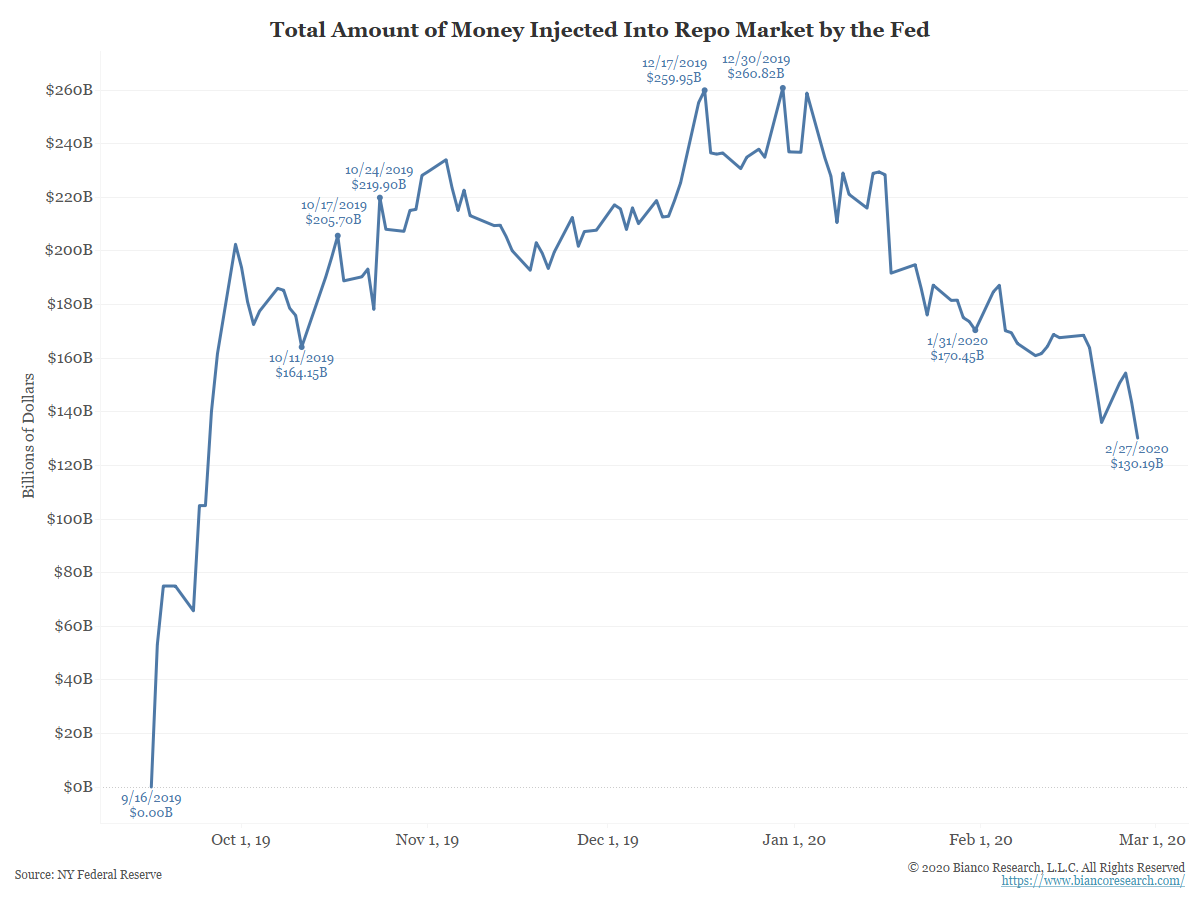

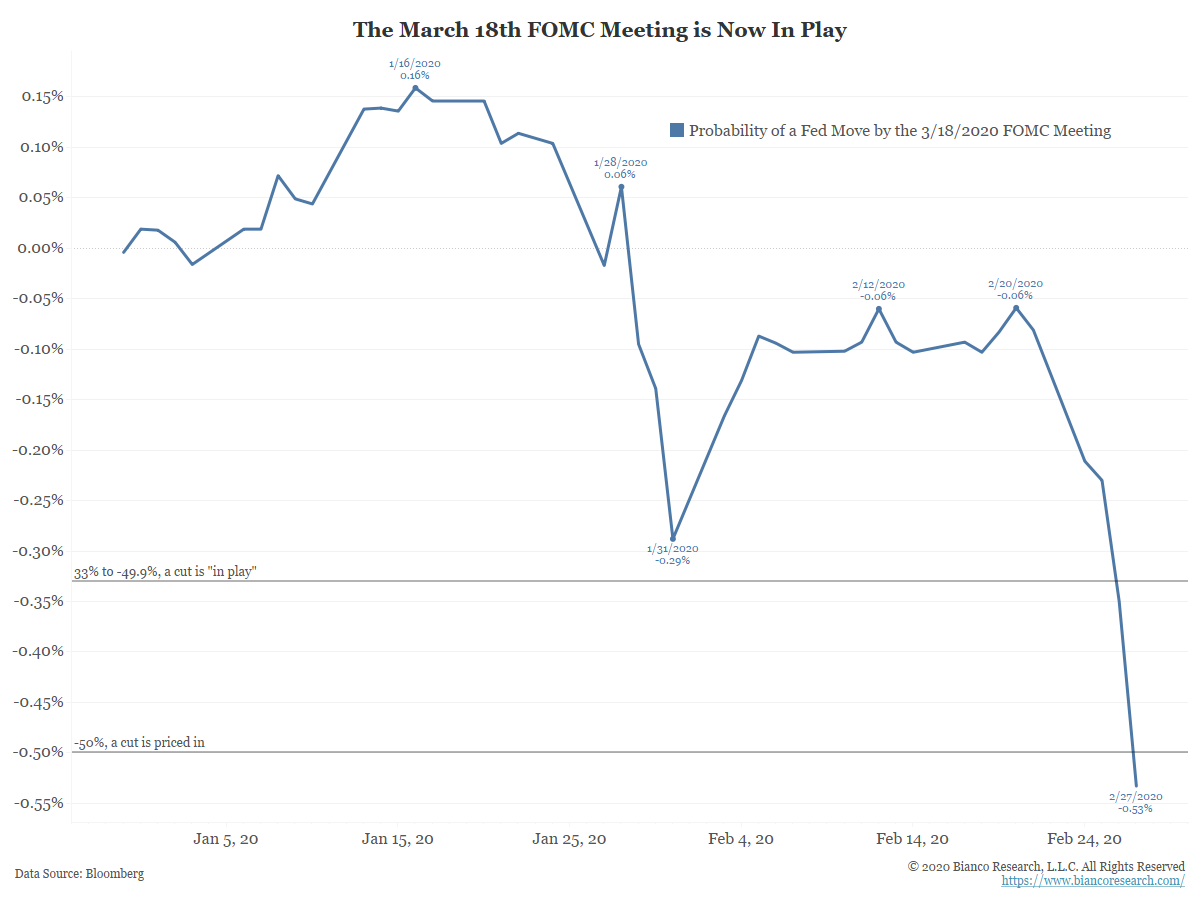

The Market Priced in a Fed Move. When Will It Happen?

Posted By Jim Bianco

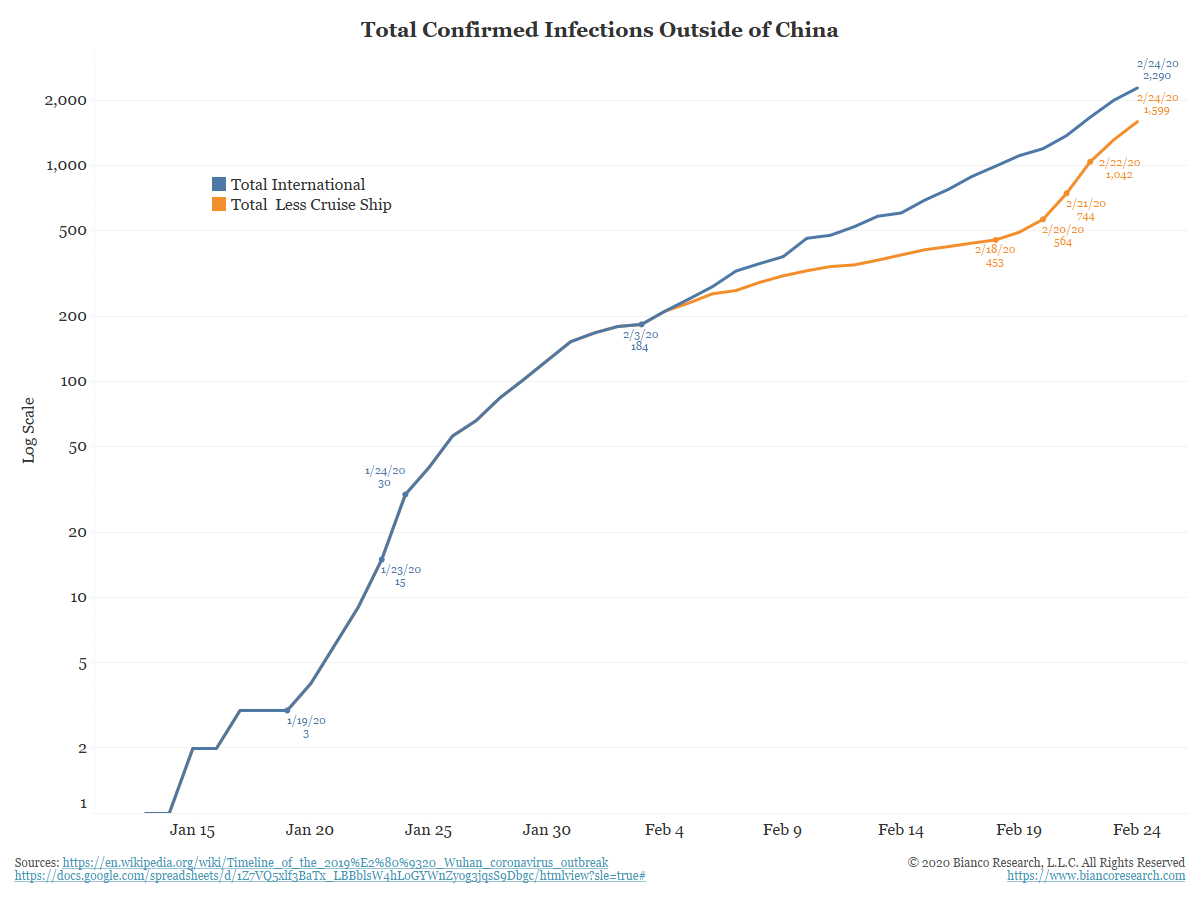

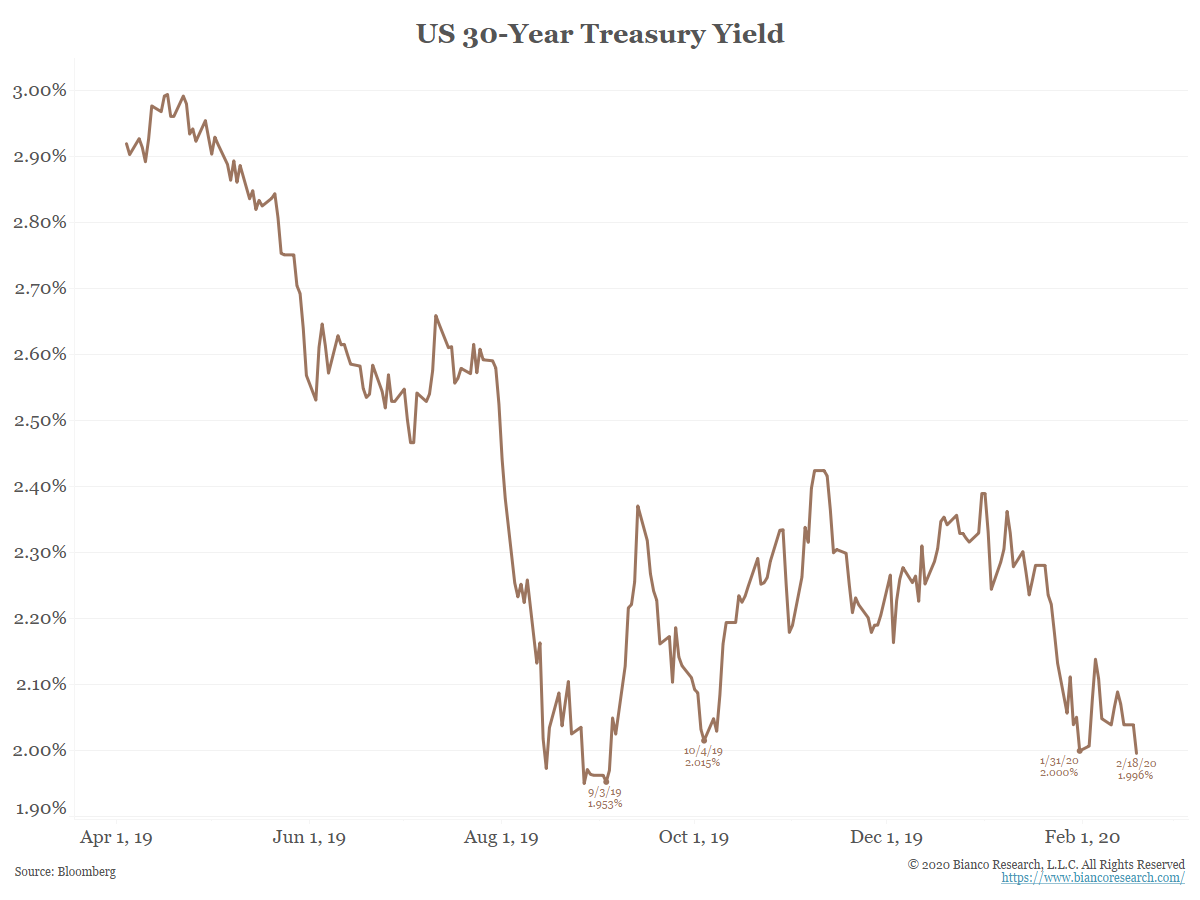

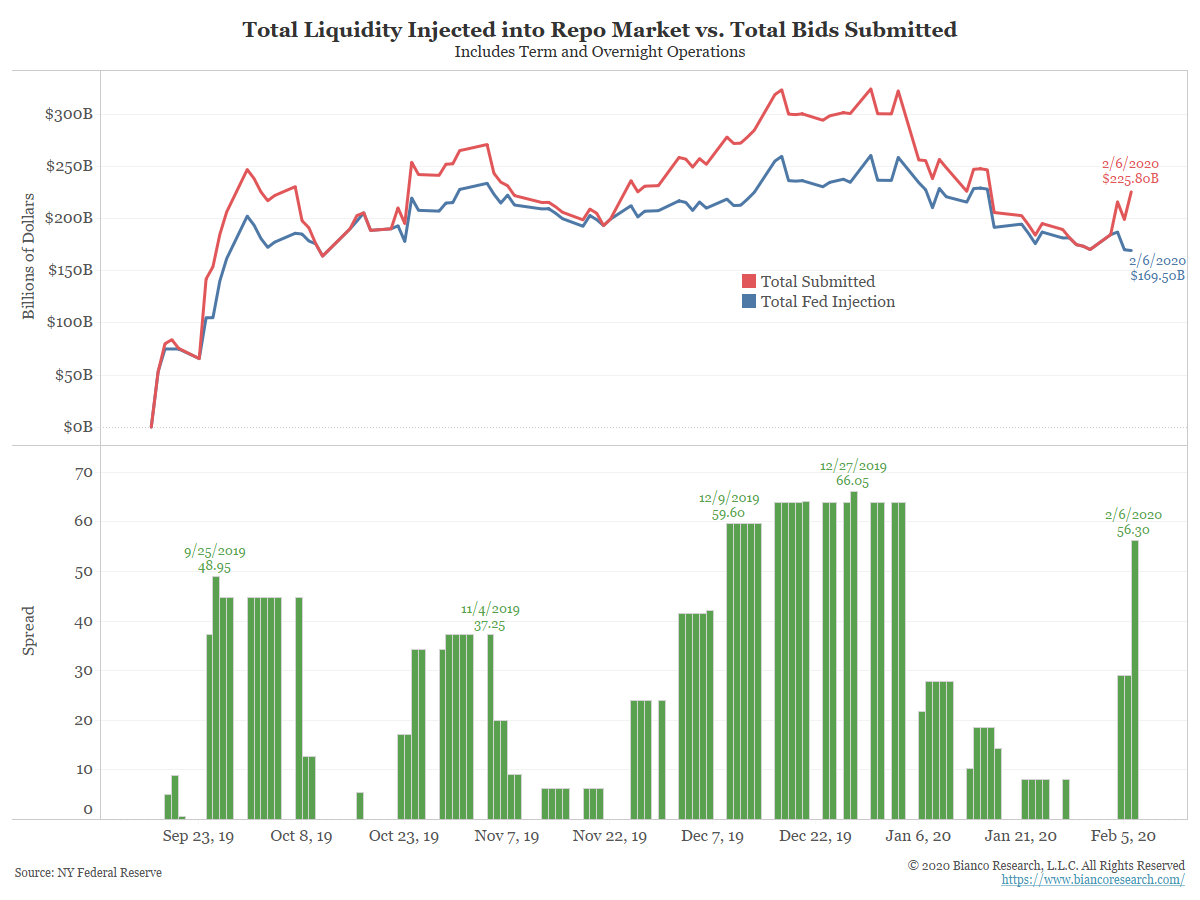

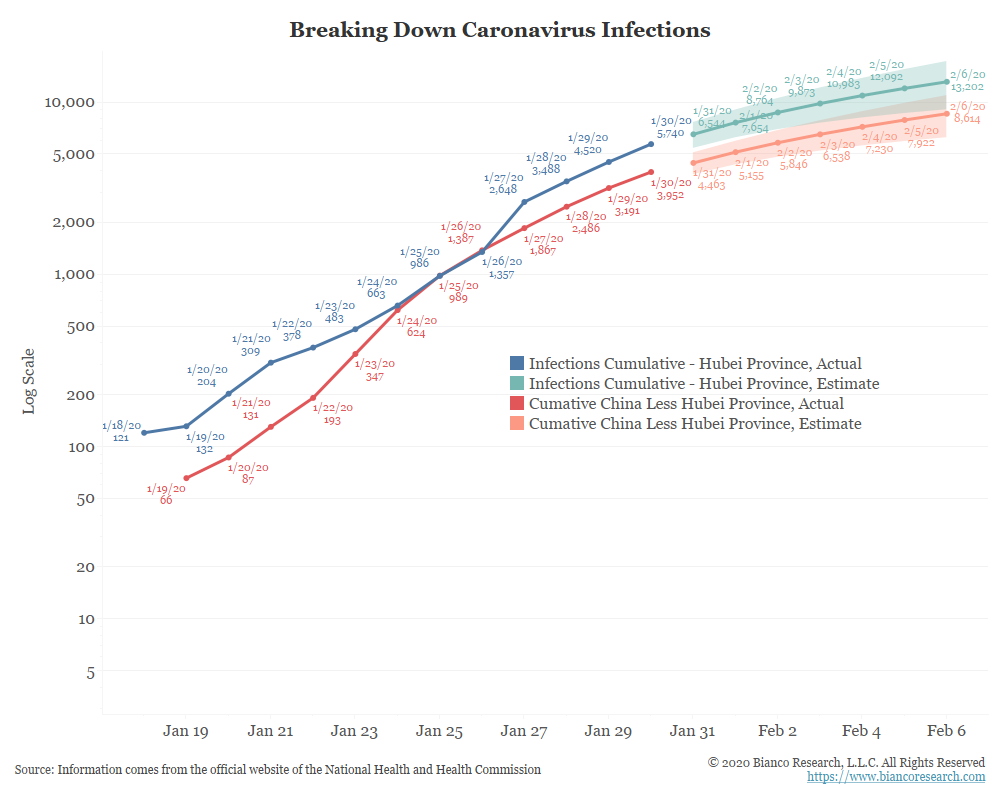

As we highlighted last night, the market has priced in a Fed move. How long will the market remain patient in waiting for a cut?... Read More