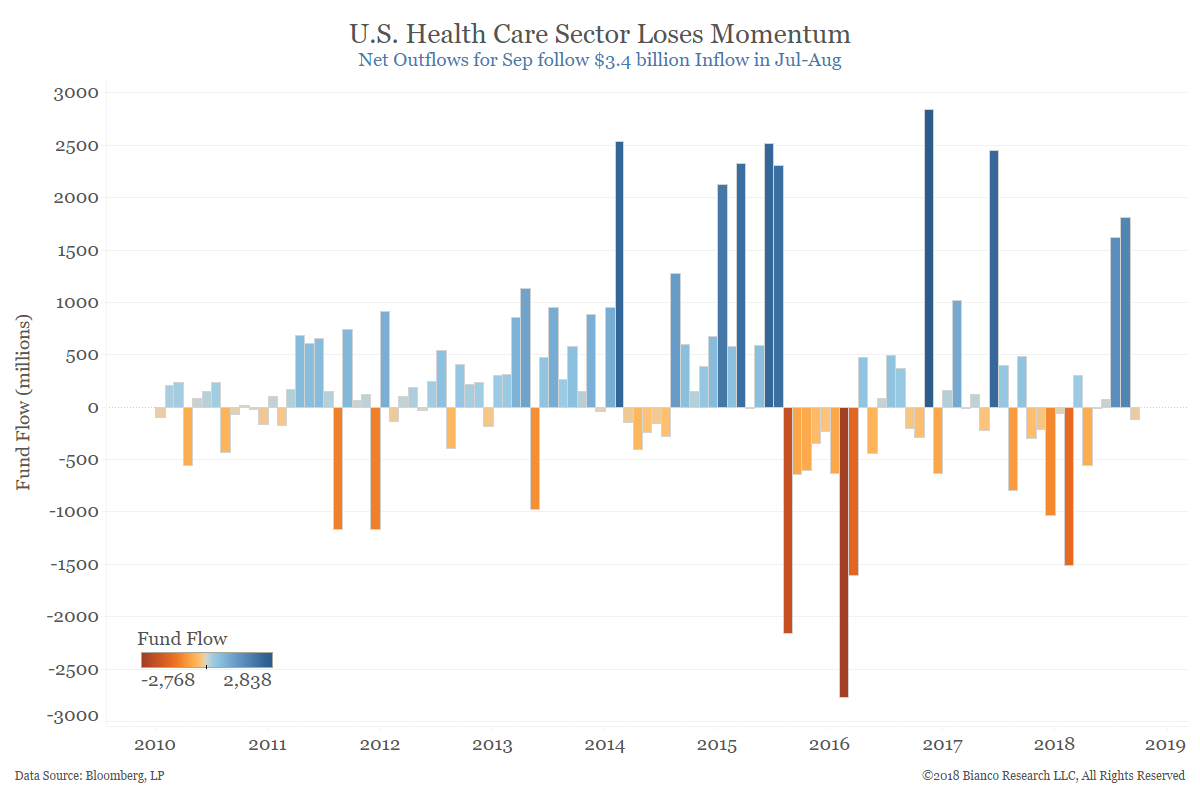

Health Care Loses Altitude

Posted By Peter Forbes

After a red-hot summer, the health care sector has cooled off a bit this month. Despite risks from rising policy uncertainty, the sector continues to outperform. ... Read More