Conference Call Replay & Notes – What’s Going on With the Bond Market?

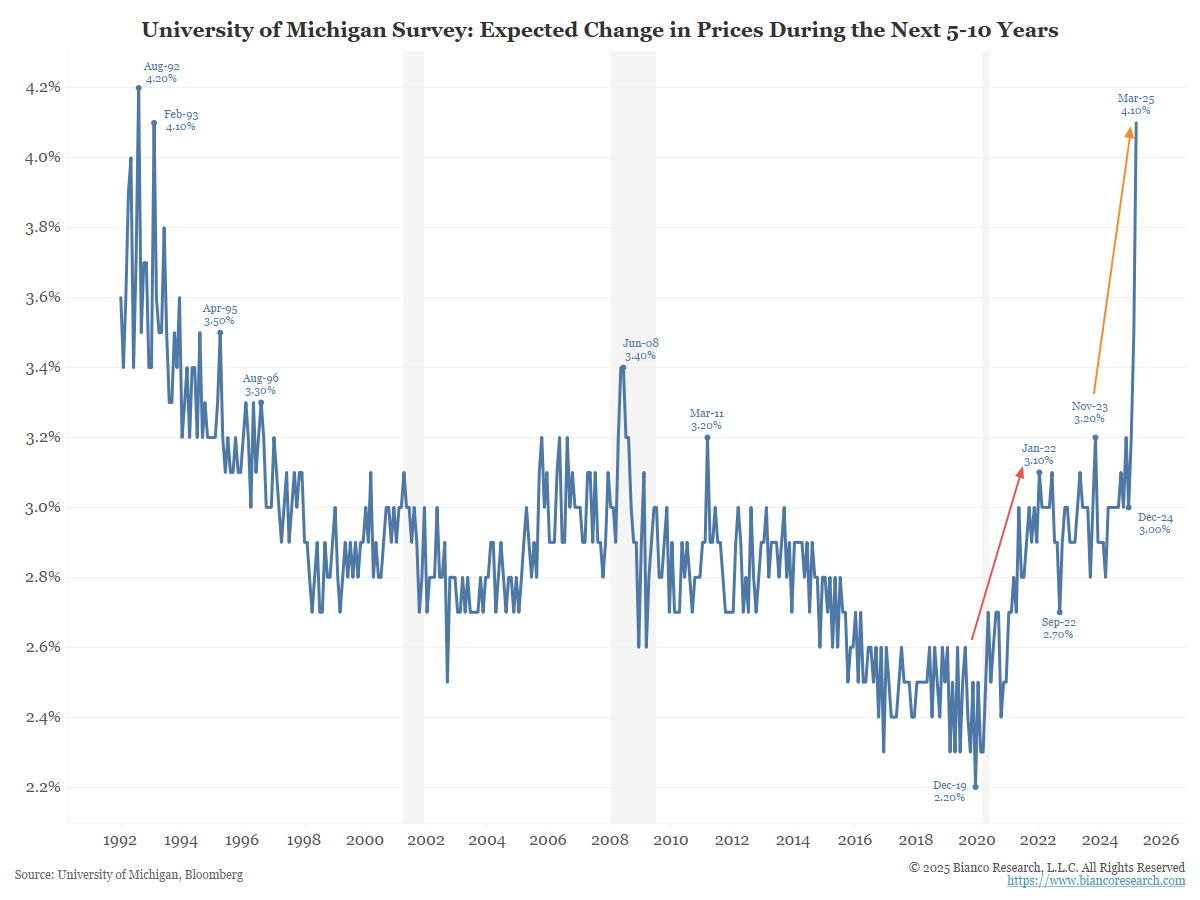

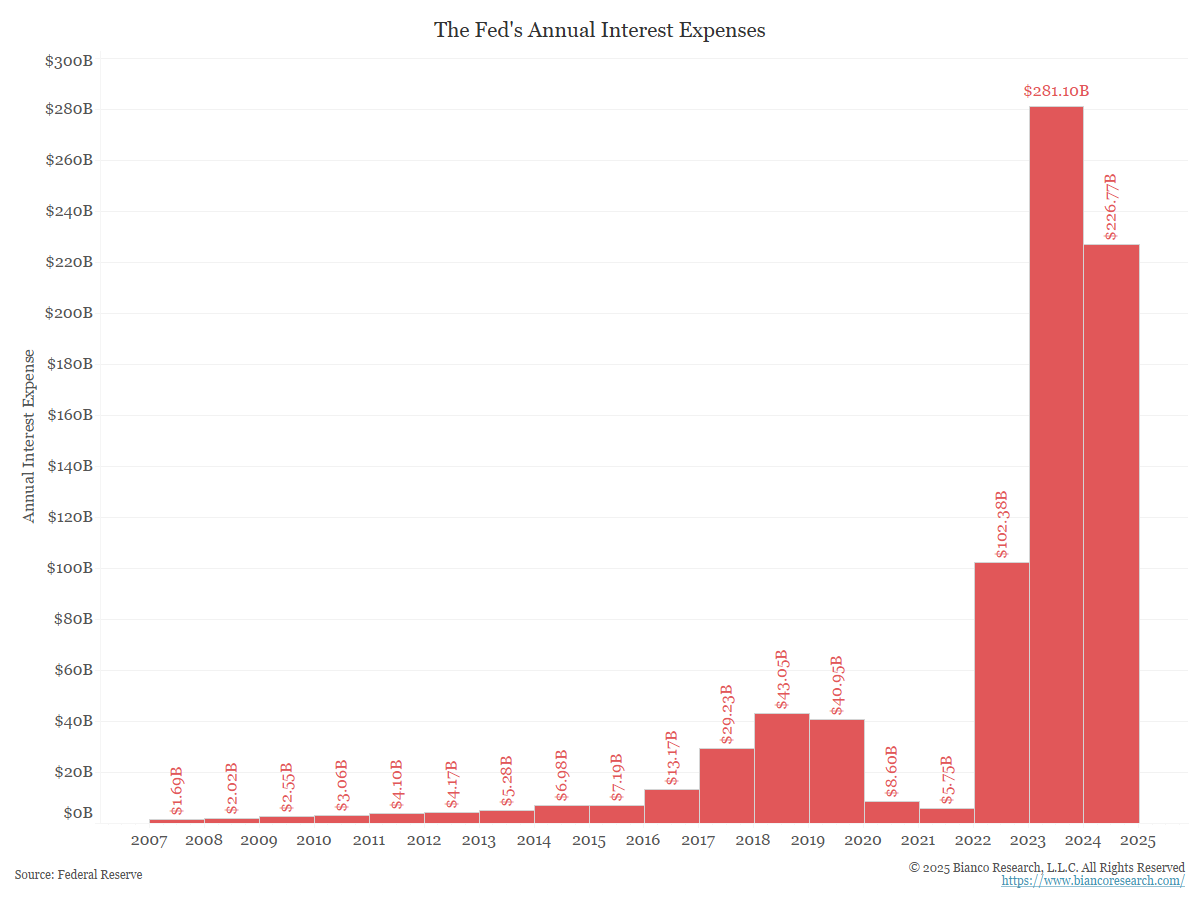

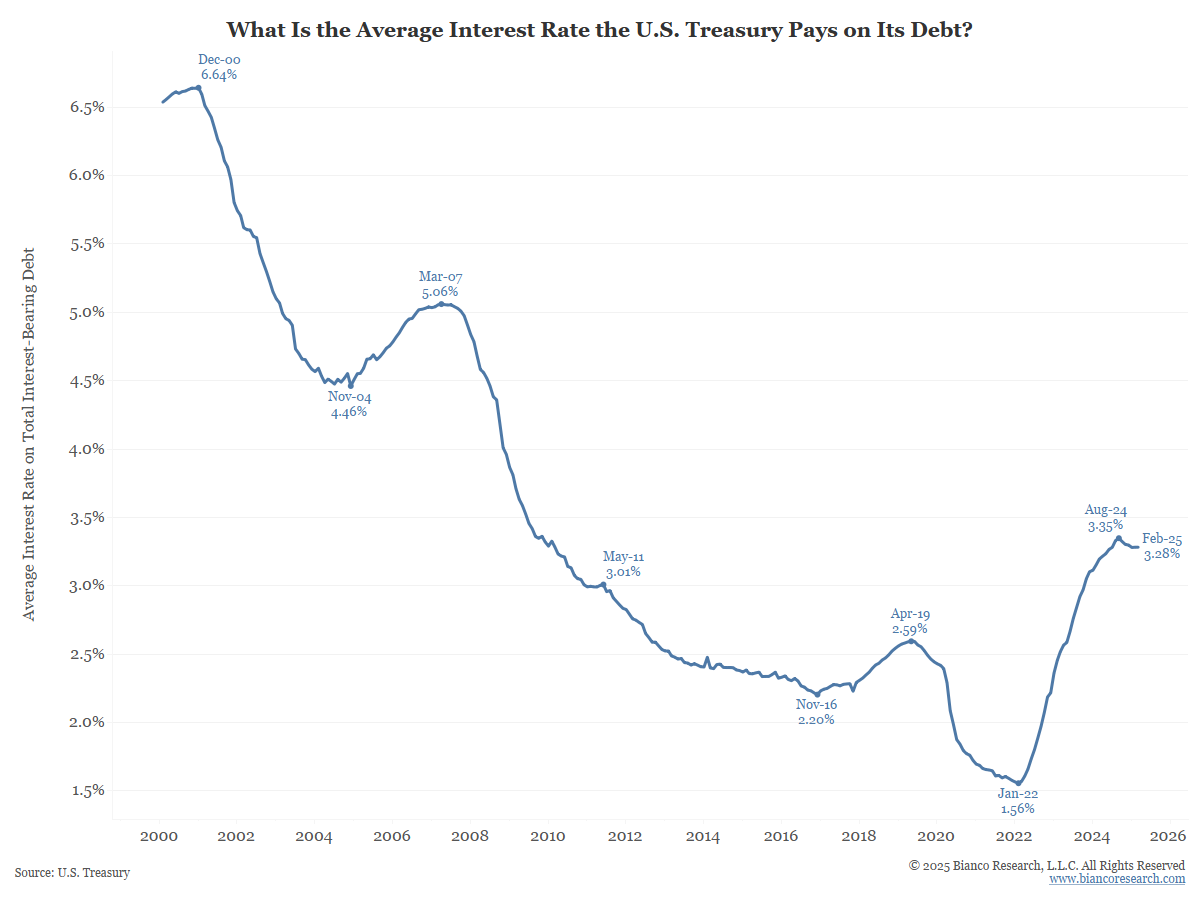

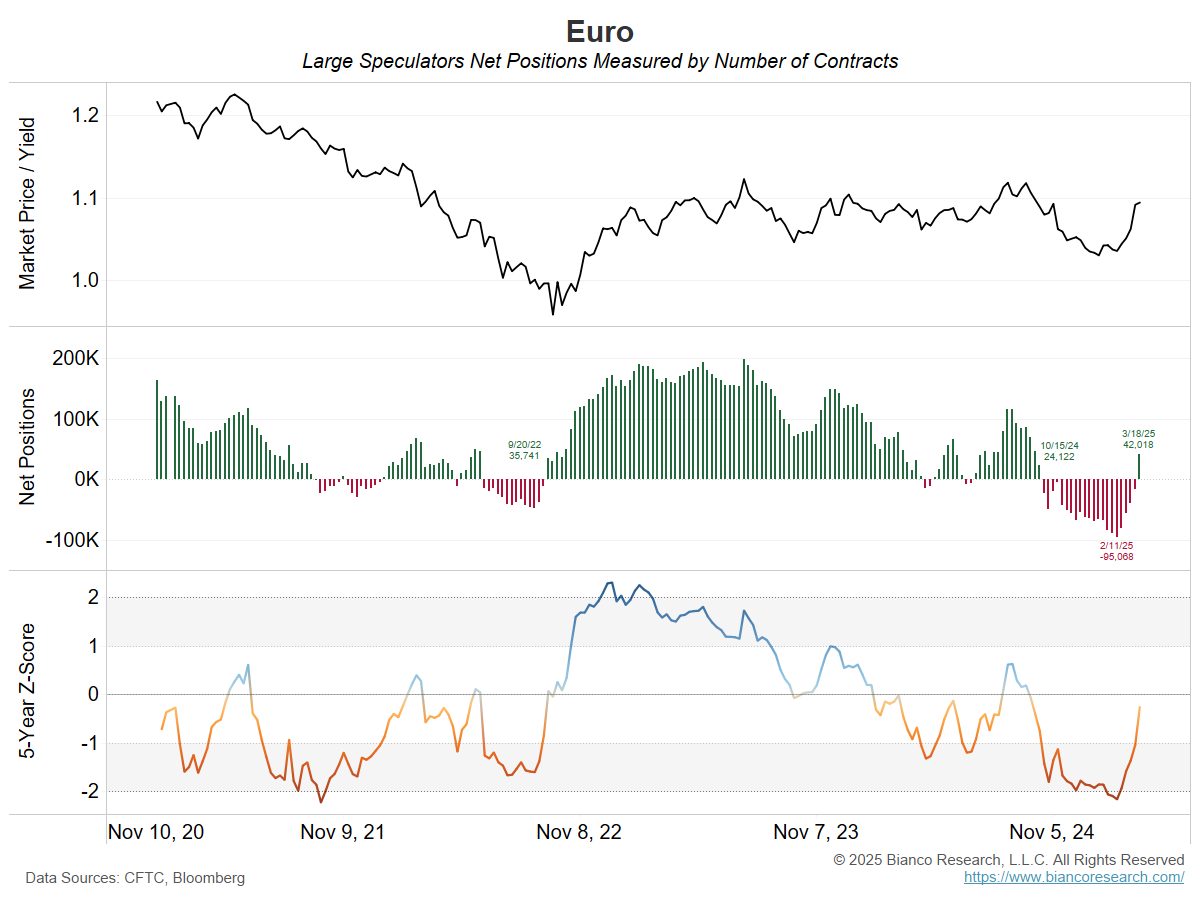

The most interesting move in the last several days has been the inability of the bond market to rally on concerns of recession and a market crash. Why is this happening?... Read More