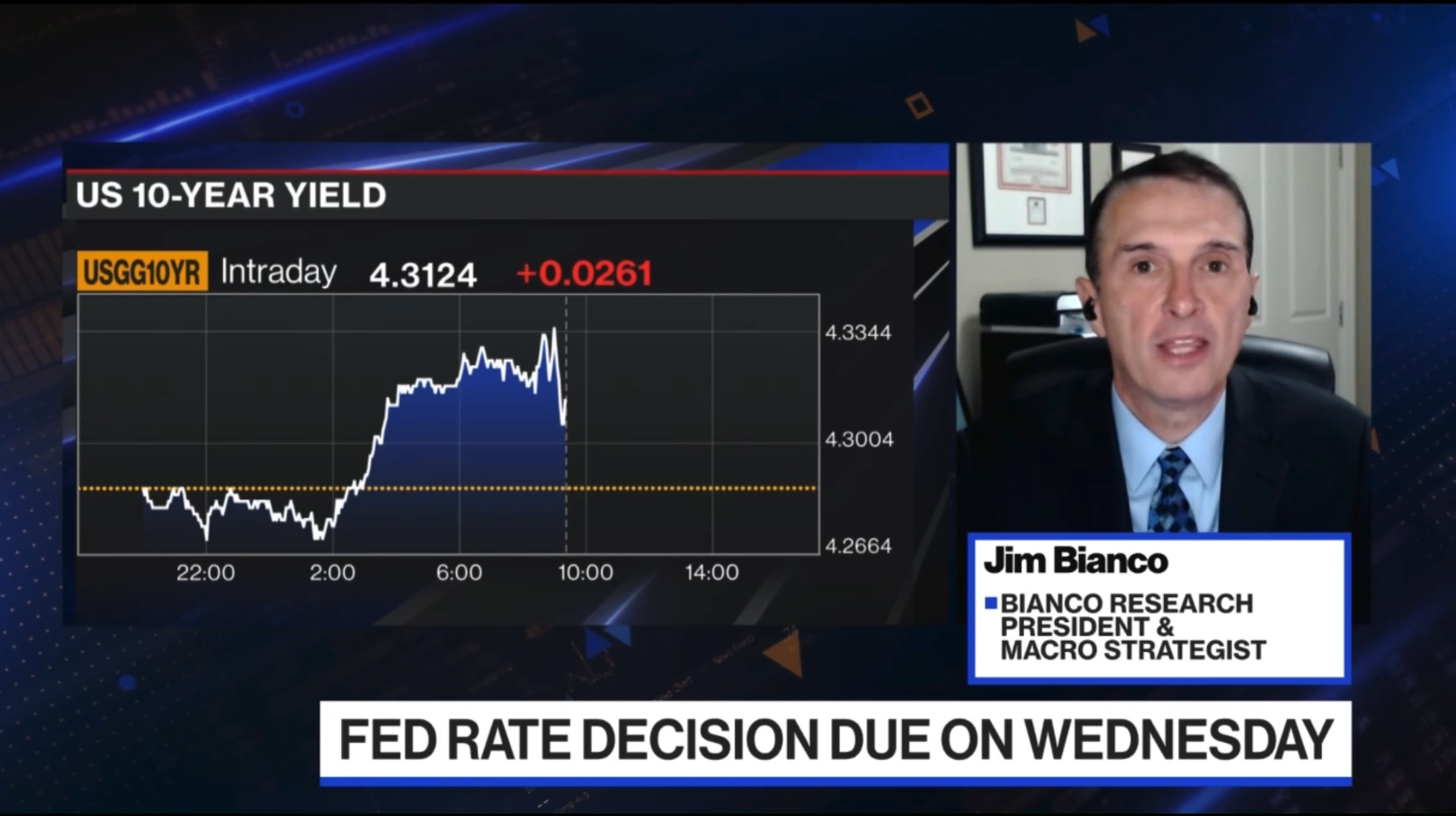

Are Rates Too High? Conference Call Replay & Notes

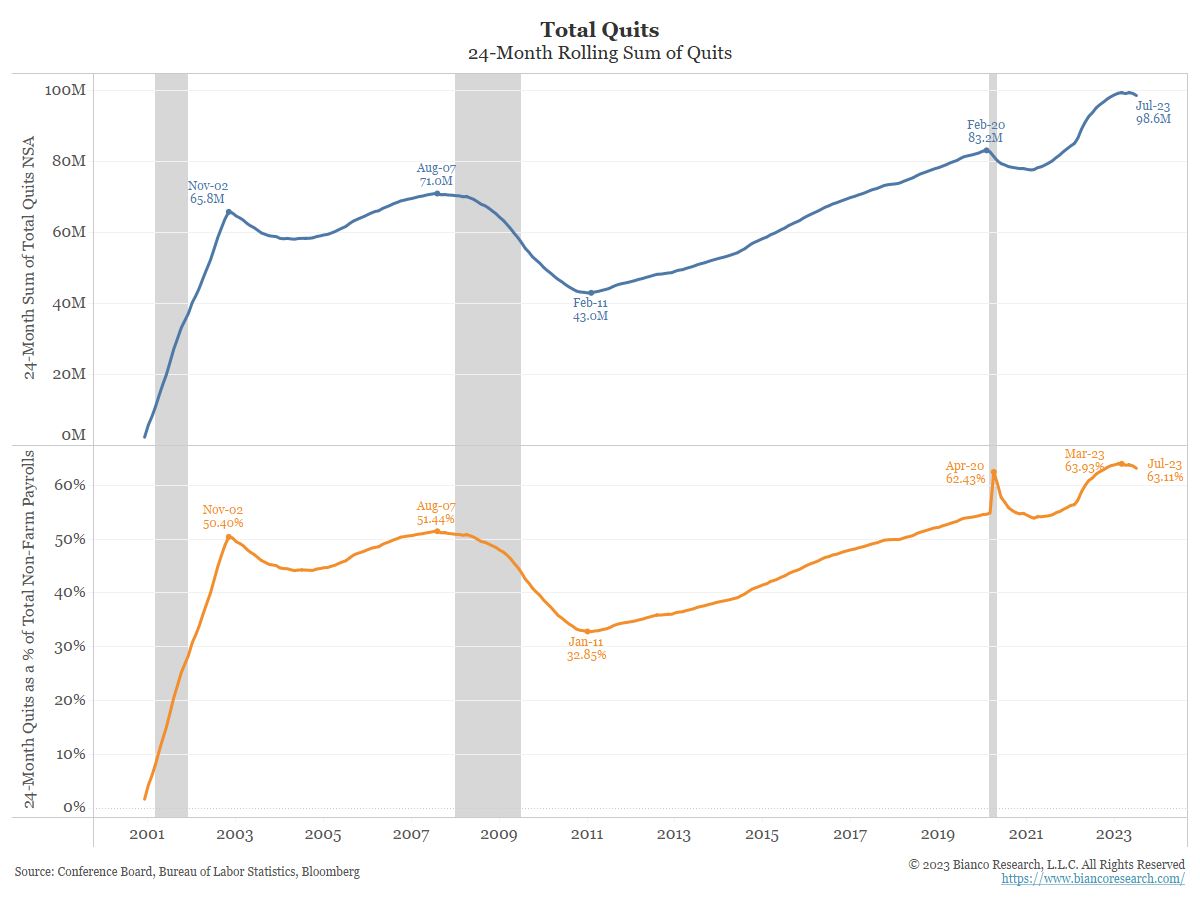

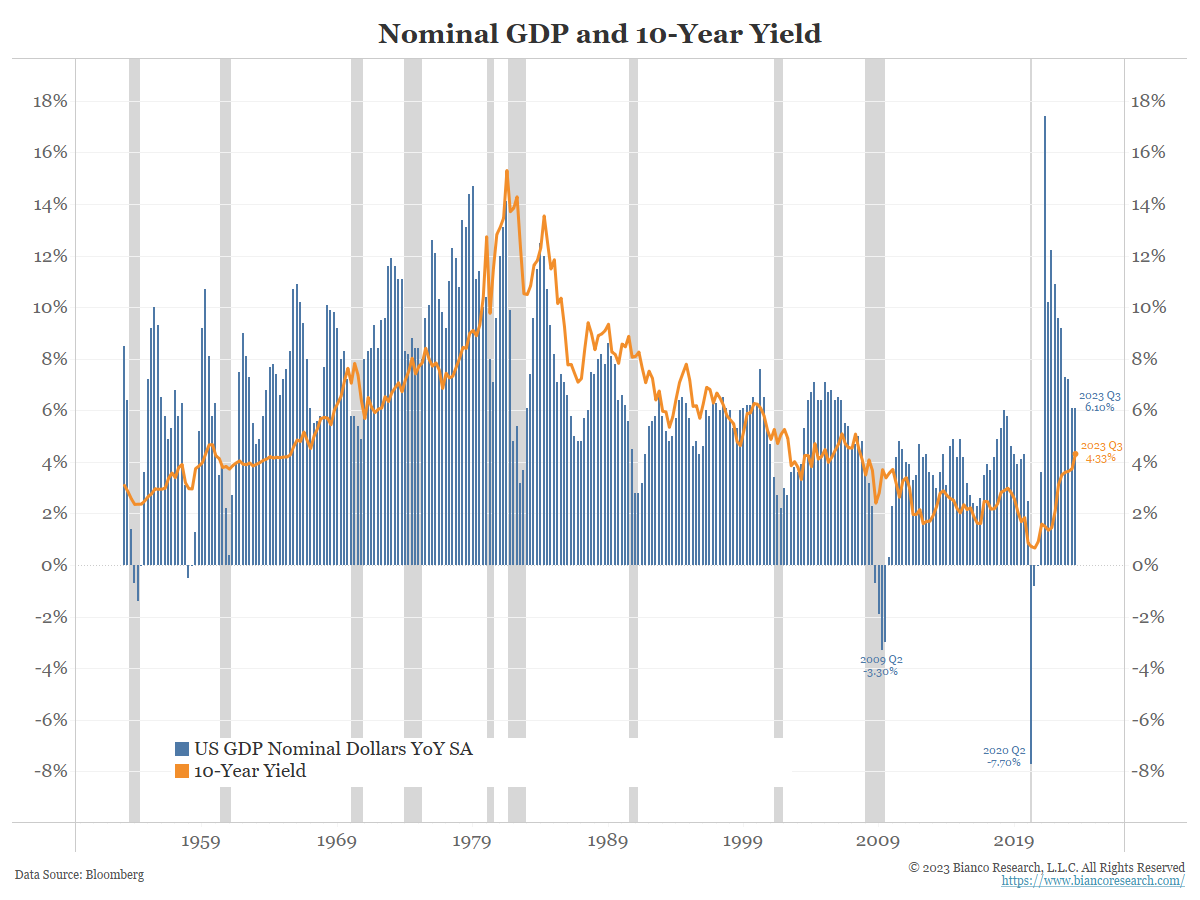

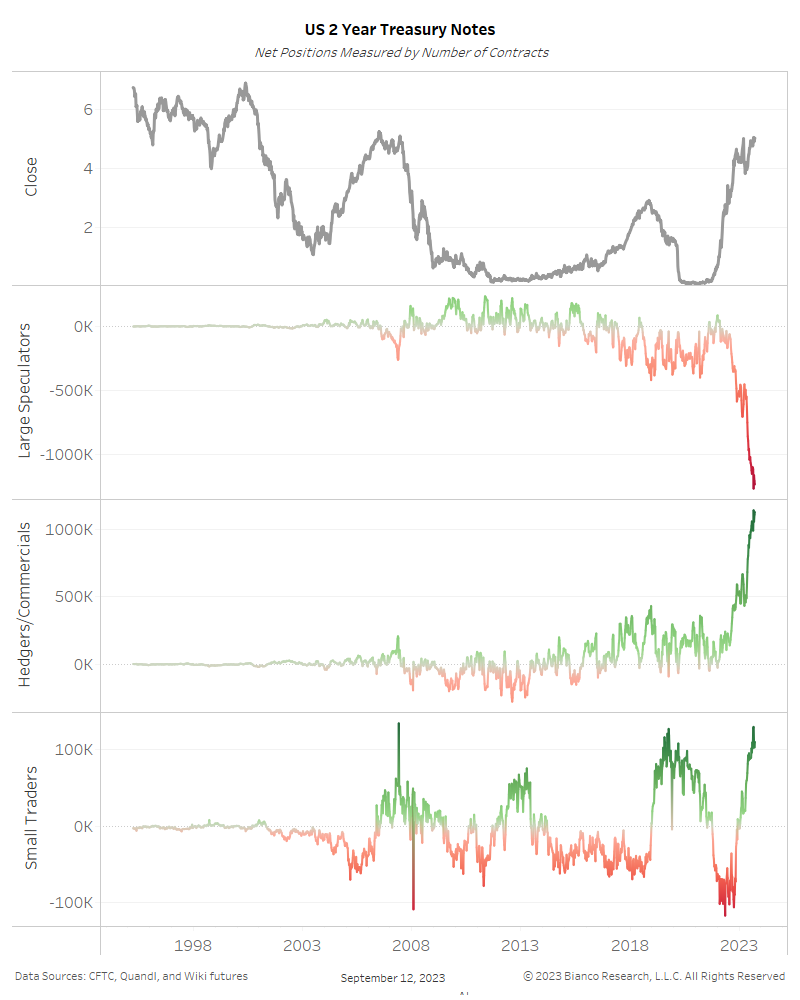

It is widely believed high rates will lead to at least an economic slowdown (?soft landing?) if not a recession (?hard landing?). But what if rates are not that restrictive? The economy could weather these rates (?no landing?) and it would take even higher rates to pull the economy down.... Read More

:format(webp)/cloudfront-us-east-1.images.arcpublishing.com/tgam/NJ724U2W6RHUHE4Z2FA5FRZRSI.jpg)