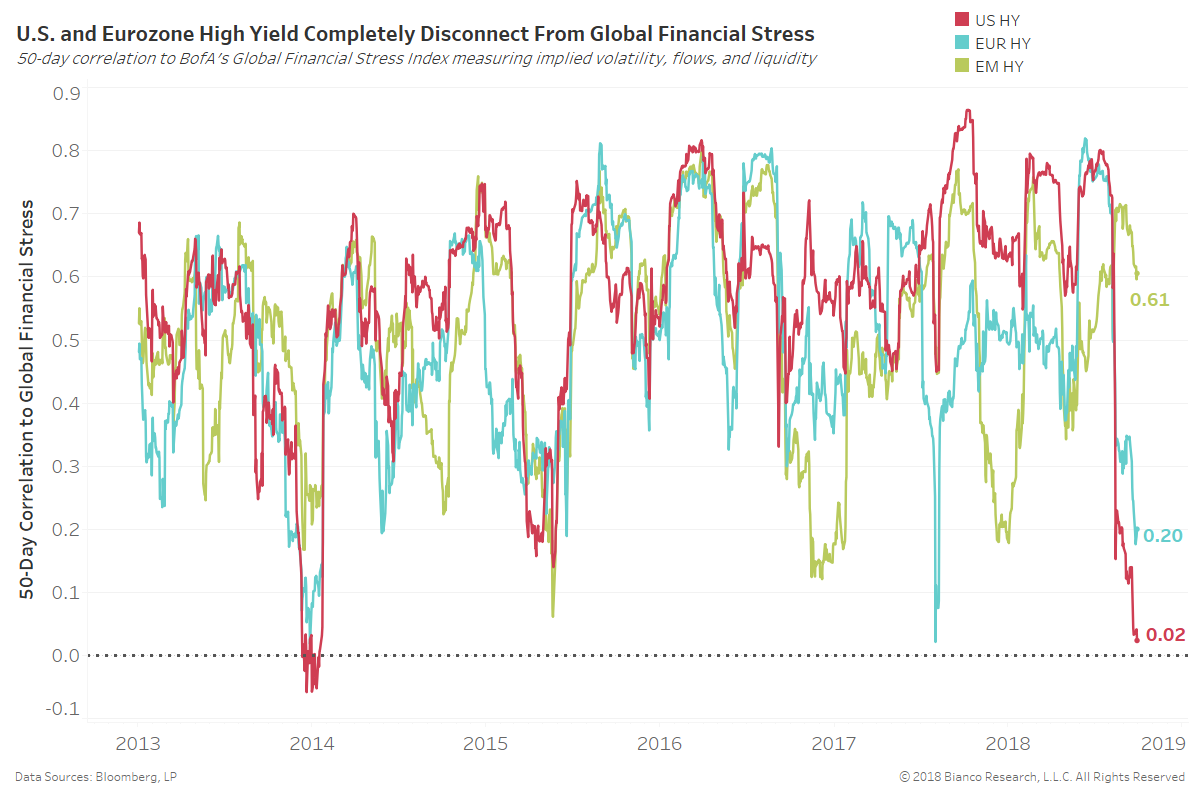

U.S. High Yield Says “Pffft” to Global Financial Stress

Posted By Ben Breitholtz

U.S. high yield has lost all connection to global financial stress, continuing a streak of stable positive returns. But, investors may be taking notice of this strange disconnection, steering assets instead to large cap equities and long-end Treasuries.... Read More