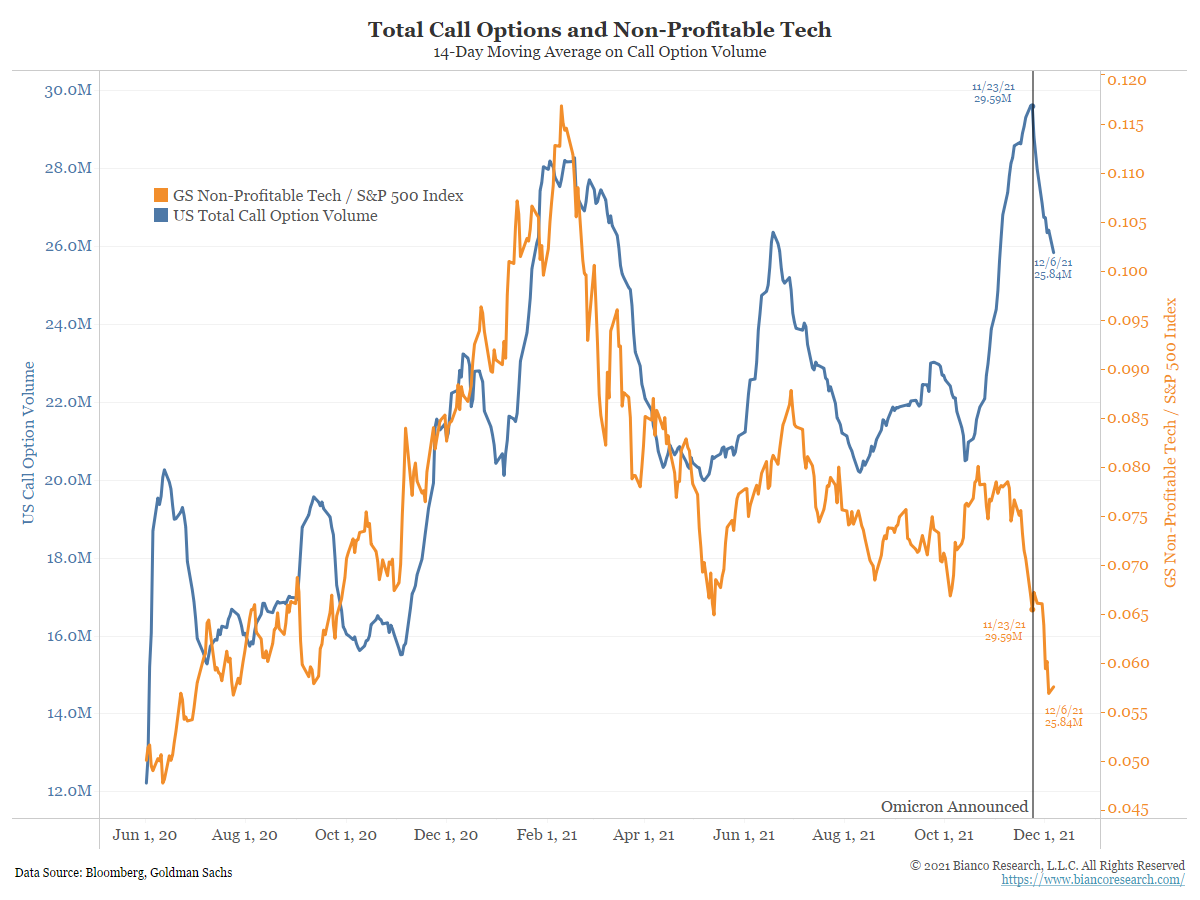

Options Volume vs. Non-Profitable Tech Stocks

Posted By Alex Malitas

The normally positive relationship between options volume and the Goldman Sachs Non-Profitable Tech Index has broken down in recent weeks.... Read More