Tag Archives: Markets

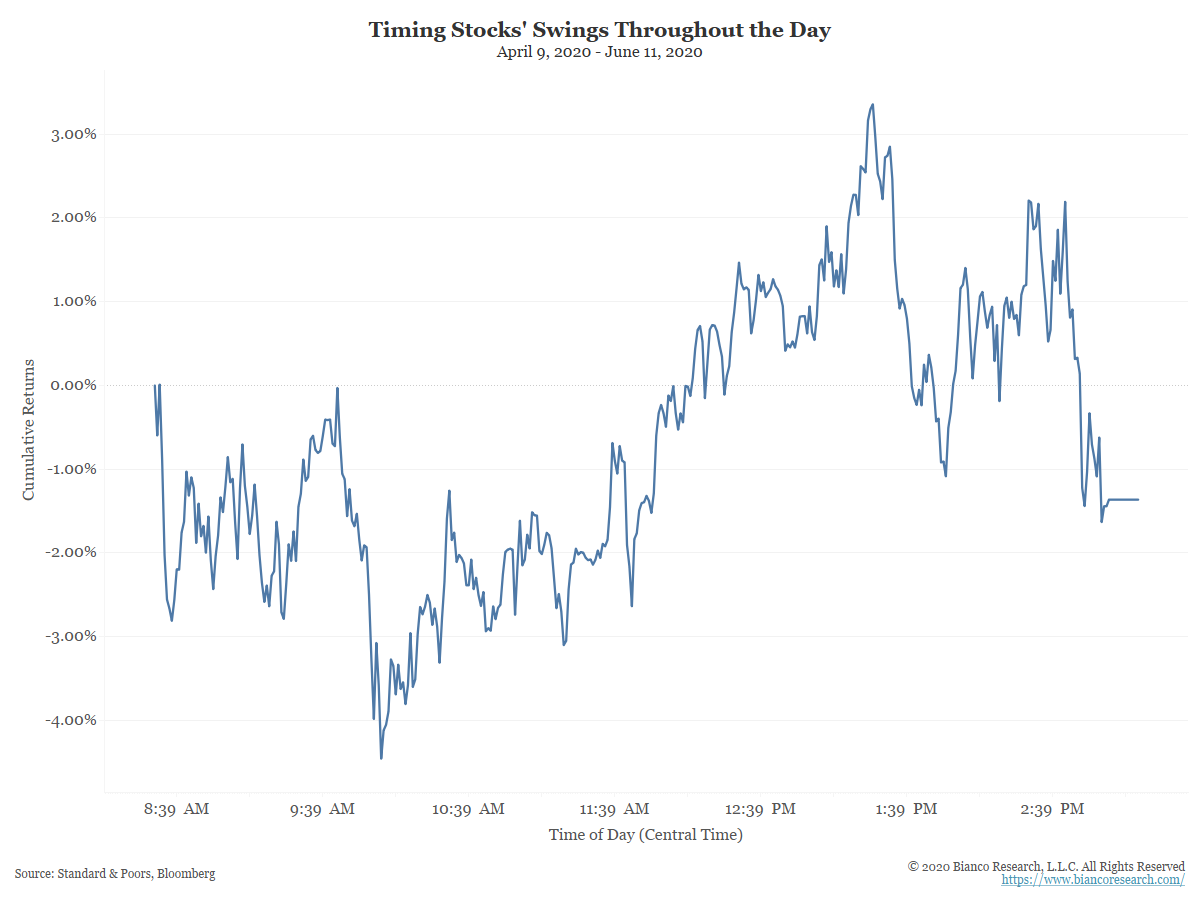

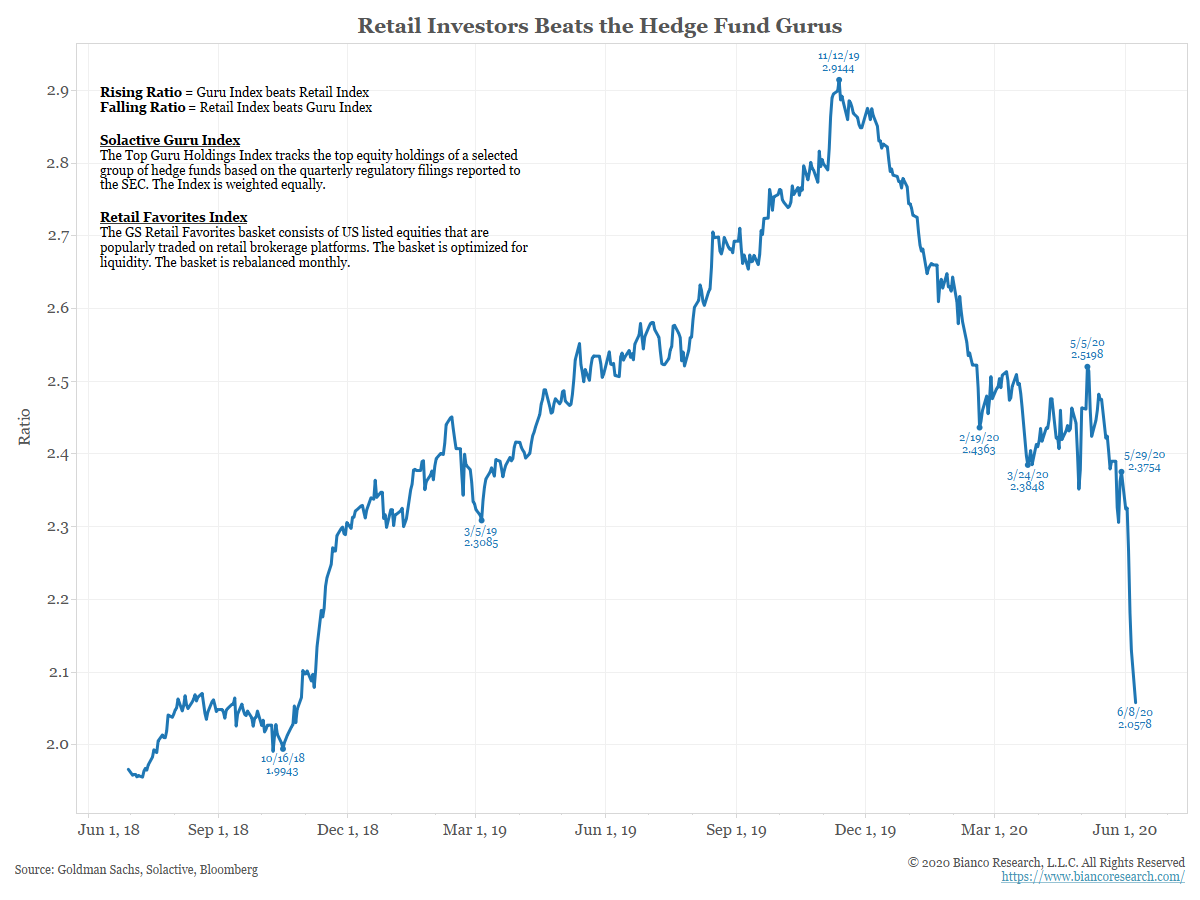

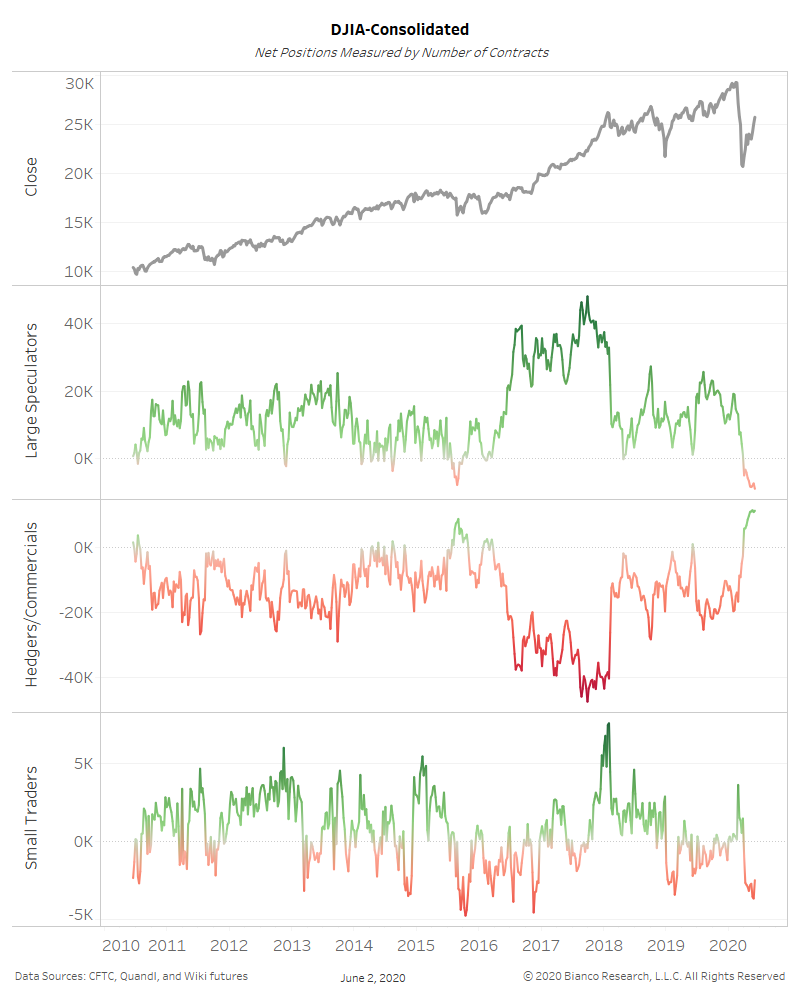

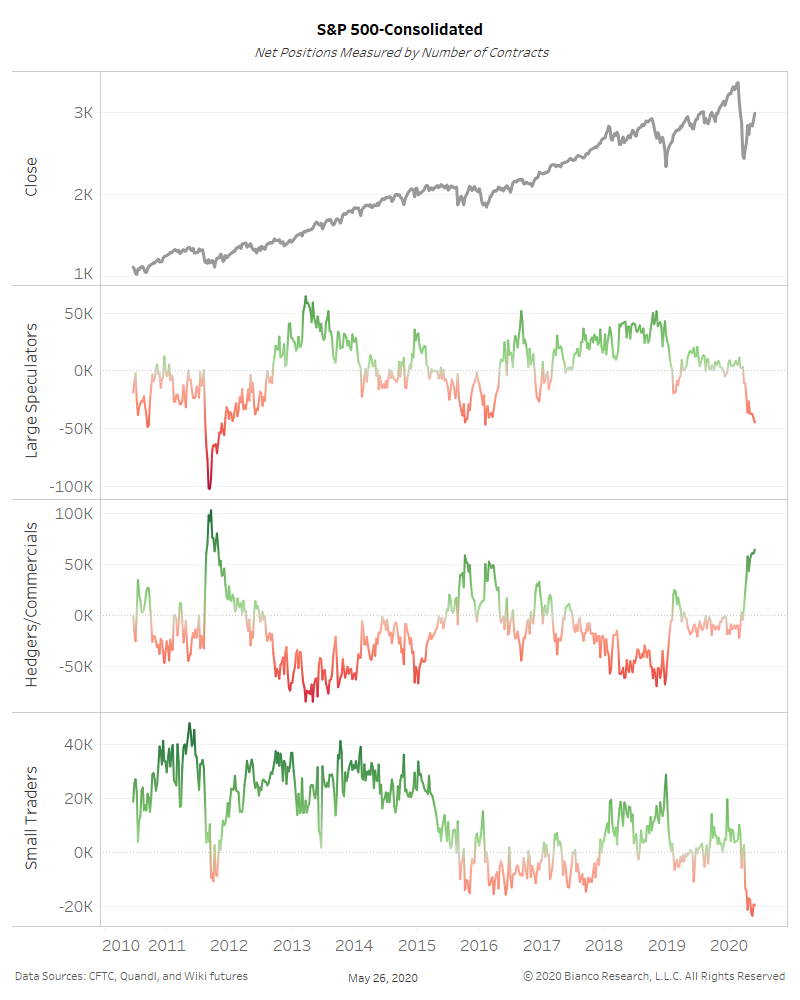

More on Retail Trading

Posted By Jim Bianco

While many are left debating the size and significance of the retail bid, the market does not sell off 6% on merely bad news. These types of daily moves occur when speculative bets reach a fever pitch.... Read More

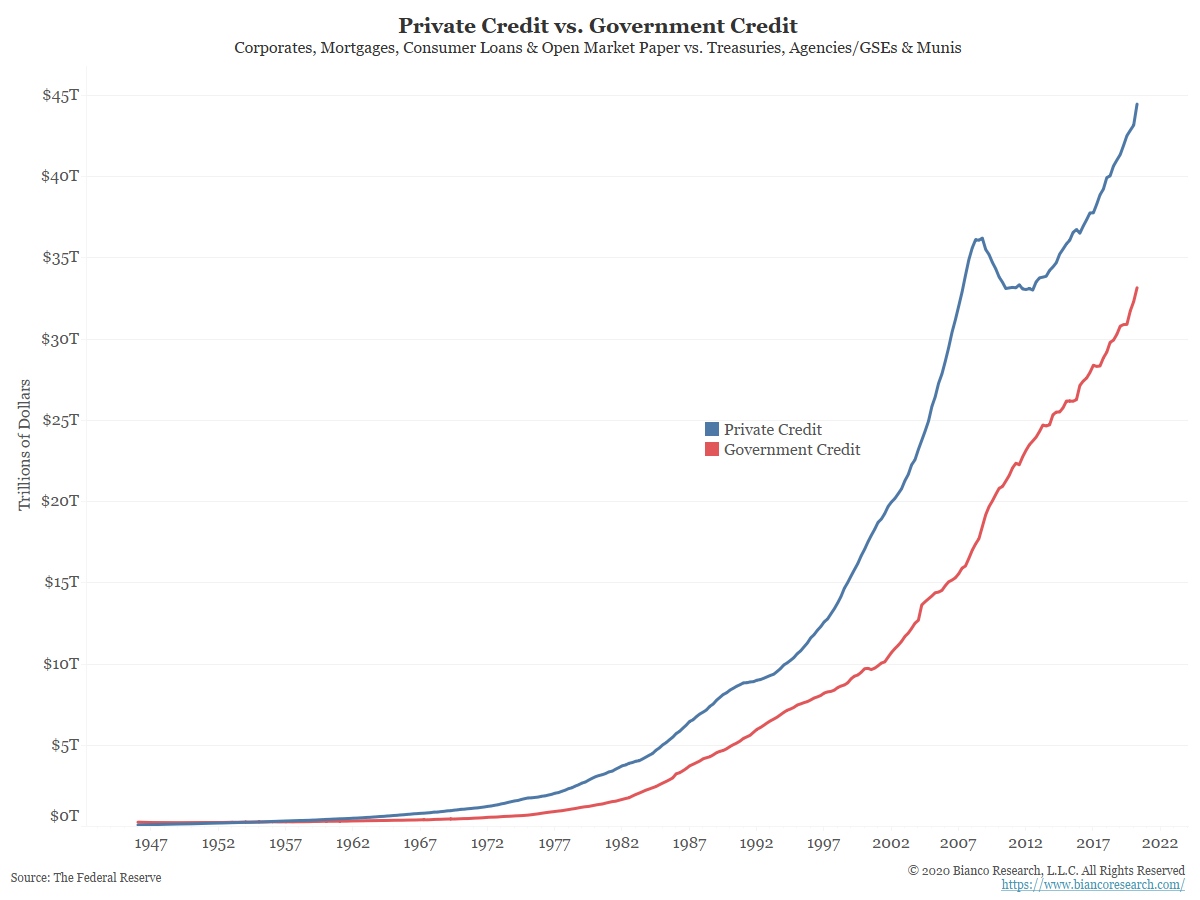

Comparing the Value of Credit in the U.S. to GDP

Posted By Greg Blaha

The amount of outstanding private credit in the U.S. experienced a brief decline during the financial crisis, but government debt grew throughout the entire period. Both are now at new highs.... Read More

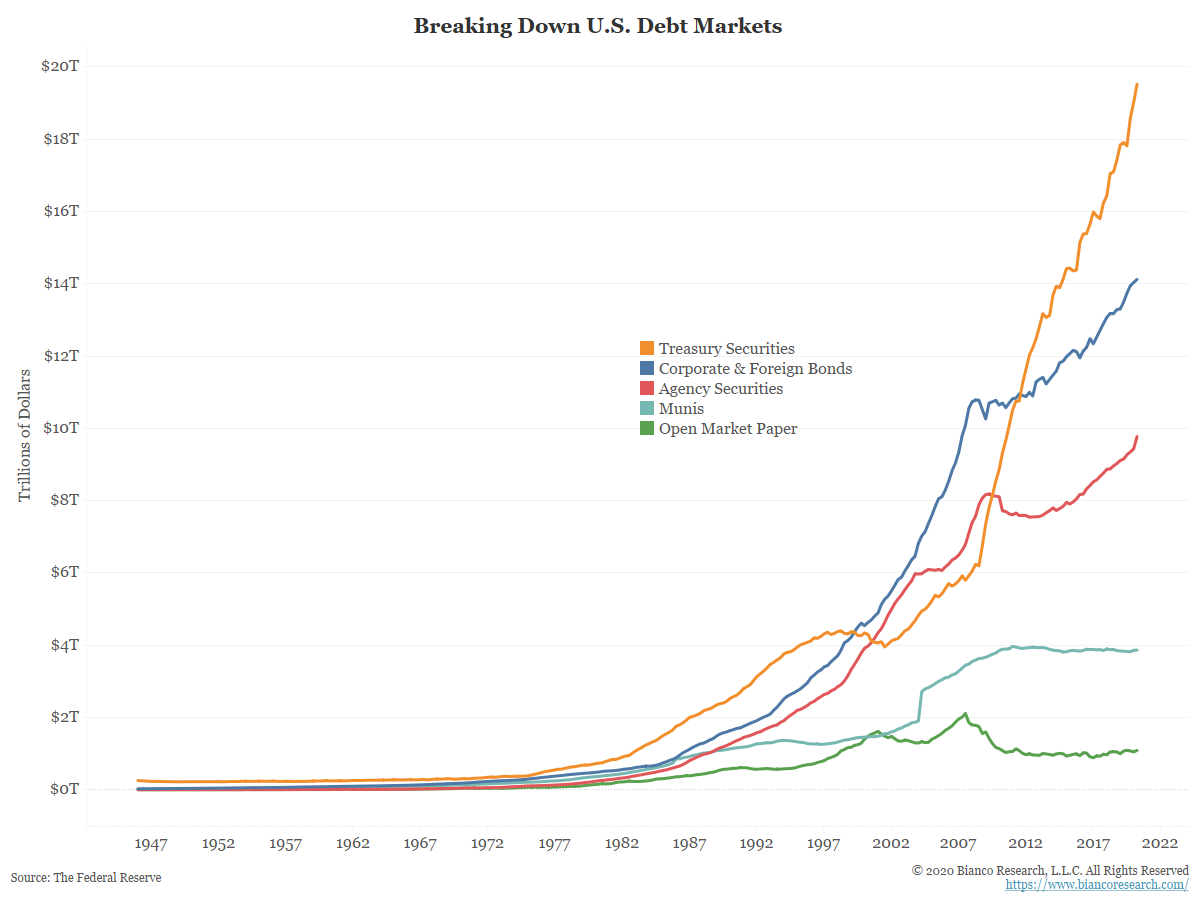

Breaking Down Debt in the U.S.

Posted By Greg Blaha

A look at outstanding amounts of Treasuries, corporates, agencies, munis and open market paper... Read More

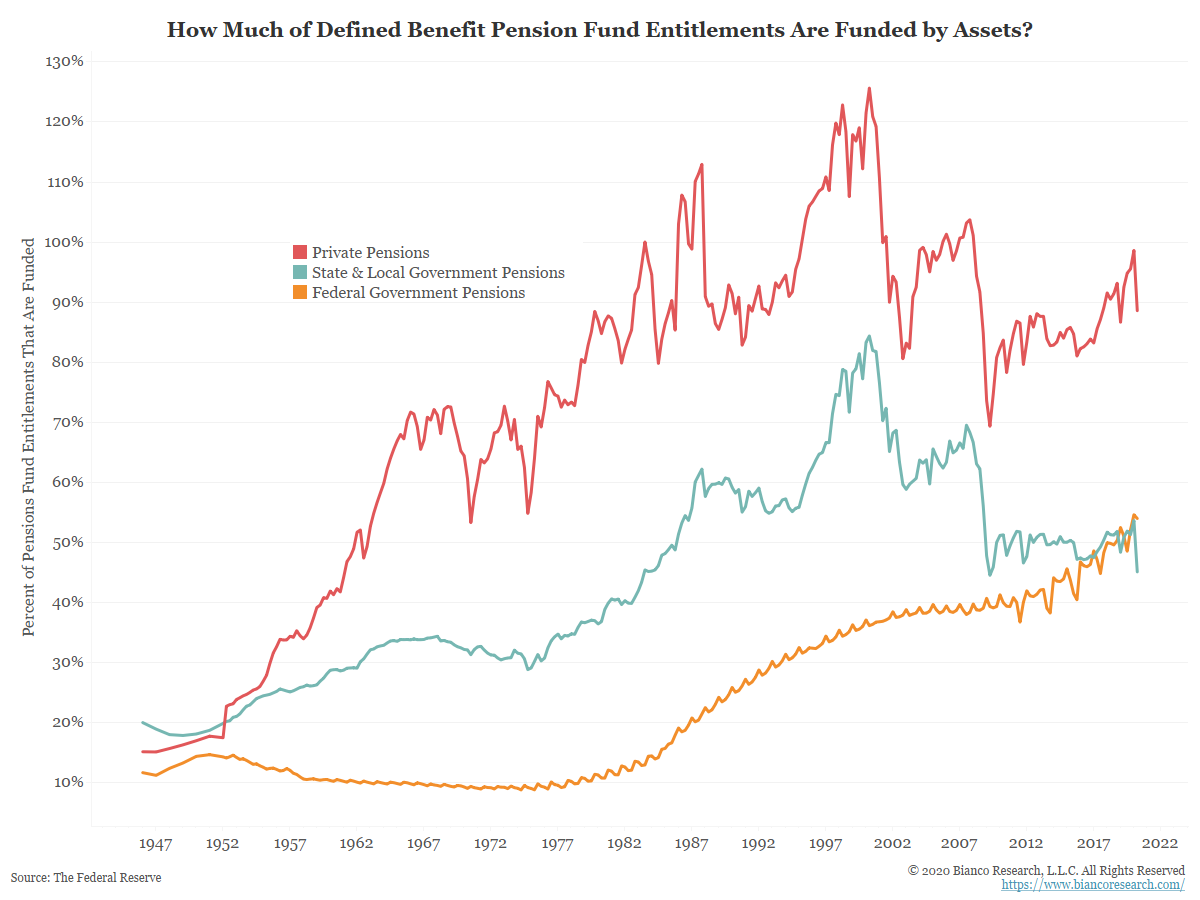

Funding Gaps at Public and Private Pensions

Posted By Greg Blaha

Private pension funds have much smaller funding gaps than their government counterparts.... Read More

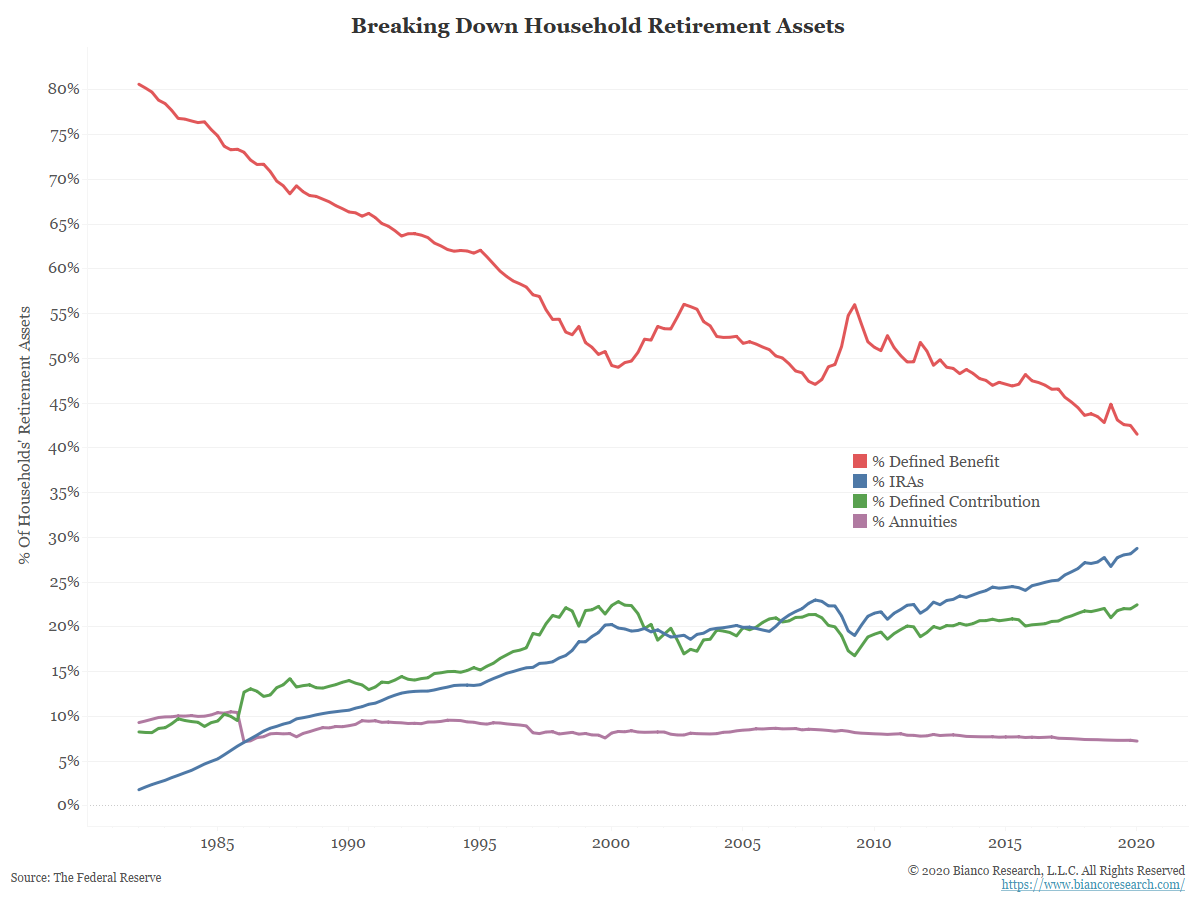

Defined Benefit Plans Continue to Shrink

Posted By Greg Blaha

Defined benefit plans continue to be replaced by IRAs and defined contribution plans.... Read More

The Fed Removes Risk From the Rally

Posted By Jim Bianco

The central bank has fostered an unprecedented amount of risk-taking at the expense of the long-term health of the economy.... Read More

The Retail Mania Keeps Growing

Posted By Jim Bianco

For weeks we have been detailing the unfolding retail mania in the stock market. It seems to be going to new heights.... Read More

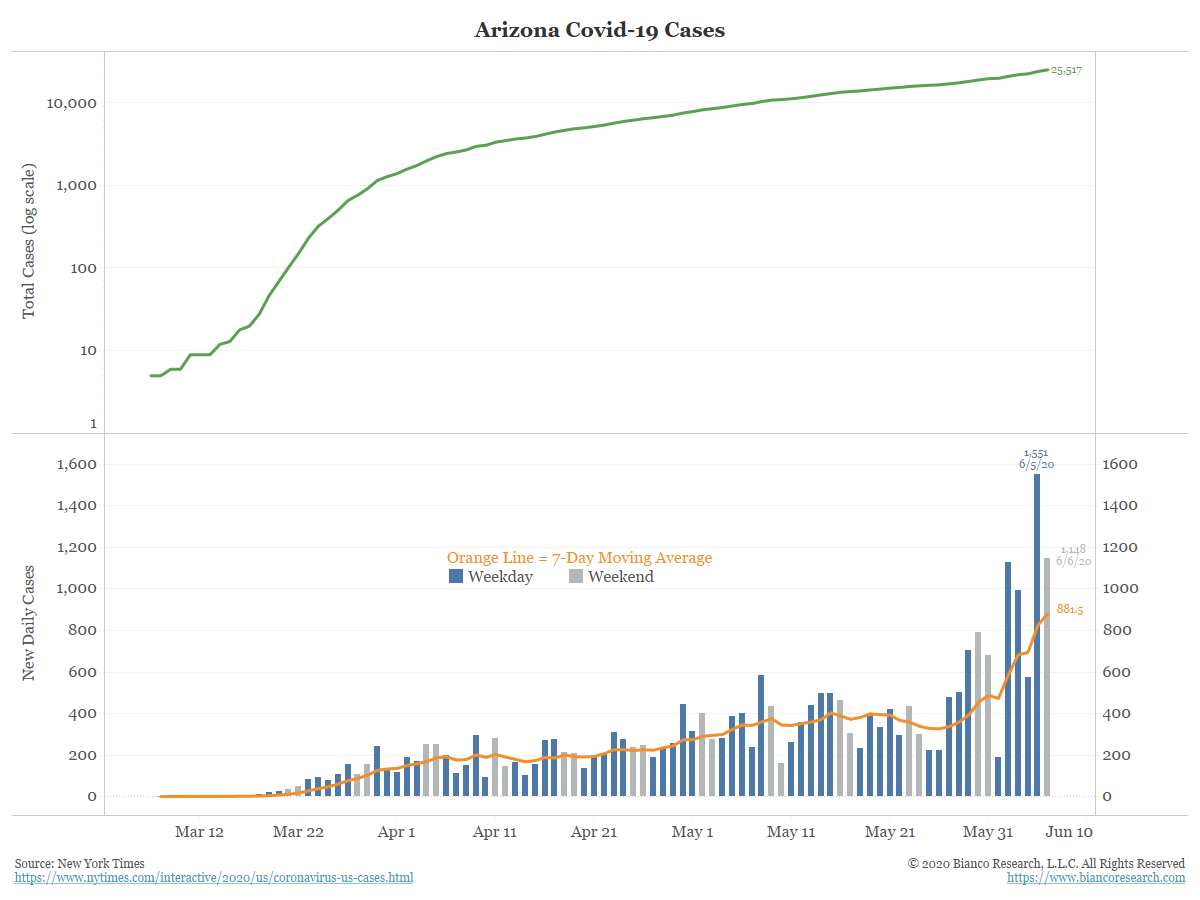

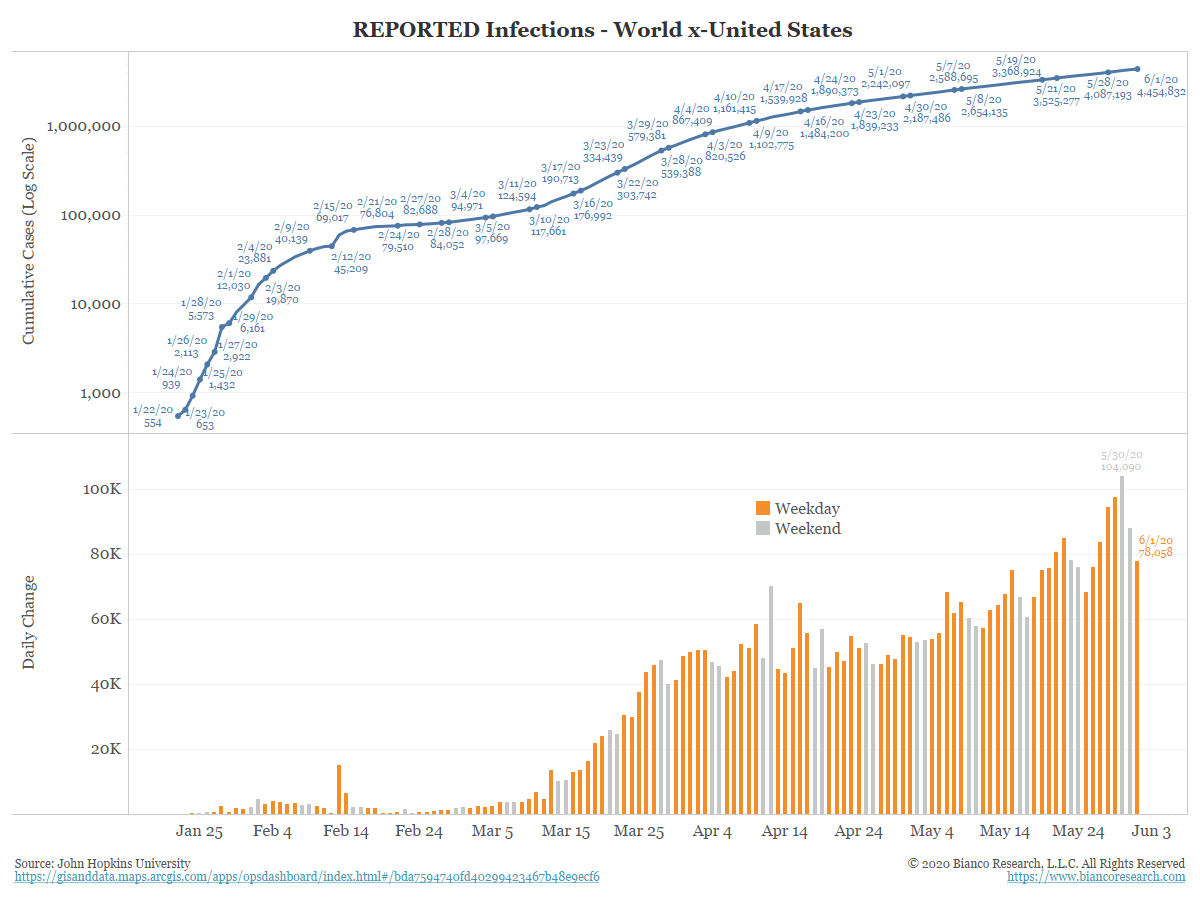

The Latest on COVID-19 Infections

Posted By Jim Bianco

Worldwide COVID-19 growth is still making new highs. In the United States, Arizona is shaping up as a test case for how to deal with a second wave.... Read More

COVID-19 Update

Posted By Jim Bianco

The world is not flattening the curve. The U.S. still has hotspots in the southeast and out west.... Read More

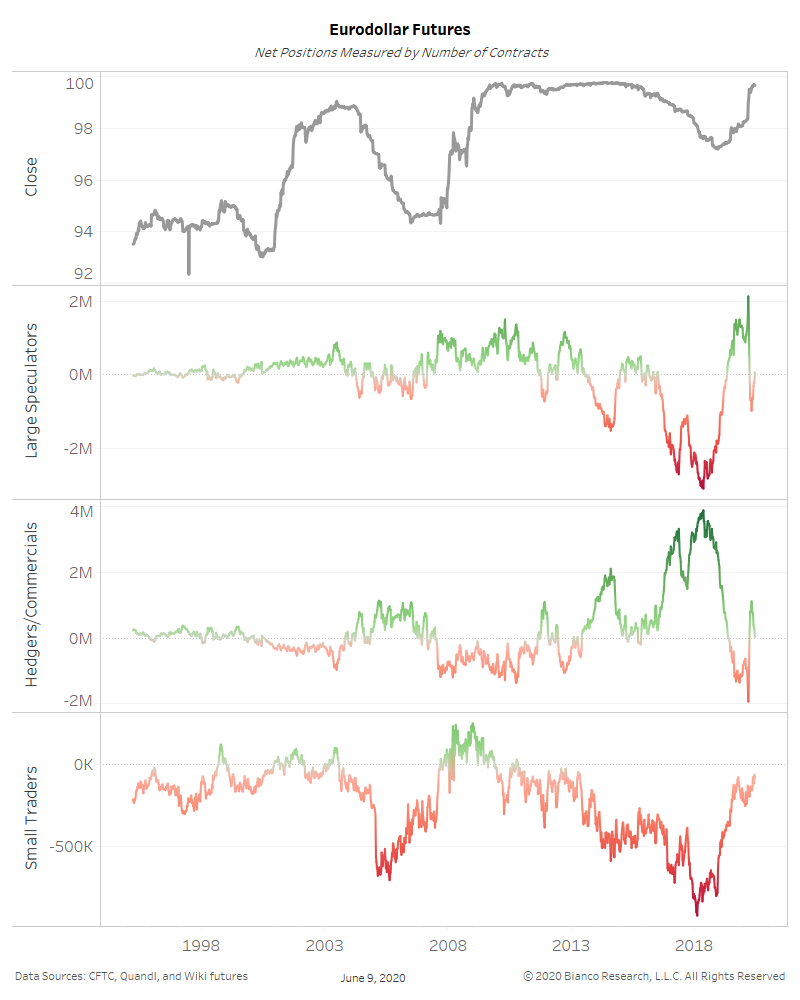

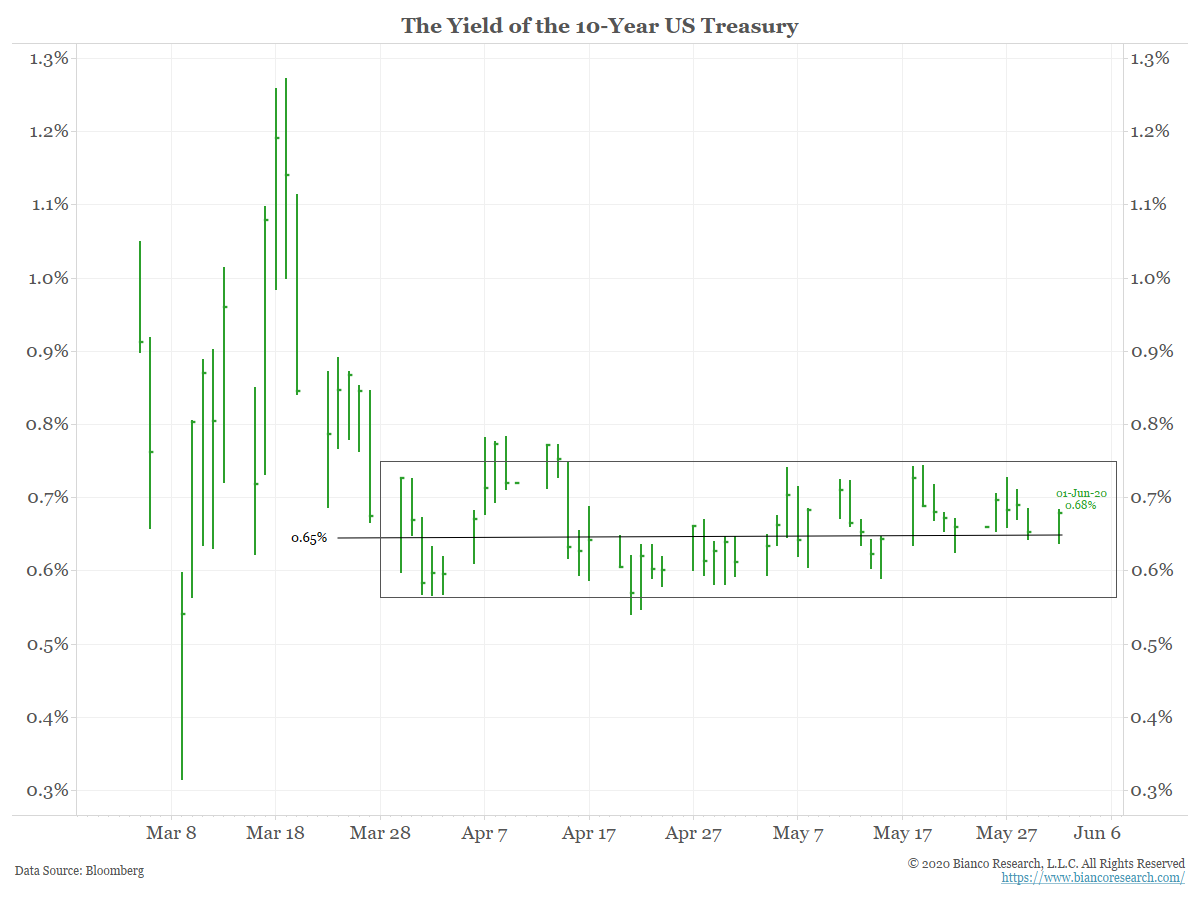

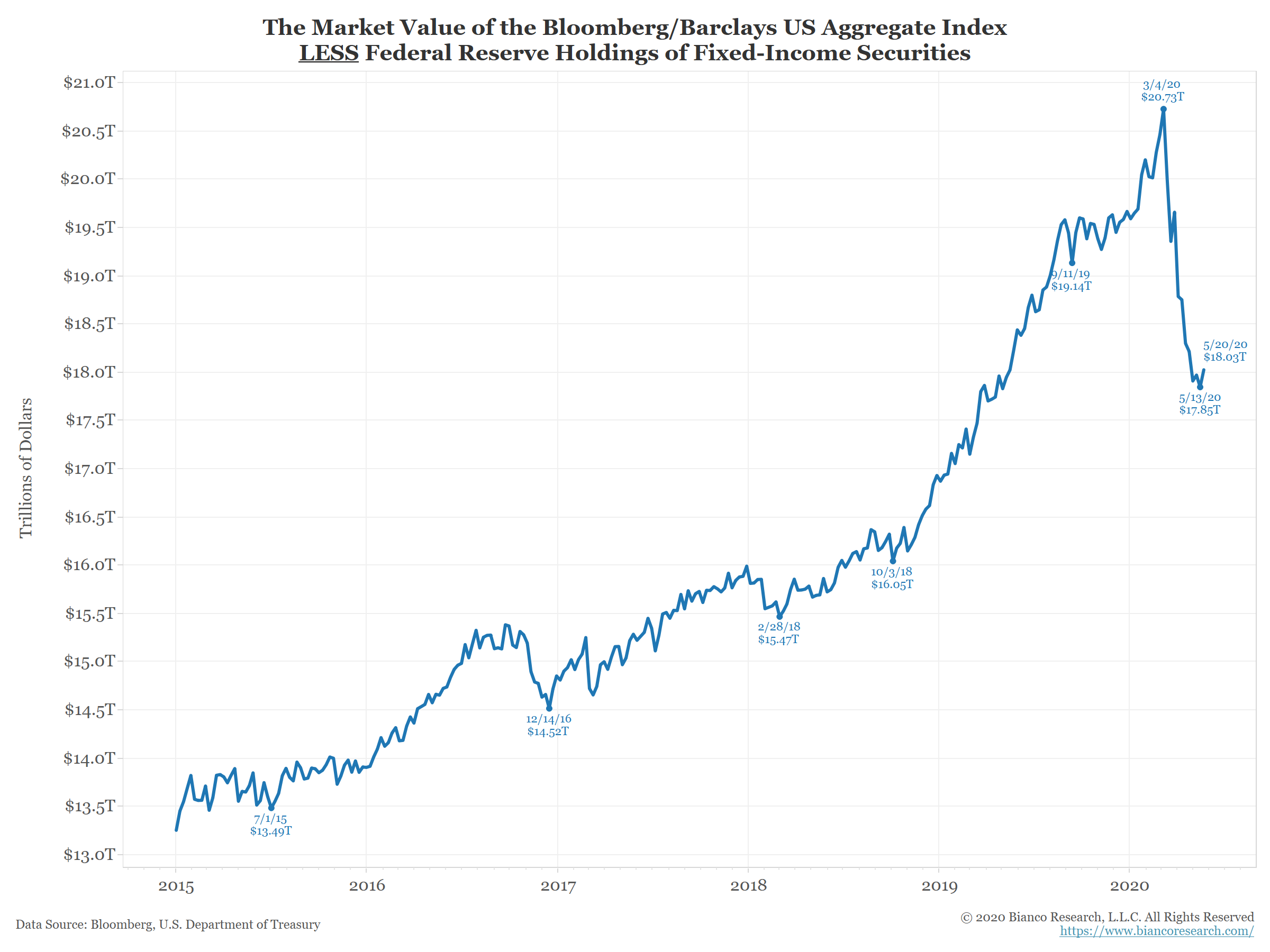

Does the Bond Market Offer Signals Anymore?

Posted By Jim Bianco

Is the bond market offering proper signals anymore? Is it a true reflection of market sentiment or a distortion from extreme Federal Reserve policy? ... Read More

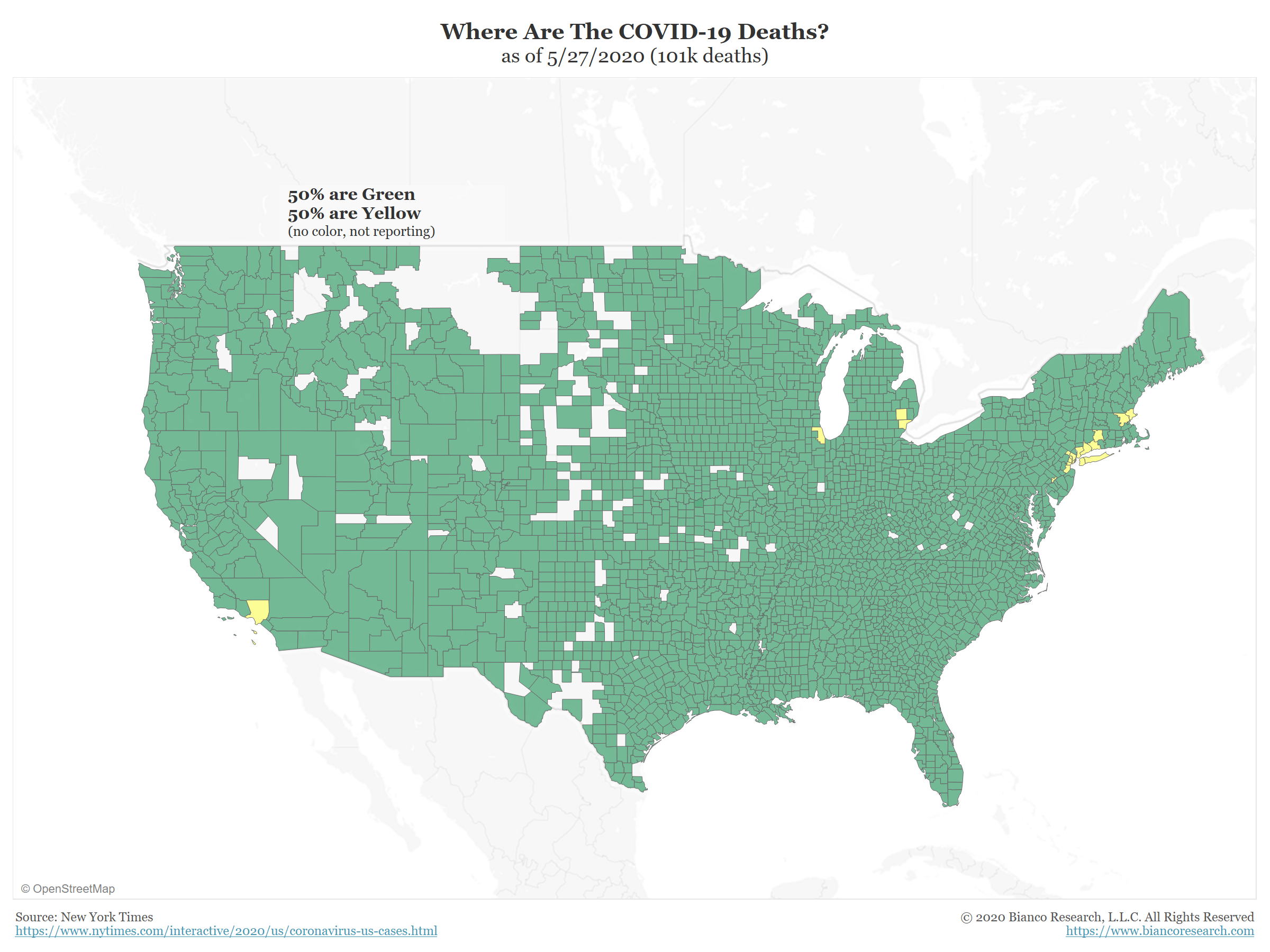

More on COVID Cases and Excess Deaths

Posted By Jim Bianco

*While the number of new daily infections is slowing in the U.S., that is not the case worldwide. *Deaths in the U.S. are still far surpassing the total suggested by statistical models during normal periods. *COVID is highly concentrated in large urban areas.... Read More

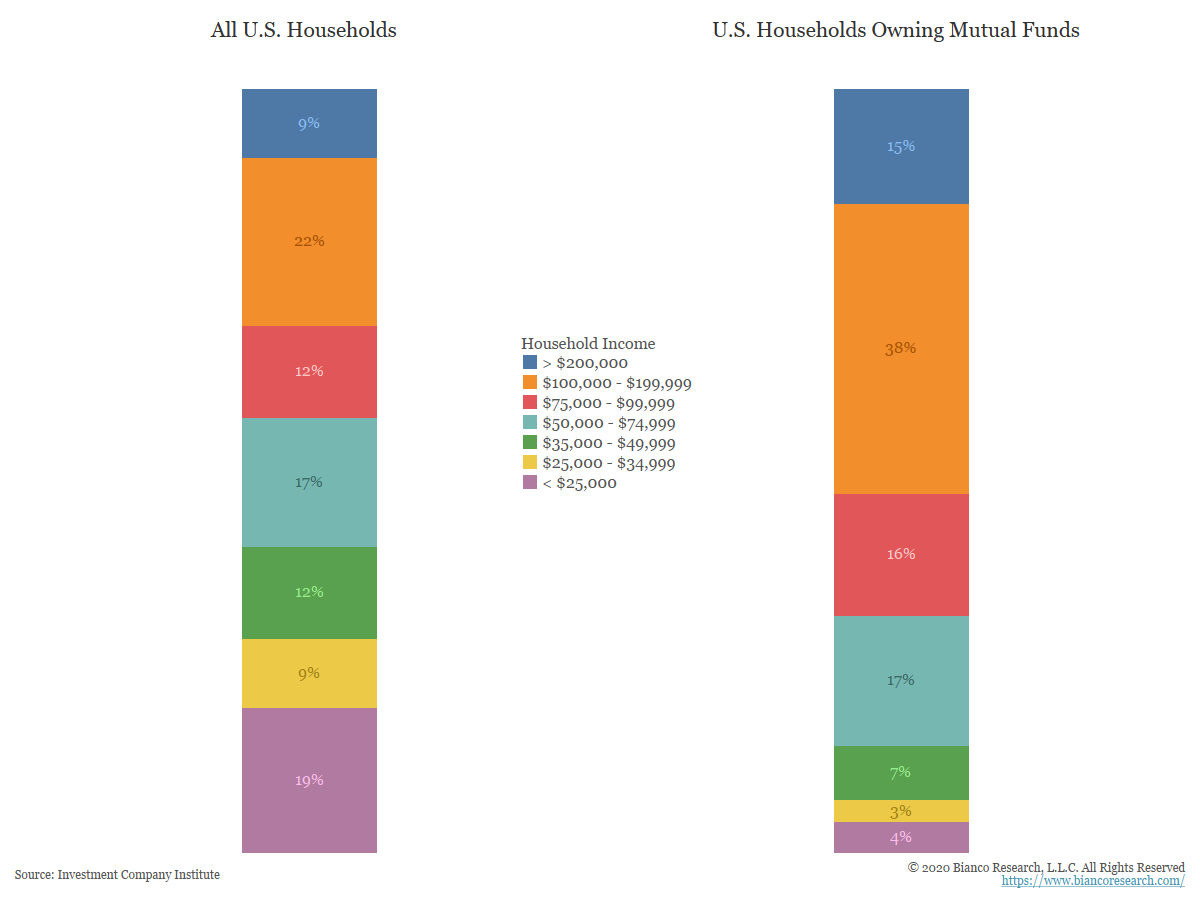

Profiling the Mutual Fund & ETF Universe

Posted By Greg Blaha

53% of households owning mutual funds make more than $100k per year.... Read More

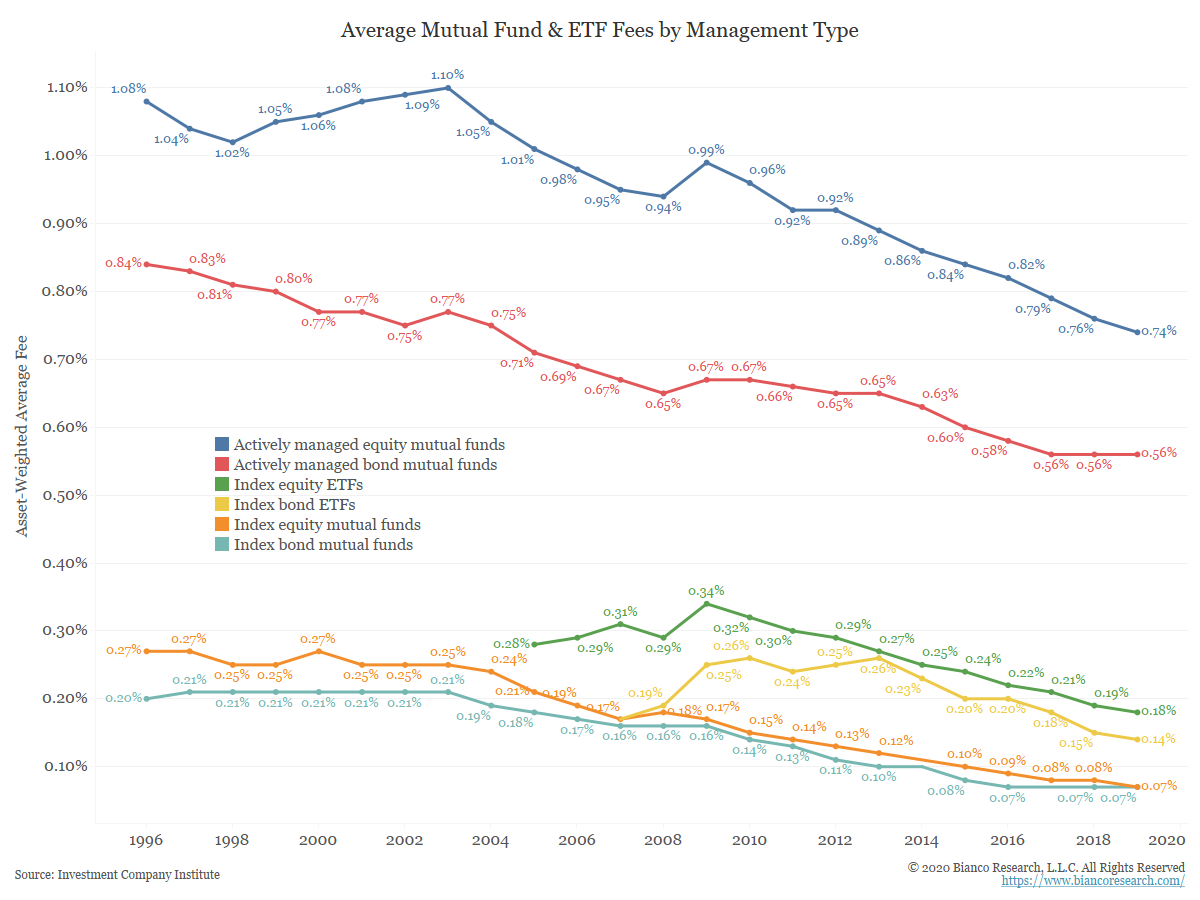

The Divide Between Active and Passive Fund Fees

Posted By Greg Blaha

Active equity funds continue to charge 10x the fees of passive equity funds.... Read More

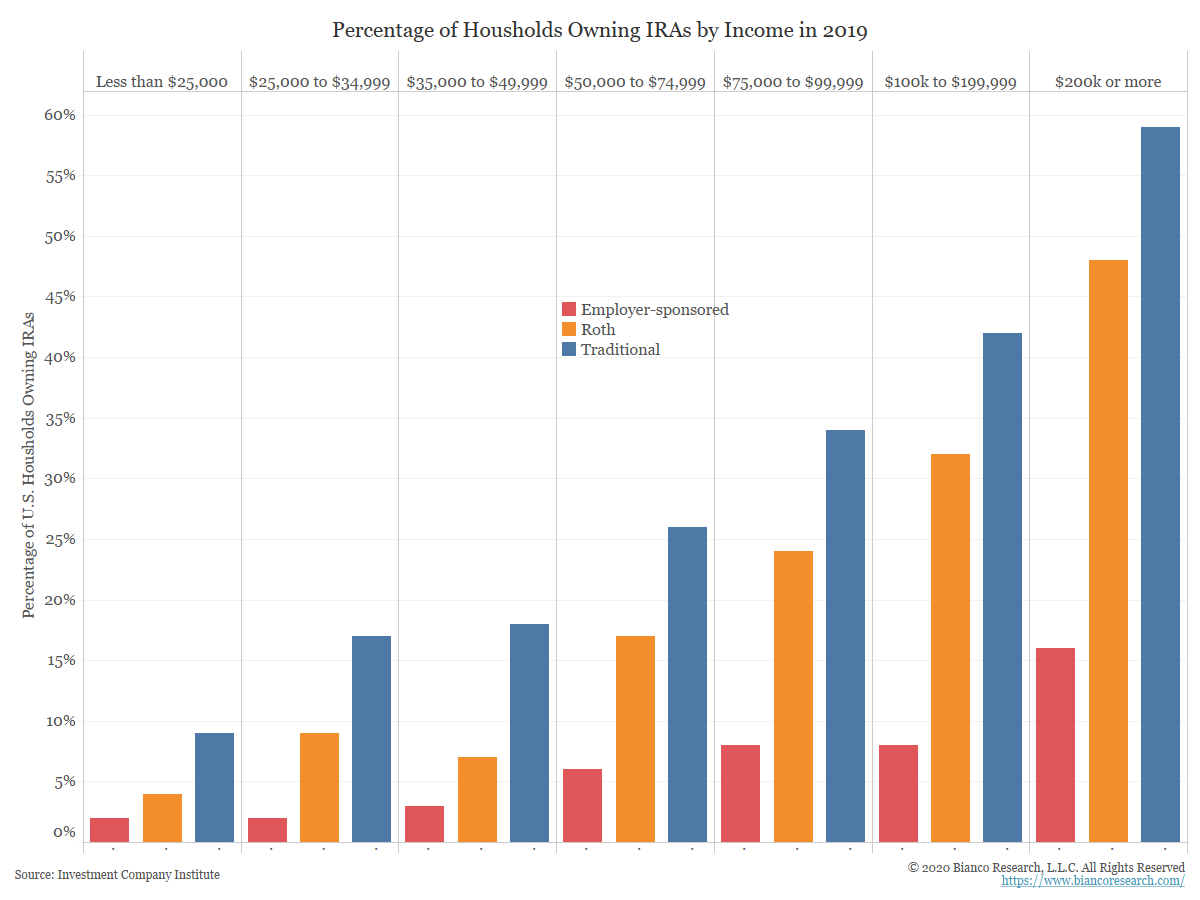

Retirement Assets

Posted By Greg Blaha

Over a third of U.S. households own an IRA. The difference in ownership between the highest and lowest income buckets is staggering.... Read More

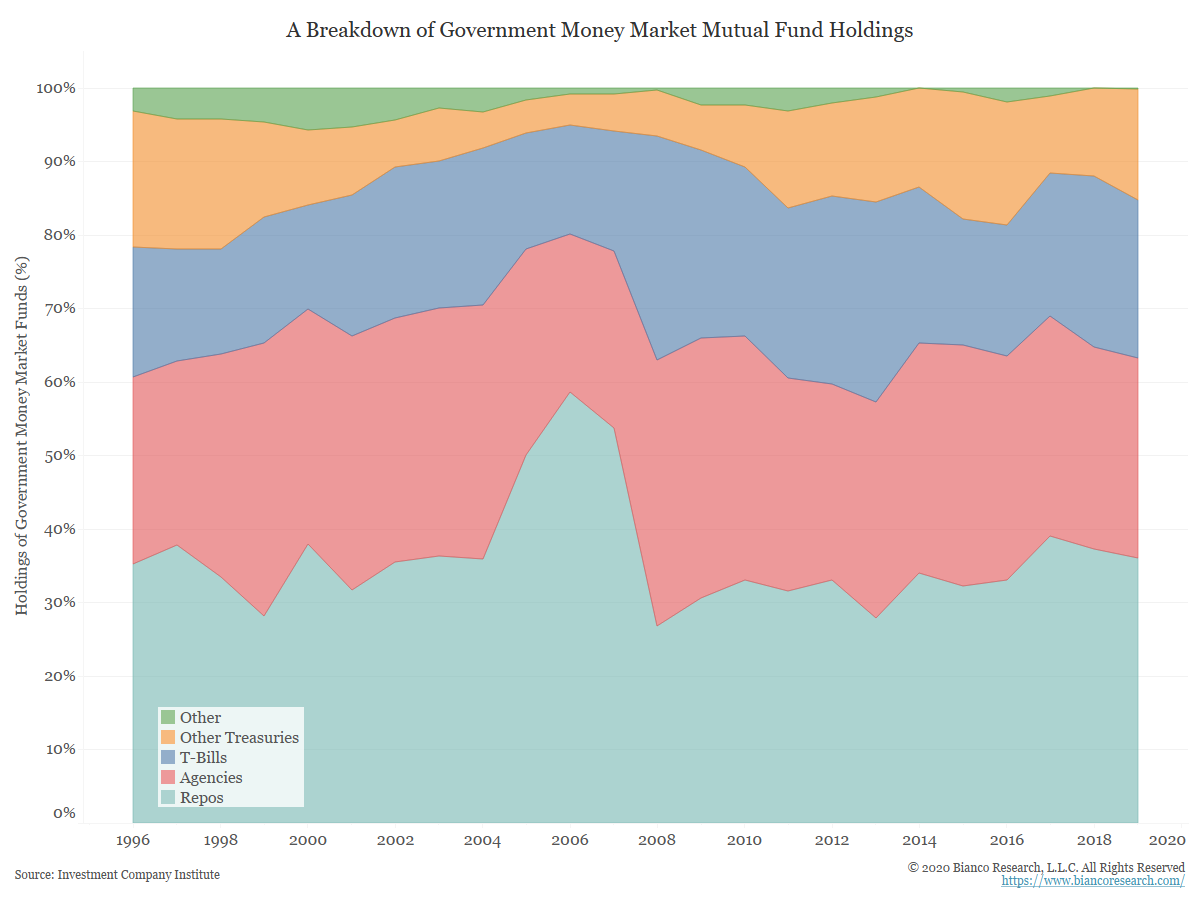

Government vs. Prime Money Market Funds

Posted By Greg Blaha

A look at the holdings of government-only money market funds versus prime money market funds... Read More

Yield Curve Control Is Already Here

Posted By Jim Bianco

The Fed may be debating yield curve control, but the market is acting as though it already started. The Fed's massive purchases of bonds over the last ten weeks is shrinking the size of the bond market available to the private sector. Bond market volatility is disappearing and yields are trending sideways.... Read More