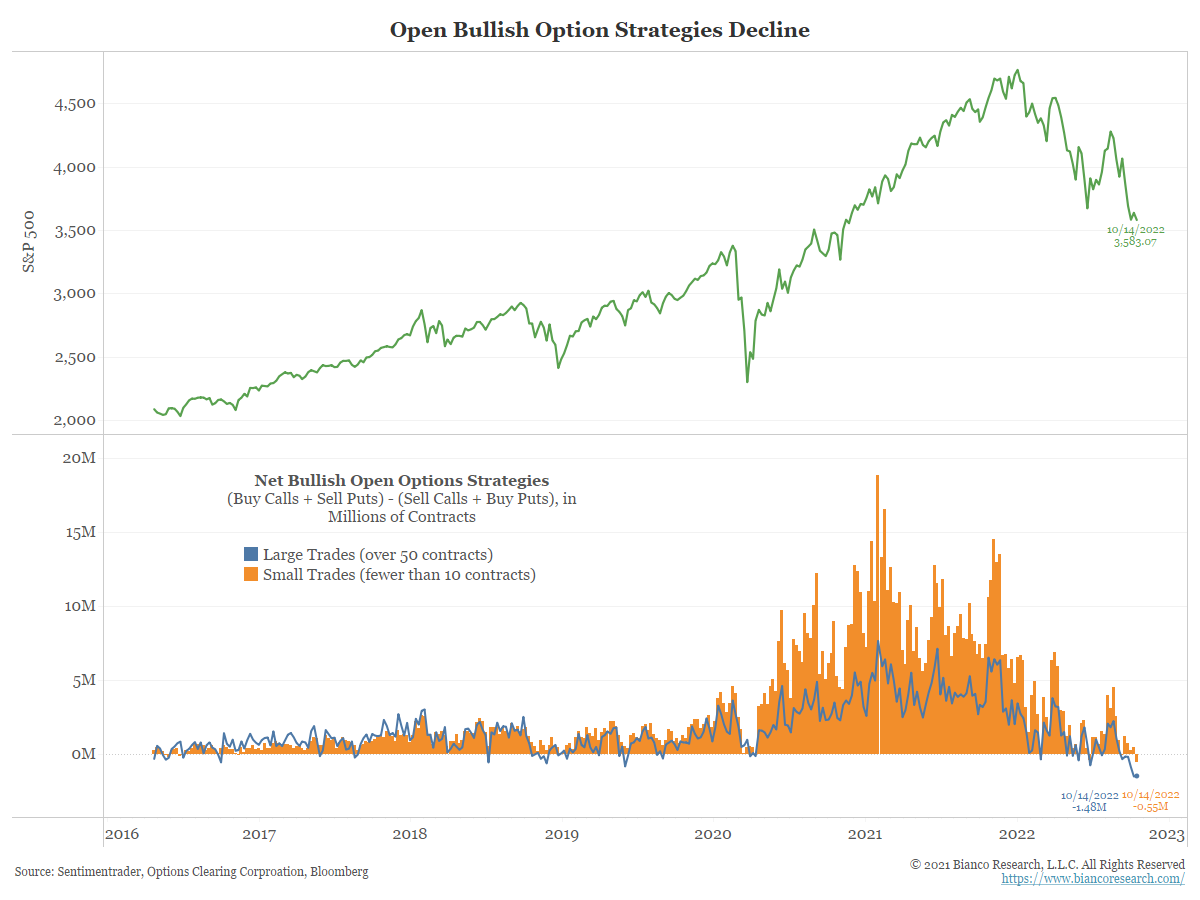

Dominant Retail Options Traders Load Up On Puts

Posted By Alex Malitas

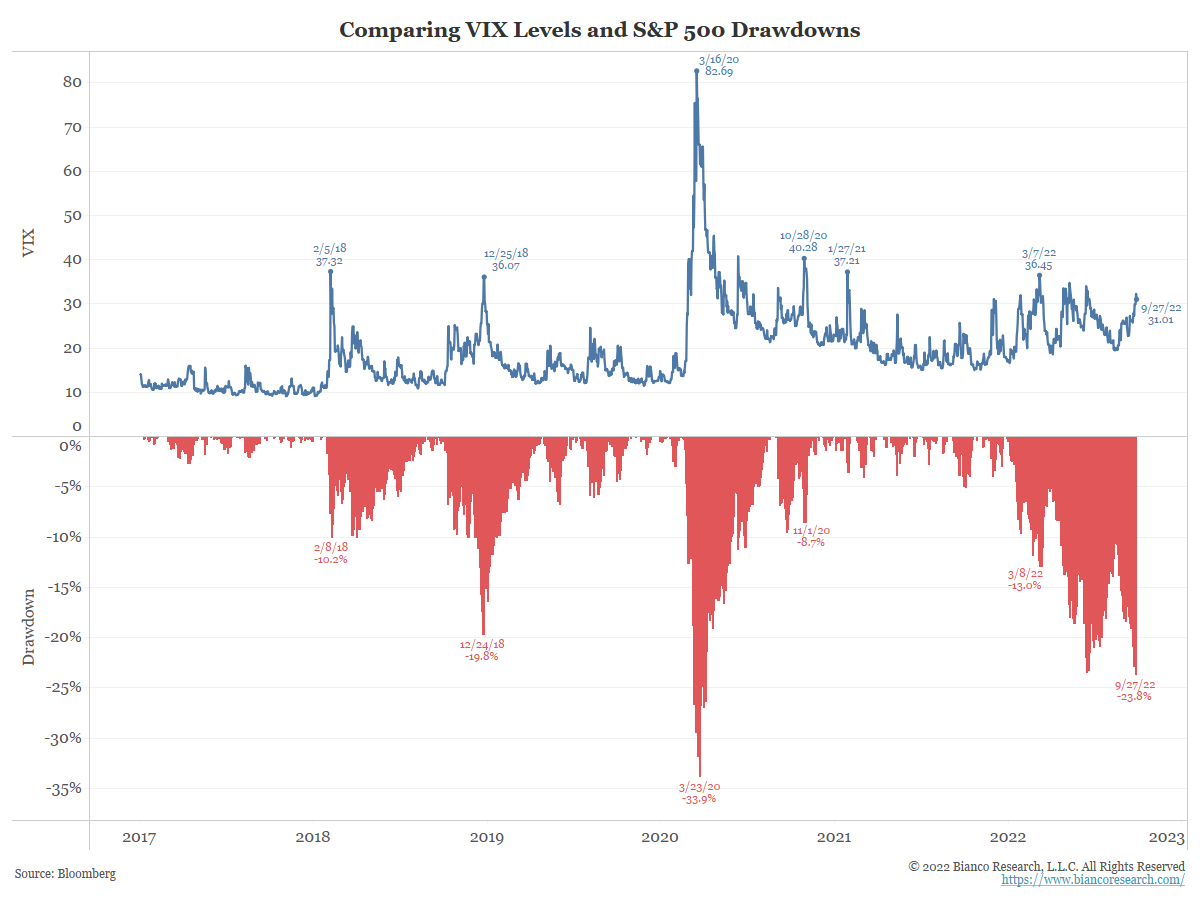

Total options volume has soared since the end of 2019 as retail traders have become dominant in using short-dated (less than a week) options as speculative tools. With the macroeconomic backdrop constantly changing, they bounce back and forth between puts and calls, This is amplifying volatility in markets.... Read More