Bespoke Commentary from Bianco Research & Arbor Data Science – January 13th, 2022

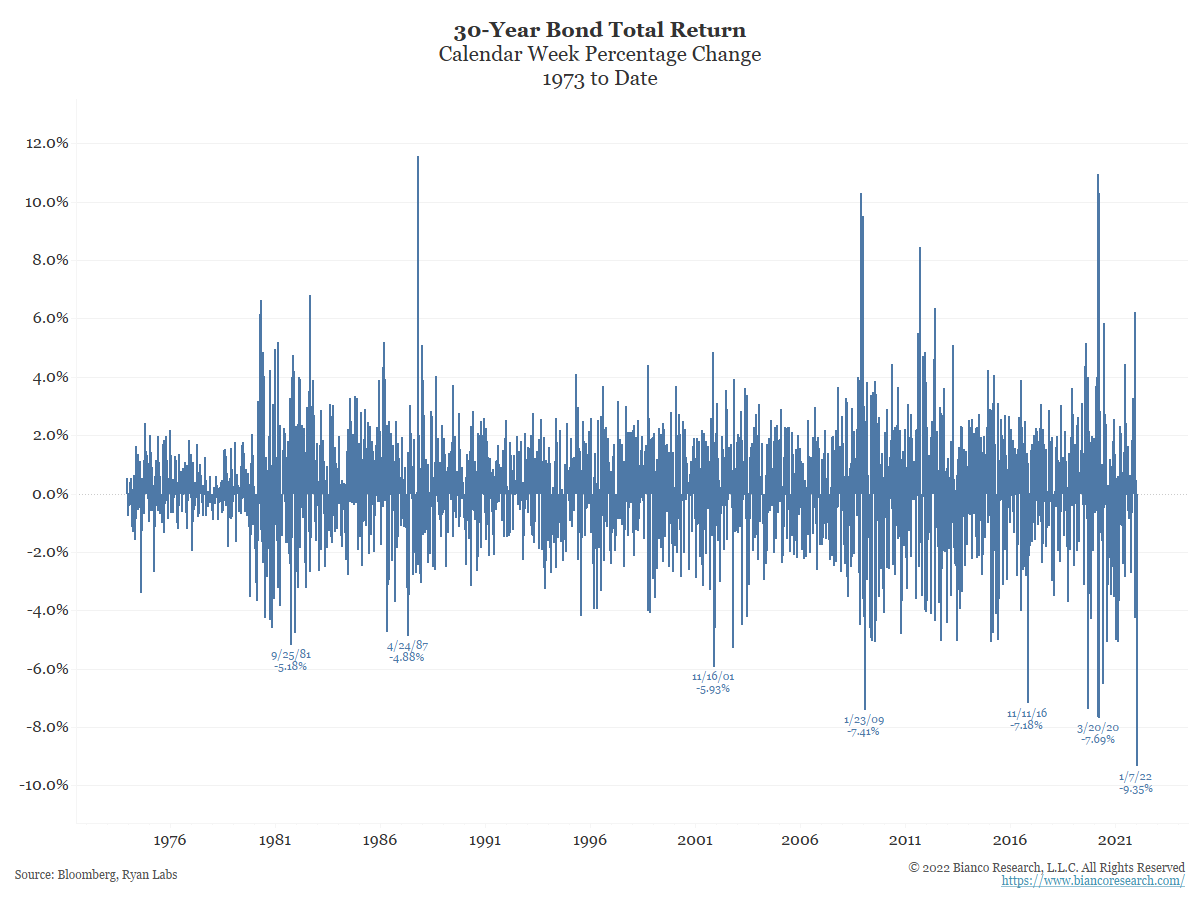

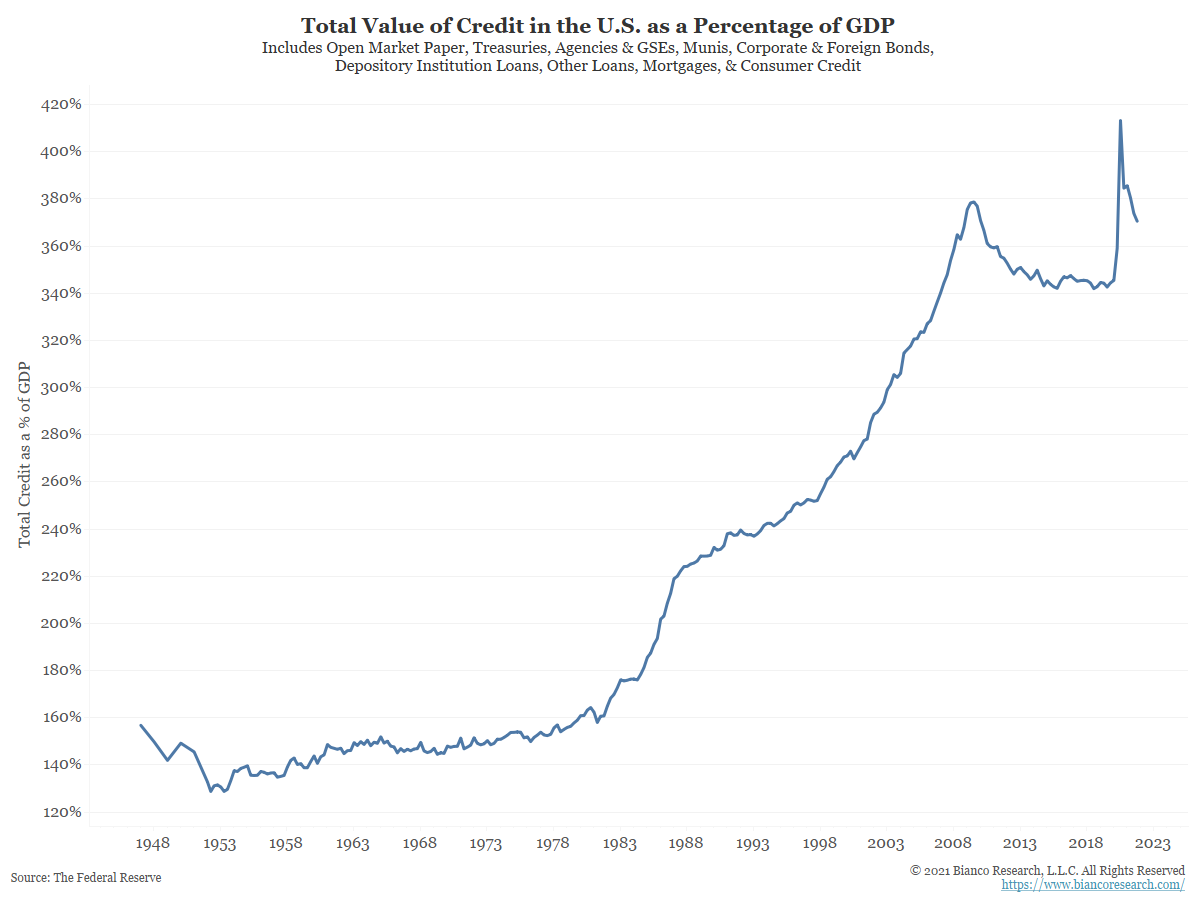

Bianco Research Conference Call Replay: The Bond Market Convulses The replay of our January 13, 2022 conference call titled The Bond Market Convulses can be found here. Colleague: *BRAINARD: BALANCE SHEET SHRINKING SOME TIME ‘BEYOND’ RATE HIKE Sam Rines: There... Read More