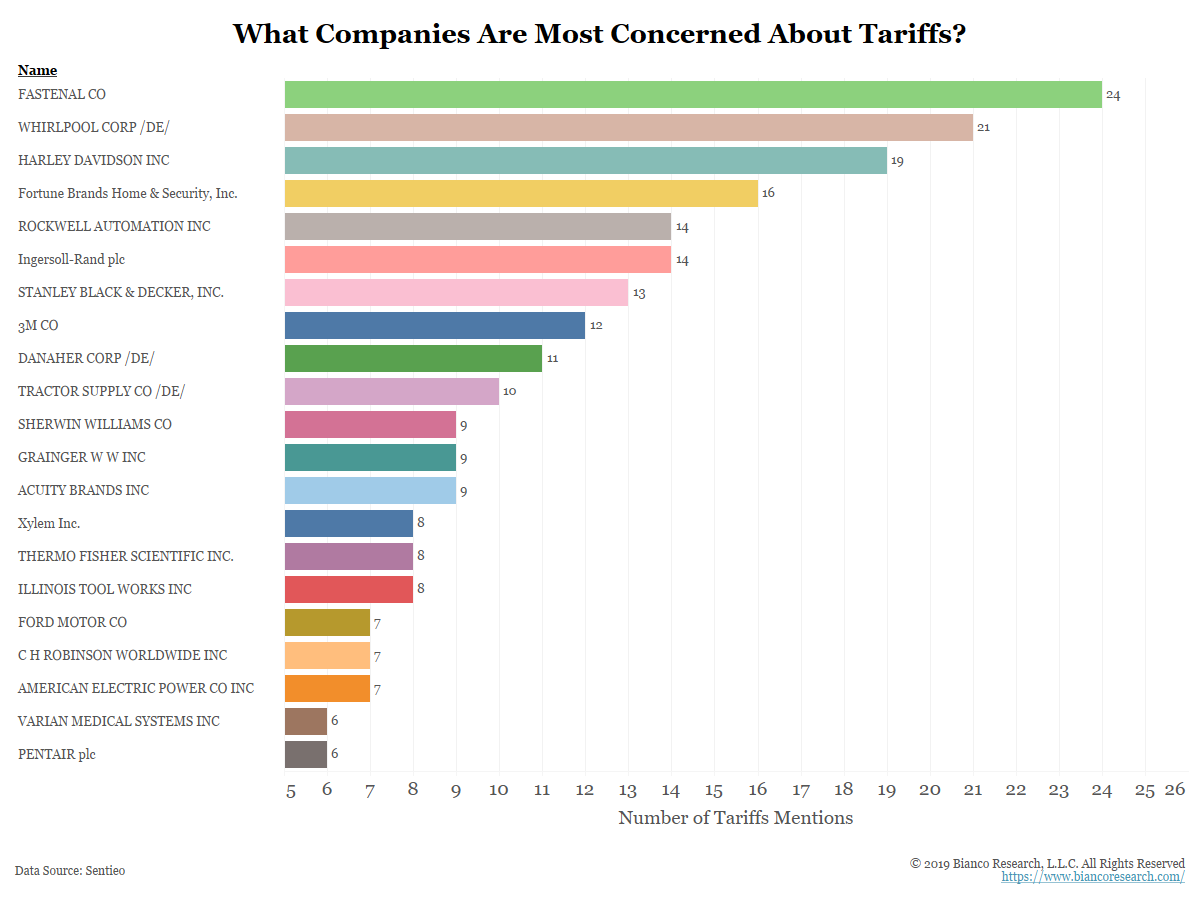

Companies Not Worried About Tariffs as March 2 Deadline Looms

Posted By Jim Bianco

Ahead of the March 2 deadline, the media continues to hyperventilate about the trade war. The vast majority of S&P 500 companies do not share the same level of concern.... Read More