Tag Archives: Markets

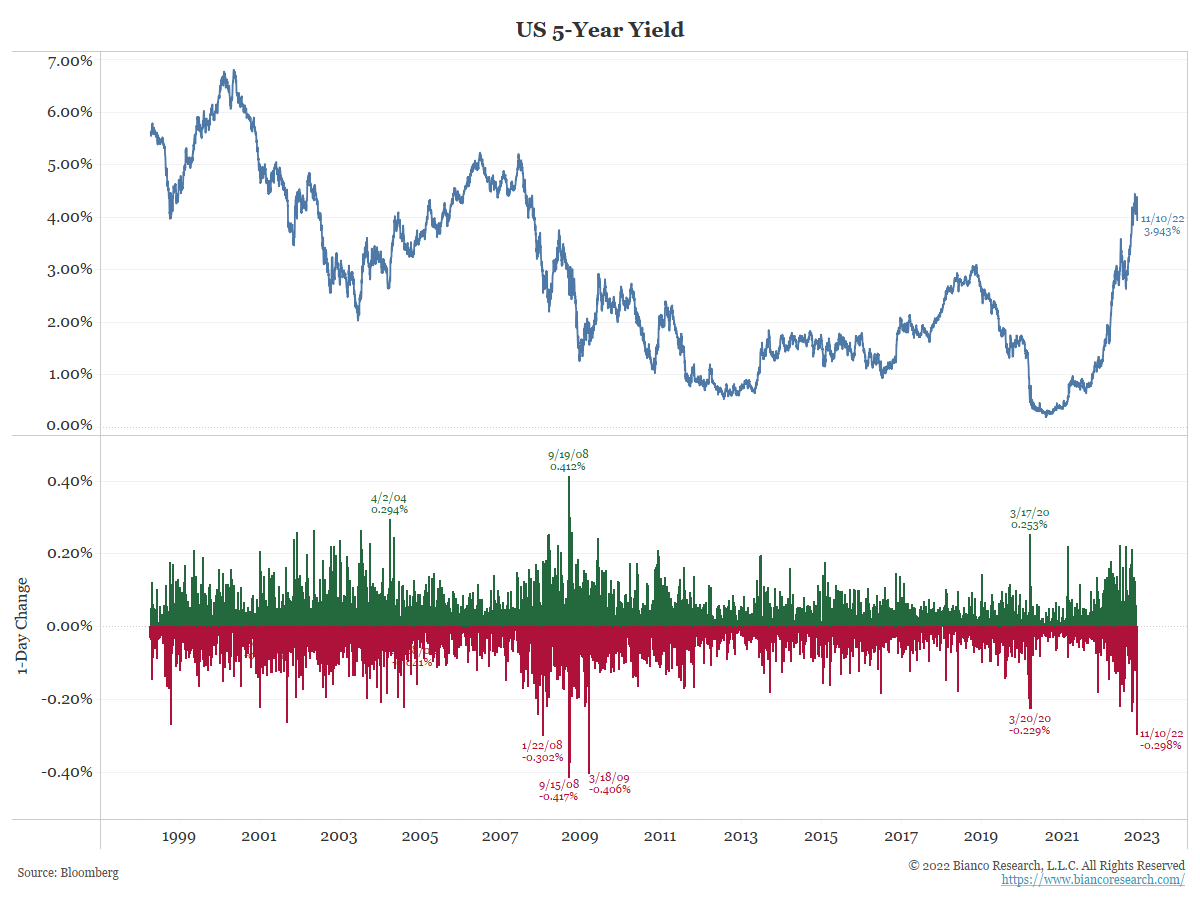

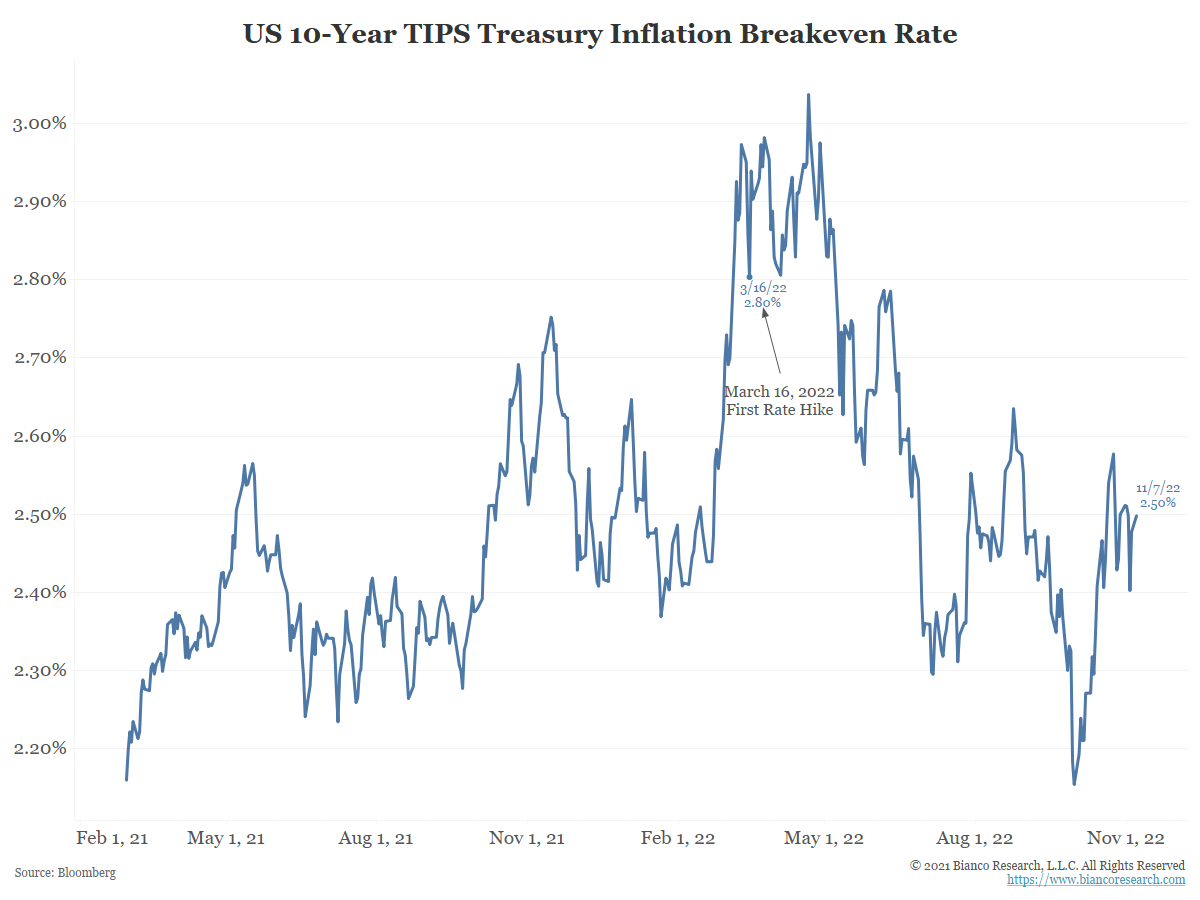

The Markets Liked Thursday’s CPI Release

Posted By Greg Blaha

Stocks ripped higher and Treasury yields plummeted in the wake of CPI's release on Thursday.... Read More

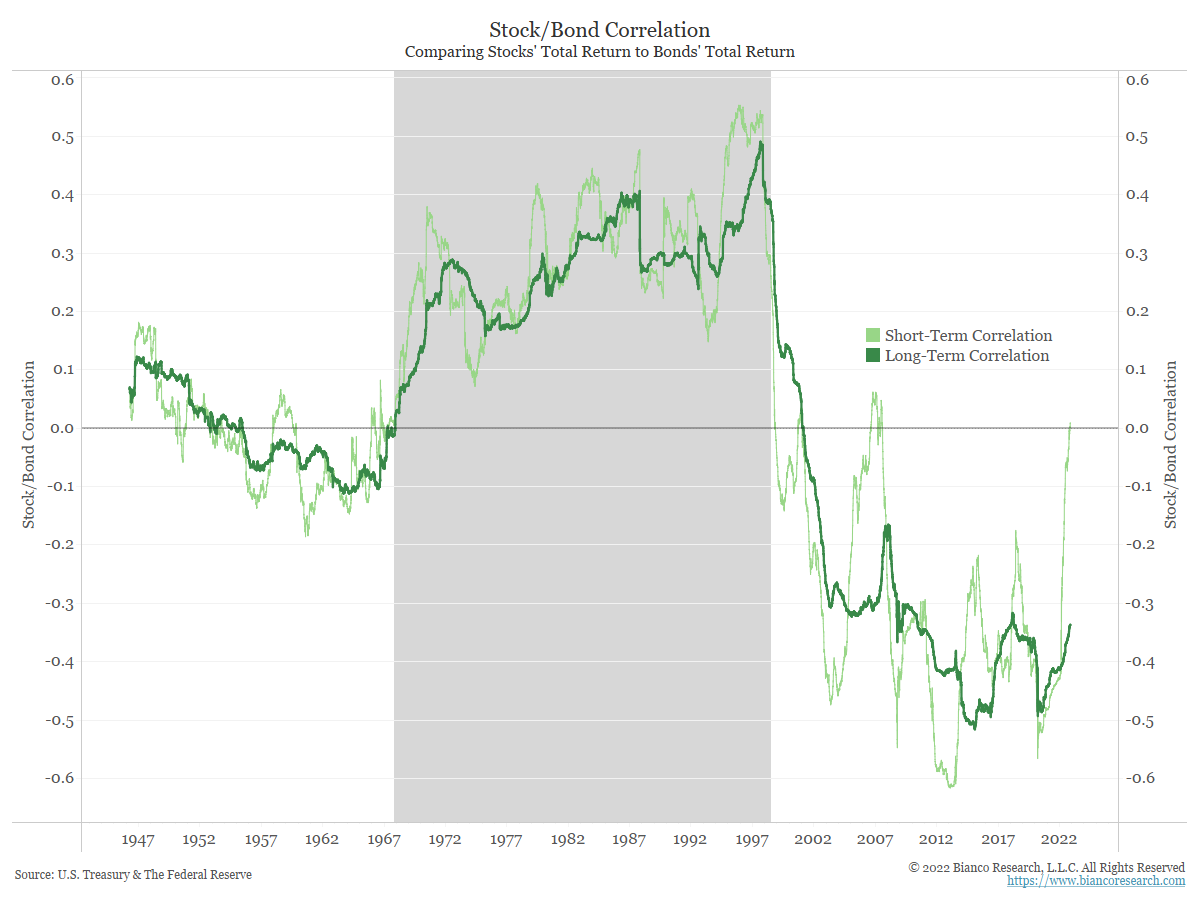

The Correlation Between Stock & Bond Returns Turns Positive

Posted By Greg Blaha

As inflation remains at elevated levels, the correlation between stock and bond returns is a telling sign on investors' thinking.... Read More

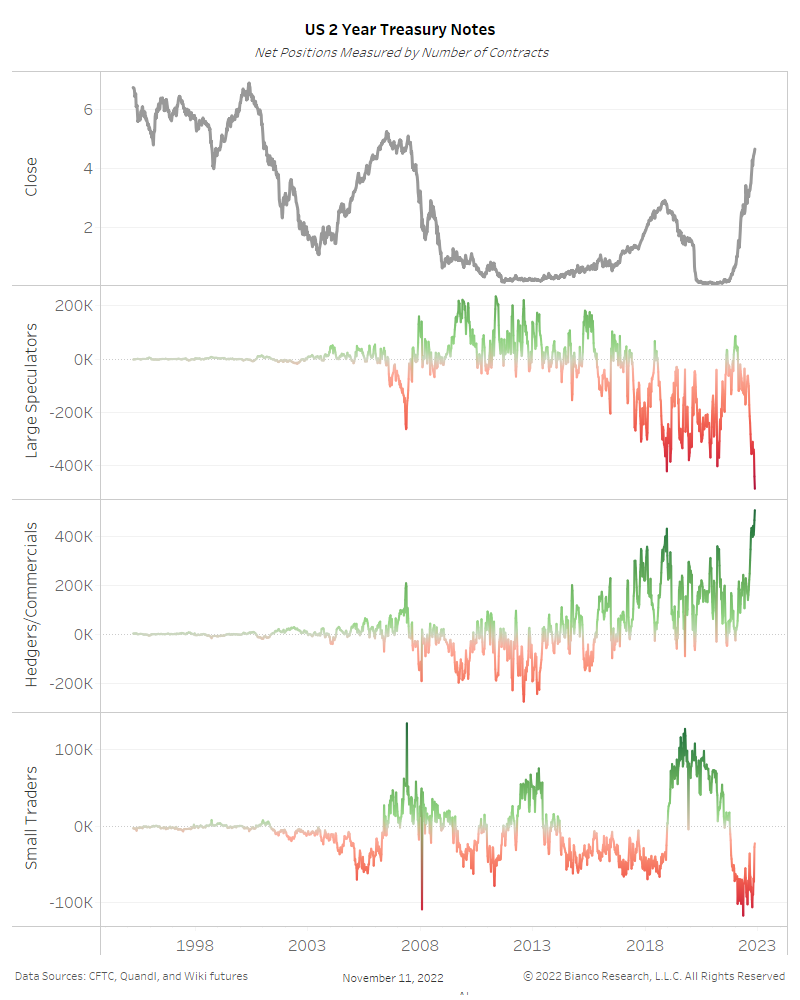

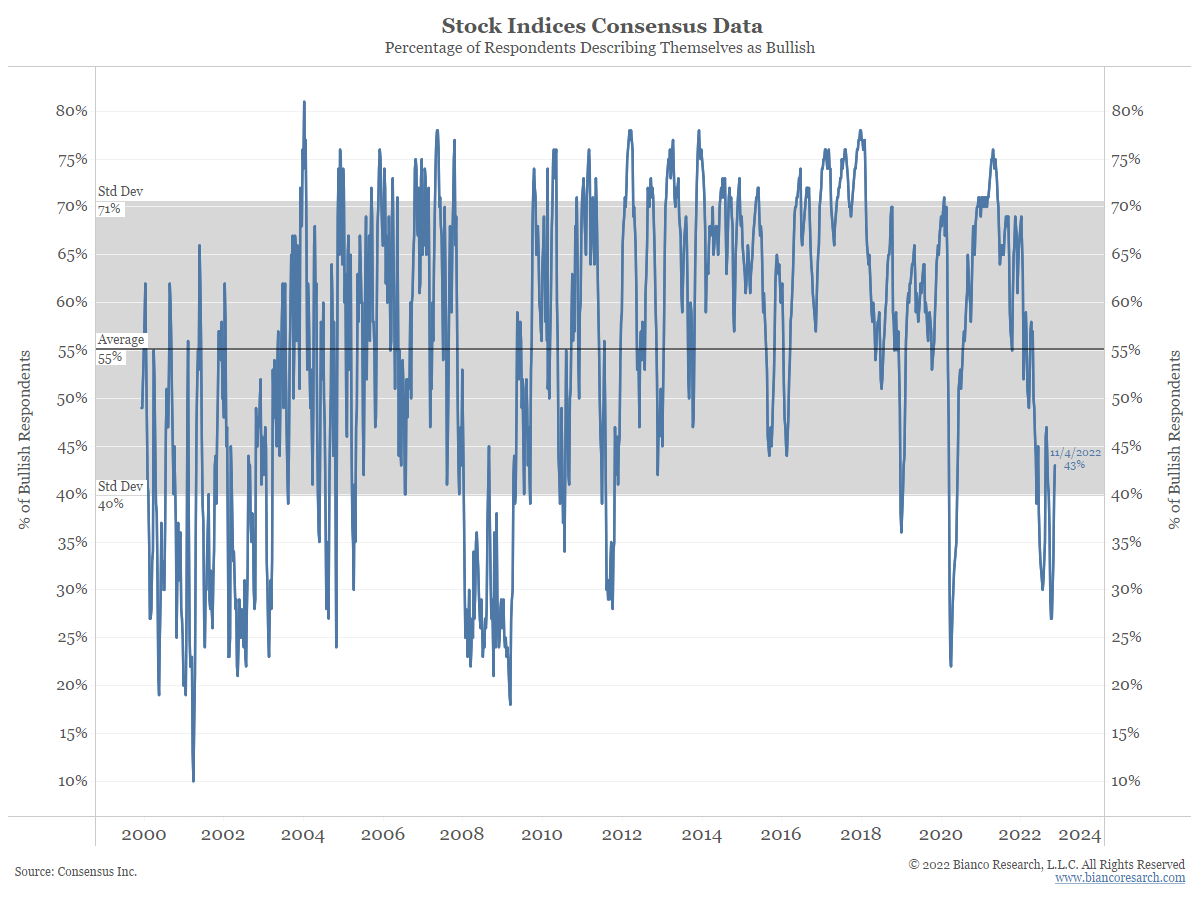

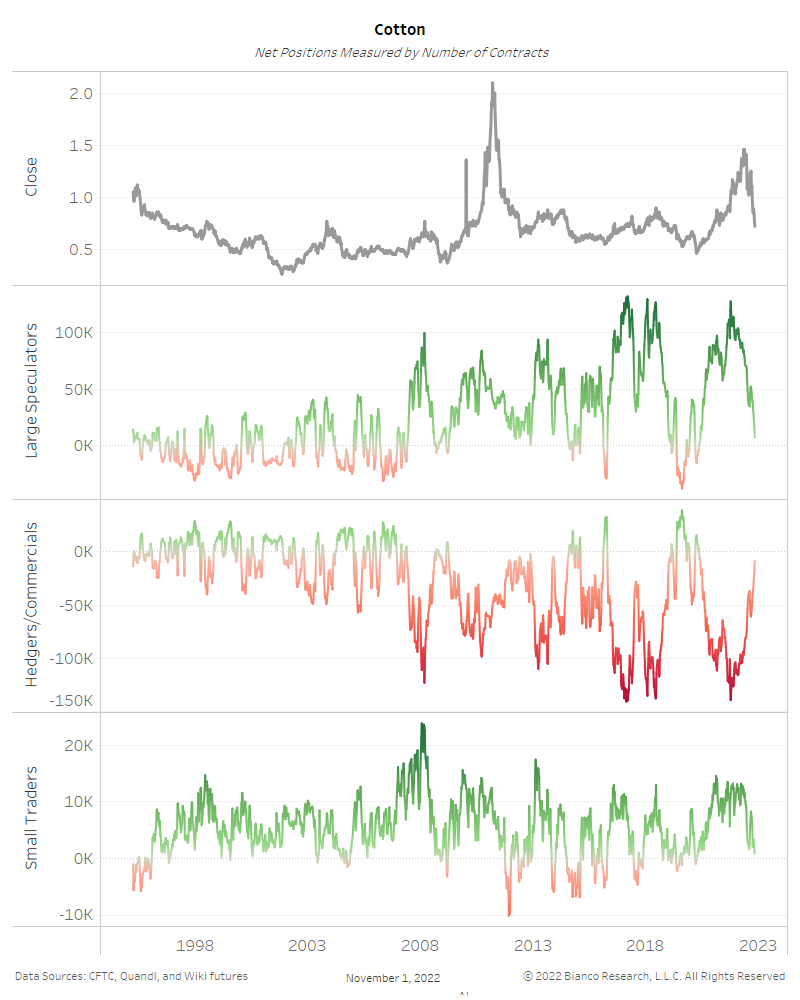

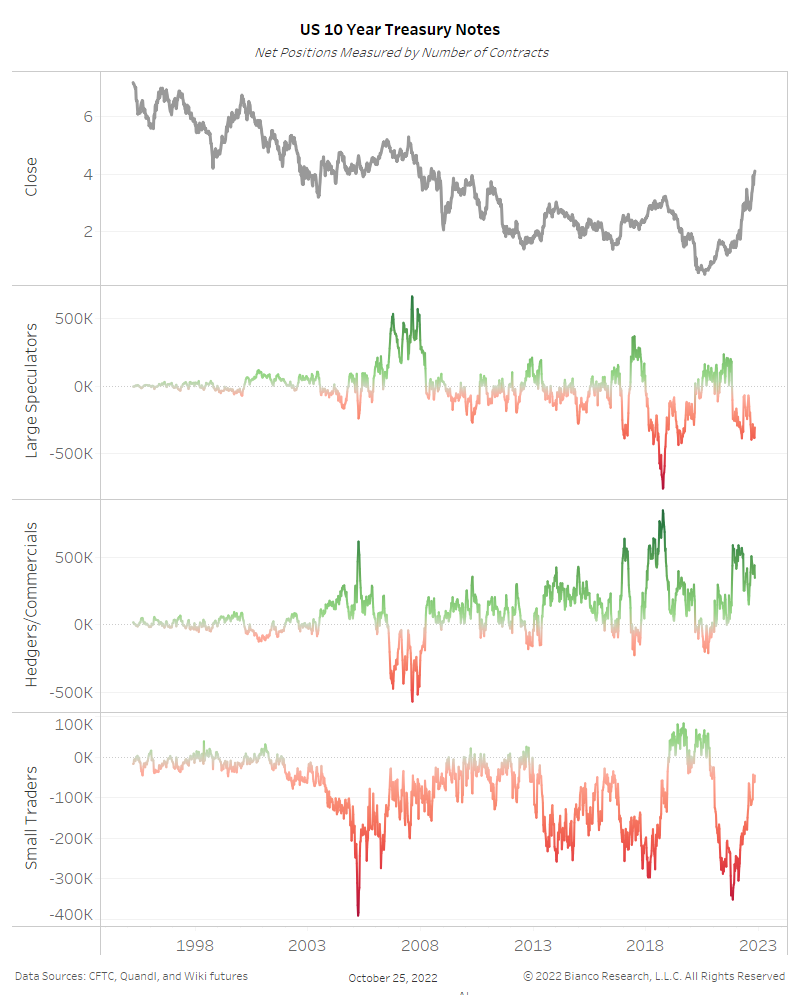

Market Sentiment and Positioning

Posted By Alex Malitas

2022 has gone from a year of asking, "could it get any worse?" to asking "what is going to break first?" Central banks' historic pace of tightening has left financial markets are feeling the pressure. We check on investor sentiment and positioning. ... Read More

Still No Long-Term Vision at the Fed

Posted By Jim Bianco

Lately, Fed officials' speeches have signaled what the FOMC will do at the next meeting. Missing is the speech explaining why an aggressive policy is needed. We believe Fed officials do not give this speech because they cannot agree on this case.... Read More

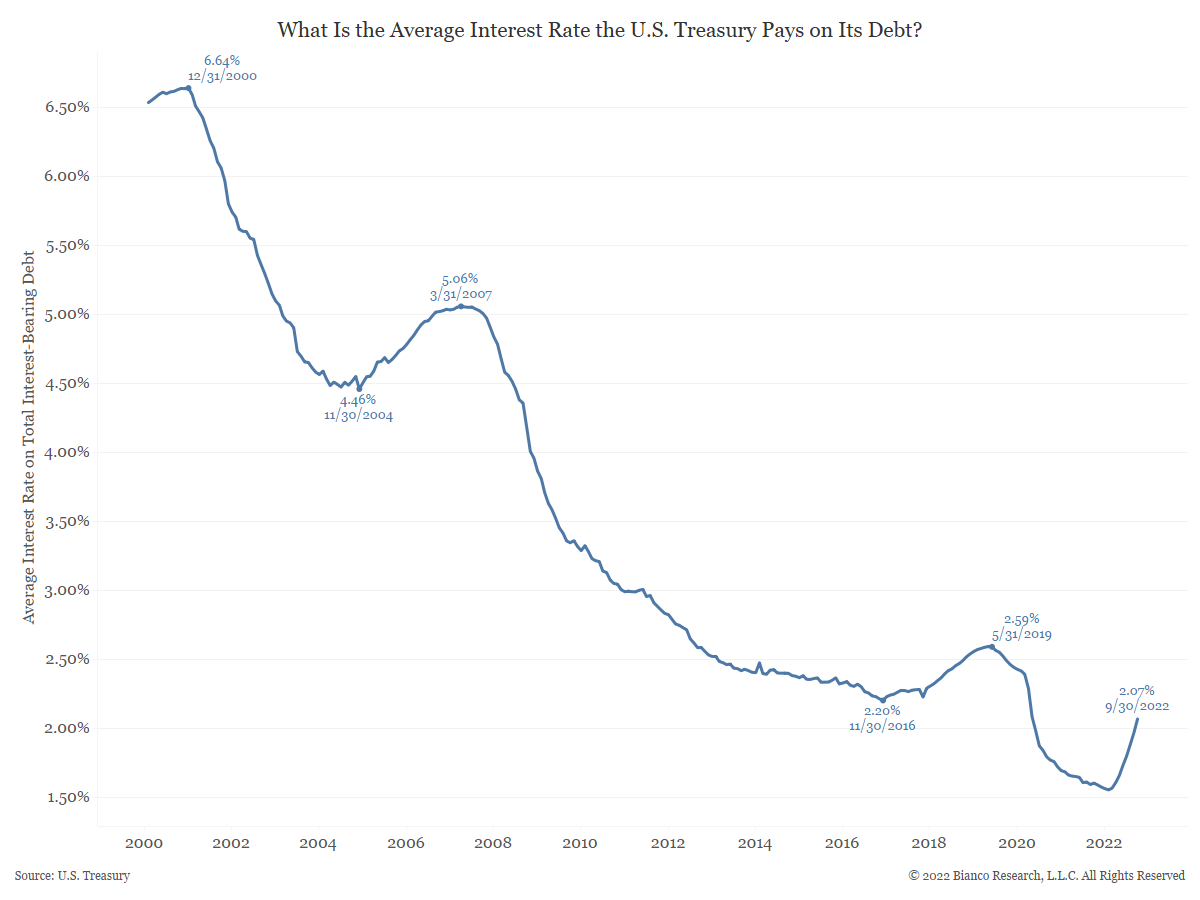

The Rising Cost of Treasury Debt

Posted By Greg Blaha

For the last few decades we have been in a low interest rate environment where deficit spending would not cause major issues. However, a 40-year high in inflation prompted the Fed to tighten monetary policy at a fast pace. Higher rates mean the cost of servicing US debt will follow higher. ... Read More

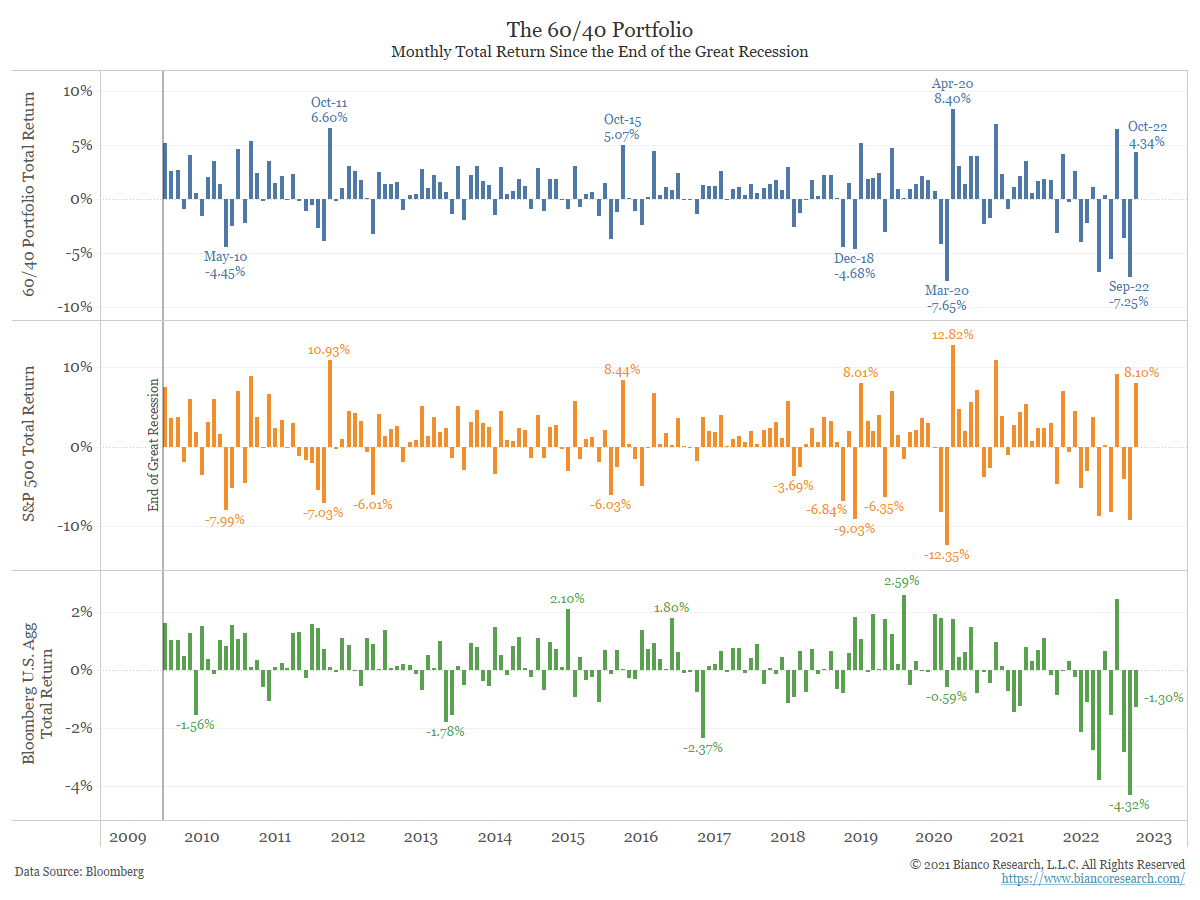

Checking in on the 60/40 Portfolio

Posted By Greg Blaha

The average 60/40 portfolio is down over 20% this year, more than any year of the past three decades.... Read More

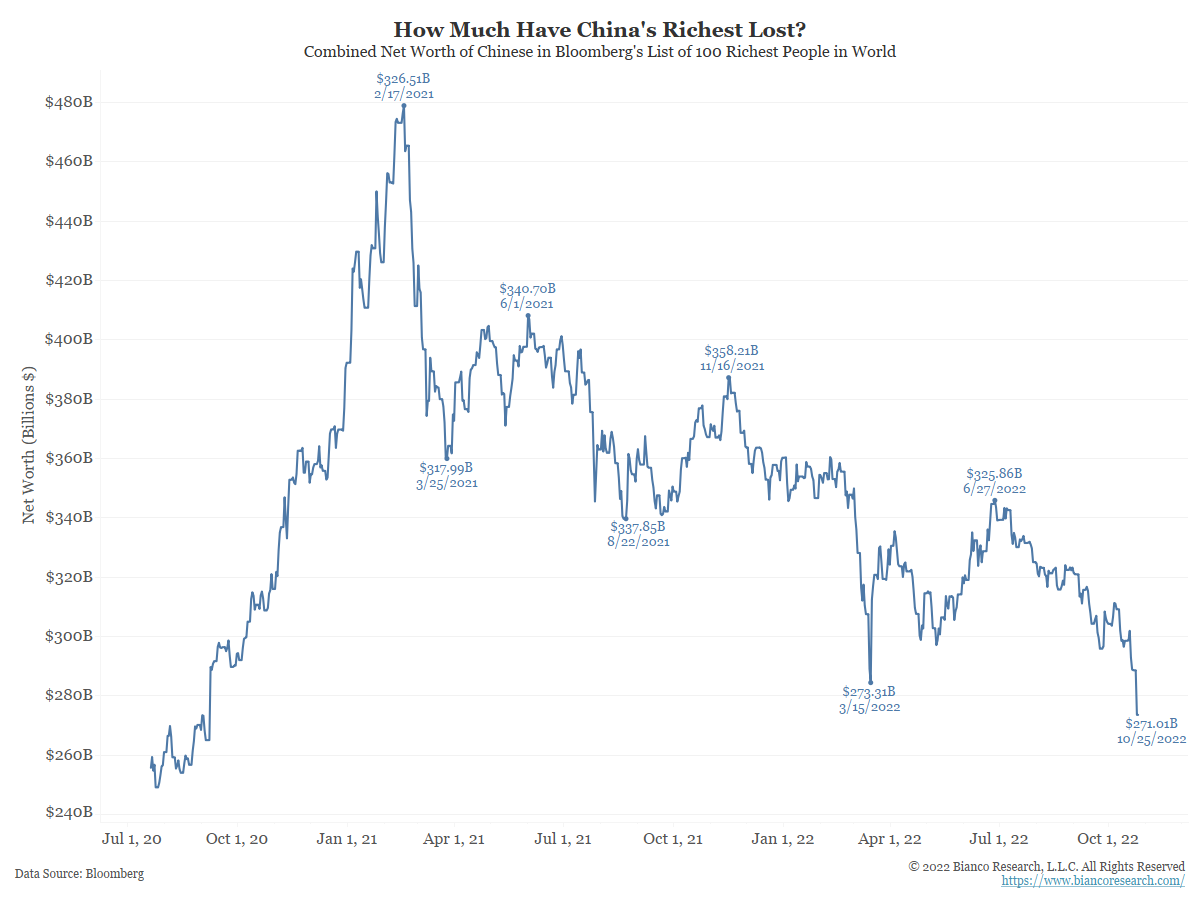

Xi’s Crackdown on China’s Wealthiest

Posted By Greg Blaha

As Xi's common prosperity initiative continues, the net worth of the richest Chinese citizens has dwindled.... Read More

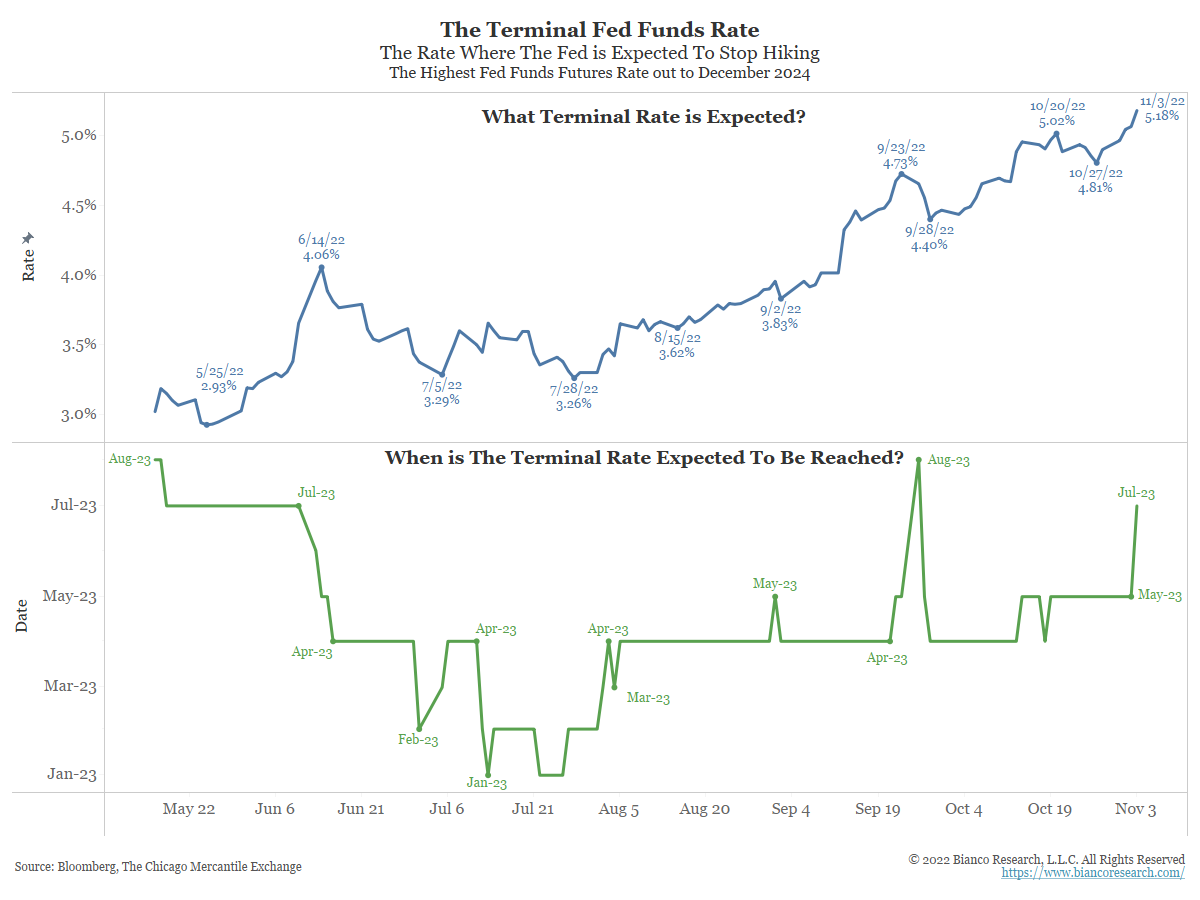

It’s All About the Terminal Rate

Posted By Jim Bianco

Powell delivered a hawkish press conference, focusing on a higher terminal rate. Risk markets, like stocks, reacted with bitter disappointment.... Read More

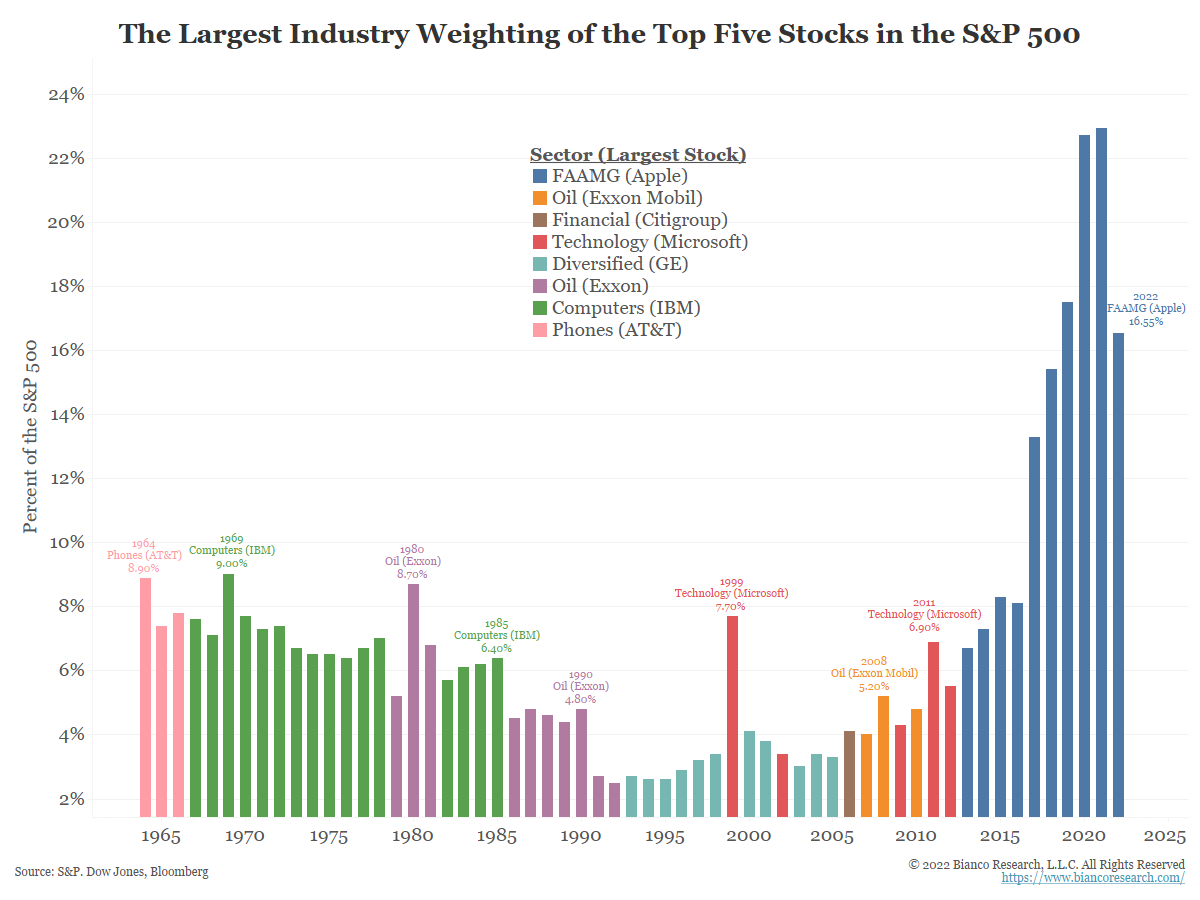

Rethinking Big Tech’s Dominance

Posted By Alex Malitas

Big tech, specifically social media companies, have struggled recently as investors realize growth doesn't last forever. Is this the end of big tech's dominance in indices?... Read More

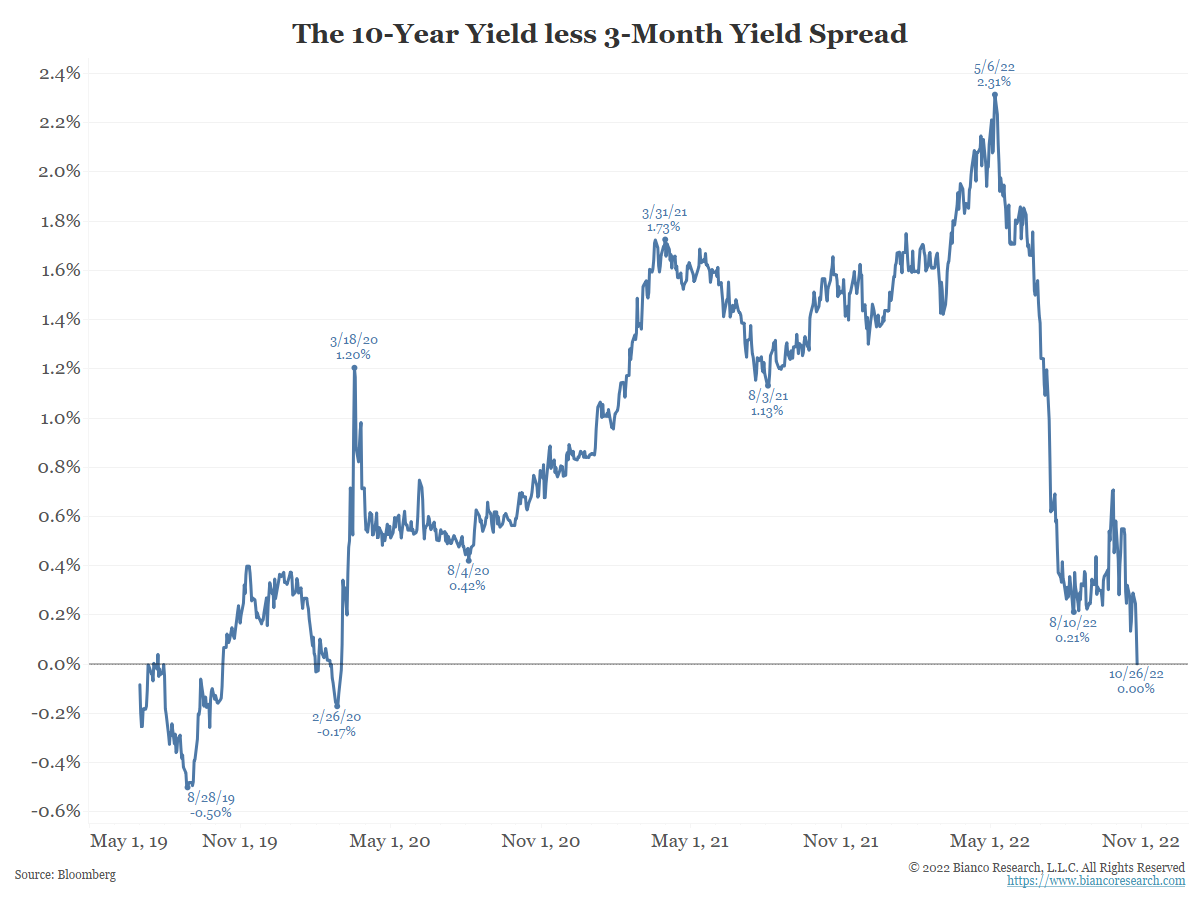

The 10-Year Less 3-Month Yield Curve Inverts

Posted By Jim Bianco

Up to this point, the 10-year less 3-month yield curve has not shown concern that the Fed may be moving too fast and breaking something. But, as the Fed is on the verge of hiking another 75 basis points to a range of 3.75% to 4.00%, the possibility of a persistently inverted yield curve is growing. If the curve is still inverted a couple weeks from now, a recession is likely to follow.... Read More

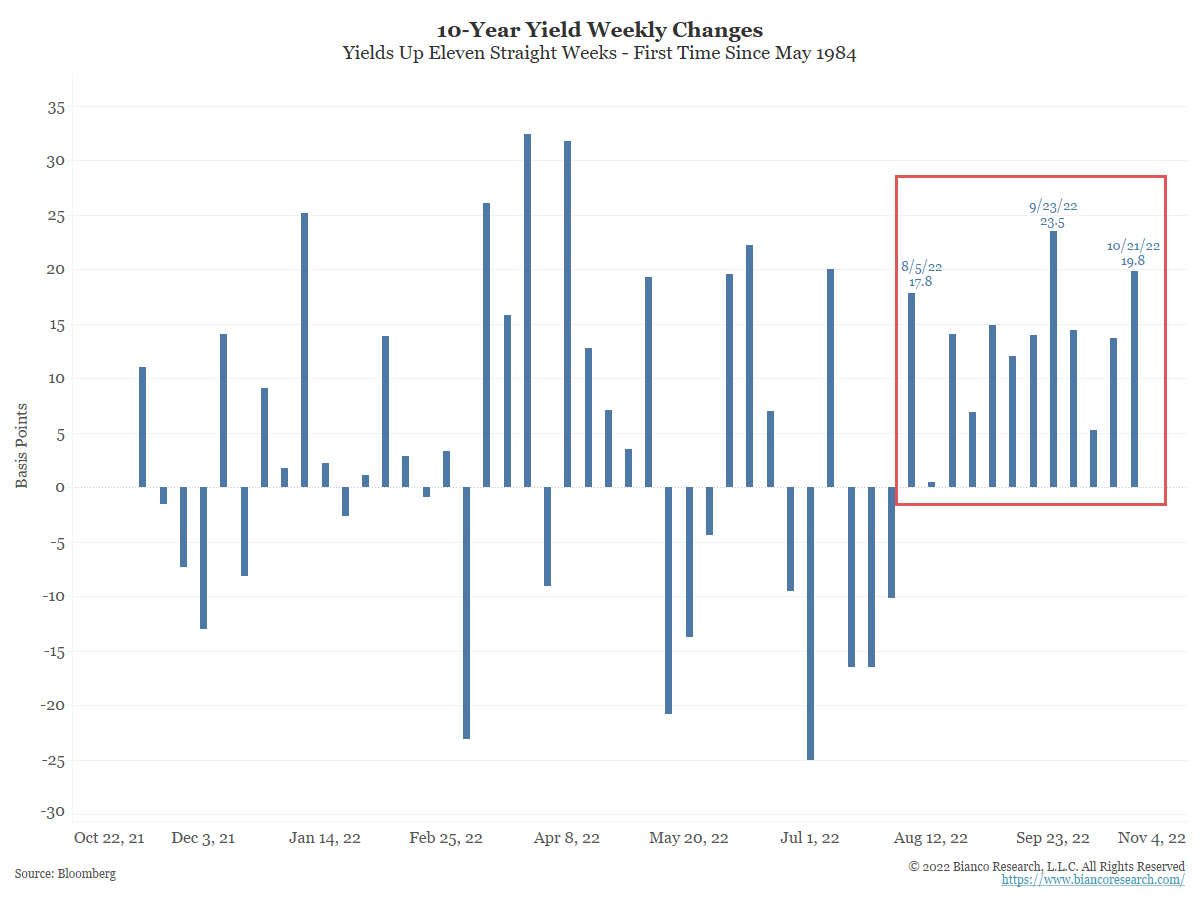

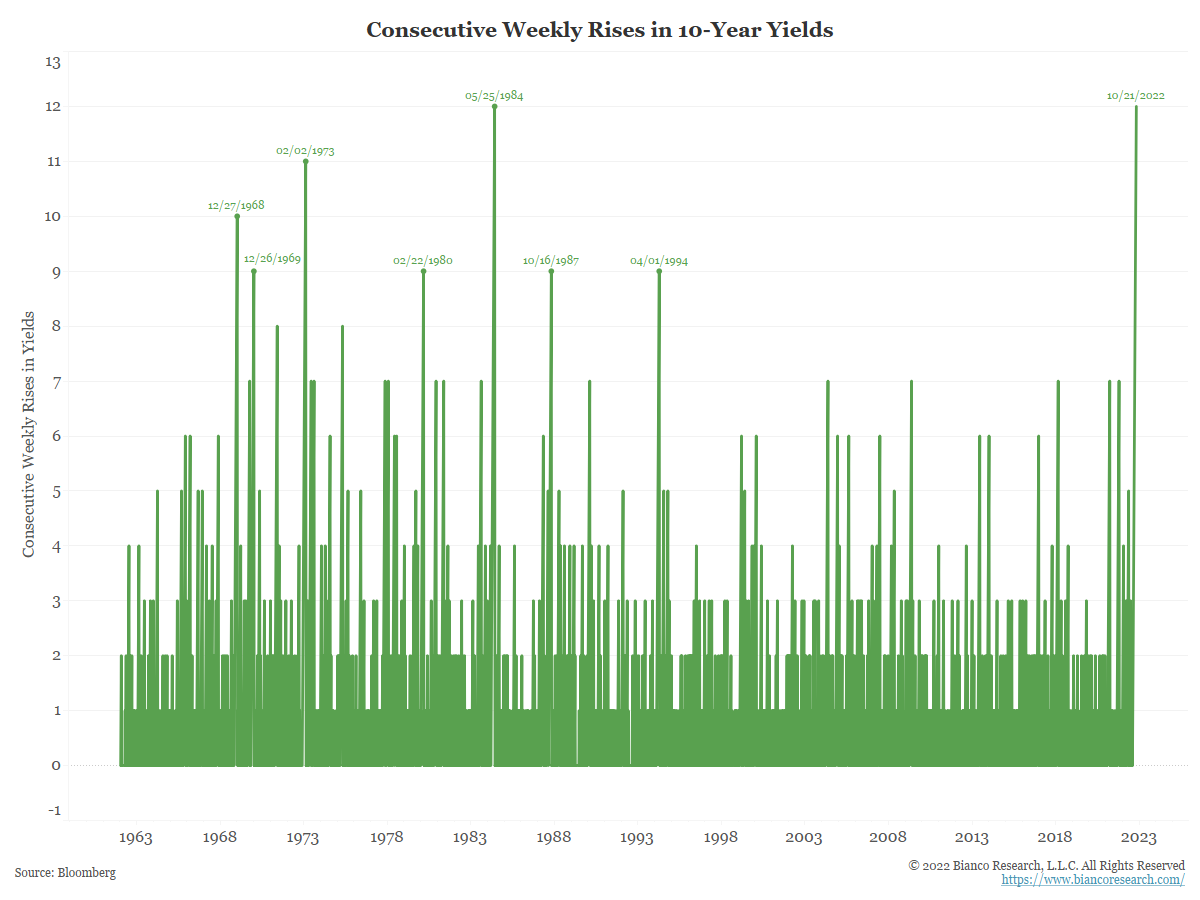

What Will End 10-Year Yields’ Consecutive Weekly Rise?

Posted By Jim Bianco

The relentless rise in yields that began in late July is not yet showing signs of abating. The S&P 500 has lost 8% over this period after being down as much as 17%. Stocks will remain under pressure until yields reverse. Will it take a harsh sell-off in the S&P 500 and a risk-off rally in Treasuries to end this streak?... Read More

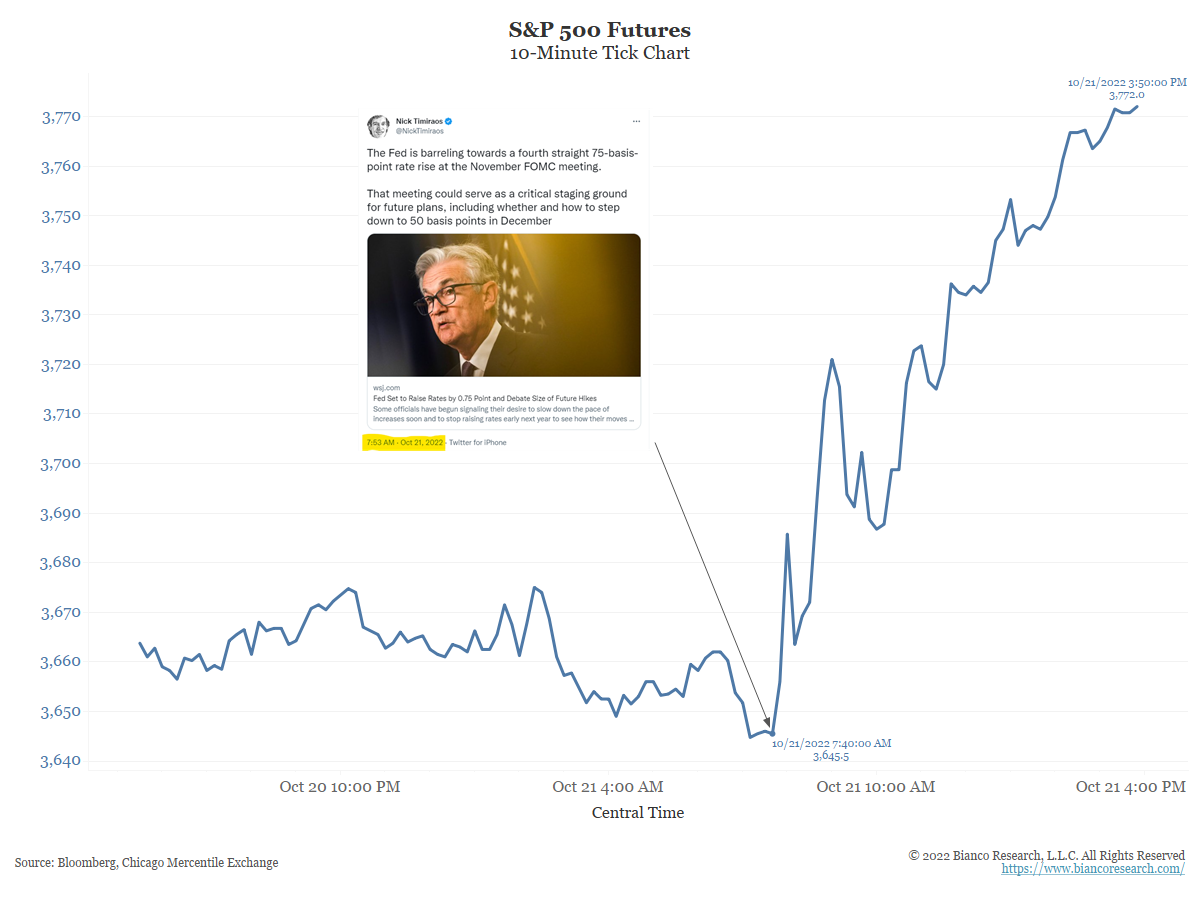

Will the Fed “Step Down”?

Posted By Jim Bianco

Just as pivot talk disappeared, a new narrative has emerged. The Fed will "step down" from consecutive 75 basis points hikes. This excited the stock market on Friday. Will this catch-phrase prove effective or will it disappoint like its previous iterations of transitory, pause, and pivot?... Read More

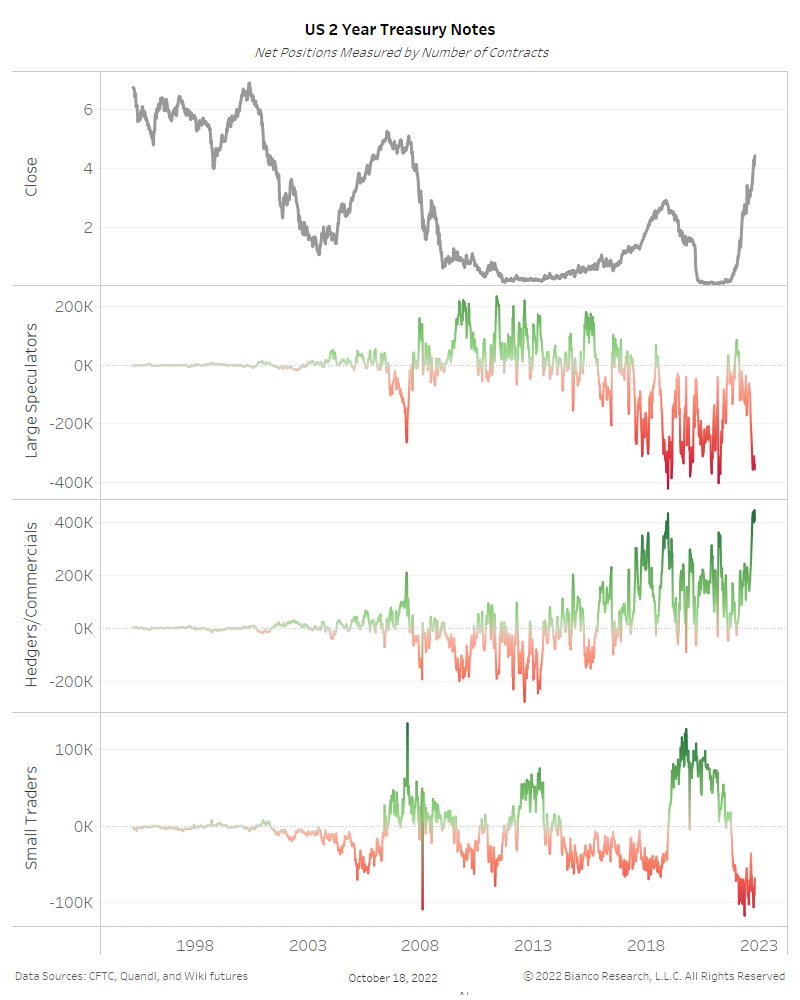

Why Rates Can Still Move Higher

Posted By Jim Bianco

Without any direct evidence of a worsening economy or a financial accident, such as plunging stock prices, both the long- and short-end of the yield curve can continue to shift higher. With the forward curve projecting a fed funds terminal rate of 5%, history suggests the 2-year yield should go above this level.... Read More

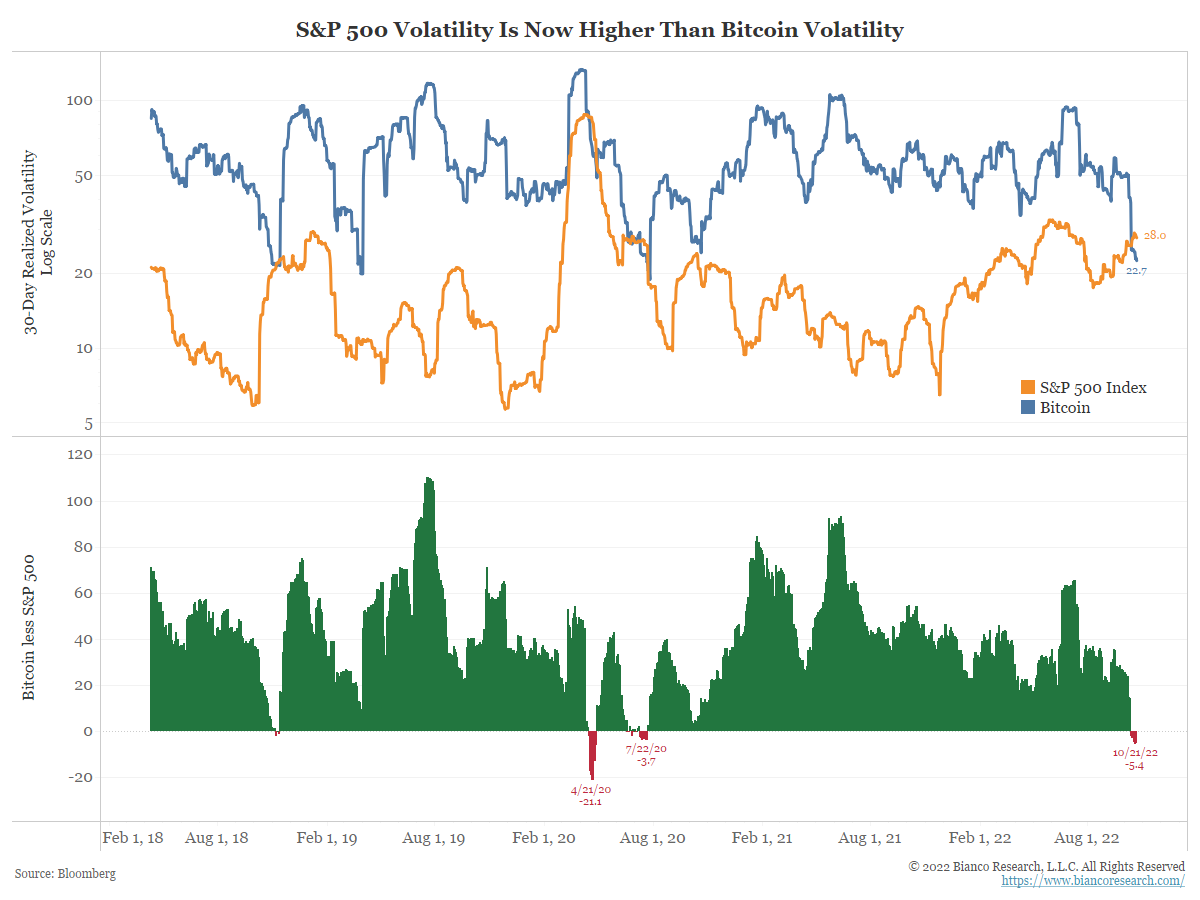

Crypto Is Now Less Volatile Than Stocks

Posted By Jim Bianco

For the first time in years, bitcoin's realized volatility is actually lower than the S&P 500's.... Read More

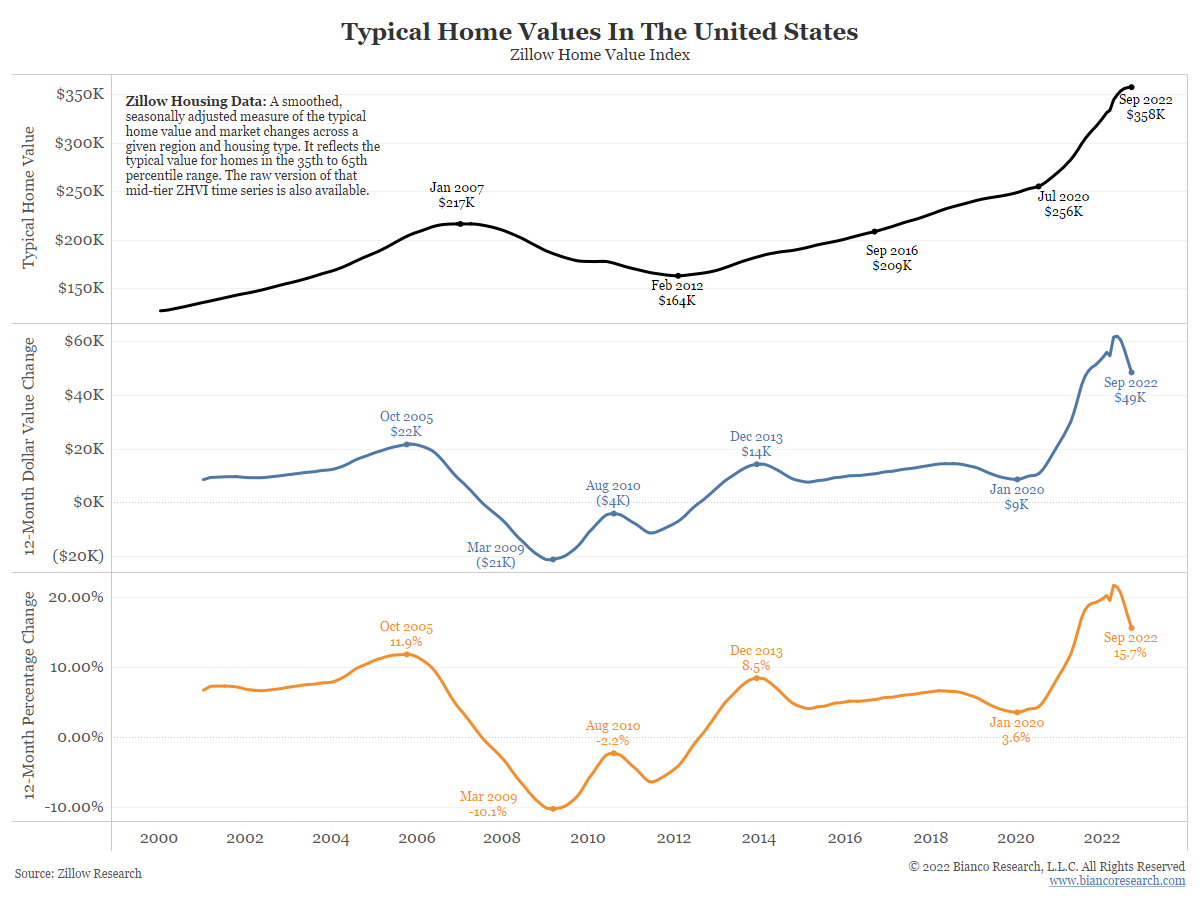

Typical Home Values Have Rolled Over

Posted By Alex Malitas

As the "Everything Bubble" accelerated, real estate values rose at an extreme fast speed, pricing would-be buyers out of the market. As the pandemic consumed the globe, home values skyrocketed to a year-over year change over $60k. This has since rolled over.... Read More

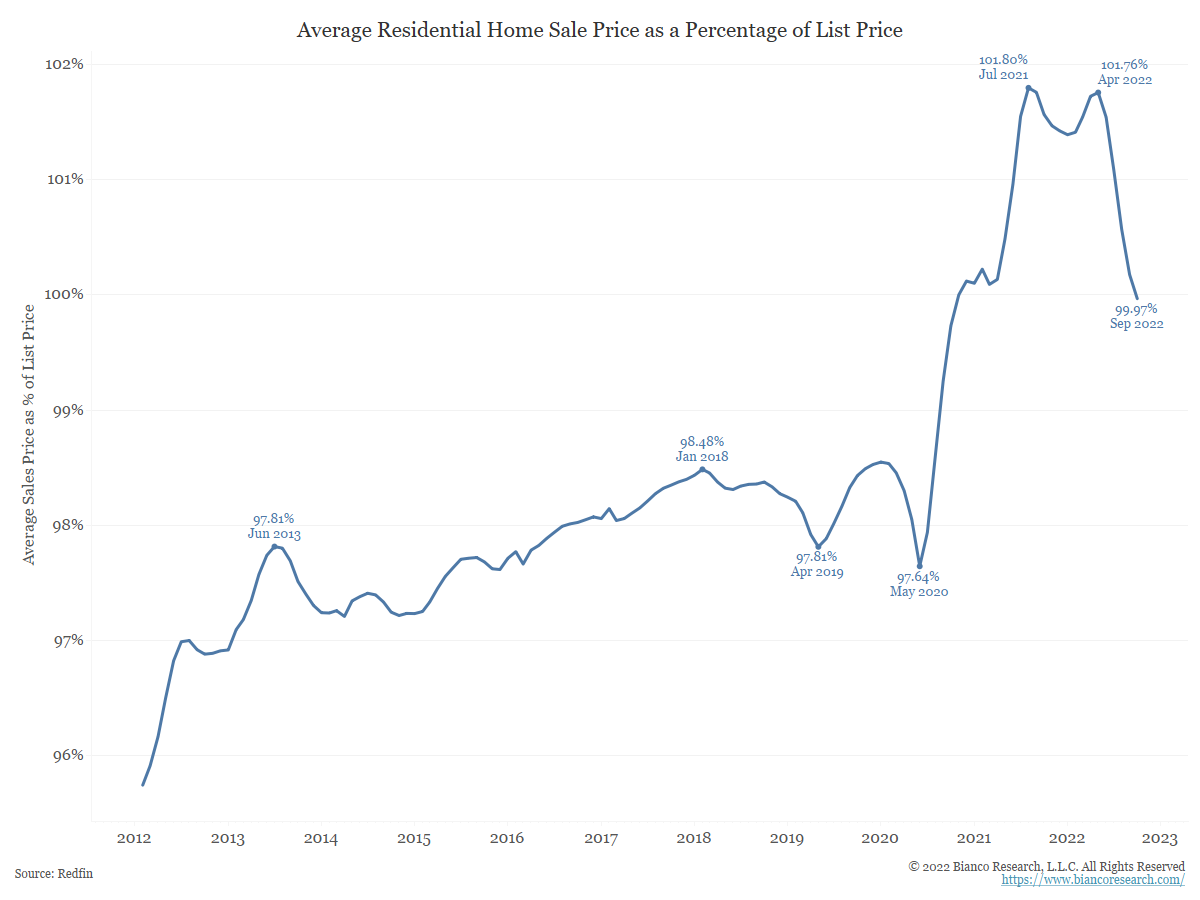

Updating Alternative Measures of Housing

Posted By Greg Blaha

Redfin's alternative measures of the housing market continue to show a deceleration in the crazy conditions of the last year.... Read More