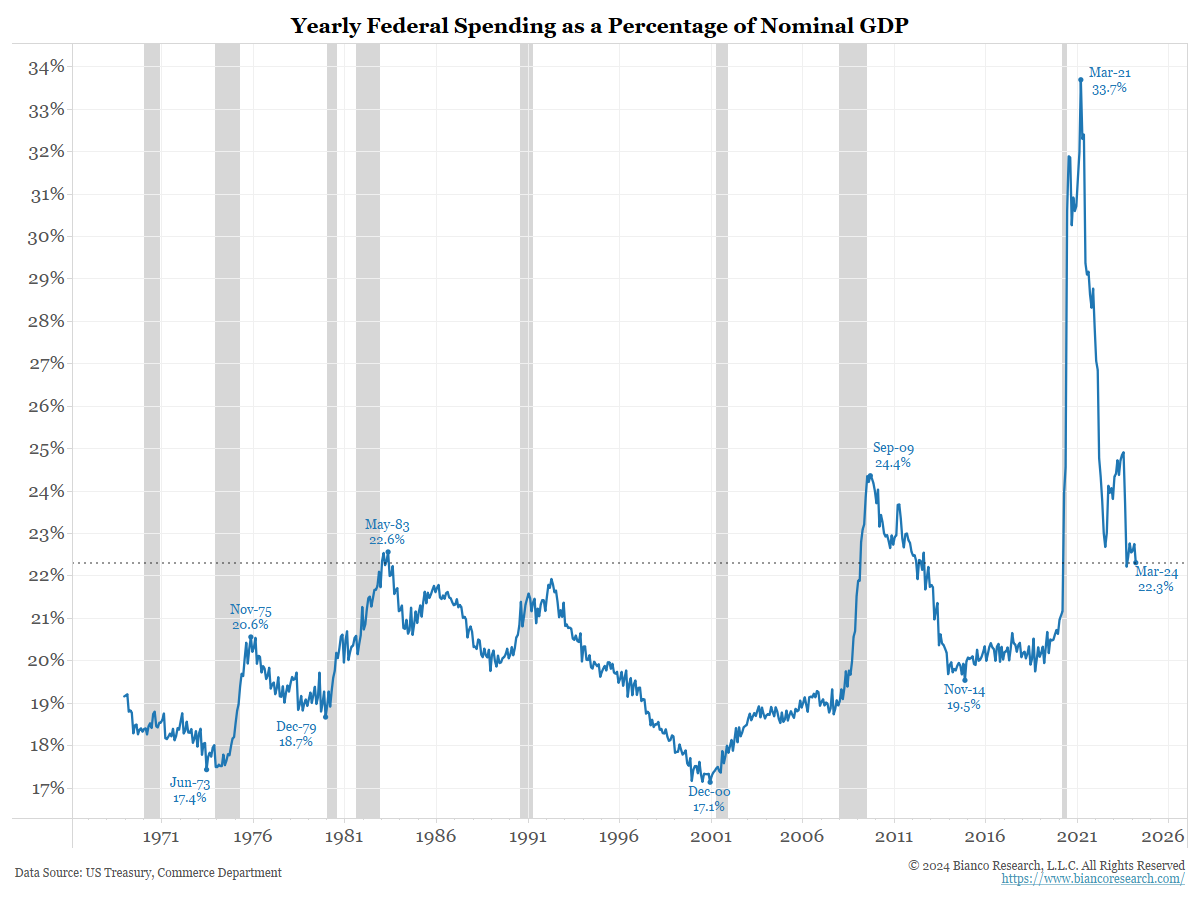

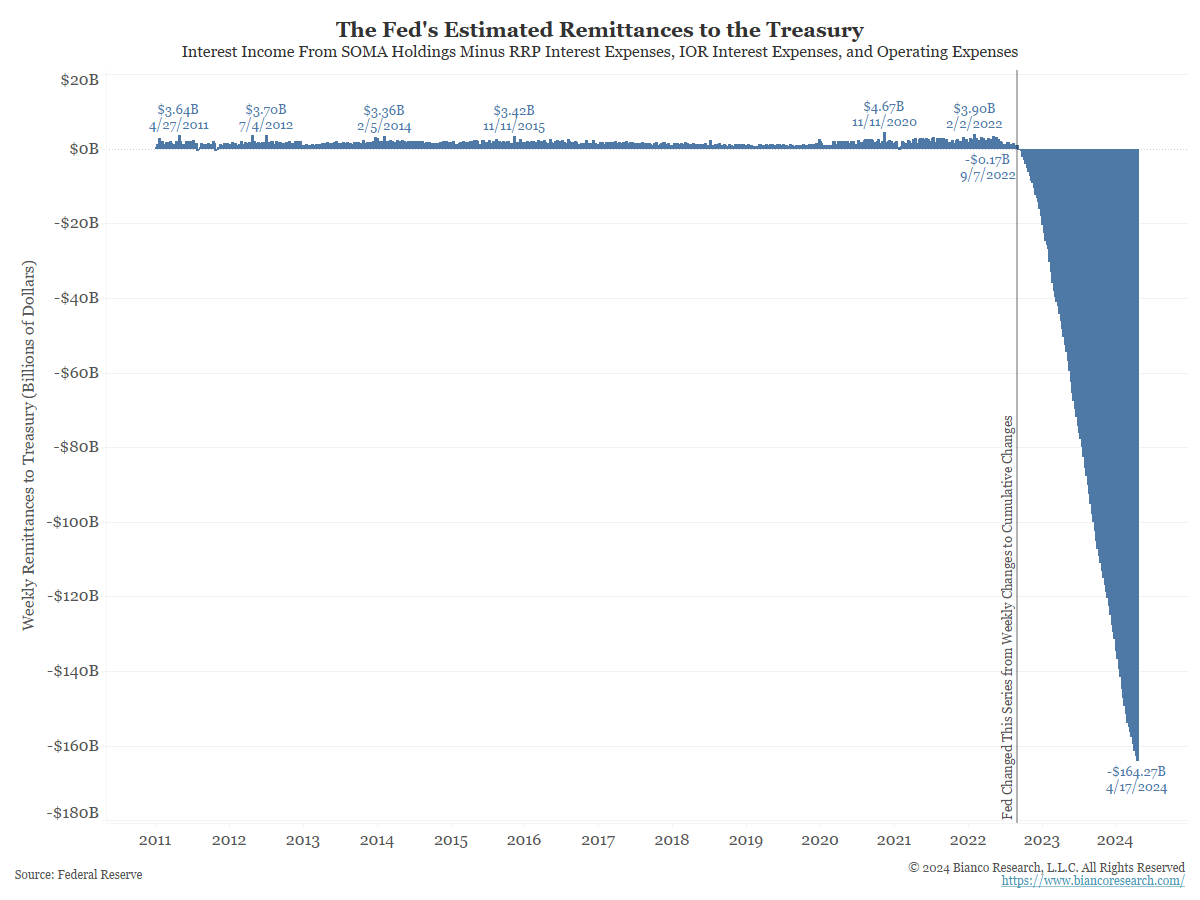

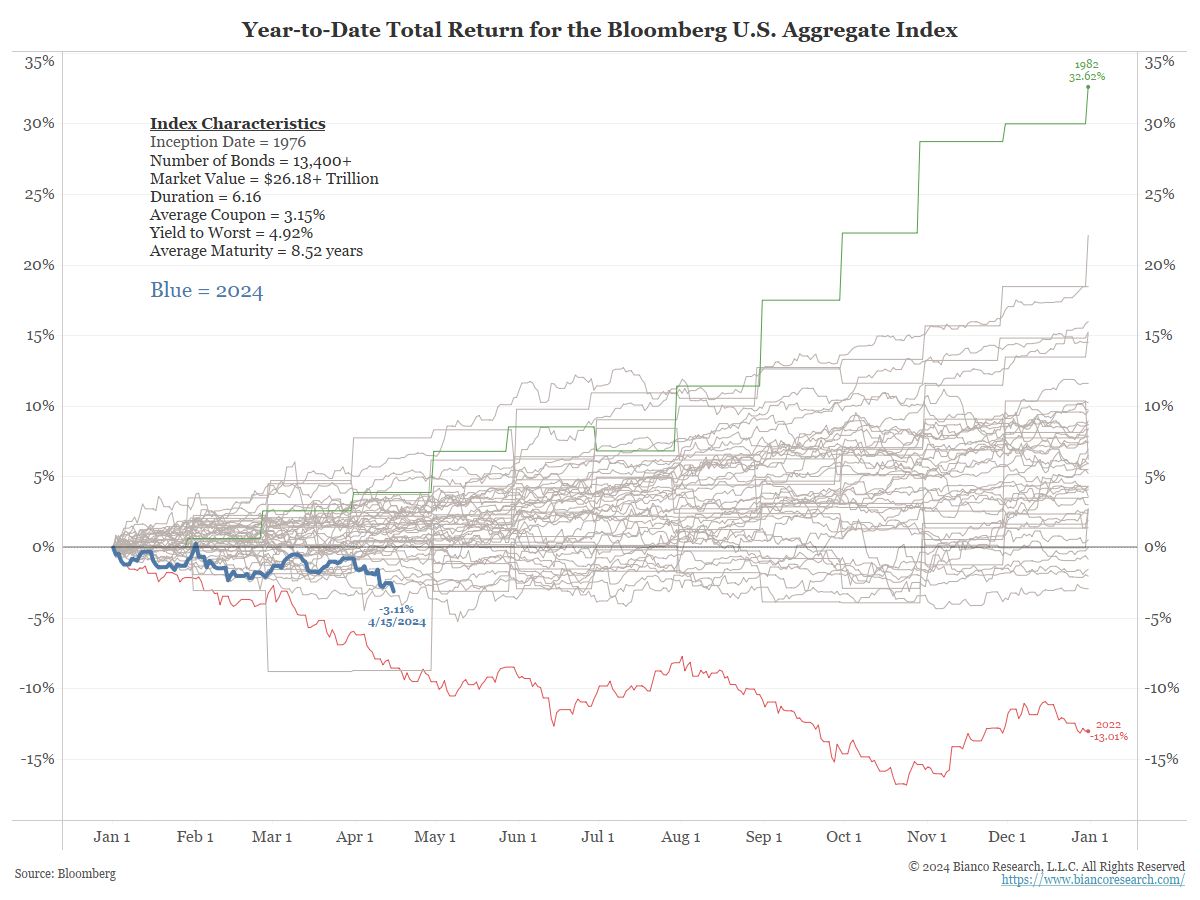

Only Markets Can Rein in the Deficits

Posted By Jim Bianco

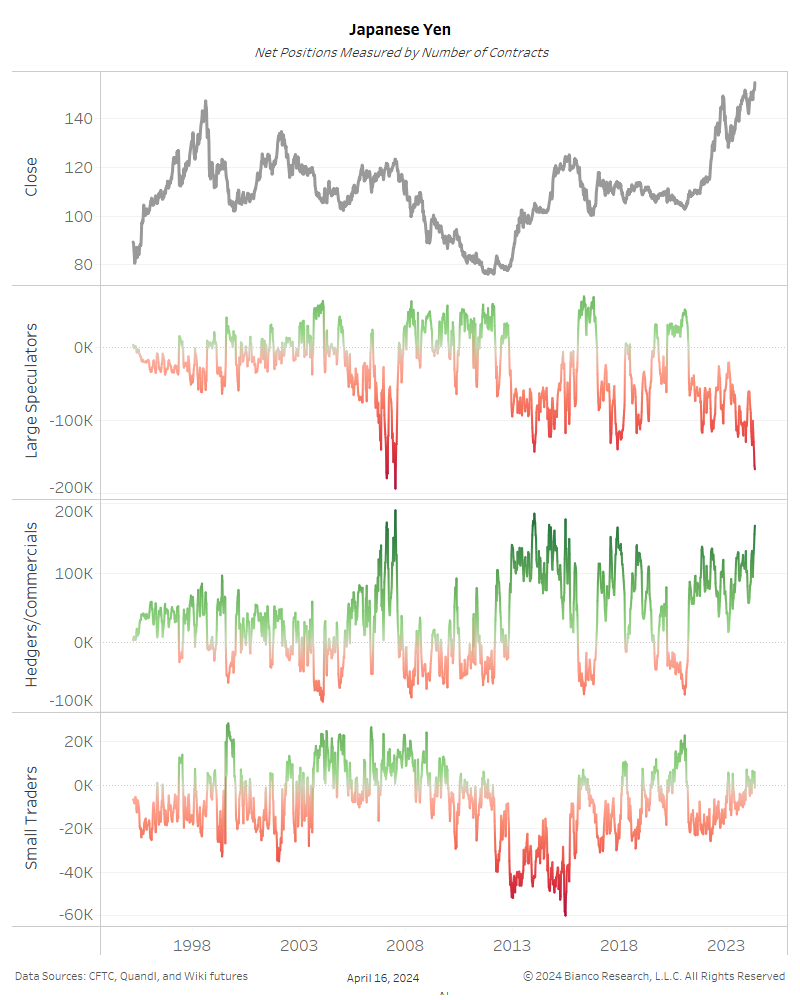

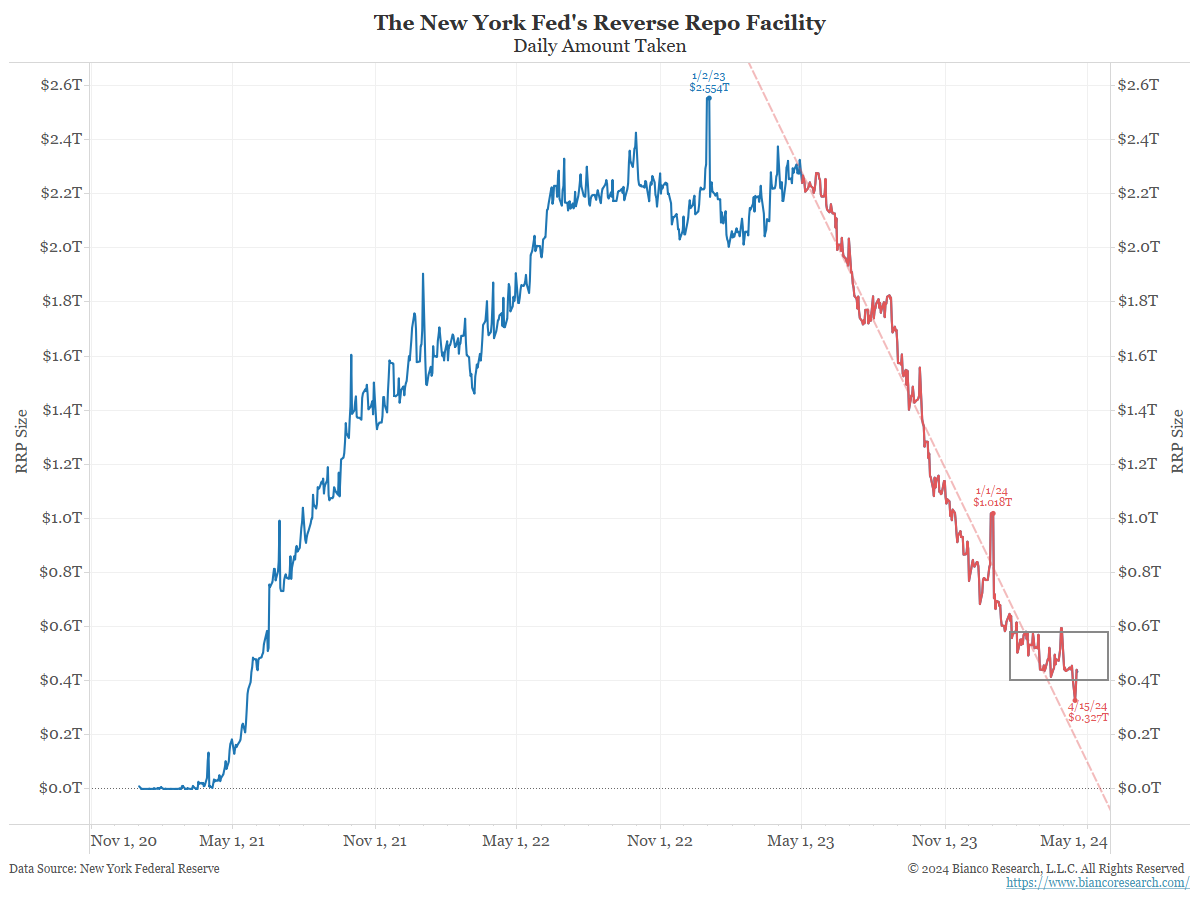

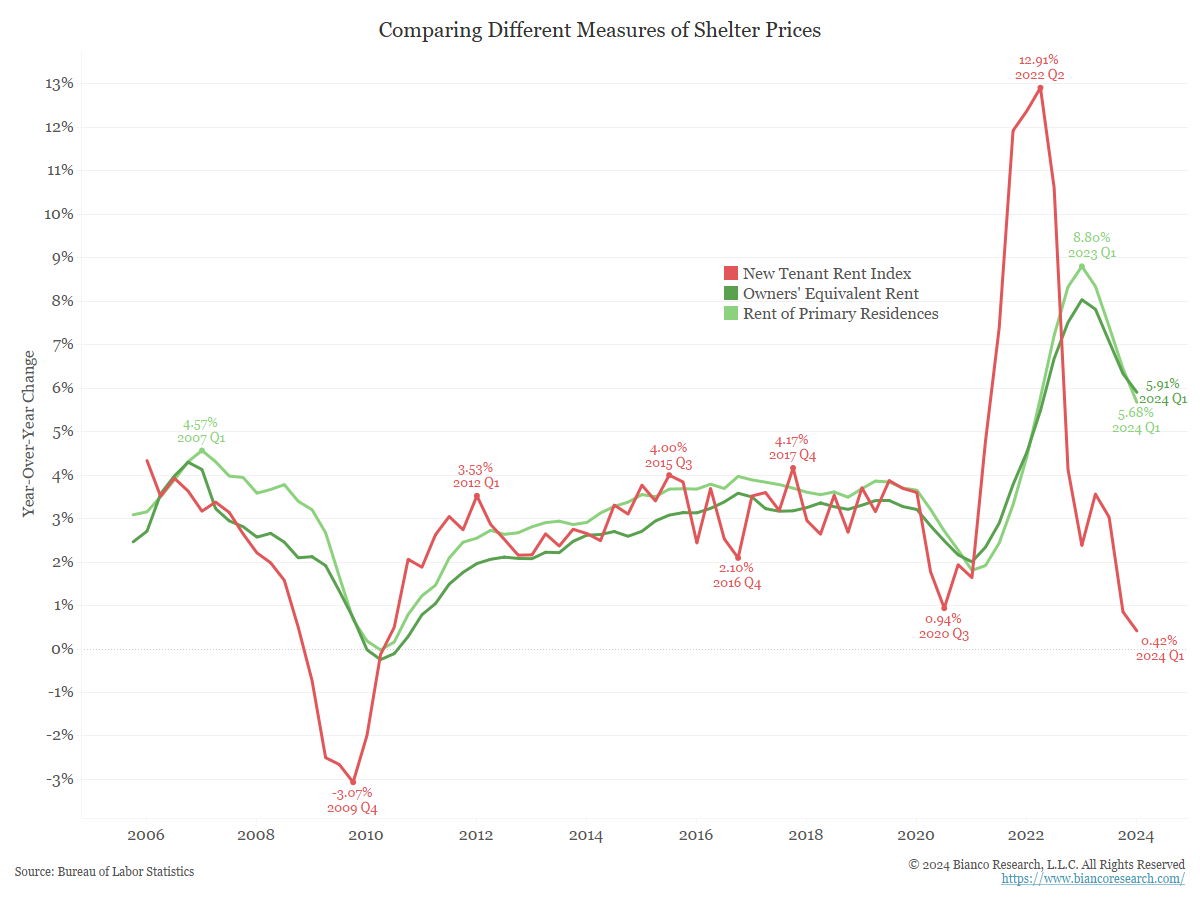

The level of deficit spending will not be solved at the ballot box. It will be solved by the market imposing discipline. When this will happen is an open question. The UK mini-budget debacle in September 2022 offers a potent roadmap.... Read More