What We’re Reading

Posted By Ryan Malo

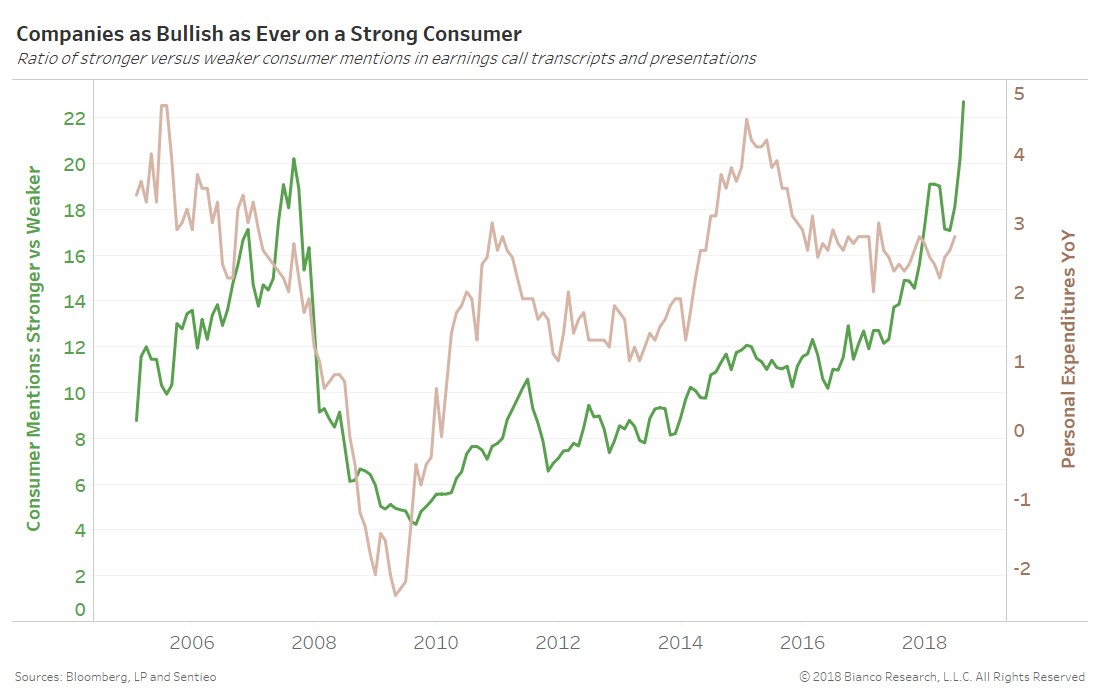

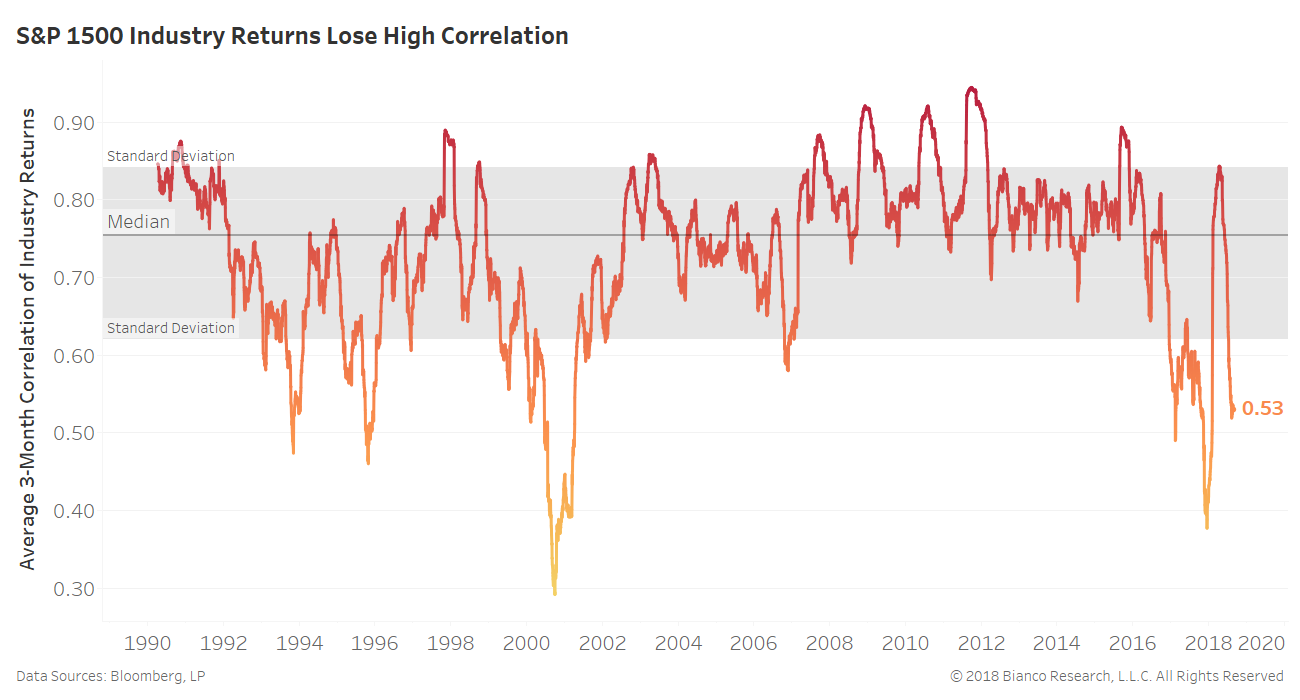

Today's topics include rising consumer confidence, yield curves and recessions, the stock market, the "fast star", the market vs the Fed, volatility, the U.S. dollar, secular stagnation, corporate debt and the stock market vs pundits. ... Read More