Tag Archives: Markets

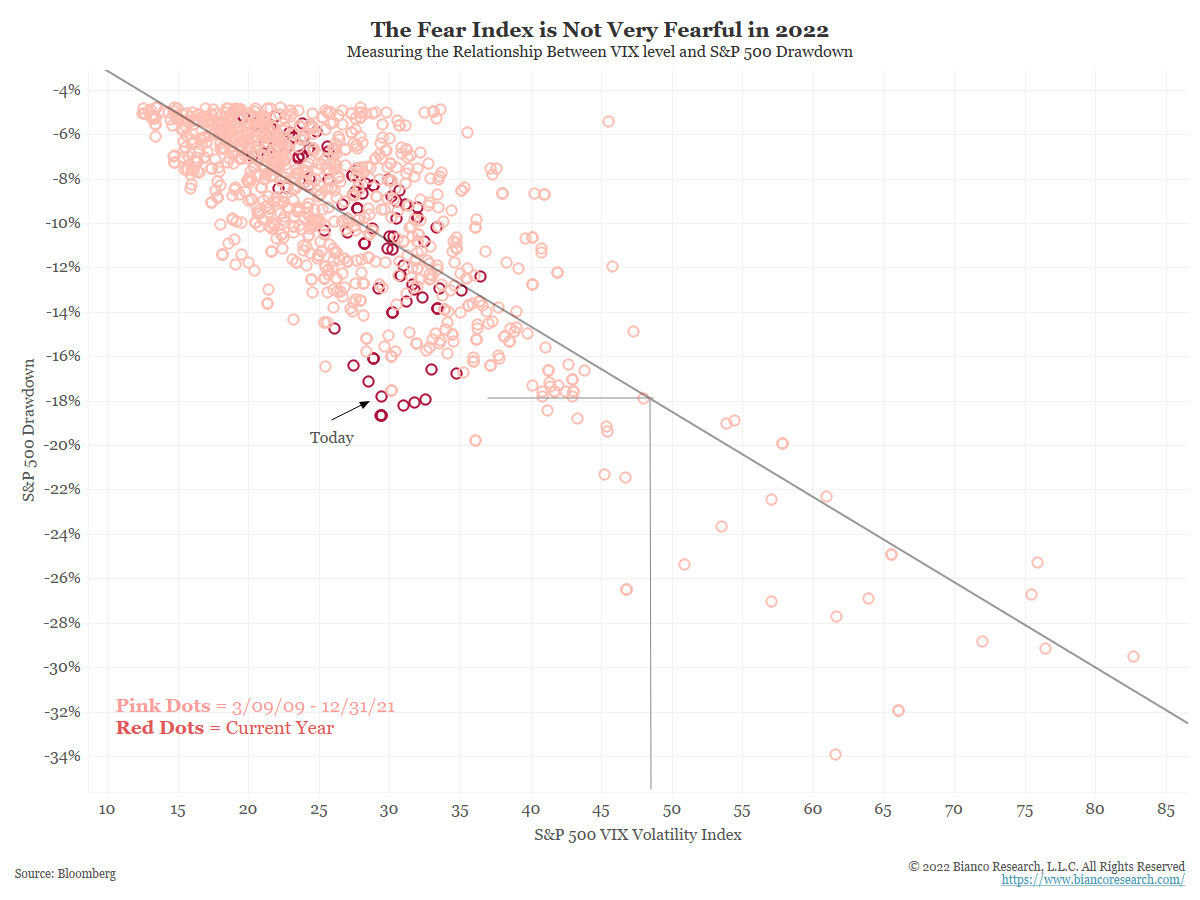

Implied vs. Realized Volatility

Posted By Alex Malitas

The end of bear markets tend to exhibit heightened volatility and increased trading volumes. Despite significant selling pressure in recent weeks, volatility indices do not indicate panic. Given this, it is important to note the connection between implied and realized volatility in markets.... Read More

Checking on Retail Investors

Posted By Alex Malitas

Retail traders and dip buyers dominated the markets in 2020 and 2021. The current bear market has dented those groups' conviction, but not yet to the point of capitulation.... Read More

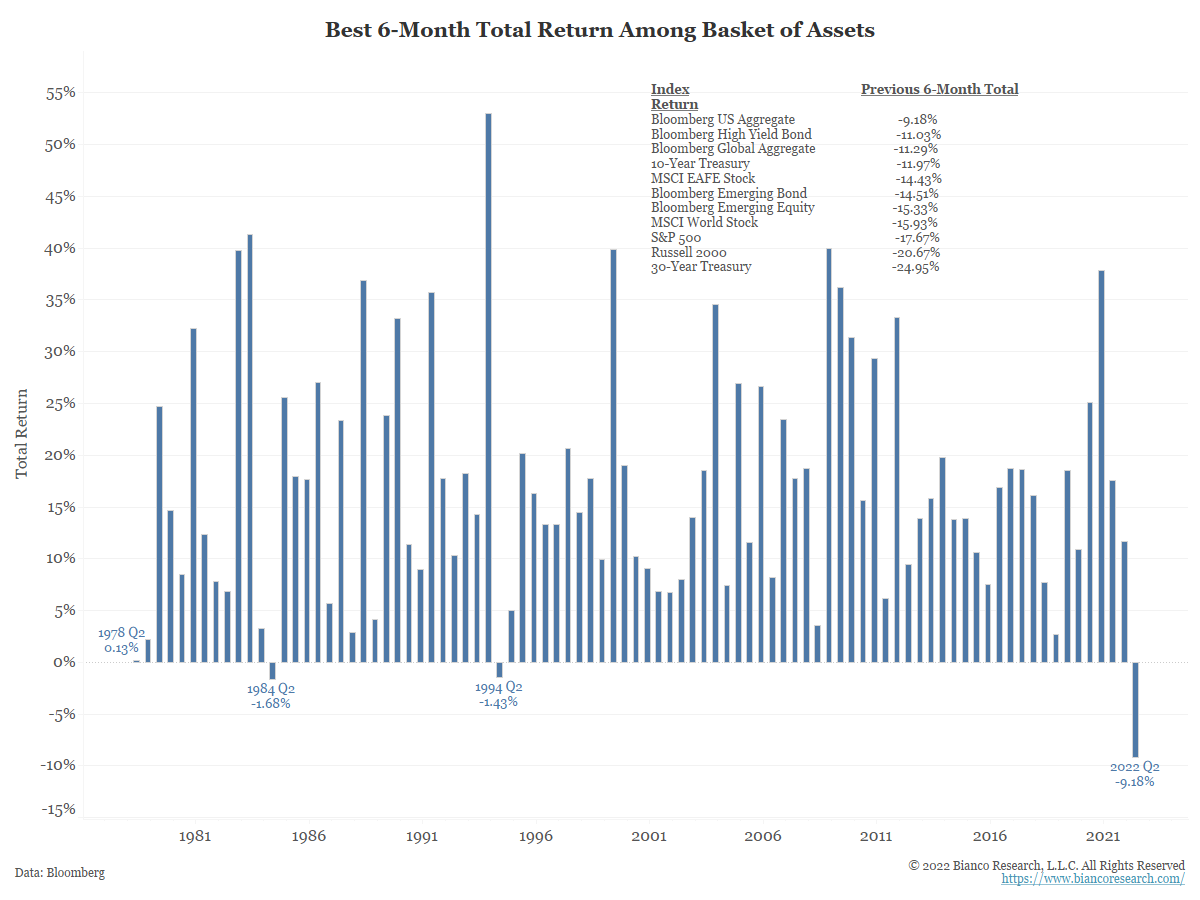

Are the Markets ‘Oversold’?

Posted By Jim Bianco

Bull markets rarely get overbought ... TINA, FOMO, and BTD. Bear markets are the opposite, they rarely get oversold, and "tradable lows" are all but impossible to measure with bull market metrics. ... Read More

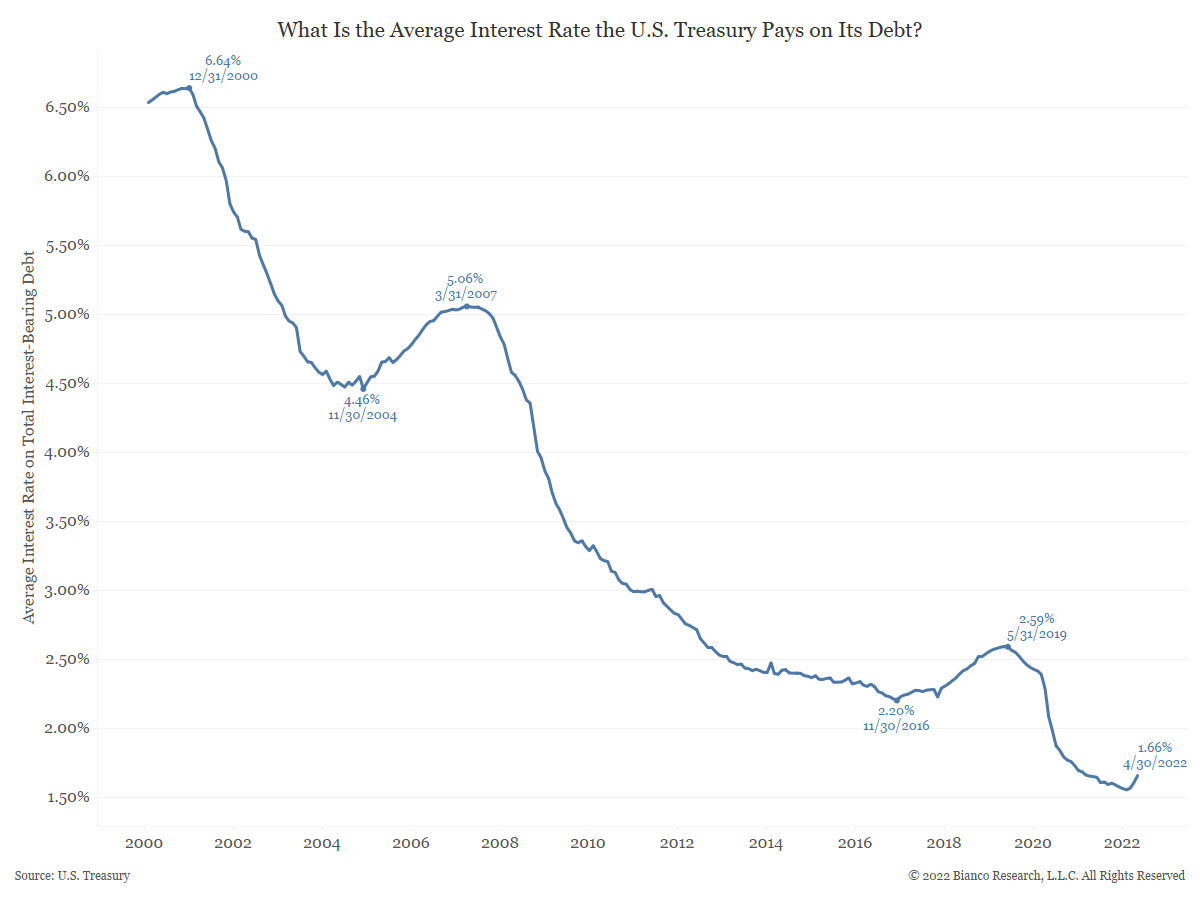

The Treasury’s Interest Costs

Posted By Greg Blaha

How much have higher yields affected the Treasury's interest expenses?... Read More

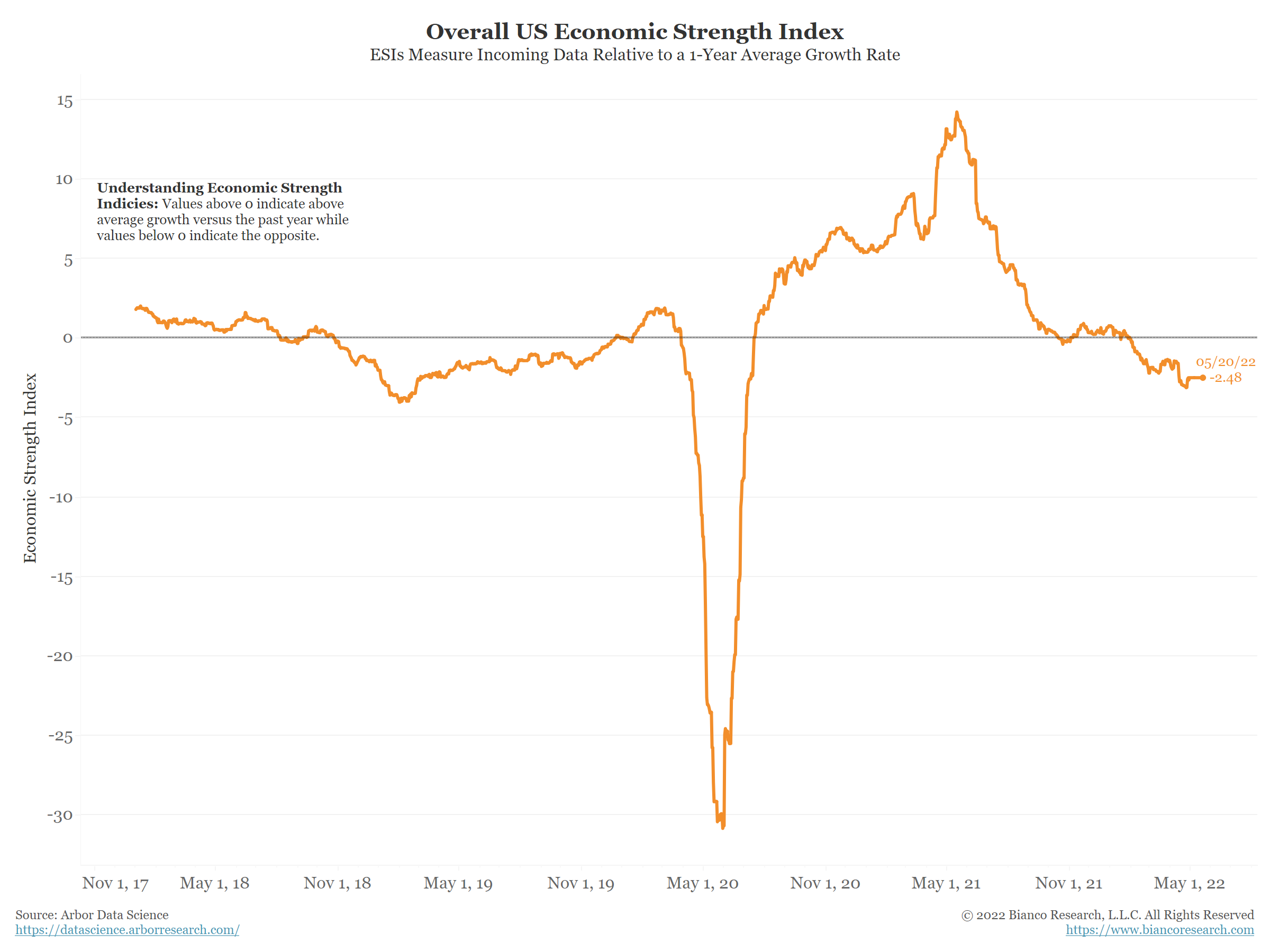

Looking at Economic Strength

Posted By Alex Malitas

We check in with some economic strength indices to measure where we are now versus one-year averages. ... Read More

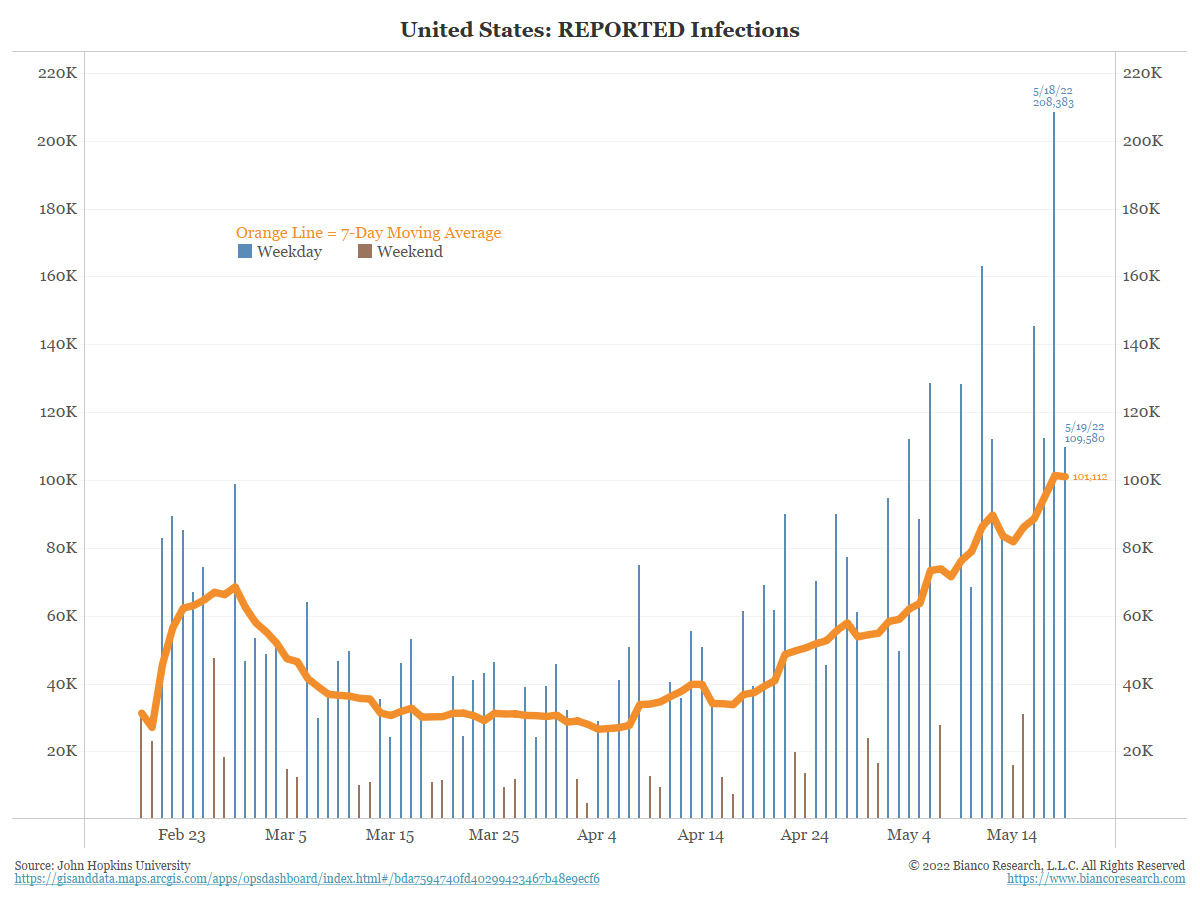

A COVID Update

Posted By Jim Bianco

The United States is the only place in the world where case counts are rising.... Read More

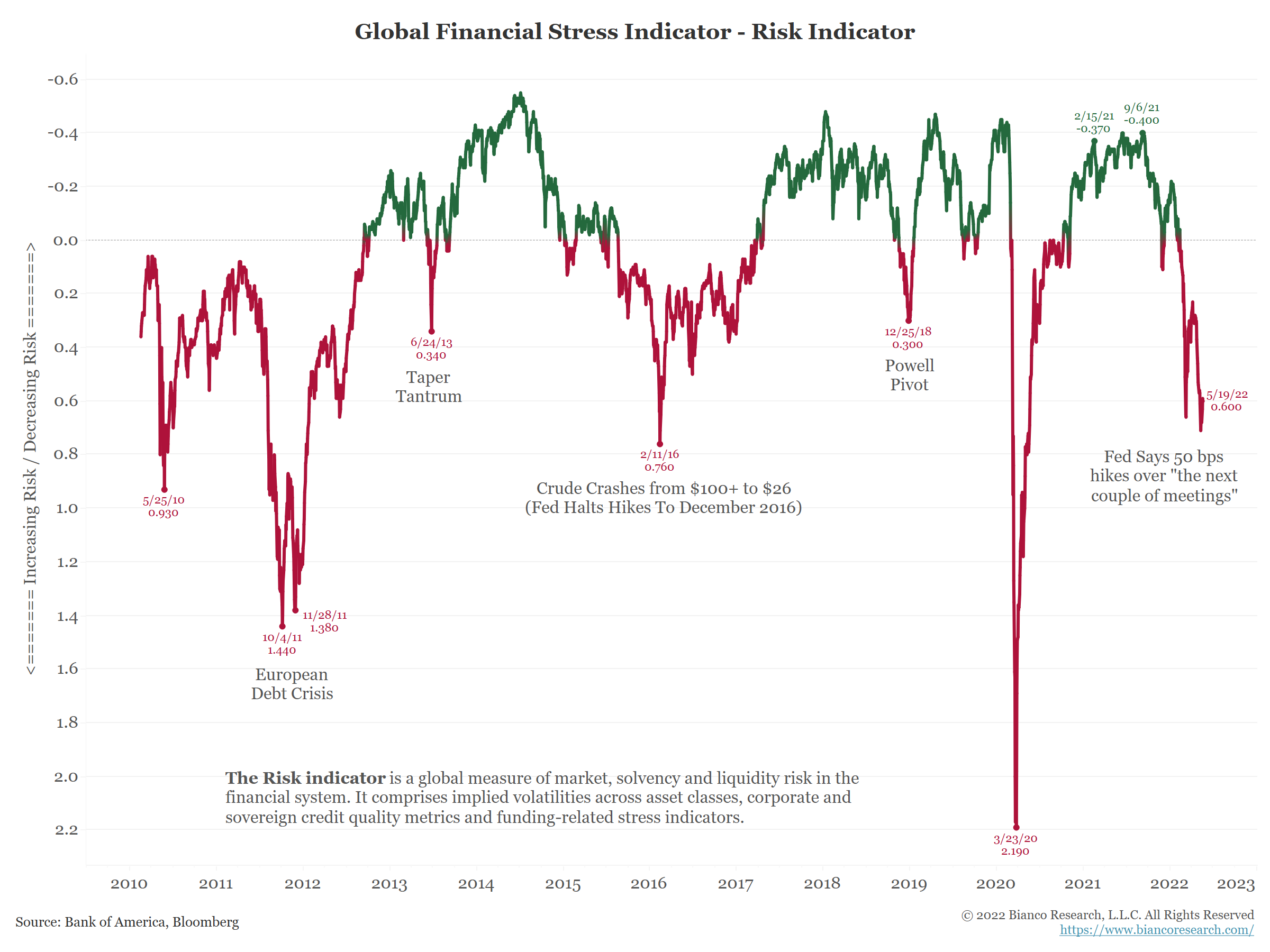

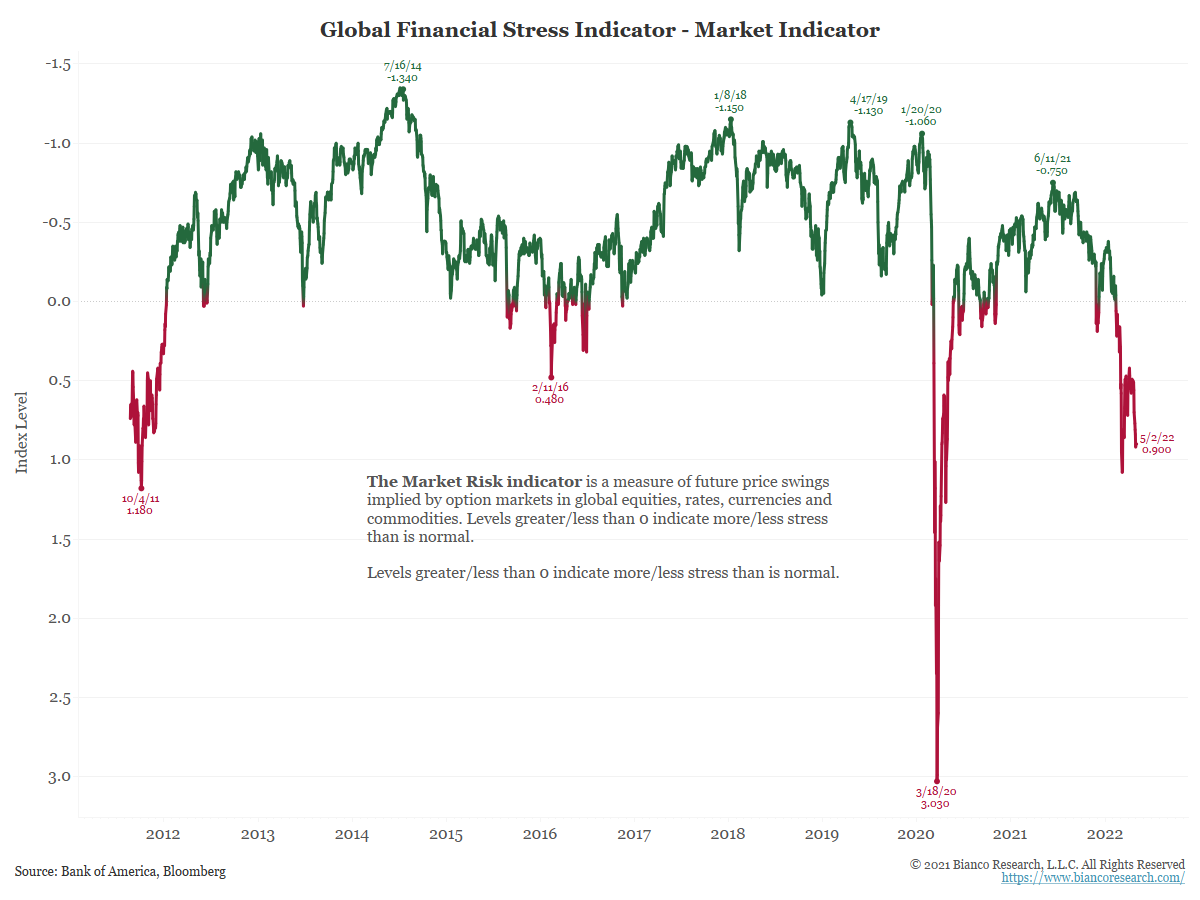

Where Is the Fed Put?

Posted By Jim Bianco

The Fed put is not 100% dead, but taming inflation is now the Fed's priority. The stress levels at which they supported markets in the past are no longer as relevant.... Read More

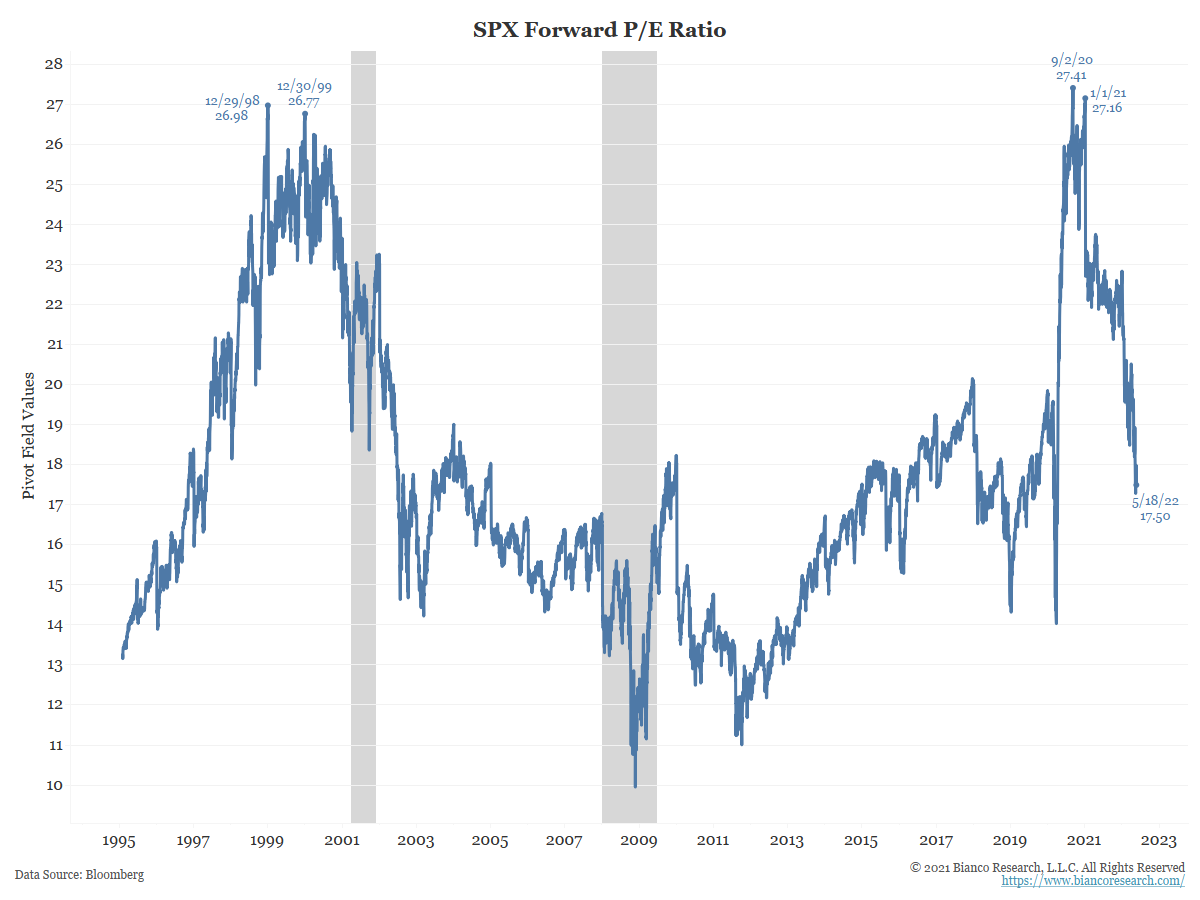

Where Are Valuations After the Correction?

Posted By Alex Malitas

Valuations have come down but are still higher than average. For forward P/E ratios to remain lower, earnings will have to continue to be strong. This may be a tall order given concerns about recession and the highest inflation in 40 years.... Read More

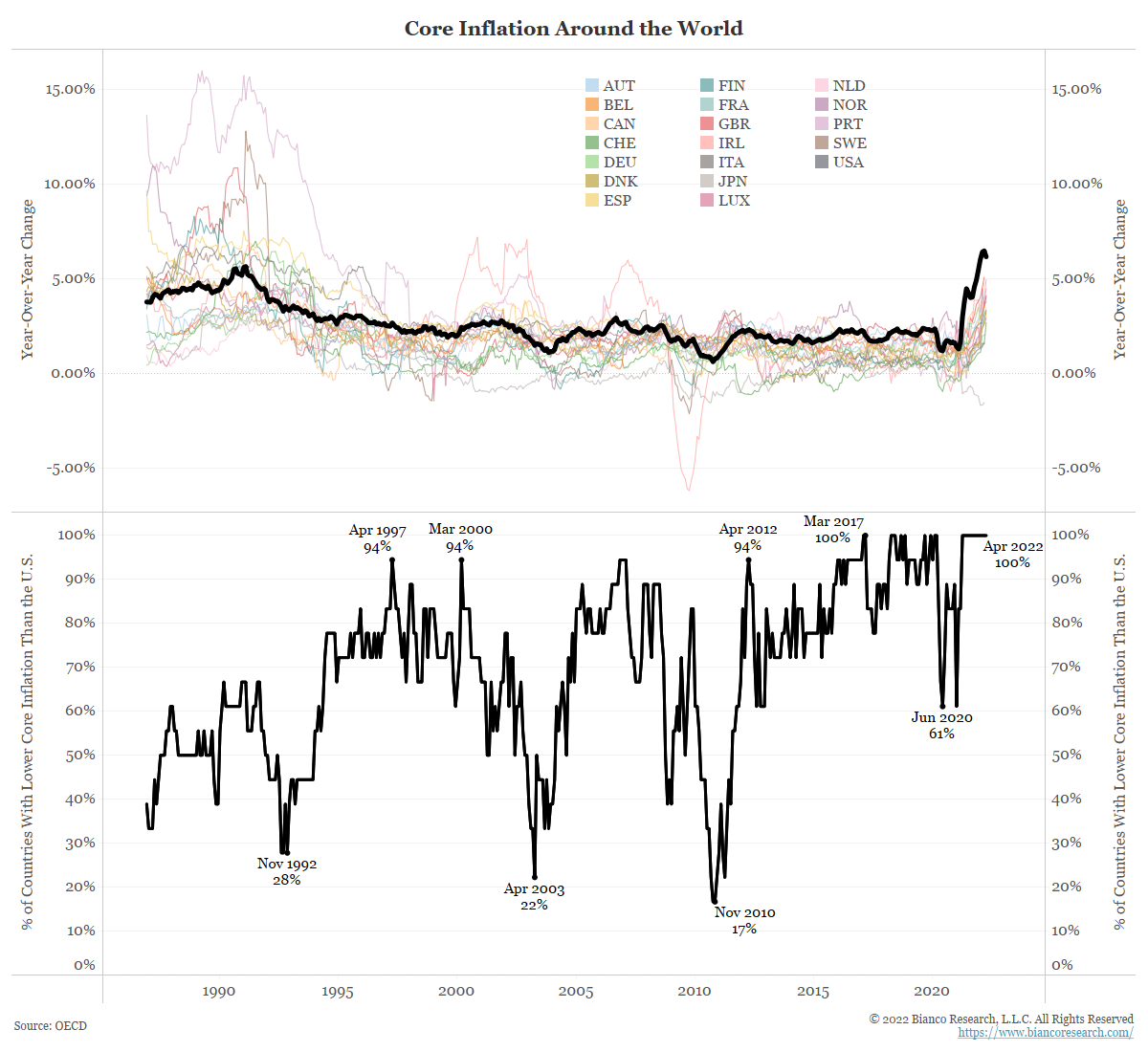

Don’t Fight the Fed

Posted By Jim Bianco

The mix of fiscal and monetary stimulus in recent years created an extra 3% inflation in the U.S. The Fed intends to remove this excess stimulus by creating a reverse wealth effect.... Read More

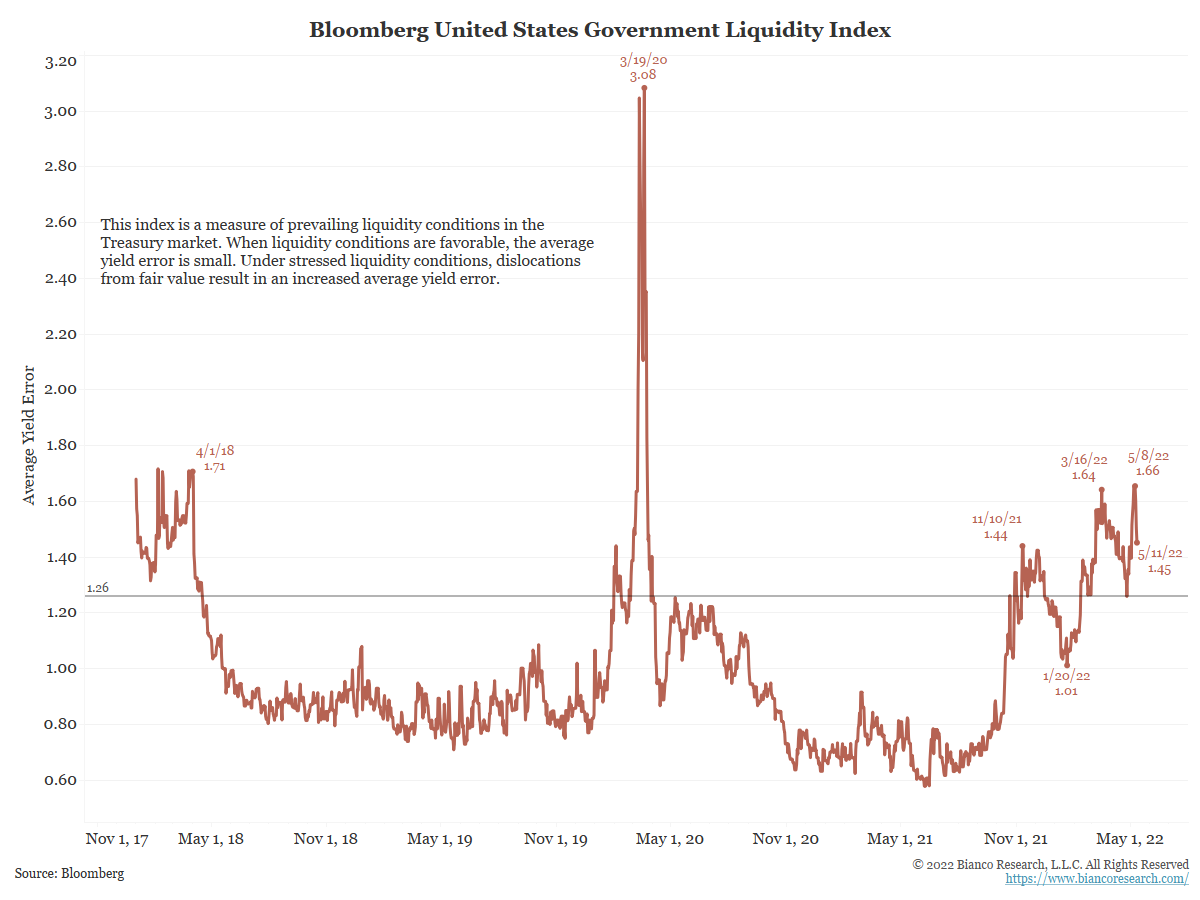

Quantifying Liquidity Concerns

Posted By Alex Malitas

Last week we raised concerns that declining liquidity across markets could be a sign that the Fed is already close to breaking something. Ahead of the Fed's planned balance sheet runoff, they have warned that liquidity is indeed an issue.... Read More

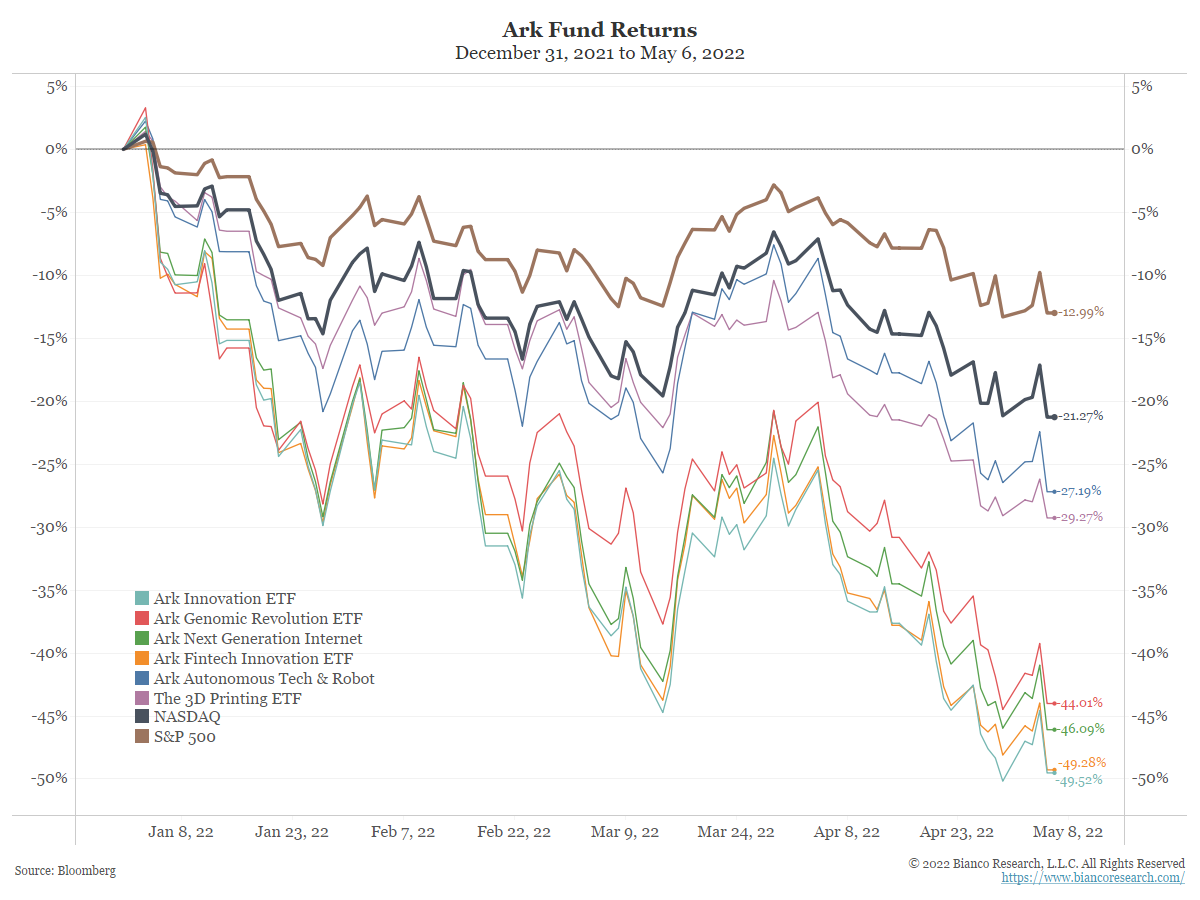

Another ARK Update as Cathie Wood Doubles Down

Posted By Alex Malitas

Cathie Wood and the ARK ETFs, headlined by ARK Innovation (ARKK), are arguably the most important manager/complex on Wall Street. After their outstanding performance in 2020, these funds significantly underperformed in 2021 and have had an abysmal start to 2022. Wood is sticking to her guns and so are her investors.... Read More

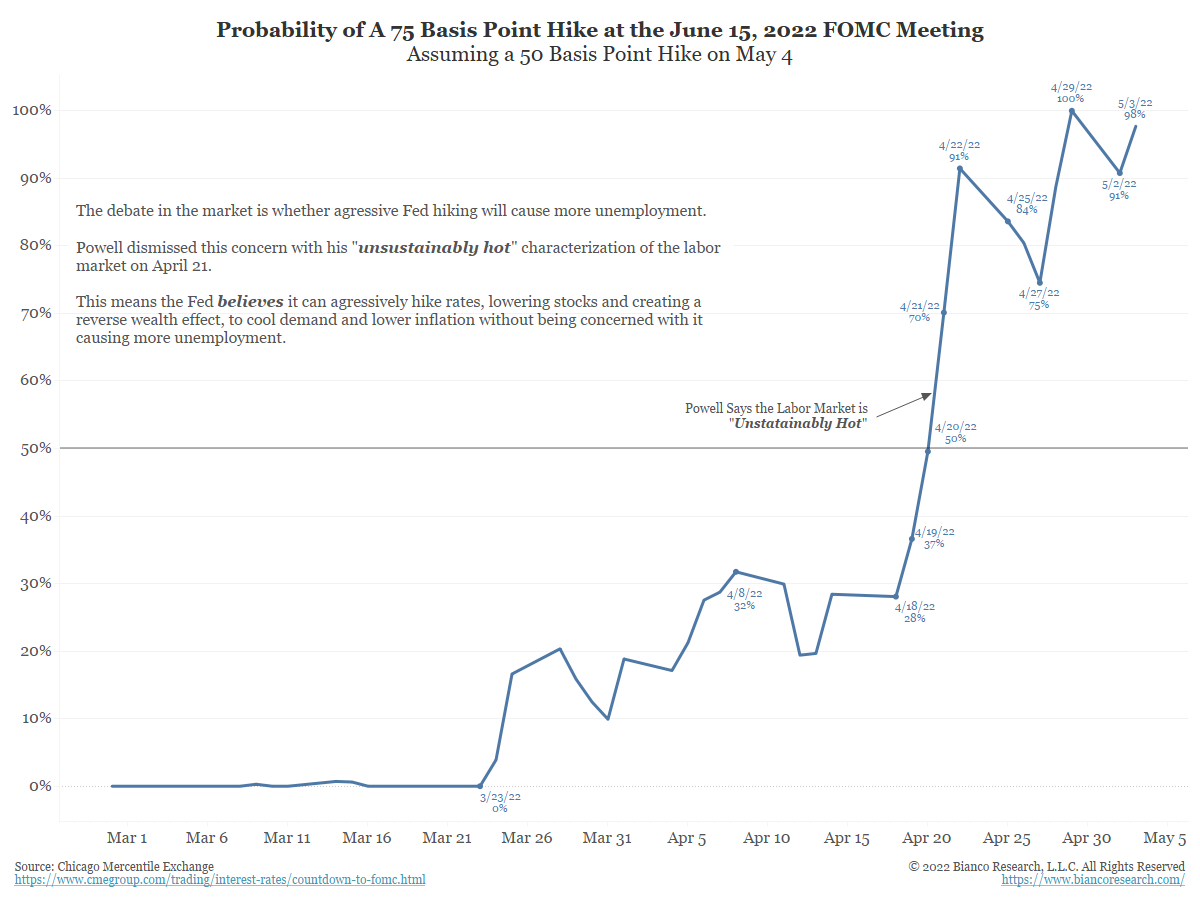

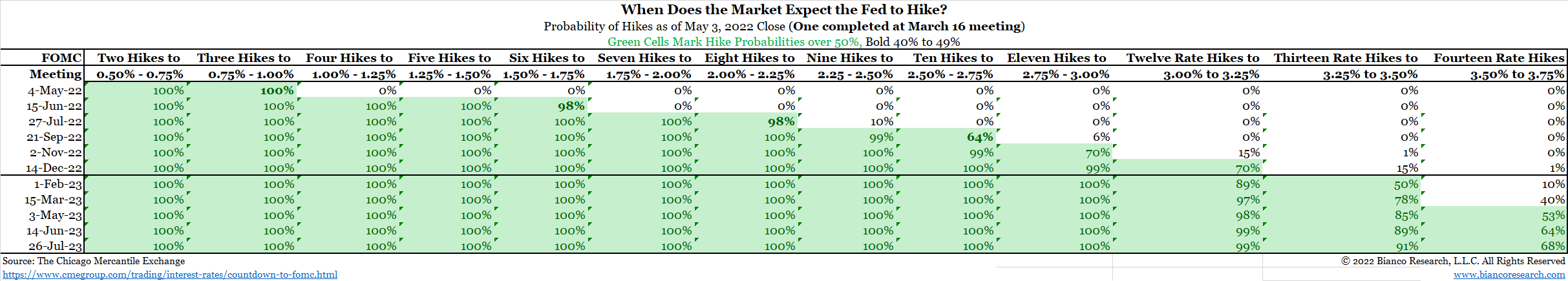

Code Words to Look for at Today’s FOMC Meeting

Posted By Jim Bianco

When Powell described the labor market as being in good shape, he was saying it could handle aggressive rate hikes without massive job losses. Will he signal this again and set the stage for a 75 basis point hike in June?... Read More

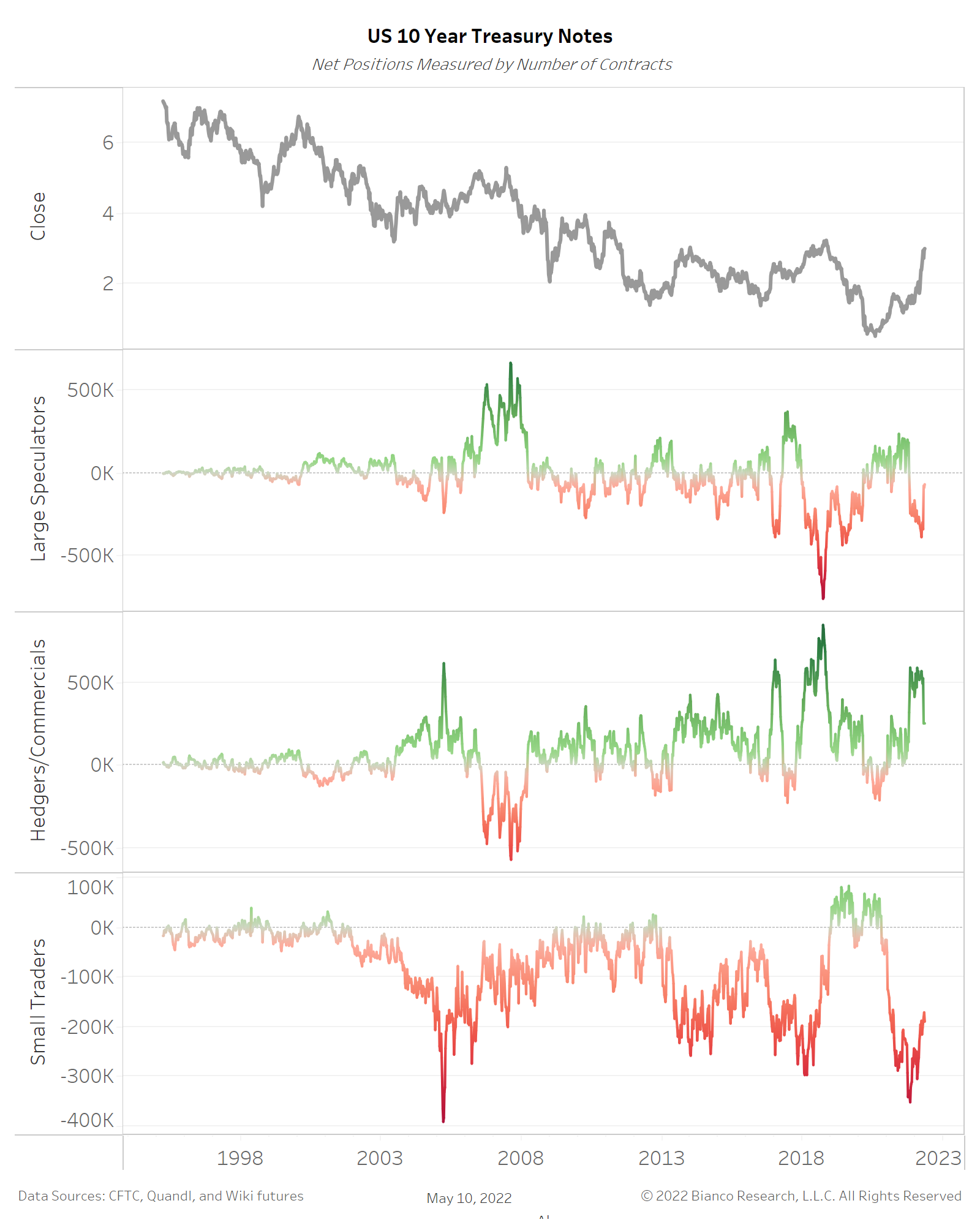

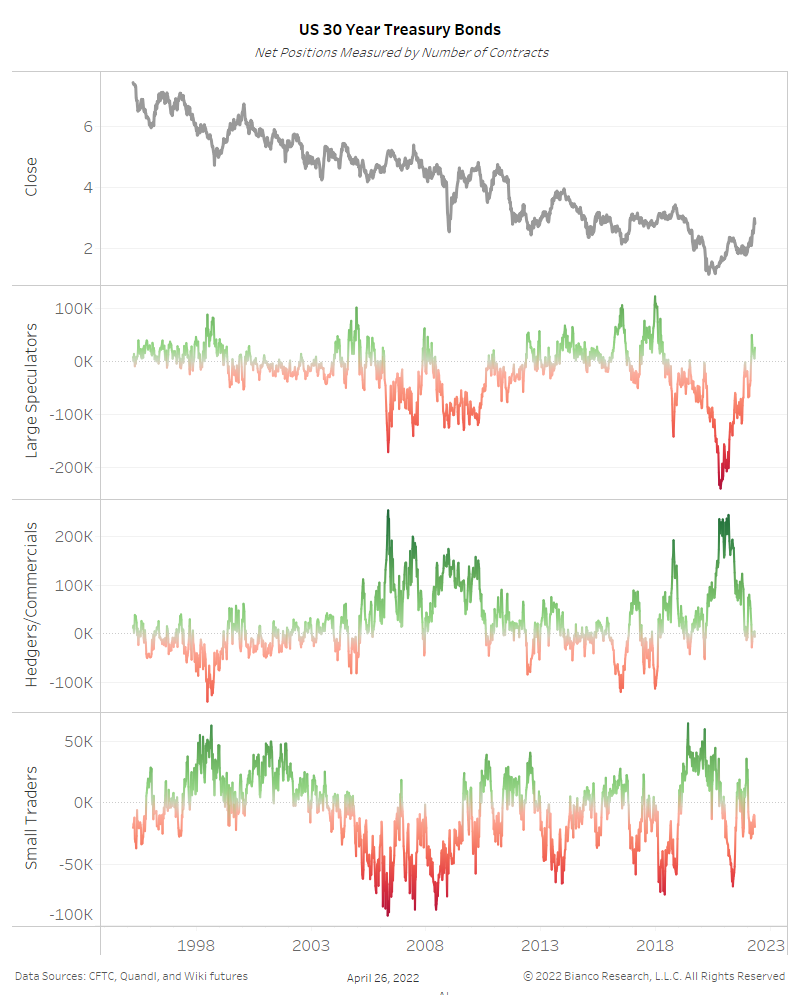

From Transitory to Breaking Something

Posted By Jim Bianco

Long-term debt and equity traders still think the fed funds market has priced in too many hikes. Stock and bond traders initially perceived inflation to be transitory. Now they believe the Fed is on the verge of going too far and breaking something.... Read More

What Might Break in the Markets?

Posted By Alex Malitas

If the Fed does not tighten far enough, they risk a period of longer and higher inflation. If the Fed raises rates at a strong pace, something in the market is likely to break. This is the catch-22 of the year 2022.... Read More