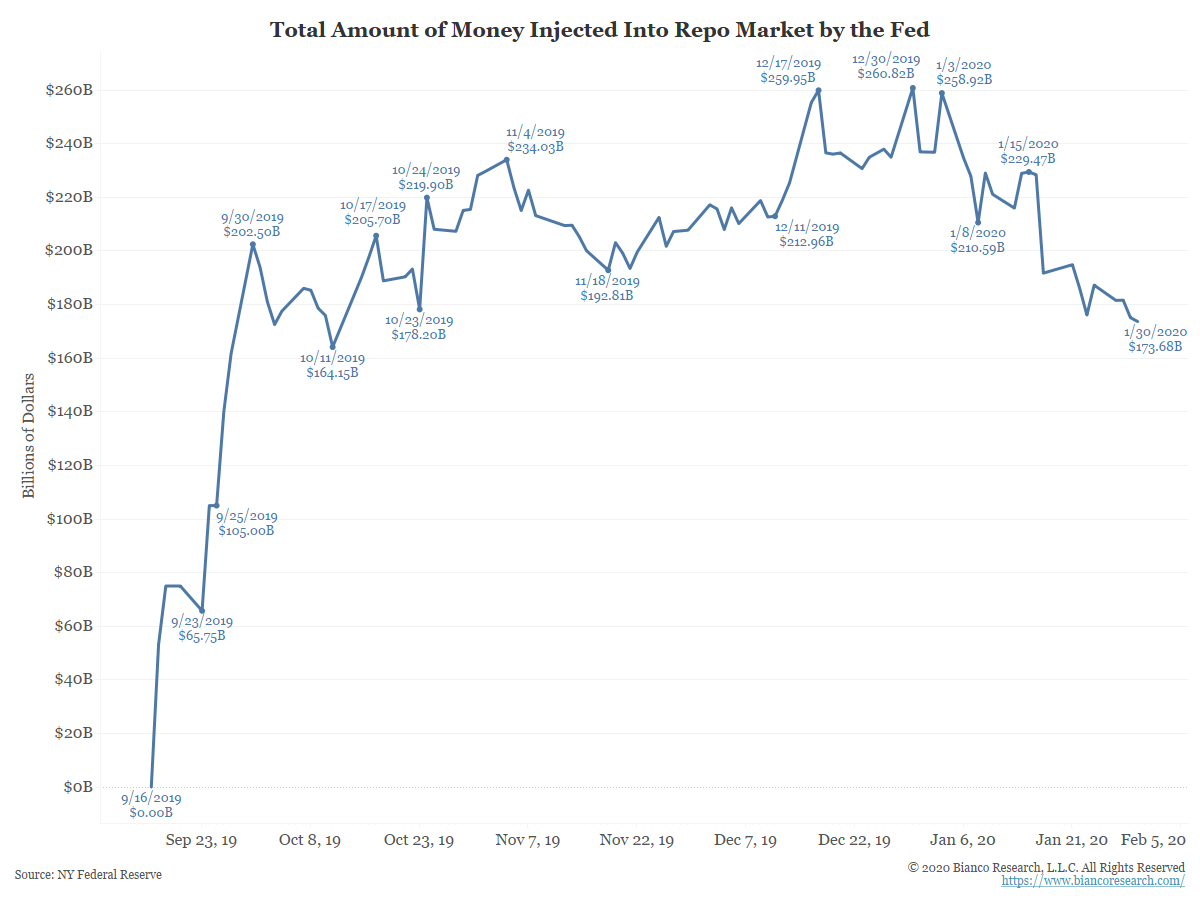

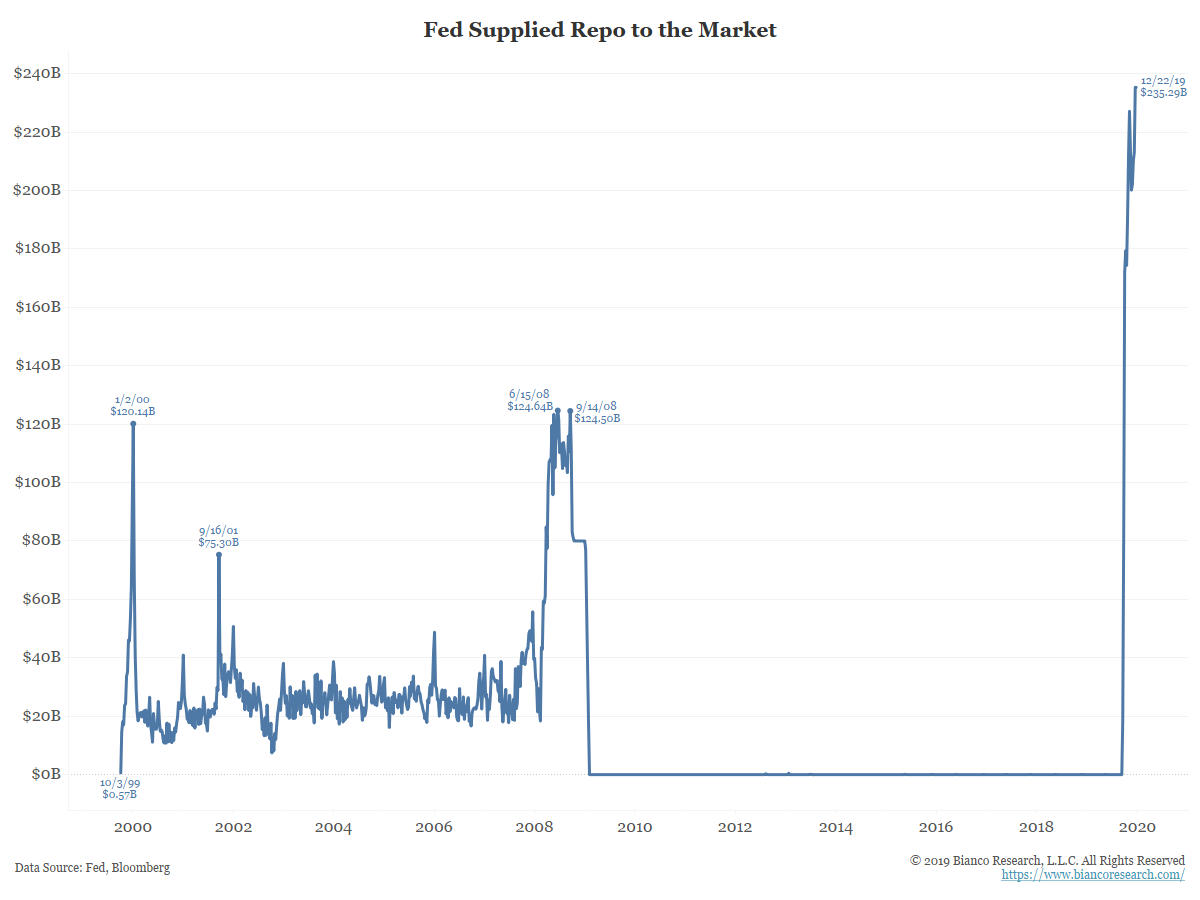

Updating the Fed’s Repo Support

Posted By Greg Blaha

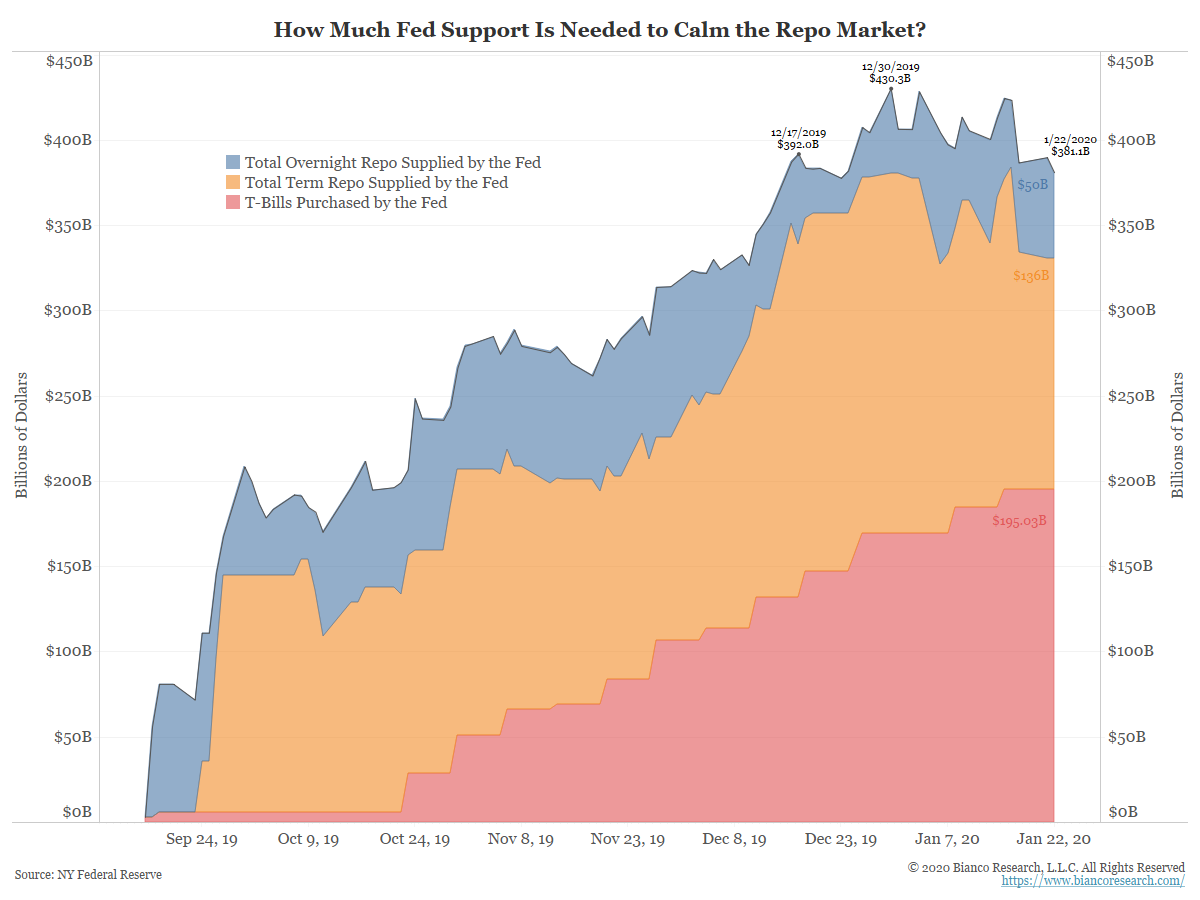

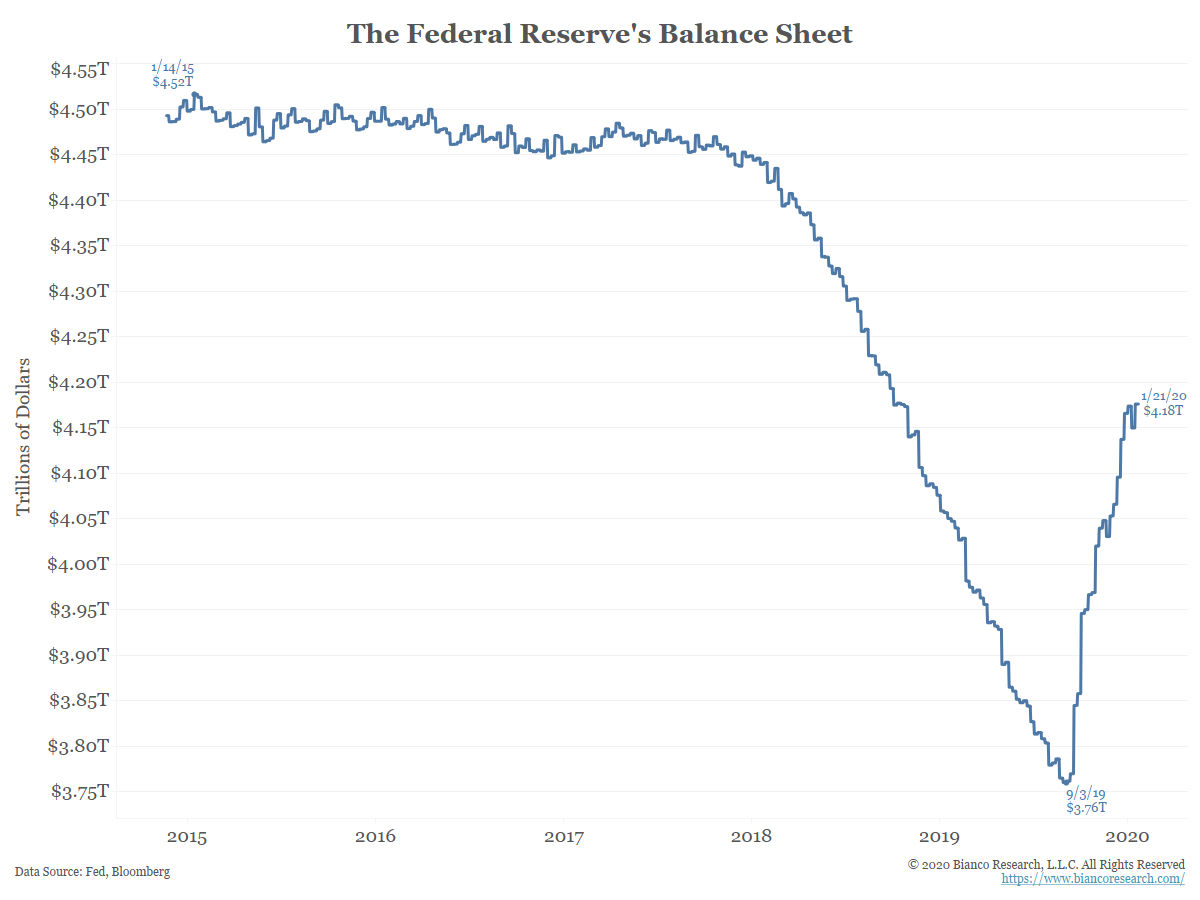

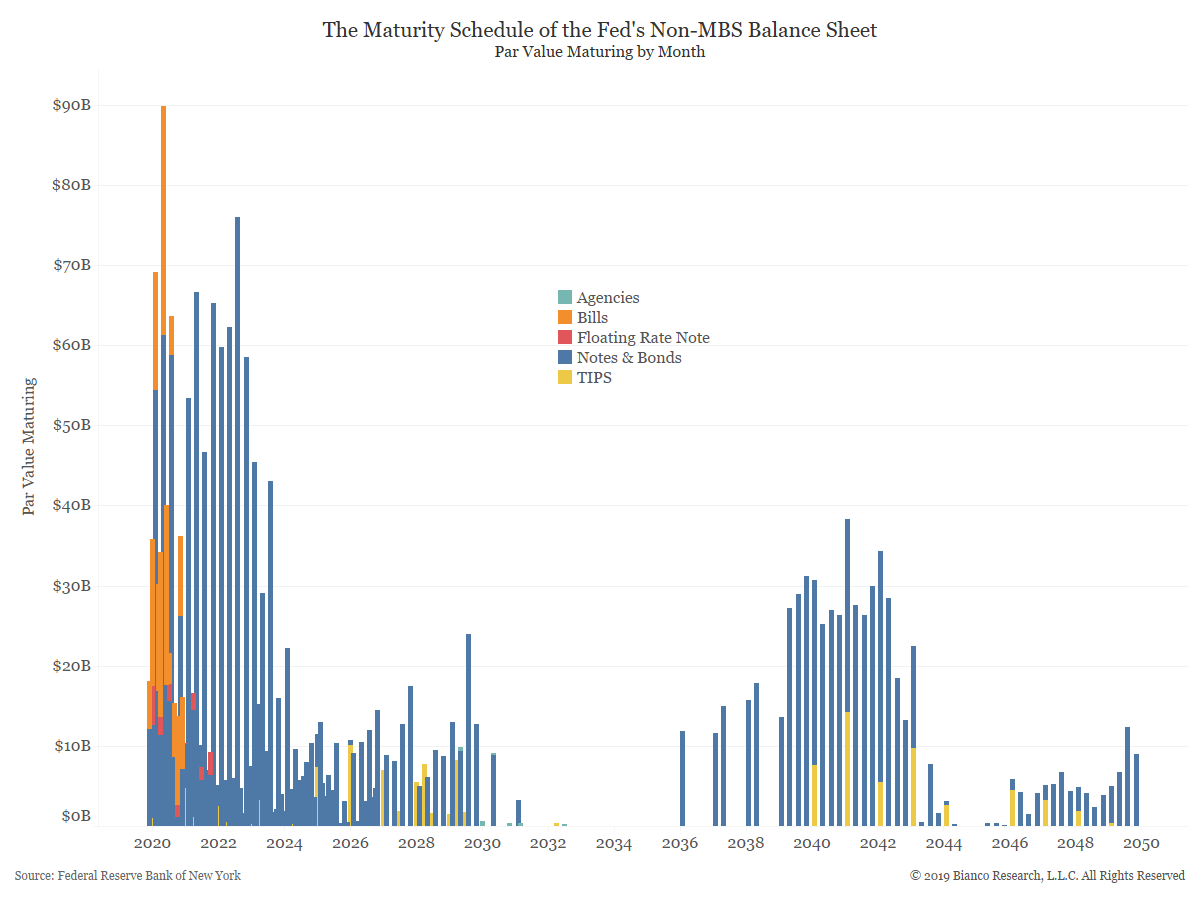

This coming week, the Fed's term repo operations will be reduced from $35 billion to $30 billion. While this will slowly pull back the Fed's involvement in the repo market, their T-bill purchases will more than outpace lost repo support.... Read More