The Pressure Is on the BoJ

Posted By Greg Blaha

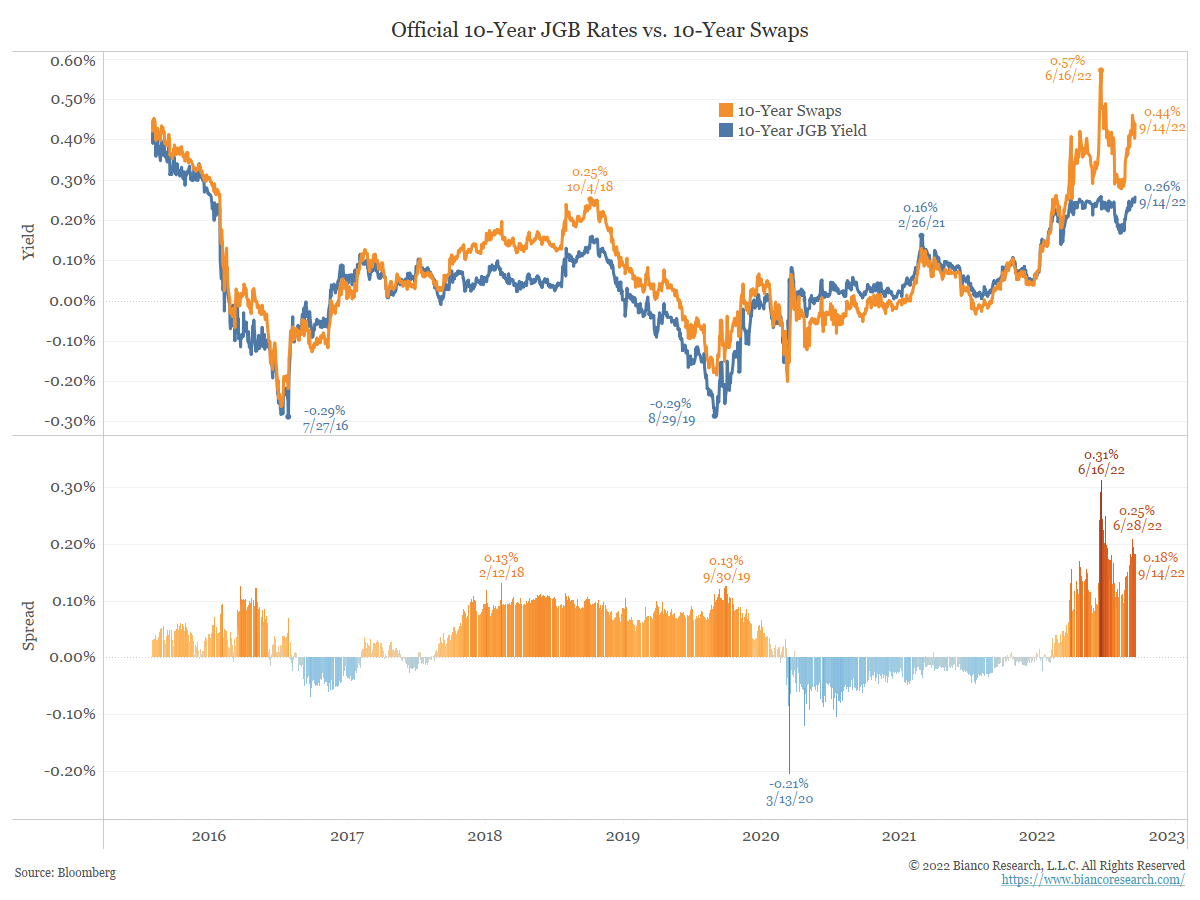

The pressure is back on the Bank of Japan as 10-year JGB rates hover around their preferred upper limit of 0.25%.... Read More