Tag Archives: Markets

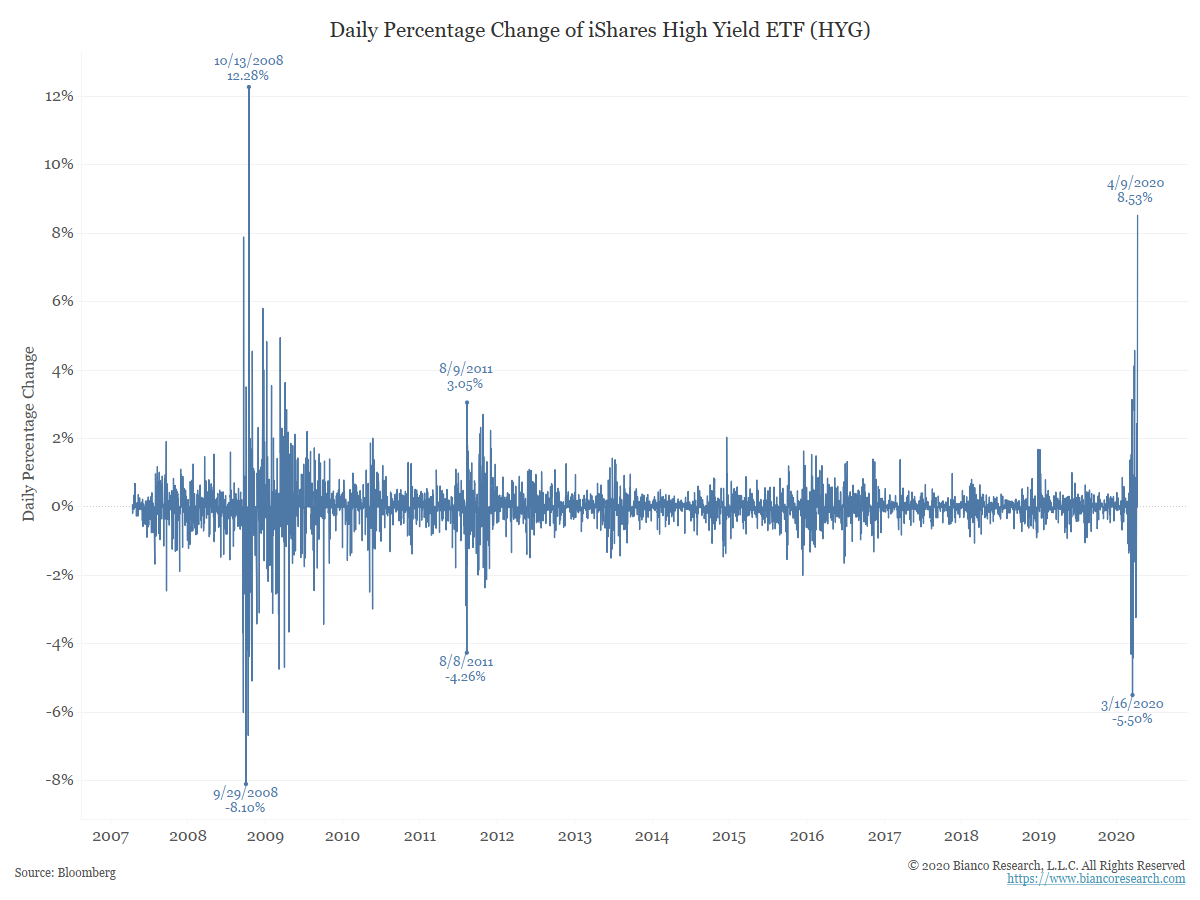

The Fed Throws Another Kitchen Sink at the Markets

Posted By Jim Bianco

The Fed greatly expanded its buying program, adding facilities to buy munis and CARES loans as well as broadening eligible bond purchases to fallen angels and a wider swath of investment grade bonds.... Read More

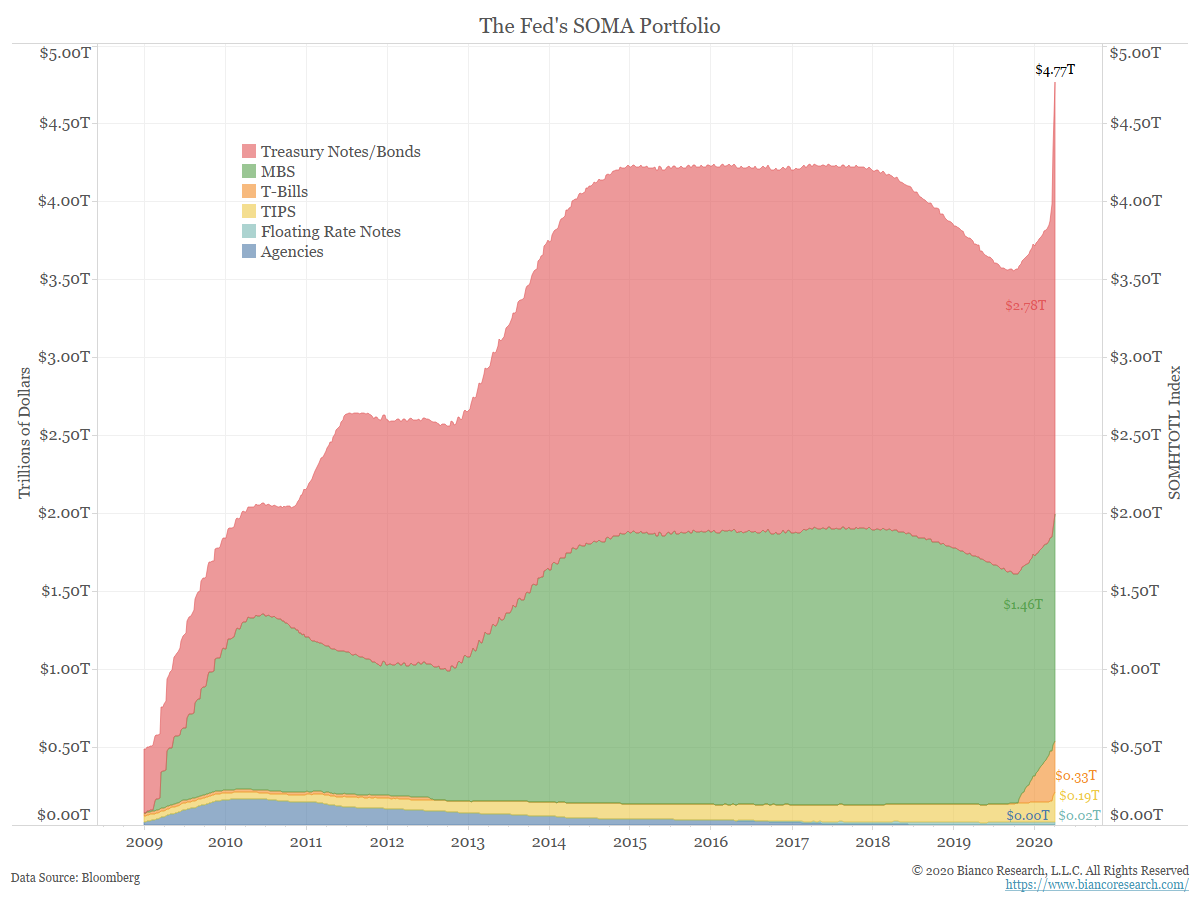

The Fed’s SOMA Portfolio Grows Substantially

Posted By Greg Blaha

A look at the assets on the Fed's balance sheet... Read More

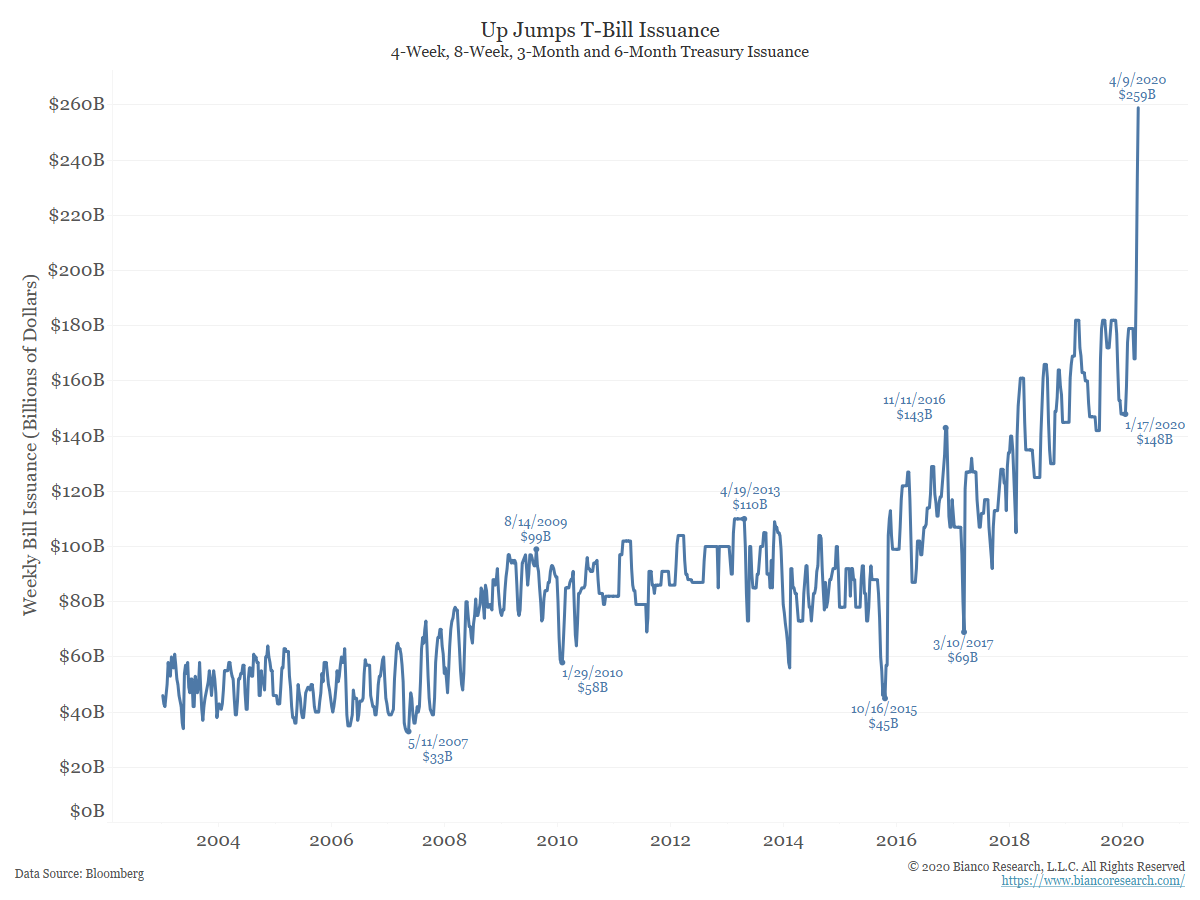

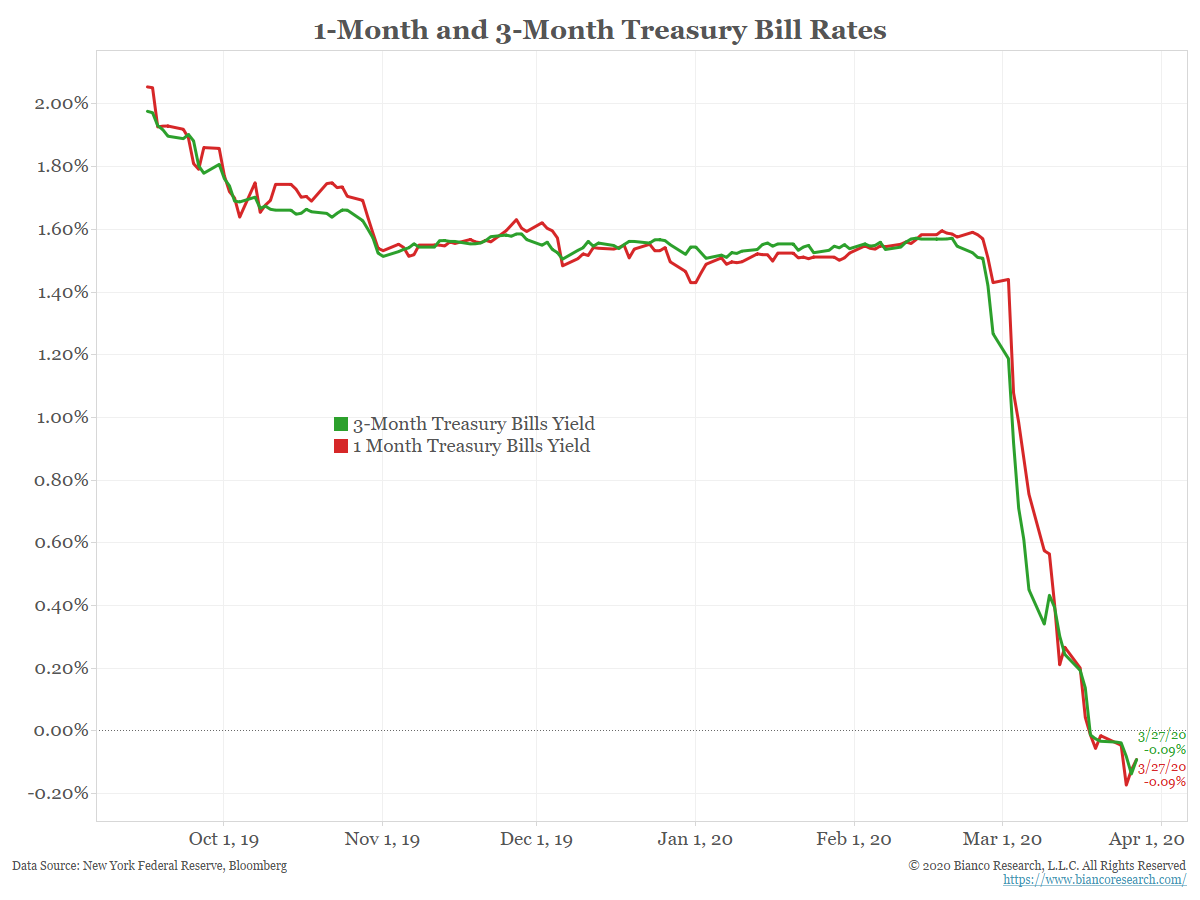

T-Bill Issuance Ramps Up

Posted By Greg Blaha

In the wake of the government's $2 trillion stimulus bill, the Treasury has ramped up T-bill issuance.... Read More

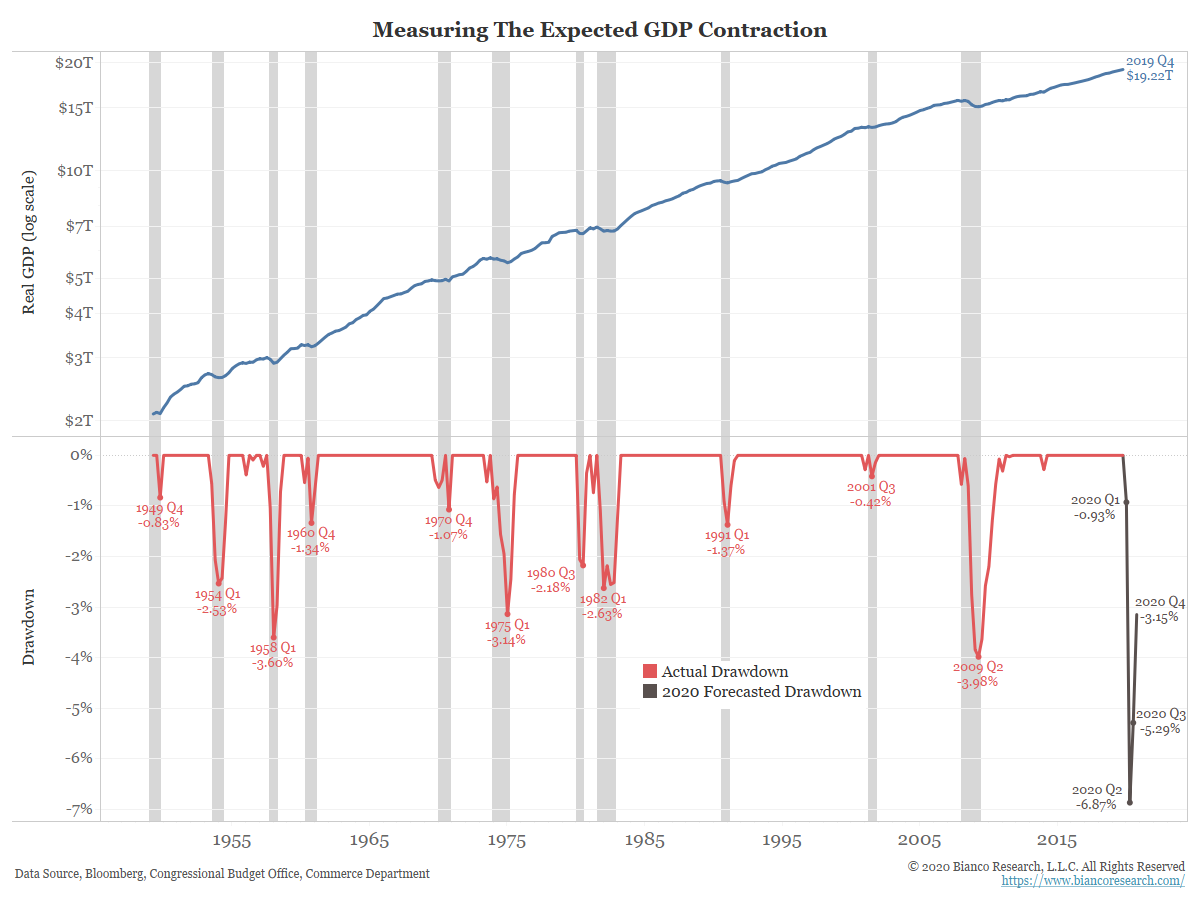

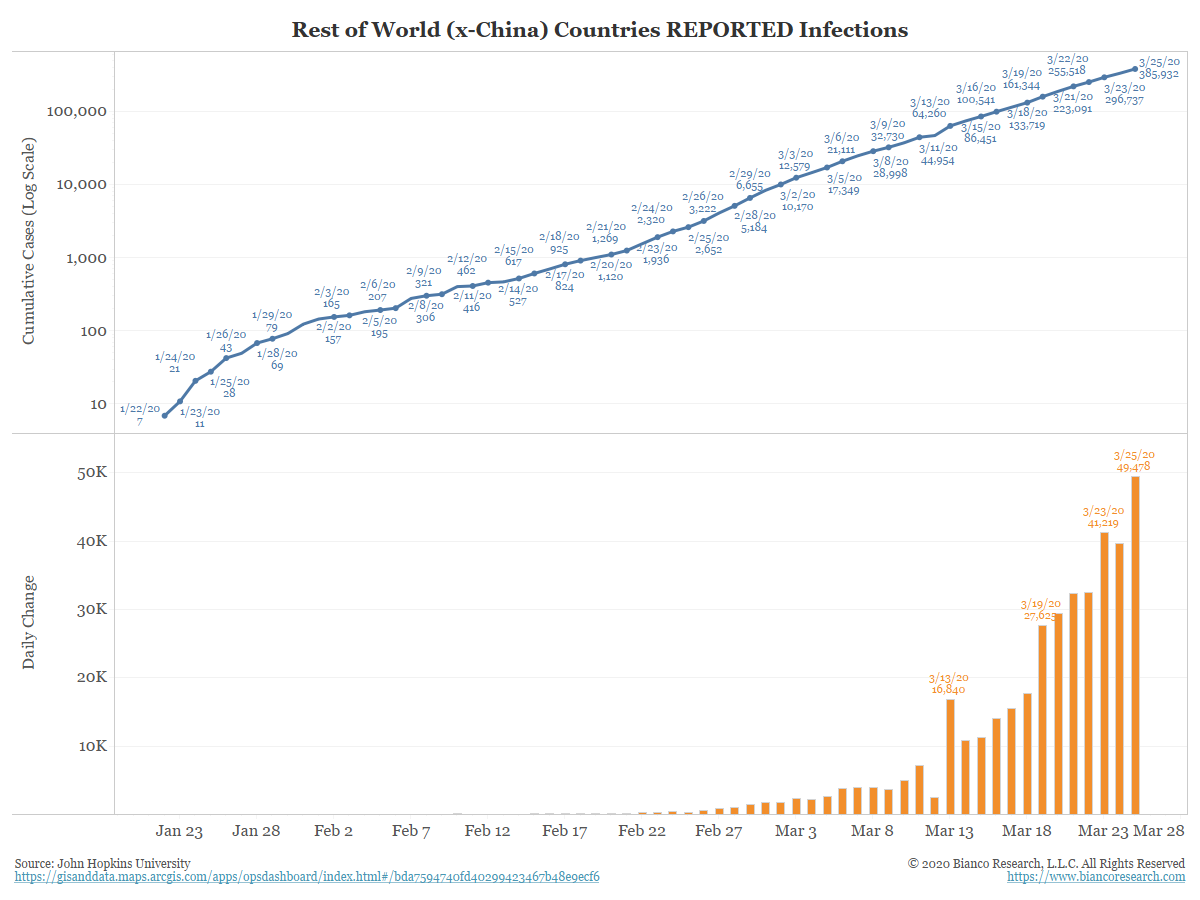

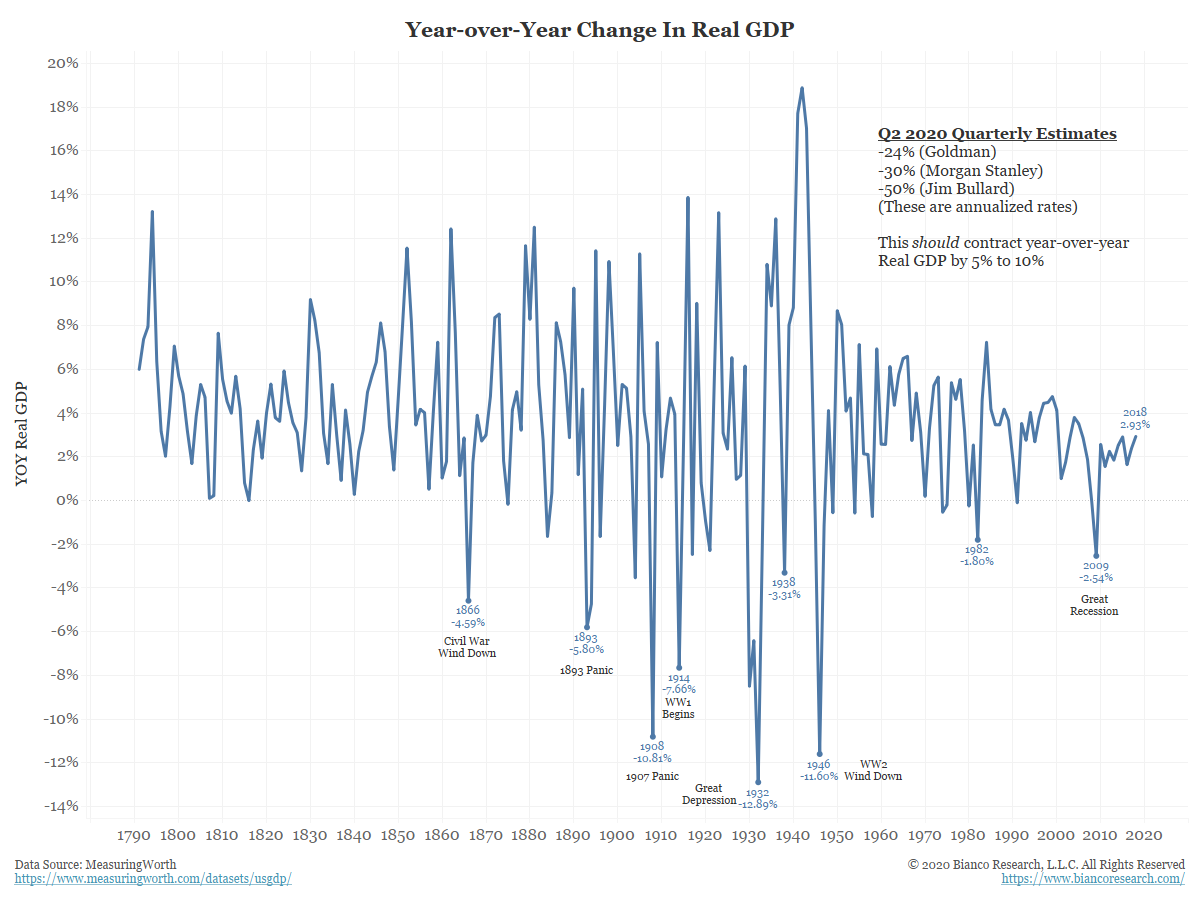

Measuring the Economic Damage

Posted By Jim Bianco

We are about to undergo the worst recession in the modern era.... Read More

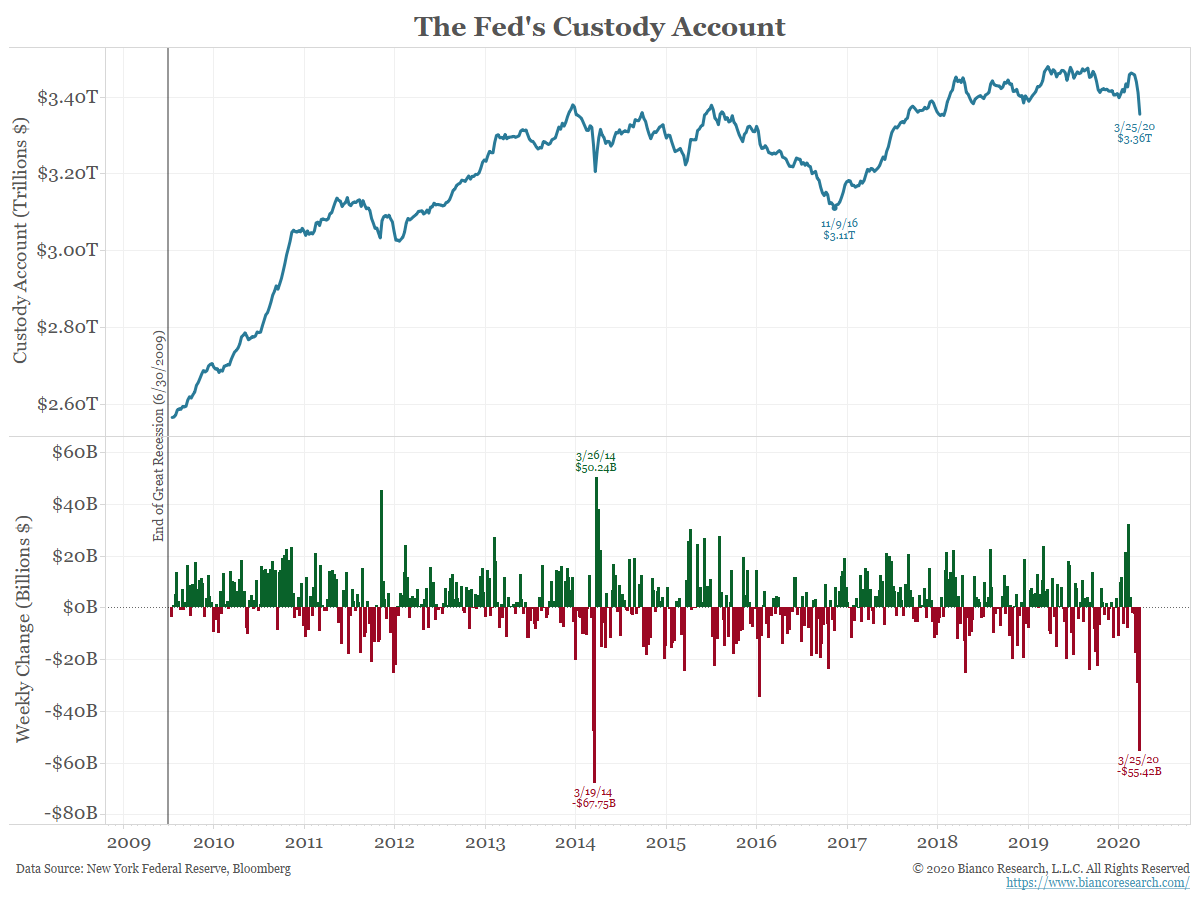

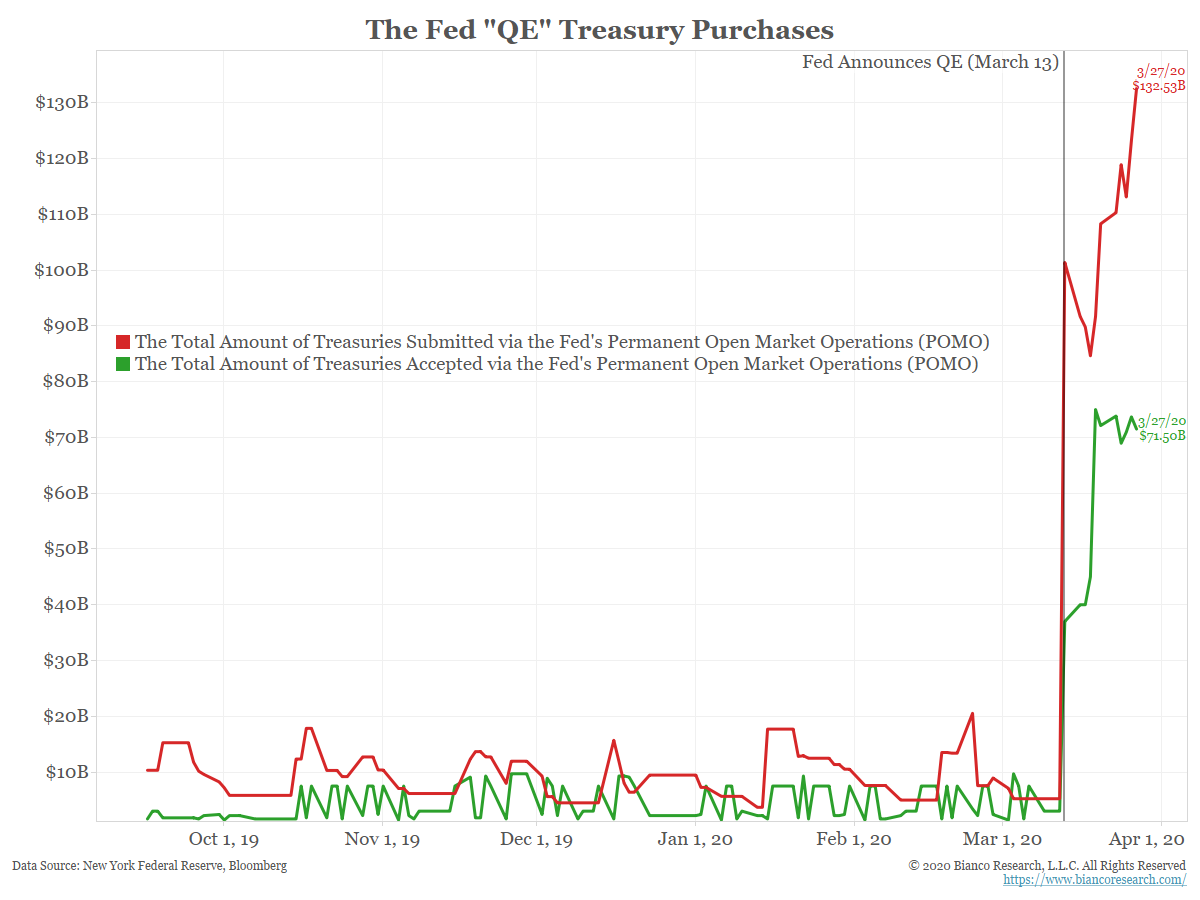

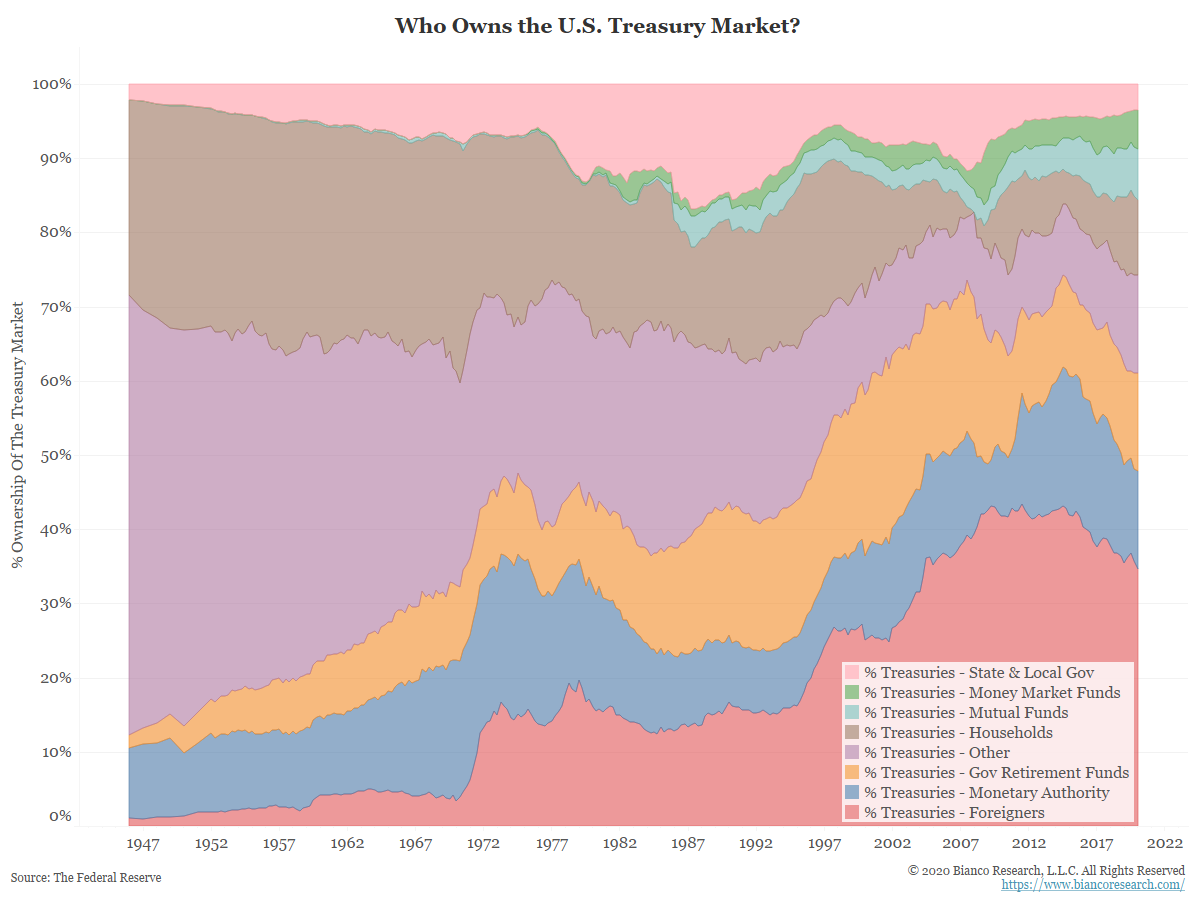

Why Aren’t Treasury Yields Plummeting on Fed Purchases?

Posted By Jim Bianco

Something extraordinary is happening in the Treasury market and few really seem to understand it. The Fed bought $1 trillion of bonds in the last three weeks and bond yields have barely budged. Why?... Read More

The Fed’s Attempts to Bolster Treasury Market Liquidity

Posted By Jim Bianco

China needs dollars. They have $1 trillion of Treasuries to sell to generate dollars. The Fed does not want this to happen. So the Fed created a new swap line Treasuries as collateral for dollars. ... Read More

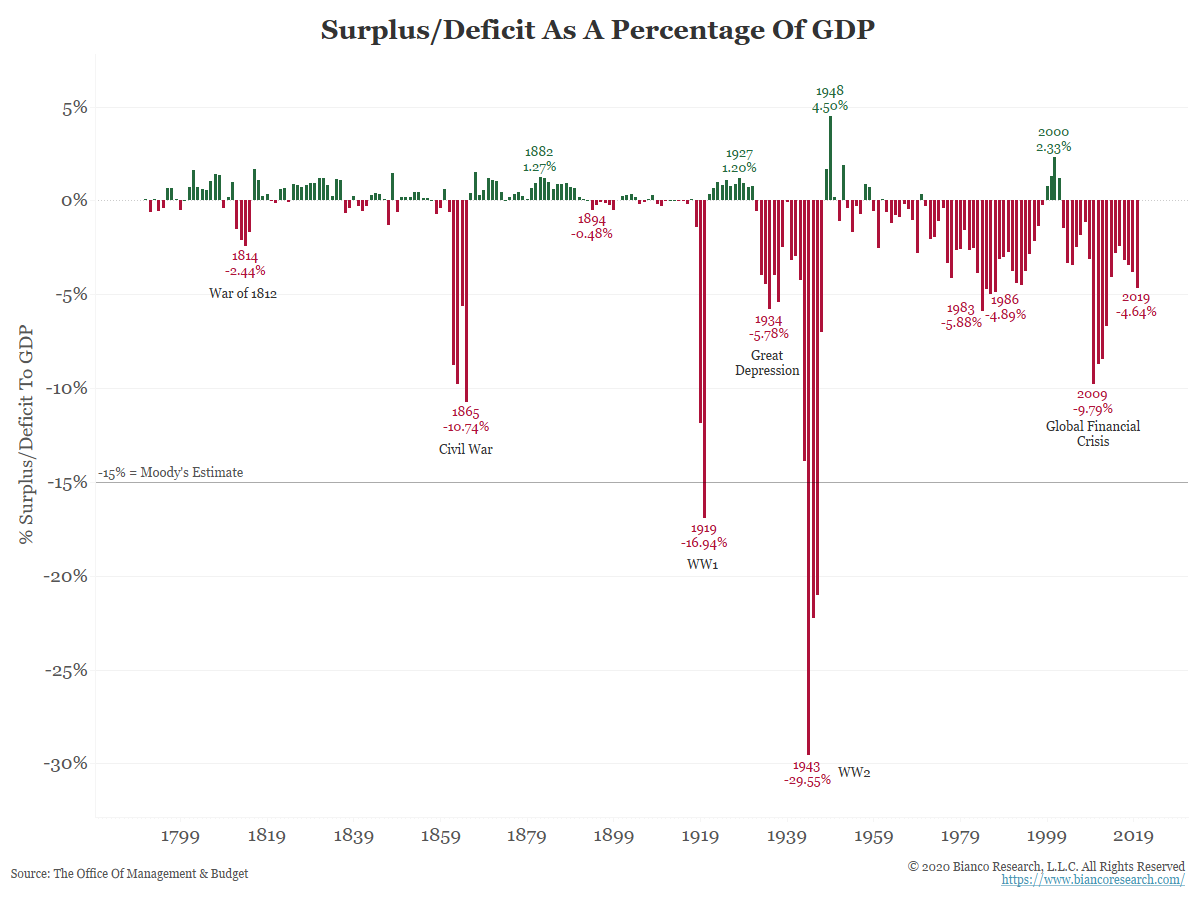

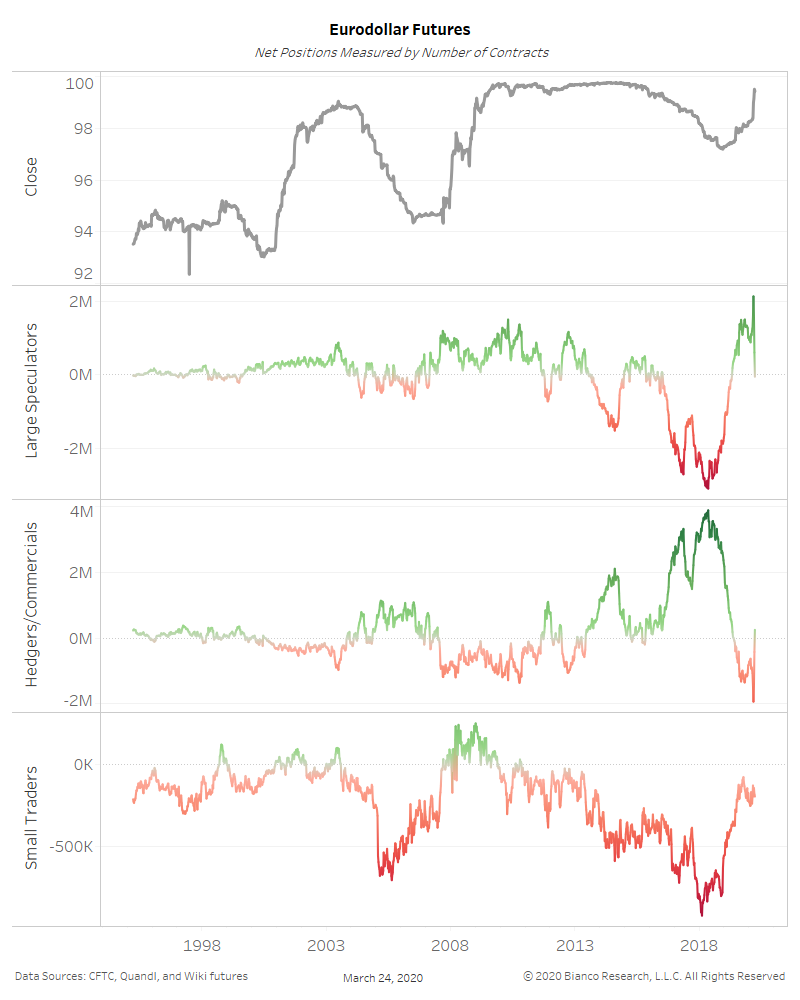

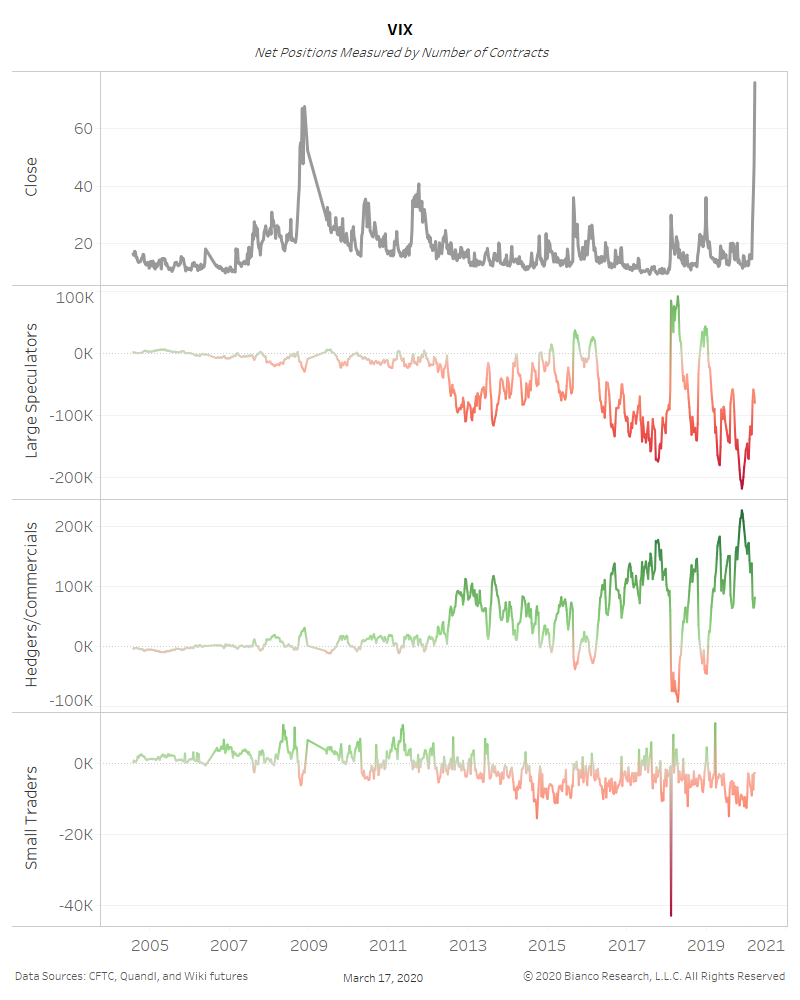

The Dealers Are Offsides and Selling

Posted By Jim Bianco

The dealers are offsides. They are too exposed to interest rate risk going into a period of lower growth, larger deficits, and potentially more inflation.... Read More

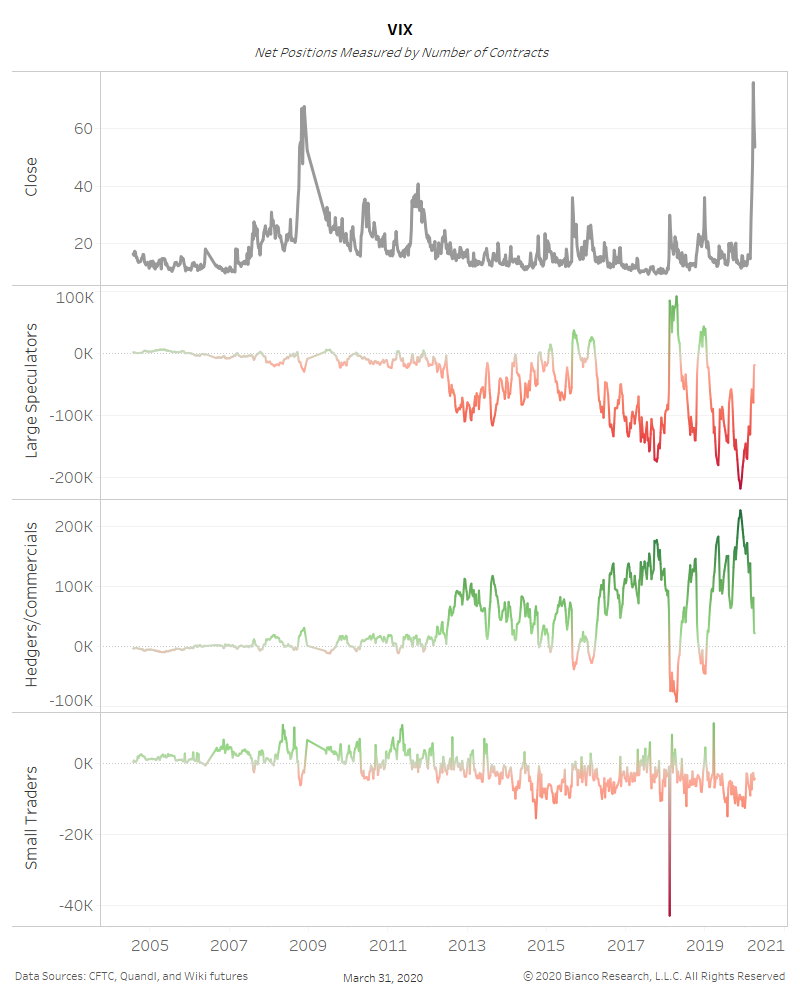

Detailing Financial Market Stress and Flows

Posted By Jim Bianco

Fund outflows are the most extreme ever seen and financial market stress remains.... Read More

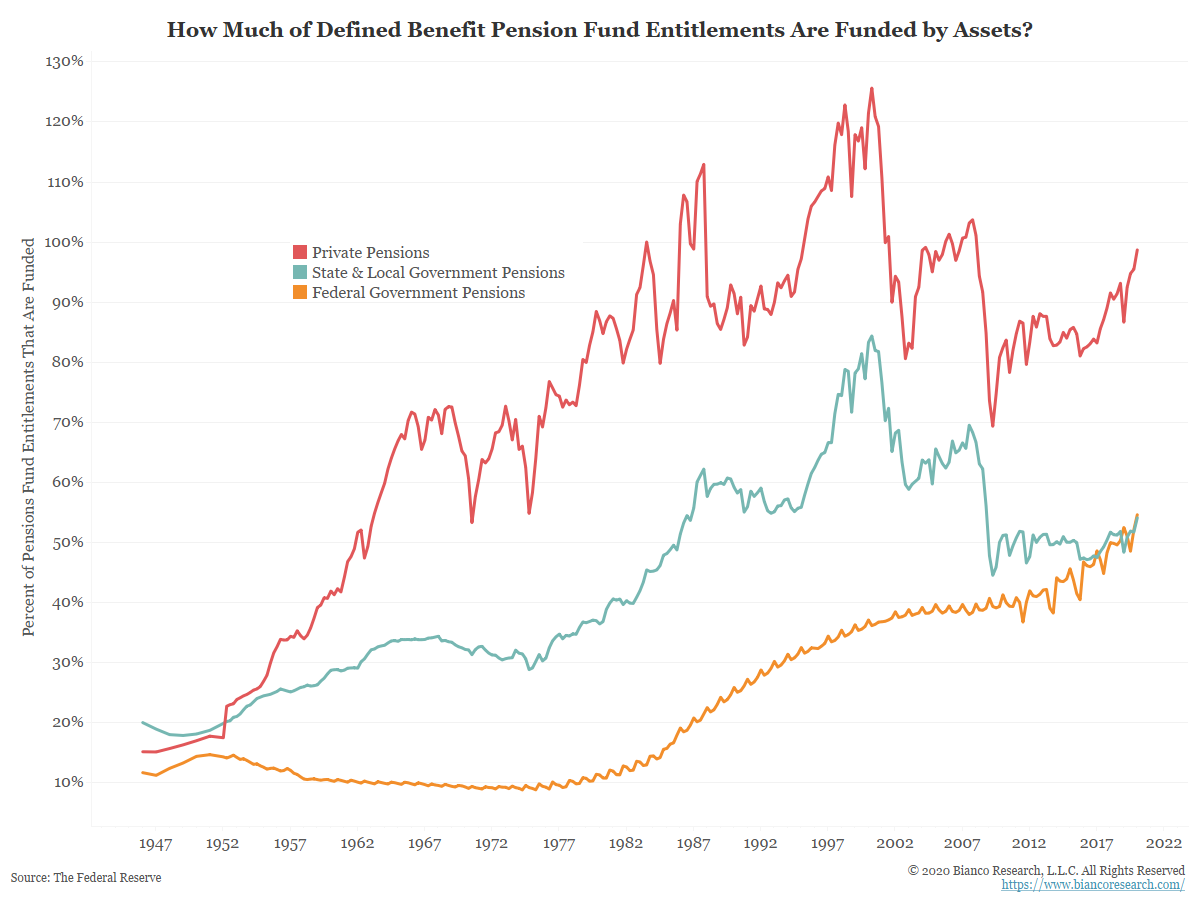

Funding Gaps at Public and Private Pensions

Posted By Greg Blaha

Private pension funds have much smaller funding gaps than their government counterparts.... Read More

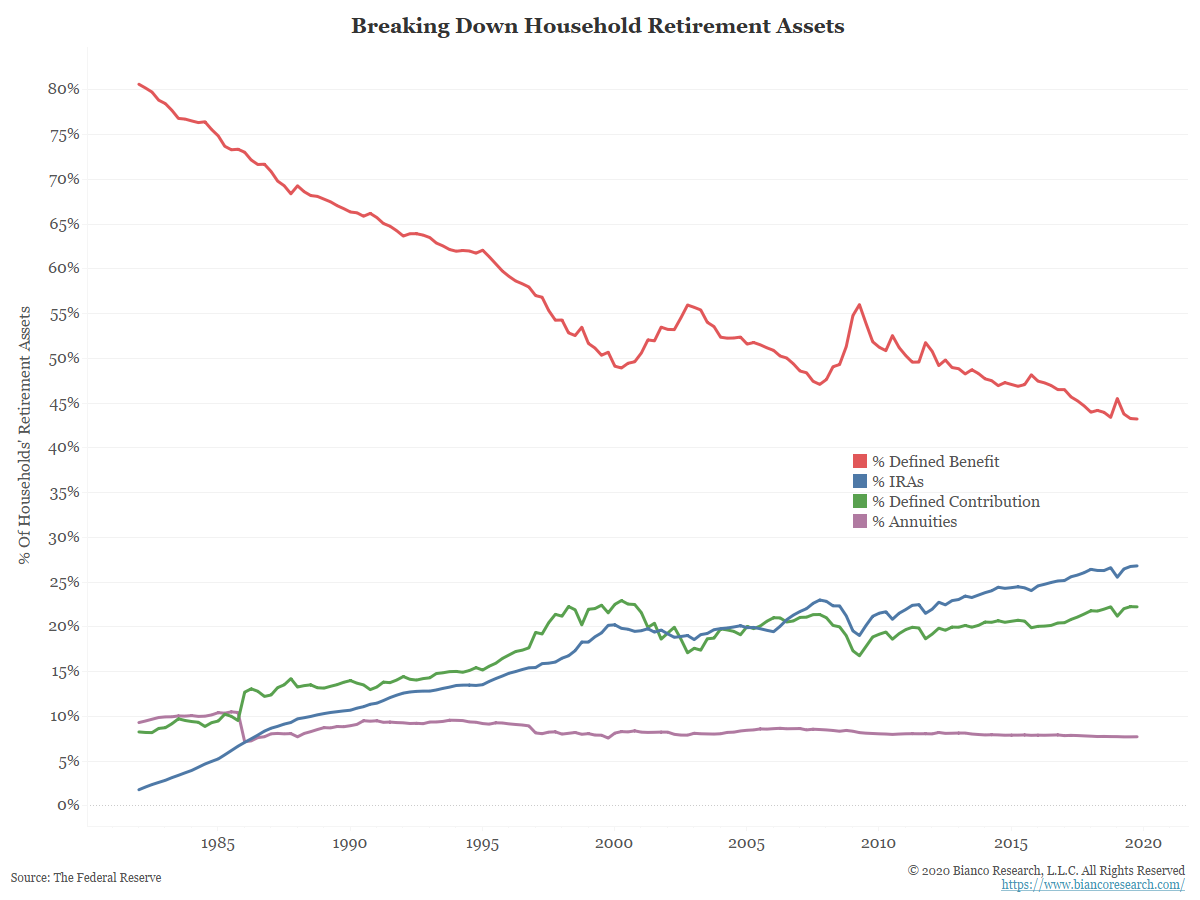

Defined Benefit Plans Continue to Shrink

Posted By Greg Blaha

Defined benefit plans continue to be replaced by IRAs and defined contribution plans.... Read More

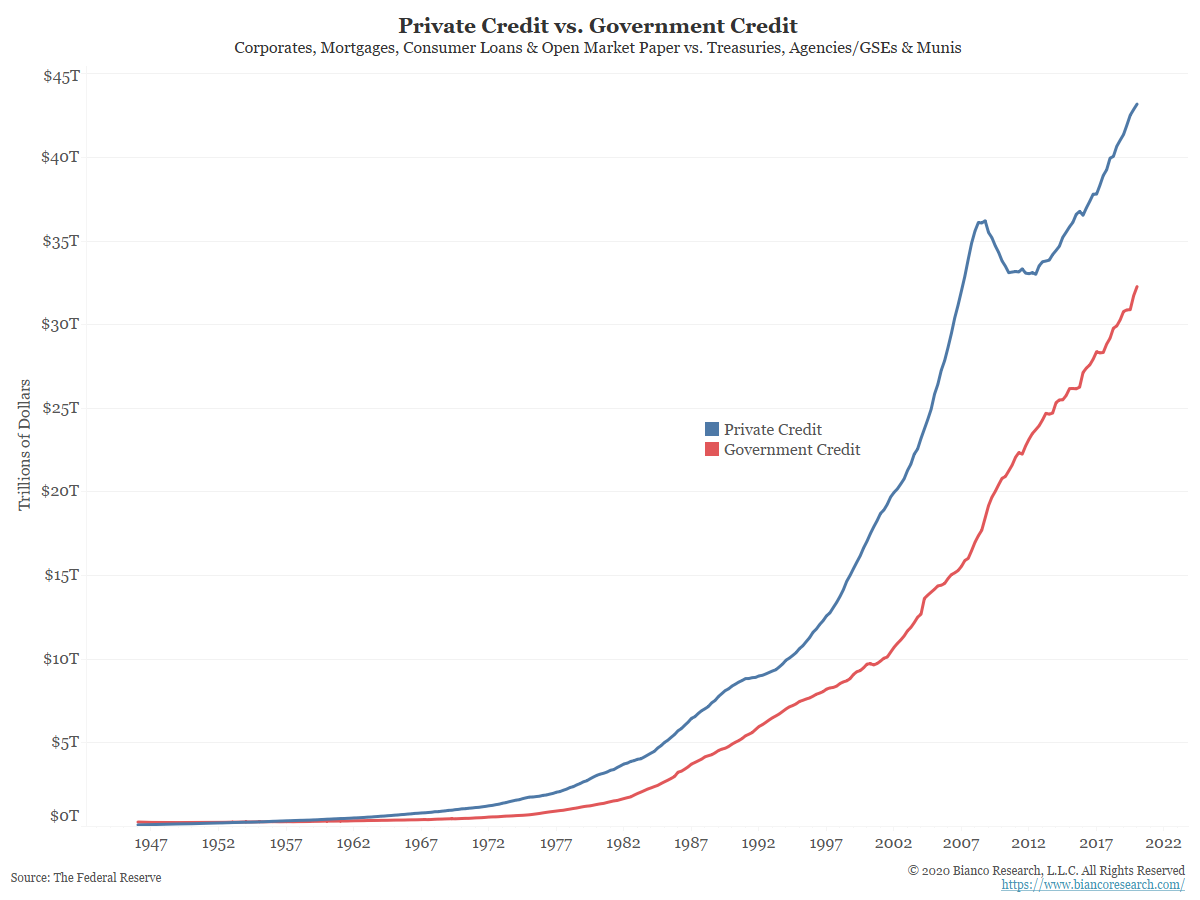

Breaking Down Debt in the U.S.

Posted By Greg Blaha

A look at outstanding amounts of Treasuries, corporates, agencies, munis and open market paper.... Read More

Comparing the Value of Credit in the U.S. to GDP

Posted By Greg Blaha

The amount of outstanding private credit in the U.S. experienced a brief decline during the financial crisis, but government debt grew throughout the entire period. Both are now at new highs.... Read More

Forecasts Slowly Responding to Coronavirus

Posted By Jim Bianco

The floodgates are open. Look for forecasts for Q2 2020 and the rest of the year to drastically change to some of the most extreme readings ever seen. At this point, these are no more than wild guesses. Take this as a signal that quantitative approaches at fair value are not possible in this environment.... Read More

Thoughts on the Fed Announcement

Posted By Jim Bianco

It is difficult to find a superlative to describe what the Fed announced this morning. At first blush, it looks like they are nationalizing financial markets, except for equities and high yield.... Read More