Tag Archives: Markets

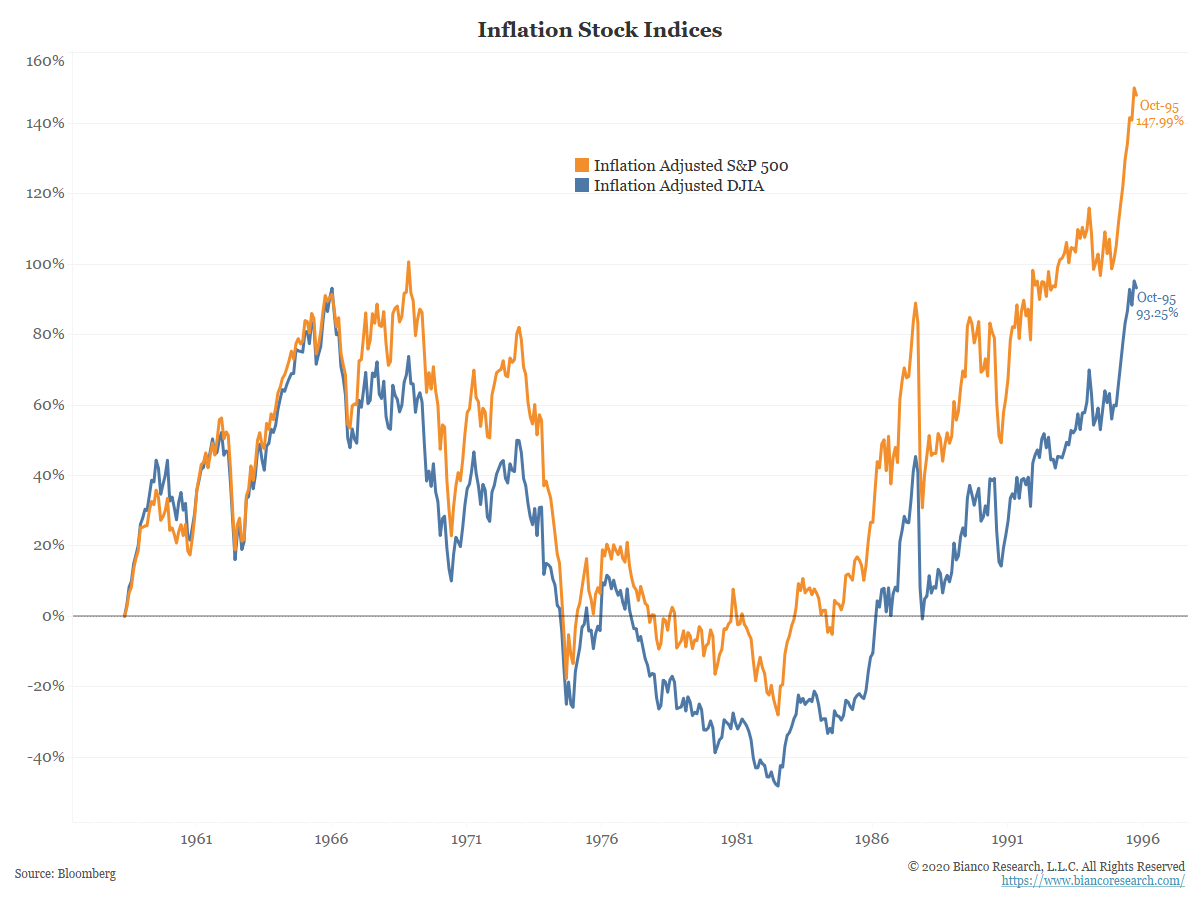

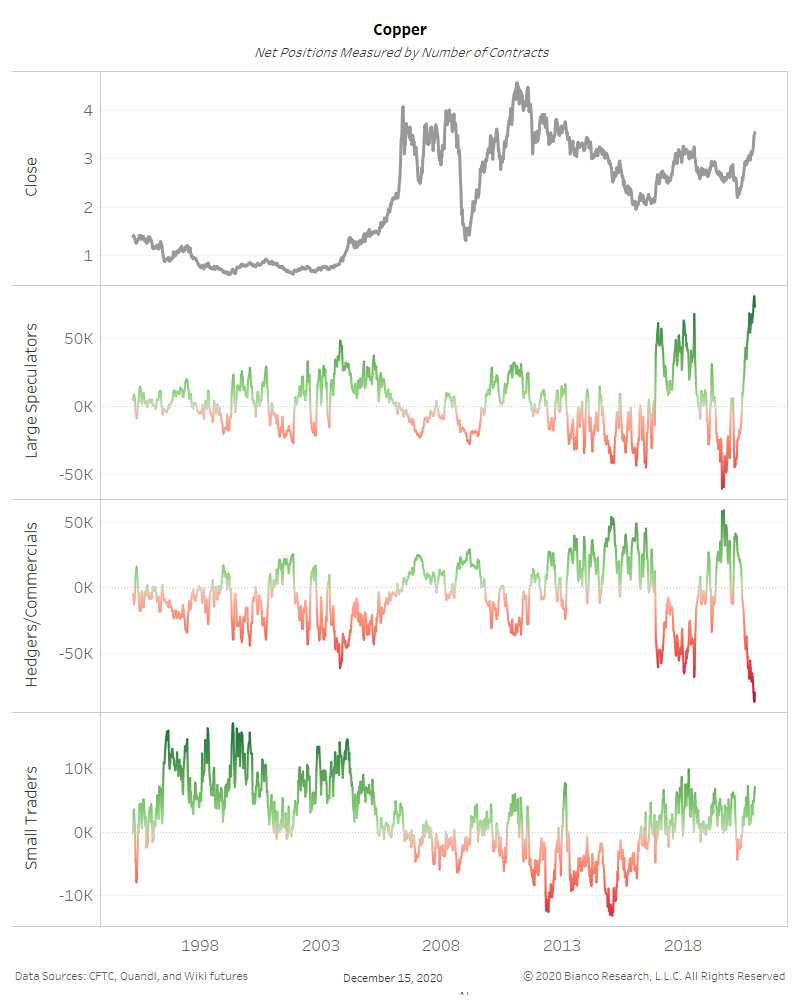

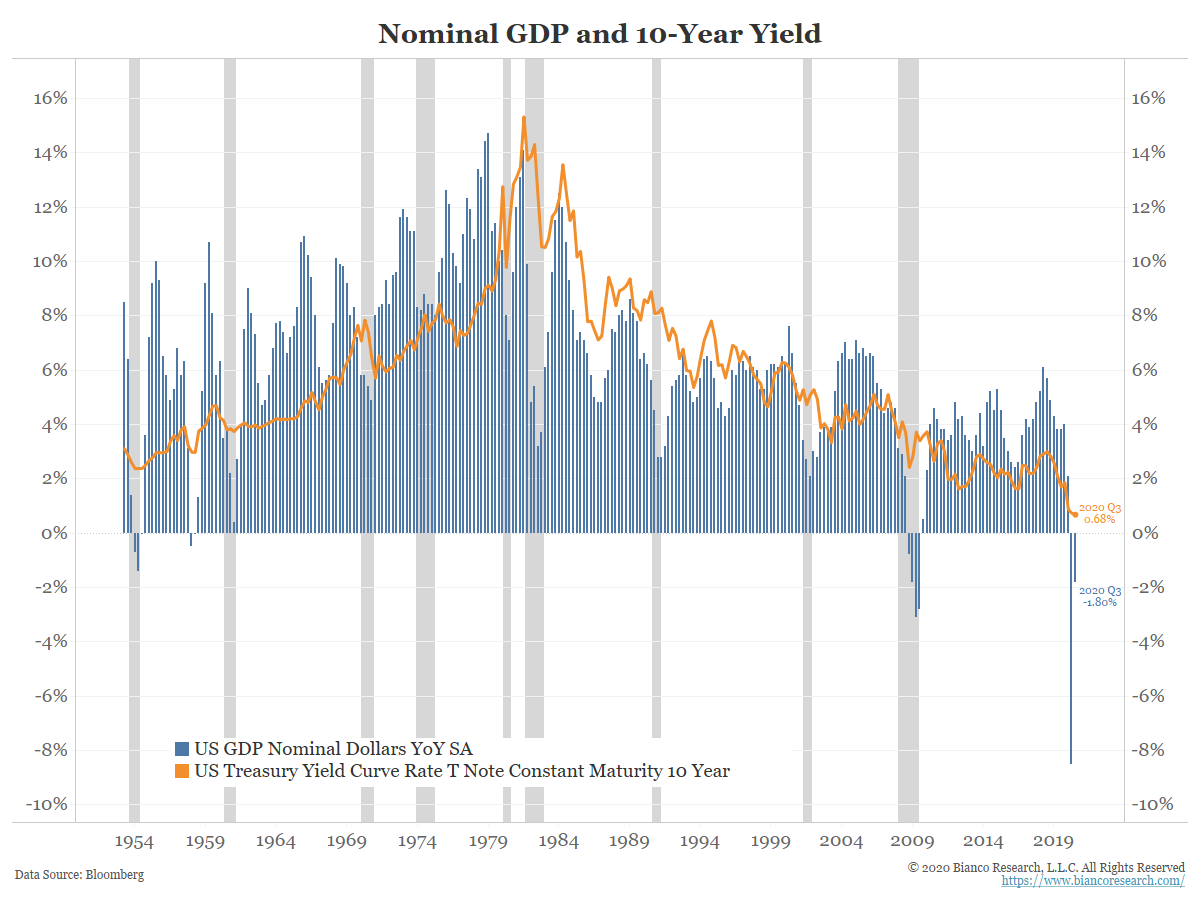

What Kind of Nominal Growth is Coming Next Year?

Posted By Jim Bianco

As booming raw industrial commodity prices point to higher nominal growth expectations in 2021, the dynamic between real growth and inflation will be a major influence on the returns of risk assets. Risk assets do not perform well when inflation is accelerating. We have not seen that in a generation. Our fear is inflation may rear its head in 2021.... Read More

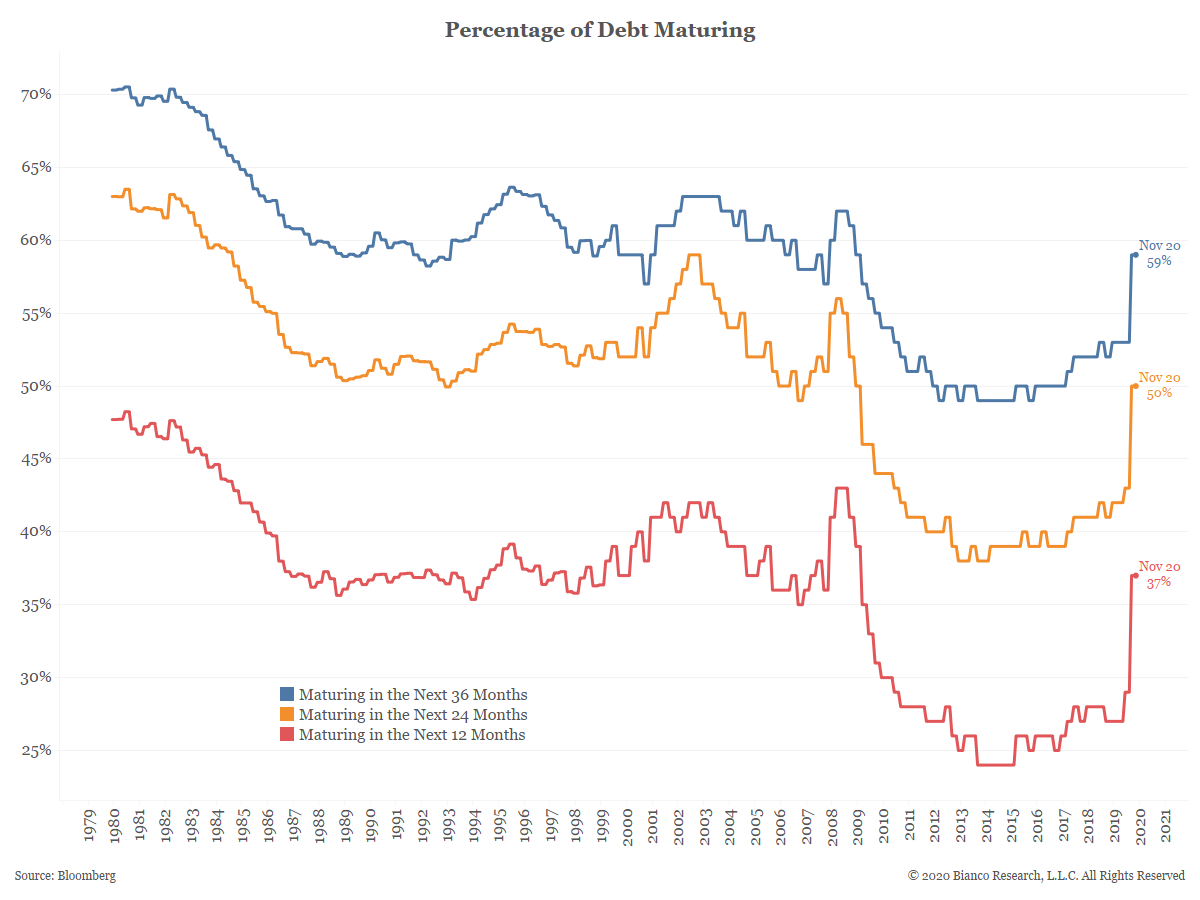

The Average Maturity of Treasury Debt

Posted By Greg Blaha

The rush of T-bill issuance has helped push down the average maturity of U.S. Treasury debt. 37% of all debt is set to mature within the next year.... Read More

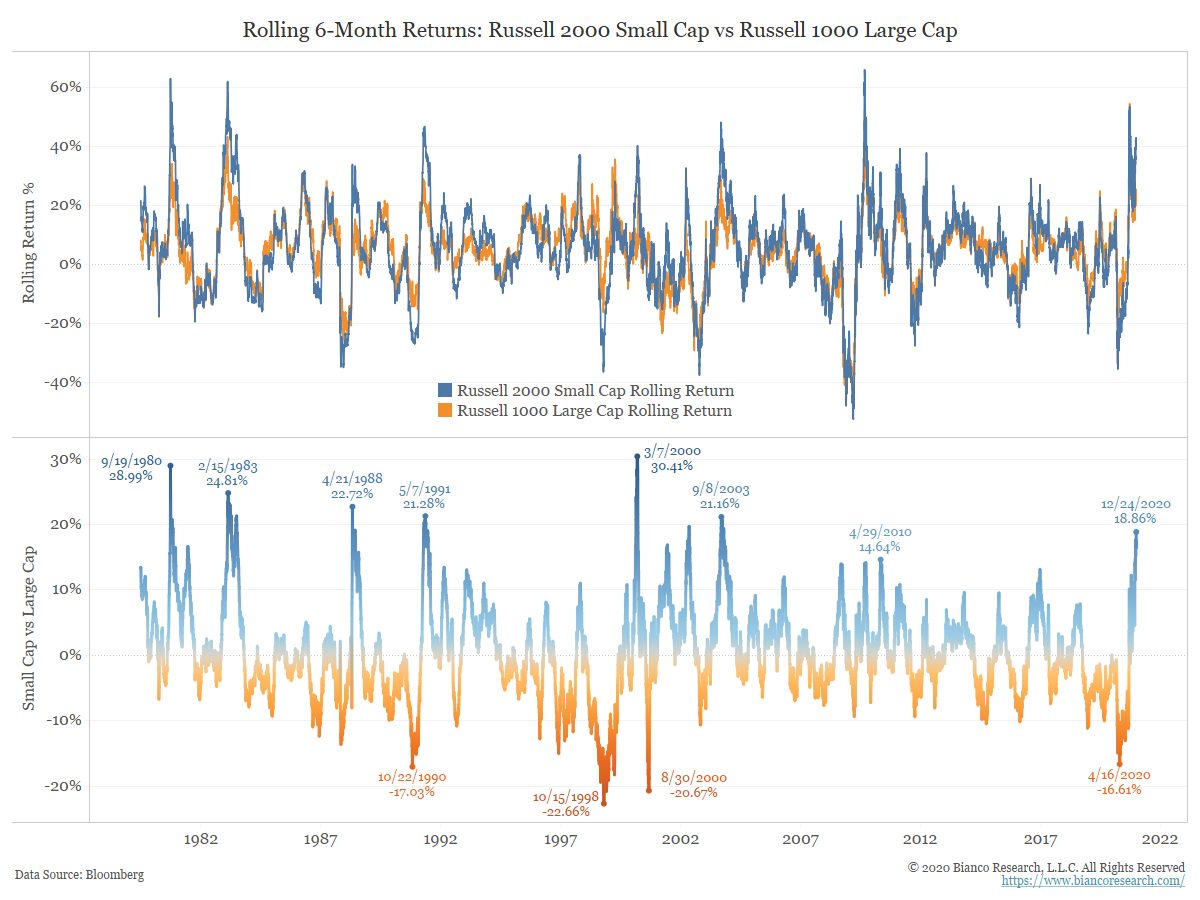

Small Cap Outperformance Hits Level Rarely Seen

Posted By Greg Blaha

Over the past three months small cap stocks returned almost 17% more than large cap stocks, setting a level of outperformance rarely seen.... Read More

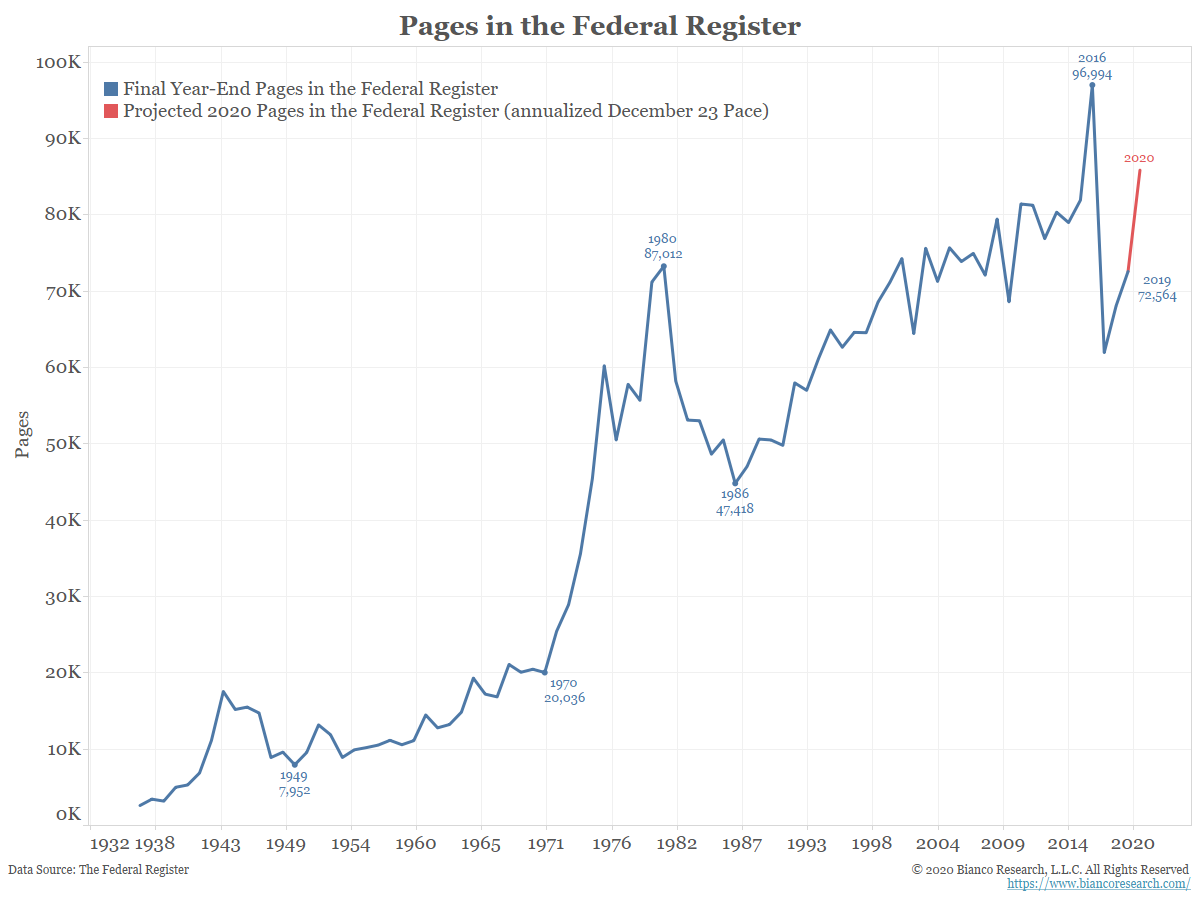

A Look at Regulatory Activity as 2020 Comes to a Close

Posted By Greg Blaha

Trump held true on his promise to cut regulations when he took office in 2016. In the past few years, however, the number of pages in the Federal Register have again crept higher.... Read More

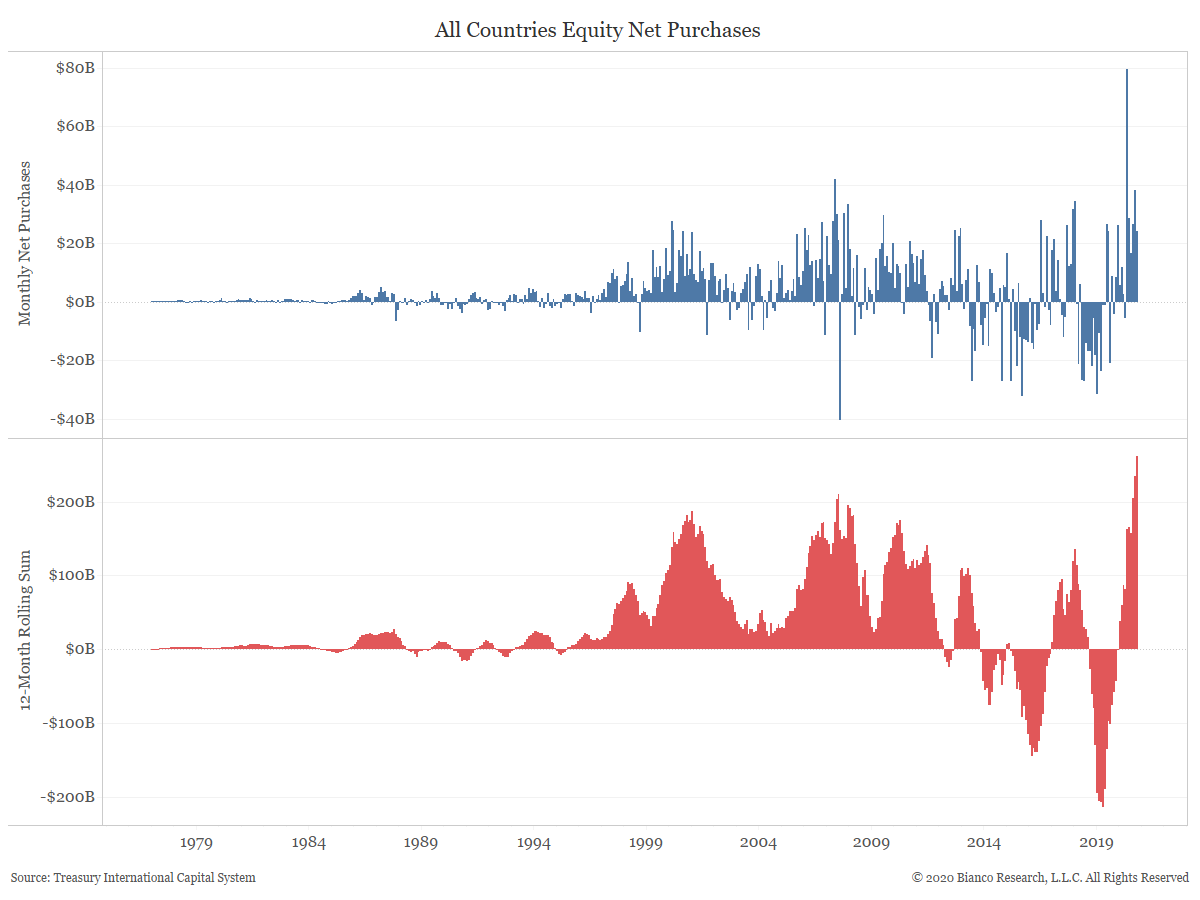

A Review of Foreign Net Purchases of U.S. Securities

Posted By Greg Blaha

A look at foreign net sales and purchases of U.S. Treasuries, agencies, corporates and equities through October... Read More

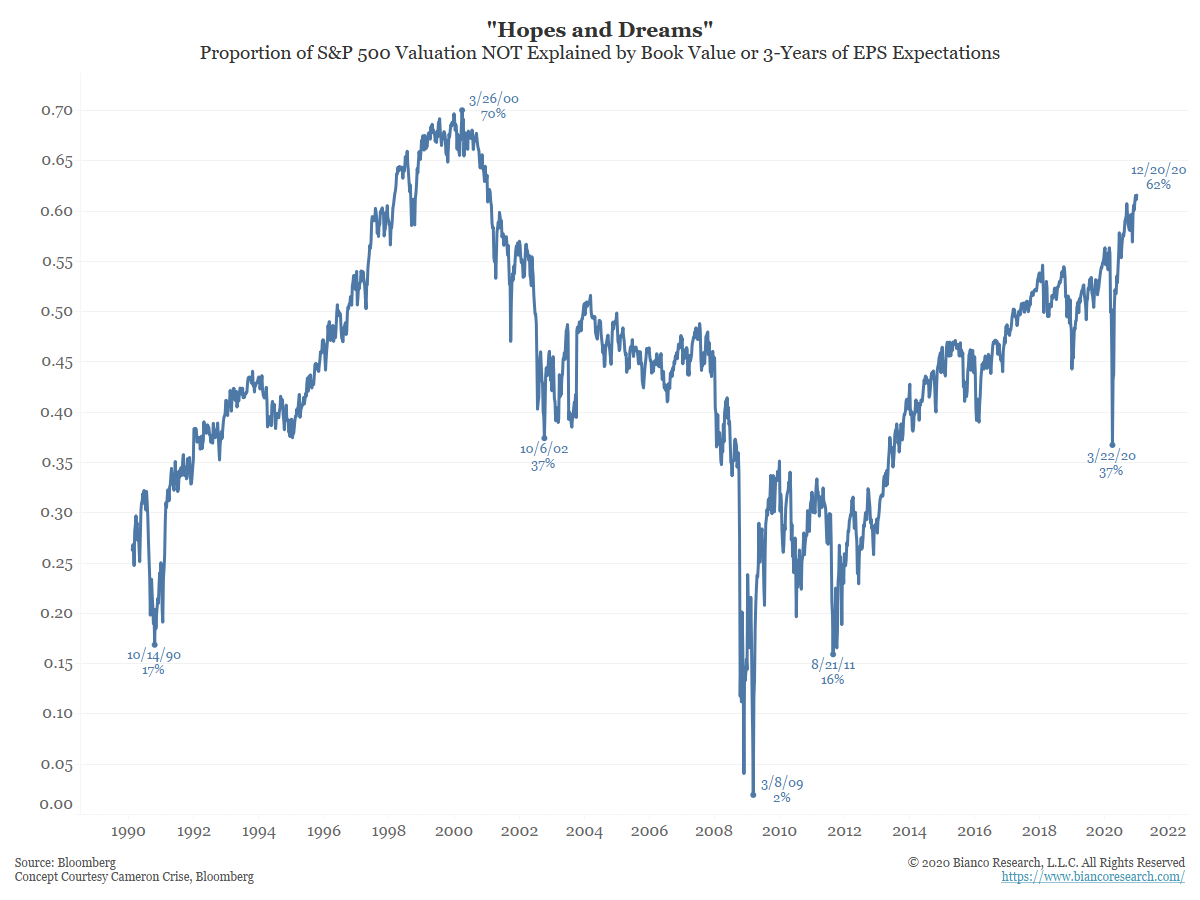

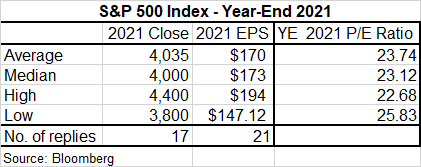

Looking at Market Valuation

Posted By Jim Bianco

The market, which has been priced for perfection lately, has taken a hit as news of a new strain of coronavirus emerges in the U.K.... Read More

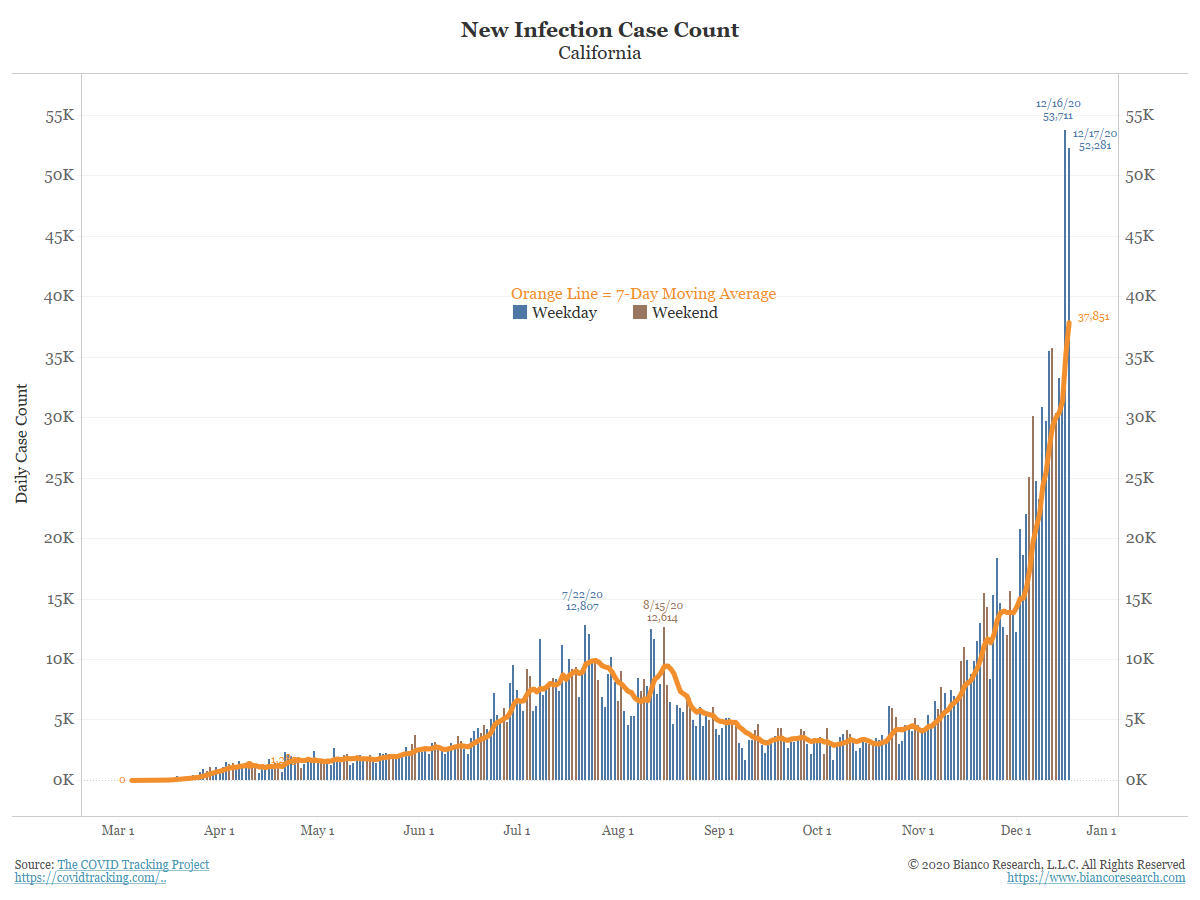

The Economic Slowdown Continues

Posted By Jim Bianco

Markets are looking past the near-term and hoping federal stimulus can help the economy. Since this is expected, markets are living in the second half of 2021, a period of mass vaccination and a return to some sort of new normal in which concerts, sporting venues, and restaurants will no longer have restrictions. This may very well be the case. But before we get there, the slowing economy is about to get worse. The federal government throwing money at everyone would help, but as of this writing, we still have no deal.... Read More

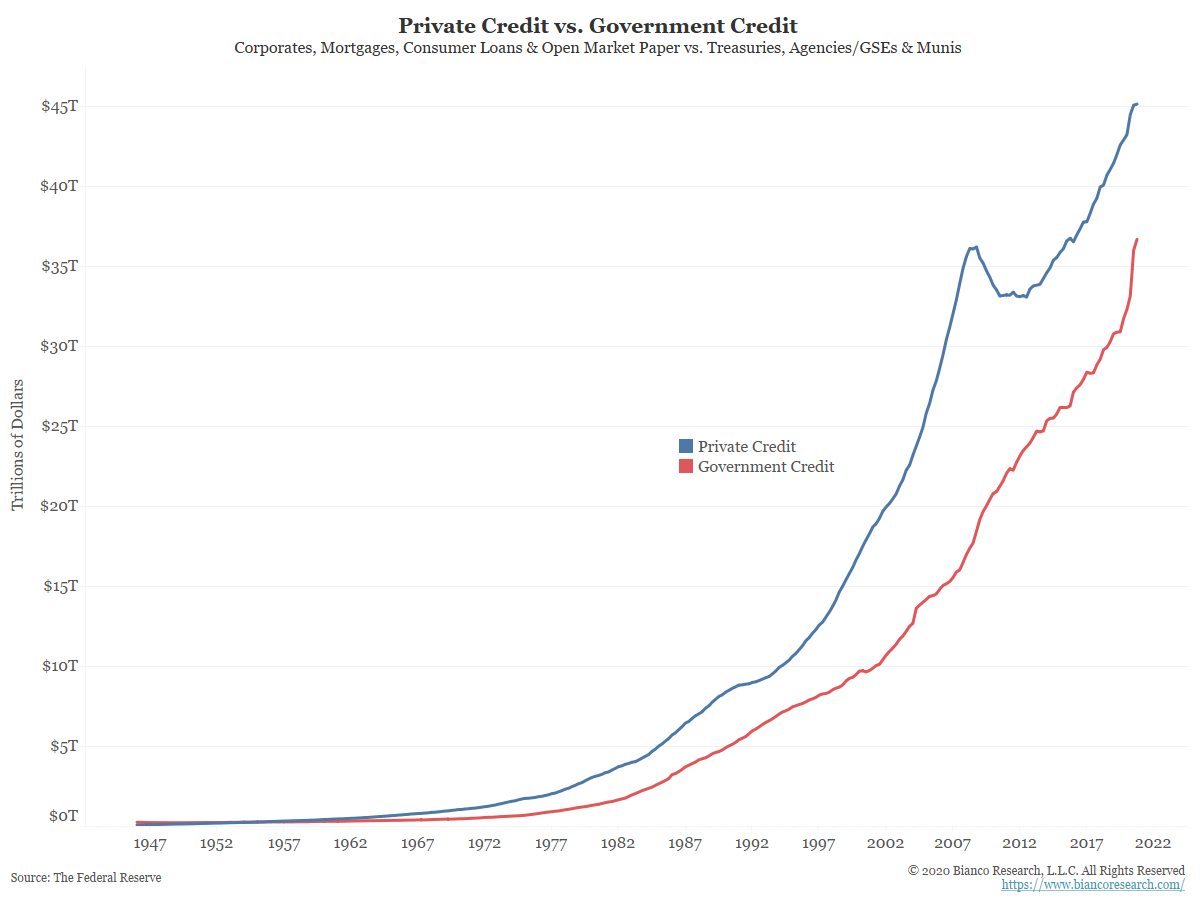

Comparing the Value of Credit in the U.S. to GDP

Posted By Greg Blaha

The amount of outstanding private credit in the U.S. experienced a brief decline during the financial crisis, but government debt grew throughout the entire period. Both are now at new highs.... Read More

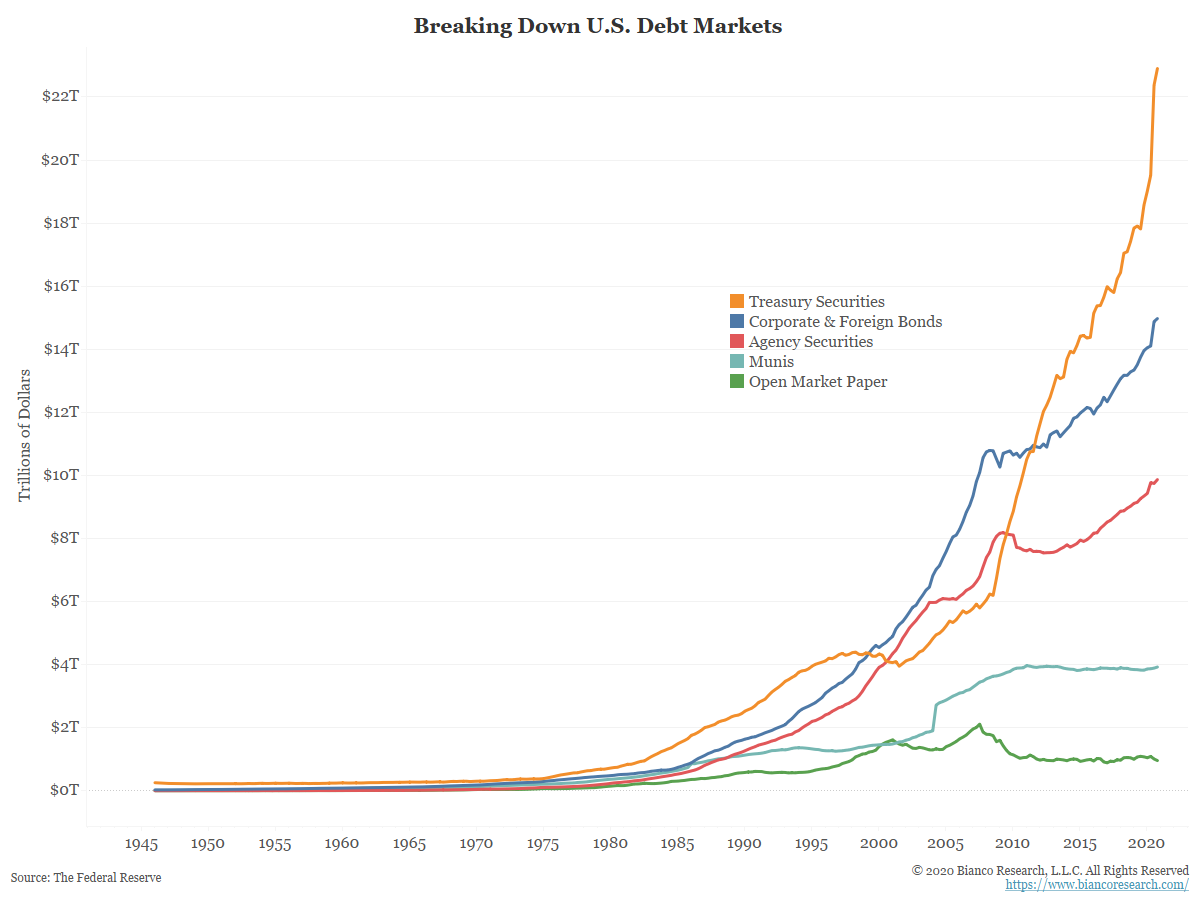

Breaking Down Debt in the U.S.

Posted By Greg Blaha

A look at outstanding amounts of Treasuries, corporates, agencies, munis and open market paper... Read More

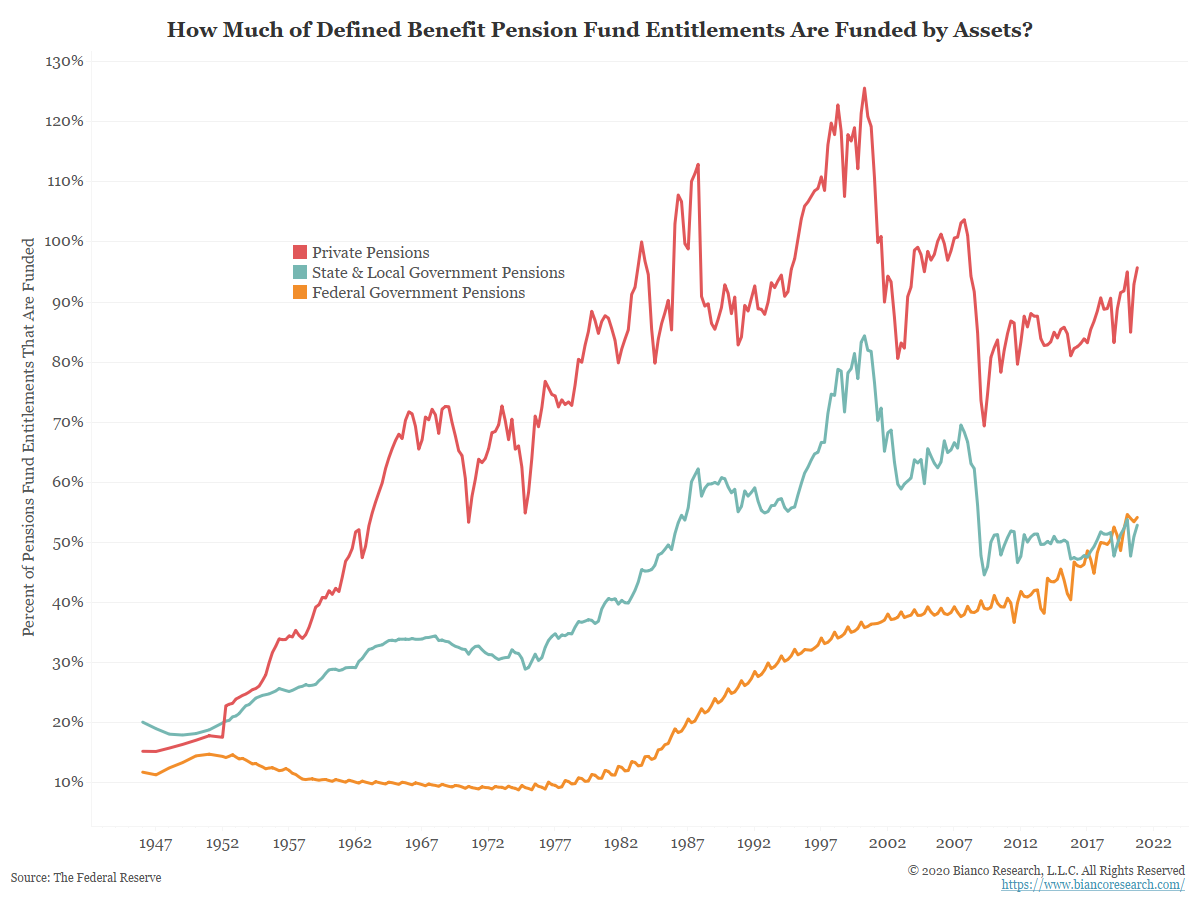

Funding Gaps at Public and Private Pensions

Posted By Greg Blaha

Private pension funds have much smaller funding gaps than their government counterparts.... Read More

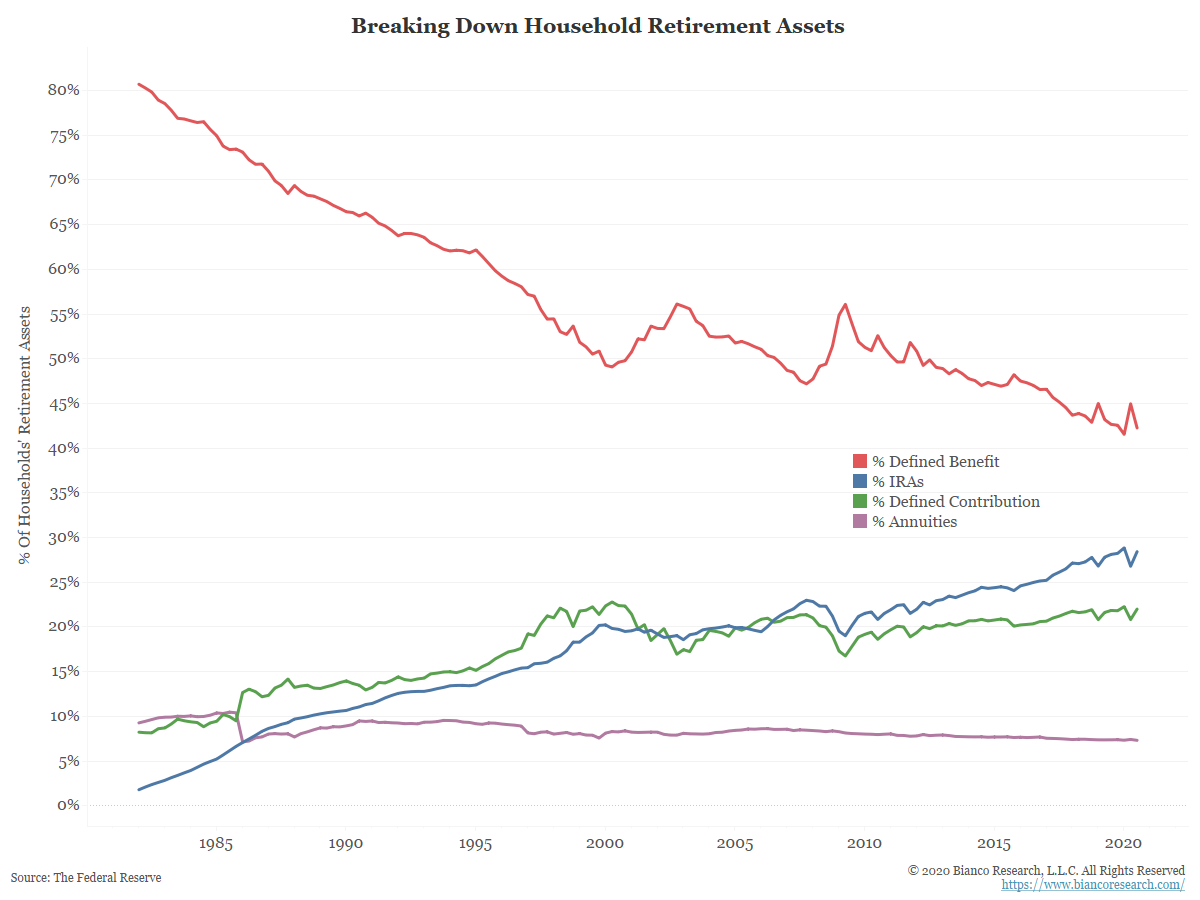

Defined Benefit Plans Continue to Shrink

Posted By Greg Blaha

Defined benefit plans continue to be replaced by IRAs and defined contribution plans.... Read More

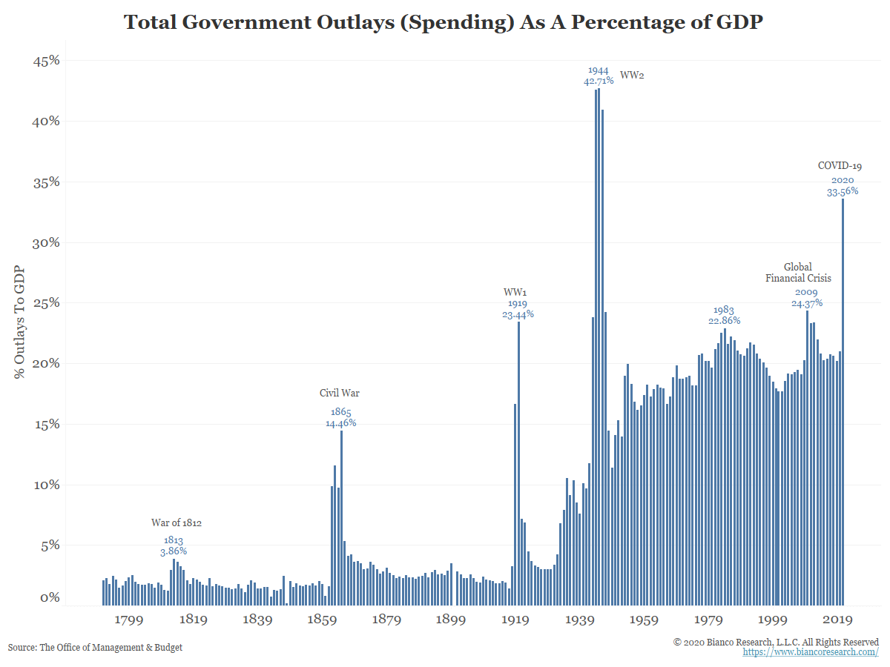

Stimulus Coming, When Does It End?

Posted By Jim Bianco

We fear the market may have to force the government's hand in reducing stimulus spending. A bad market reaction, perhaps in the form of a big rise in inflation caused by too much stimulus, would be one such scenario. If nothing "bad" happens, why would the government stop regularly mail checks to everyone?... Read More

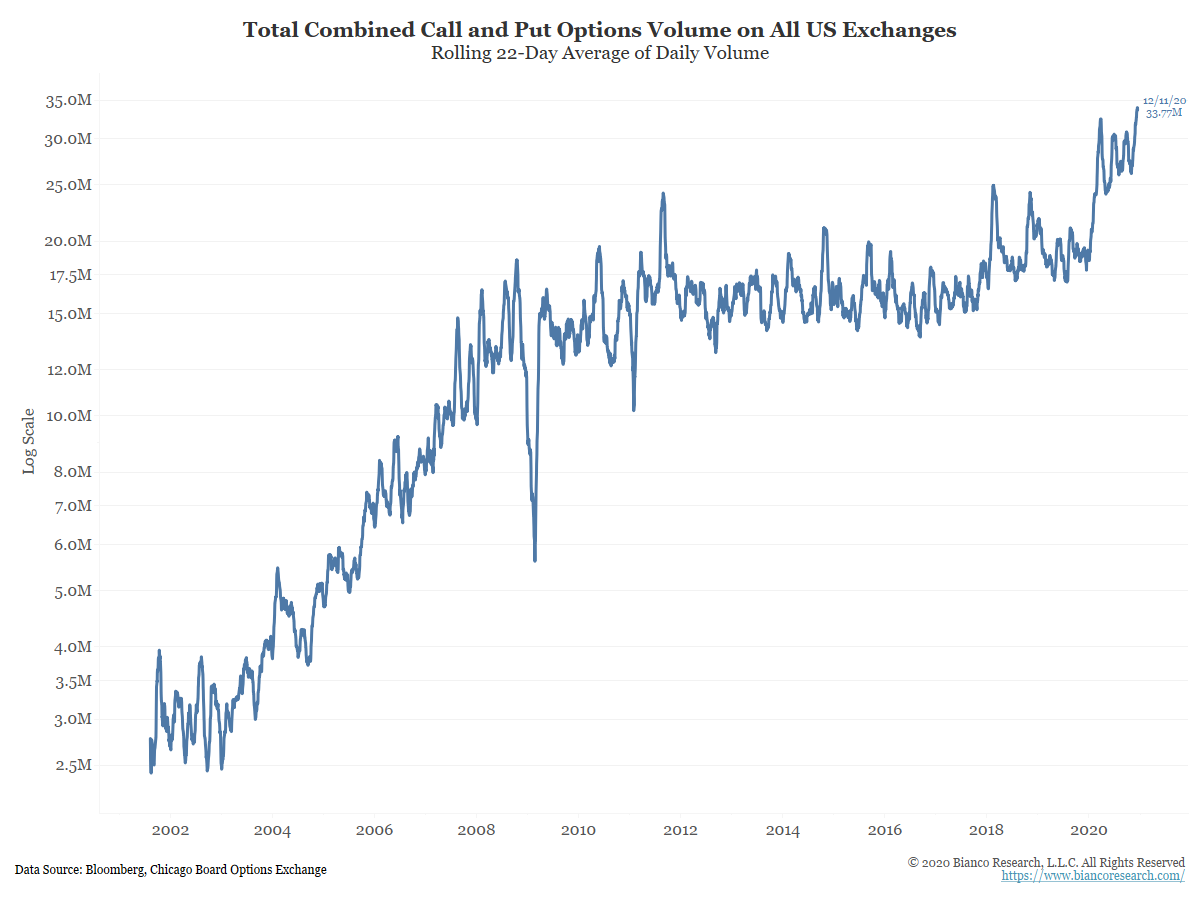

Excessive Optimism Is Changing Investing Patterns

Posted By Jim Bianco

There is more than excessive optimism in the market. There is a structural shift in how retail investors put their money to work. They are buying stocks directly and buying options (leverage) to a degree never seen.... Read More

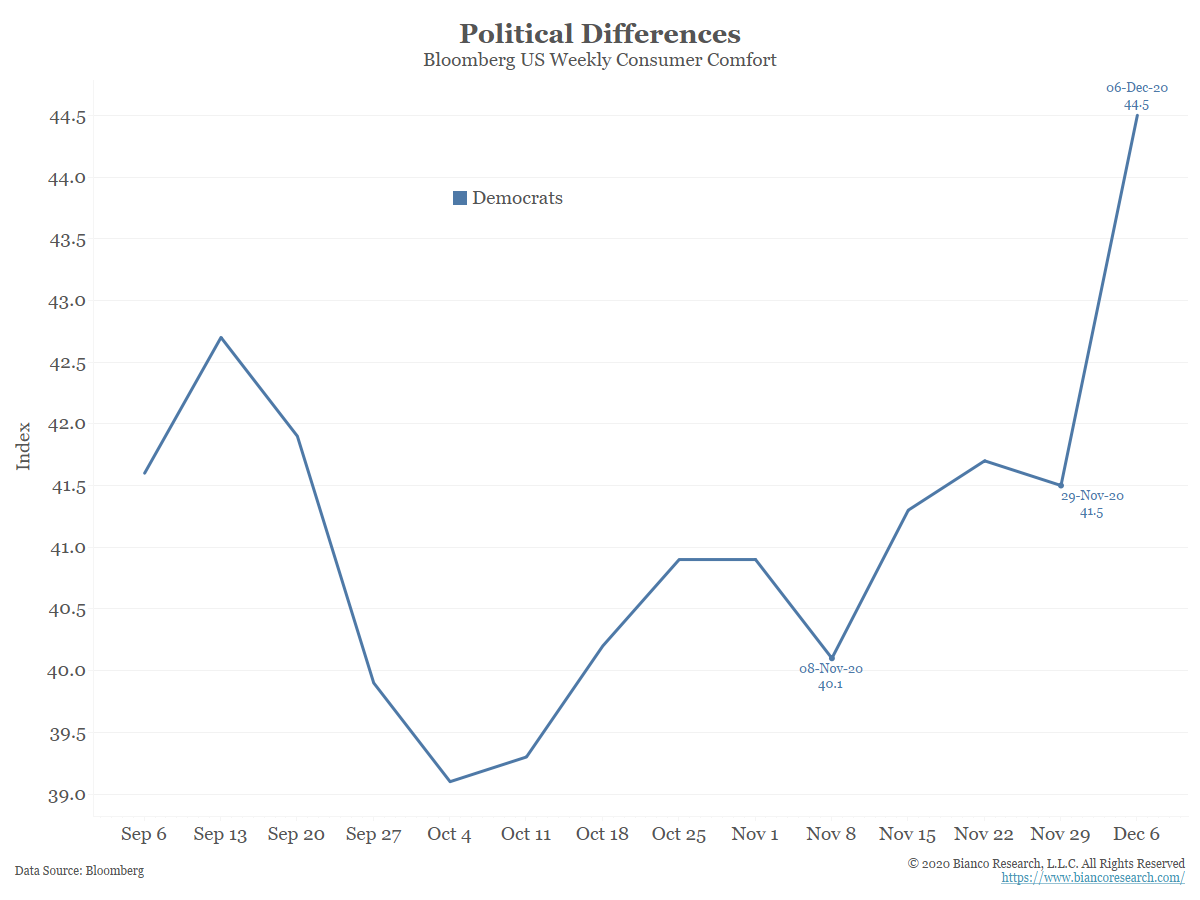

Beware of Consumer Confidence

Posted By Jim Bianco

One should always consider the political nature of consumer confidence readings when judging the economy. This is probably even truer after a contested election.... Read More

Wall Street Strategists’ New Normal

Posted By Jim Bianco

Wall Street strategists are bullish and perceive record valuations to be the "new normal." The belief is the Fed will continue to suppress interest rates, allowing these valuations to persist.... Read More

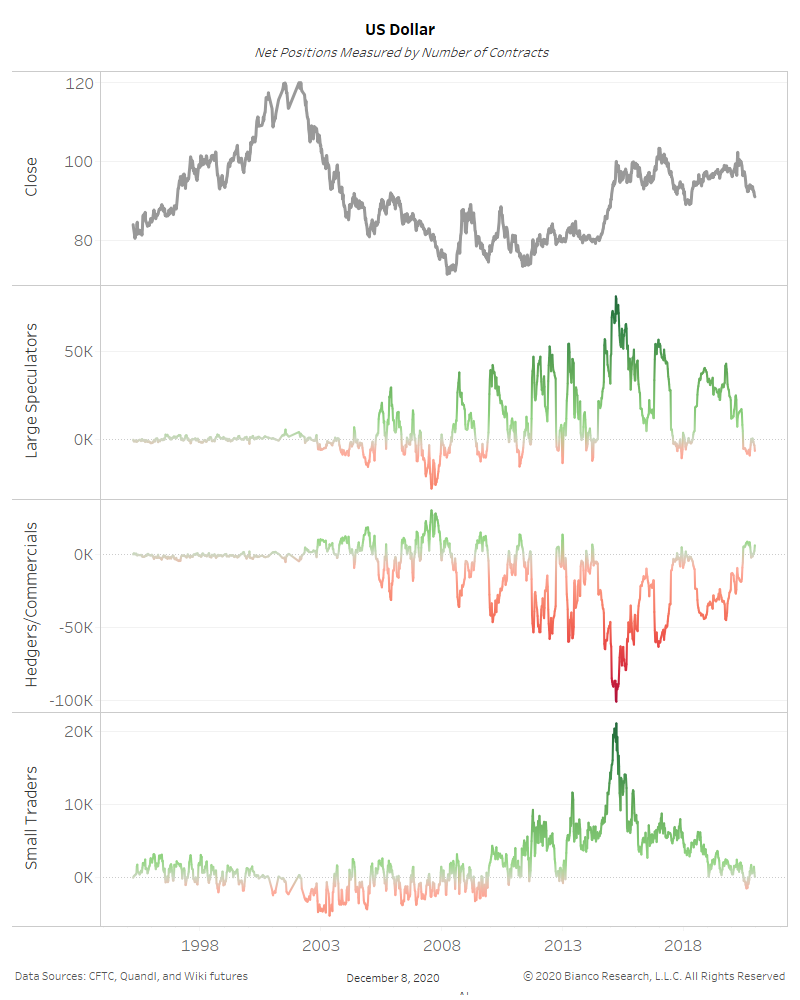

Interest Rates and Nominal Growth

Posted By Jim Bianco

Are interest rates heading higher on real growth or higher inflation expectations? Risk markets would respond very differently depending on the reason.... Read More