Tag Archives: Markets

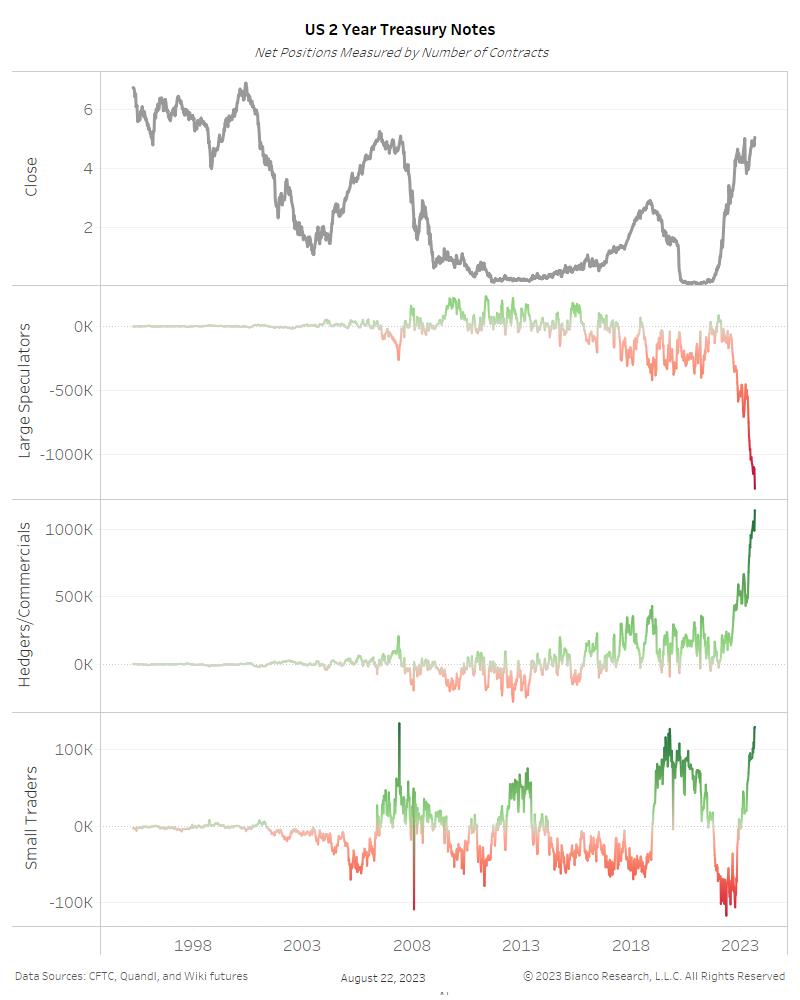

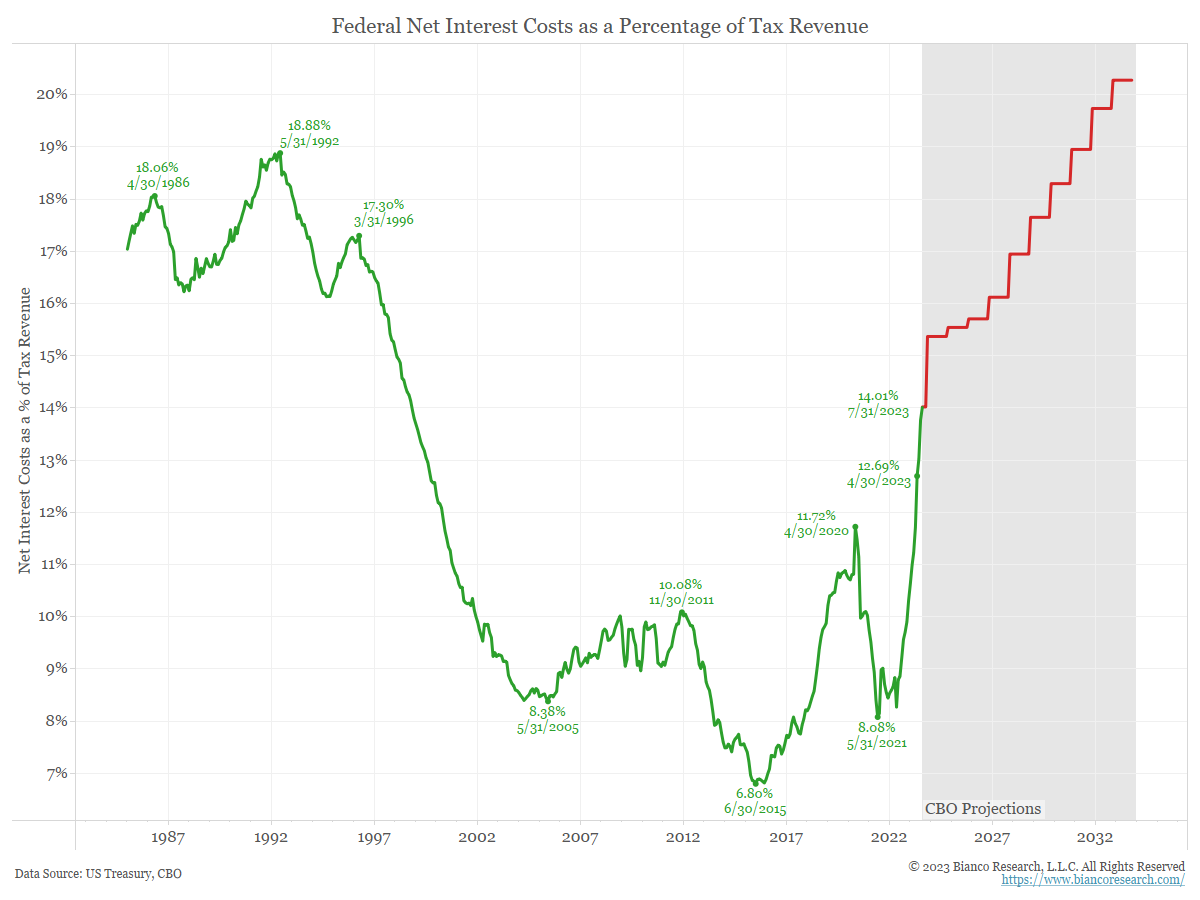

Fiscal Dominance

Posted By Jim Bianco

As the cost of carrying debt increases for governments, the idea of hiking rates becomes more politicized.... Read More

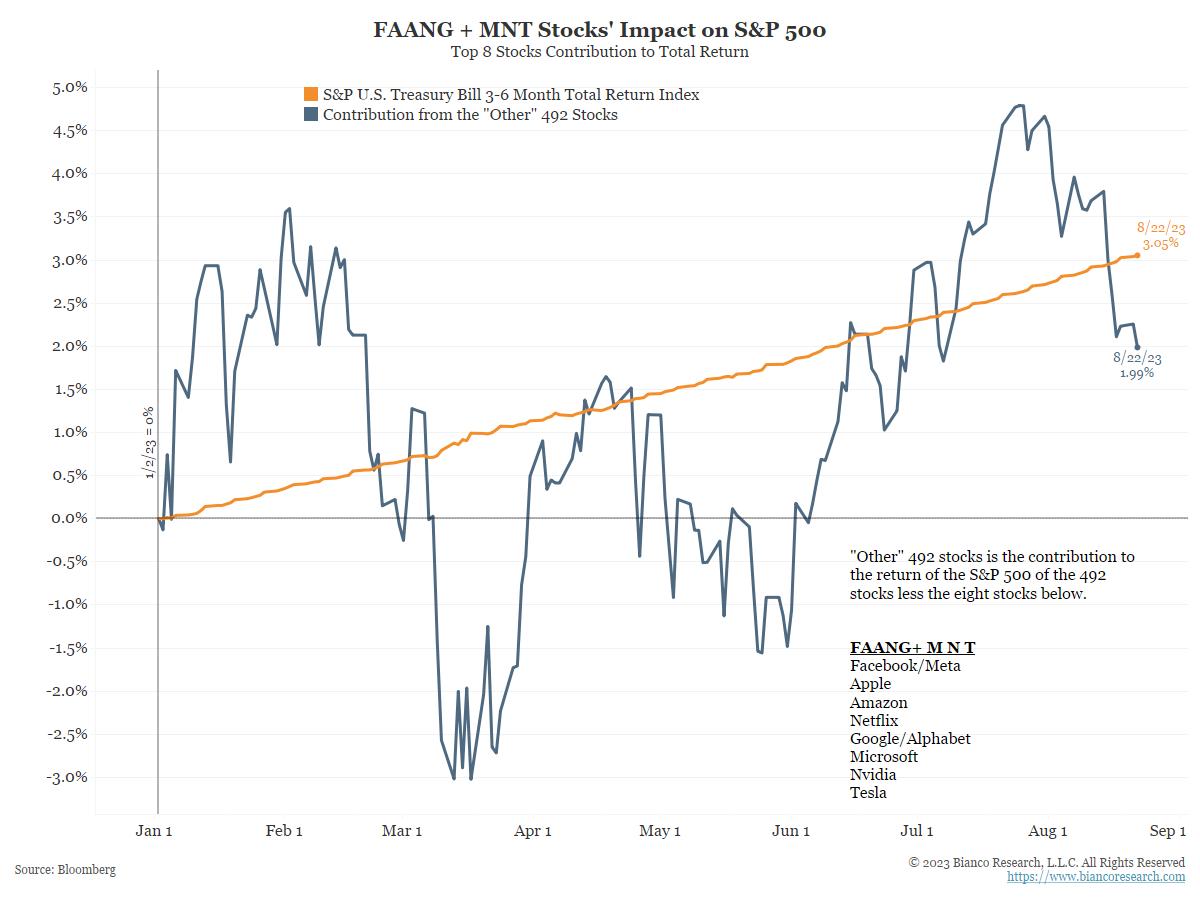

Market Breadth Still an Issue

The S&P 500's market cap has increased nearly 12% year-to-date. However, most stocks are struggling. Eight stocks have provided the majority of returns for the index this year.... Read More

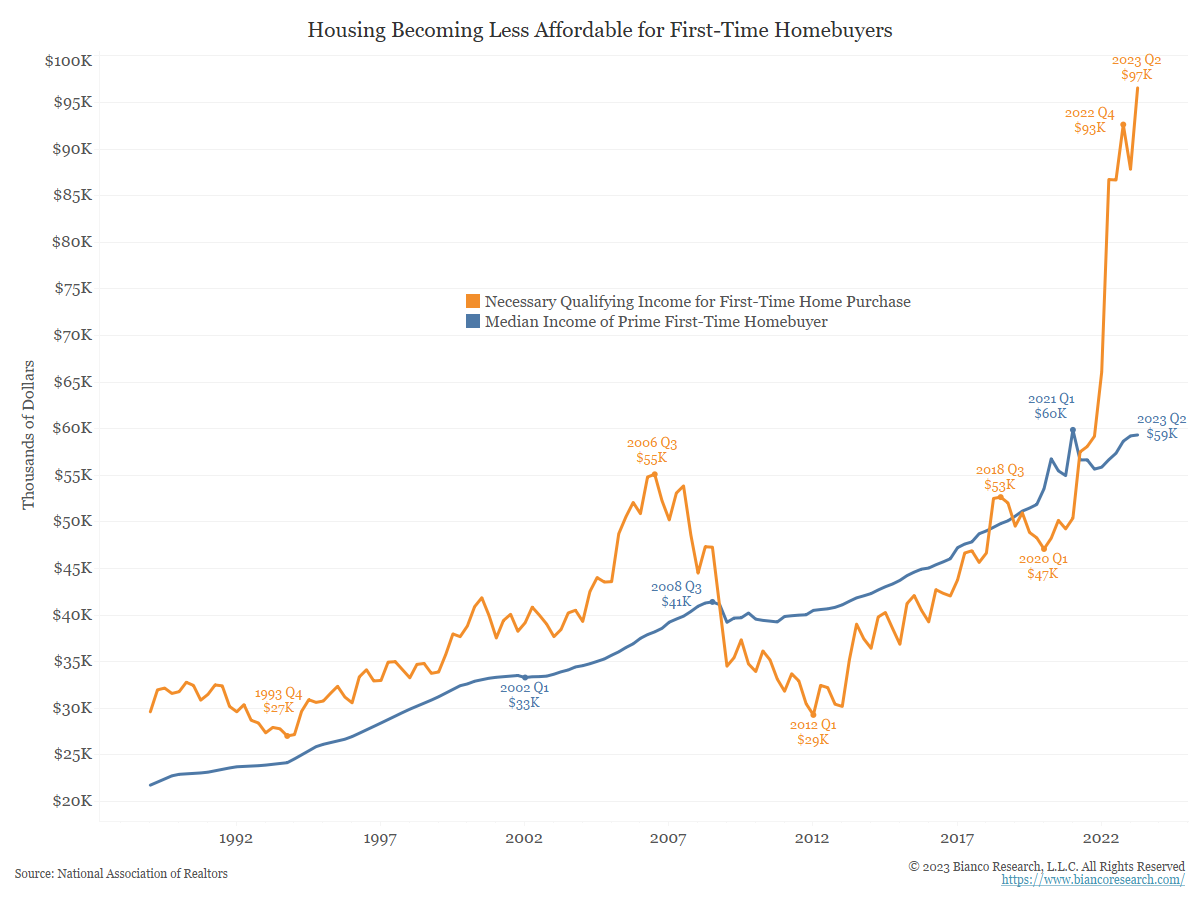

Costs Continue to Rise for First-Time Homeowners

Posted By Greg Blaha

Homebuyers enjoyed a relatively affordable market in the decade following the housing crash. The recent rise in prices and mortgage rates put homeownership out of reach for many prospective first-time buyers.... Read More

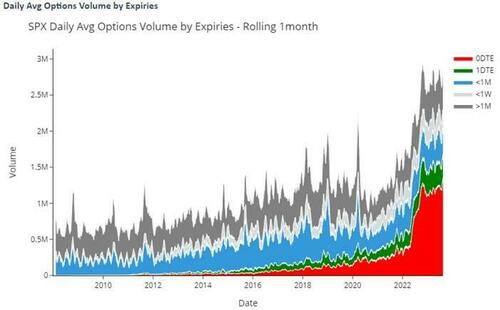

Revisiting 0DTE and Market Effects

Posted By Alex Malitas

Zero Days-to-Expiration options now make up over half of all options volume for the S&P 500. Risks stemming from these short-term options are still relatively unknown. Below we update our commentary on 0DTE options as their prevalence continues to rise.... Read More

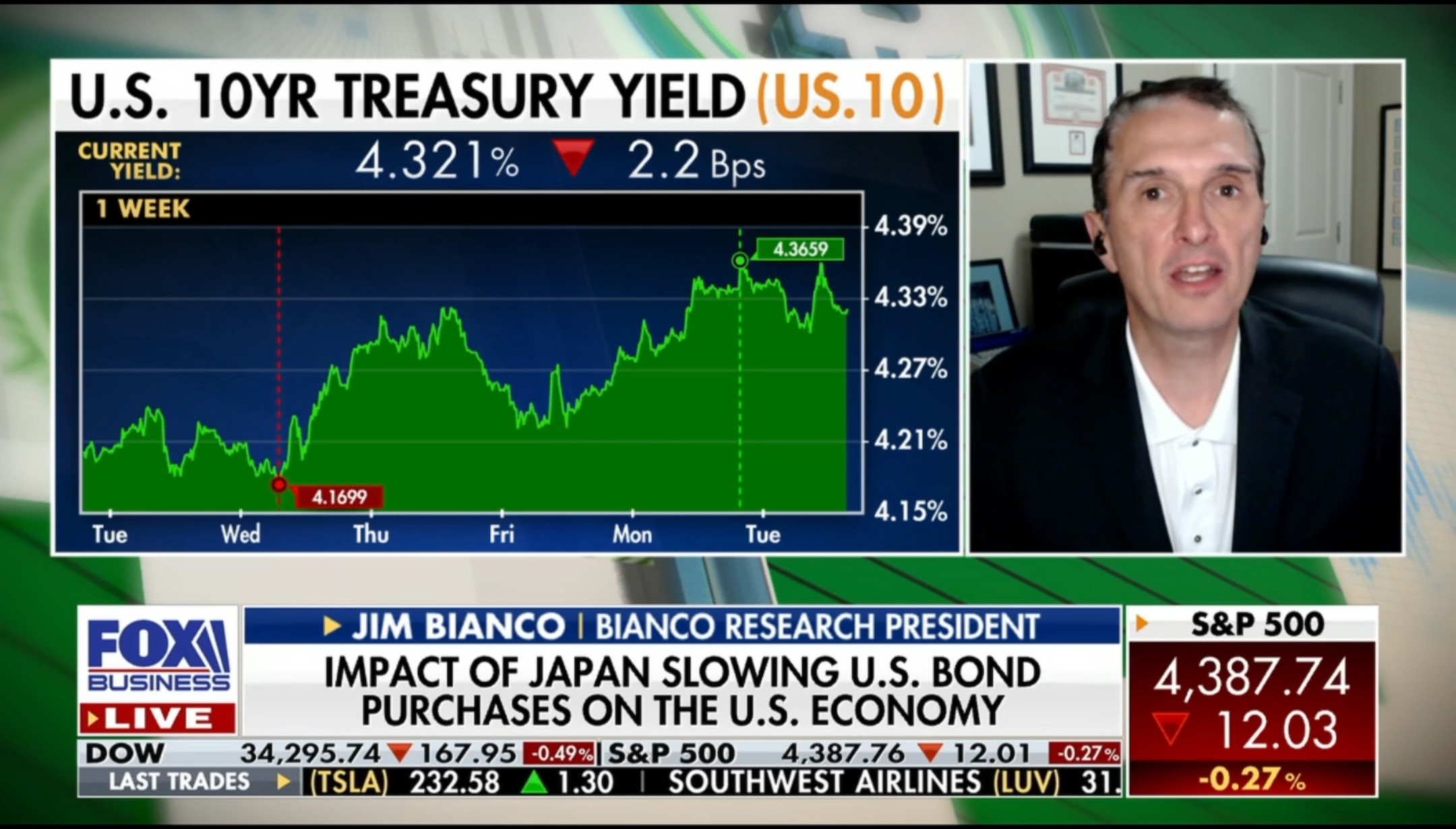

Jim Bianco joins Fox Business to discuss The Magnificent 7, a Bank Walk Update & The Bank of Japan

Jim Bianco joins Fox Business to discuss The Magnificent 7, a Bank Walk Update & The Bank of Japan with Charles Payne.... Read More

Jim Bianco joins Fox Business to discuss The Magnificent 7, a Bank Walk Update & The Bank of Japan

Jim Bianco joins Fox Business to discuss The Magnificent 7, a Bank Walk Update & The Bank of Japan with Charles Payne.... Read More

Jim Bianco joins CNBC to discuss what the Bond Market sell-off means for investors and the upcoming Jackson Hole Economic Symposium

Jim Bianco joins ?Fast Money? to talk the U.S. Bond Market, what to expect out of Jackson Hole this week and more.... Read More

Jim Bianco joins CNBC to discuss what the Bond Market sell-off means for investors and the upcoming Jackson Hole Economic Symposium

Jim Bianco joins ?Fast Money? to talk the U.S. Bond Market, what to expect out of Jackson Hole this week and more.... Read More

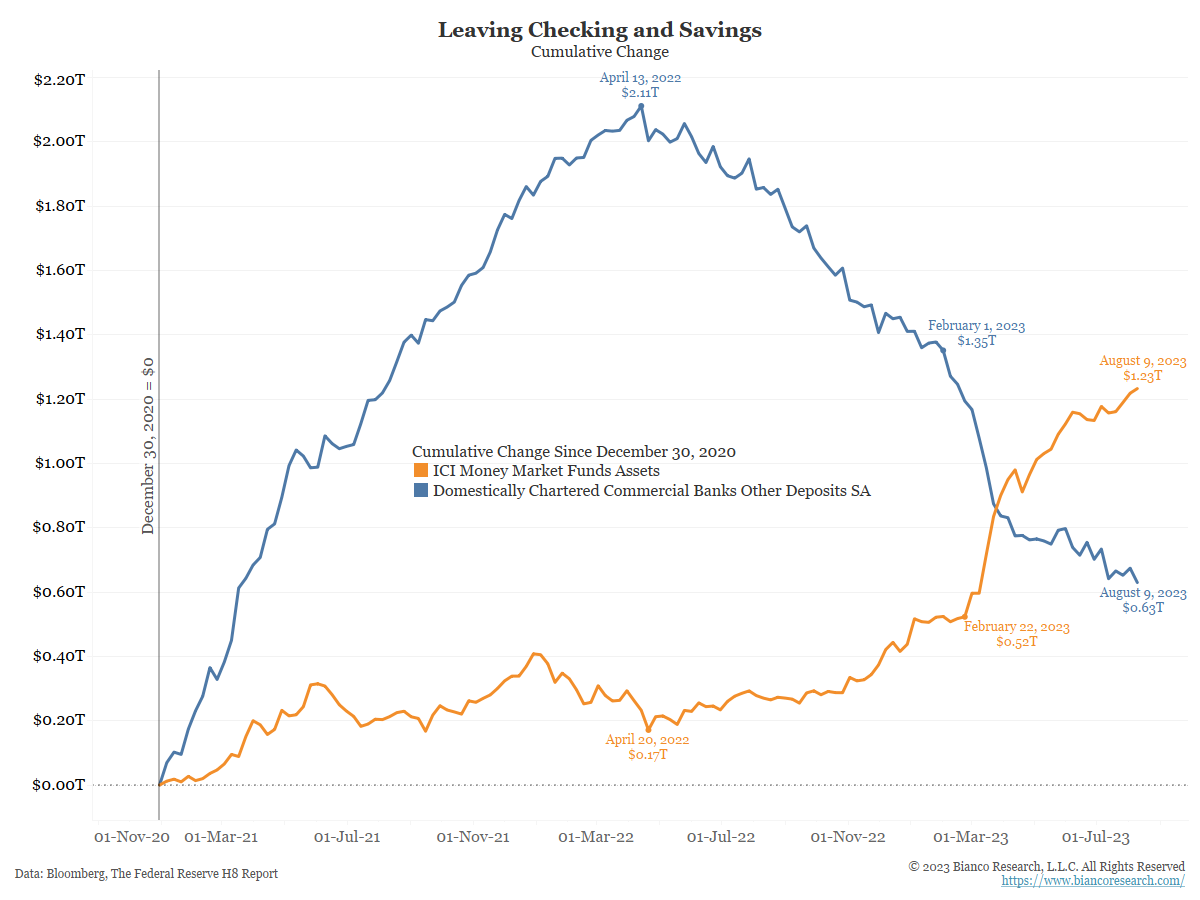

Updating the Bank Walk

Posted By Jim Bianco

Deposits continue to leave banks for market-oriented alternatives like money market funds. Banks continue to tighten lending standards, dragging on smaller companies that depend on banks for financial services.... Read More

Jim Bianco joins CNBC to discuss the Reasoning & Impact of Higher Bond Yields, Jackson Hole & China

Jim Bianco joins CNBC to discuss the Reasoning & Impact of Higher Bond Yields, Jackson Hole & China with Kelly Evans, Tyler Mathisen and Ron Insana.... Read More

Jim Bianco joins CNBC to discuss the Reasoning & Impact of Higher Bond Yields, Jackson Hole & China

Jim Bianco joins CNBC to discuss the Reasoning & Impact of Higher Bond Yields, Jackson Hole & China with Kelly Evans, Tyler Mathisen and Ron Insana.... Read More

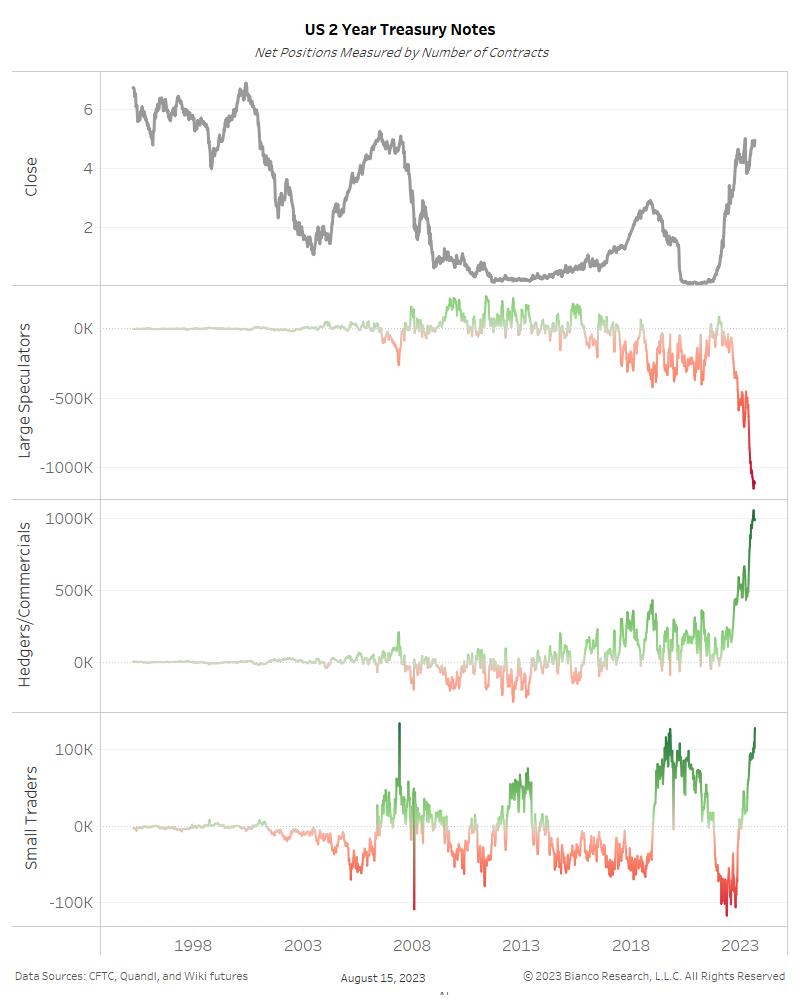

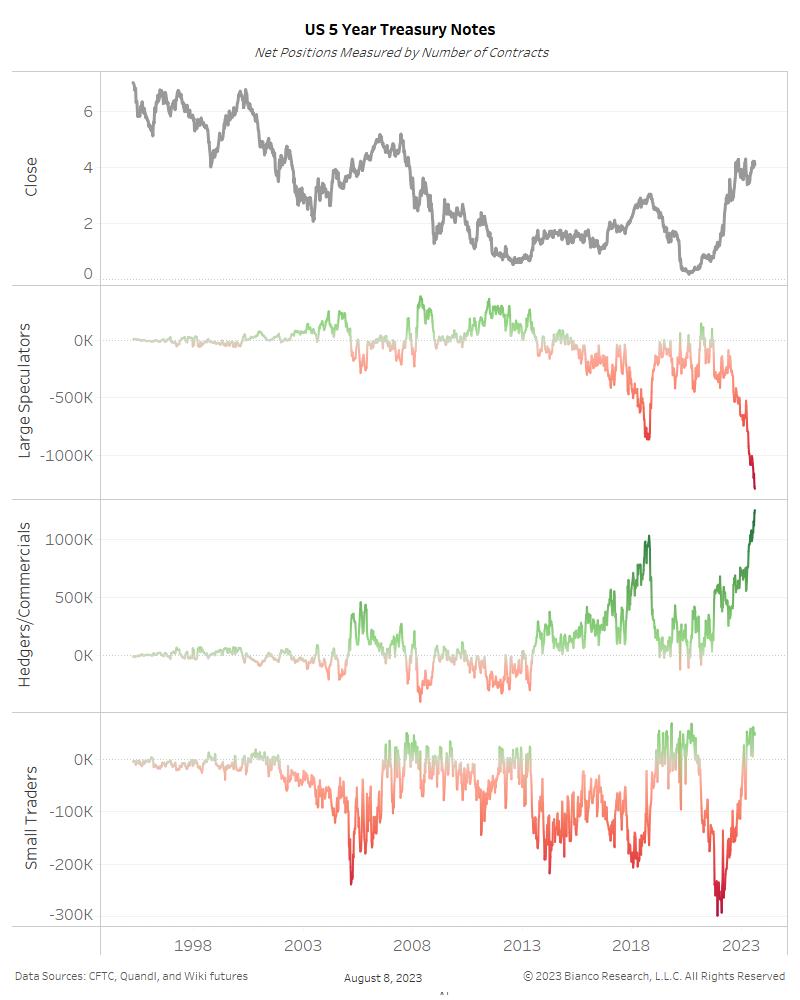

The Rise in Long Rates Replay & Notes

Just as many are ready to declare victory in the battle against inflation and the Fed is expected to start cutting rates, long-term interest rates are challenging or exceeding their 2022 highs. Why is this happening and what does it mean for risk markets, the economy, and Fed policy?... Read More

Jim Bianco joins Fox Business to discuss Capitalism, Bond Yields, Mortgage Rates & the Oil Market

Jim Bianco joins Fox Business to discuss Capitalism, Bond Yields, Mortgage Rates & the Oil Market with Charles Payne.... Read More

Jim Bianco joins Fox Business to discuss Capitalism, Bond Yields, Mortgage Rates & the Oil Market

Jim Bianco joins Fox Business to discuss Capitalism, Bond Yields, Mortgage Rates & the Oil Market with Charles Payne.... Read More

Jim Bianco joins CNBC to discuss Treasury Inflows, Yield Curve Steepening, Inflation Reaccelerating

Jim Bianco joins CNBC to discuss Treasury Inflows, Yield Curve Steepening, Inflation Reaccelerating, Recession and No Landing Scenario, Bond Auctions with Carl Quintanilla and Sara Eisen.... Read More

Jim Bianco joins CNBC to discuss Treasury Inflows, Yield Curve Steepening, Inflation Reaccelerating

Jim Bianco joins CNBC to discuss Treasury Inflows, Yield Curve Steepening, Inflation Reaccelerating, Recession and No Landing Scenario, Bond Auctions with Carl Quintanilla and Sara Eisen.... Read More

The Fed’s Fight With Inflation Is Not Over (Here’s Why) | Jim Bianco & Samuel Rines (Camp Kotok)

Jim Bianco, founder and CEO of Bianco Research, and Samuel Rines, of Arbor Data Science, join Jack Farley on beautiful Leen?s Lodge for the first week of ?Camp Kotok.?... Read More