Tag Archives: Markets

Skew is Toward Lower, Not Higher Sovereign Yields

Posted By Ben Breitholtz

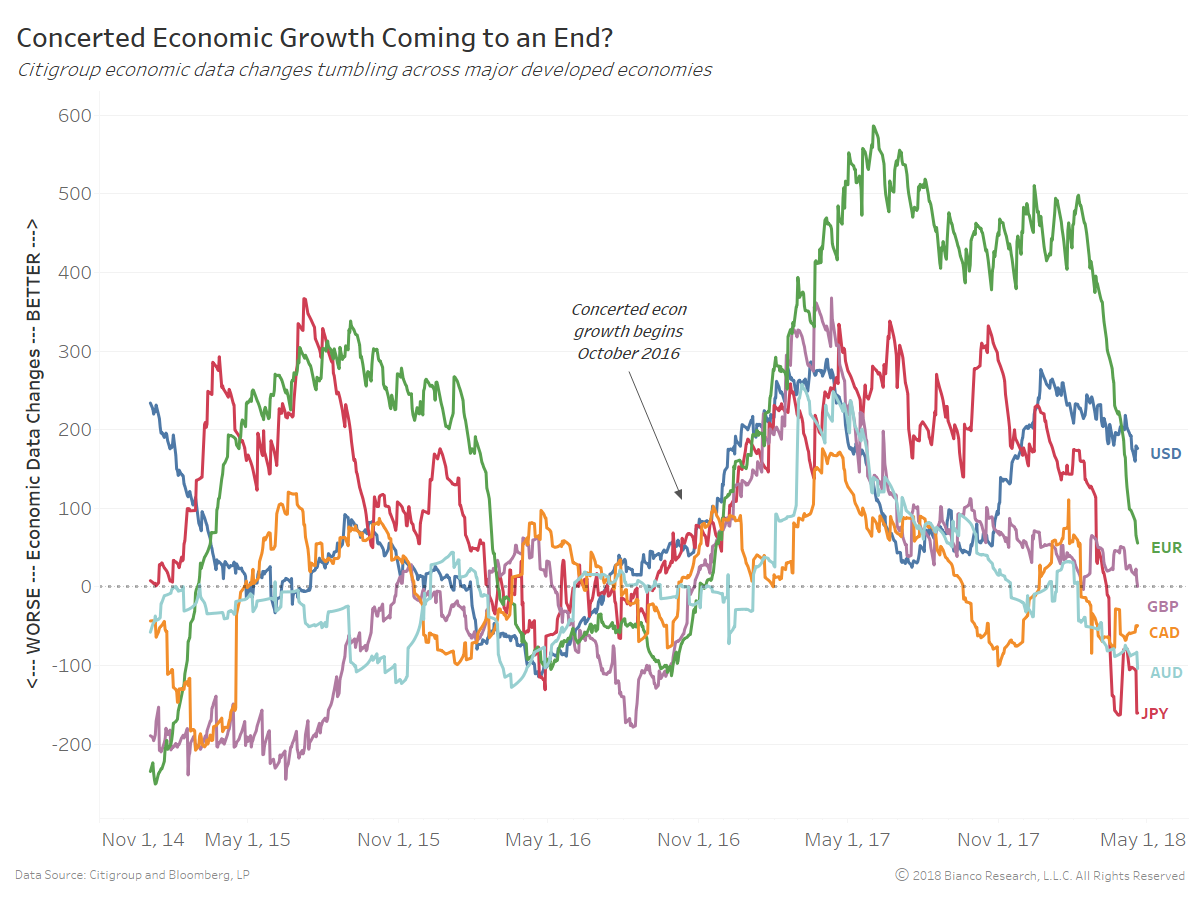

Inflation expectations have been rebounding with a rally across industrial metals and energy. But, enthusiasm for higher sovereign yields are not yet reflecting deteriorating economic growth across the globe. Our outlook suggests a skew toward lower yields, not higher. The air has yet to come out of lofty survey expectations.... Read More

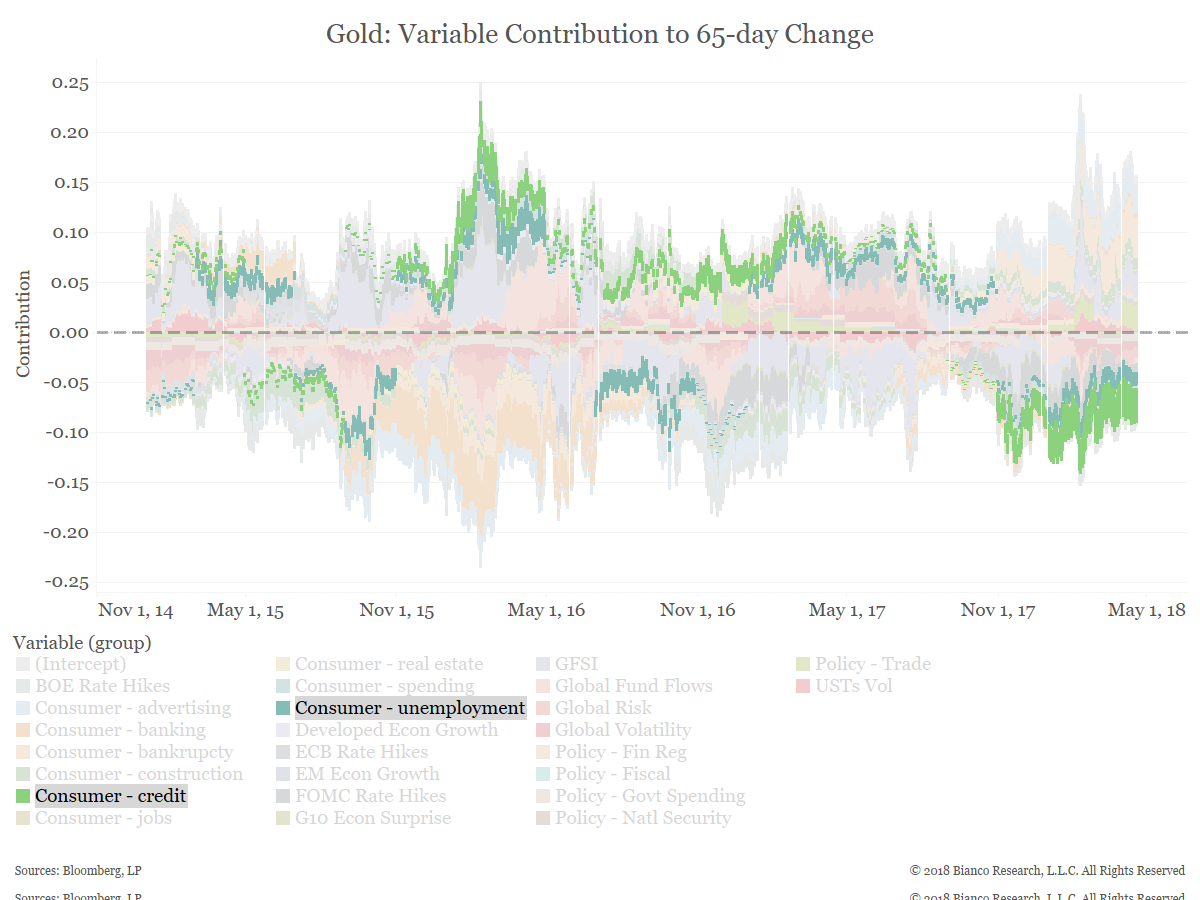

Weak Consumer Making Gold a Dollar Trade

Posted By Peter Forbes

Weakening consumer balance sheets are a headwind for gold performance. ... Read More

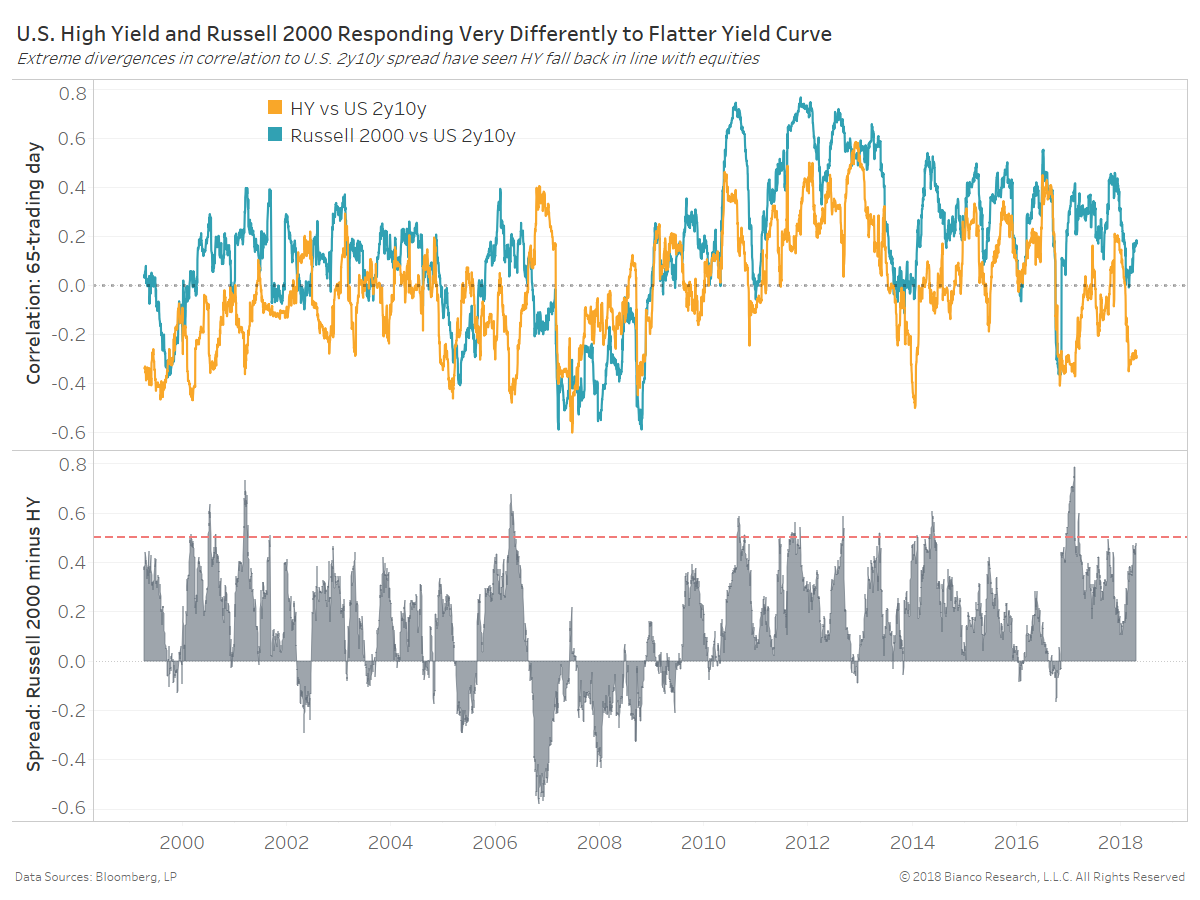

U.S. High Yields’ Odd Connection to the Yield Curve Will Soon End

Posted By Ben Breitholtz

U.S. high yield returns are oddly showing a negative correlation to the U.S. yield curve, unlike their equity brethren. History suggests high yield will snap back into line with equities, meaning potential exists for drawdowns nearing 6% in the months to come.... Read More

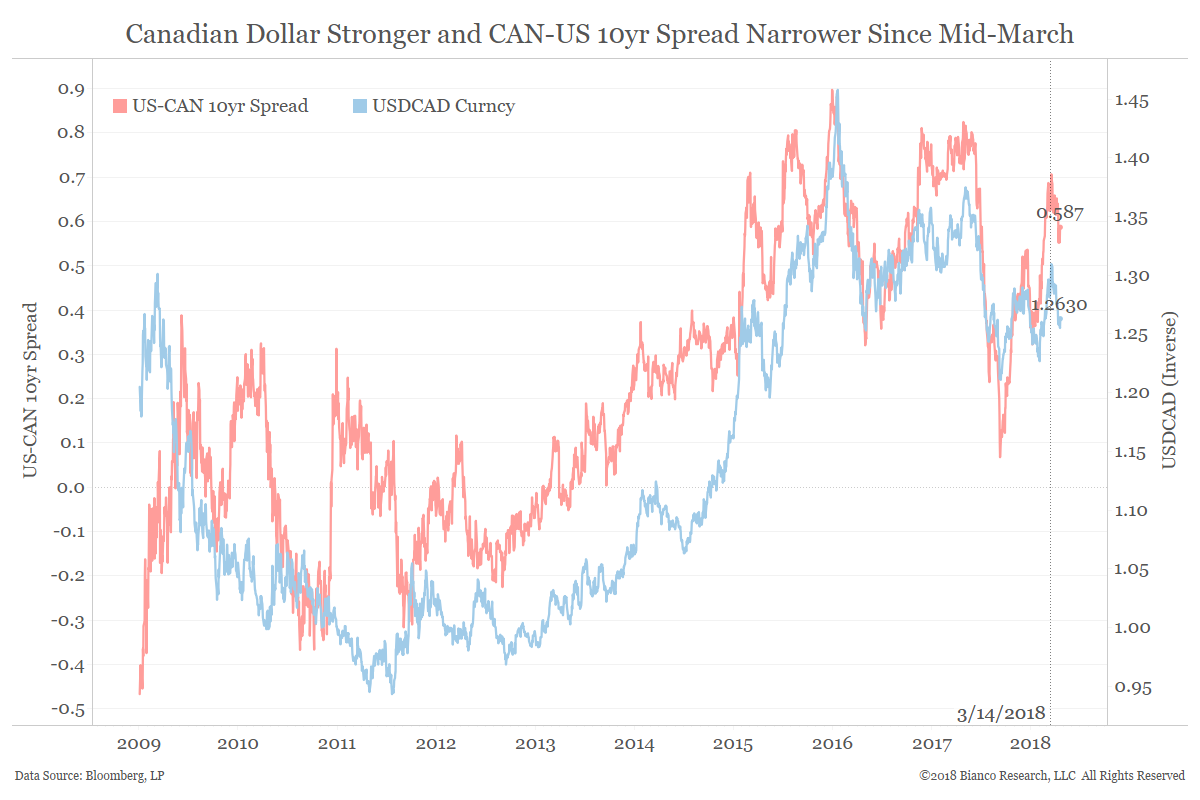

Poloz’s Patience May Sap Canadian Dollar Strength

Posted By Peter Forbes

The Bank of Canada is emphasizing patience in gauging the response to improving trade tensions with the U.S. The more dovish stance is likely to temper Canadian dollar strength. ... Read More

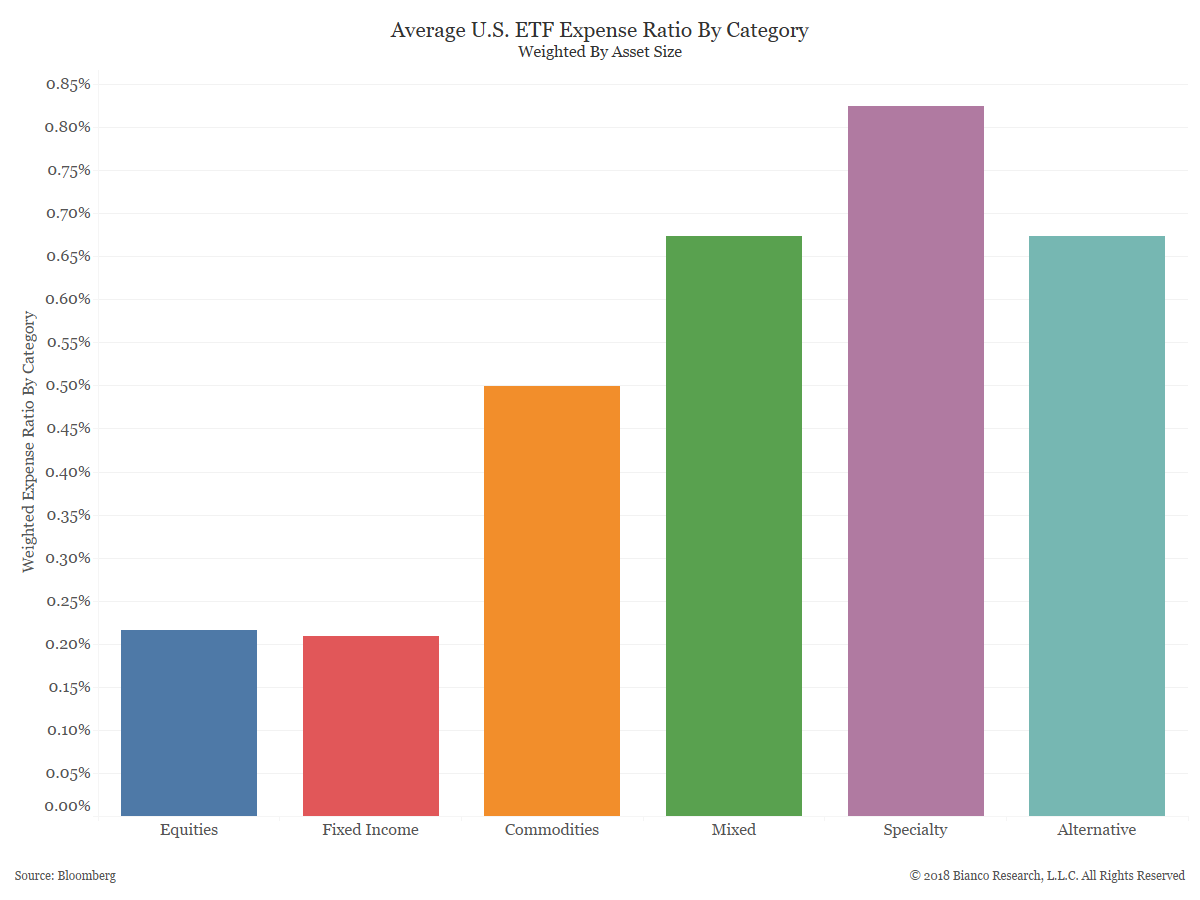

A Quick Glimpse of the ETF Industry

Posted By Greg Blaha

A quick glimpse at the ETF industry... Read More

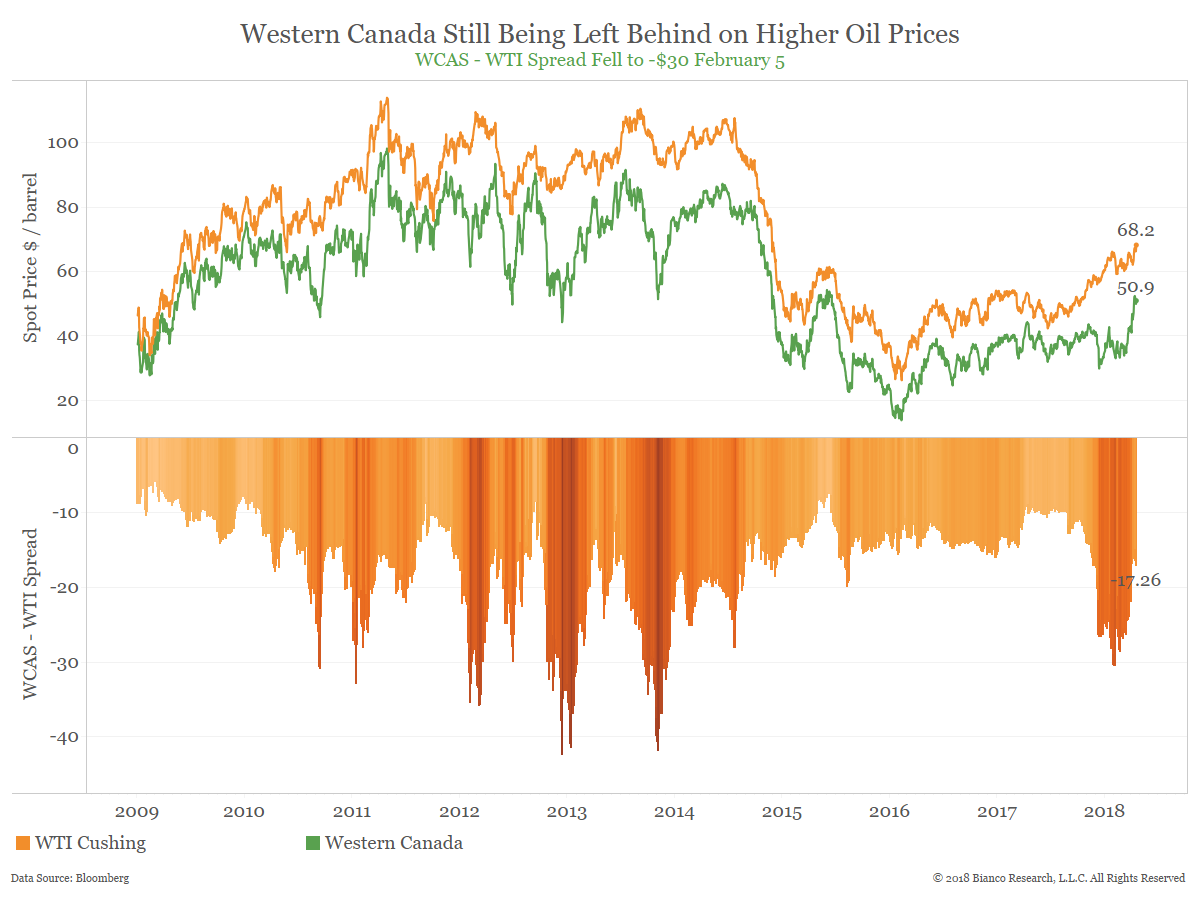

Hits Keep Coming for Canadian Oil Production

Posted By Peter Forbes

Dark skies are on the horizon for Western Canadian oil.... Read More

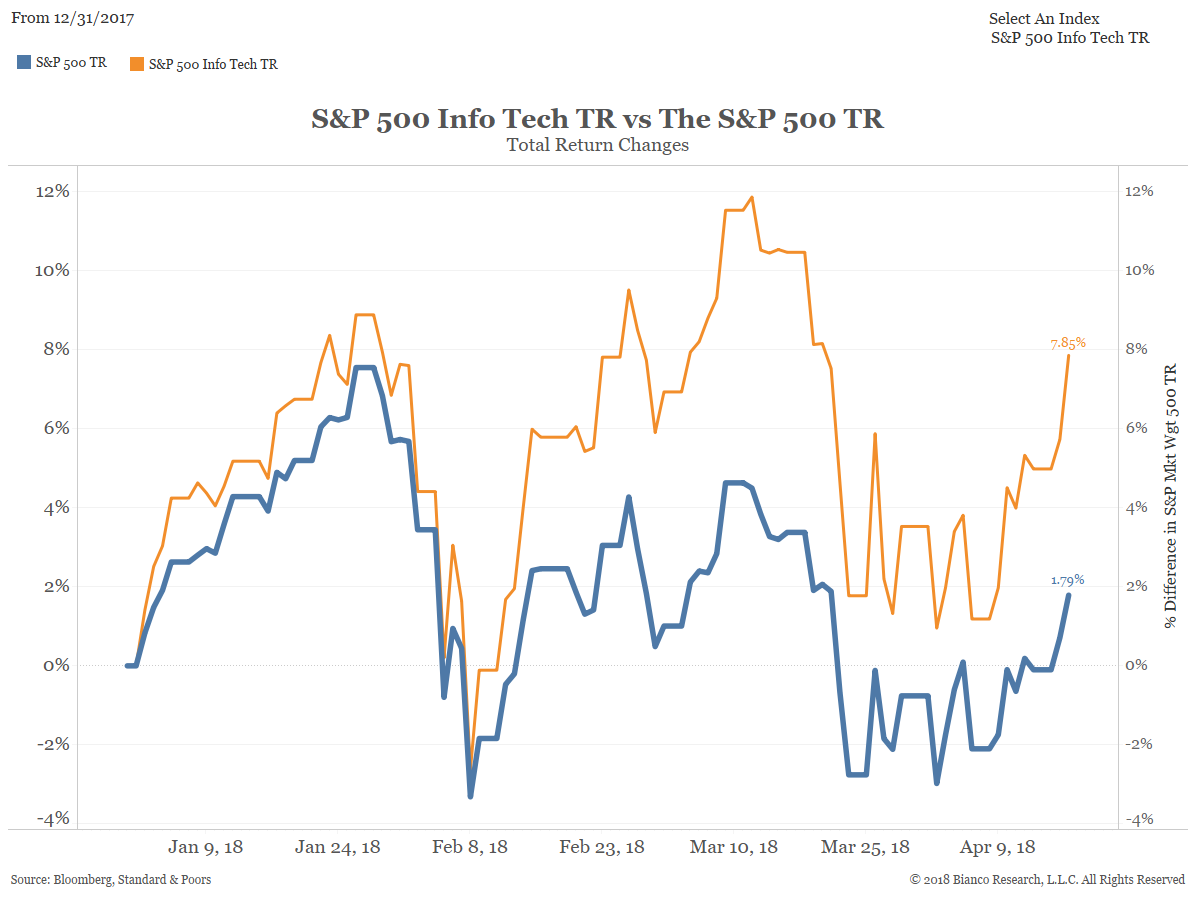

Stock Total Returns In 2018 – Tech Stocks up 7.85%

Stock returns since the beginning of 2018.... Read More

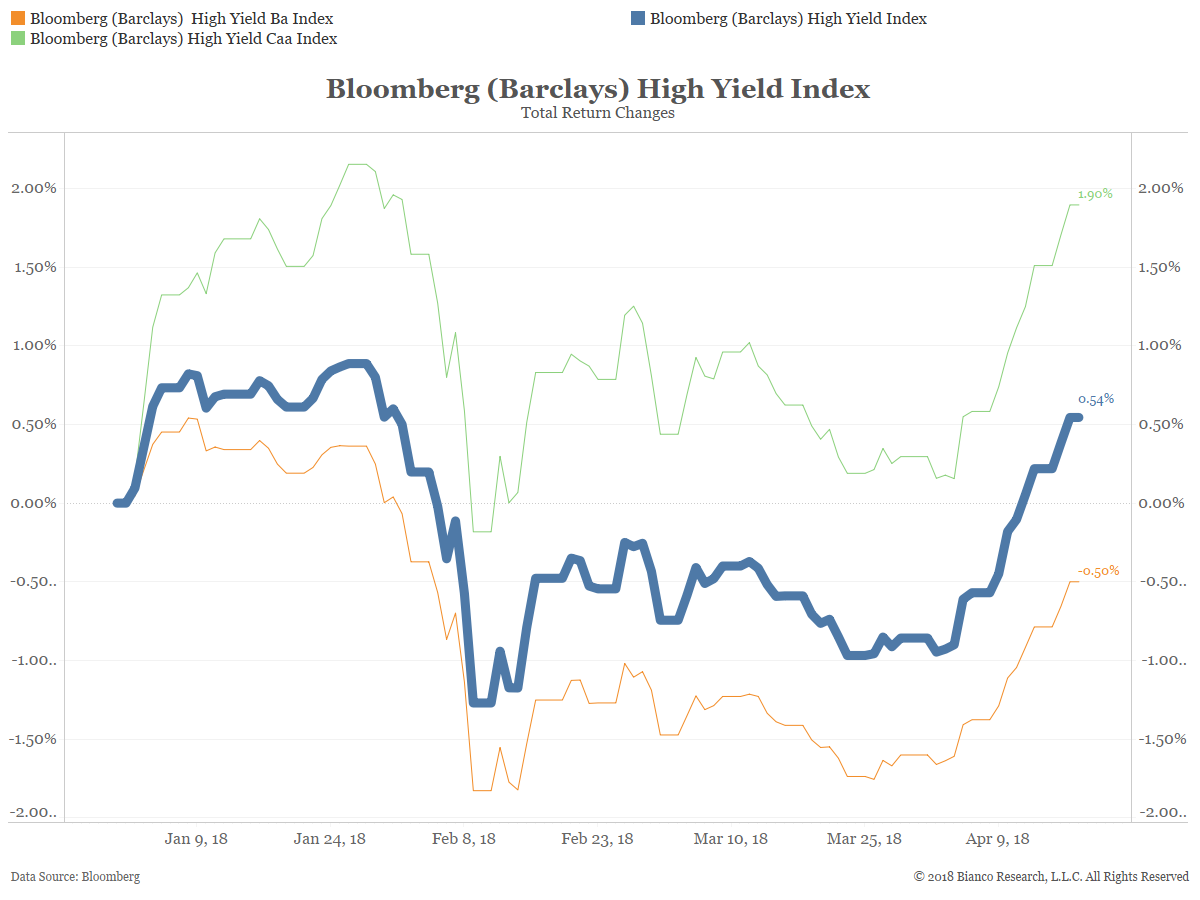

Bond Total Returns in 2018 – High Yield up 0.54%

Bond total returns since the beginning of 2018.... Read More

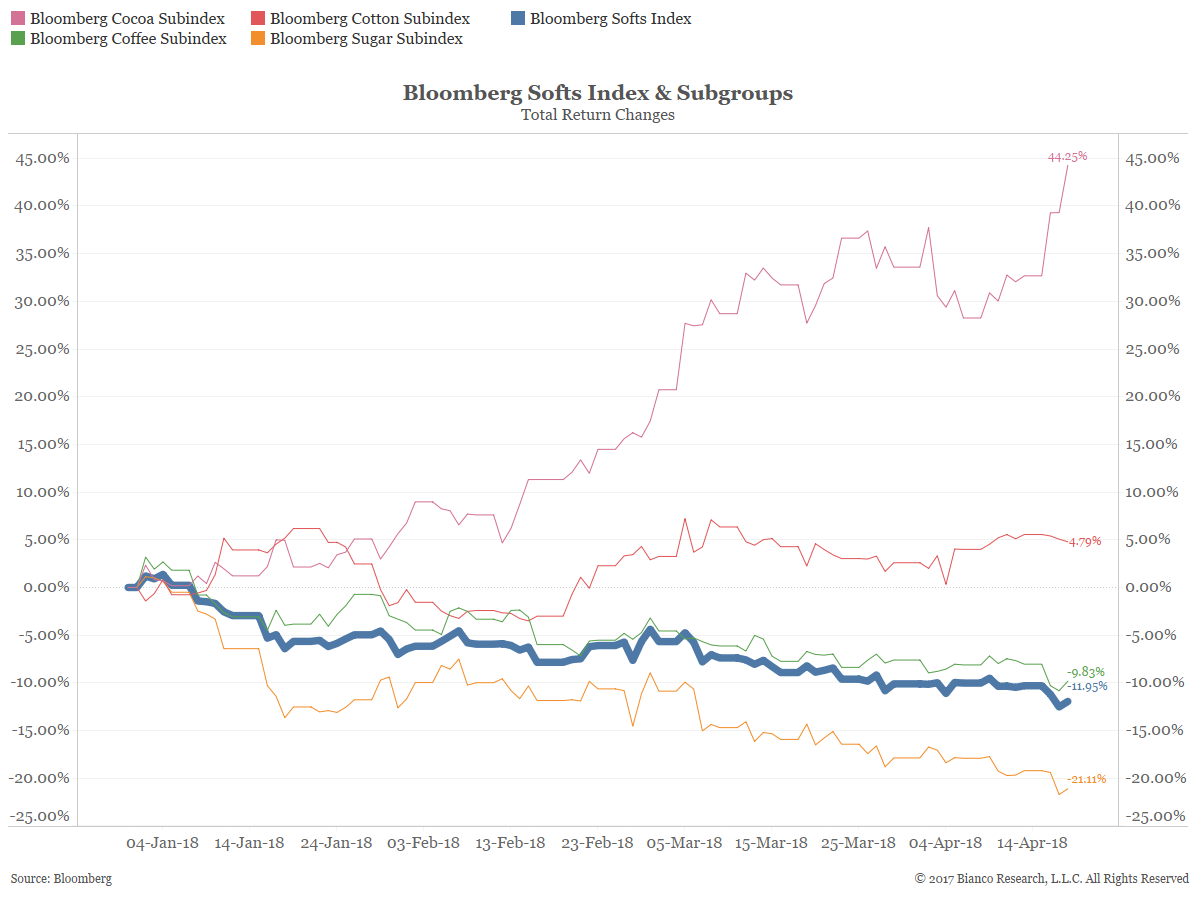

Commodity Total Returns in 2018 – Softs up 44%

Commodity total returns since the beginning of 2018.... Read More

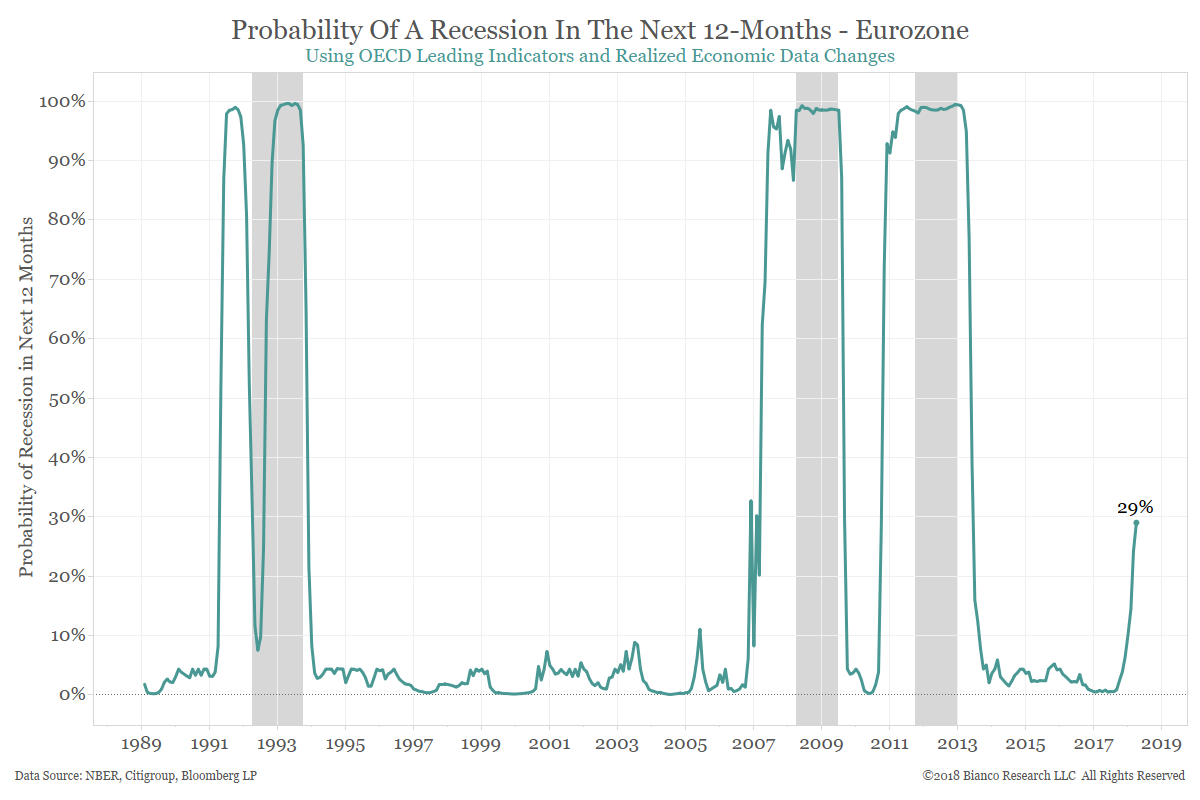

Recession Forecast Clear for U.S. but Darkening for Eurozone

Posted By Peter Forbes

A better approach to 12-month recession forecasts sounds an all-clear for the U.S. but shows slowing growth in Europe presents a real threat. ... Read More

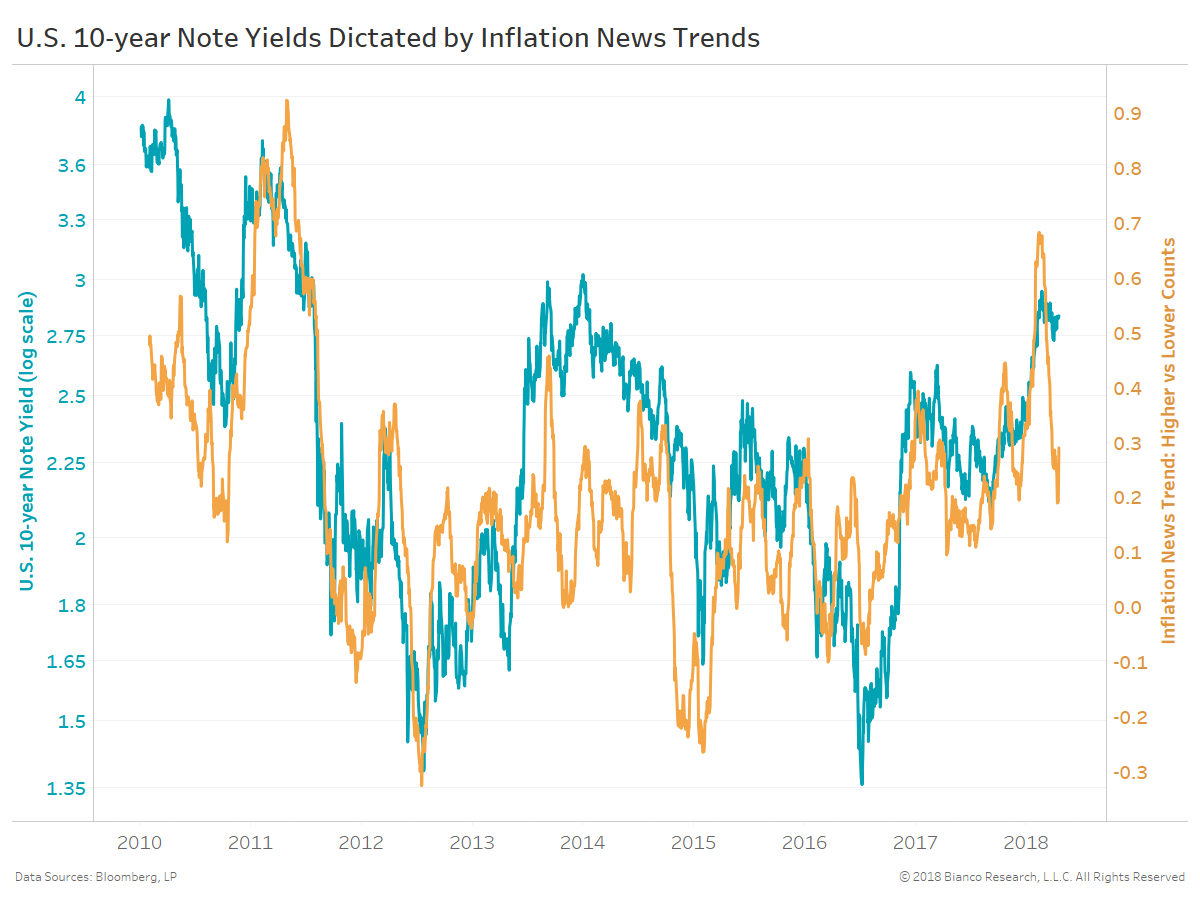

Bond Investors are Shouting ‘Put Up or Shut Up’ Over Inflation

Posted By Ben Breitholtz

U.S. Treasury investors are NOT necessarily underestimating the Fed or inflation's potential to rise, but requiring rising prices and wages to truly show up in realized data. This is the 'put up or shut up' phase after investors priced in improving surveys for growth and inflation earlier this year. Range-trading will persist as long as inflation news trends remain subdued. ... Read More

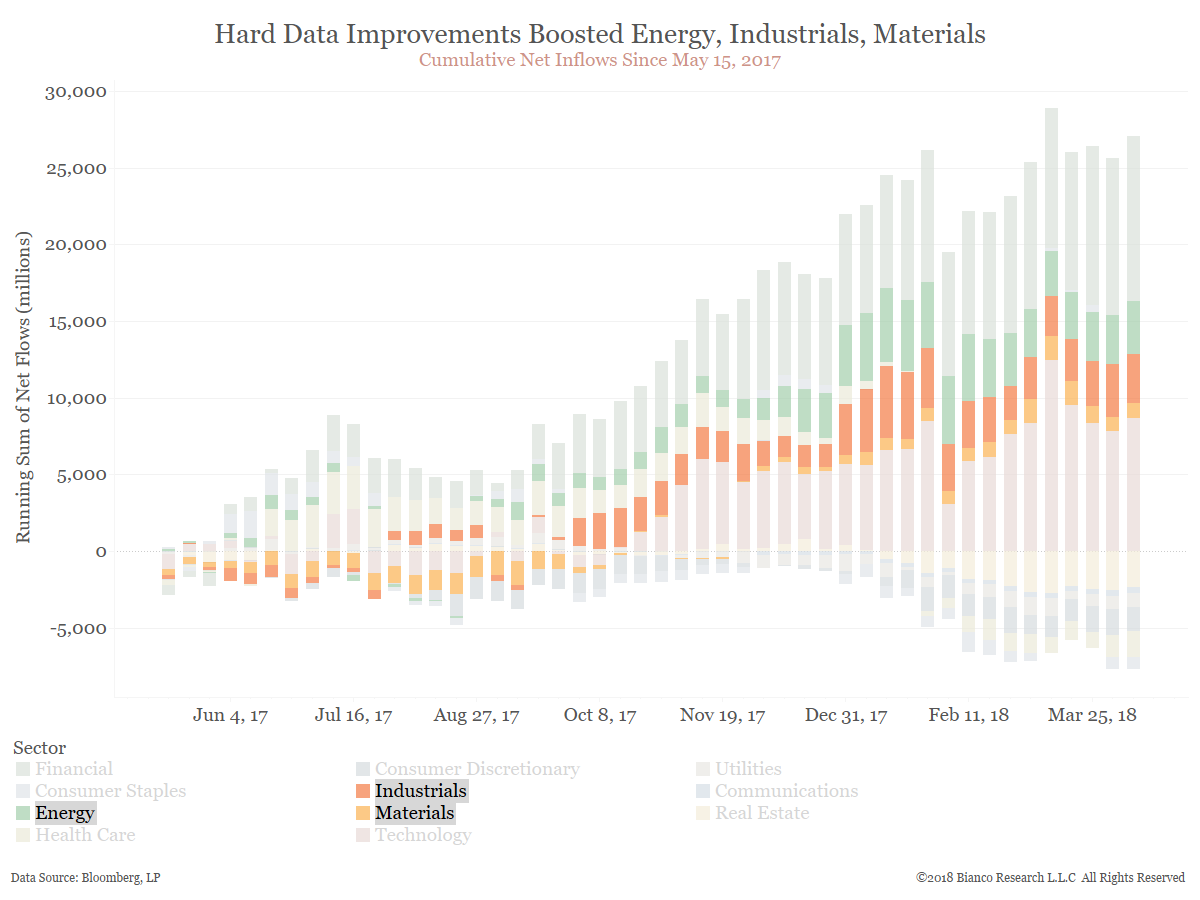

Decision Time for Hard Data, Cyclical Sectors

Posted By Peter Forbes

Decelerating realized economic growth in the Eurozone threatens to undermine cyclical sector performance in the U.S. ... Read More

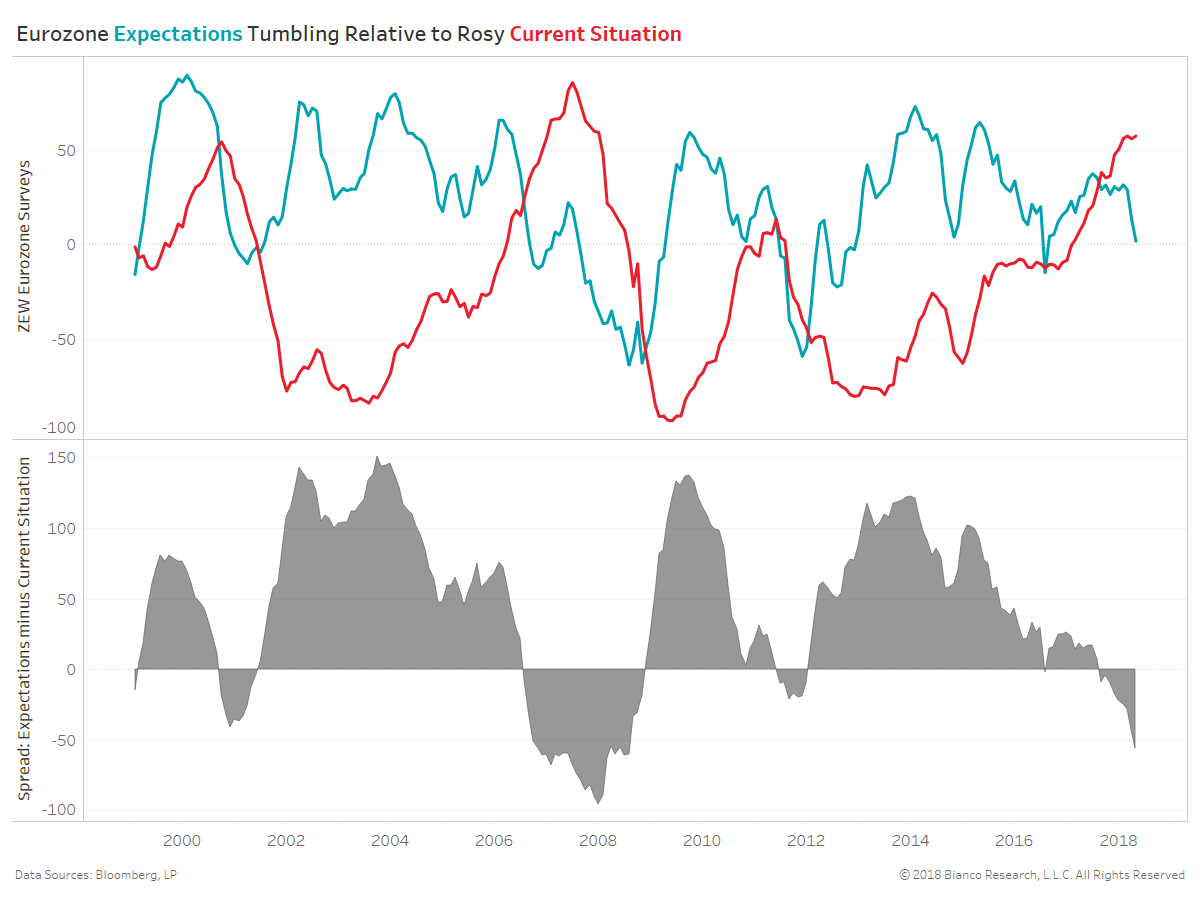

Eurozone Expectations Tumbling, But No Reason to Utter ‘Recession’ (Yet)

Posted By Ben Breitholtz

Economic expectations across the Eurozone are tumbling even while the assessment of current activity remains rosy. The Stoxx 50 will likely struggle given this divergence. But, do not rush to recession talk as these very surveys have disconnected from realized economic growth.... Read More

The New York Fed Miscalculates SOFR For Two Weeks

Posted By Jim Bianco

The New York Fed miscalculates its new LIBOR replacement, SOFR. ... Read More

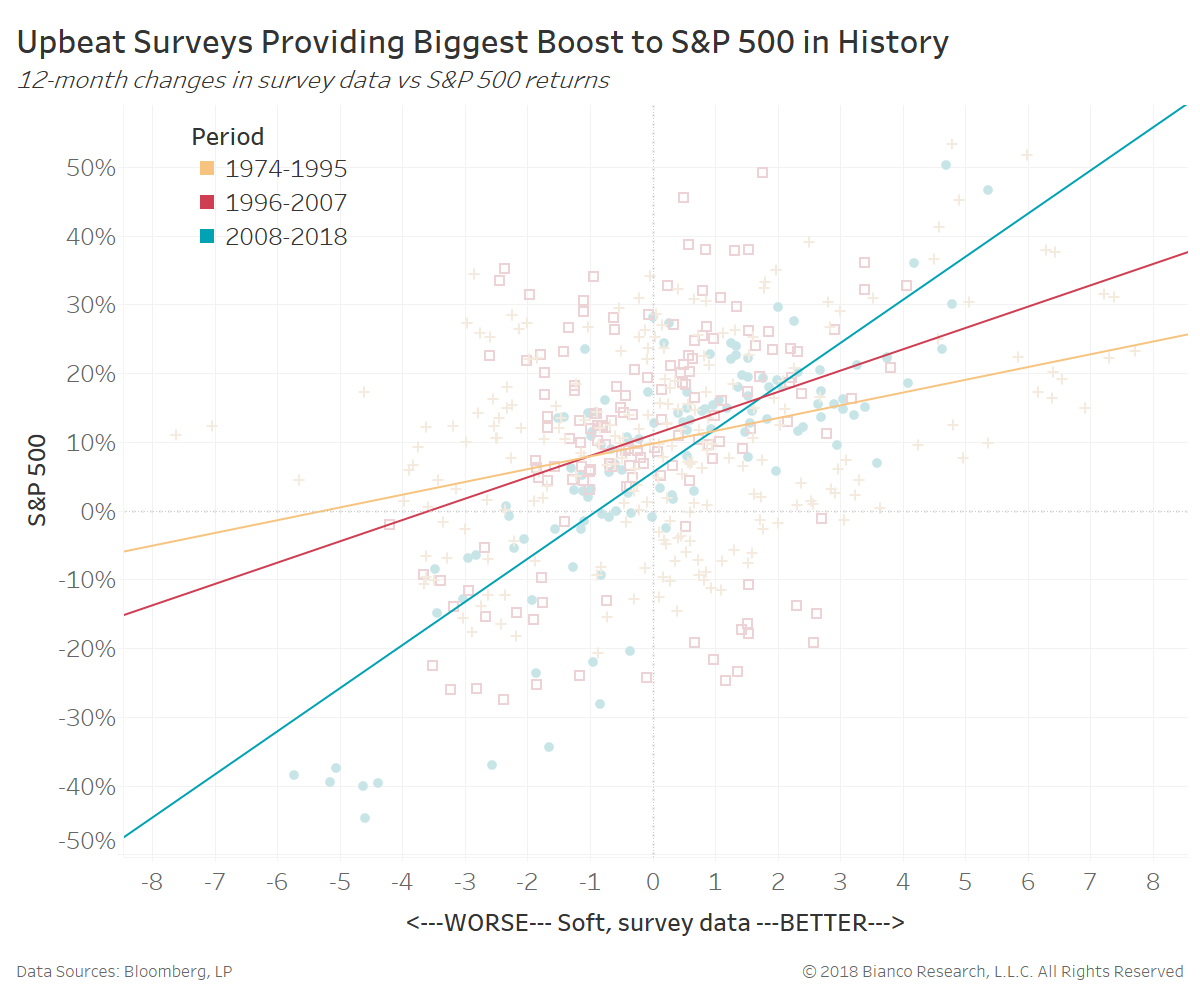

Have Surveys Become False Prophets?

Financial markets are unfortunately suffering from a circular reference due to group-think and herd mentality. We use the information and ideas from 'the group' as a heuristic to form our own opinions. The world has become exponentially more complicated and inter-connected, therefore to remain functional we allow the crowd to help us make decisions. Unfortunately, positioning in financial markets become polarized and surveys of the economy are of waning utility.... Read More

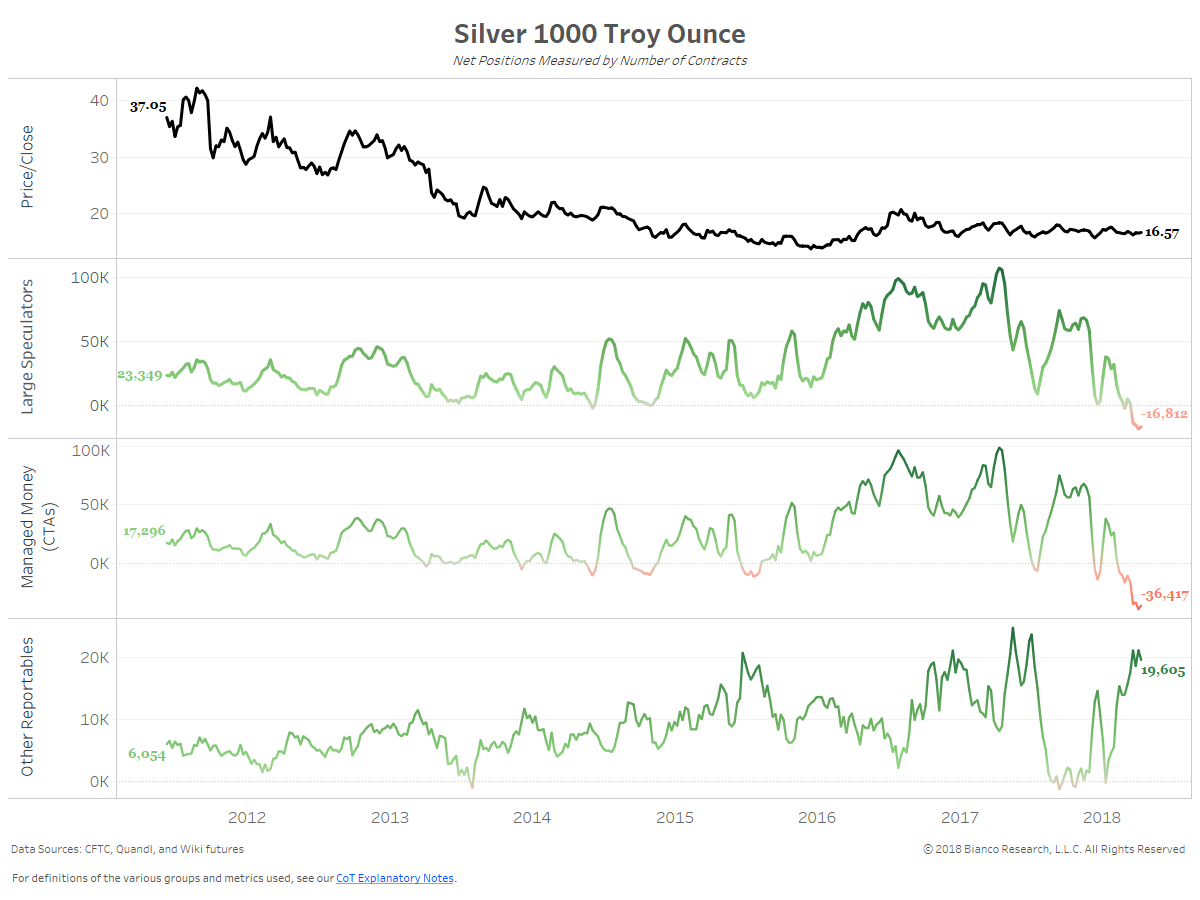

Massive Silver Short

Posted By Jim Bianco

Massive Silver Short by large speculators sets up a contrarian buy signal.... Read More

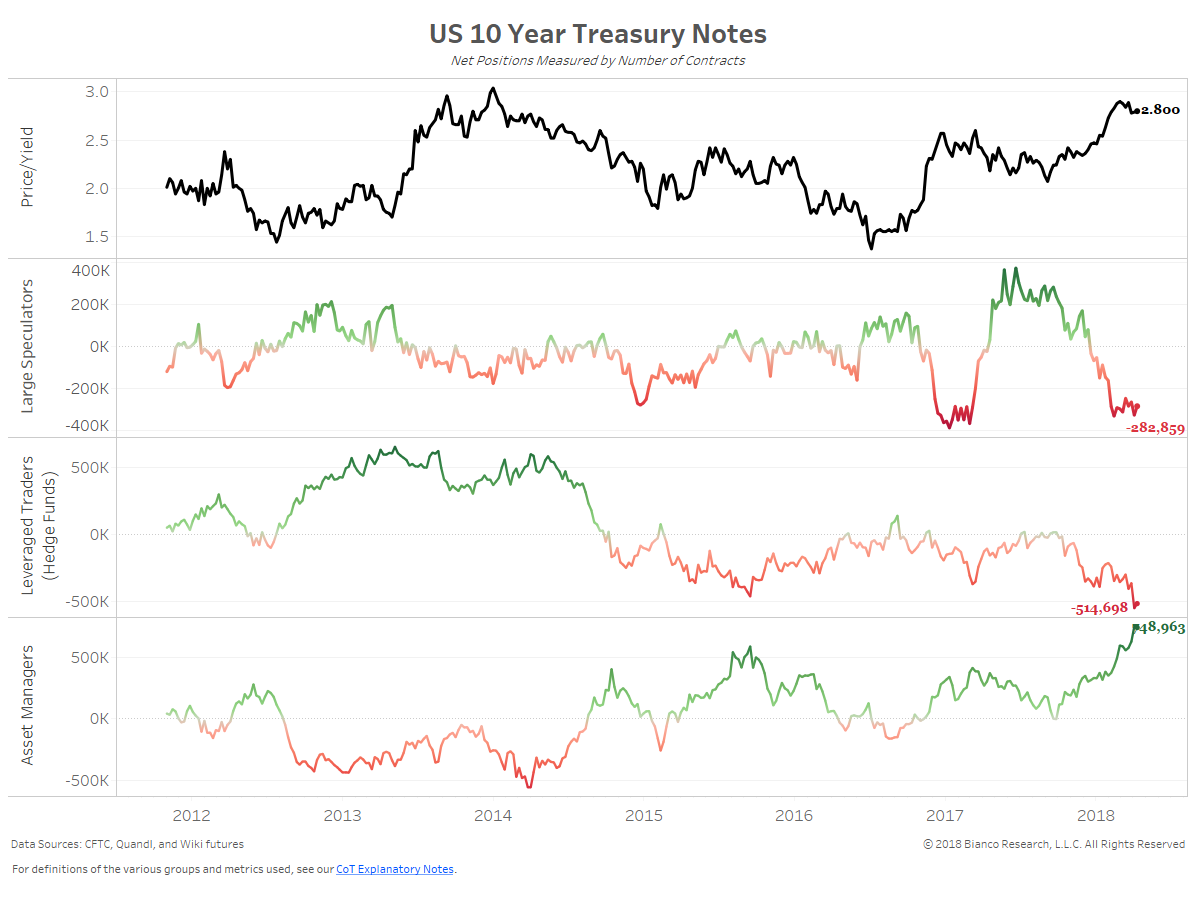

10-Year Treasury Specs Remain Heavily Short

10-Year speculators are near an extreme net short position.... Read More