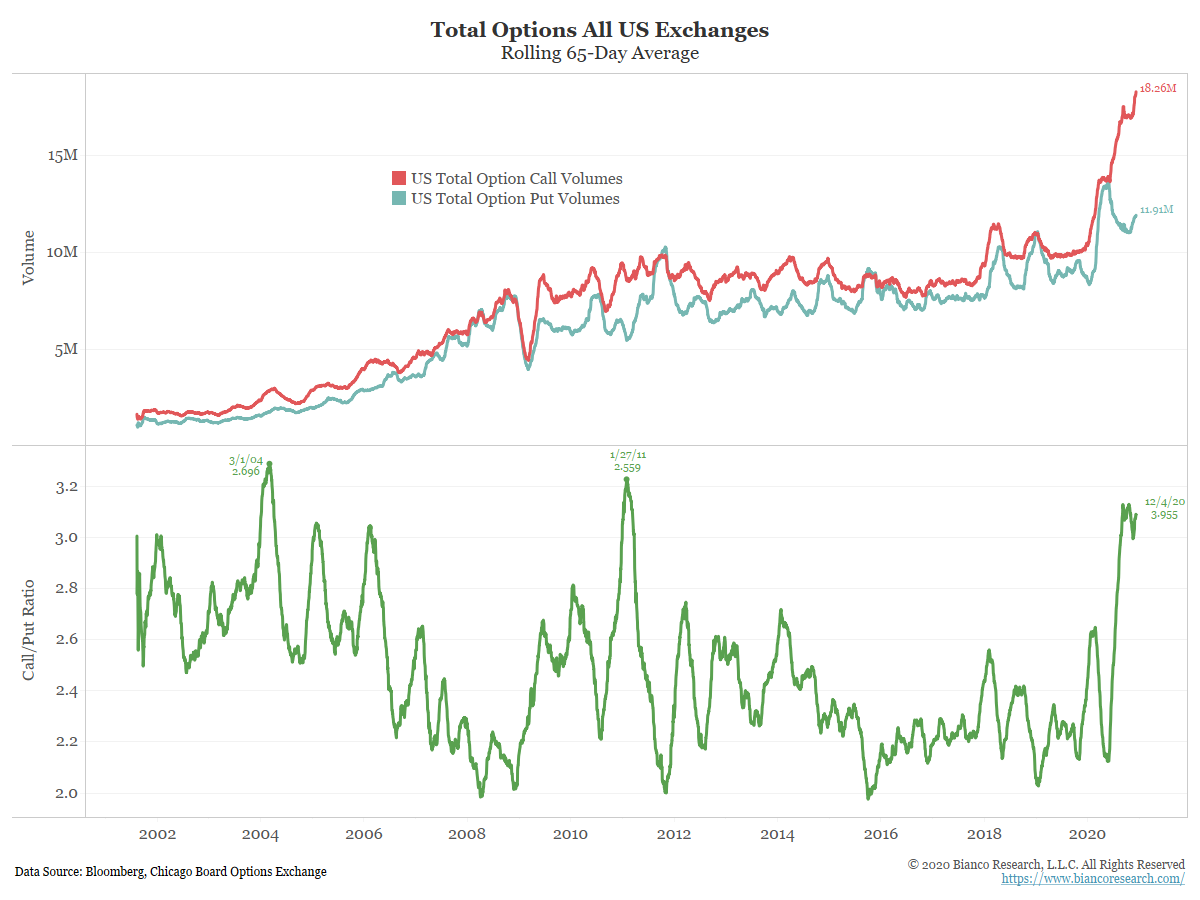

Options Mania Makes New Highs

Posted By Jim Bianco

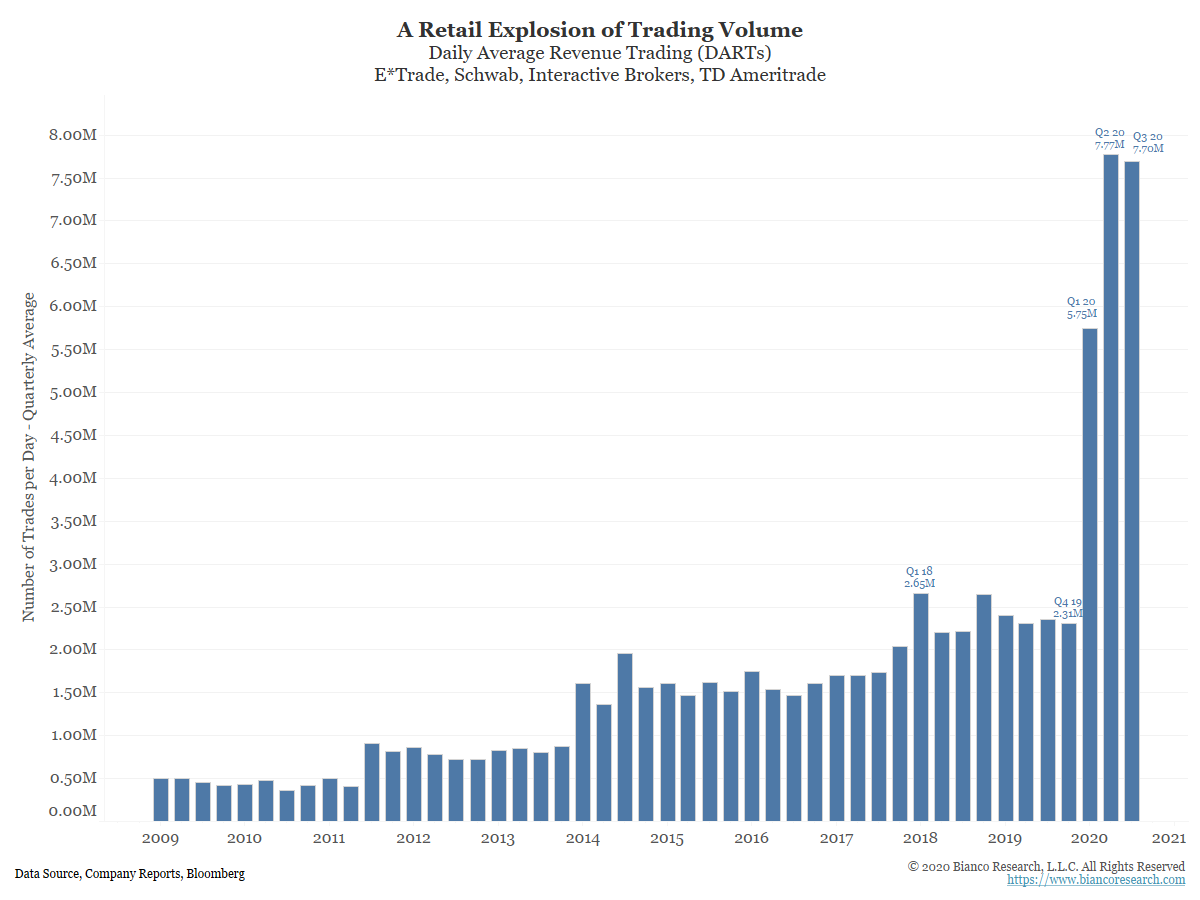

The public's shift from mutual funds and ETFs towards speculating in individual stocks and options continues without pause. Last week's options volume boomed to a new record. All signs suggest the mania is making new peaks.... Read More