Tag Archives: Markets

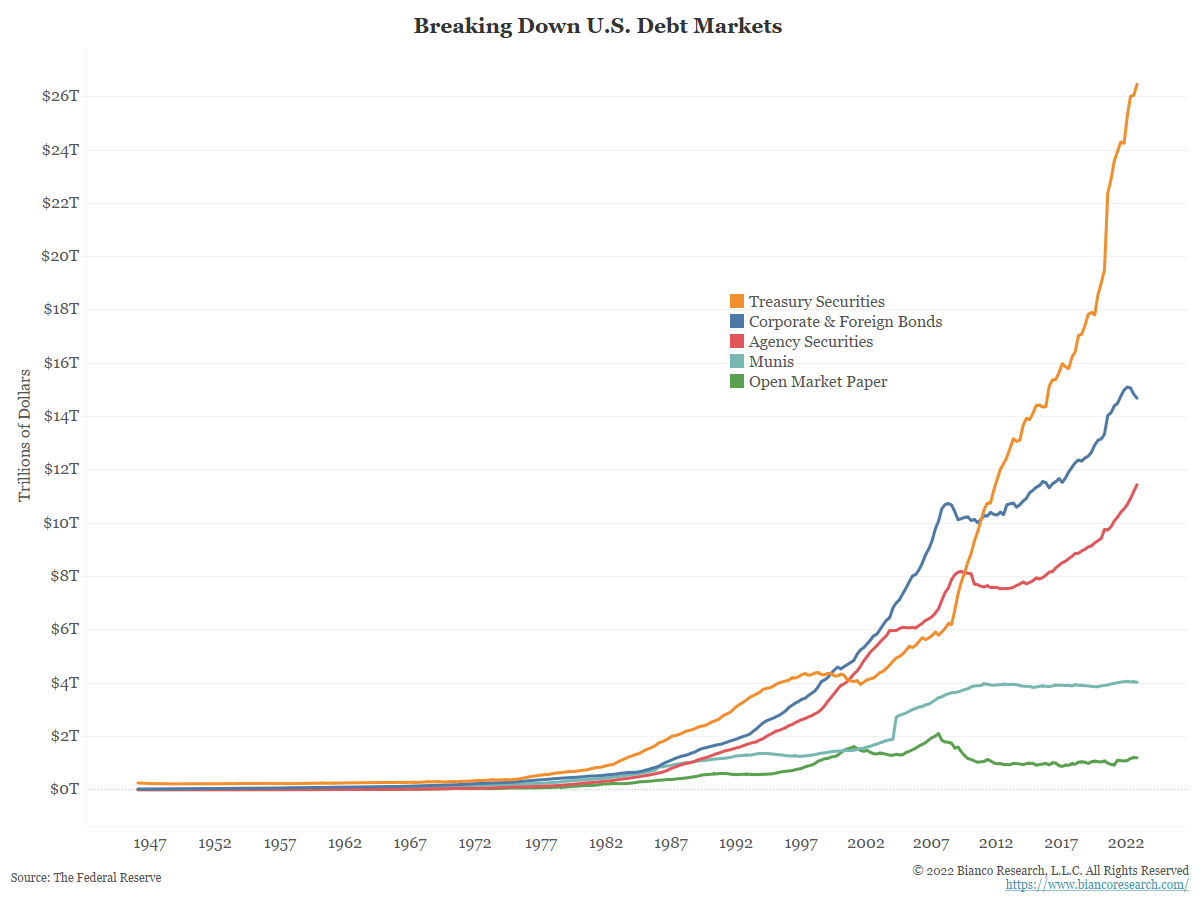

Breaking Down Debt in the U.S.

A look at outstanding amounts of Treasuries, corporates, agencies, munis and open market paper... Read More

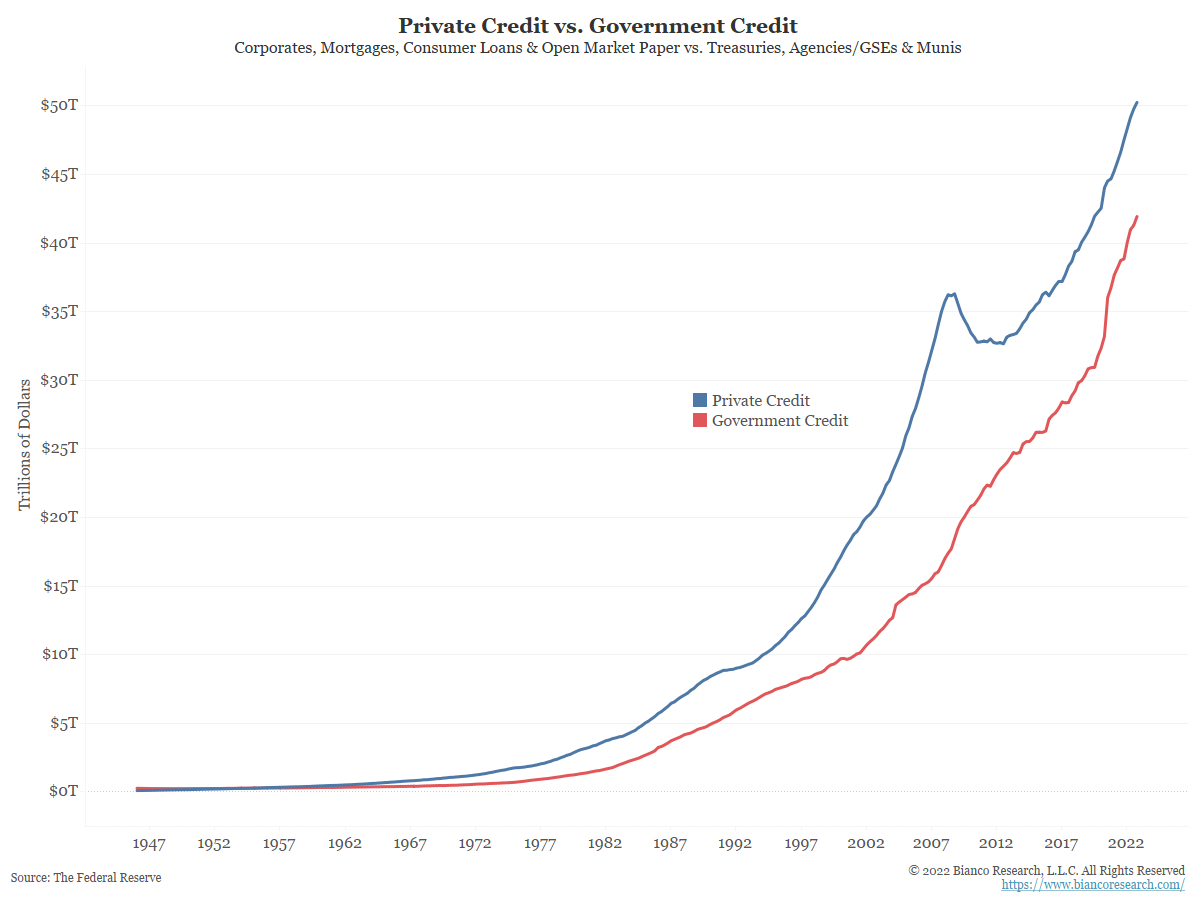

Comparing the Value of Credit in the U.S. to GDP

The amount of outstanding private credit in the U.S. experienced a brief decline during the financial crisis, but government debt grew throughout the entire period. Both are now at new highs.... Read More

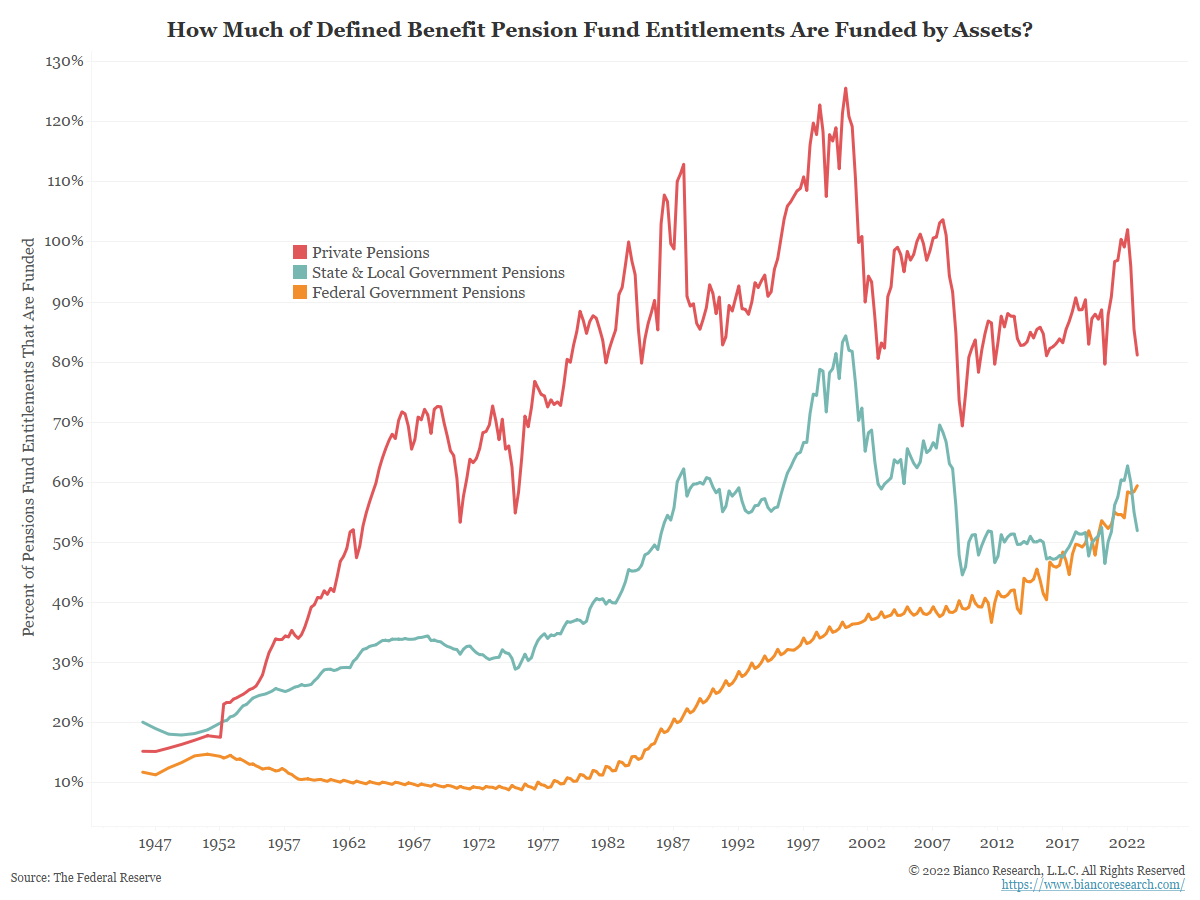

Funding Gaps at Public and Private Pensions

Private pension funds have much smaller funding gaps than their government counterparts.... Read More

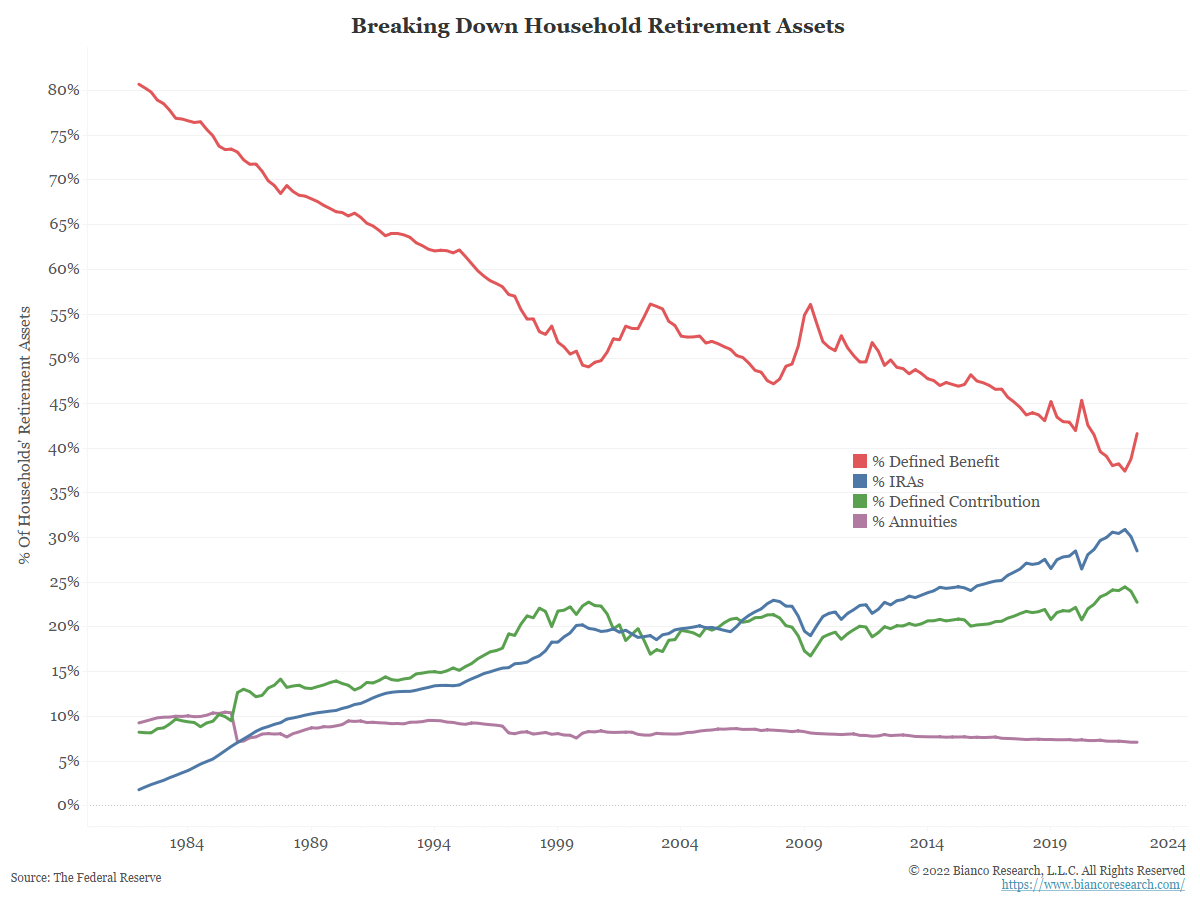

Defined Benefit Plans vs. IRAs

Defined benefit plans continue to be replaced by IRAs and defined contribution plans.... Read More

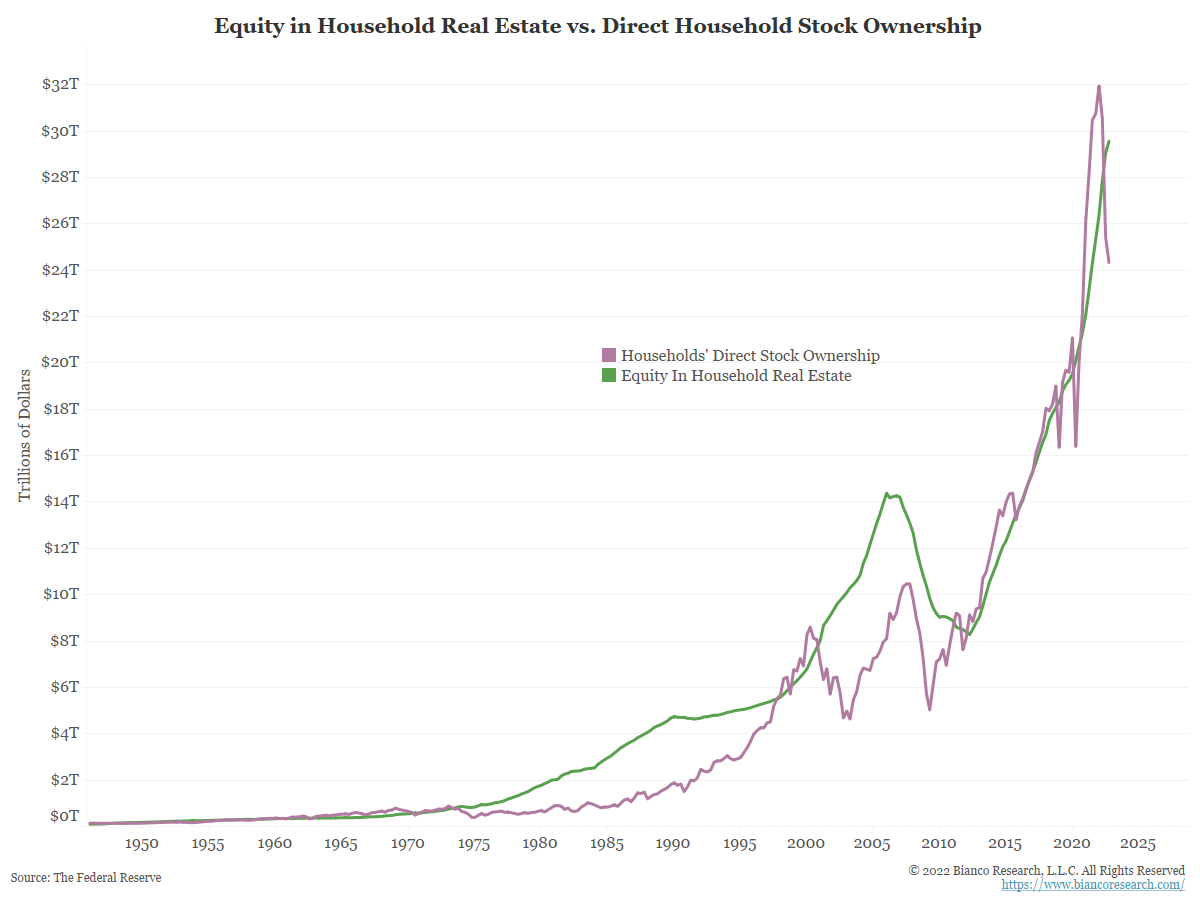

Comparing Real Estate to GDP and Stock Ownership

Over the past couple quarters, households' real estate equity actually surpassed stock ownership.... Read More

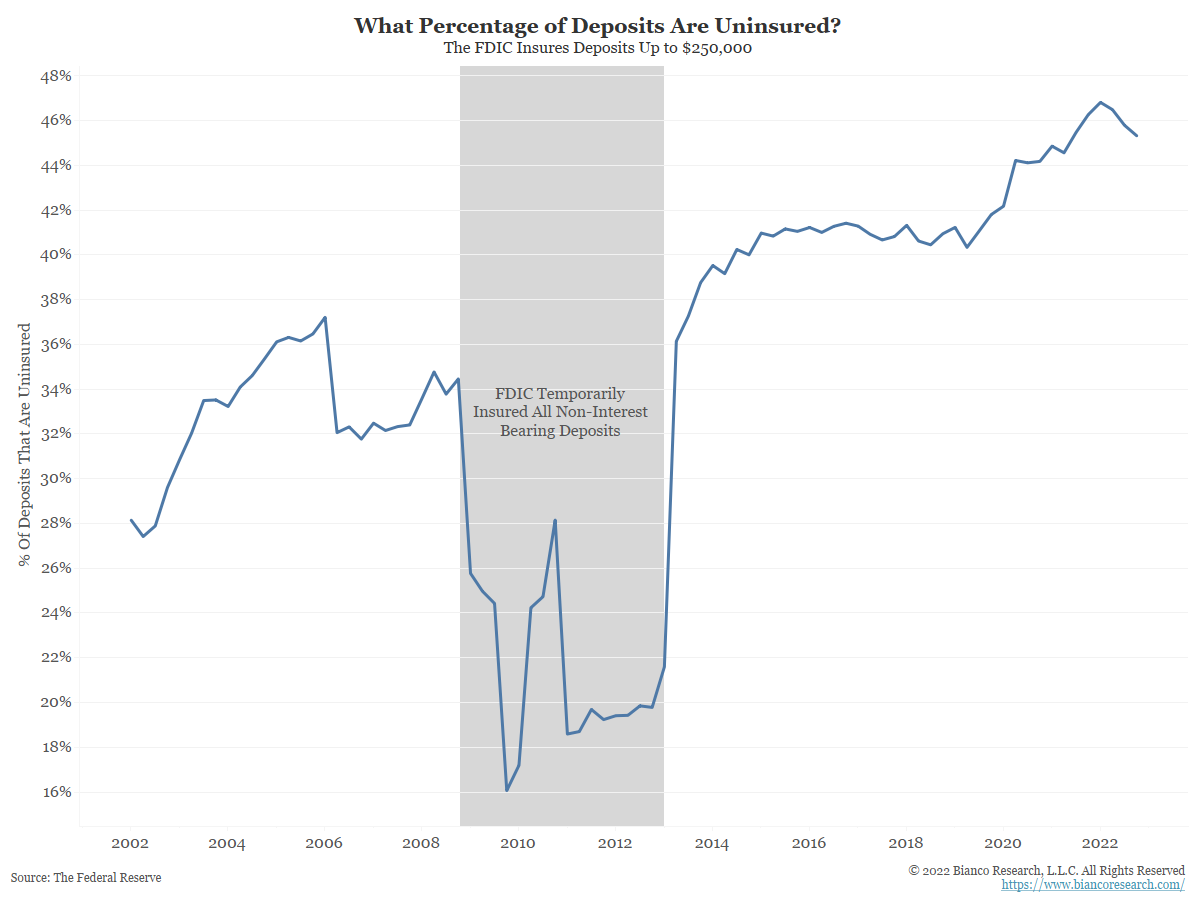

Over 45% of FDIC Deposits Are Uninsured

Over 45% of FDIC deposits in the U.S. are uninsured.... Read More

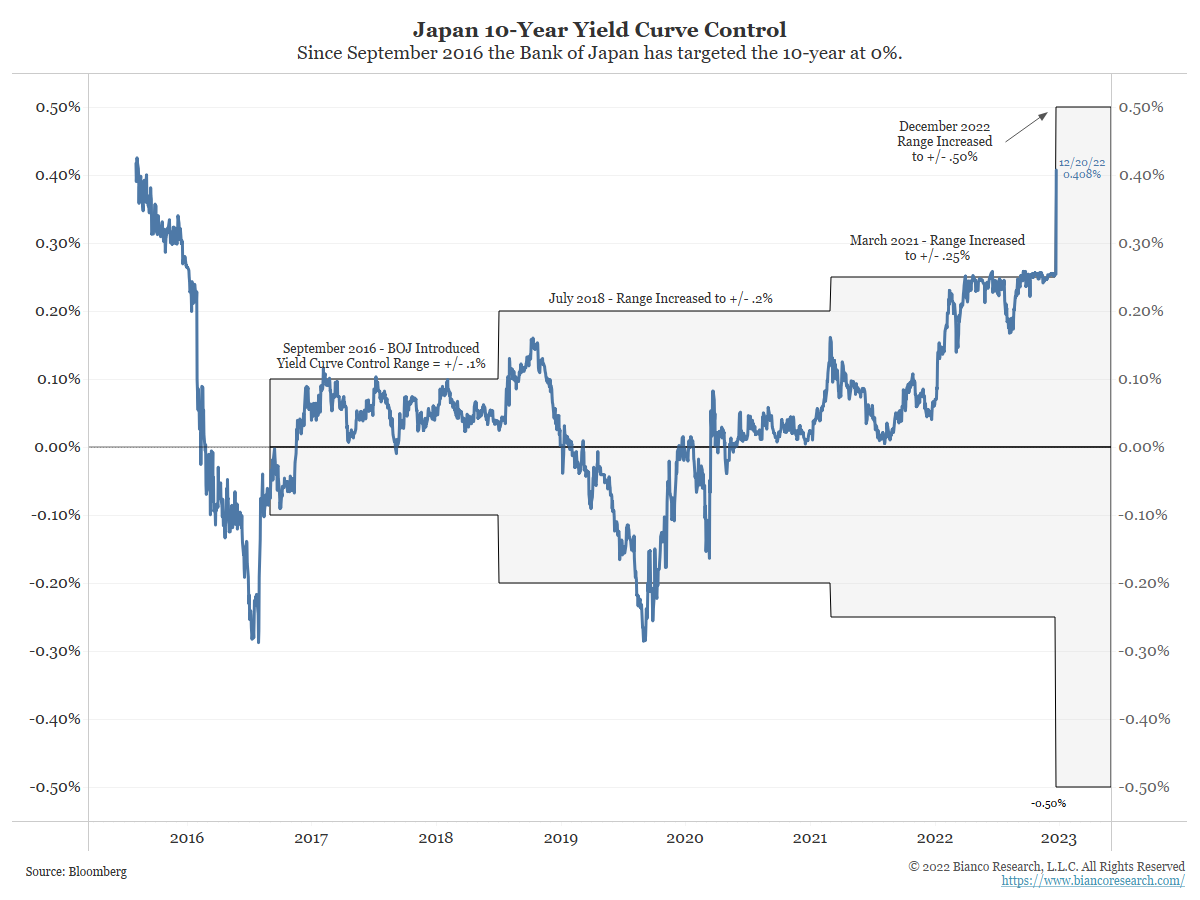

Did the Bank of Japan Succumb to Inflation?

Posted By Jim Bianco

The Bank of Japan raised the cap on 10-year JGB yields in what they called a technical adjustment due to financial stability issues. The real reason this move was necessary is that inflation is running way ahead of their target and forcing yields higher.... Read More

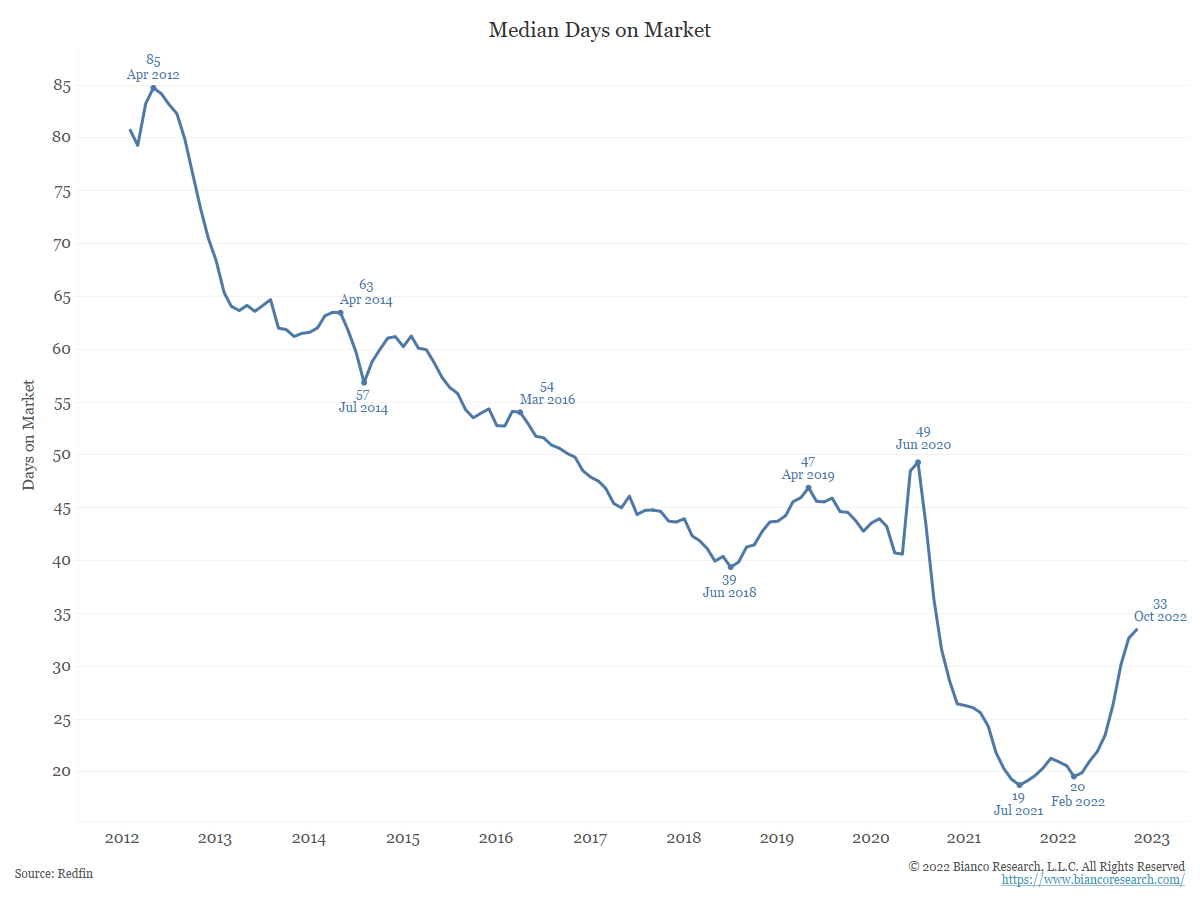

Alternative Measures of Housing

Posted By Greg Blaha

Redfin's alternative measures of the housing market continue to show a slowdown in the crazy conditions of the last year.... Read More

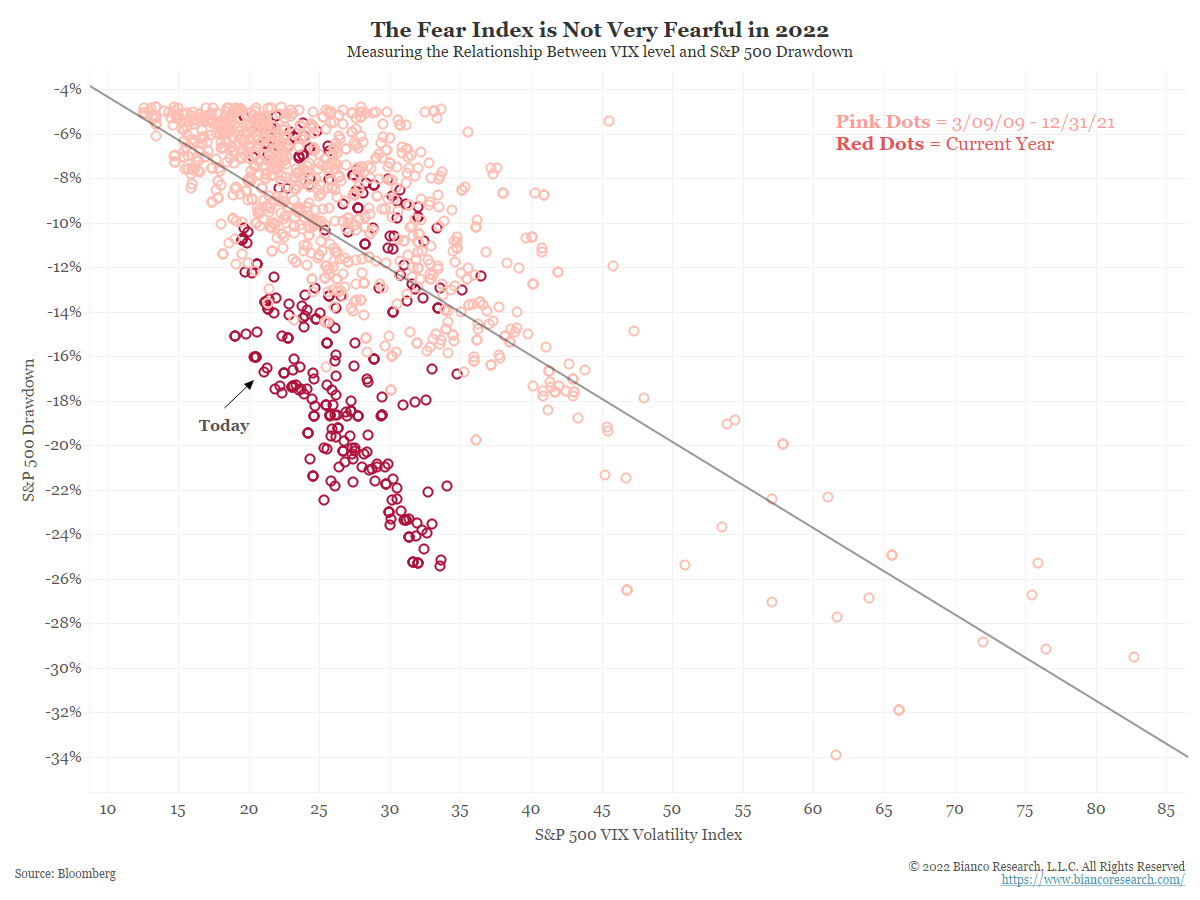

Are Short-Expiration Options Driving Intraday Volatility?

Posted By Alex Malitas

The past two years have produced wild swings across financial markets. While the S&P 500 often sees intraday moves greater than 2%, the VIX remains near a historically low level of around 20. Near-expiration options help explain this contradiction.... Read More

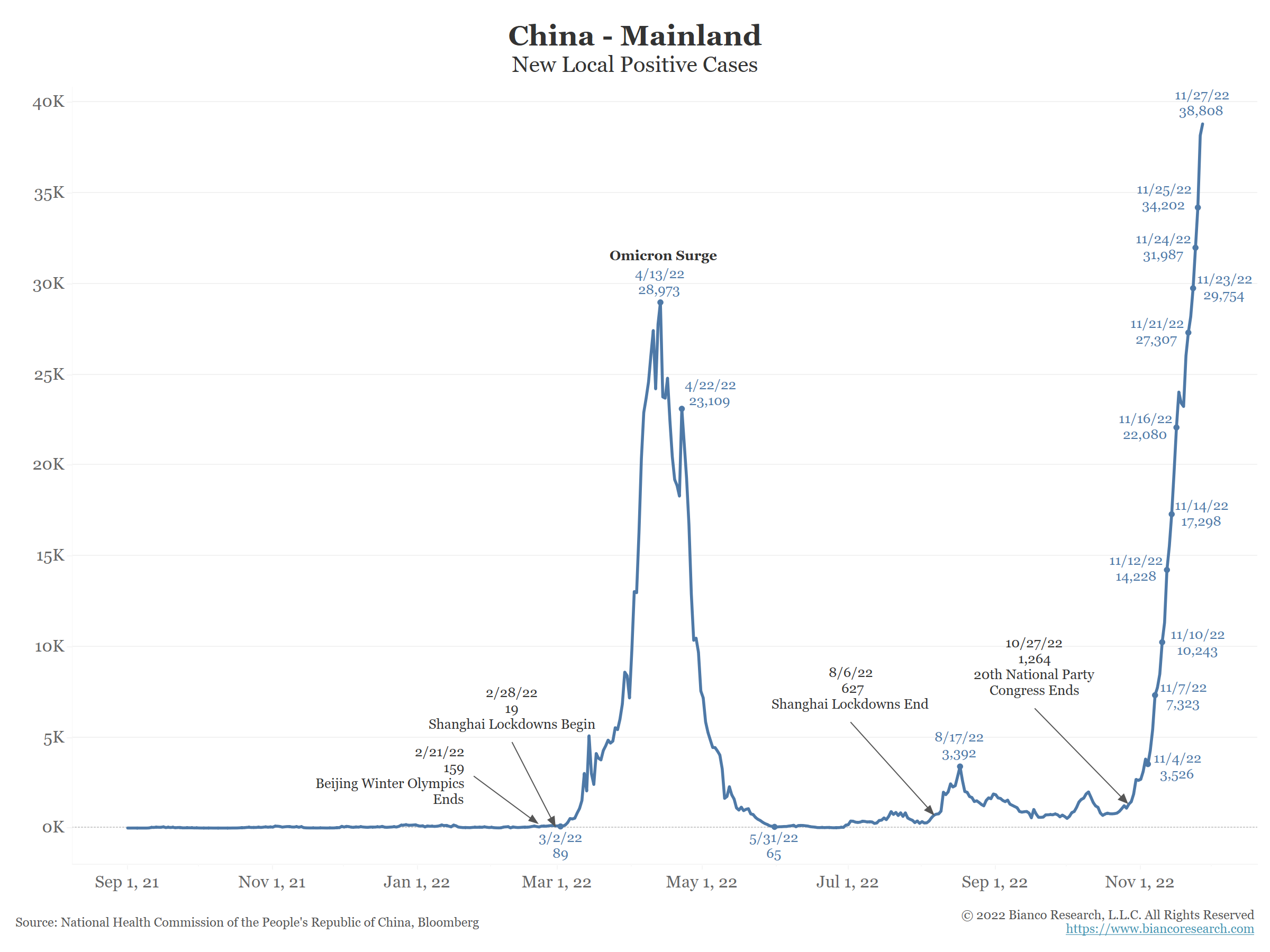

Chinese Lockdowns Impact Everyone

Posted By Jim Bianco

China Is the factory for the world, so its zero-COVID policy and subsequent protests will impact everyone.... Read More

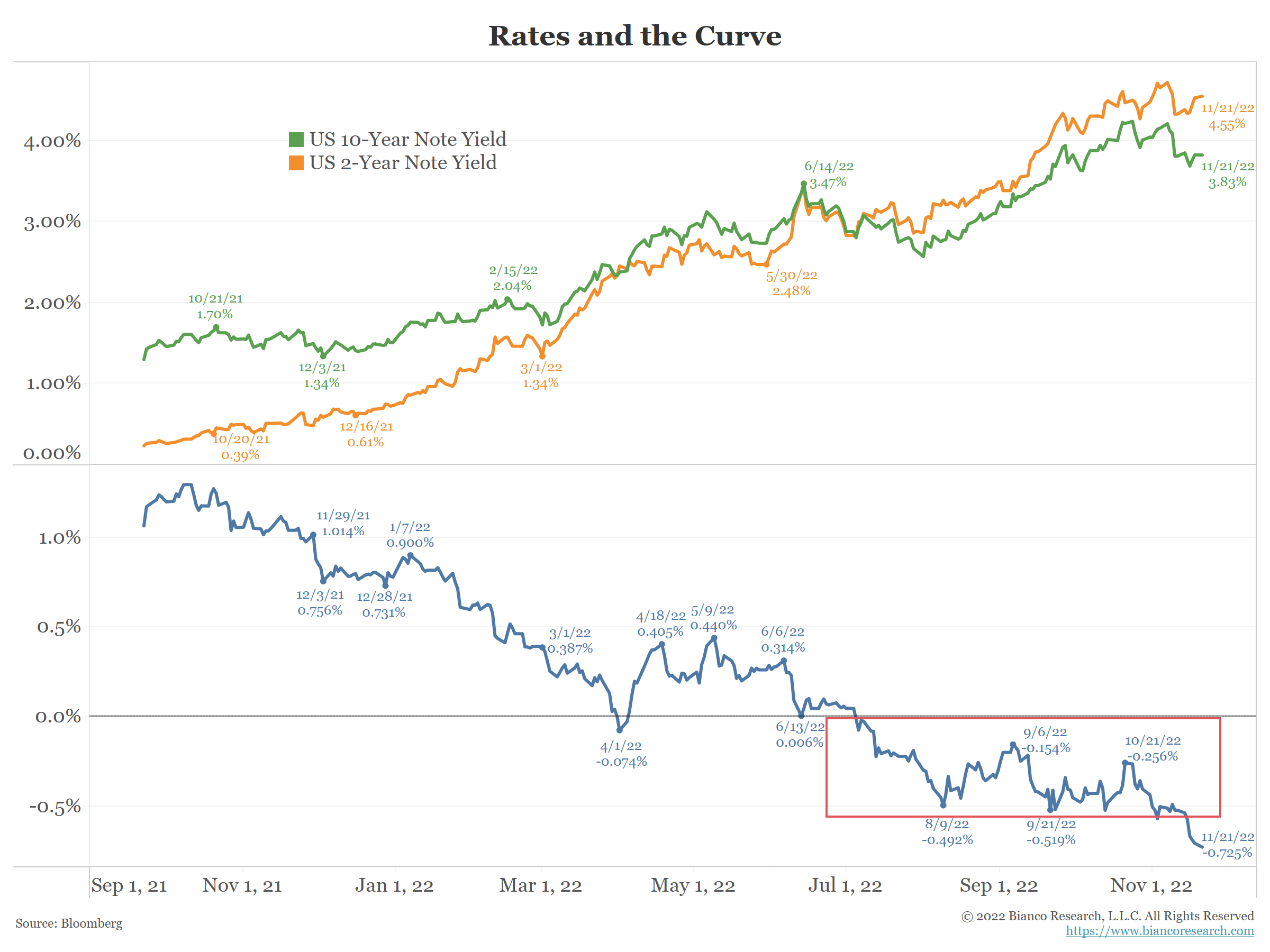

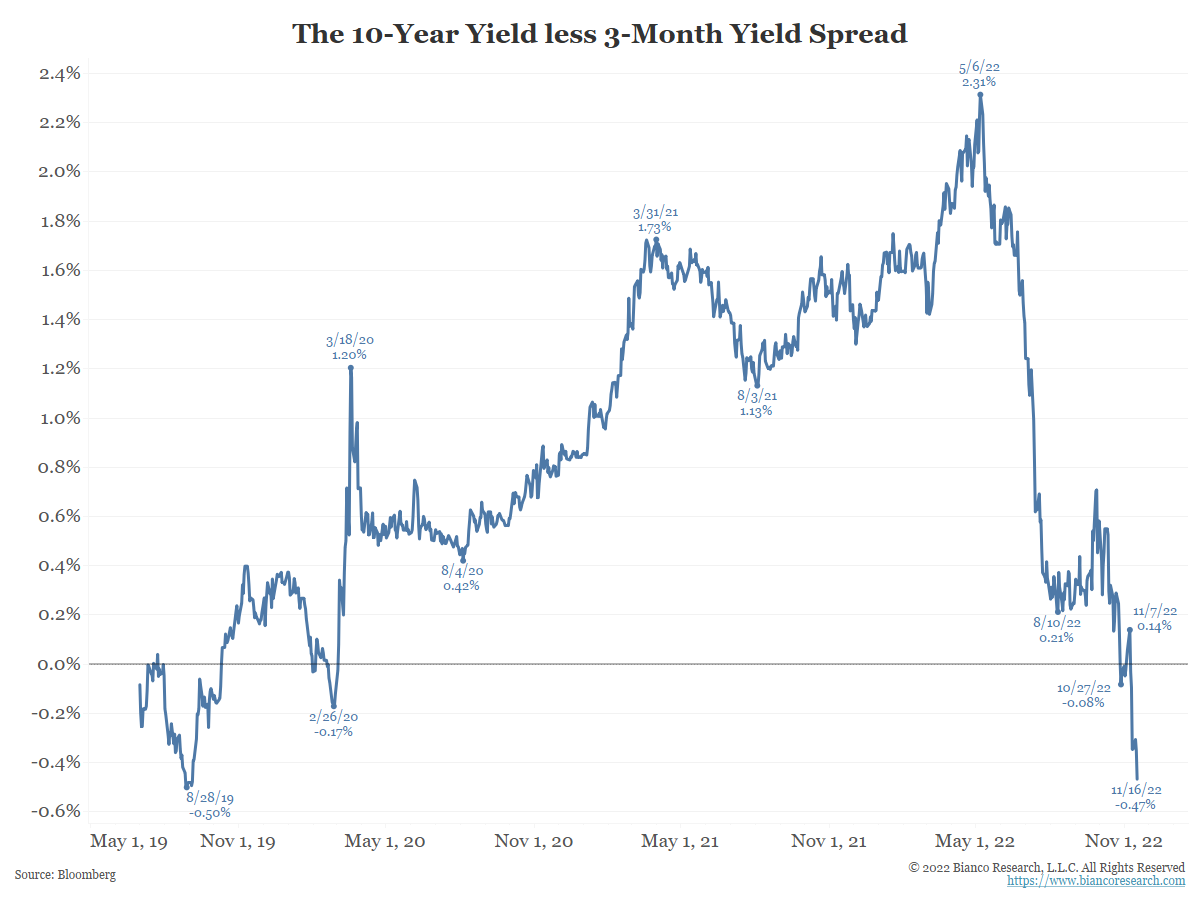

The Yield Curve Officially Flashes a Recession Signal

Posted By Jim Bianco

Today marks the 10th consecutive day that the 10-year less 3-month yield curve has been inverted. When inverted for this long, the yield curve has an eight-for-eight track record over the last 50+ years in predicting recession. On average, recessions typically start 10 months later.... Read More

Valuations in a Bear Market Rally

Posted By Alex Malitas

The S&P 500 bounced strongly off the latest CPI data that indicated inflation may be peaking. If October 10th was the bear market low, how do valuations now compare to previous bear market bottoms?... Read More

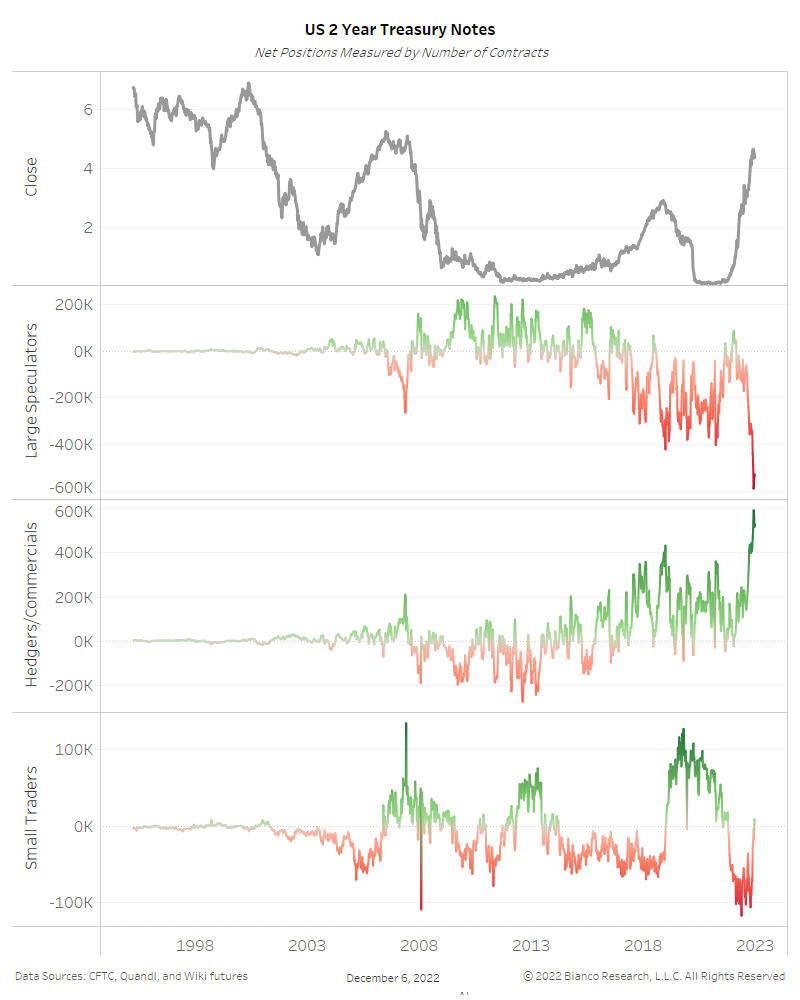

The Yield Curve Goes Extreme

Posted By Jim Bianco

Extremely inverted yield curves signal the Fed is too tight. But they have only reached this point in the last few weeks. It typically takes several months of this condition for a slowdown/recession or policy pivot to materialize.... Read More