The Fed’s Fight With Inflation Is Not Over (Here’s Why) | Jim Bianco & Samuel Rines (Camp Kotok)

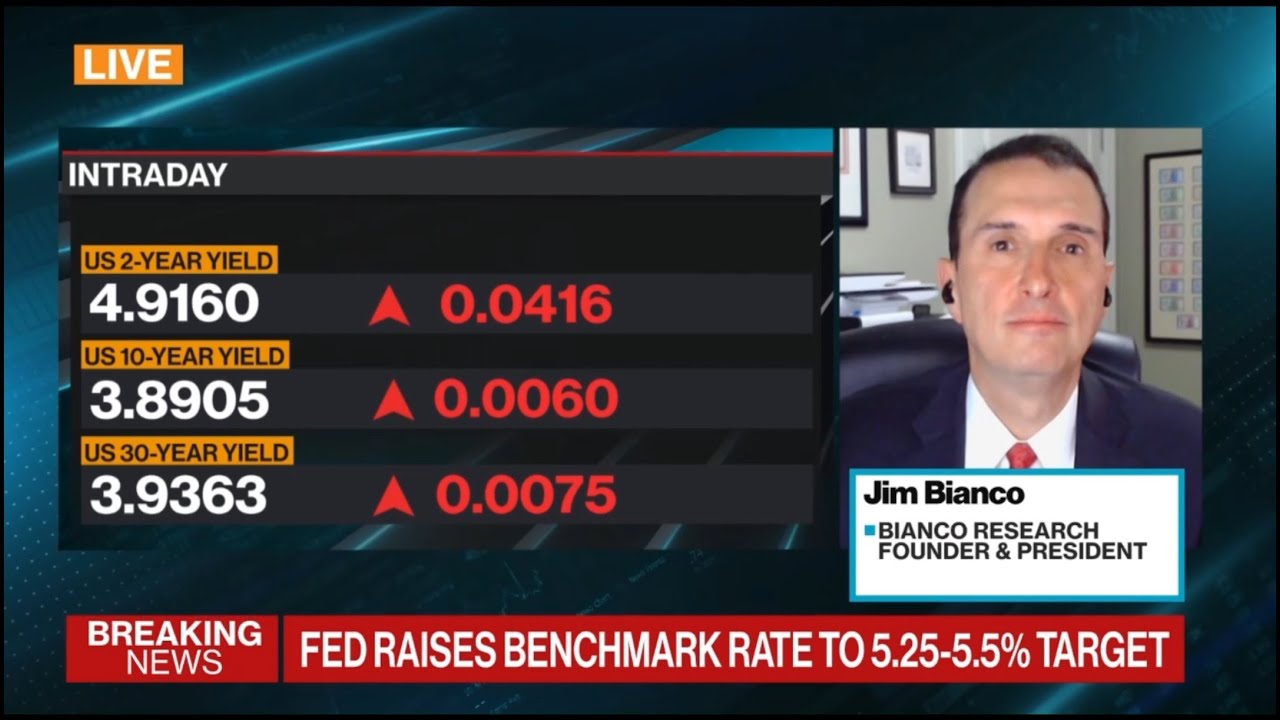

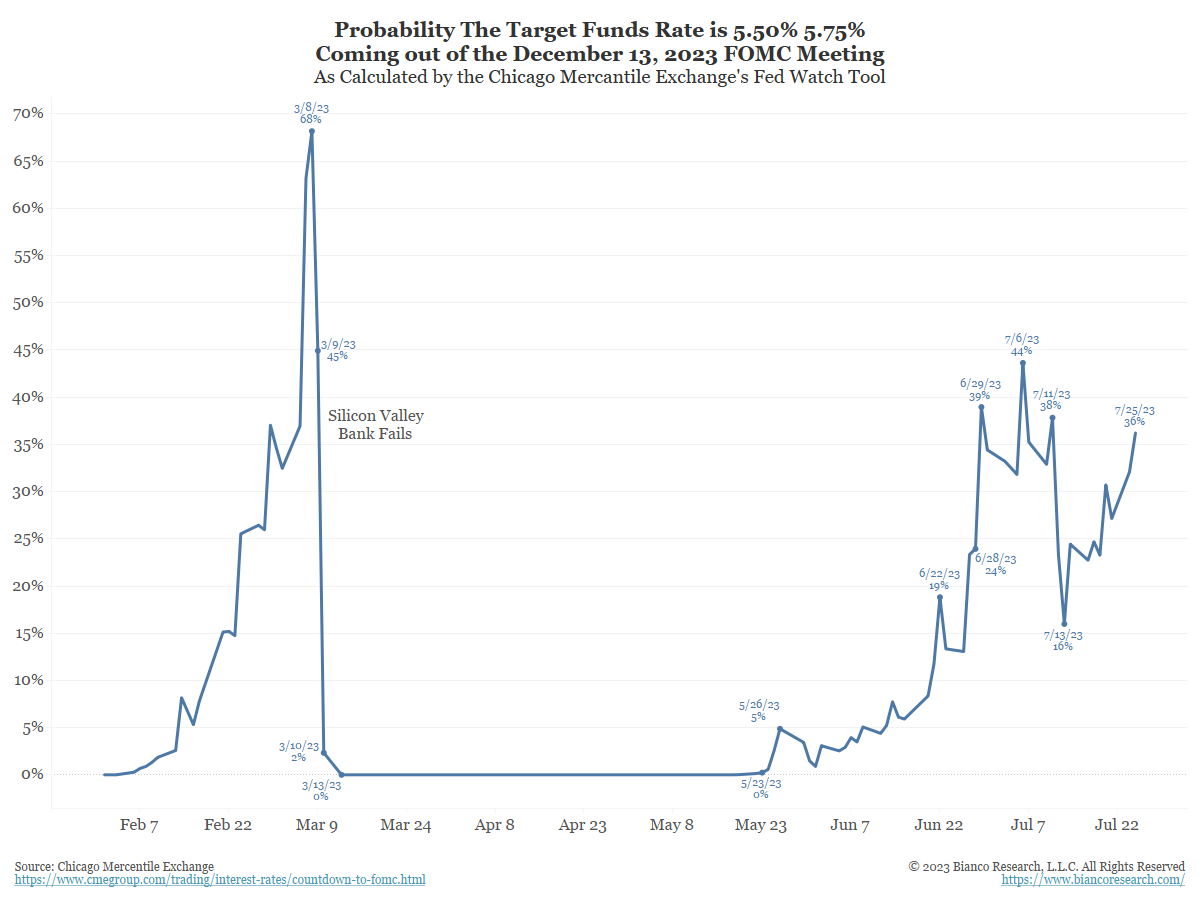

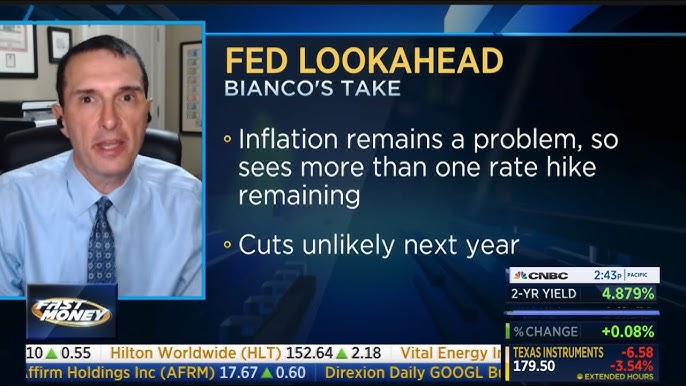

Jim Bianco, founder and CEO of Bianco Research, and Samuel Rines, of Arbor Data Science, join Jack Farley on beautiful Leen?s Lodge for the first week of ?Camp Kotok.?... Read More