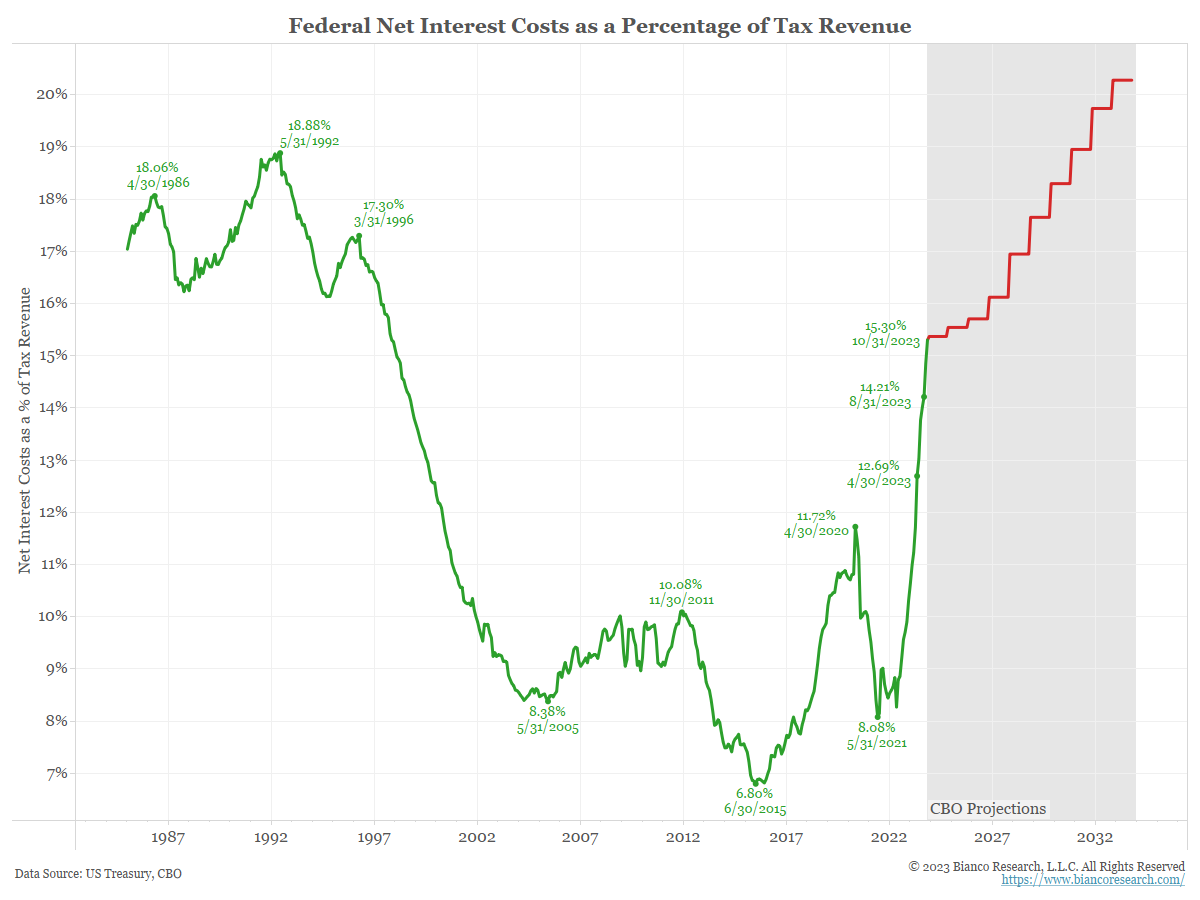

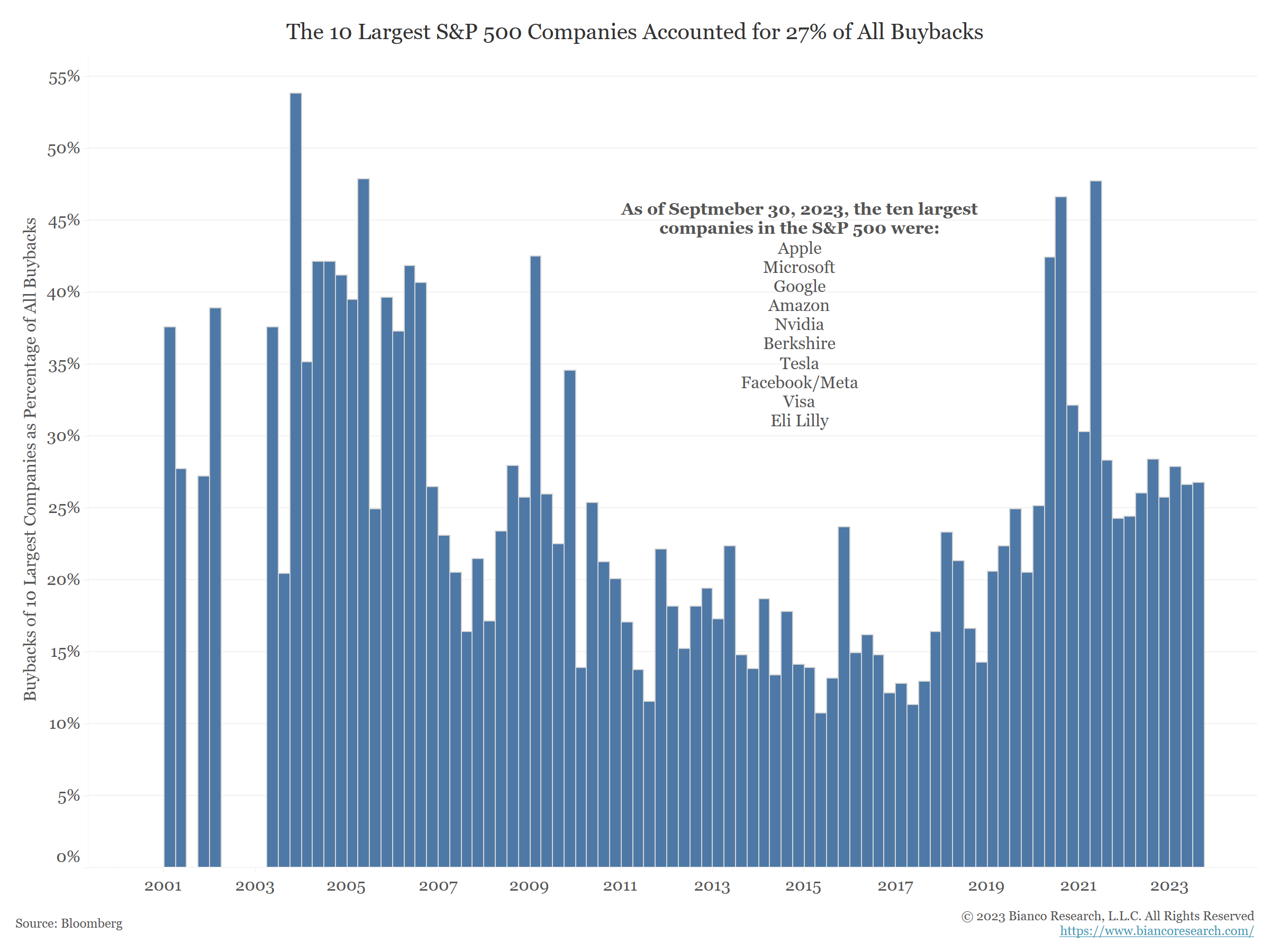

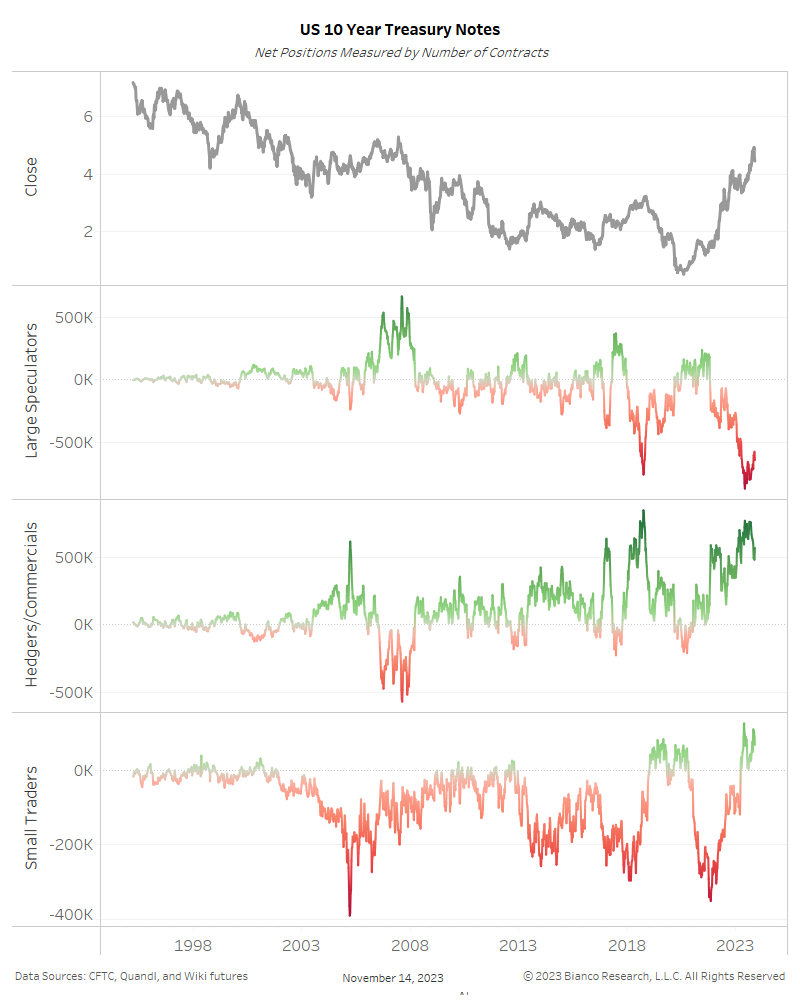

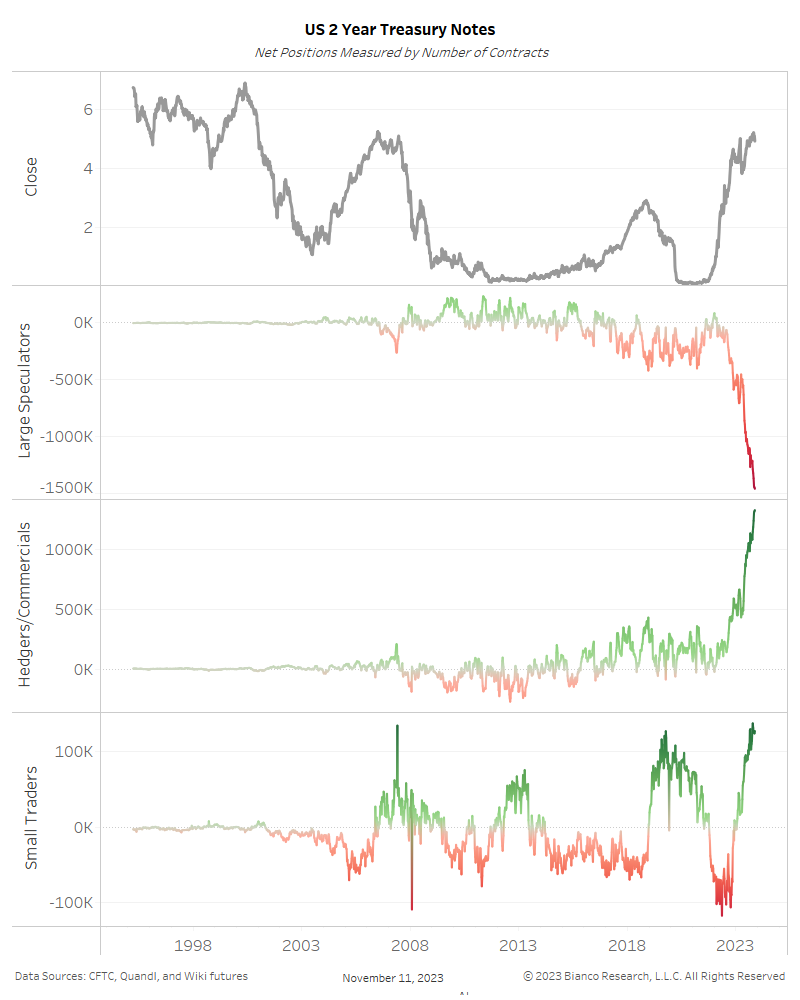

Jim Bianco discusses External Forces on the Economy, Rate Hikes/Cuts in 24, Impact of Interest Rates

Jim Bianco discusses External Forces on the Economy, Rate Hikes/Cuts in 24, Impact of Interest Rates with Charles Payne on Fox Business.... Read More