A Review of Foreign Net Purchases of U.S. Securities

Posted By Greg Blaha

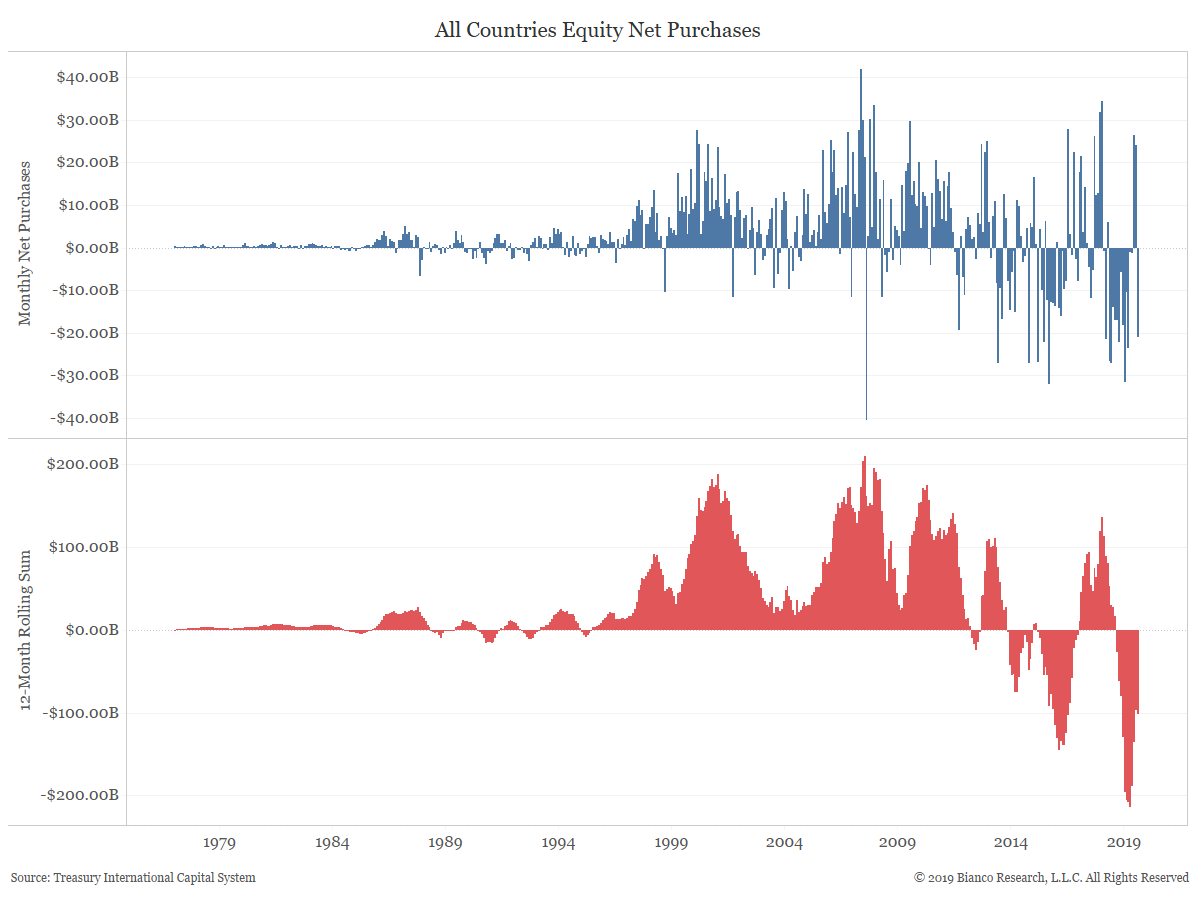

A look at foreign net sales and purchases of U.S. Treasuries, agencies, corporates and equities through August... Read More