Stocks & Fed Hikes in 2022

Posted By Jim Bianco

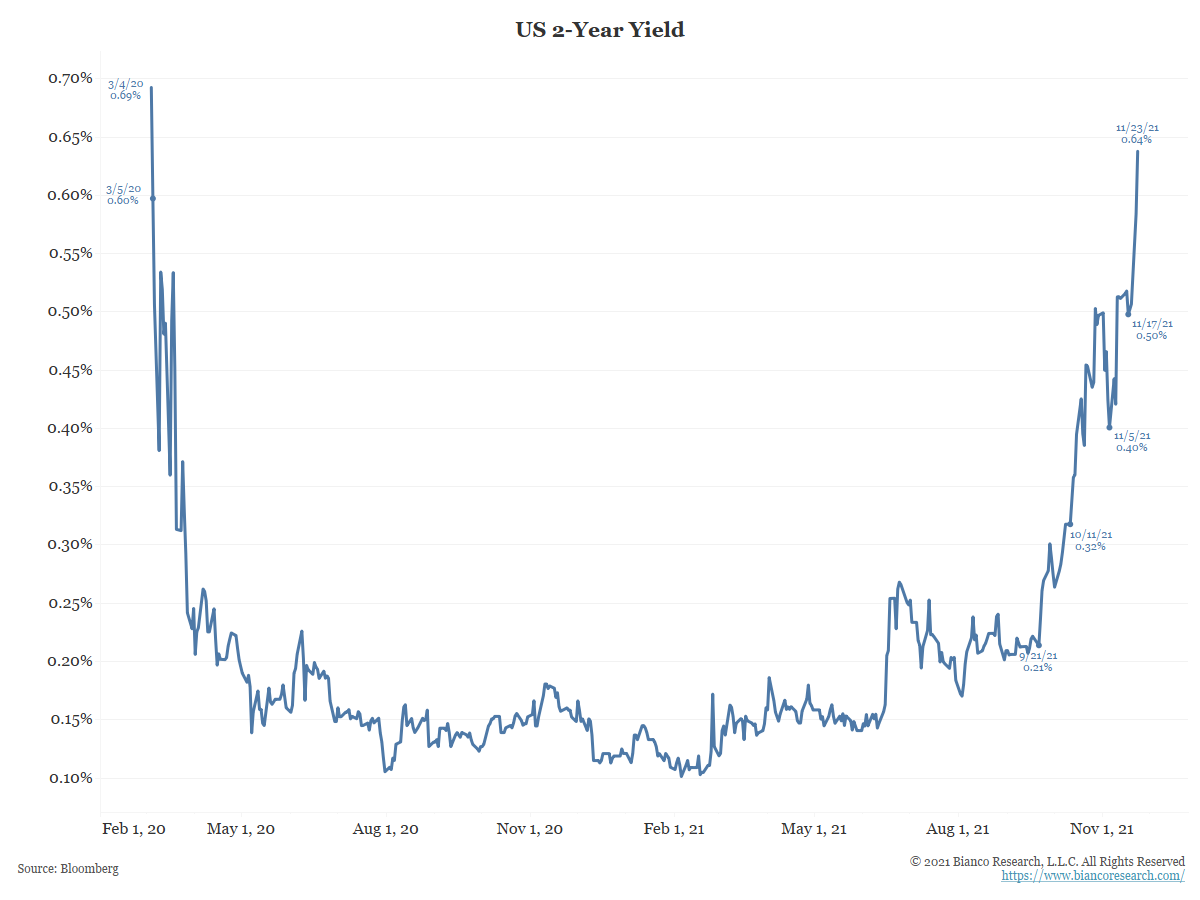

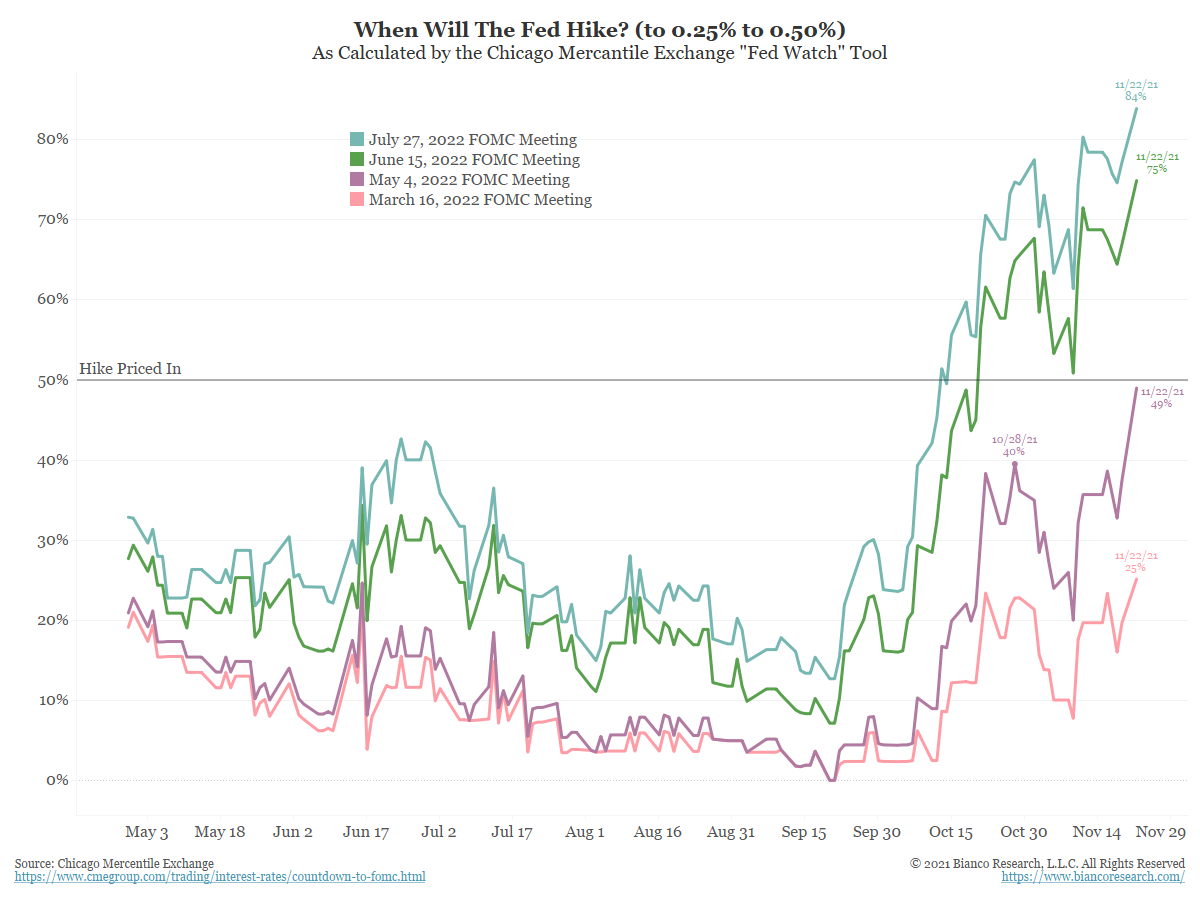

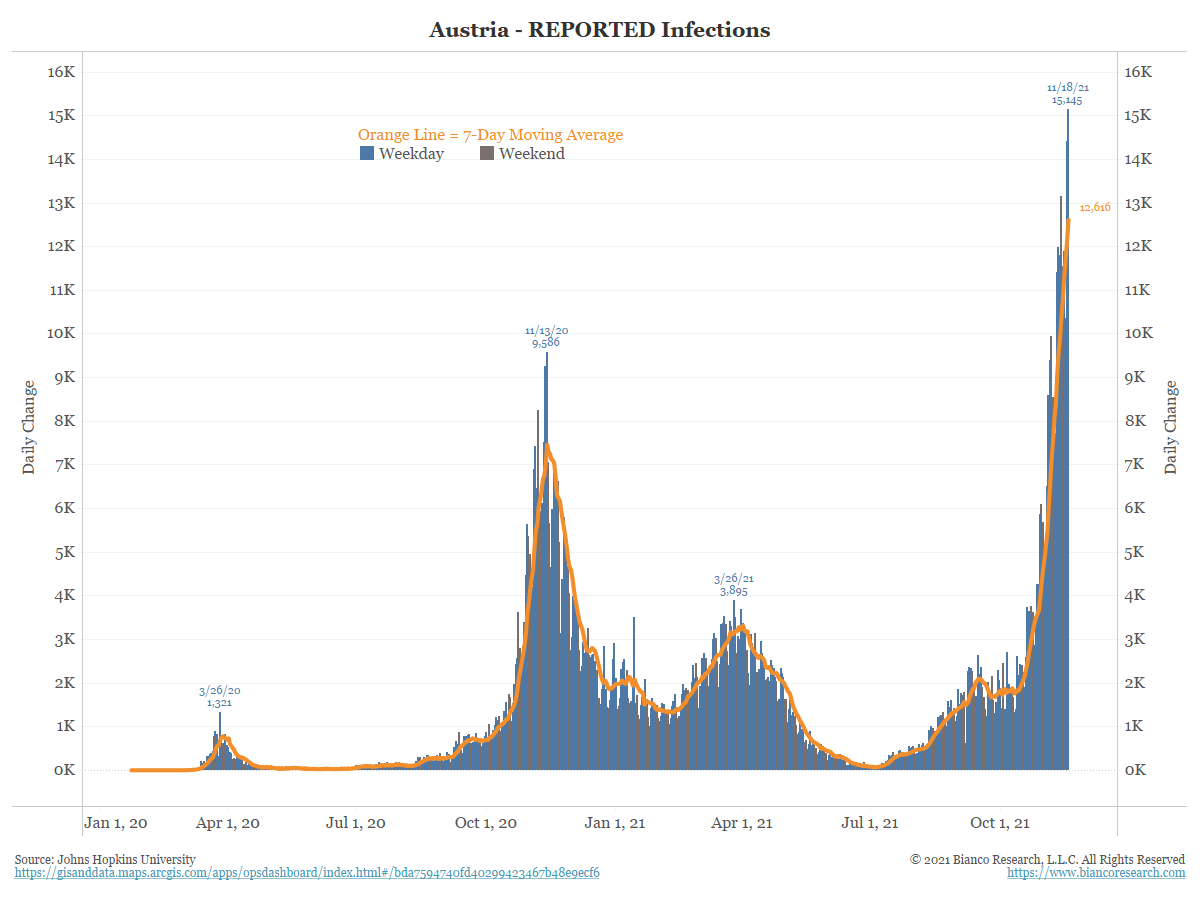

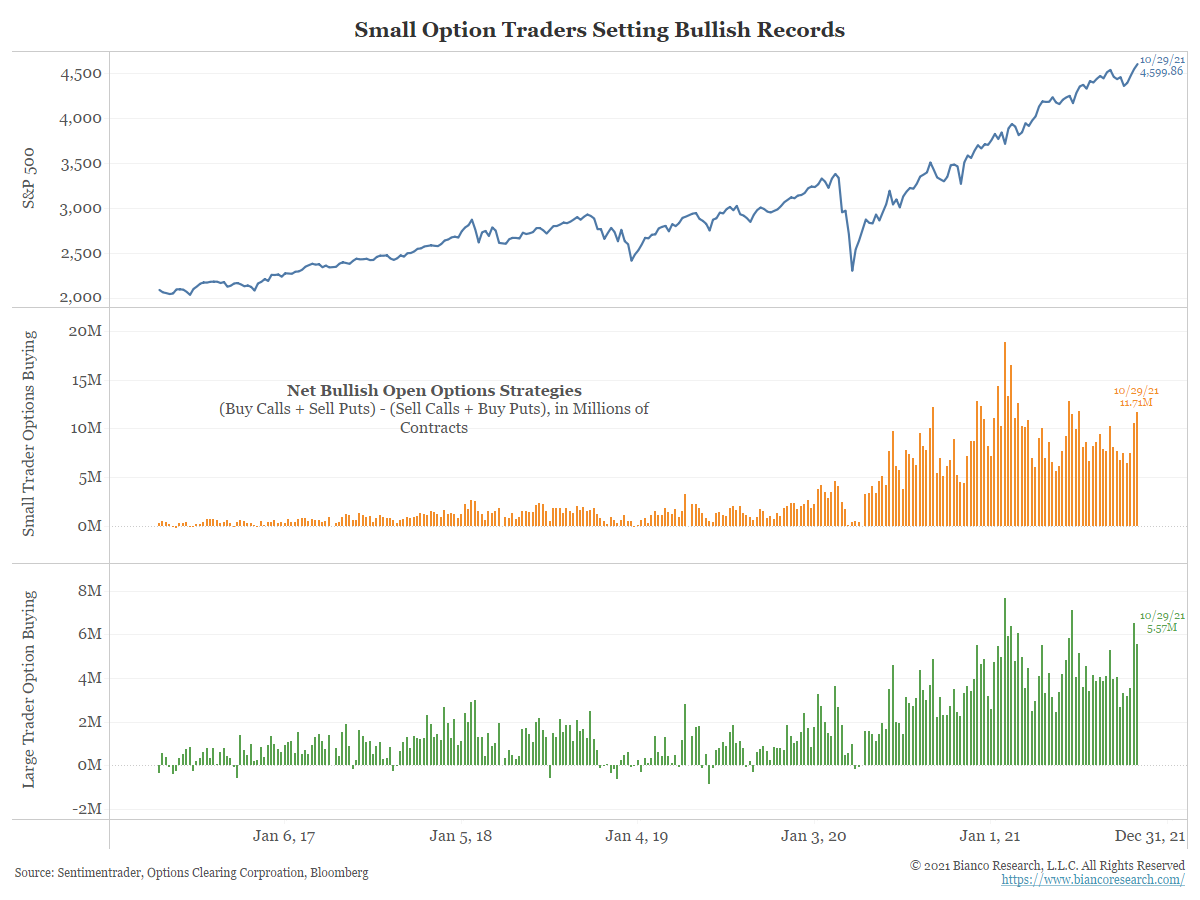

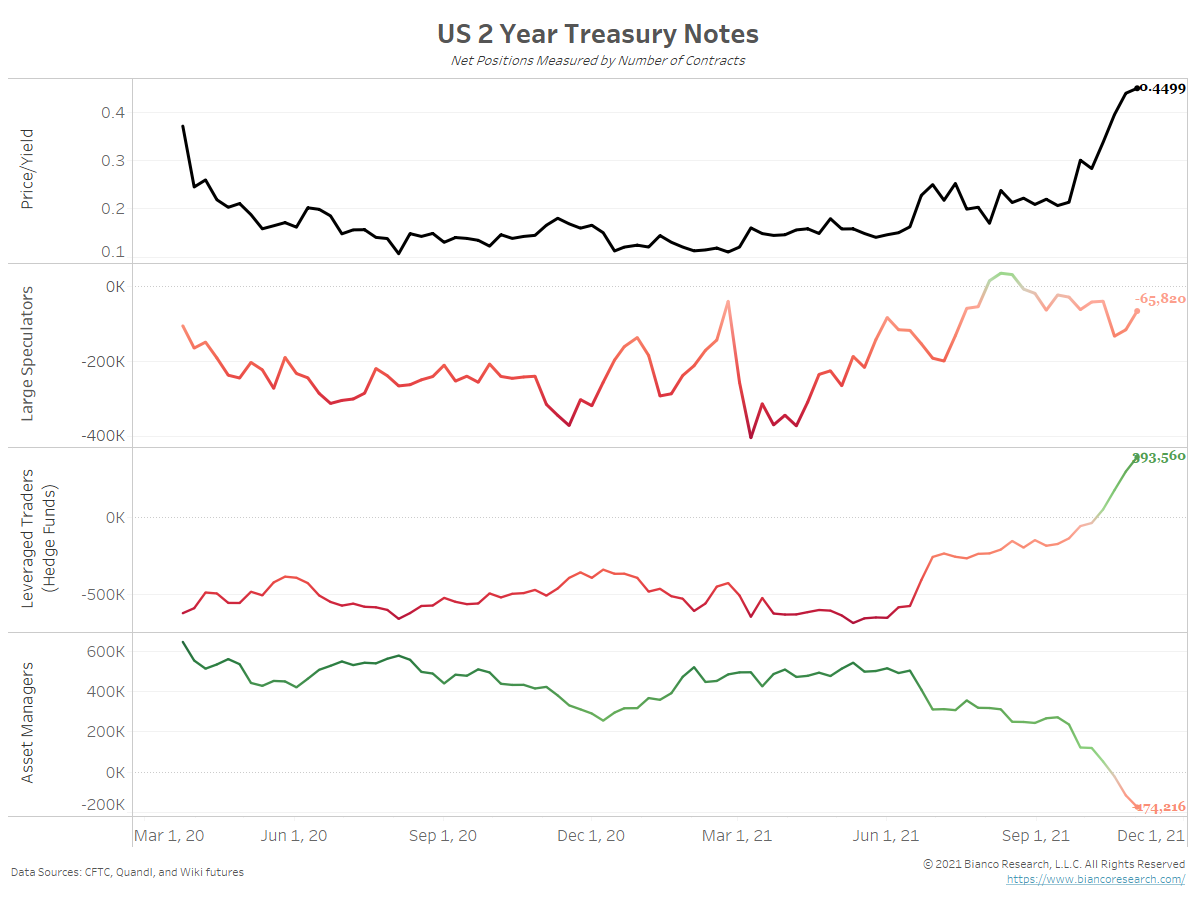

Short rates are moving higher on the belief the Fed has to get aggressive next year. If this happens because of persistent inflation, the Fed is in a tough spot. They would have to pick one market to help. They cannot help both.... Read More