Tag Archives: Markets

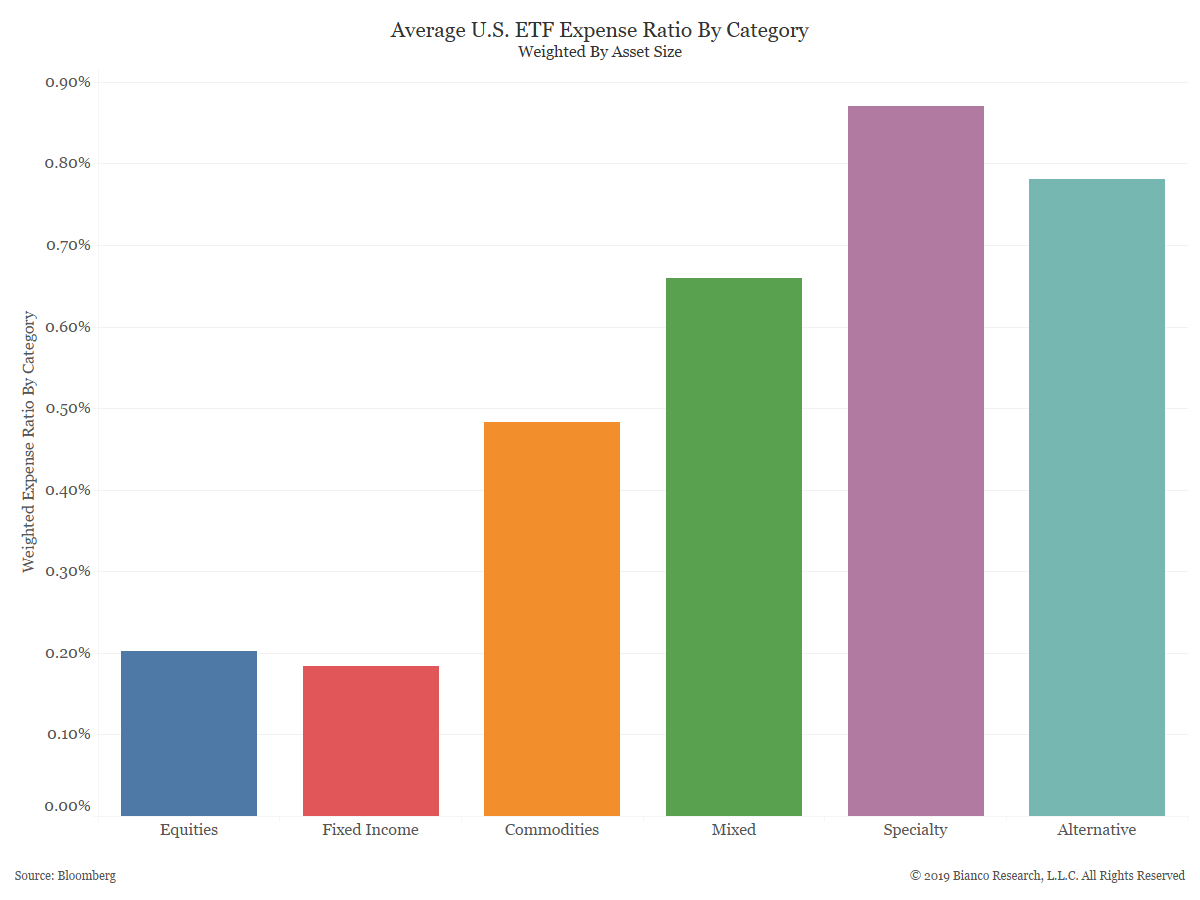

A Glimpse of the ETF Industry

Posted By Greg Blaha

A quick glimpse of the ETF industry... Read More

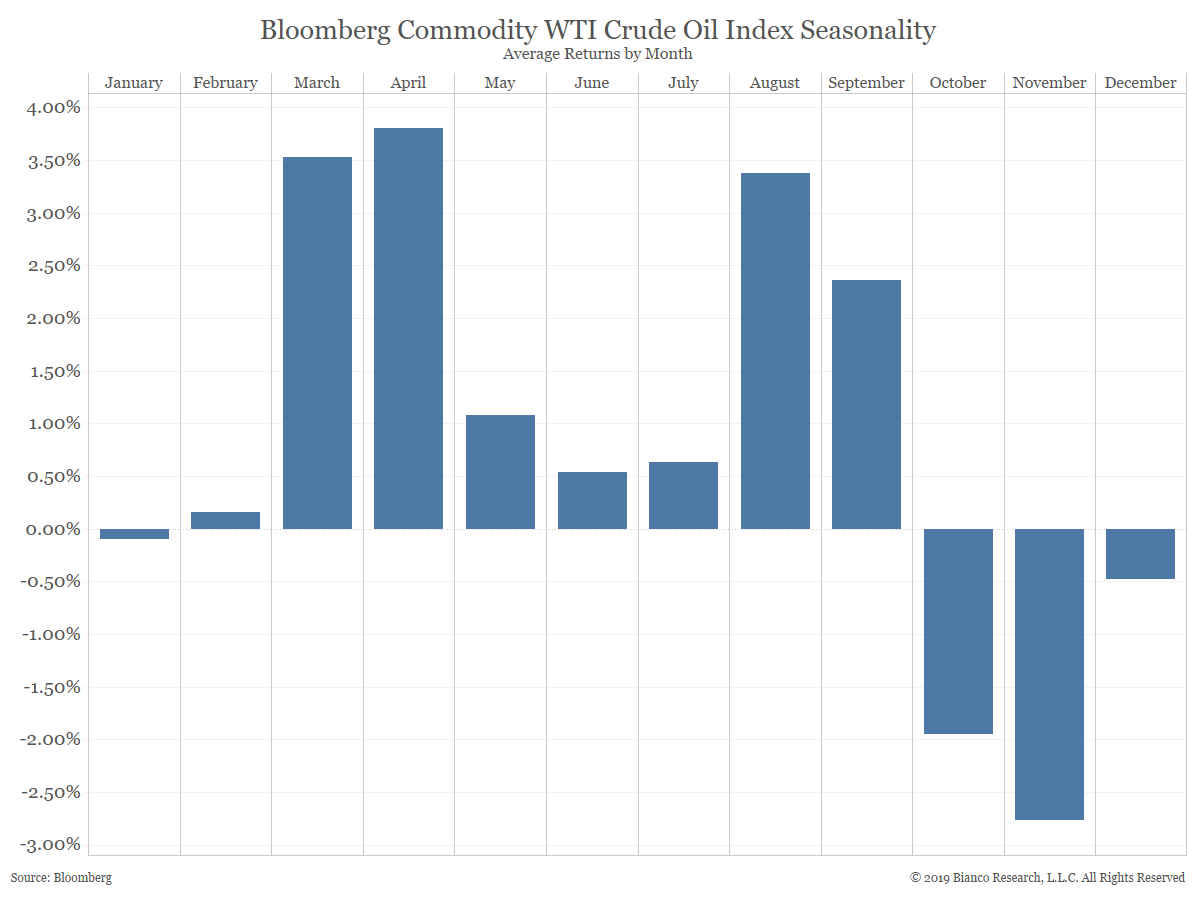

Seasonal Trends Worth Noting

Posted By Greg Blaha

As March approaches, we point out a couple seasonal trends worth noting.... Read More

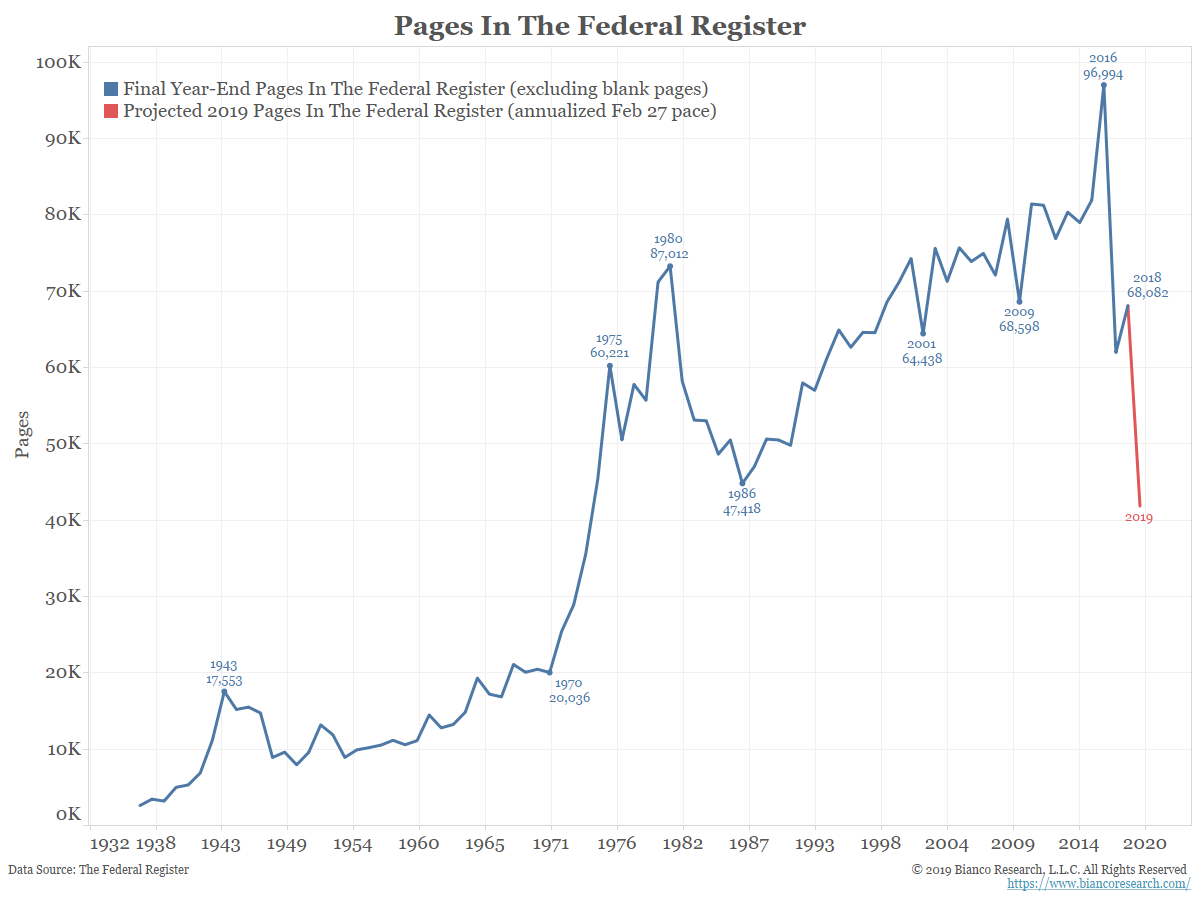

Washington D.C. Gets Back to Work

Posted By Greg Blaha

Now that politicians have been back to work for a month, the pace of regulatory activity has picked up some. However, the projected number of pages in the Federal Register at year-end 2019 are still well below 2018 levels.... Read More

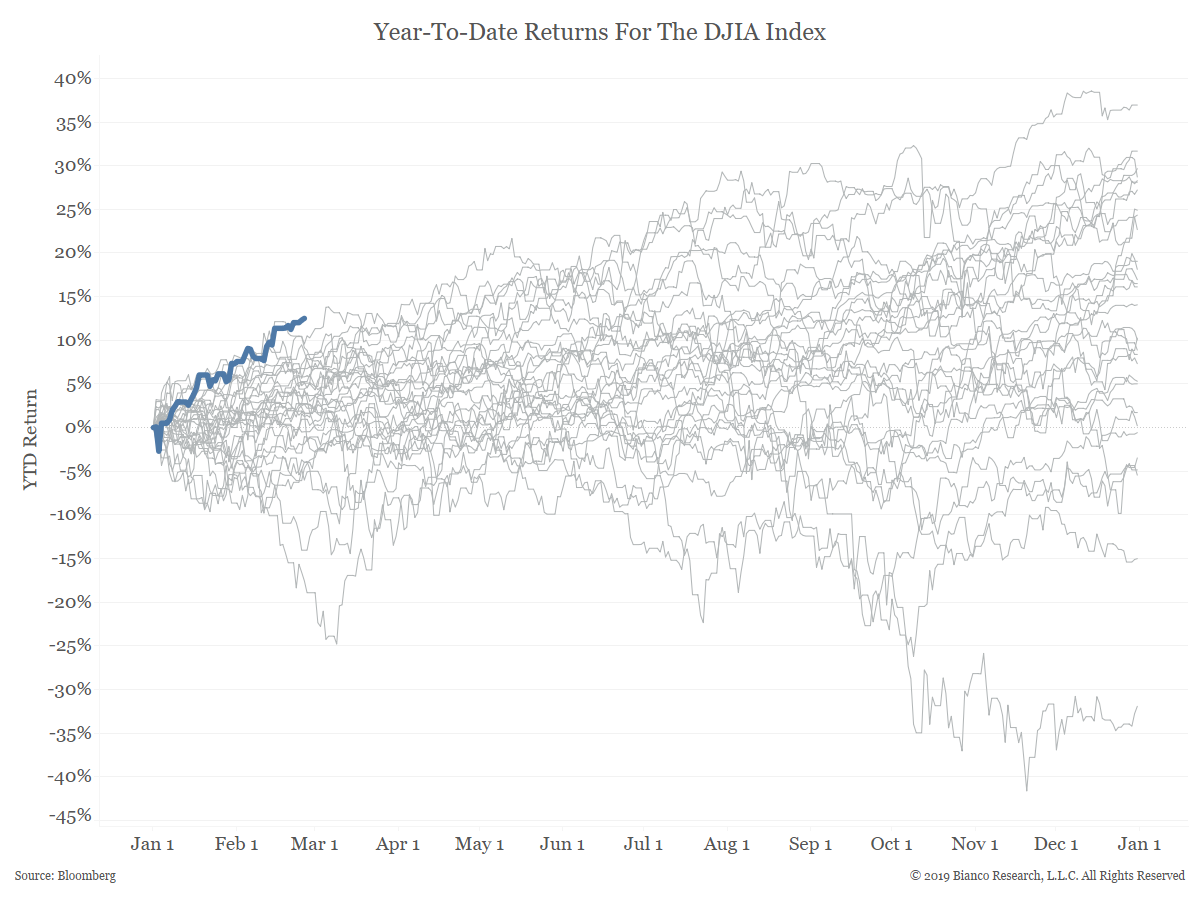

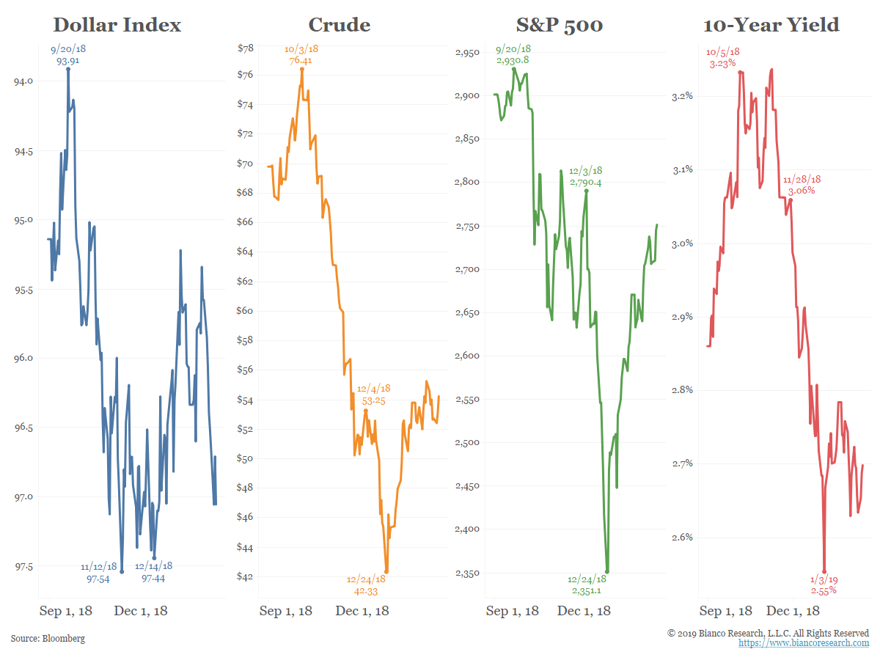

Stocks & Crude Oil Off to Hot Start in 2019

Posted By Greg Blaha

Stocks and crude oil are off to fast starts in 2019.... Read More

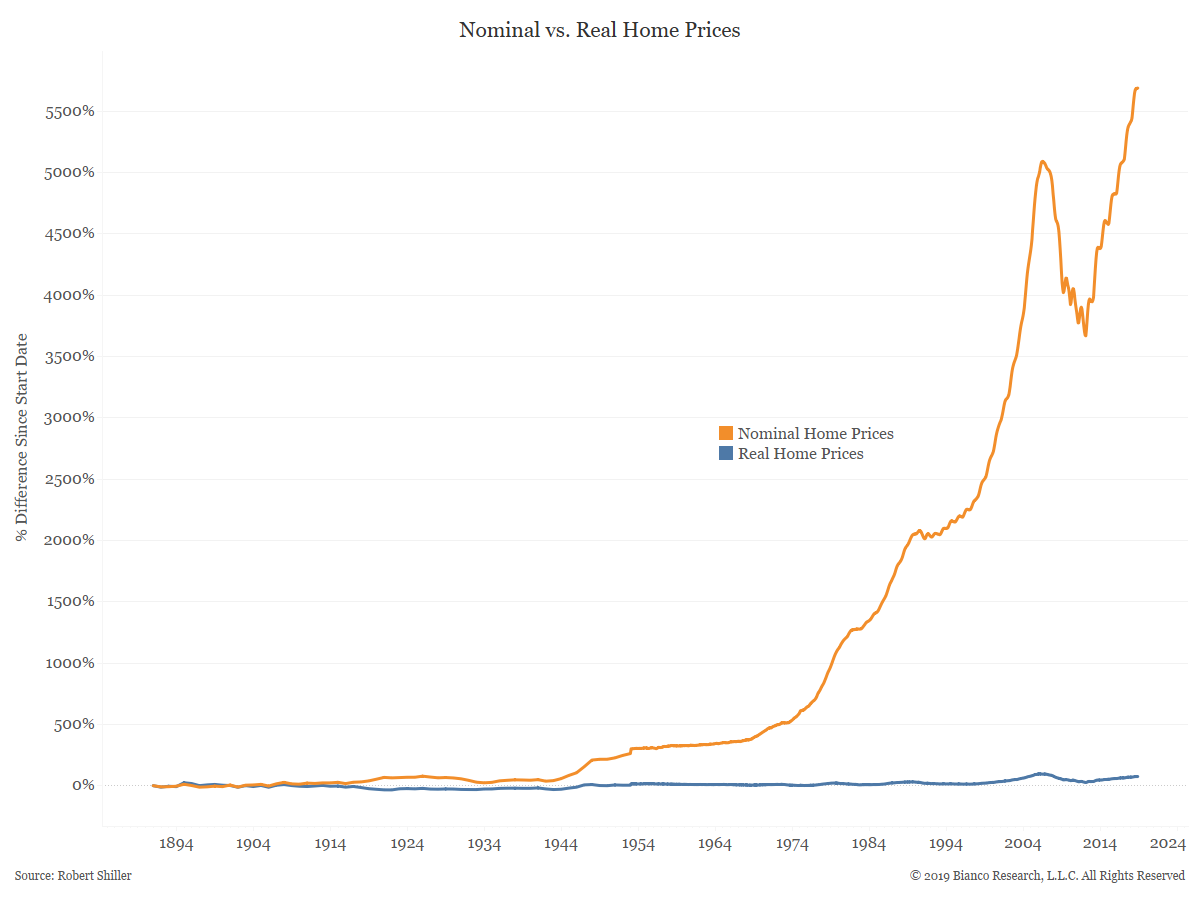

LT Outlook: Inflation Takes a Bite Out of Home Appreciation

Posted By Greg Blaha

For those who include their homes as part of their retirement portfolio, consider the bite inflation takes out of any price appreciation.... Read More

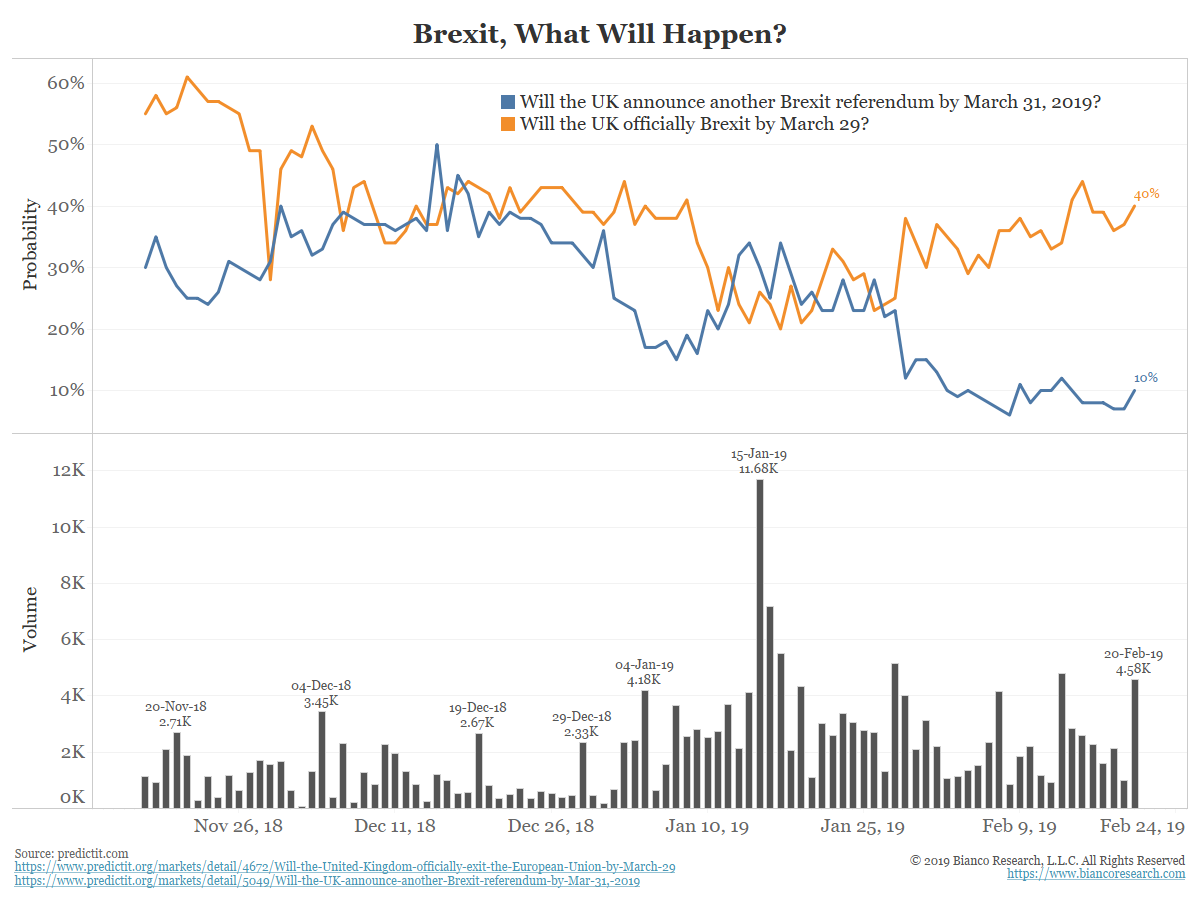

Brexit: Markets and Bettors Disagree

Posted By Jim Bianco

While the news and betting markets remain concerned over a no-deal exit on March 29, the UK markets are rallying on the hopes of a deal to exit or an extension.... Read More

A Review of Why a Retest Is Likely

Jim Bianco commented on why a retest is likely in a recent conference call.... Read More

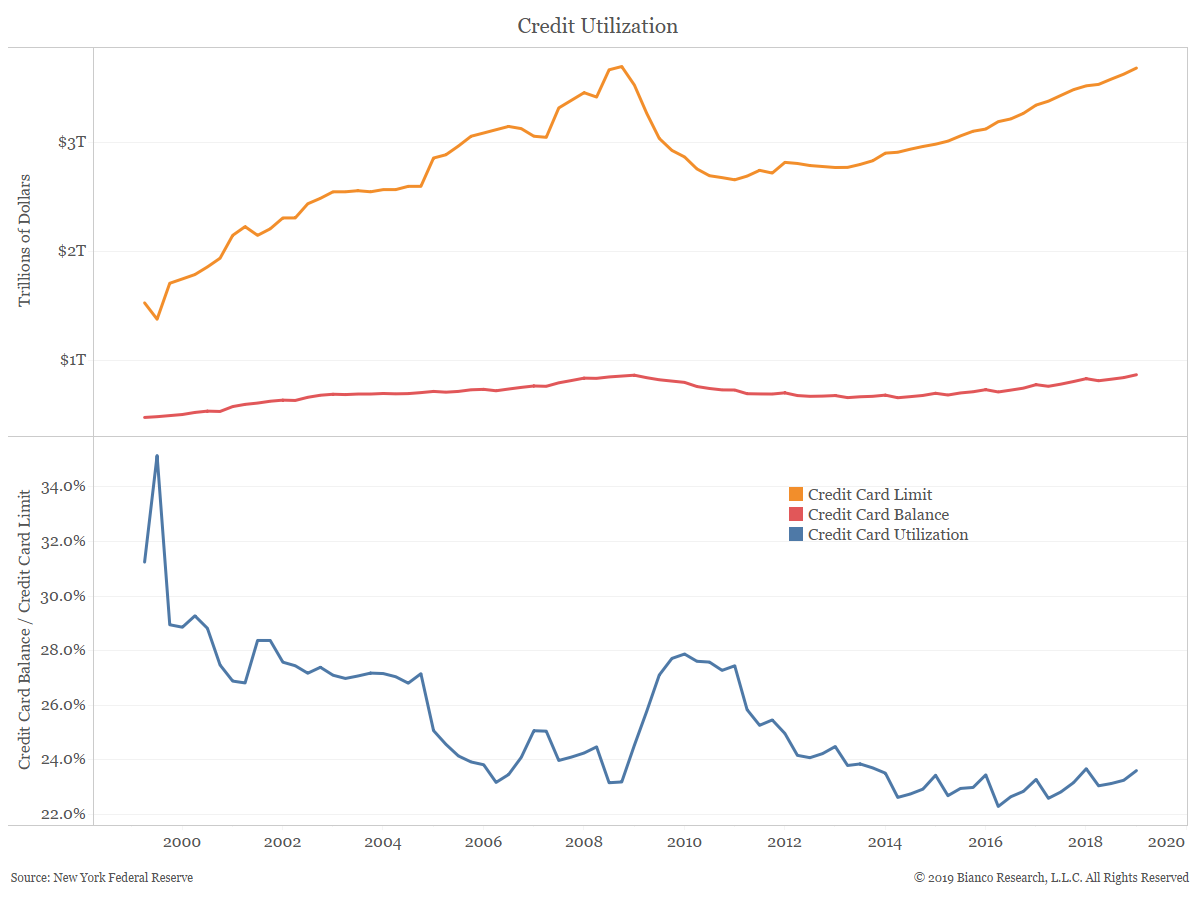

Consumers Use 24% of Credit Limit

Posted By Greg Blaha

Credit limits in the U.S. have regained pre-crisis levels, but utilization rates remain low.... Read More

Student Loan Debt Has Tripled Since 2005

Posted By Greg Blaha

Since 2005, student loan debt has grown at an astronomical rate.... Read More

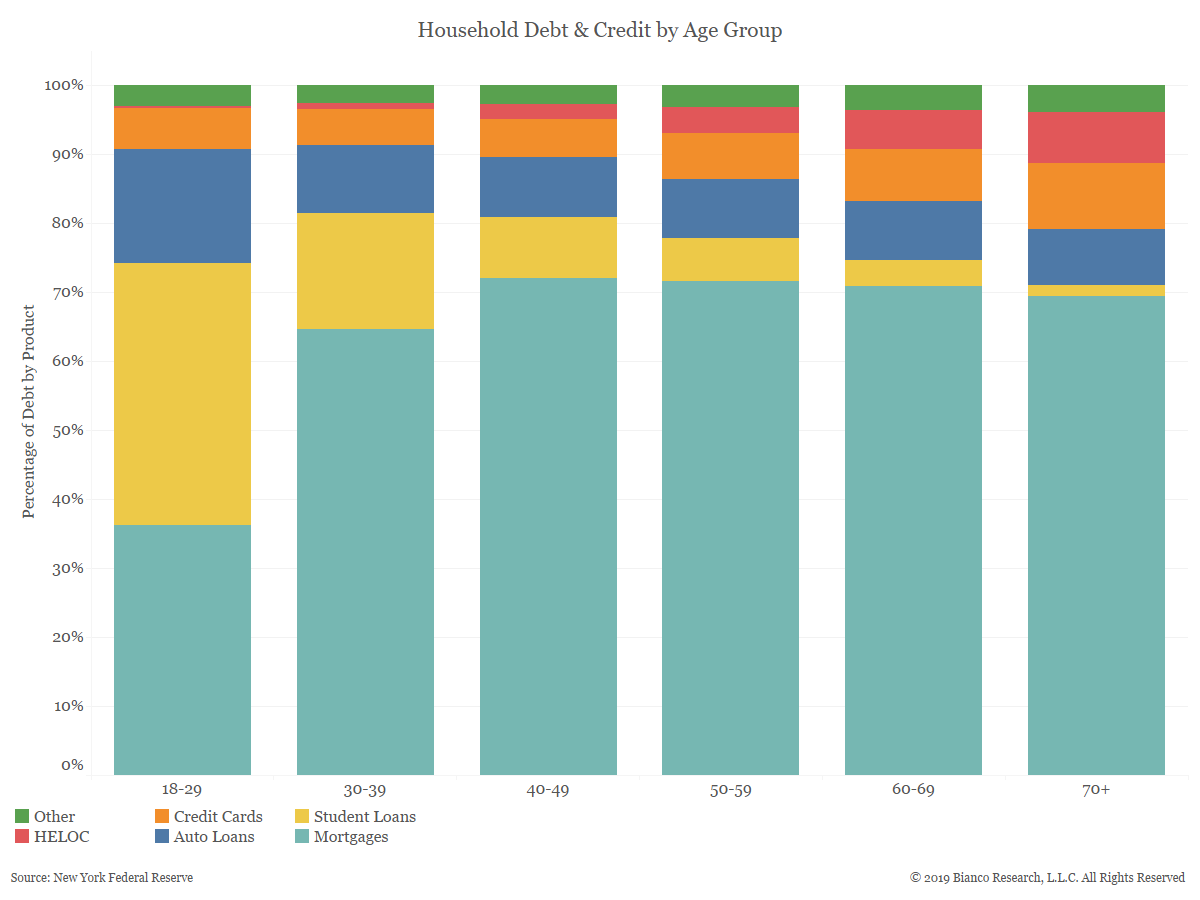

Breaking Down Household Debt by Age Group

Posted By Greg Blaha

People under 30 hold a relatively small amount of debt compared to other age groups. Student loans make up the largest portion of their debt.... Read More

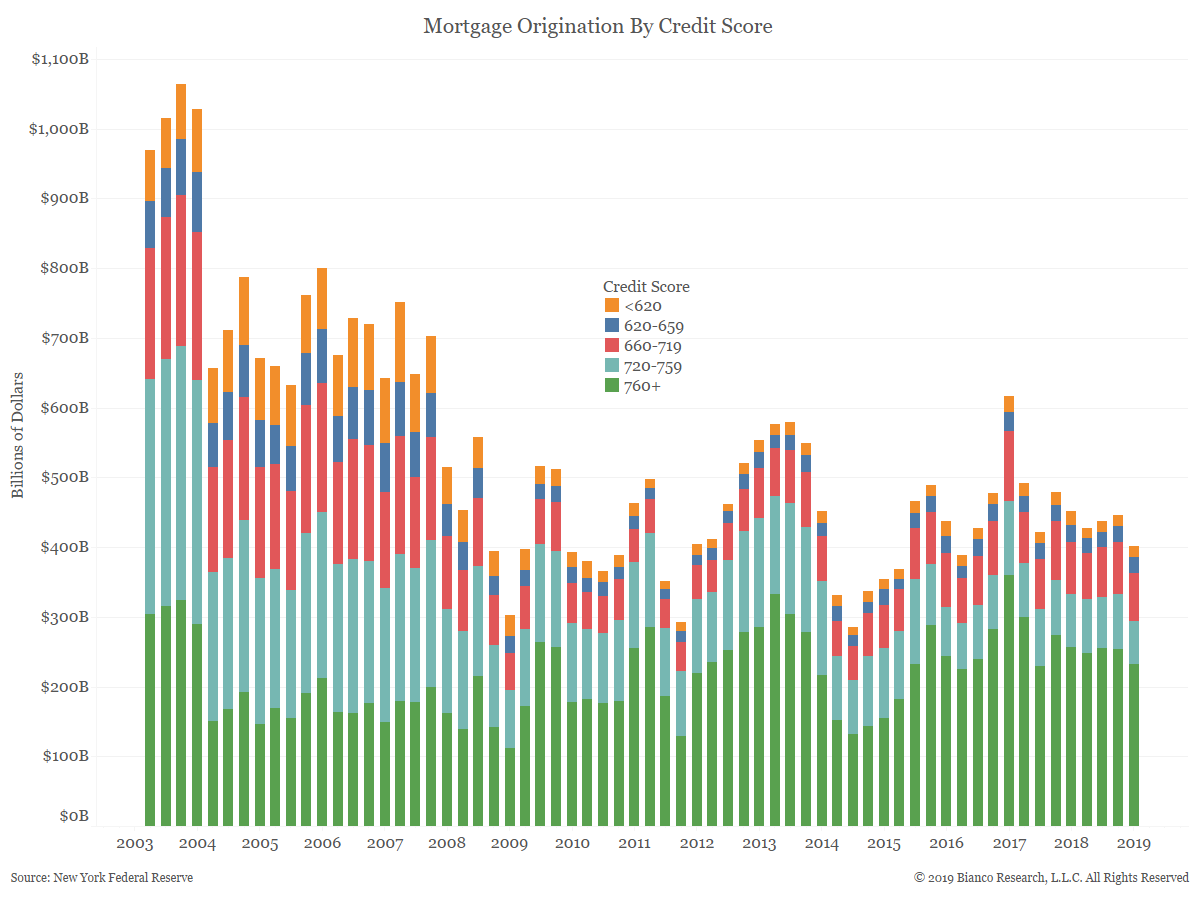

Mortgage Origination by Credit Score

Posted By Greg Blaha

Since the housing crash, mortgage originators have lent far less money to people with the riskiest credit scores.... Read More

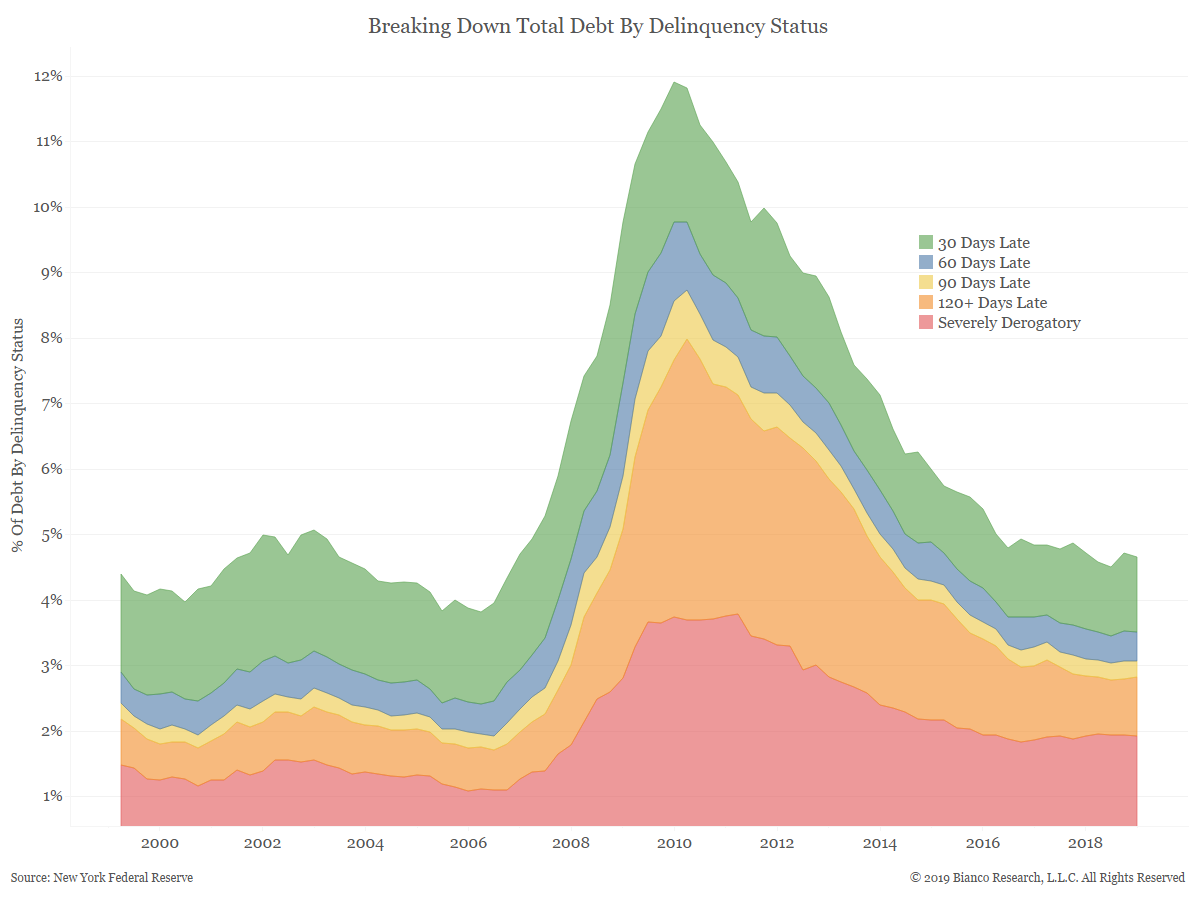

Household Debt Delinquency Status

Posted By Greg Blaha

Household debt broken down by delinquency status.... Read More

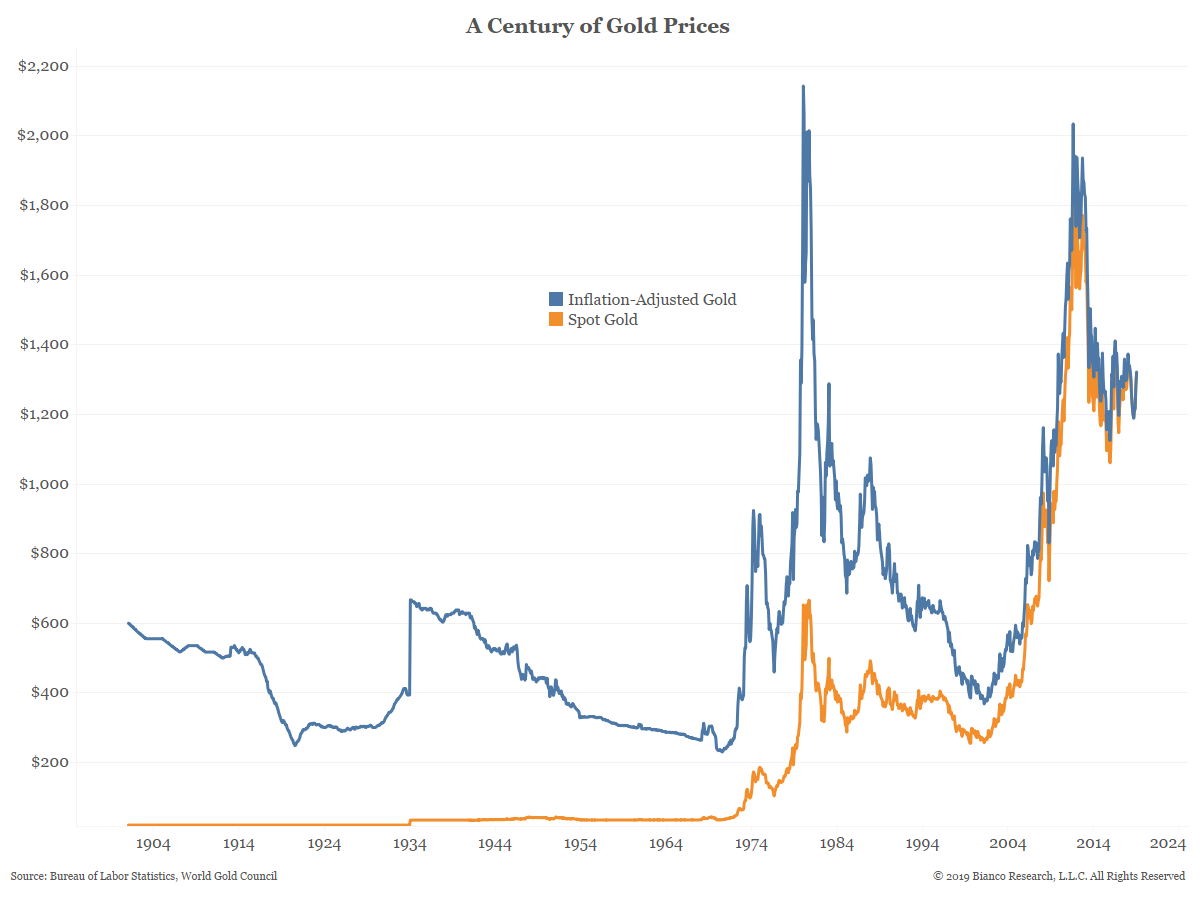

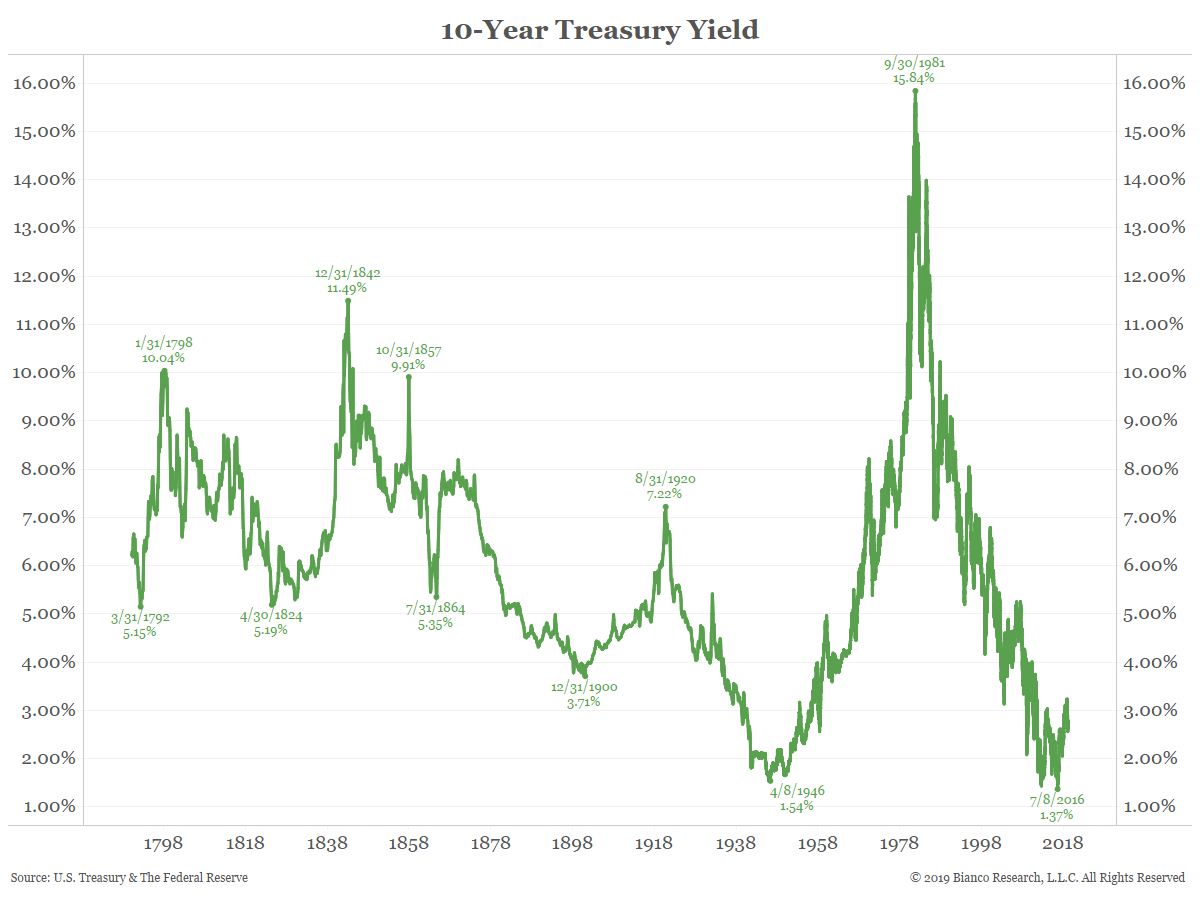

LT Outlook: A Century of Gold Prices

Posted By Greg Blaha

A look at spot and inflation-adjusted gold prices since 1901... Read More

A Study of Inflation, Deflation and the Markets

Posted By Greg Blaha

A study of market performance under various inflation and deflation scenarios since 1801... Read More

Conference Call Replay – Is a Retest Coming?

A replay of our February 14, 2019 conference call. ... Read More

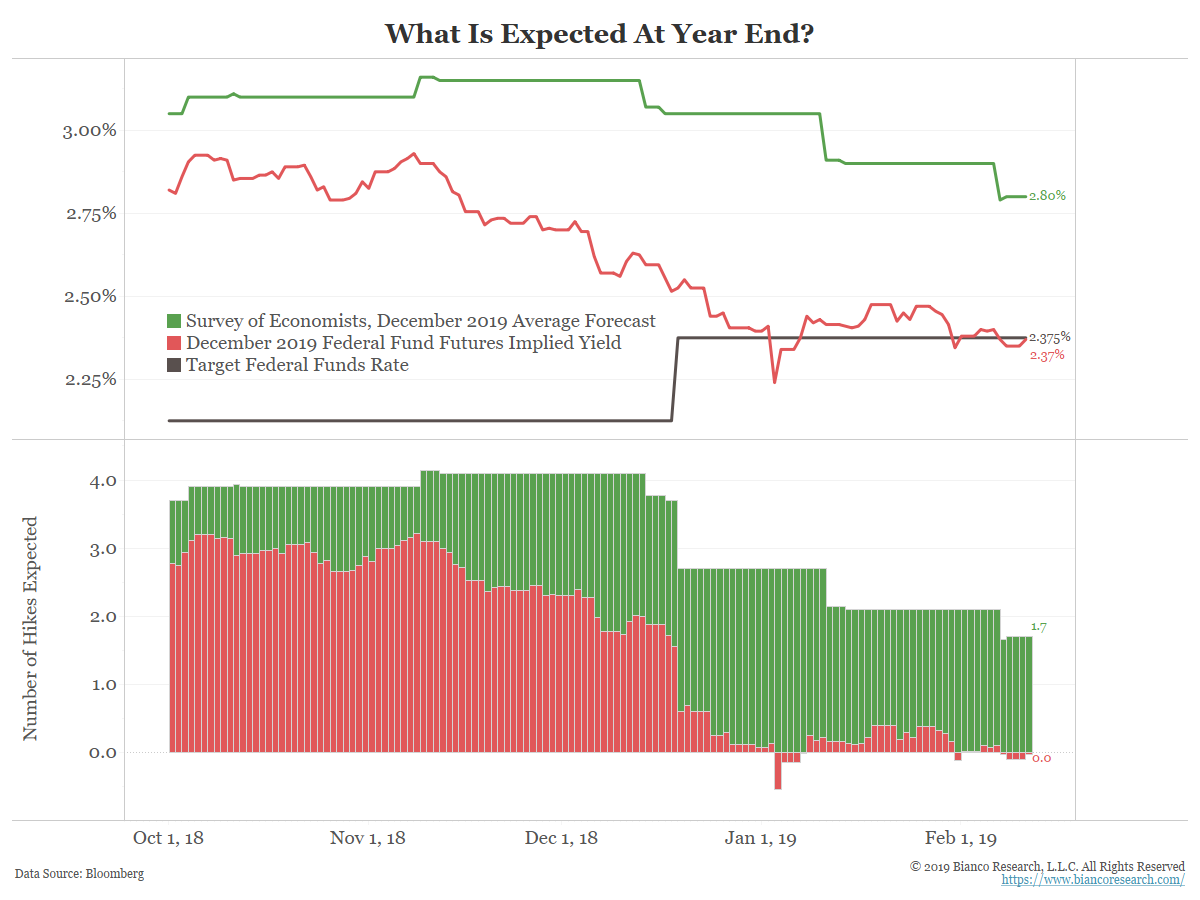

Why Are Economists and Markets on Different Pages?

Posted By Jim Bianco

Economists see growth and more inflation. The market sees a slowdown and tightening liquidity.... Read More

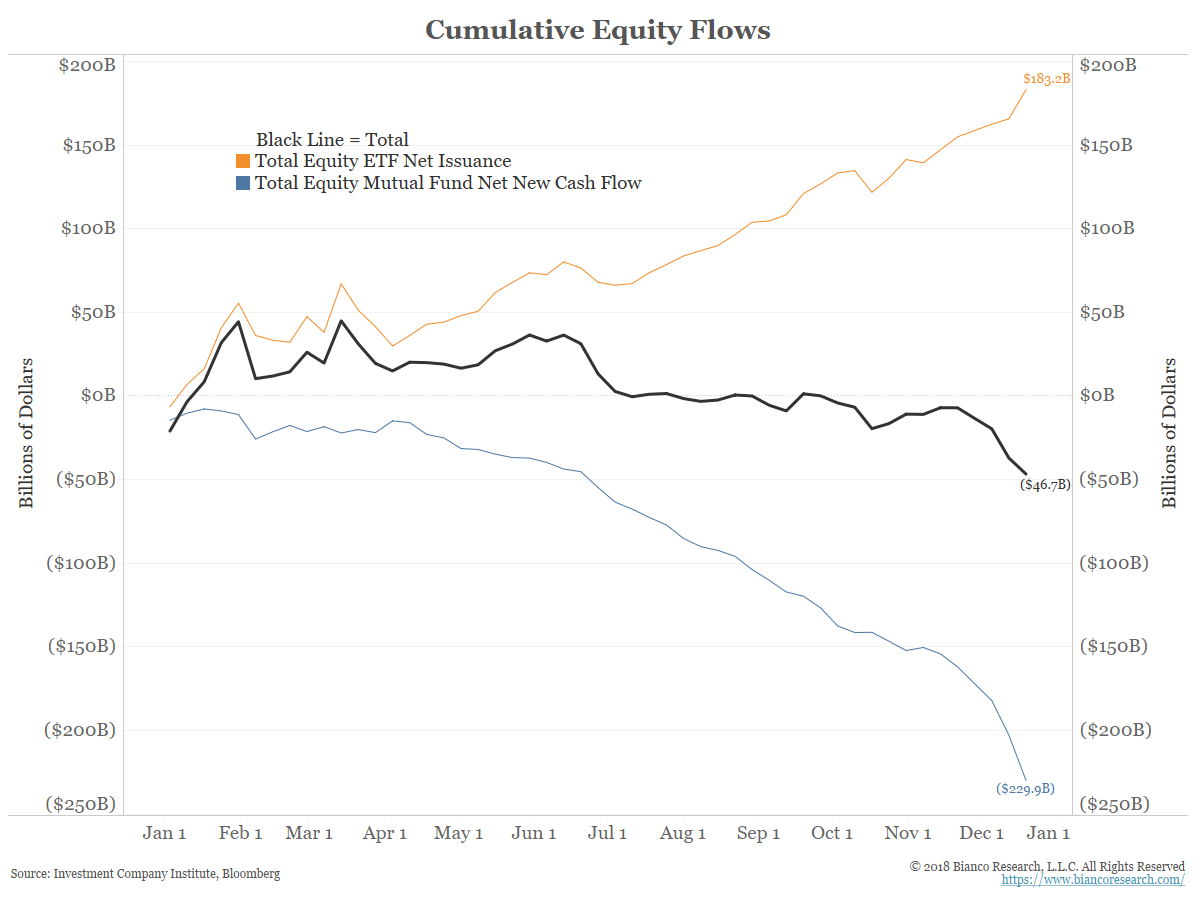

Outflows from Passive ETFs a Drop in the Bucket

Posted By Jim Bianco

Despite $16 billion in passive ETF outflows in January, active managers should not be declaring victory just yet.... Read More

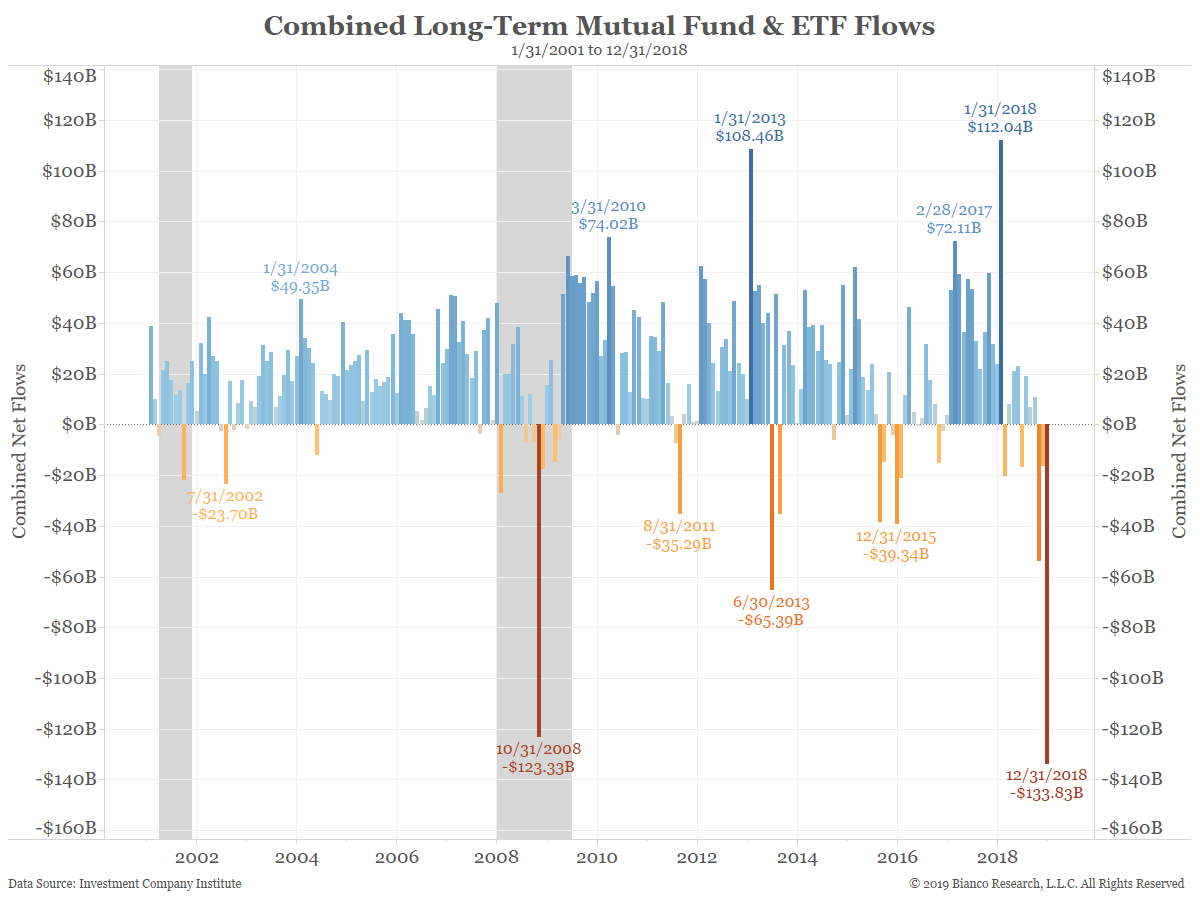

Record Outflows from ETFs & Mutual Funds

Posted By Greg Blaha

With a combined $134 billion in net sales, December saw record outflows from mutual funds and ETFs, surpassing those seen in October 2008.... Read More

Weekly Research Roundup

Selected charts and excerpts from our research over the past week.... Read More