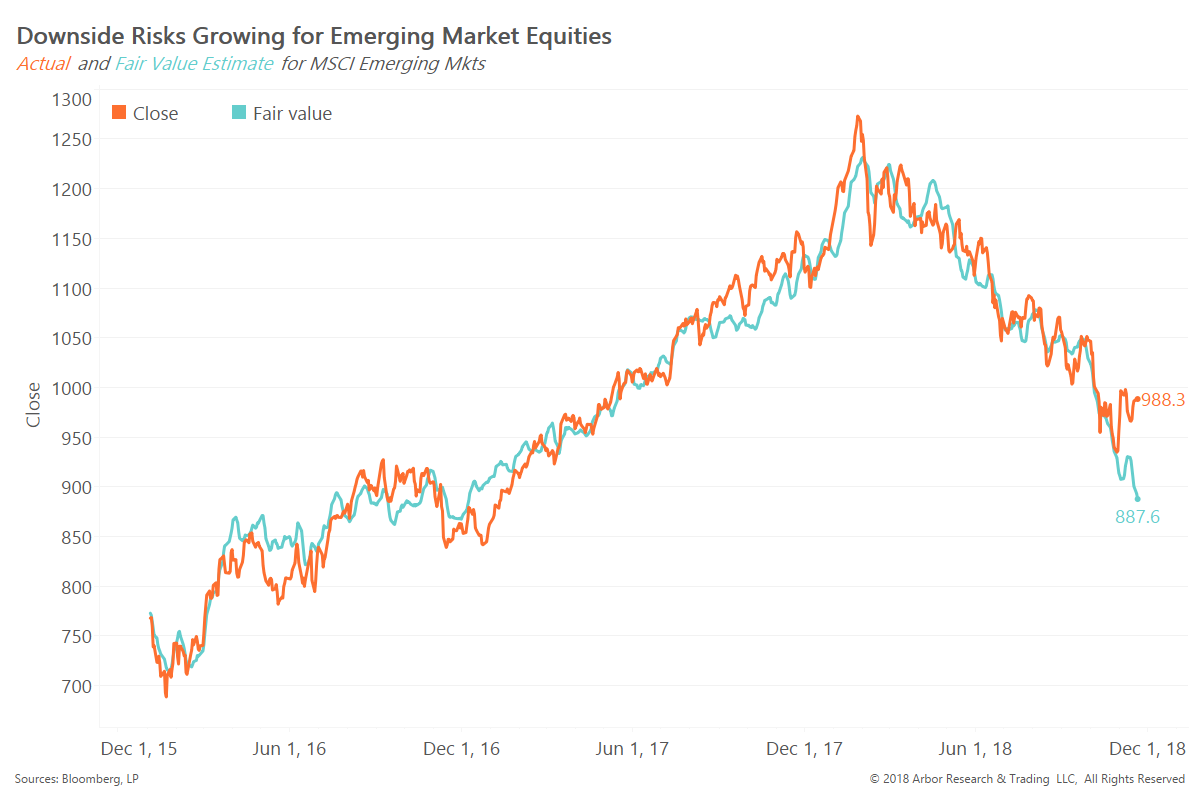

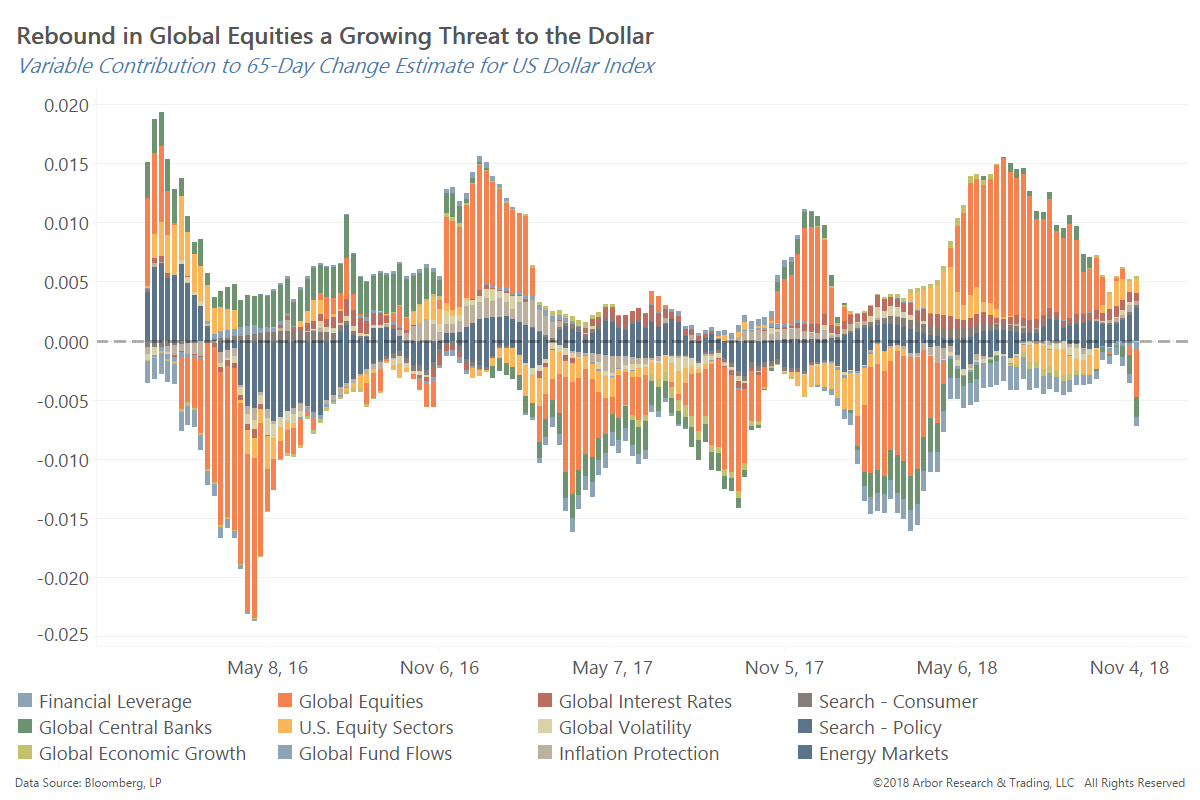

Investors are buying into a bounce in emerging market equities, especially in Brazil. Their faith may be tested as we see growing risks from global fund flows and U.S. dollar strength. ... Read More