Tag Archives: Markets

2023 Market Outperformance

Posted By Alex Malitas

2022 returns left investors shielding their eyes from their portfolios. 2023 has been a different story as eye popping equity market returns drive the narrative.... Read More

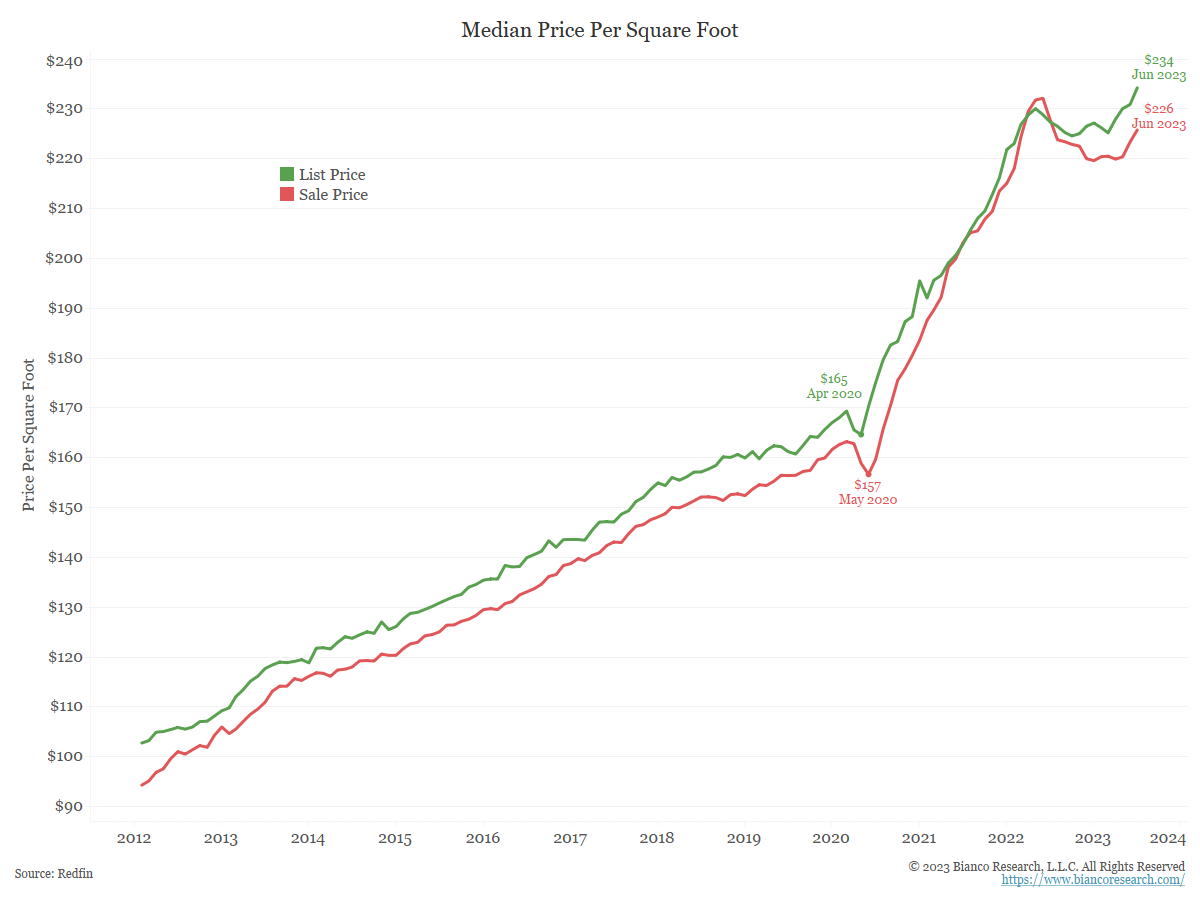

Alternative Measures of the Housing Market

Posted By Greg Blaha

The median price of a house is the most basic measure of the housing market. The median sale price per square foot (red) was $226 in June, down from its May 2022 peak of $232.... Read More

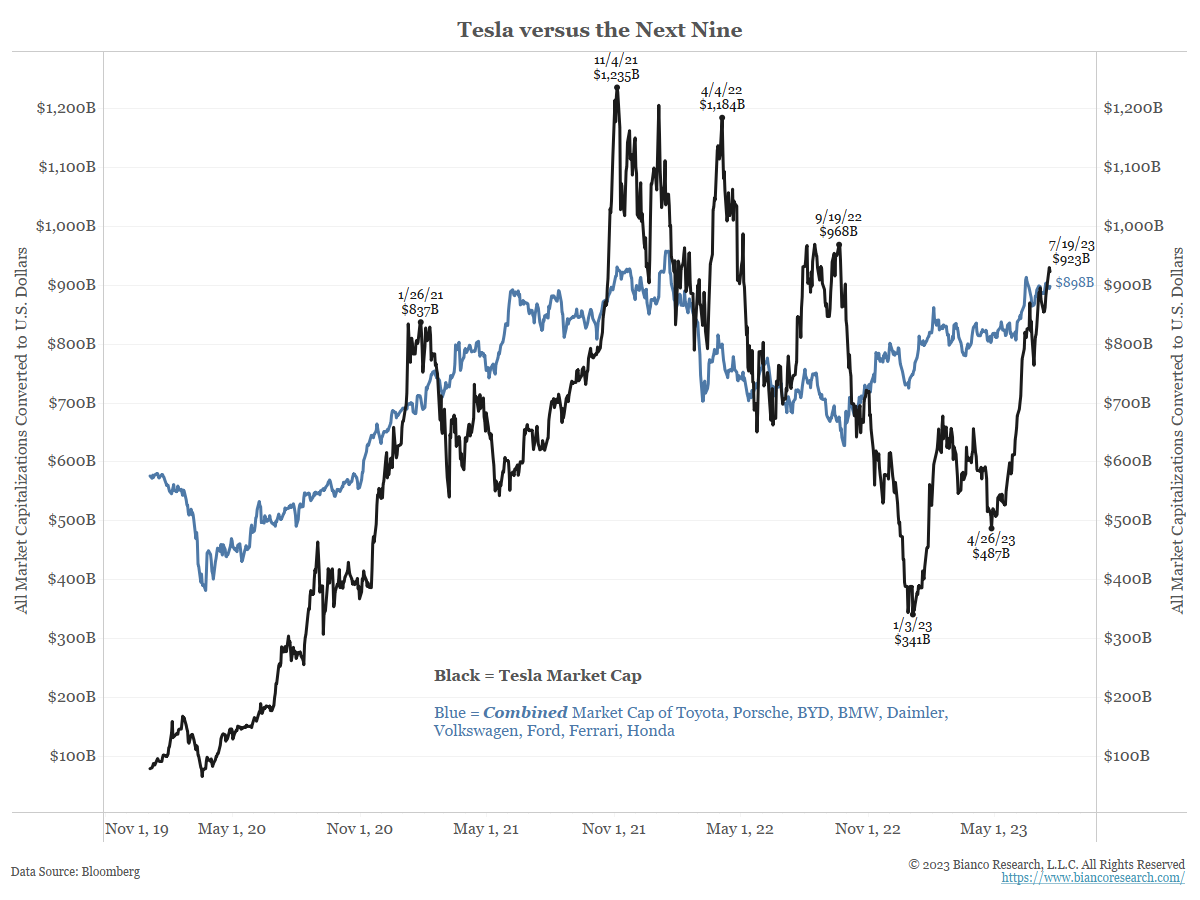

Updating the Market Cap of the Automakers

Posted By Jim Bianco

How big is Tesla versus other automakers?... Read More

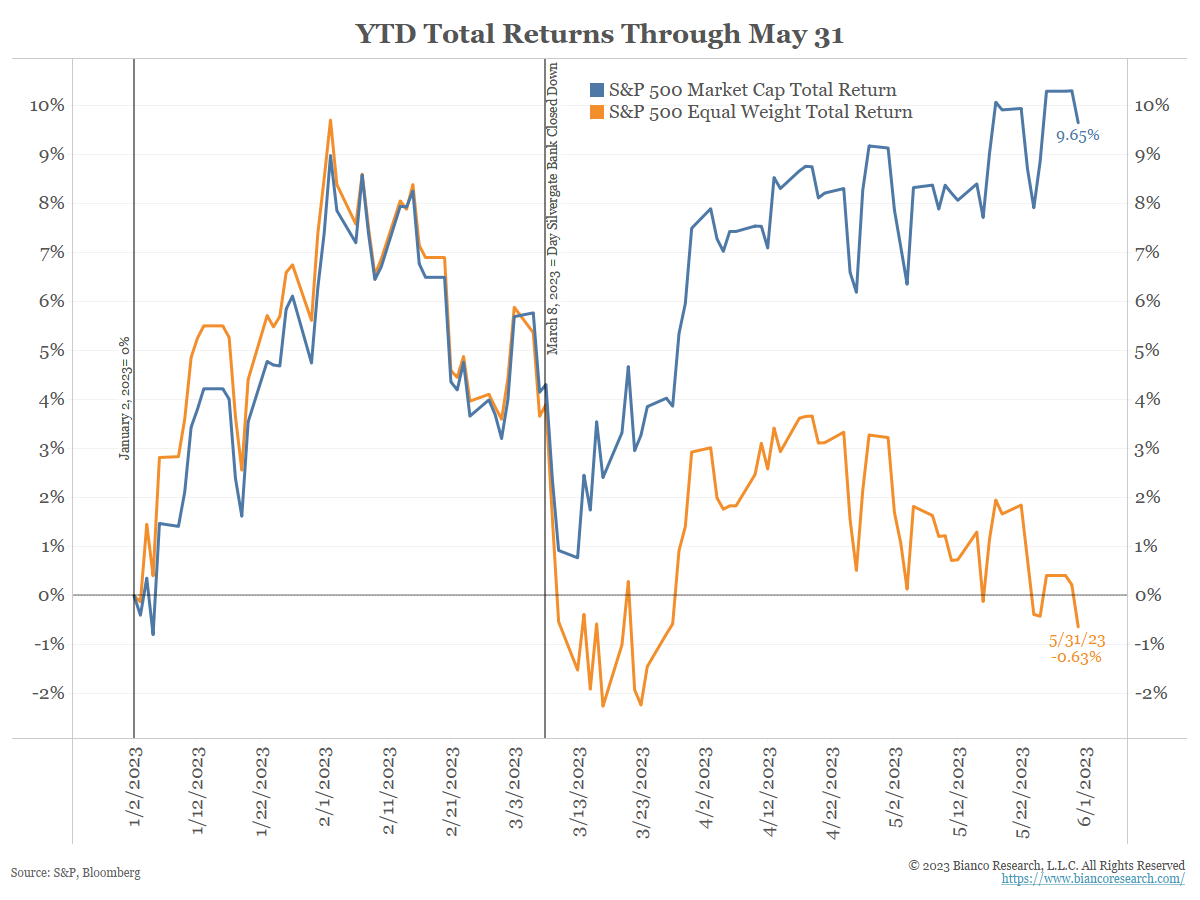

What Does The Stock Market See?

Posted By Jim Bianco

Since the beginning of June, the stock market's rally has been broadening beyond Big Tech/AI. The narrative is the debt ceiling deal prevented a liquidity crisis, and inflation has finally been tamed. Yet, no other markets are confirming this move.... Read More

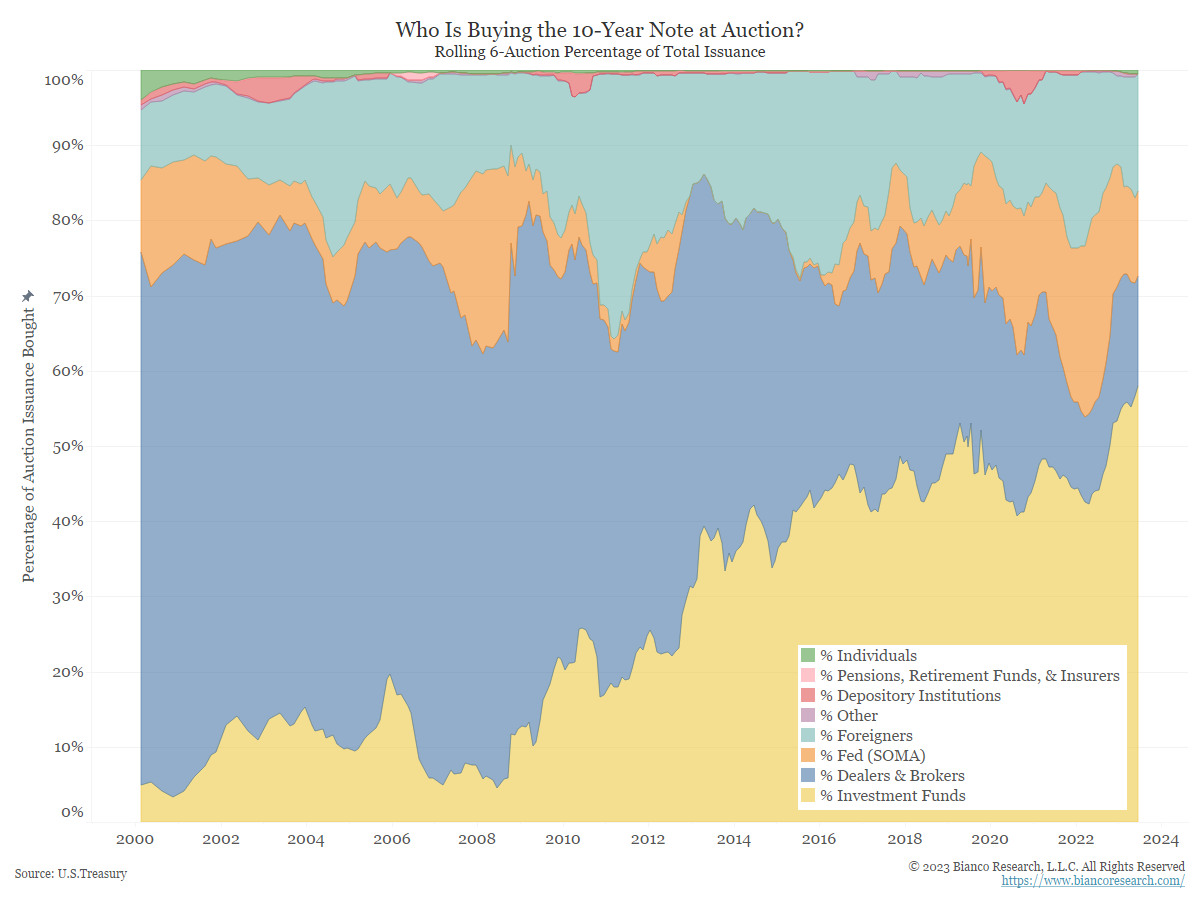

Who is Buying Treasuries at Auction?

In the last three auctions, dealers bought just 16% of the 10-year notes offered, on average. In contrast, investment funds are now taking down more than half of the average auction.... Read More

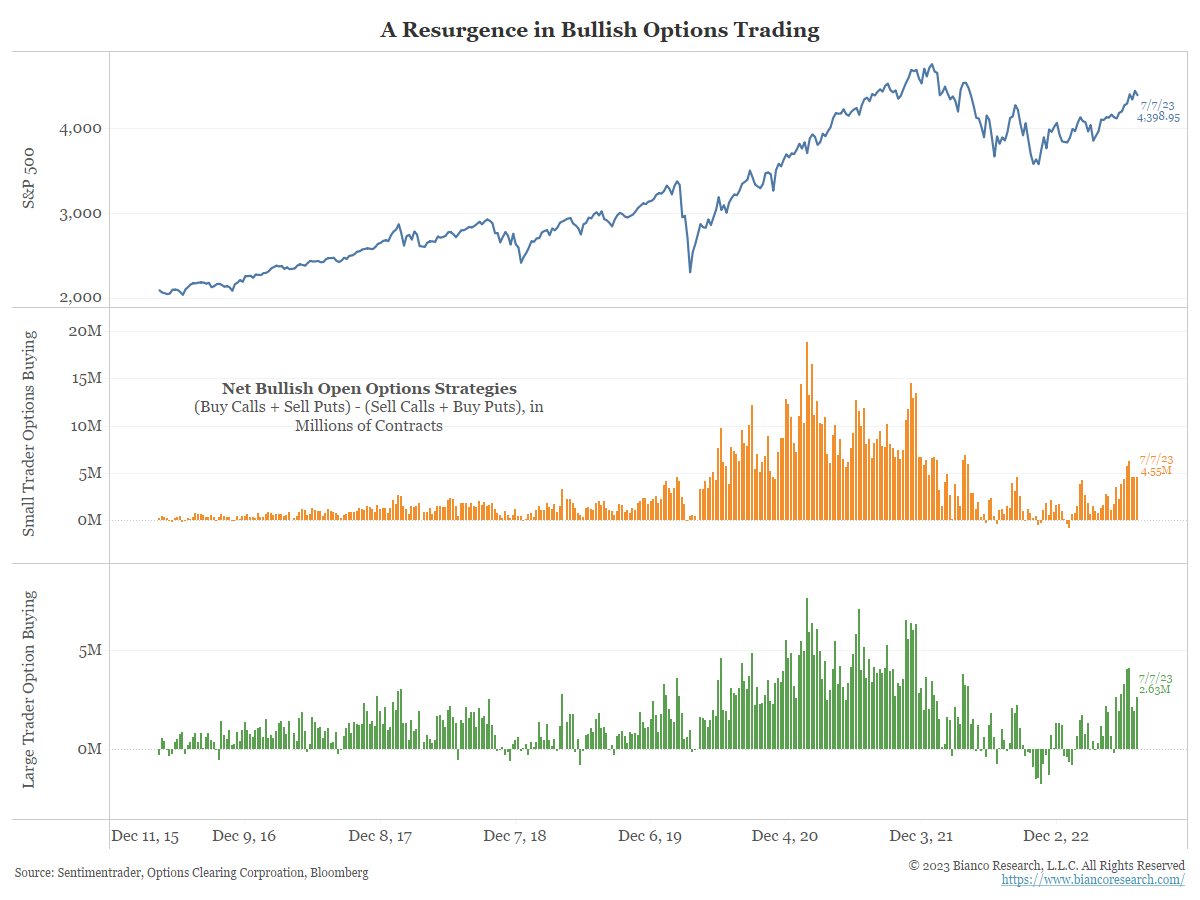

Options Traders Bought Calls in the First Half Rally

Posted By Alex Malitas

As the S&P 500 raced towards a bull market in the first half of 2023 driven by an AI stock boom, bullish options volume began to rise. ... Read More

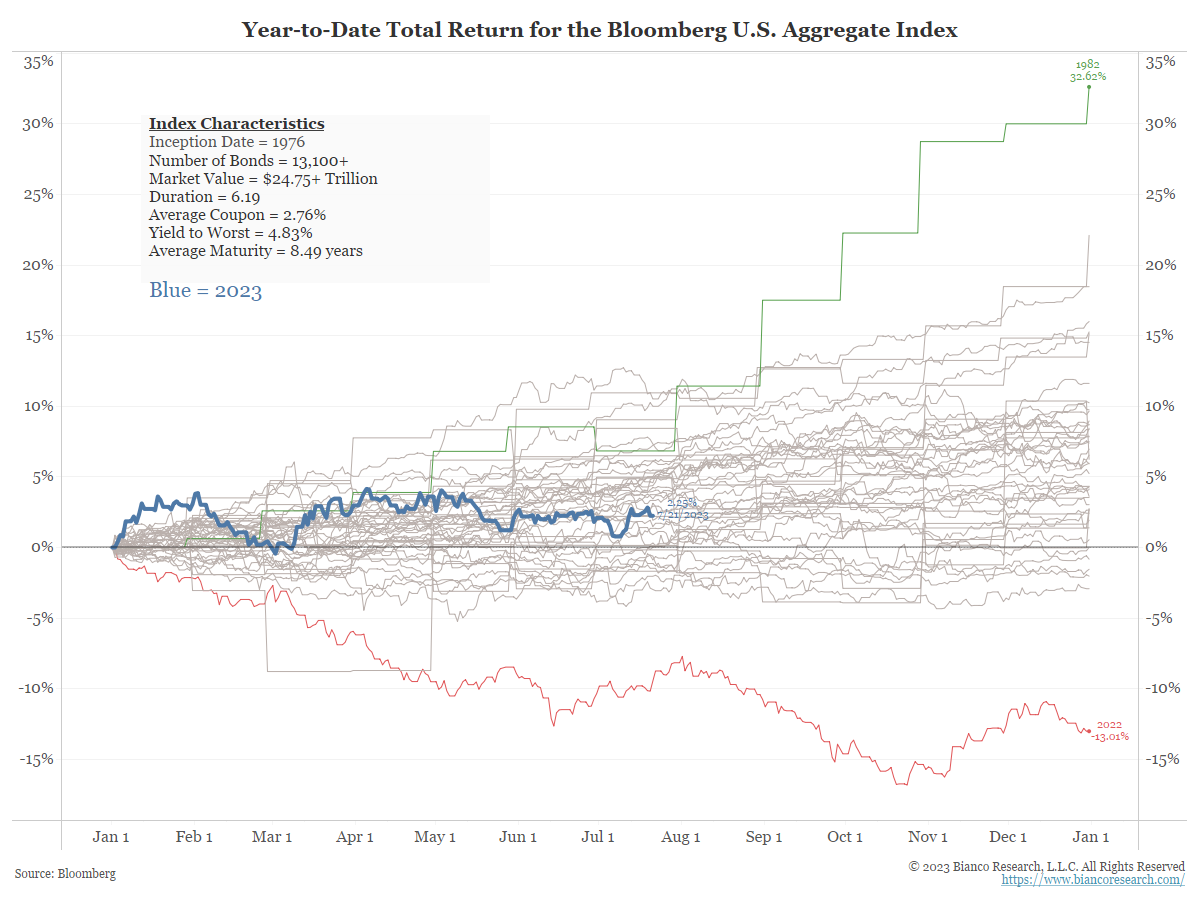

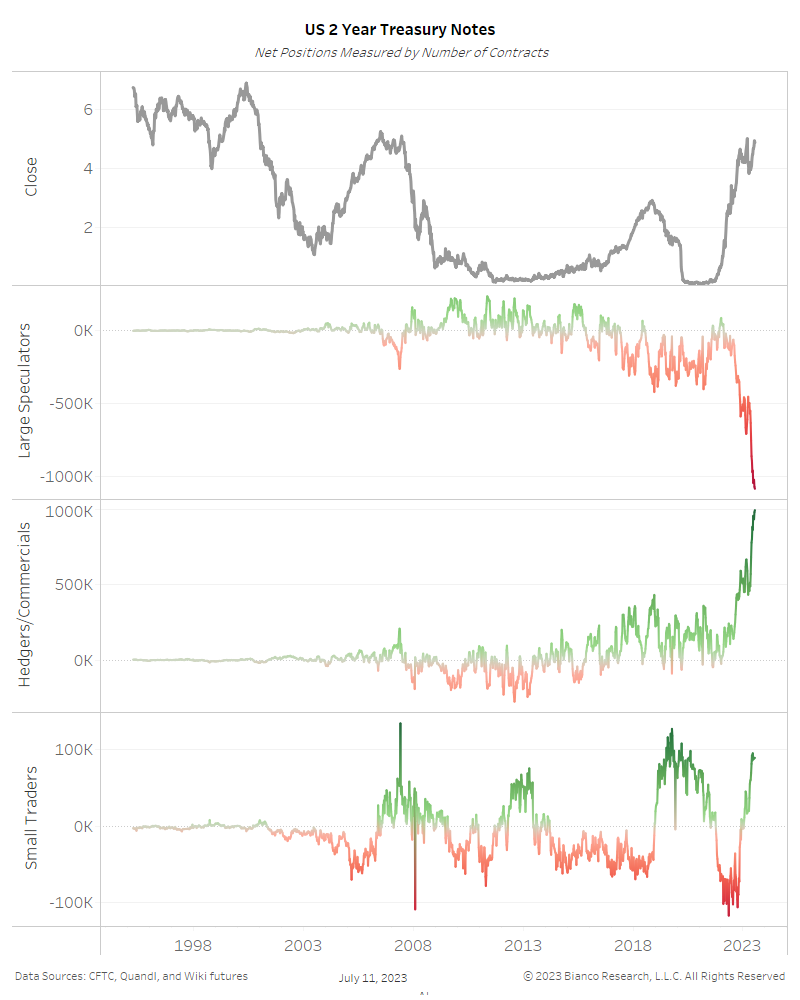

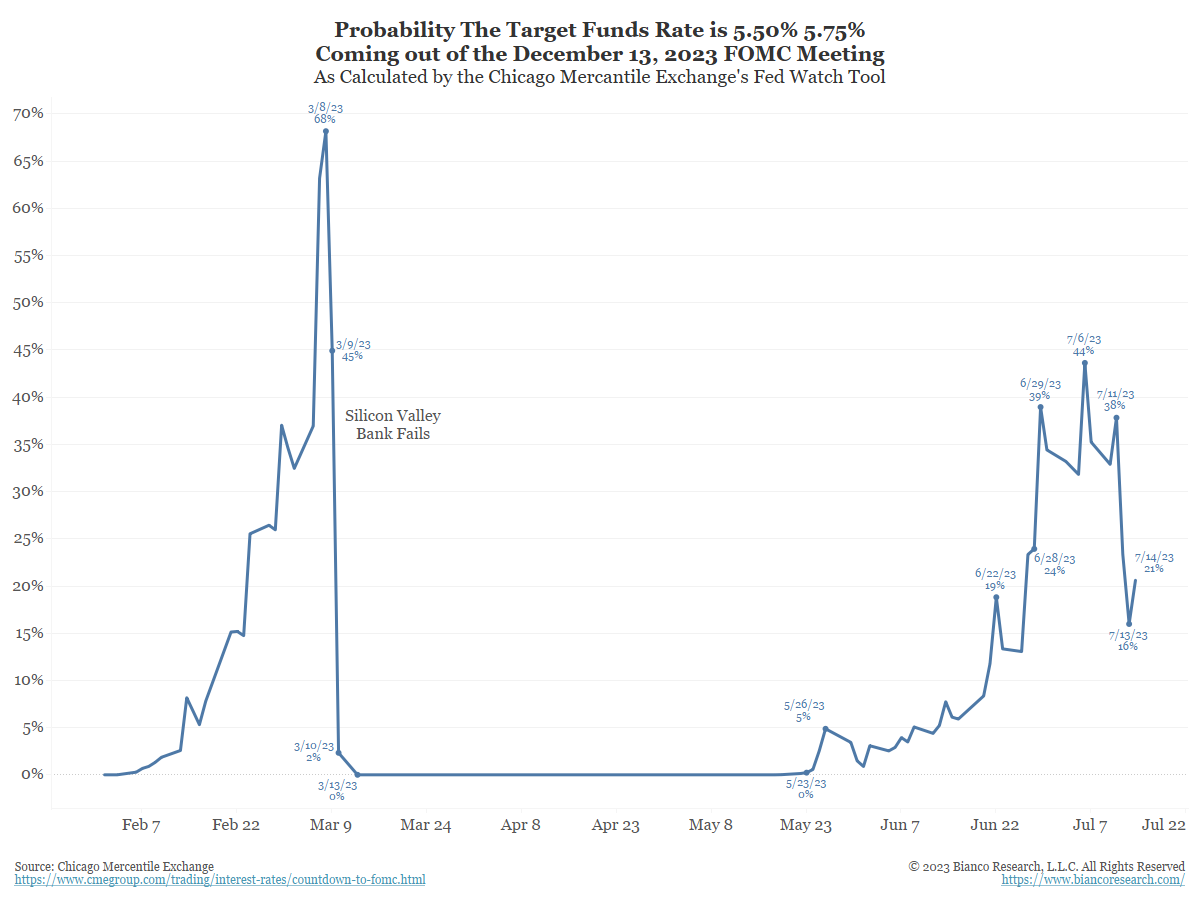

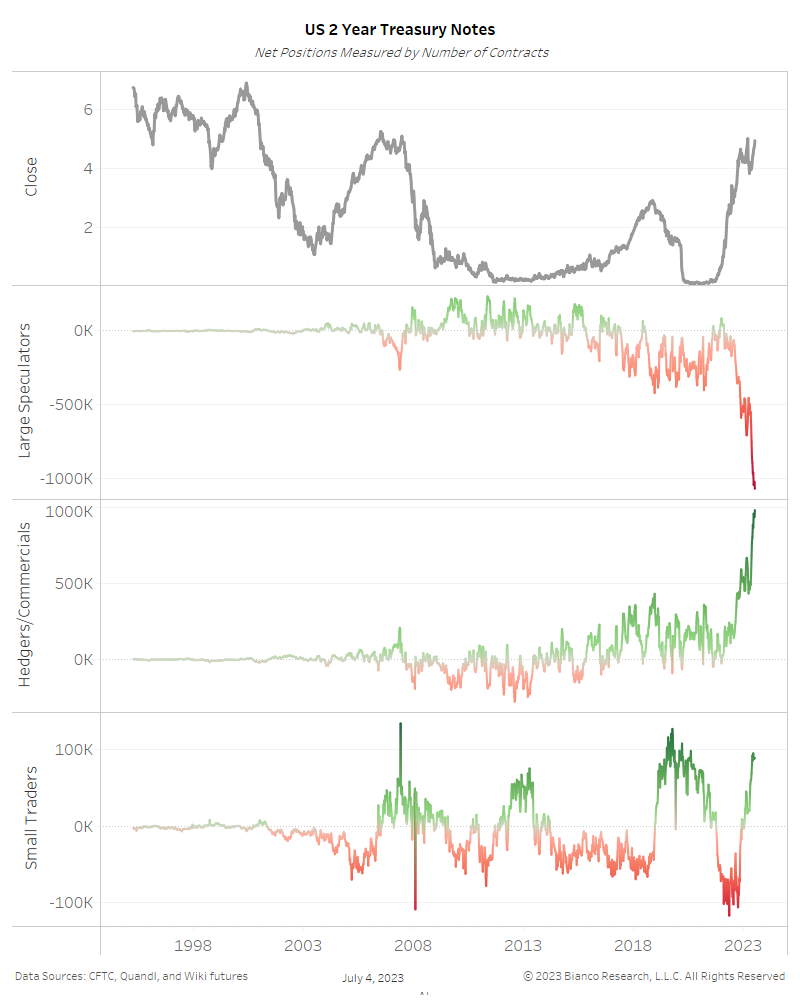

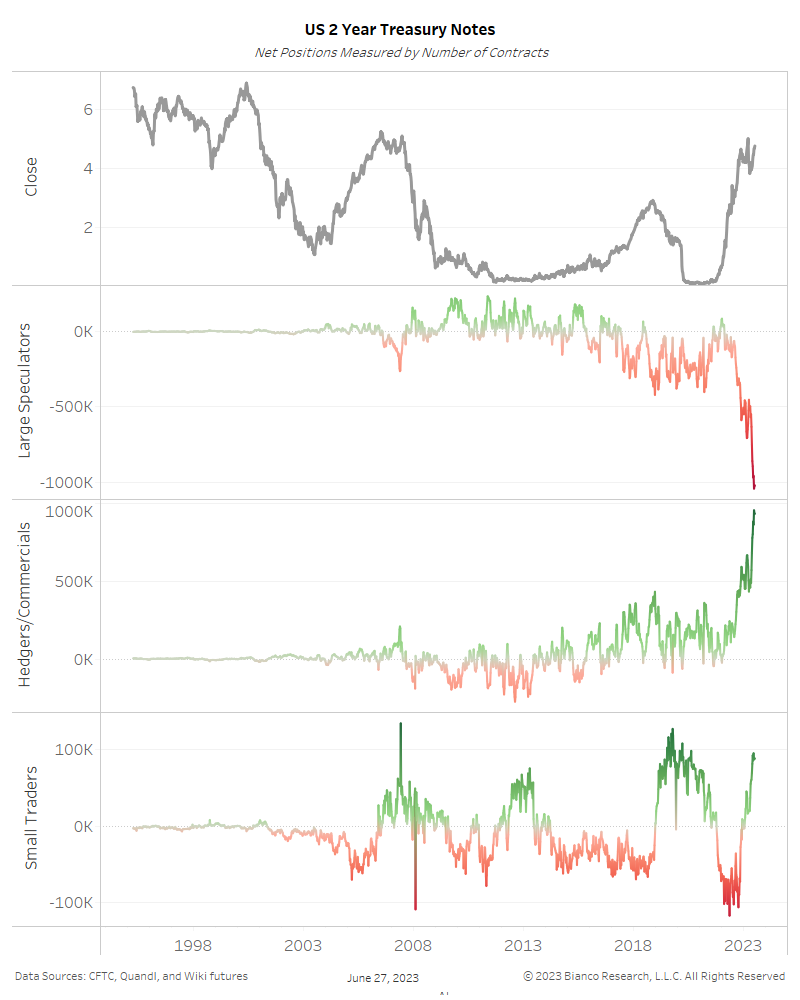

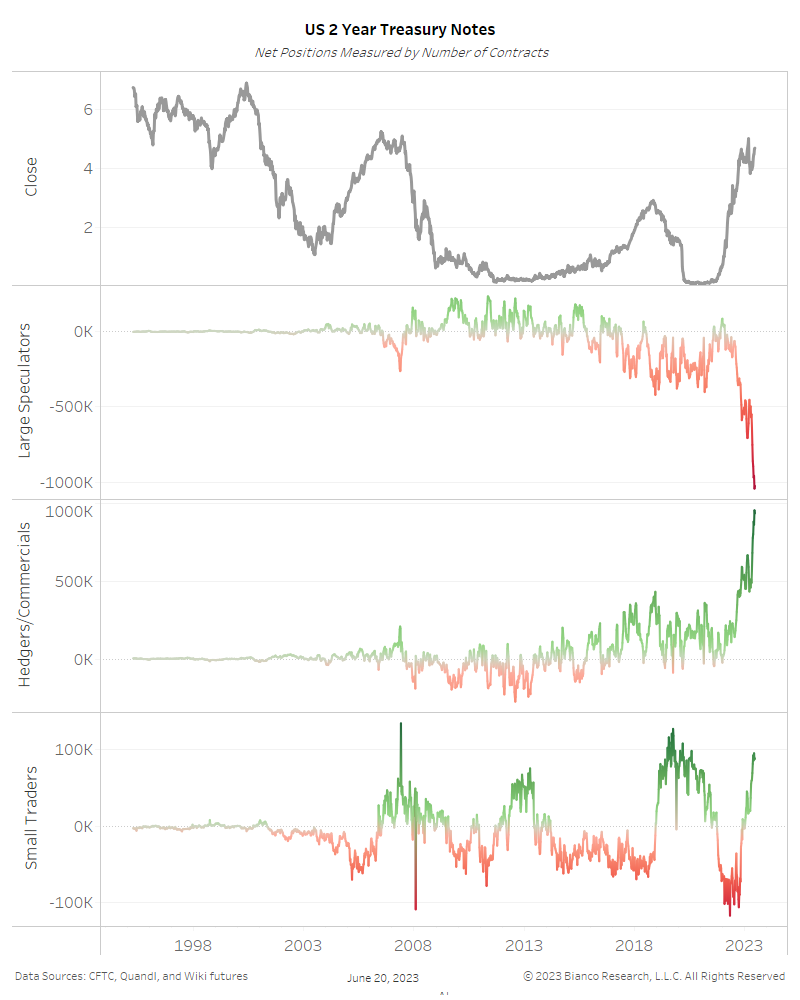

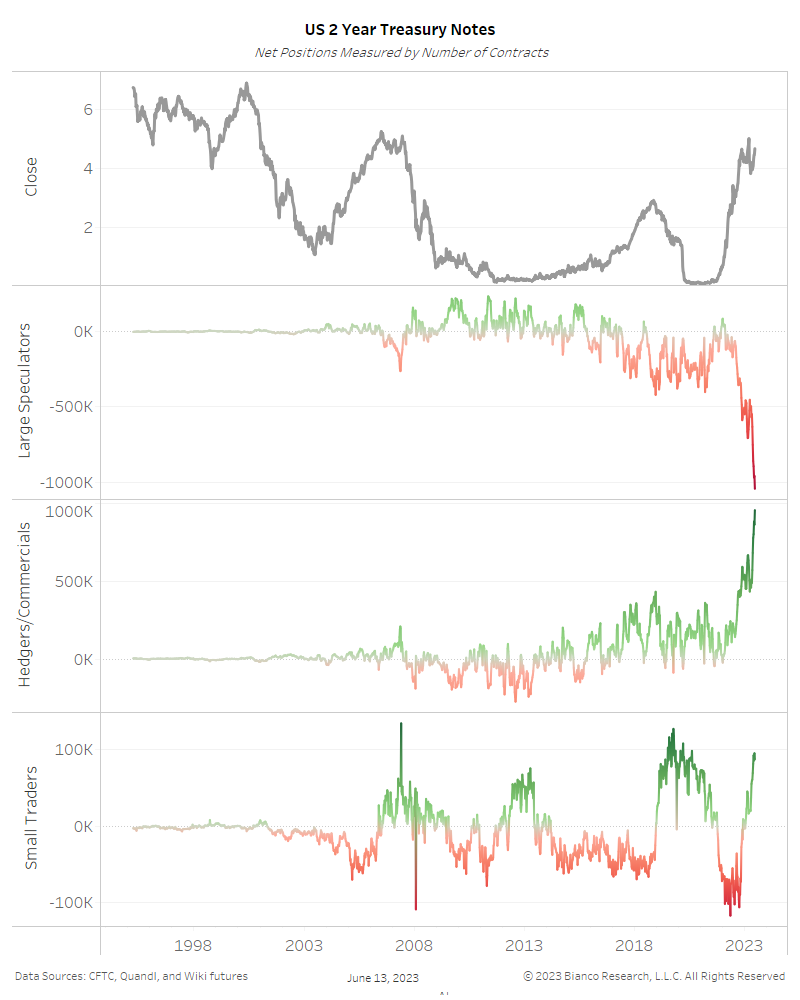

A Bond Rally In The Offing?

Posted By Jim Bianco

Over the last several days, fixed-income markets have been attempting to reverse yields lower. Driving this is a belief that inflation has been vanquished. With crude oil rallying and a base effect pushing year-over-year inflation higher, the Fed might not see it this way.... Read More

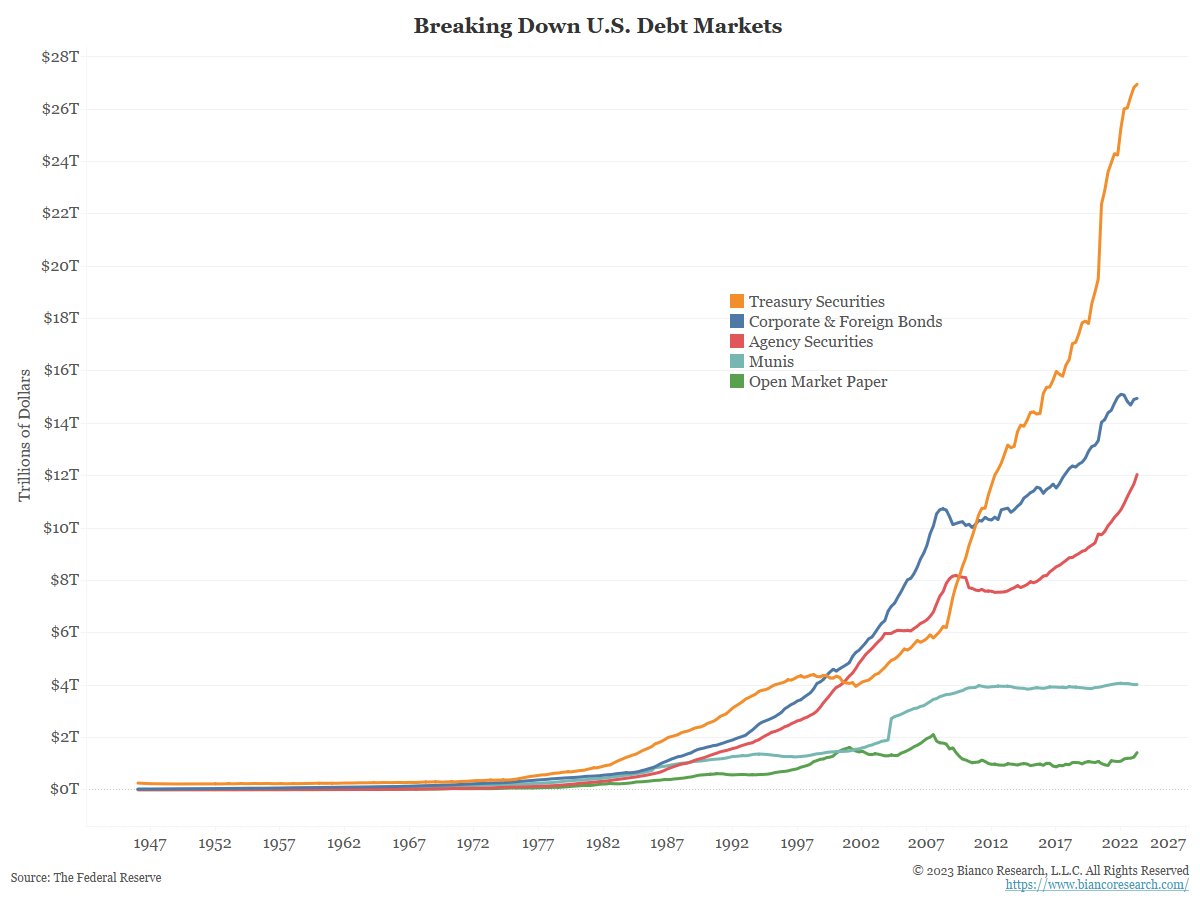

Breaking Down Debt in the U.S.

A look at outstanding amounts of Treasuries, corporates, agencies, munis and open market paper... Read More

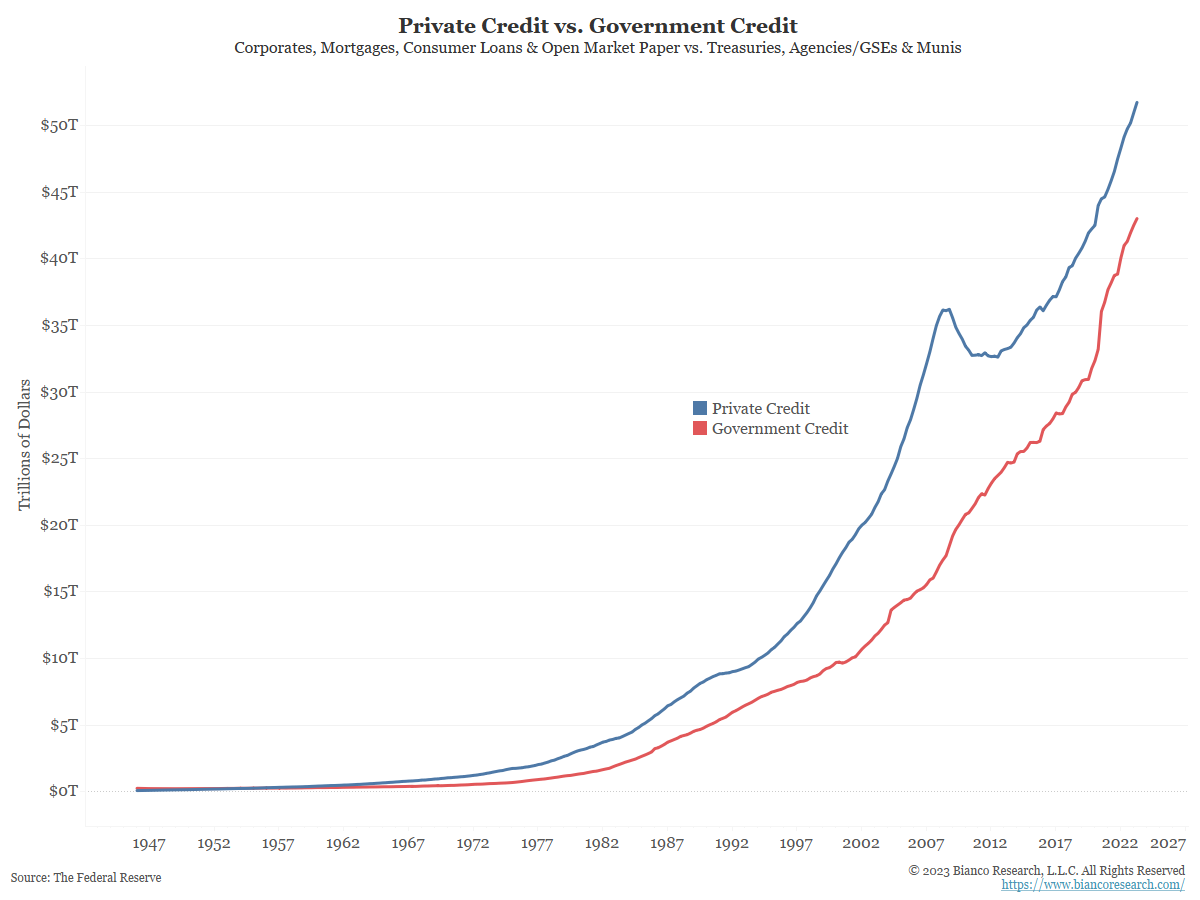

Comparing the Value of Credit in the U.S. to GDP

The amount of outstanding private credit in the U.S. experienced a brief decline during the financial crisis, but government debt grew throughout the entire period. Both are now at new highs.... Read More

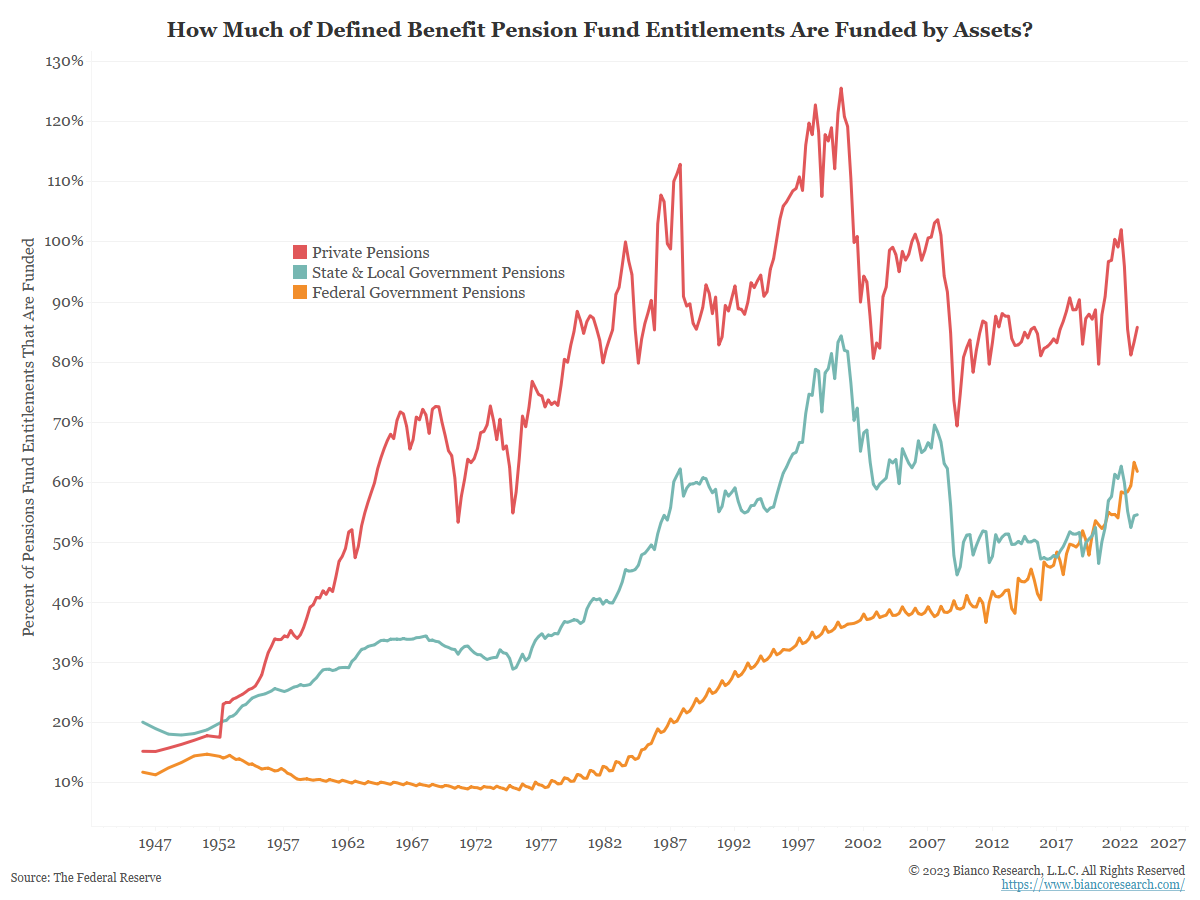

Funding Gaps at Public and Private Pensions

Private pension funds have much smaller funding gaps than their government counterparts.... Read More

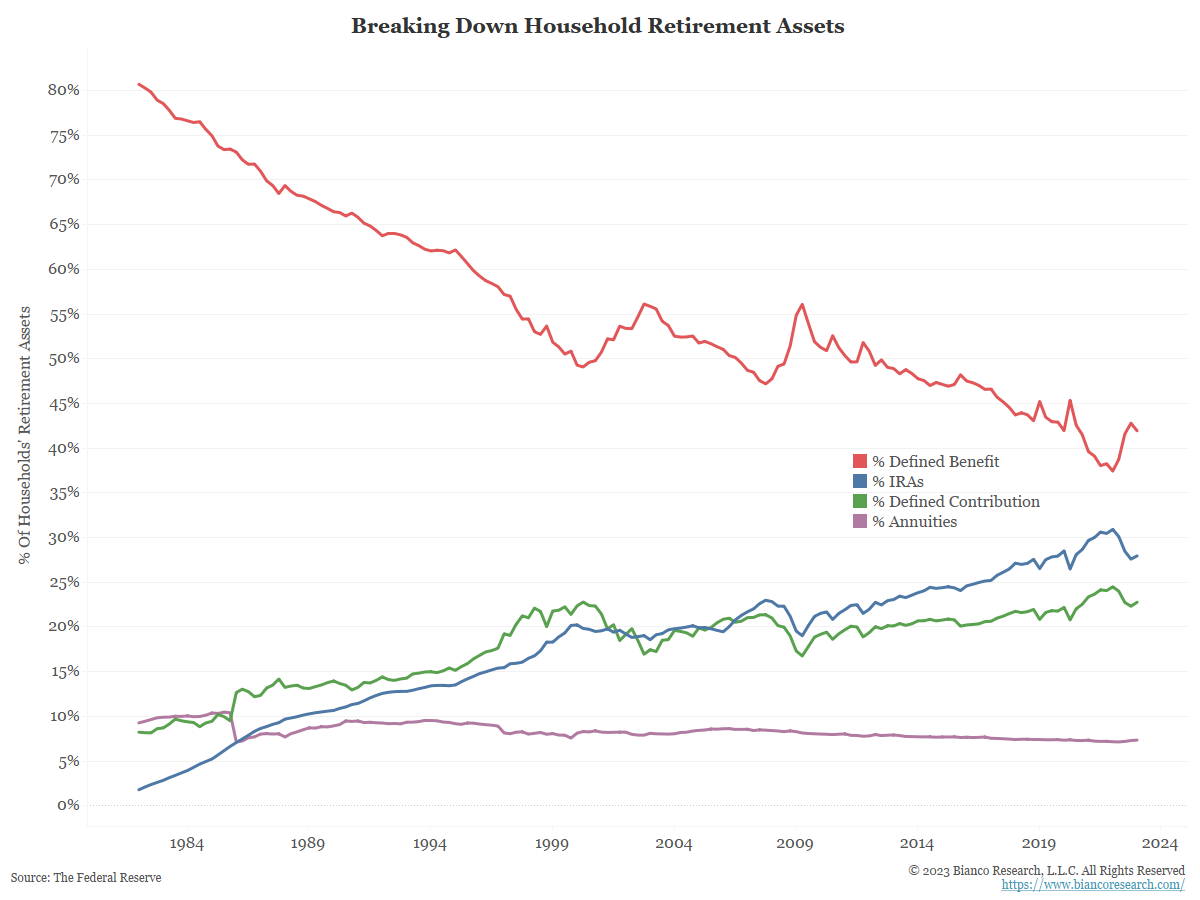

Defined Benefit Plans vs. IRAs

Defined benefit plans continue to be replaced by IRAs and defined contribution plans.... Read More

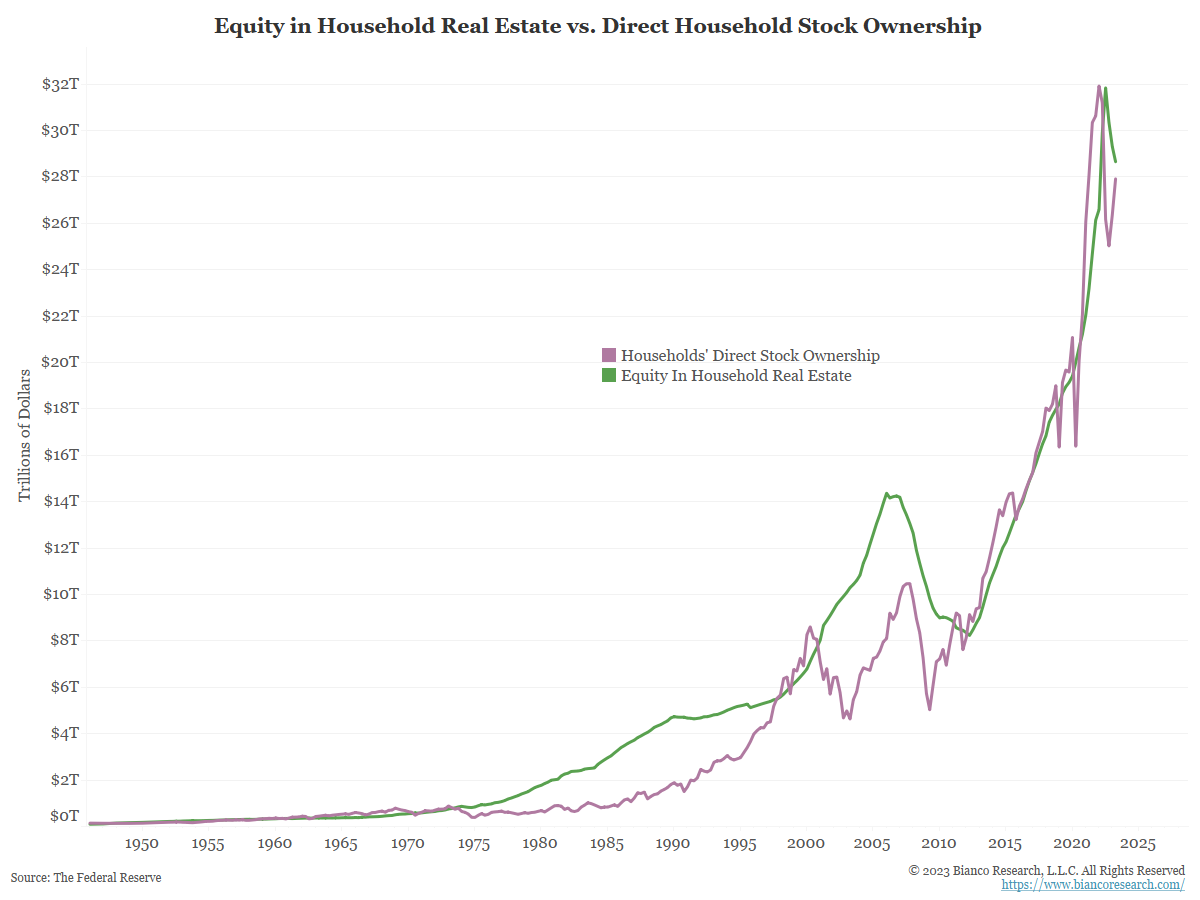

Comparing Real Estate to GDP and Stock Ownership

Over the past couple quarters, households' real estate equity actually and direct stock ownership converged to similar levels.... Read More

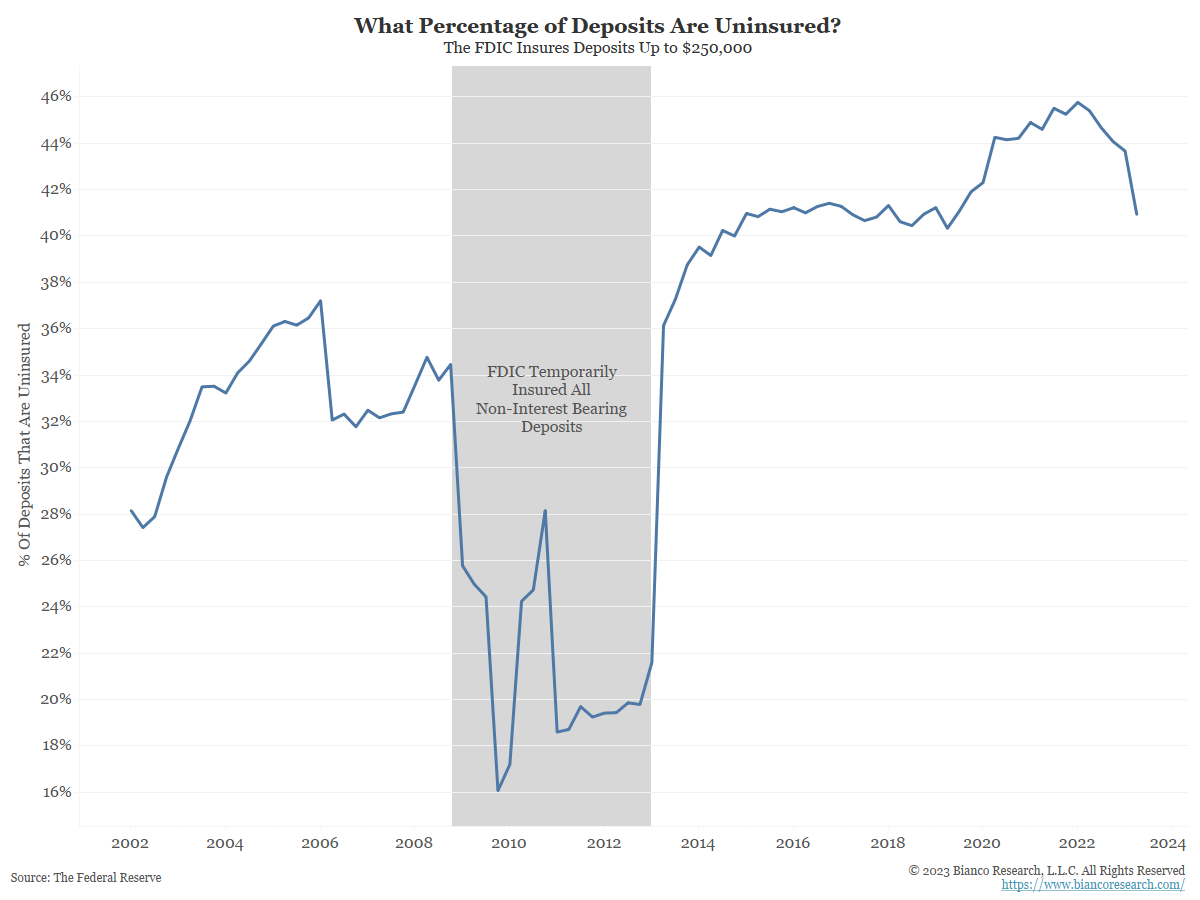

Roughly 41% of FDIC Deposits Are Uninsured

Roughly 41% of FDIC deposits in the U.S. are uninsured.... Read More

Wait, Inflation Is Going To Start RISING Again This Summer?

No one can doubt the bulls are in control of the financial markets right now. But will it stay that way long enough for investors to make good returns from here? It's unclear. There are a lot of ways the future can play out from here, as there are cross-currently galore in both the macro and market data. To discuss and make sense of it all, we're fortunate to welcome Jim Bianco of macro research firm Bianco Research back to the program. ... Read More