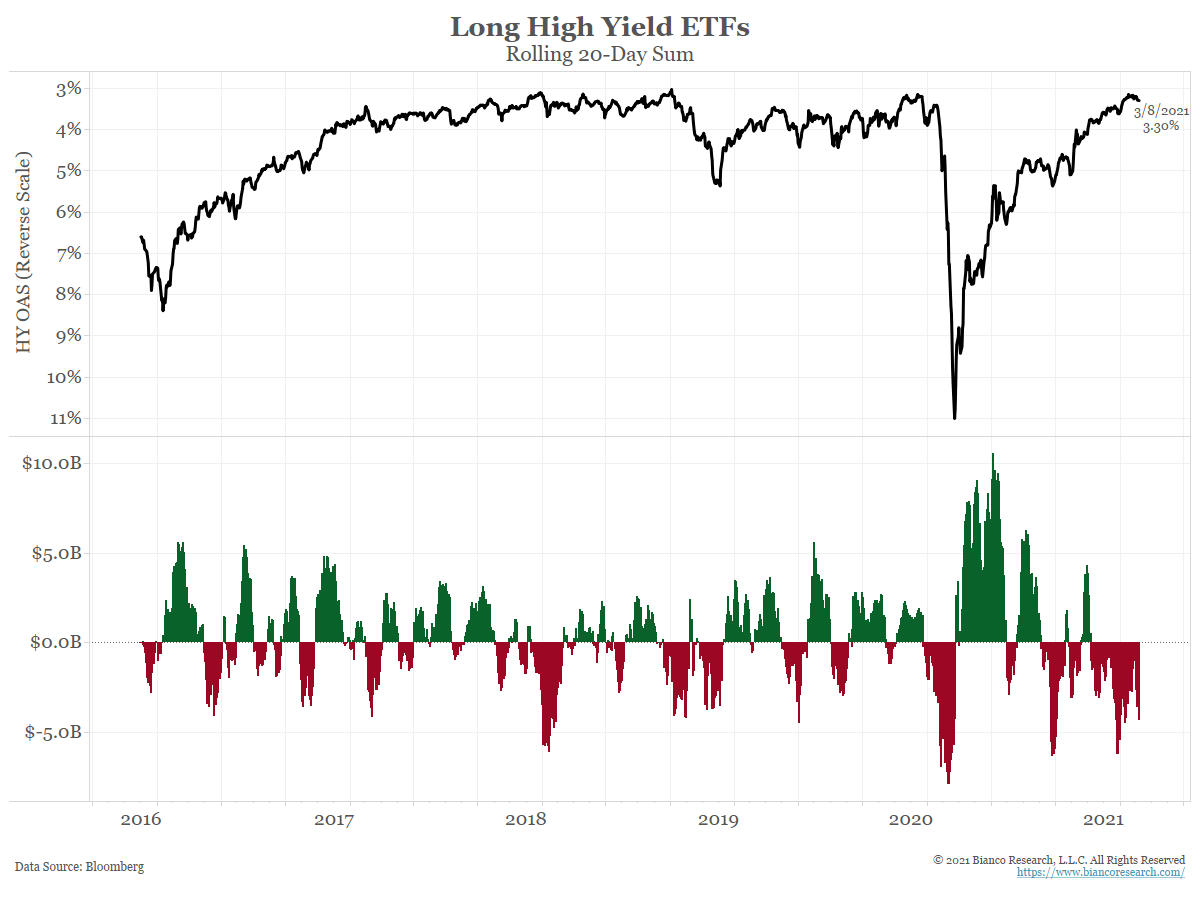

Is High Yield Becoming a Market of Bonds Again?

Posted By Jim Bianco

For quite a few years now, the high yield market has been driven by macro trading from options and ETFs. Maybe it is now returning to a market of high yield bonds in which credit is differentiated by issuers. Weaning this market off its macro dominance would be a positive development as it makes capital allocation much more efficient.... Read More