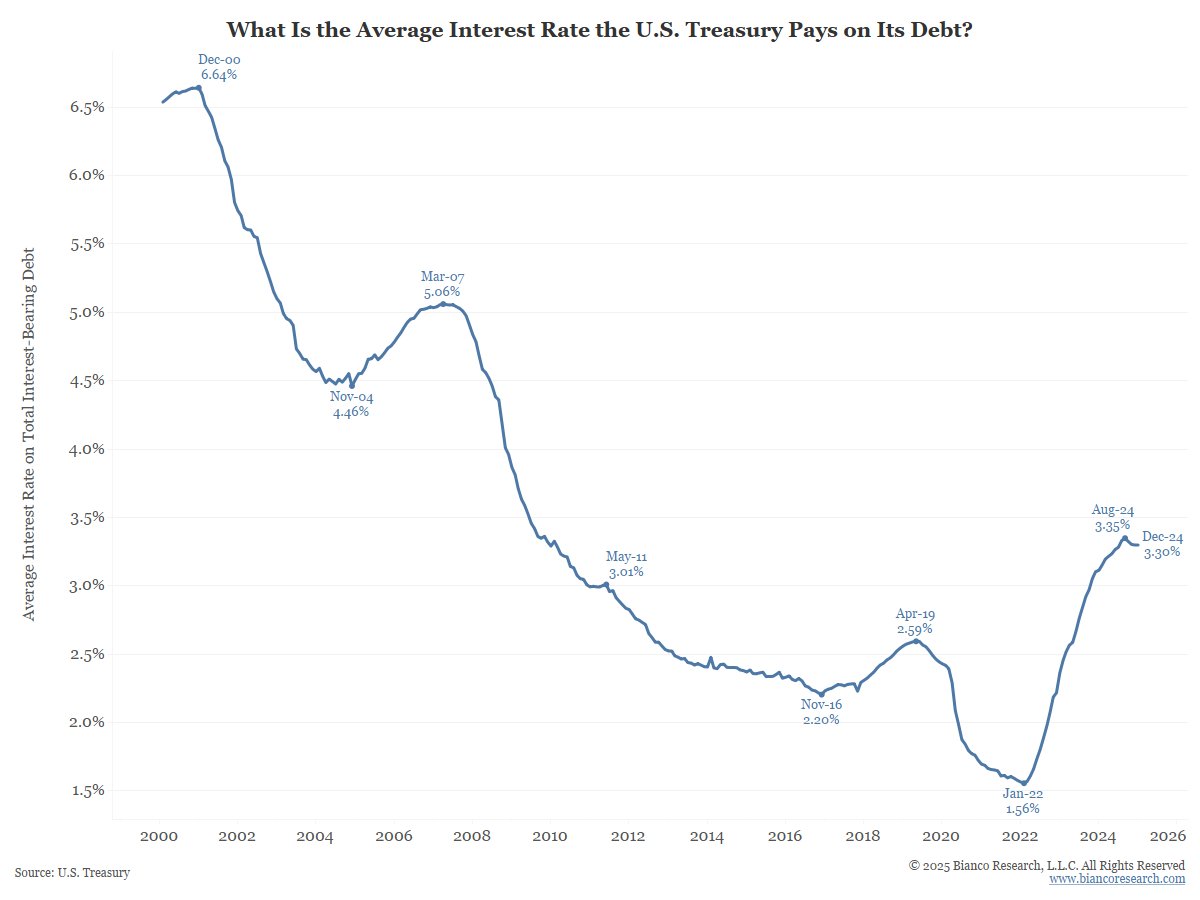

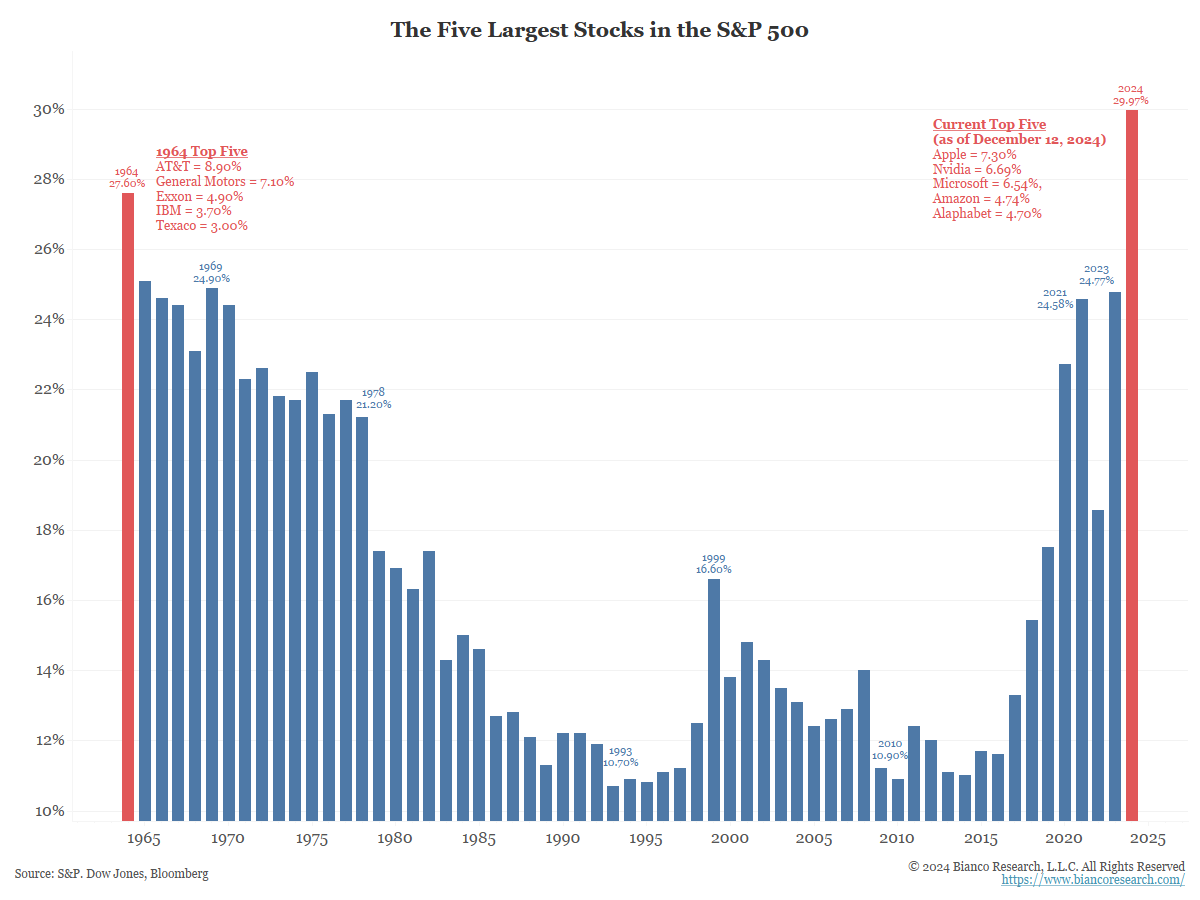

Rising U.S. Government Interest Costs

Posted By Greg Blaha

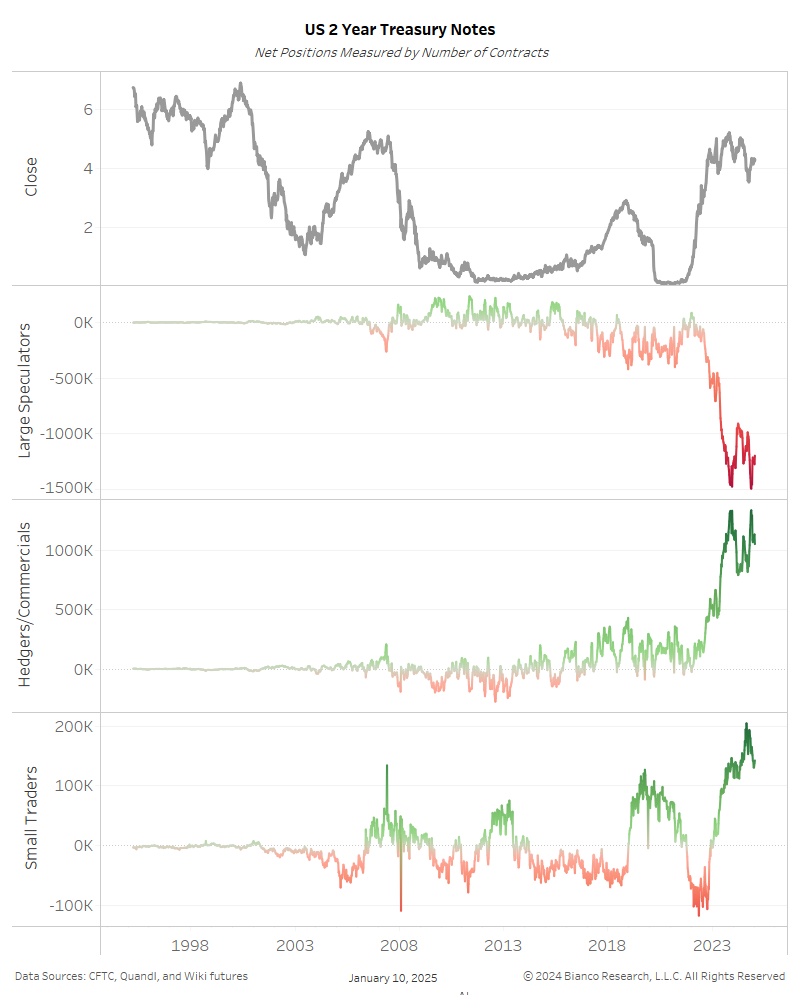

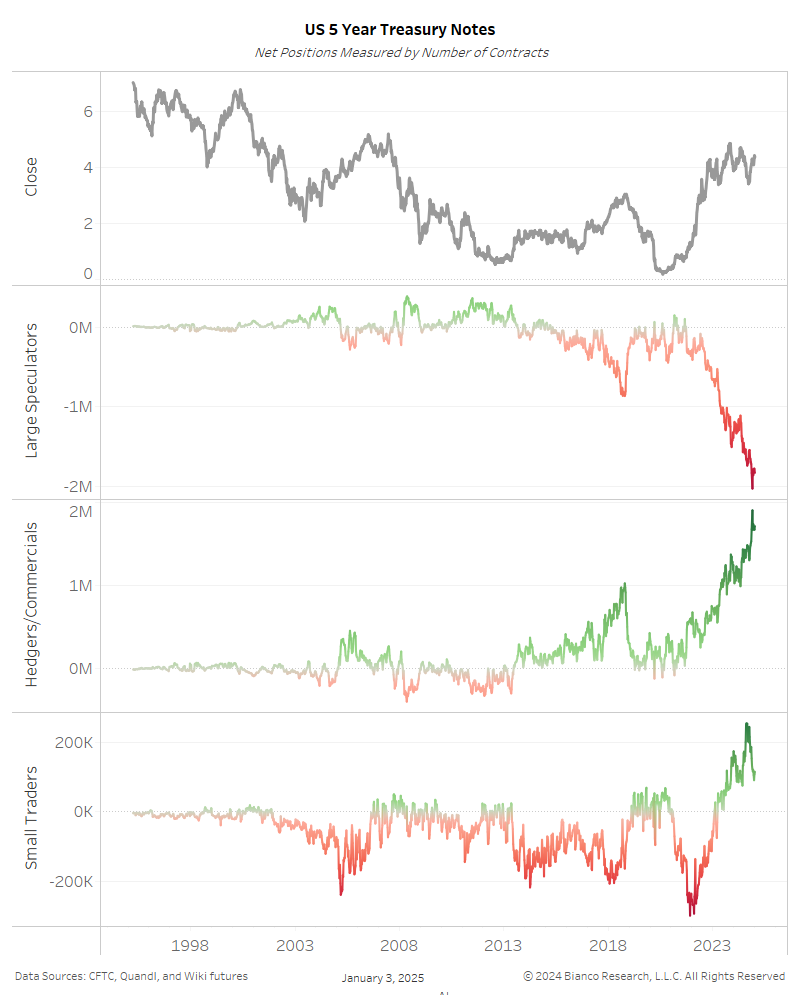

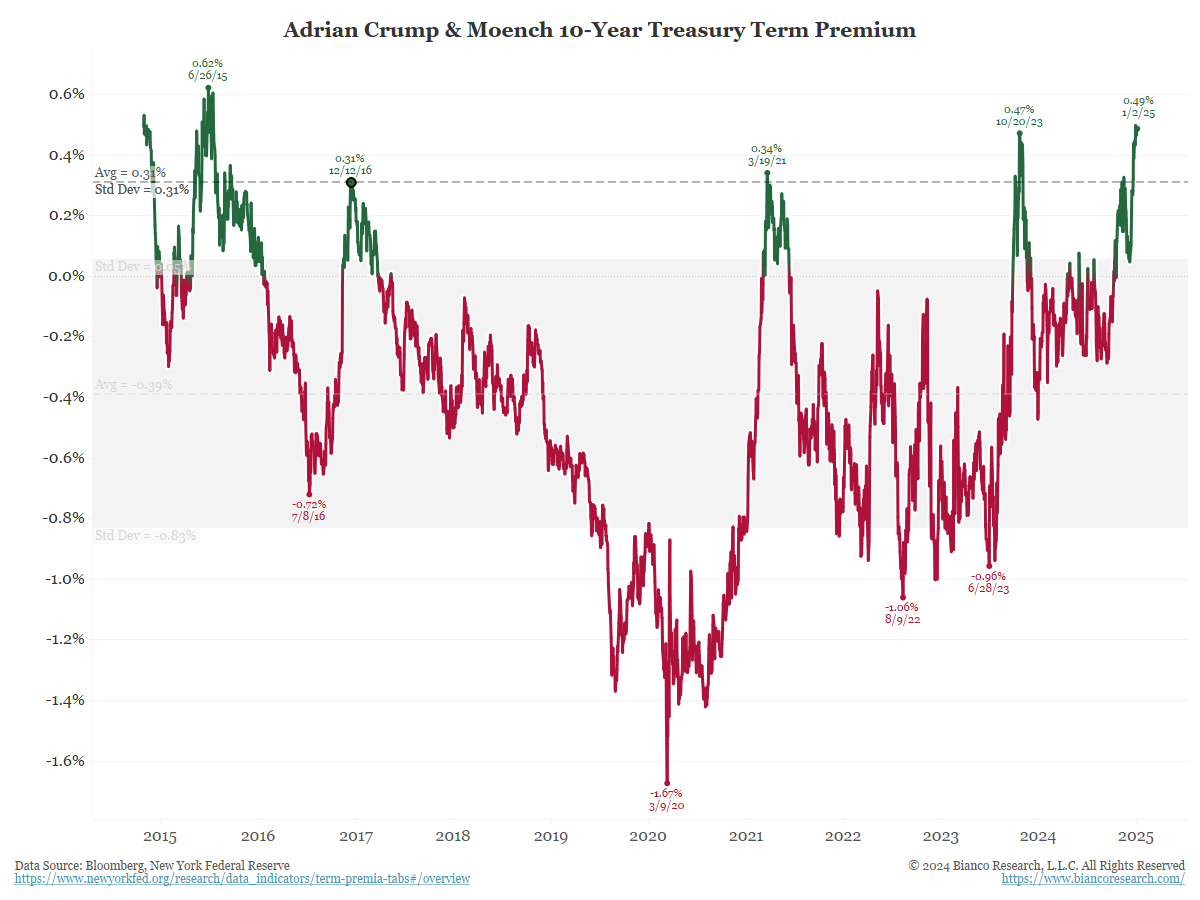

For the last few decades the U.S. has been in a low interest rate environment where deficit spending would not cause major issues. A 40-year high in inflation and the higher rates that followed are stressing the country's finances.... Read More