Tag Archives: Markets

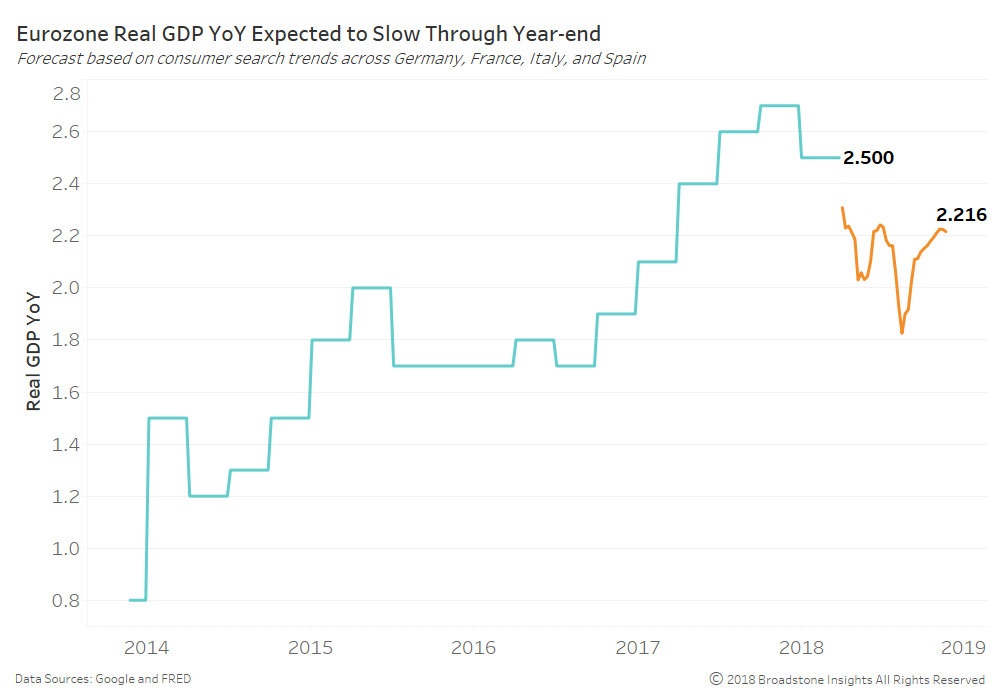

Slowing Eurozone Growth Telegraphed by Waning Consumer Search Trends

Posted By Ben Breitholtz

Consumer search trends within Germany, France, Italy, and Spain are reflecting slowing spend. Germany leads the pack in a deteriorating outlook, but some bright spots exist in Spain. Real GDP is expected to slow toward 2.2% year-over-year into year-end.... Read More

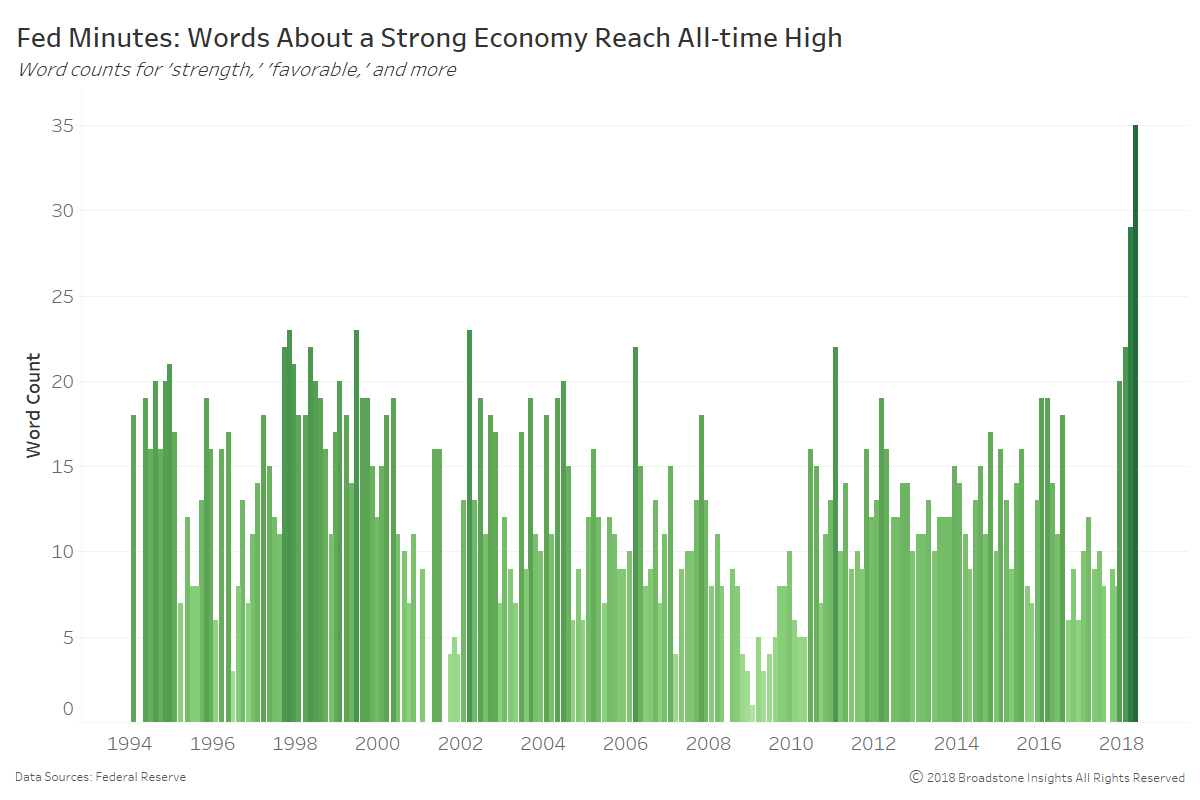

Strength and Agreement Pervasive at Fed

Posted By Ben Breitholtz

Uncertainty reflected by both Fed officials and markets over tightening policy has become ultra-low. The Fed is transitioning away from not only financial stability concerns, but also employment in general. The consumer's ability to remain healthy and spend will dictate policy.... Read More

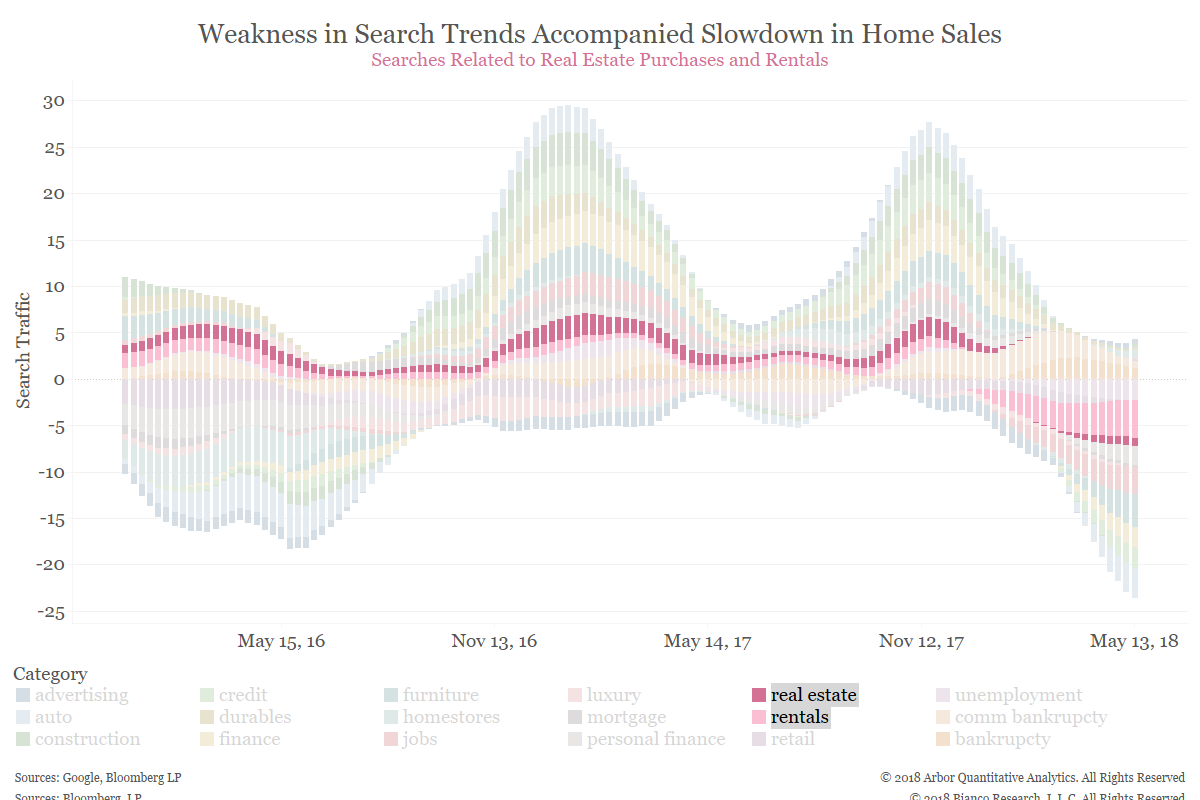

Falling Interest in Rental Housing Bearish for Metals, Staples

Posted By Peter Forbes

Declining search traffic for rental housing is bearish for industrial metals and a number of typically non-cyclical industries in the S&P 500. ... Read More

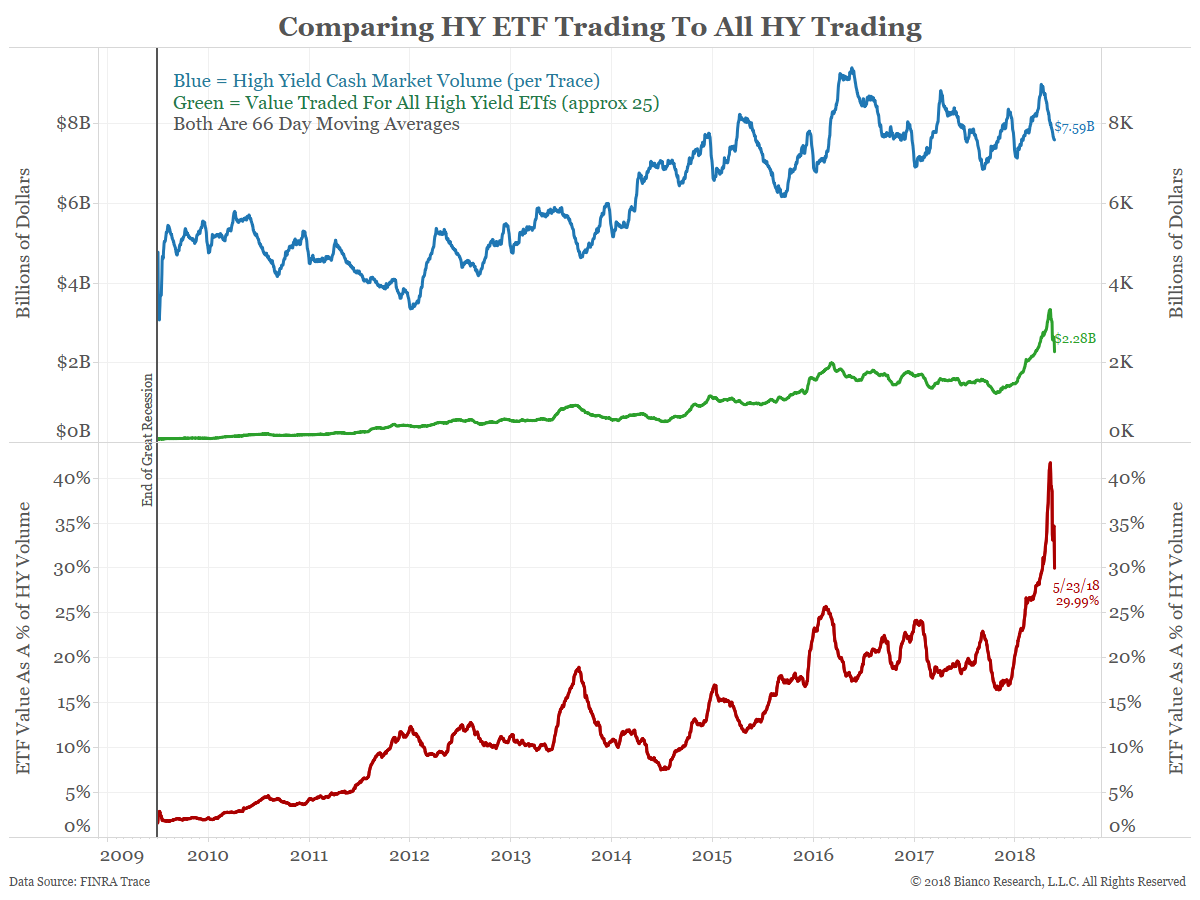

High Yield ETF Volume and Flows Update

Posted By Ryan Malo

An updated look at high yield ETFs... Read More

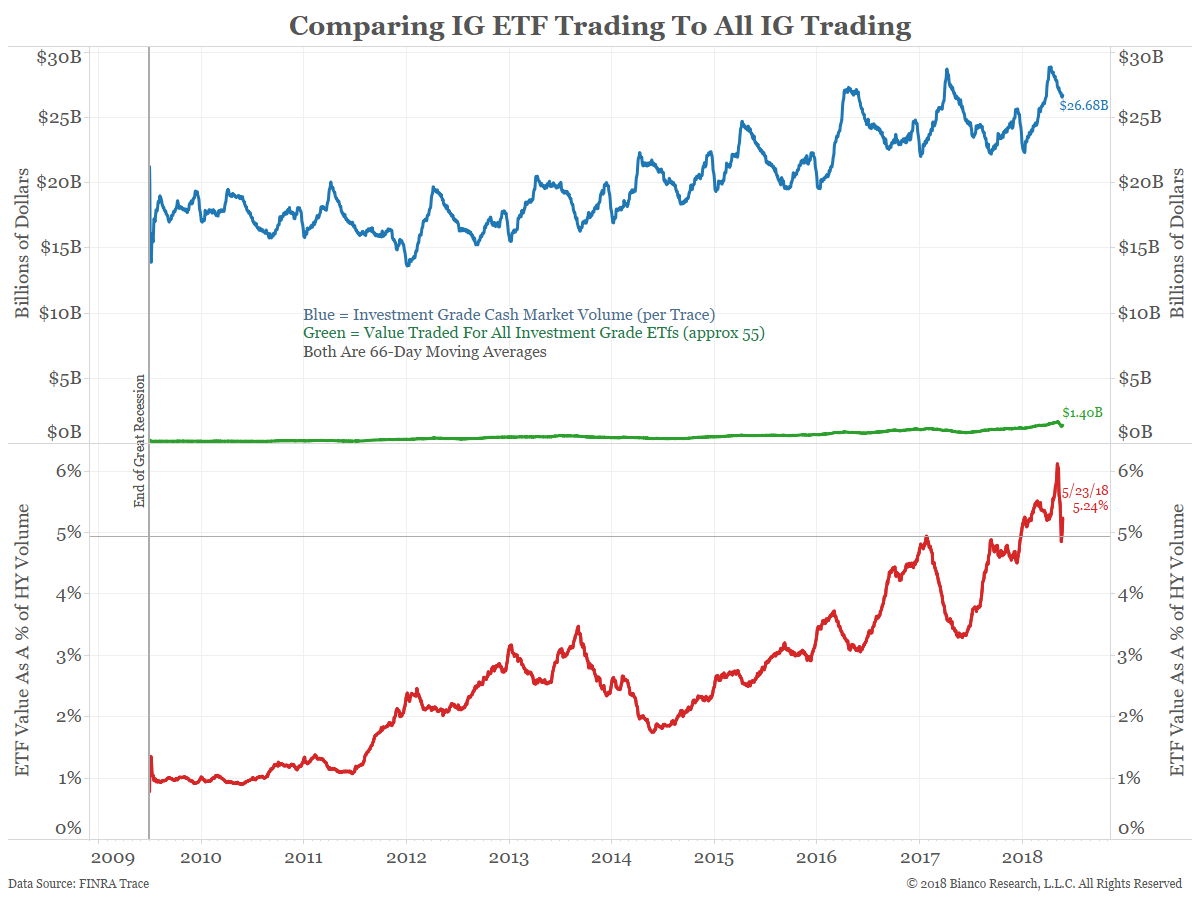

Investment Grade ETF Volume and Flows Update

Posted By Ryan Malo

An updated look at investment grade ETFs... Read More

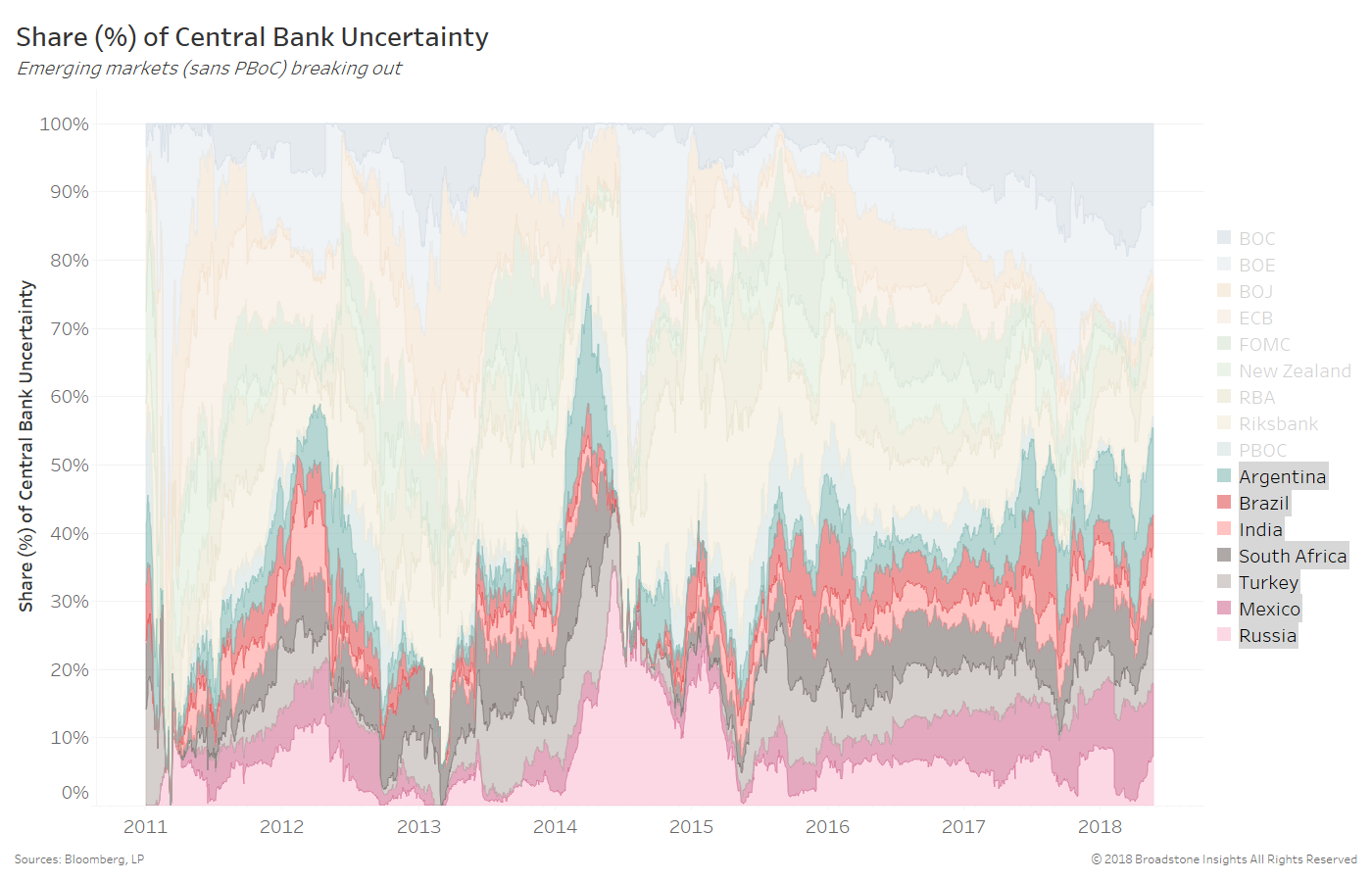

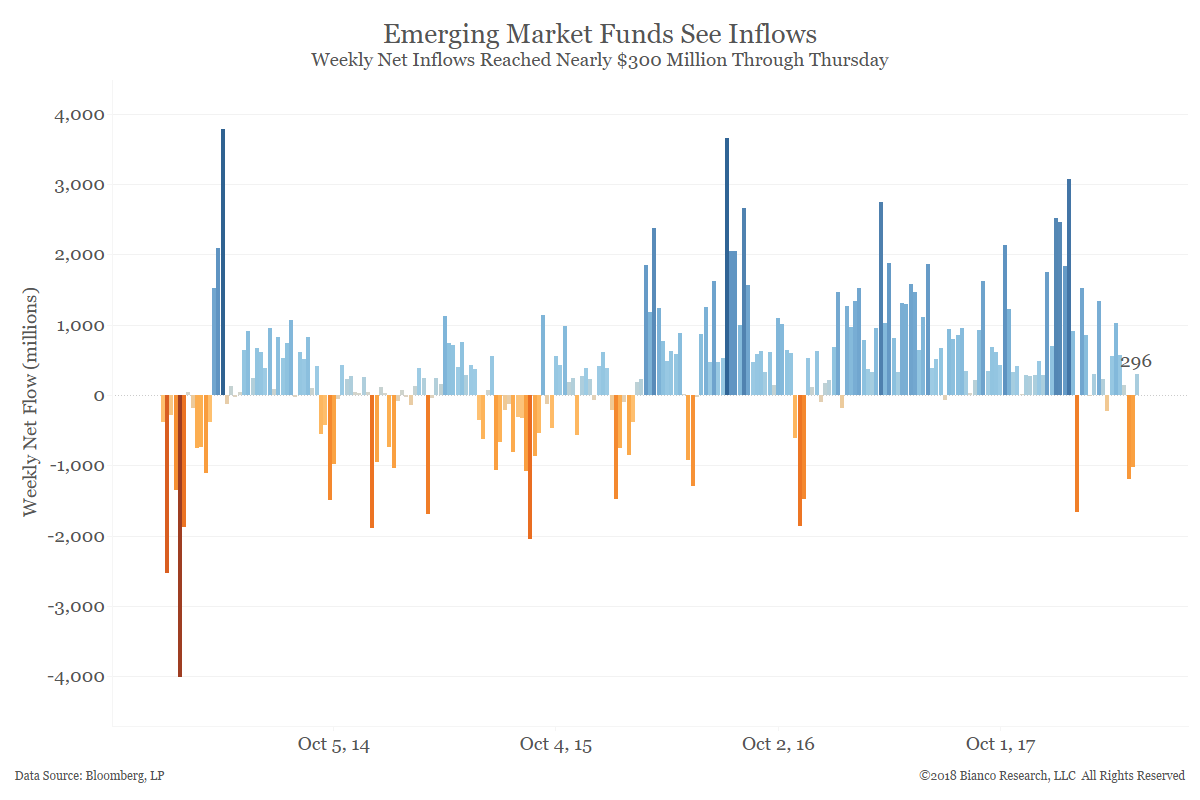

Percolating Uncertainty Across EM Likely to Boil Over

Posted By Ben Breitholtz

Emerging markets have broken out to heightened levels of uncertainty regarding central bank actions and currency returns. We believe ulta-low concern from the FOMC, ECB, and BoJ will not last, meaning U.S. 10-year yields could very well make a return to sub 3.00% in the near-term.... Read More

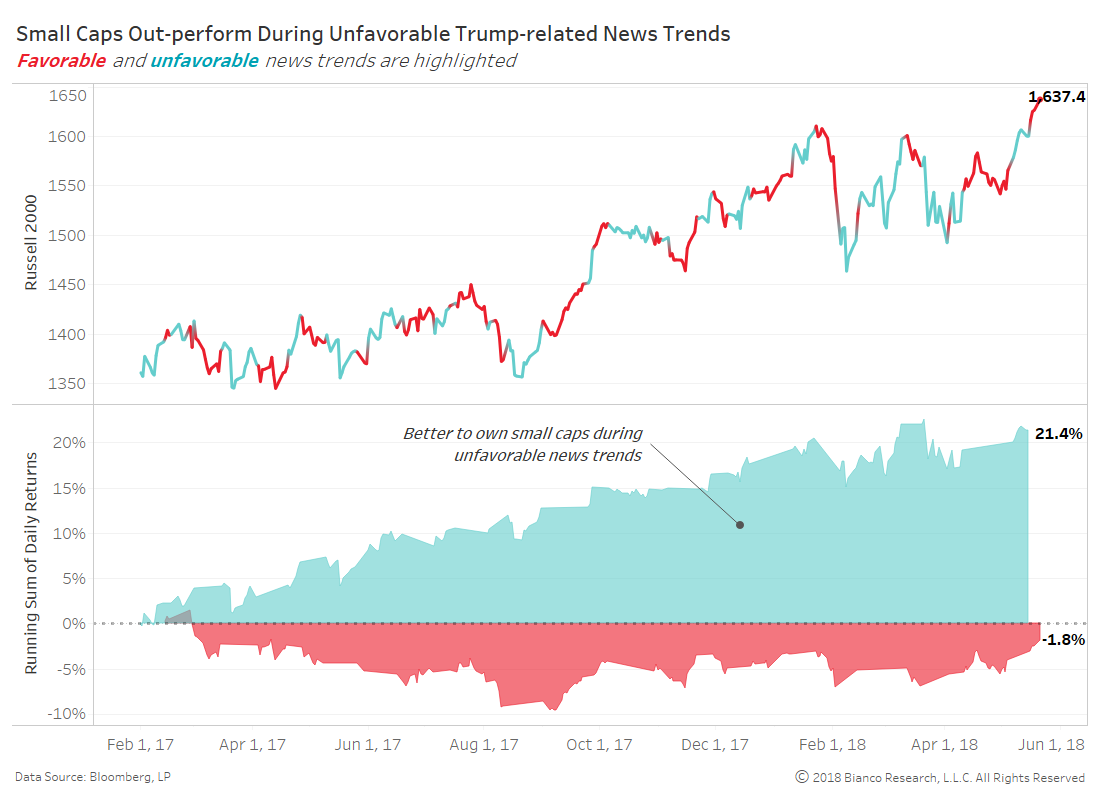

Goodbye, Fed Put and Hello, Trump Put

Posted By Ben Breitholtz

The Fed put may very well have been replaced by a Trump put. Investors appears pre-programmed to anticipate a run of unfavorable news coverage of Trump will be corrected in the days and weeks ahead. Small caps and technology equities have greatly out-performed following these periods of unfavorable Trump-related news trends.... Read More

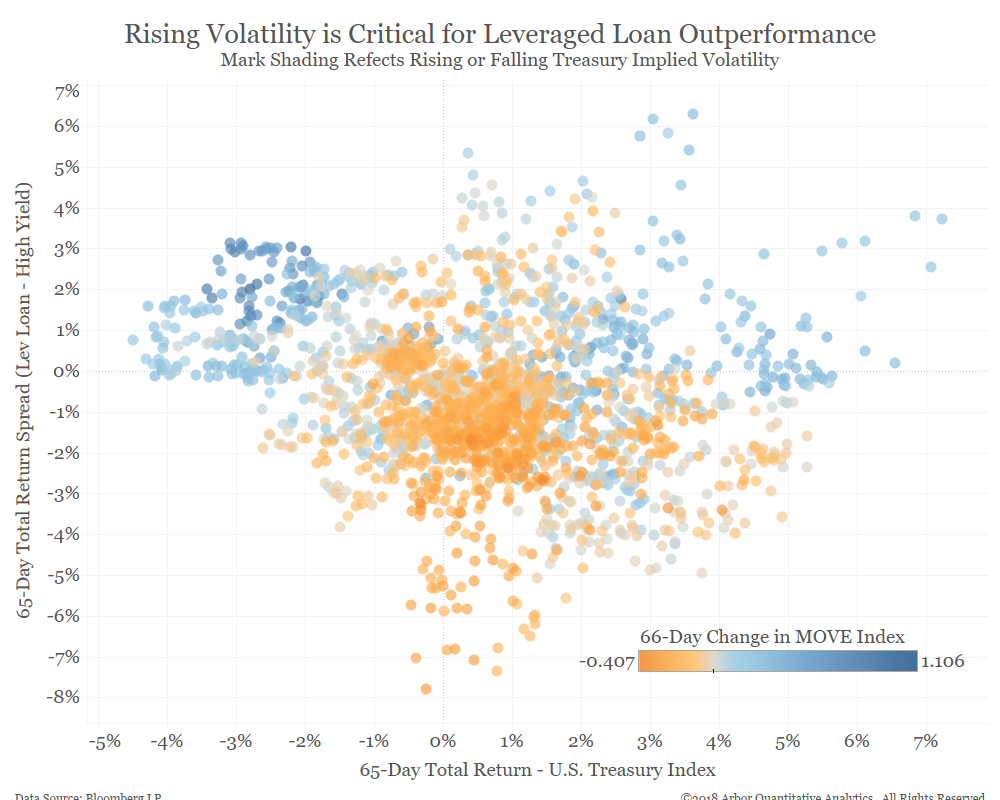

Can Leveraged Loans Keep Up the Pace?

Posted By Peter Forbes

Leveraged loans are booming as investors chase higher yields and position for rising rates. Bond market volatility needs to rise for leveraged loans to keep outperforming high yield bonds. ... Read More

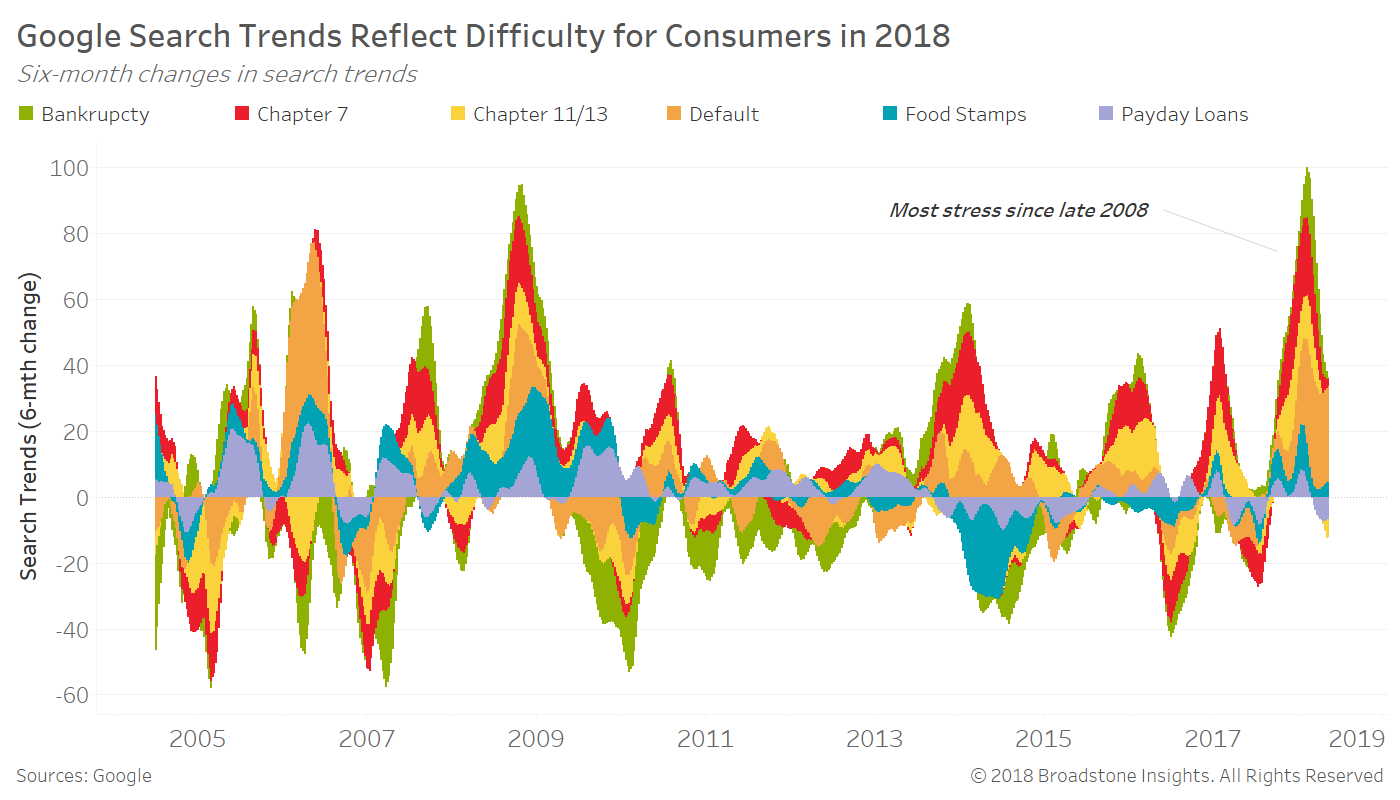

Worsening Consumer Trends Reflect Rising Delinquency Rates

Posted By Ben Breitholtz

Google search trends are reflecting a rise in consumer stress and waning spending patterns. Forecasts show delinquencies across the top 100 banks could rise from 2.5% to 3.7% in the year ahead. Defensive sectors should provide better shelter than banks and diversified financials.... Read More

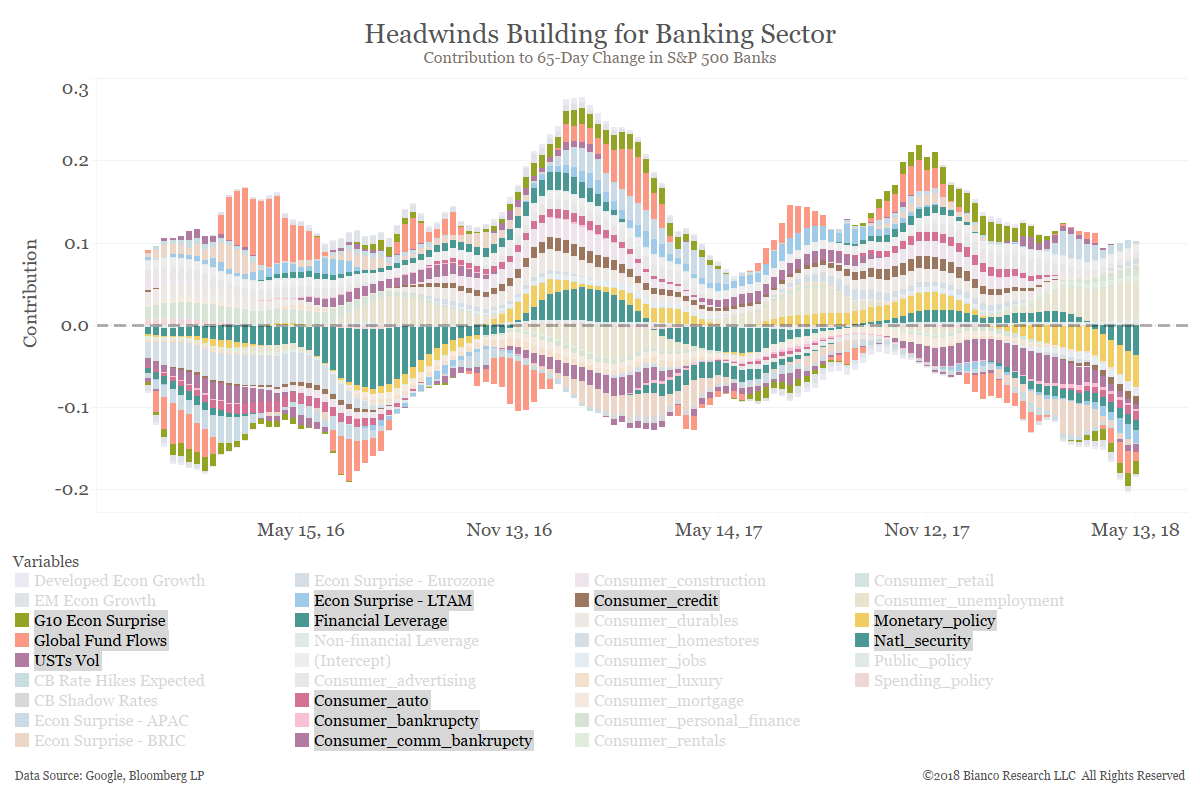

Insurance an Option as Storm Builds for Banks

Posted By Peter Forbes

U.S. bank equities face rising headwinds from weaker consumers, rising uncertainty, and slowing growth. The insurance sector is better positioned to ride out the storm. ... Read More

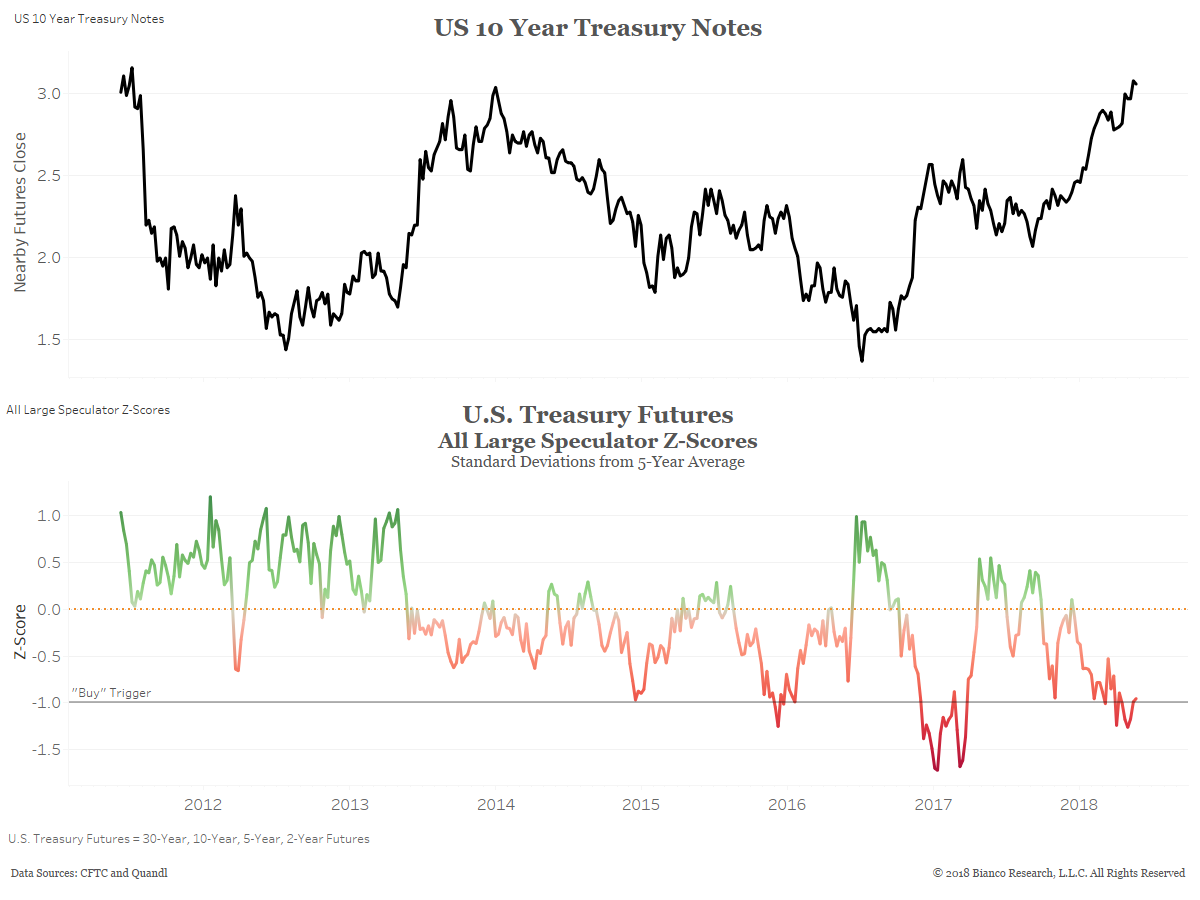

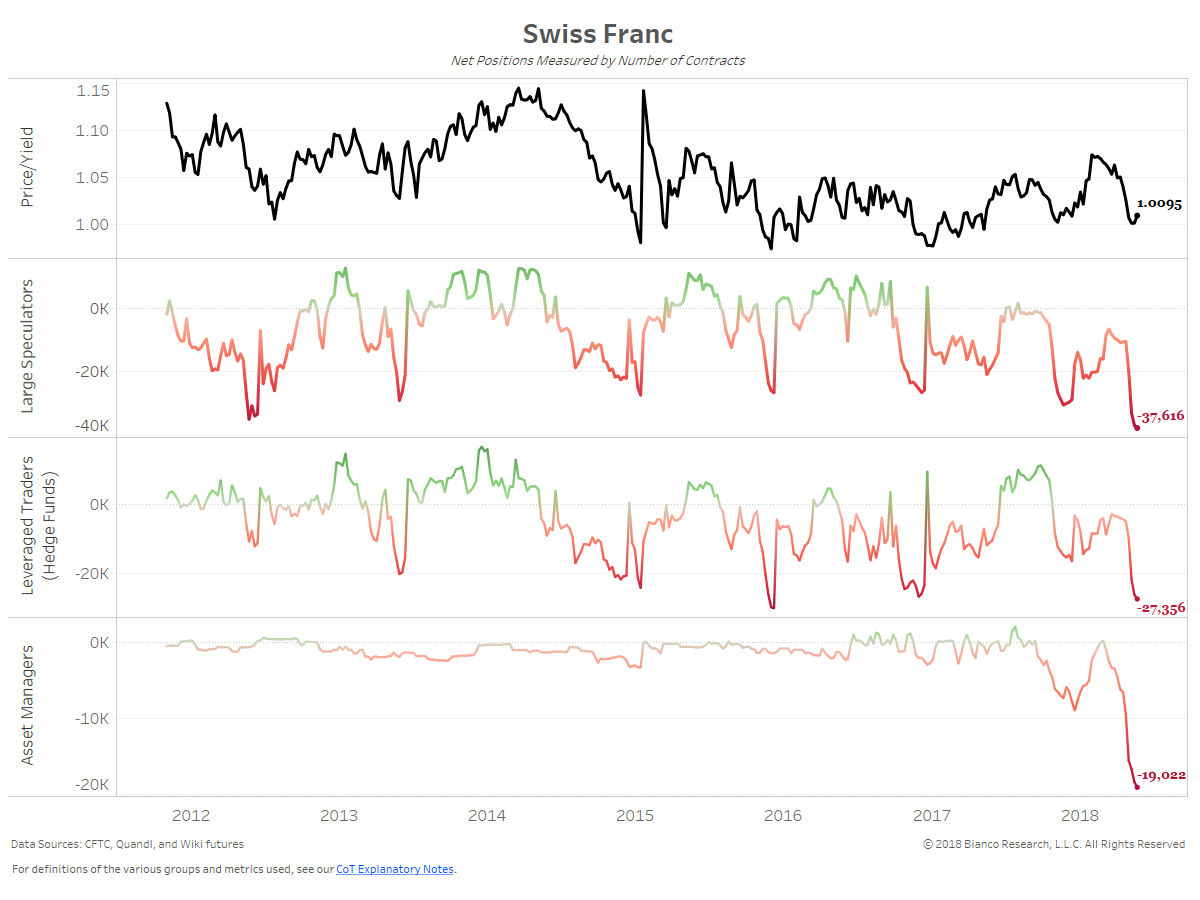

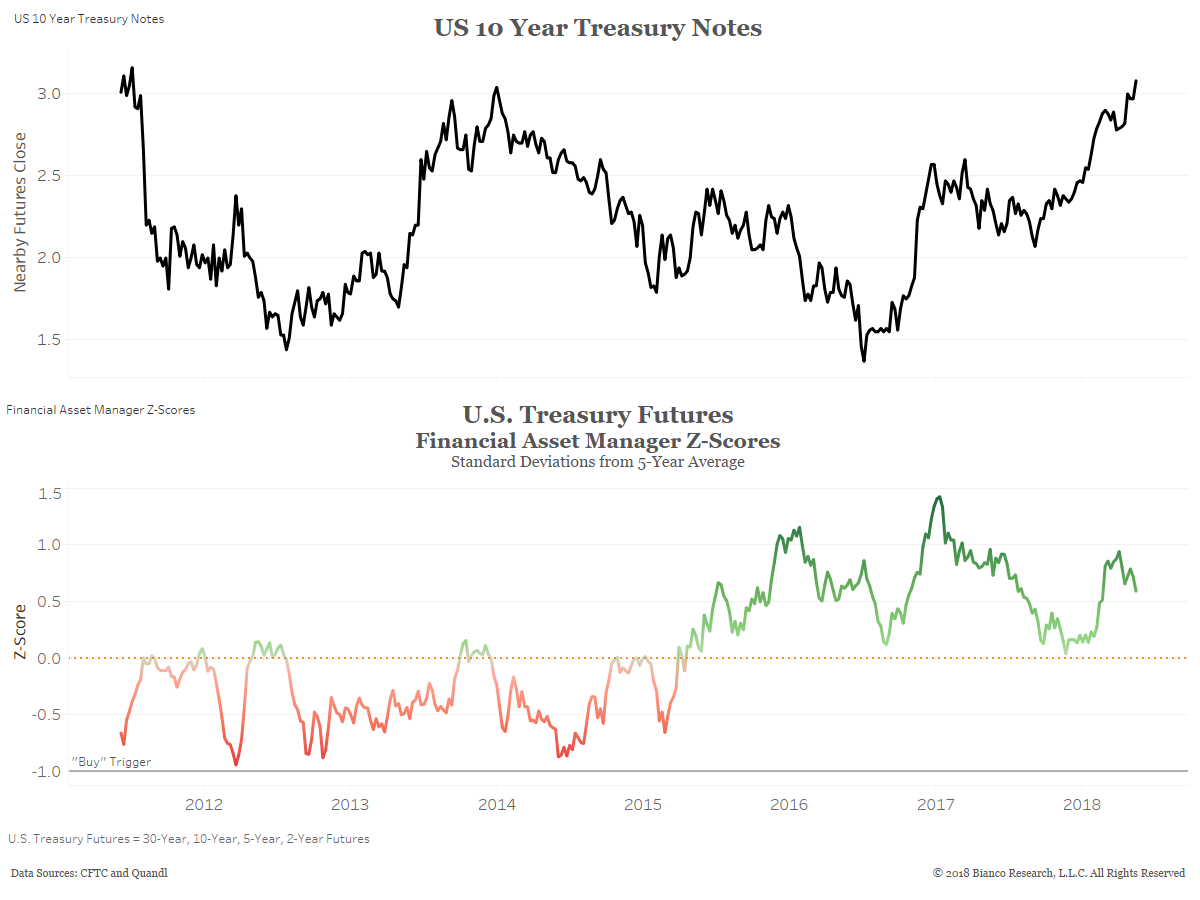

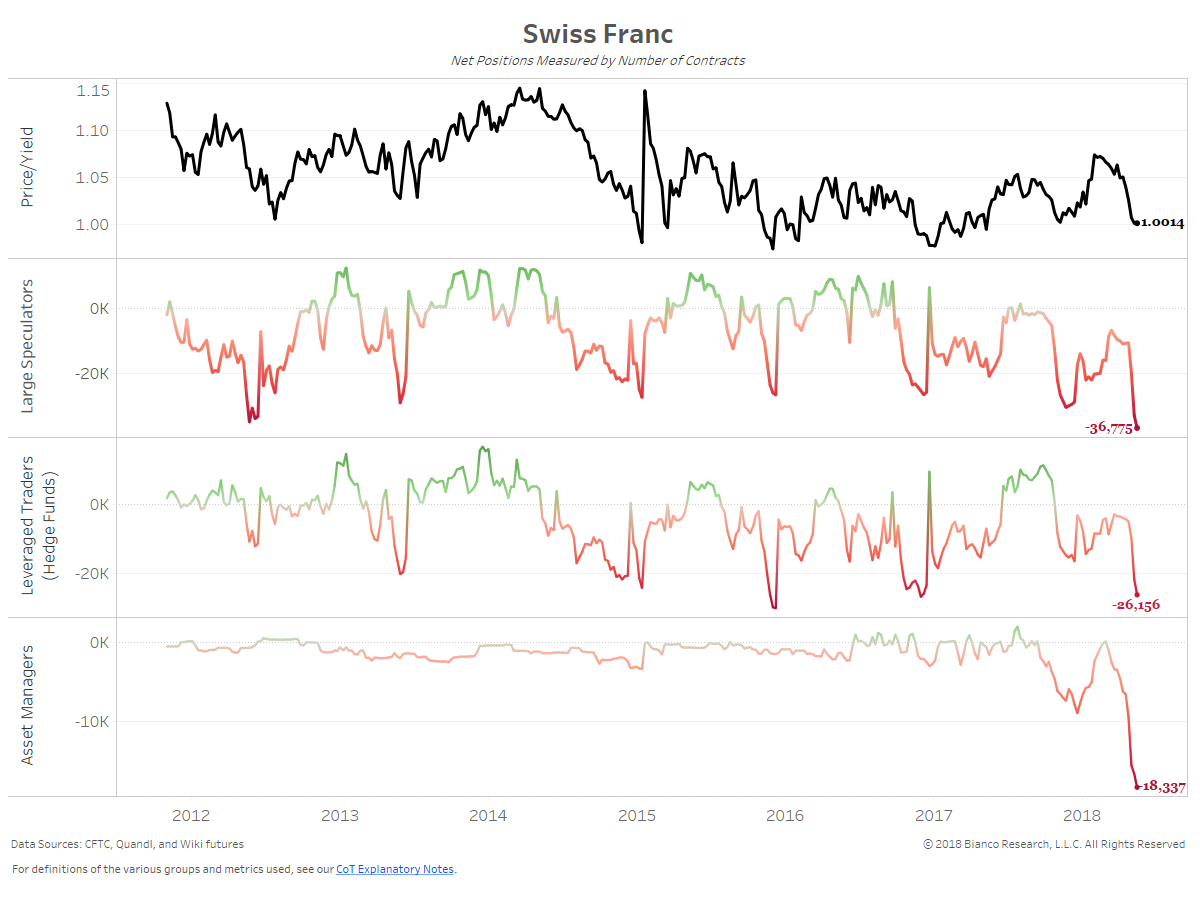

CoT Detail: Interest Rates

Posted By Ryan Malo

A breakdown of the COT data for interest rates... Read More

Separating Wheat from Chaff in Emerging Markets

Posted By Peter Forbes

Regional economic growth, commodity performance and trade uncertainty have Brazil standing out from its peers. ... Read More

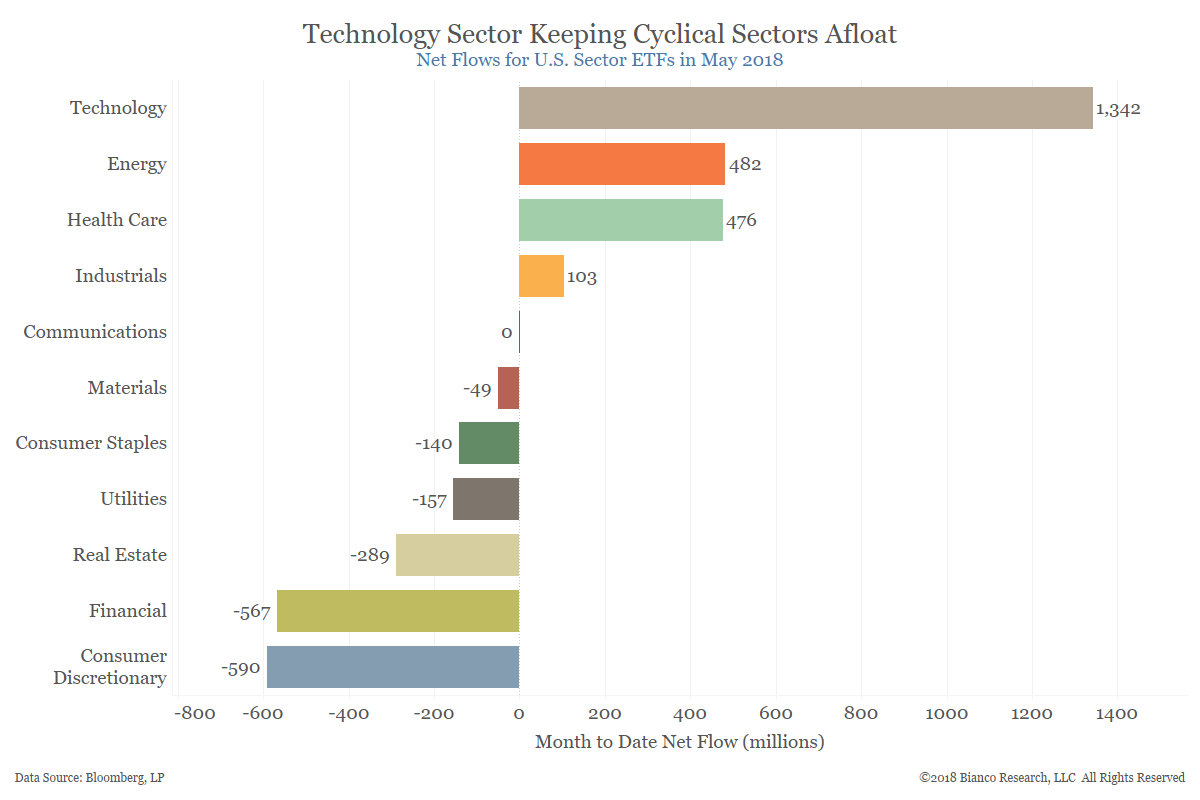

No Interest in Non-Cyclicals

Posted By Peter Forbes

Margin compression fears are adding to the woes of underperforming consumer staples. Expectations for rising Treasury yields will likely keep ETF investors looking elsewhere. ... Read More

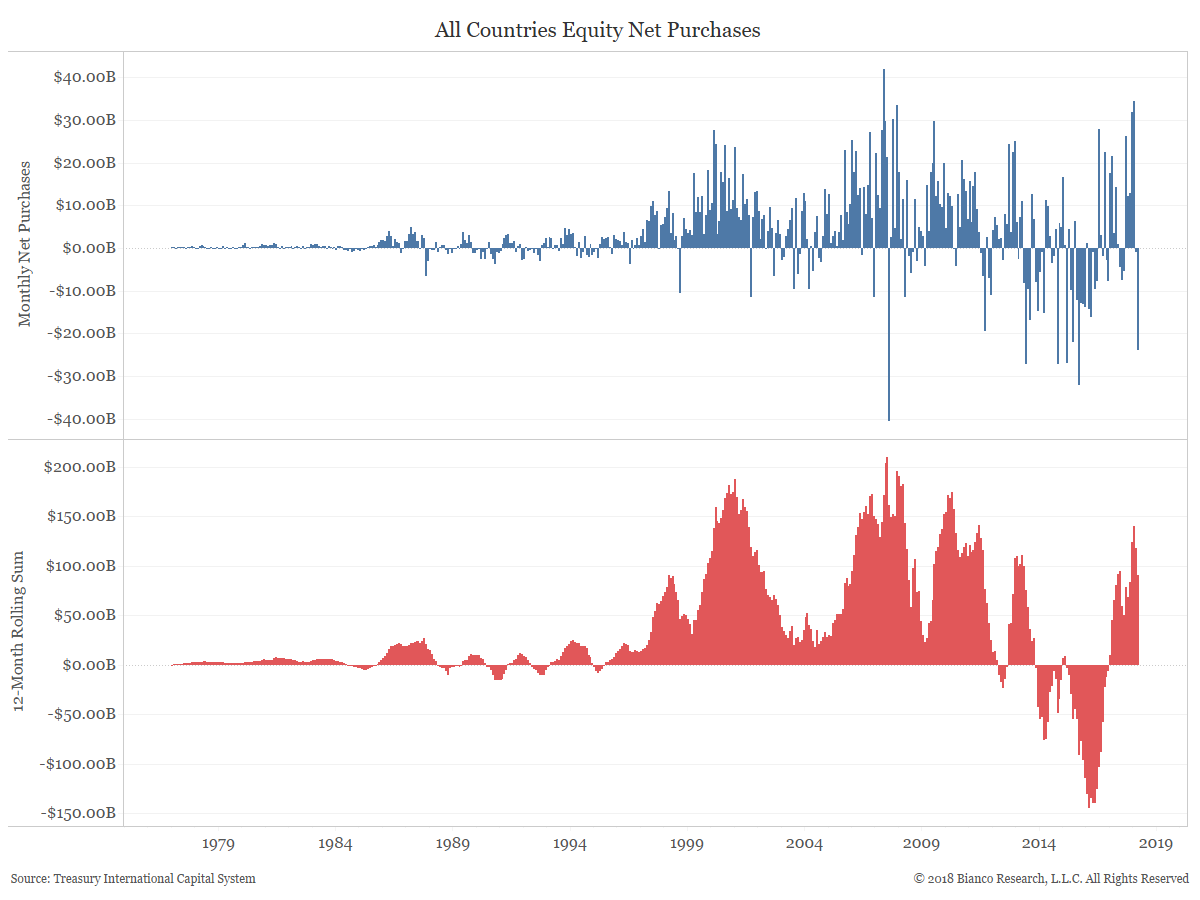

Foreigners Sold A Large Sum Of U.S. Equities In March

Posted By Greg Blaha

An overview of foreign net purchases of U.S. Treasuries, agencies, corporates and equities... Read More

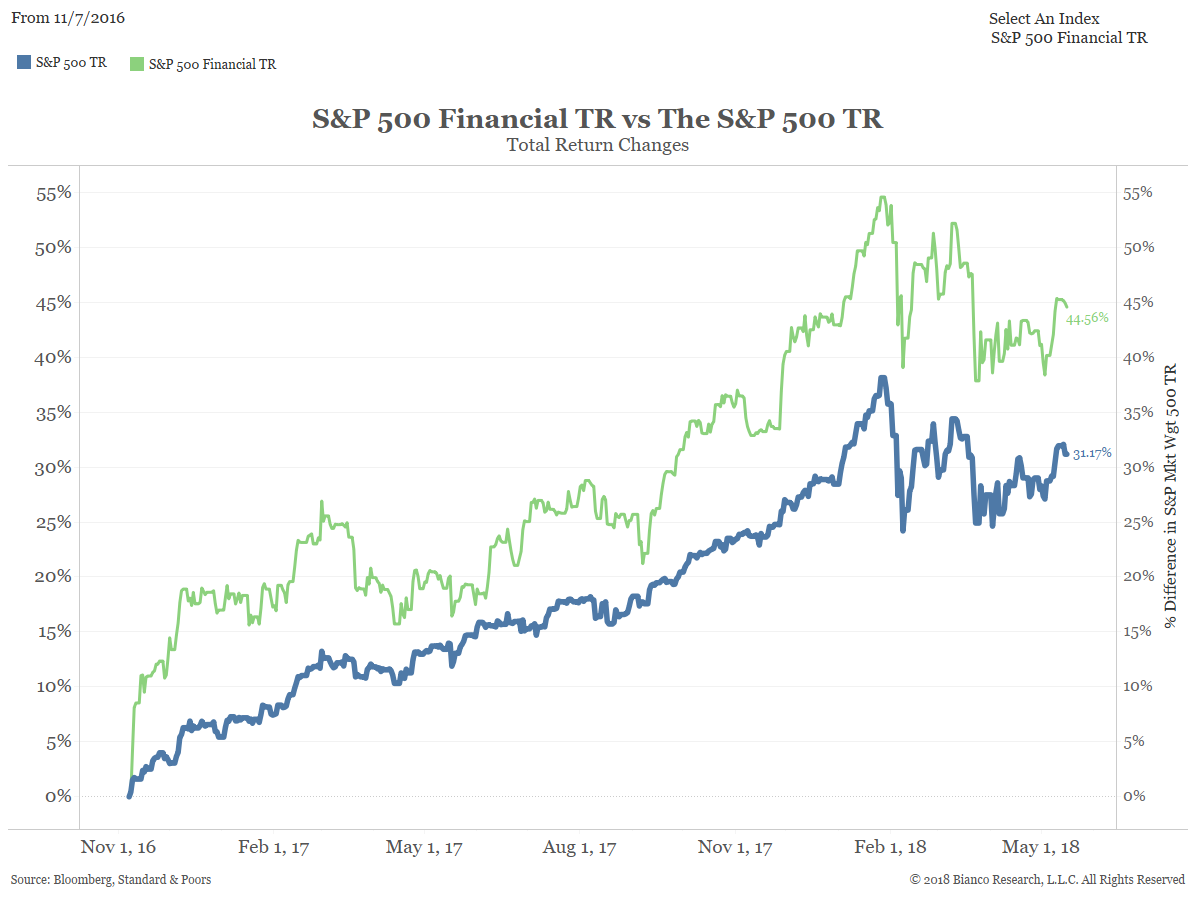

Stock Returns Since The Election – Financials Up 45%

Stock total returns since the election. ... Read More

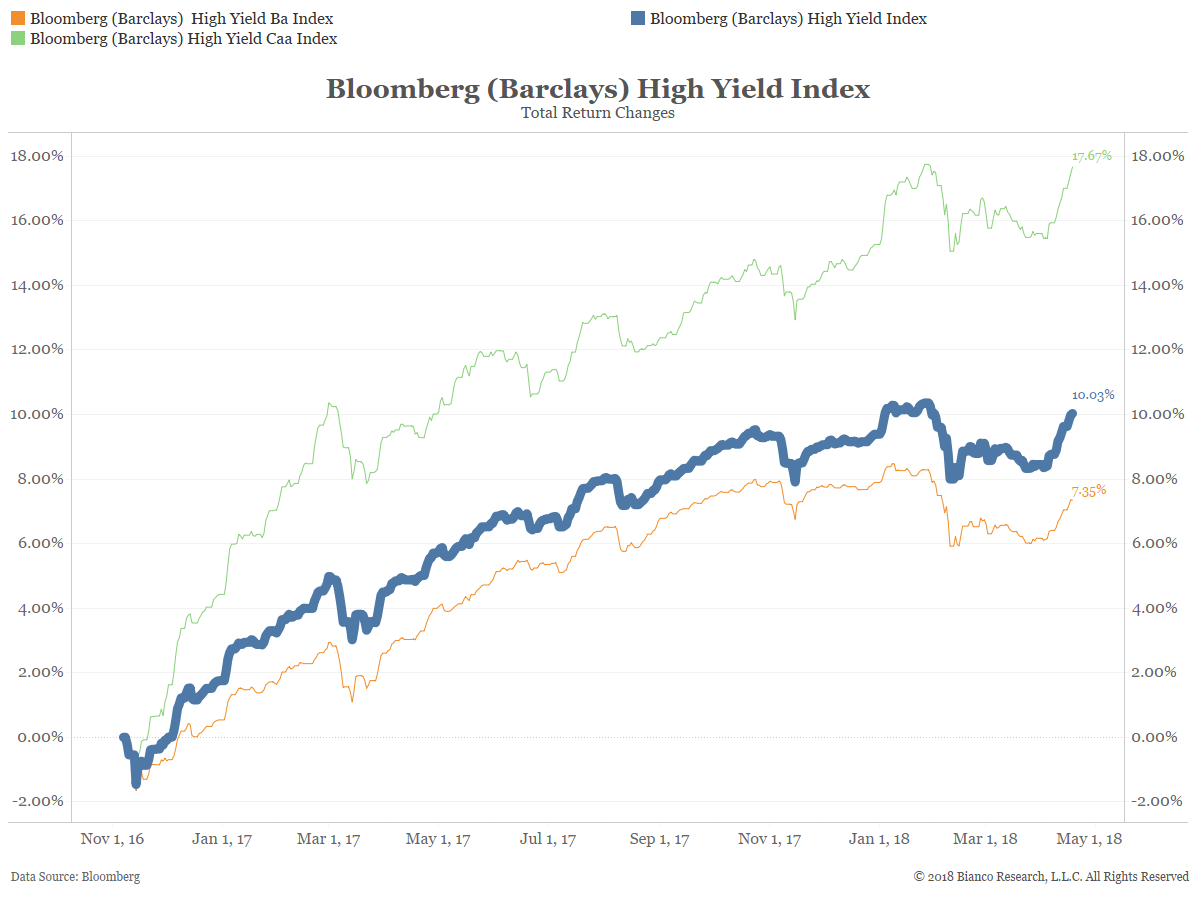

Bond Returns Since The Election – High Yield Up 10%

Bond total returns since the election. ... Read More

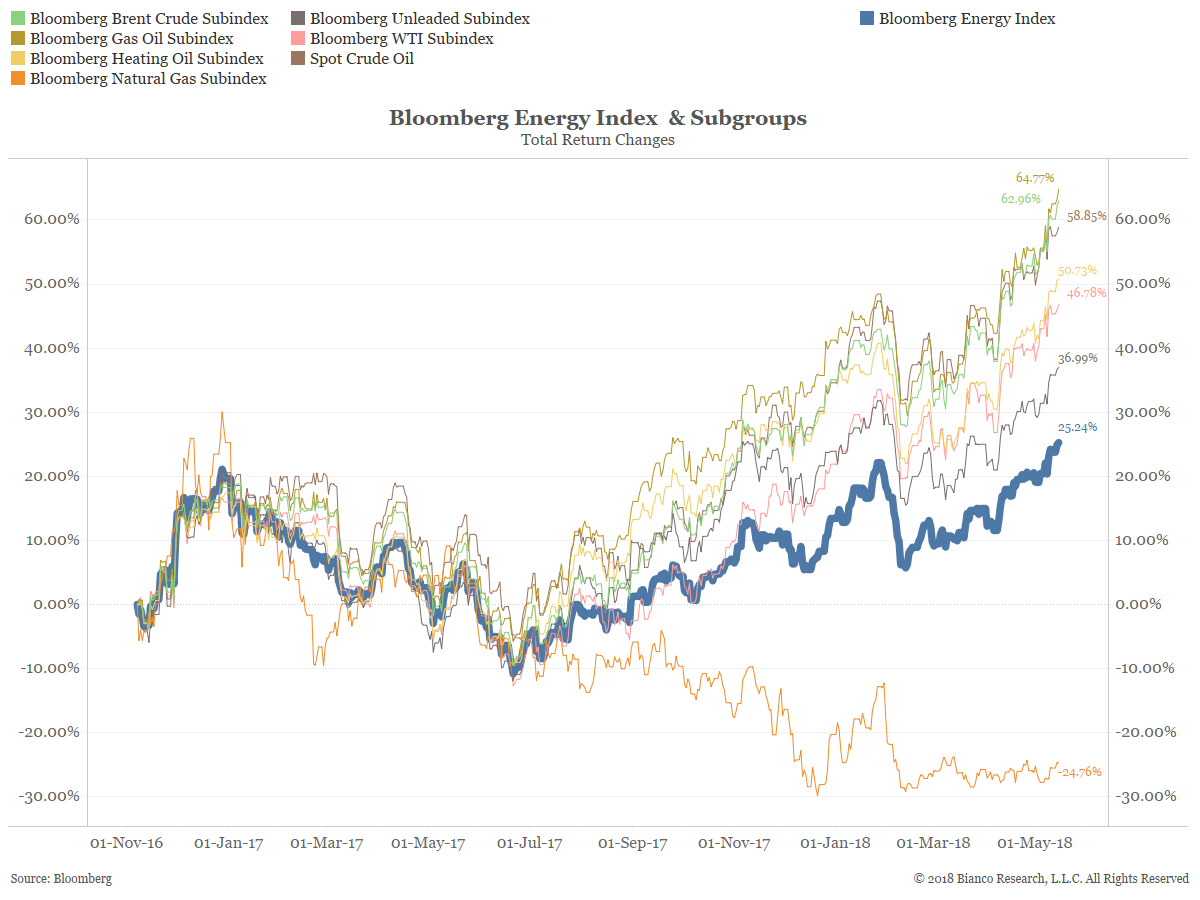

Commodity Returns Since The Election – Energy Up 25%

Commodity returns since the election. ... Read More