What Will Move Interest Rates?

Posted By Jim Bianco

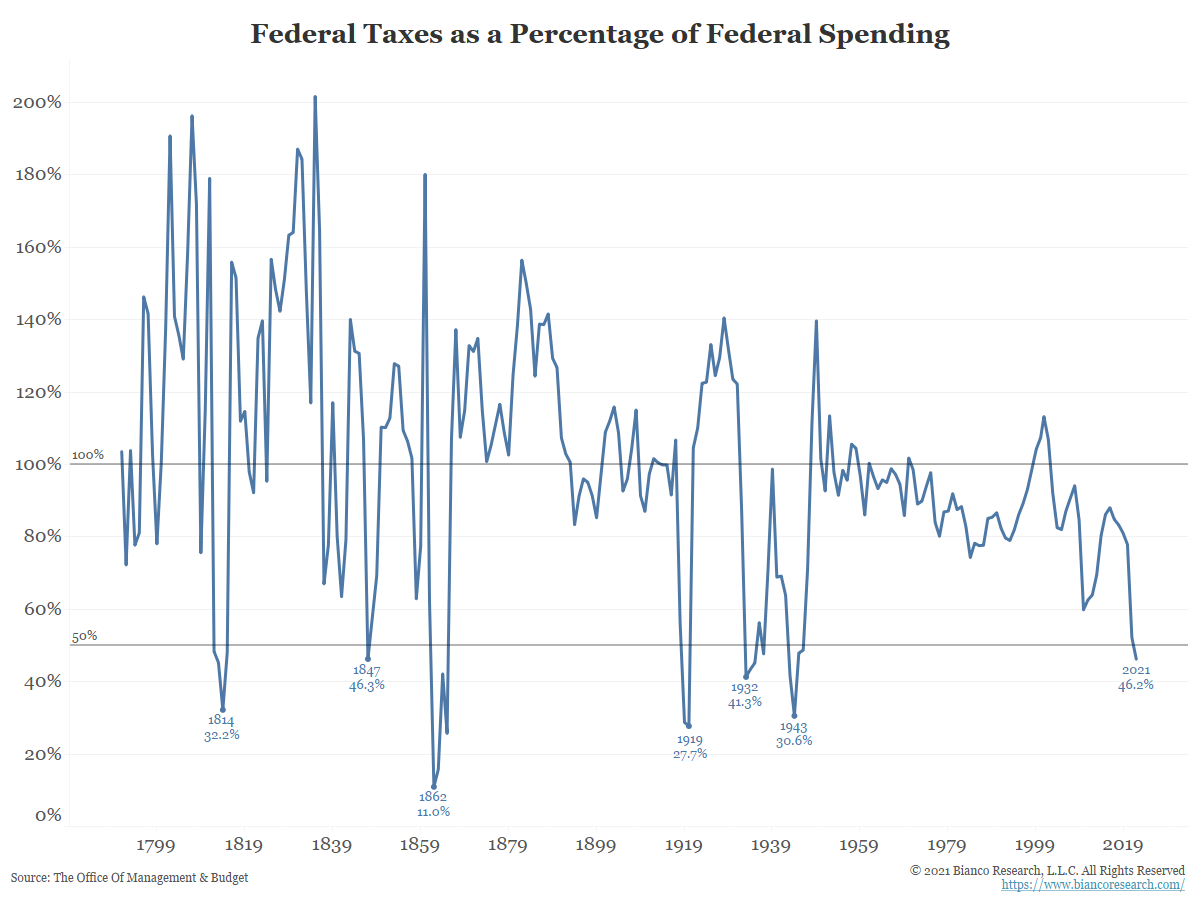

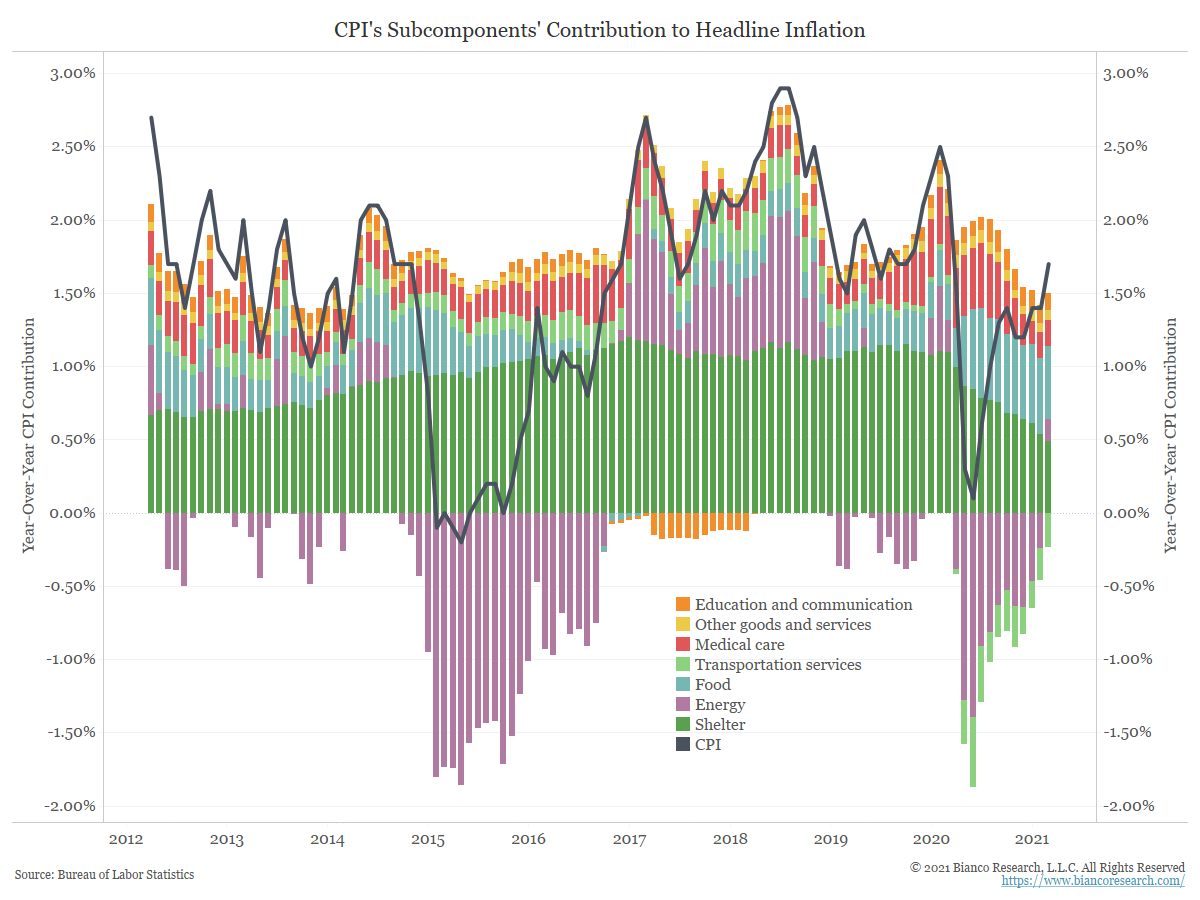

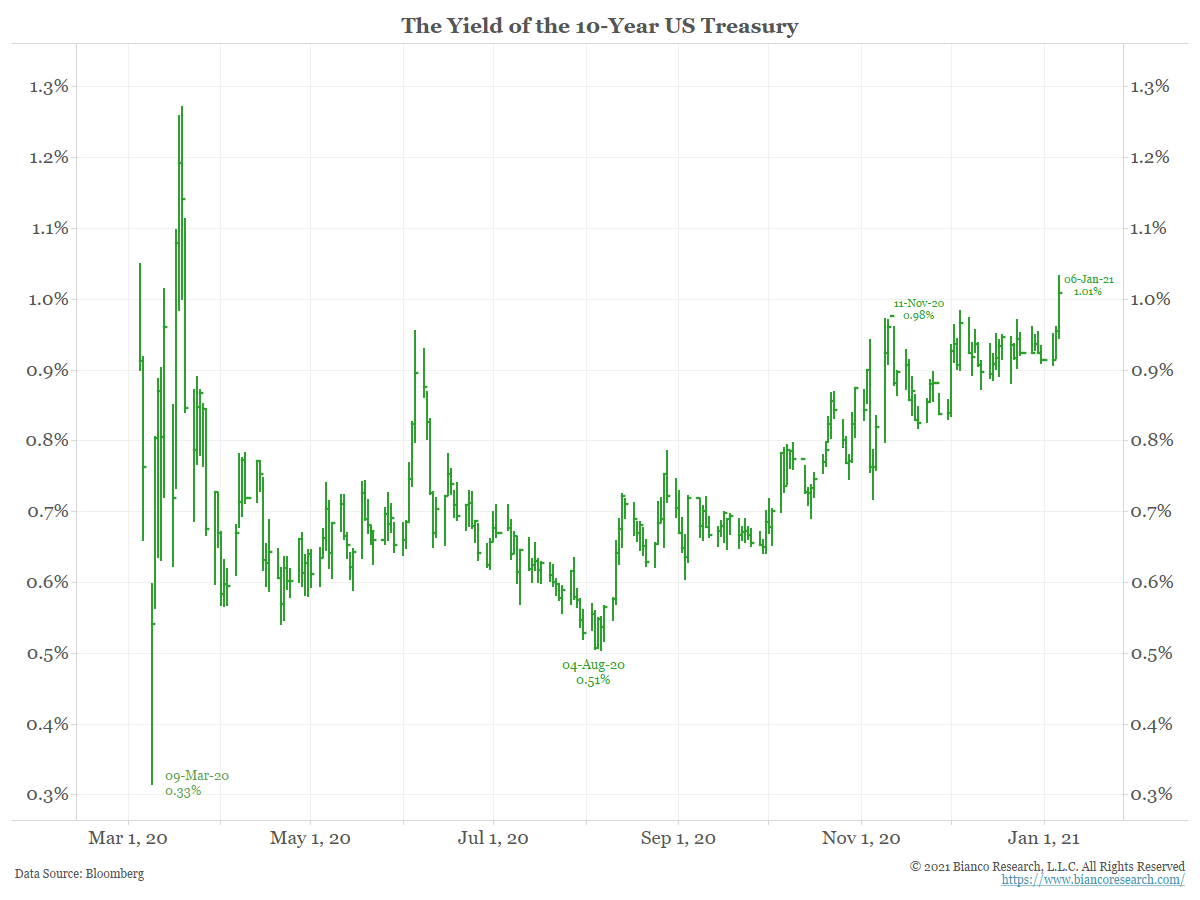

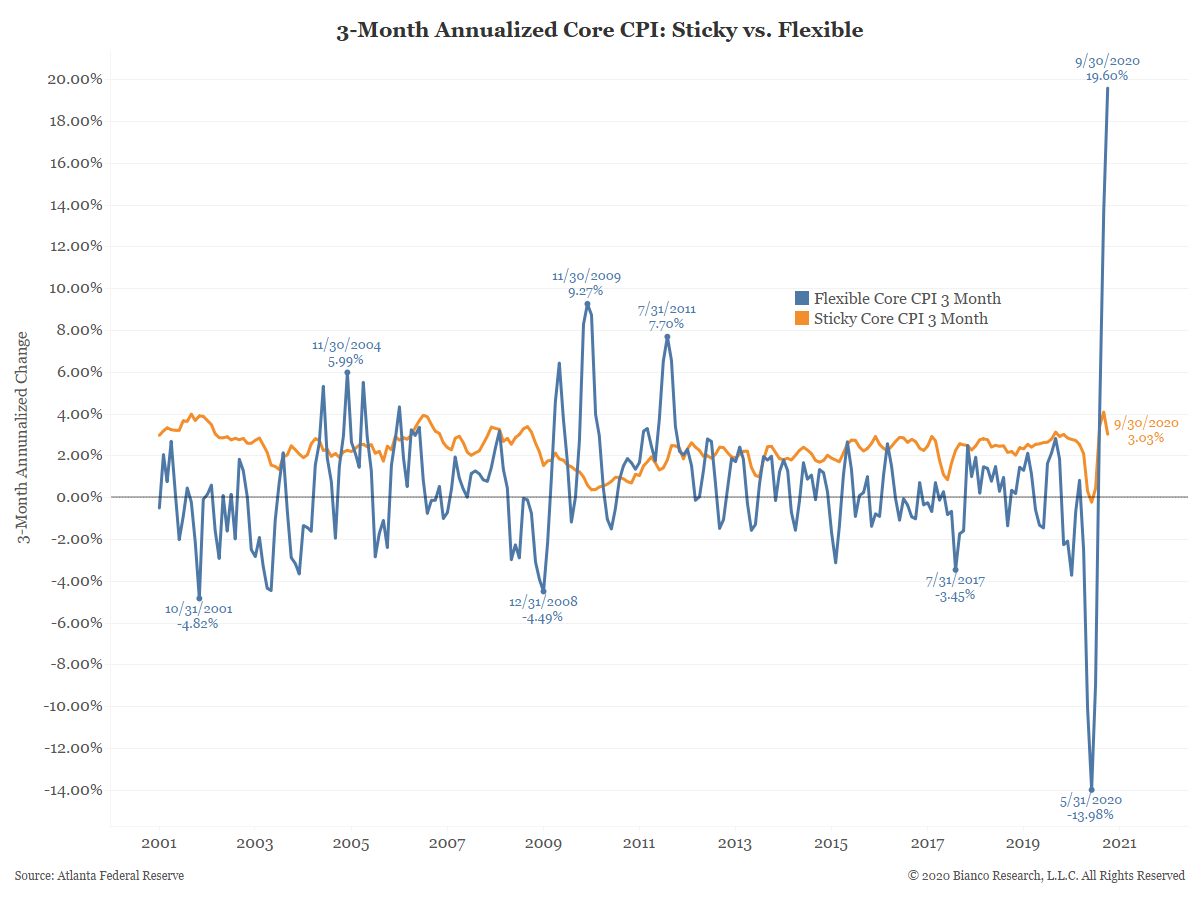

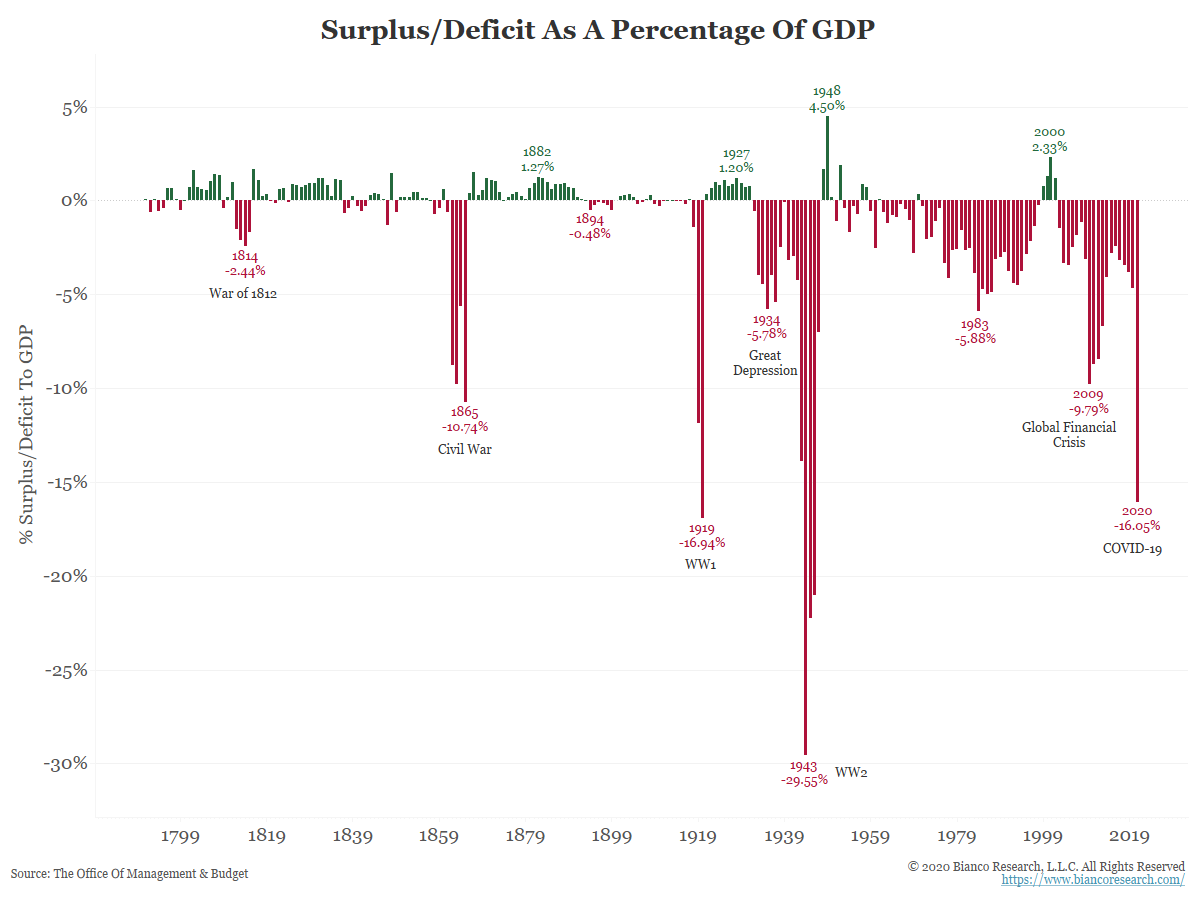

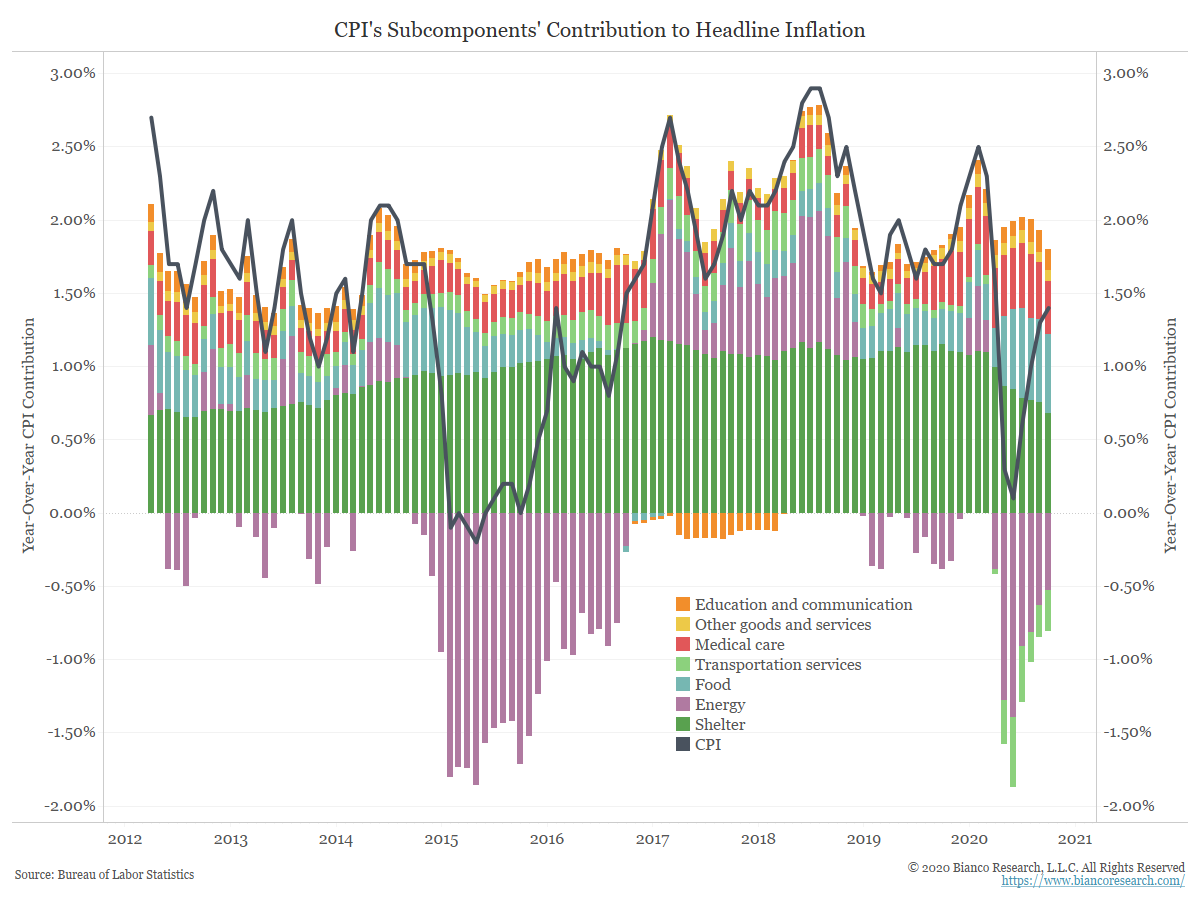

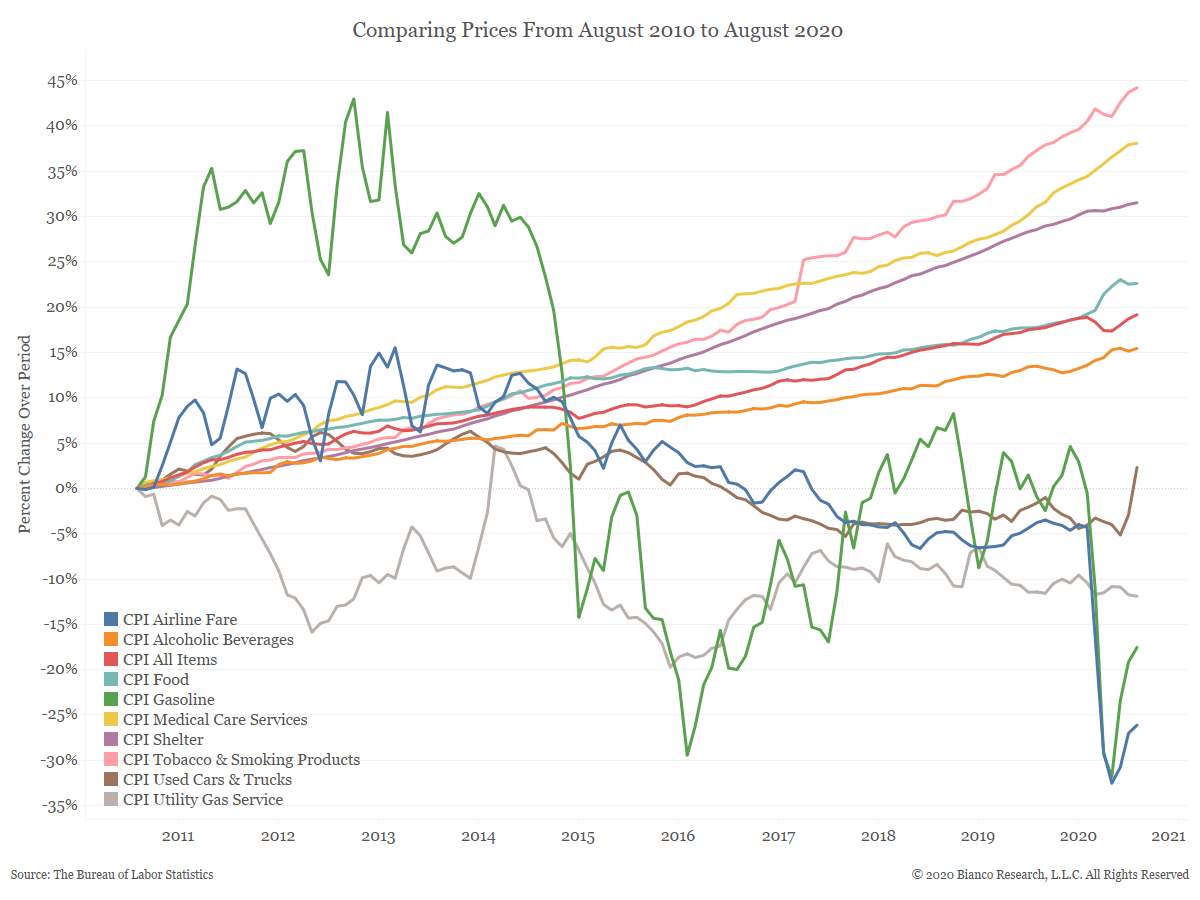

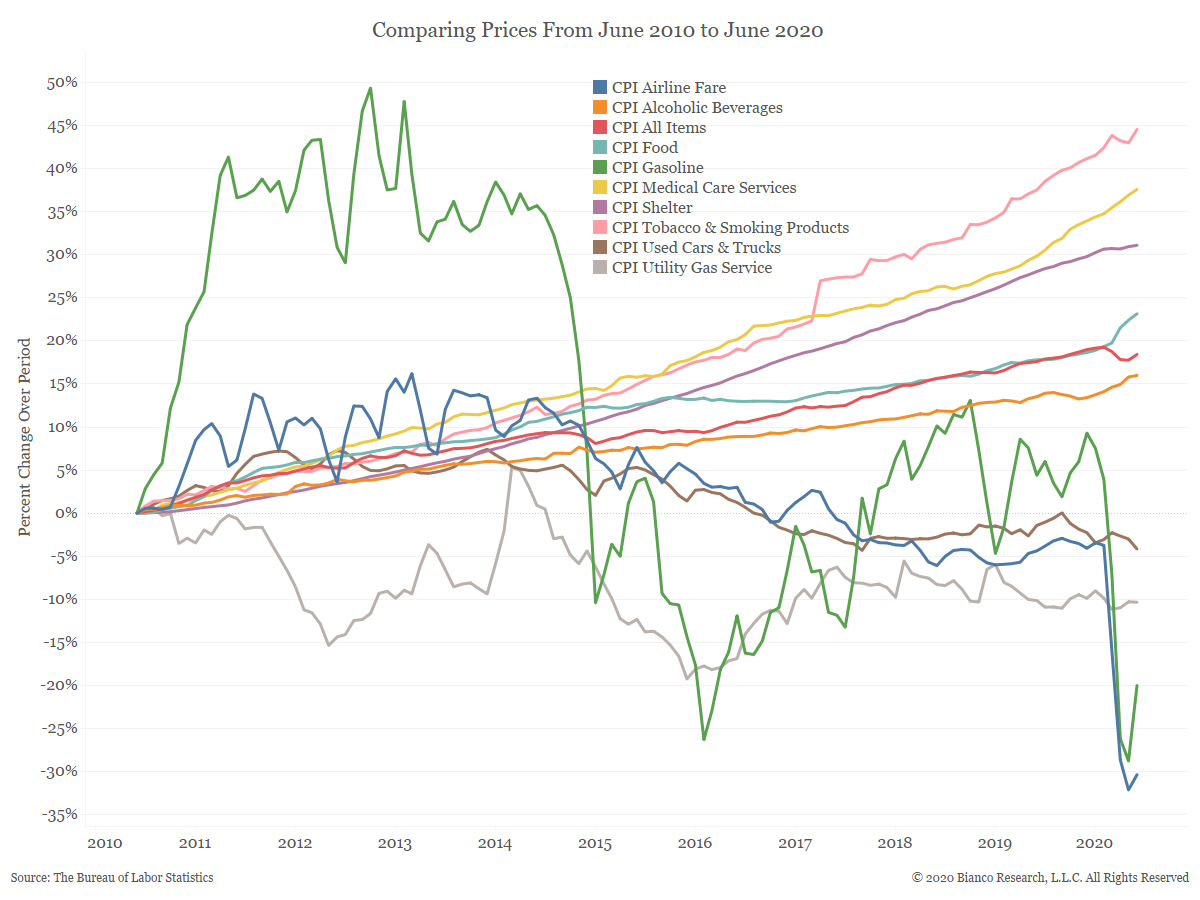

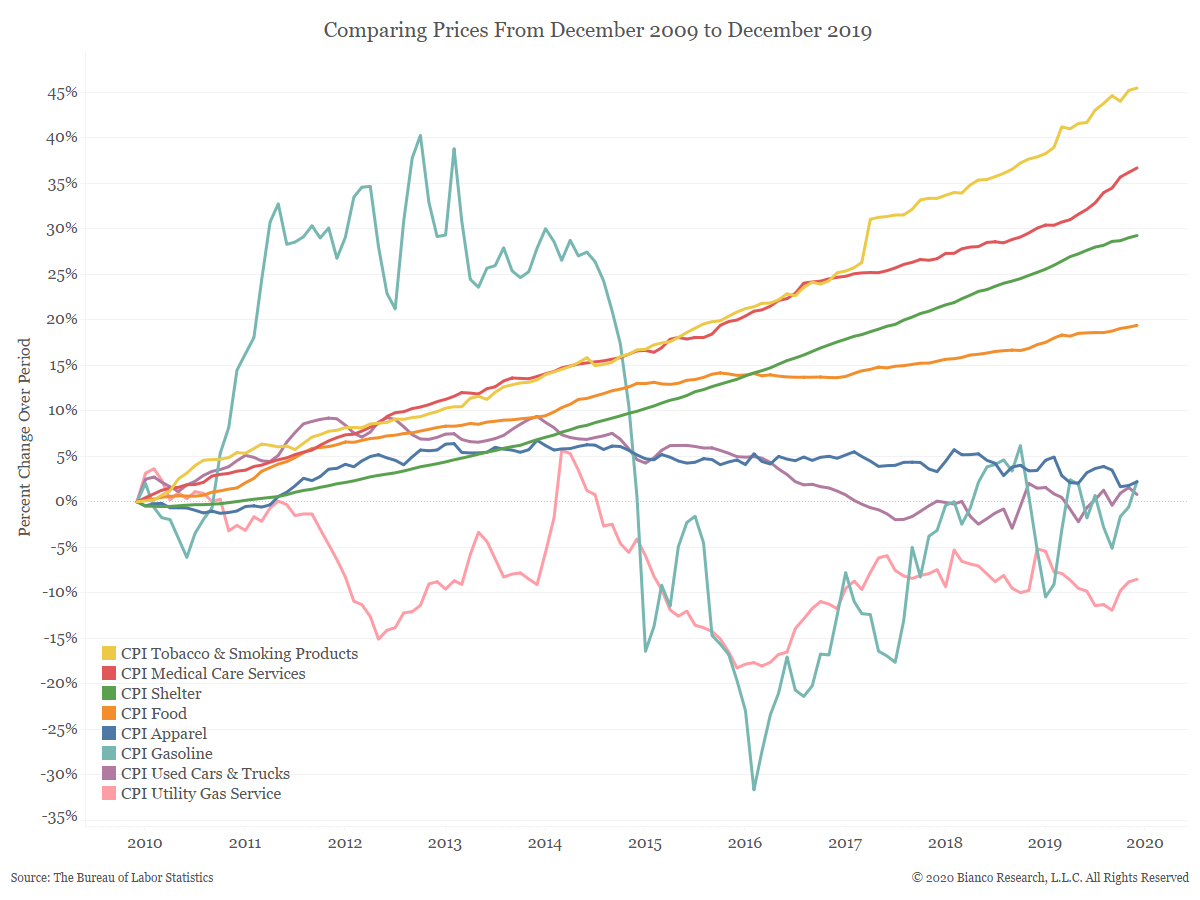

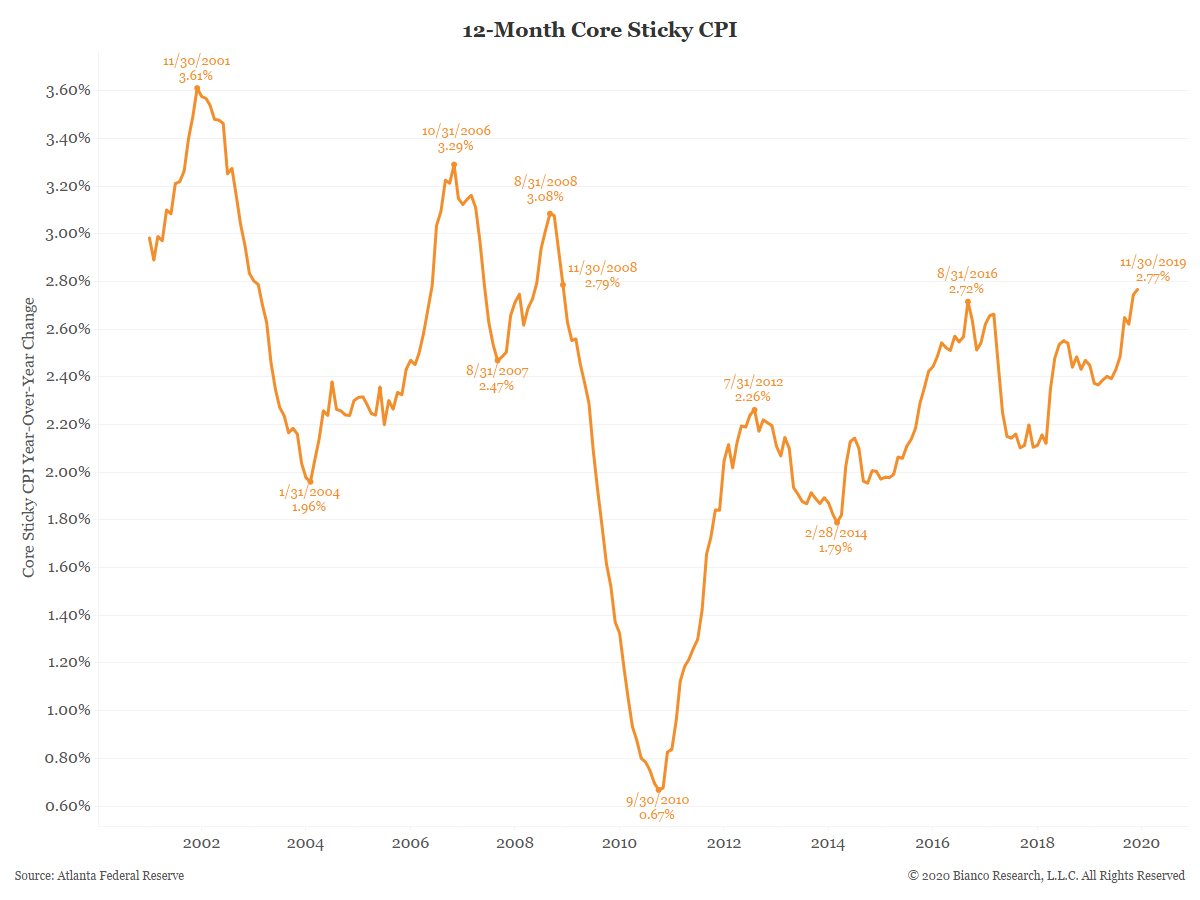

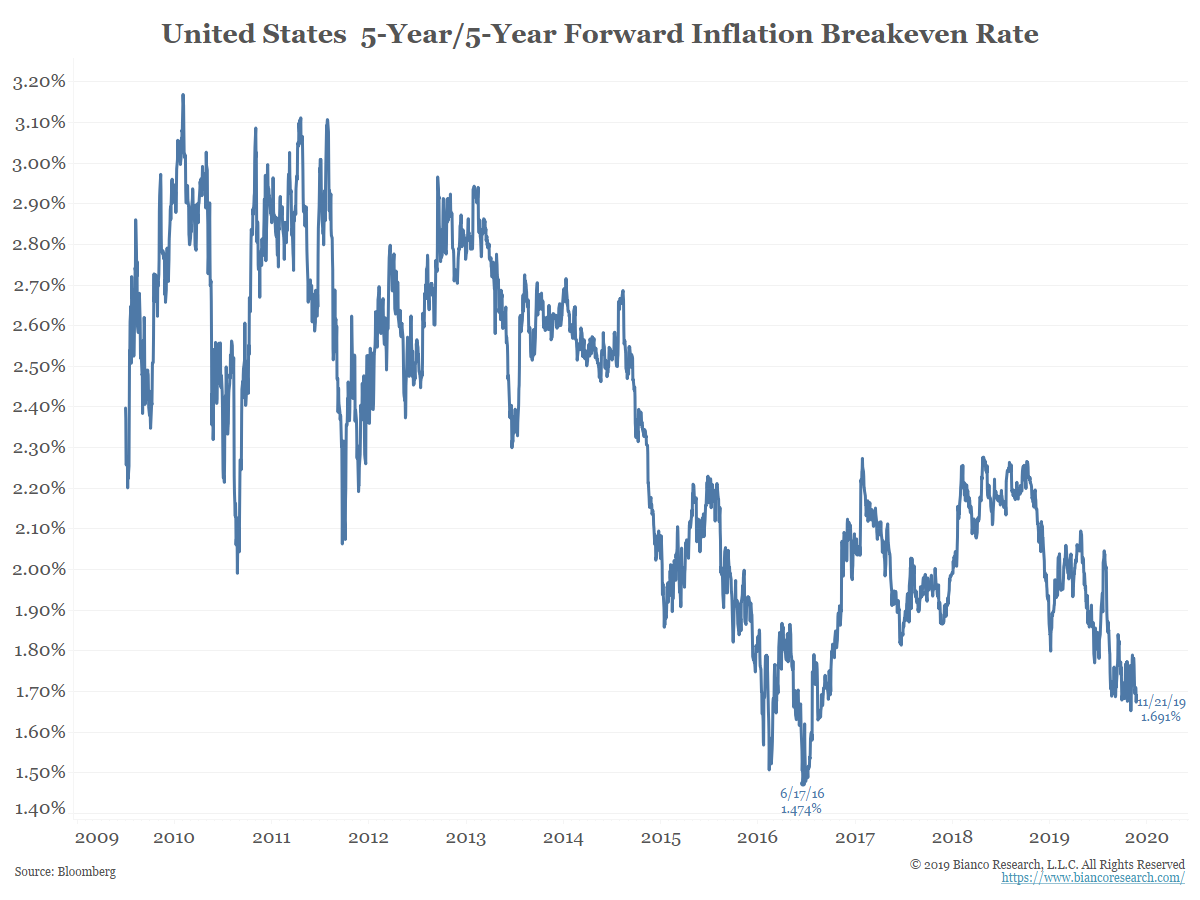

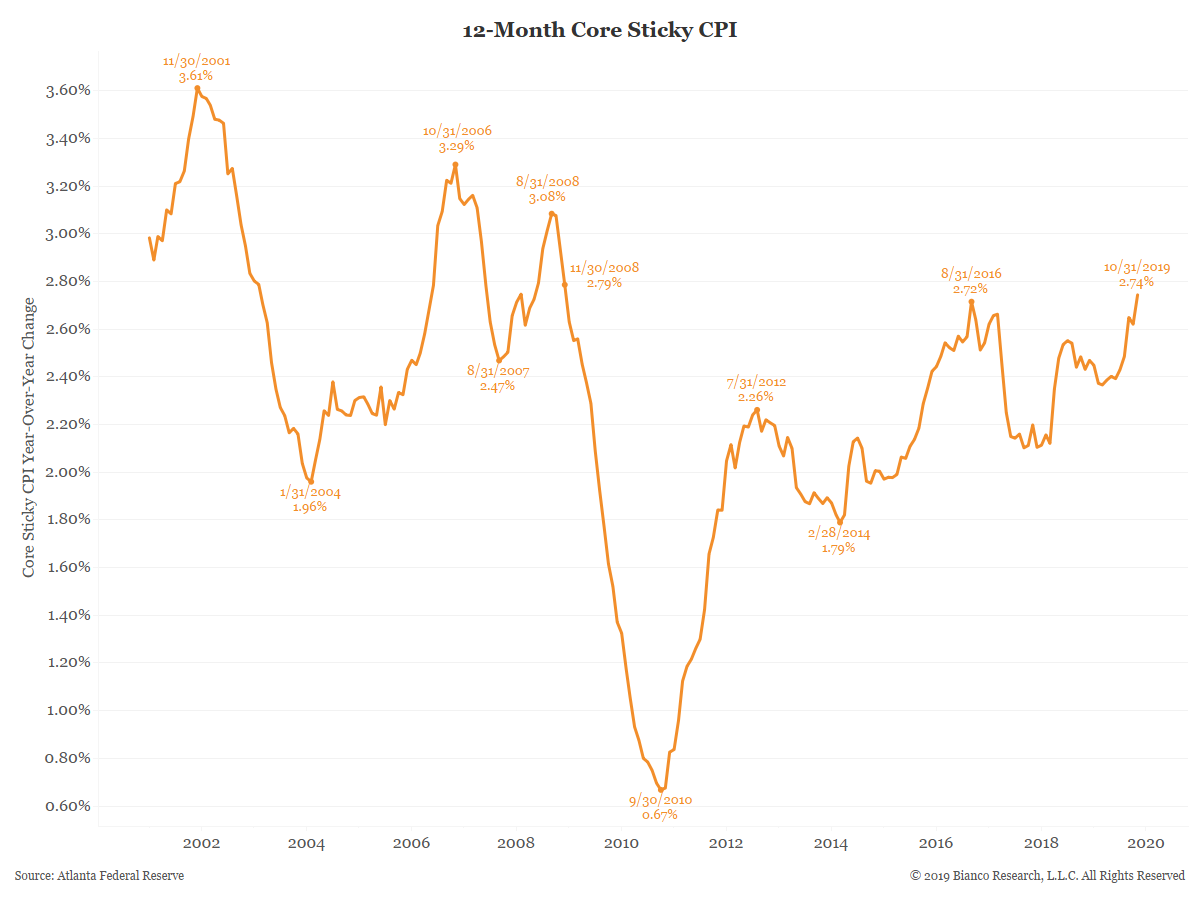

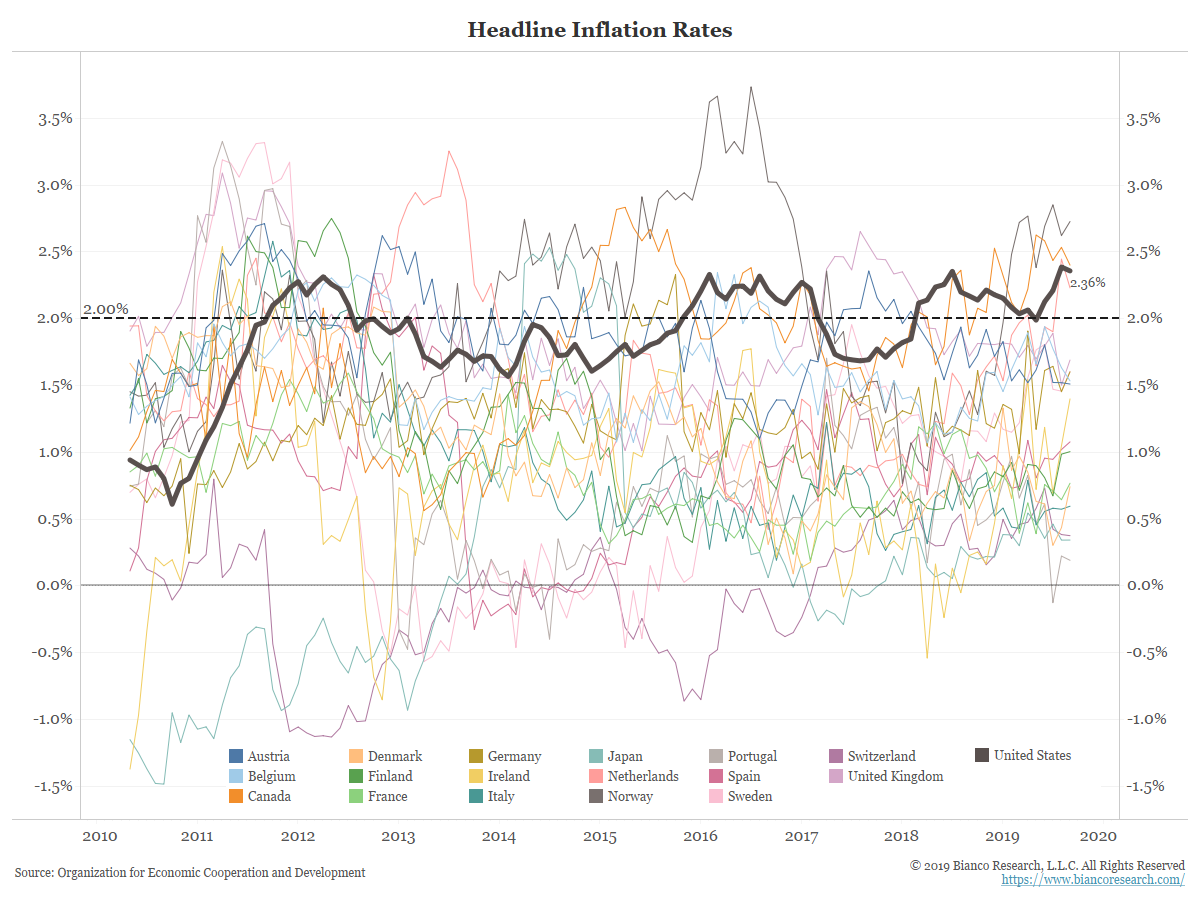

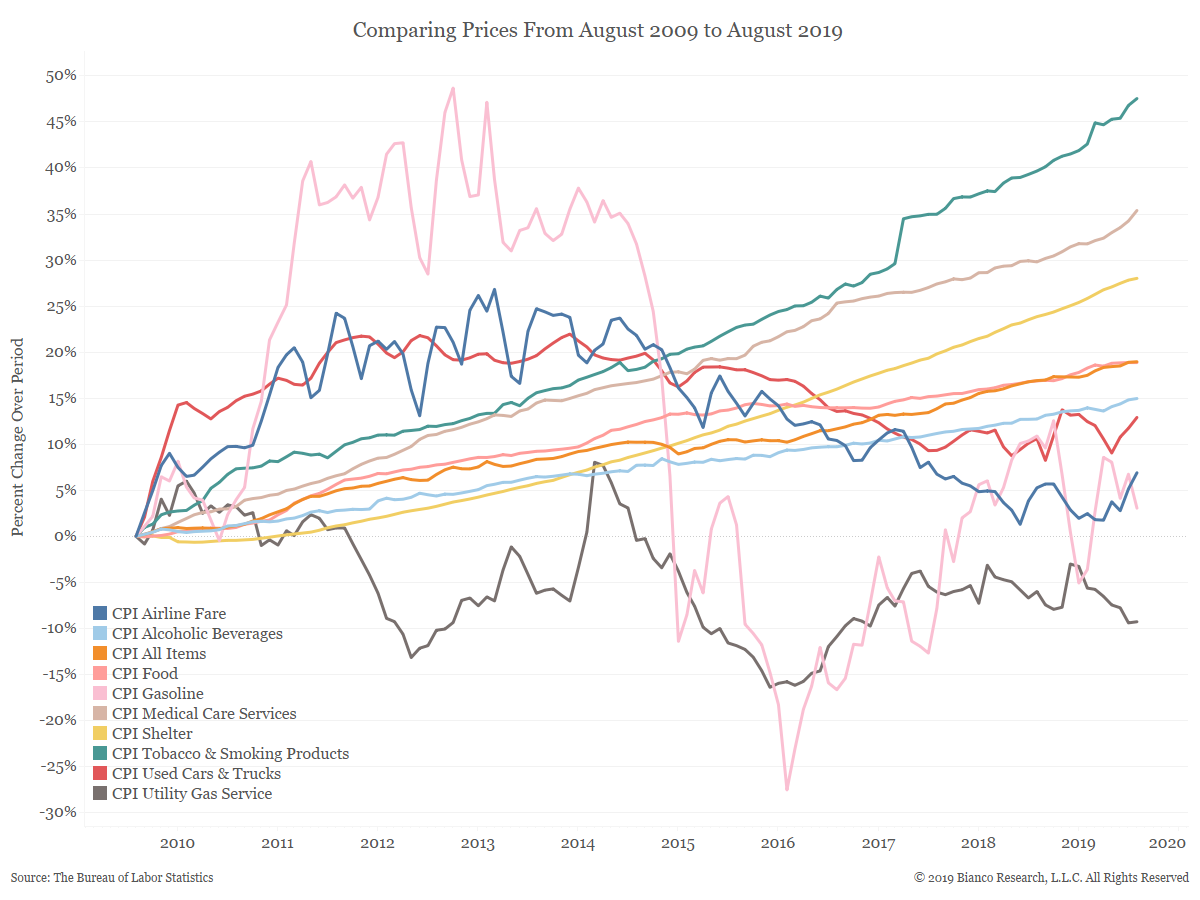

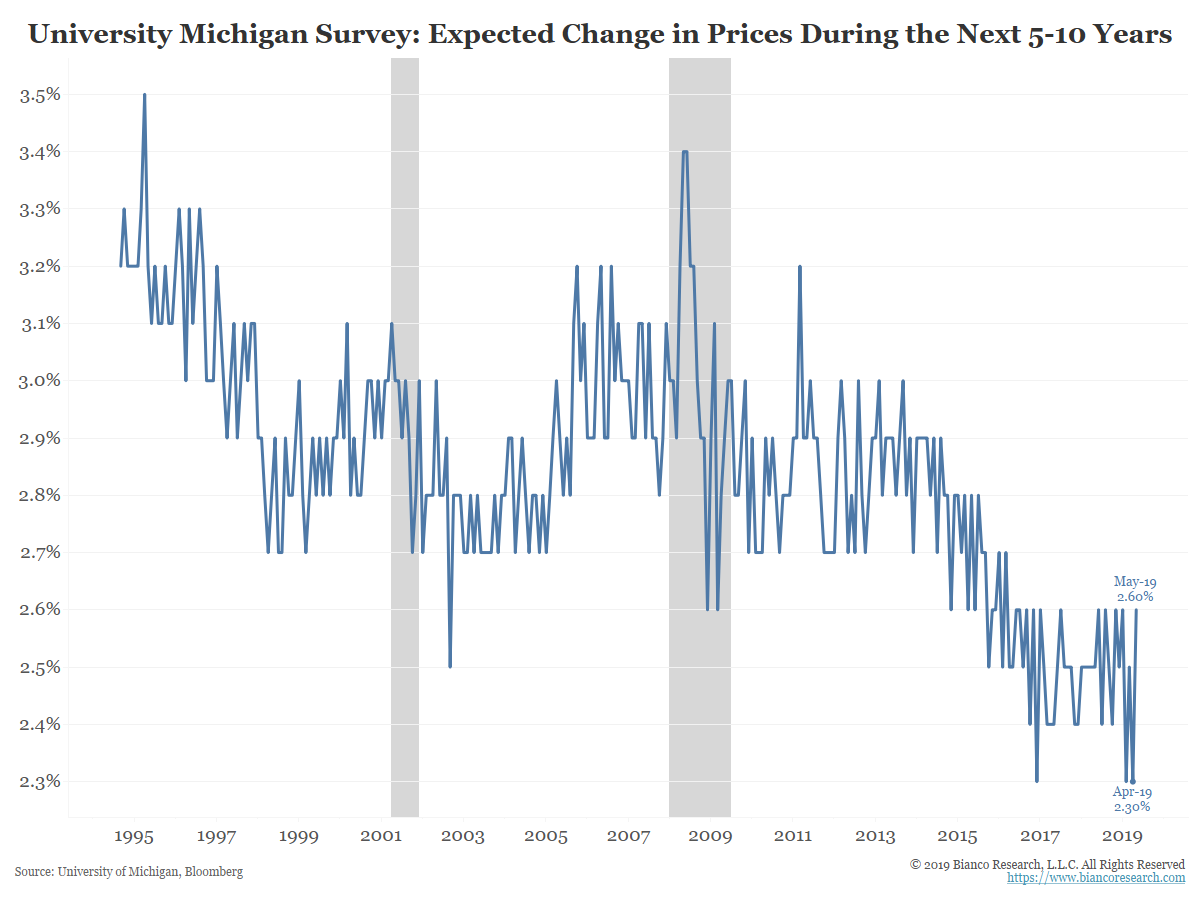

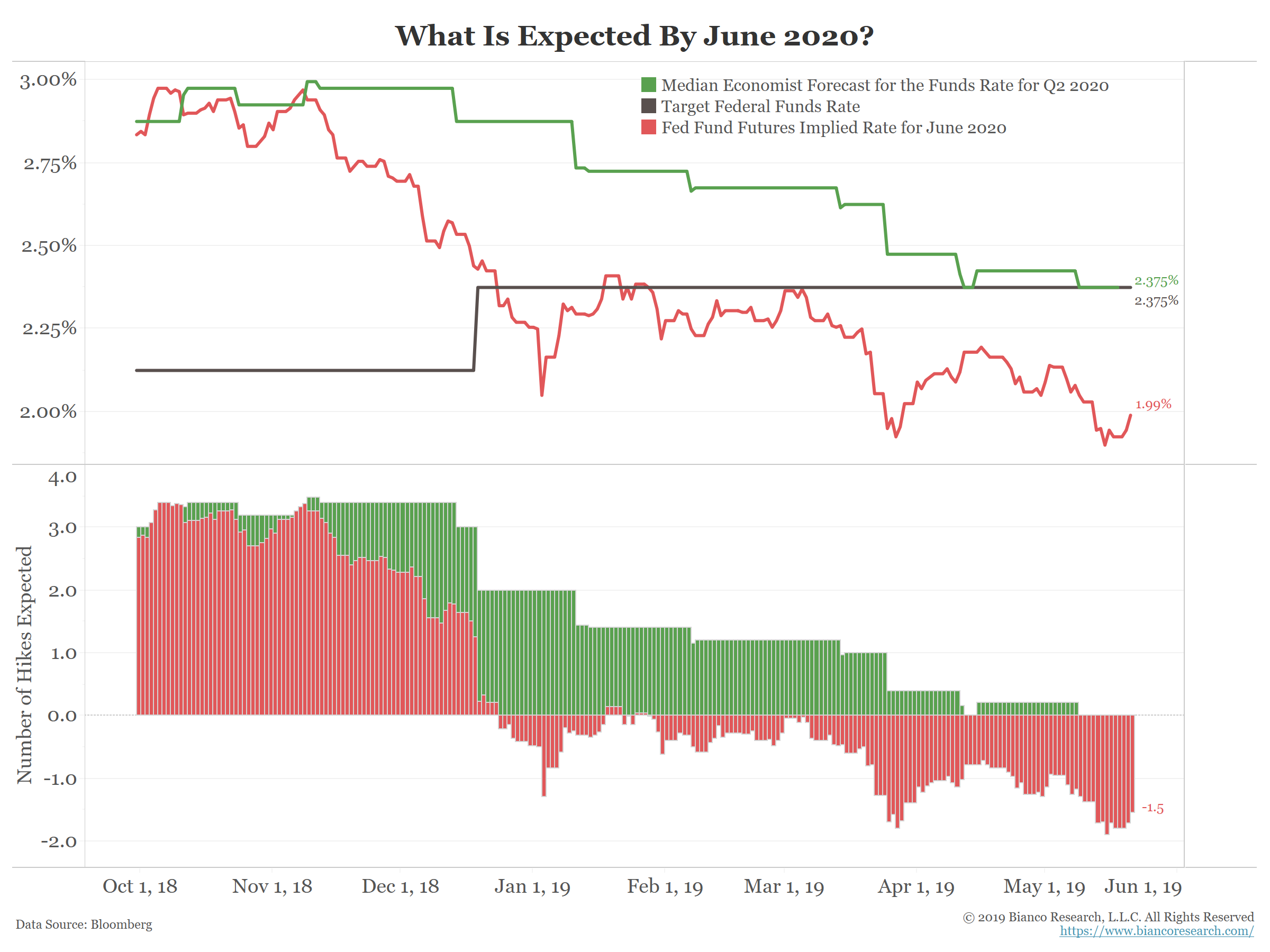

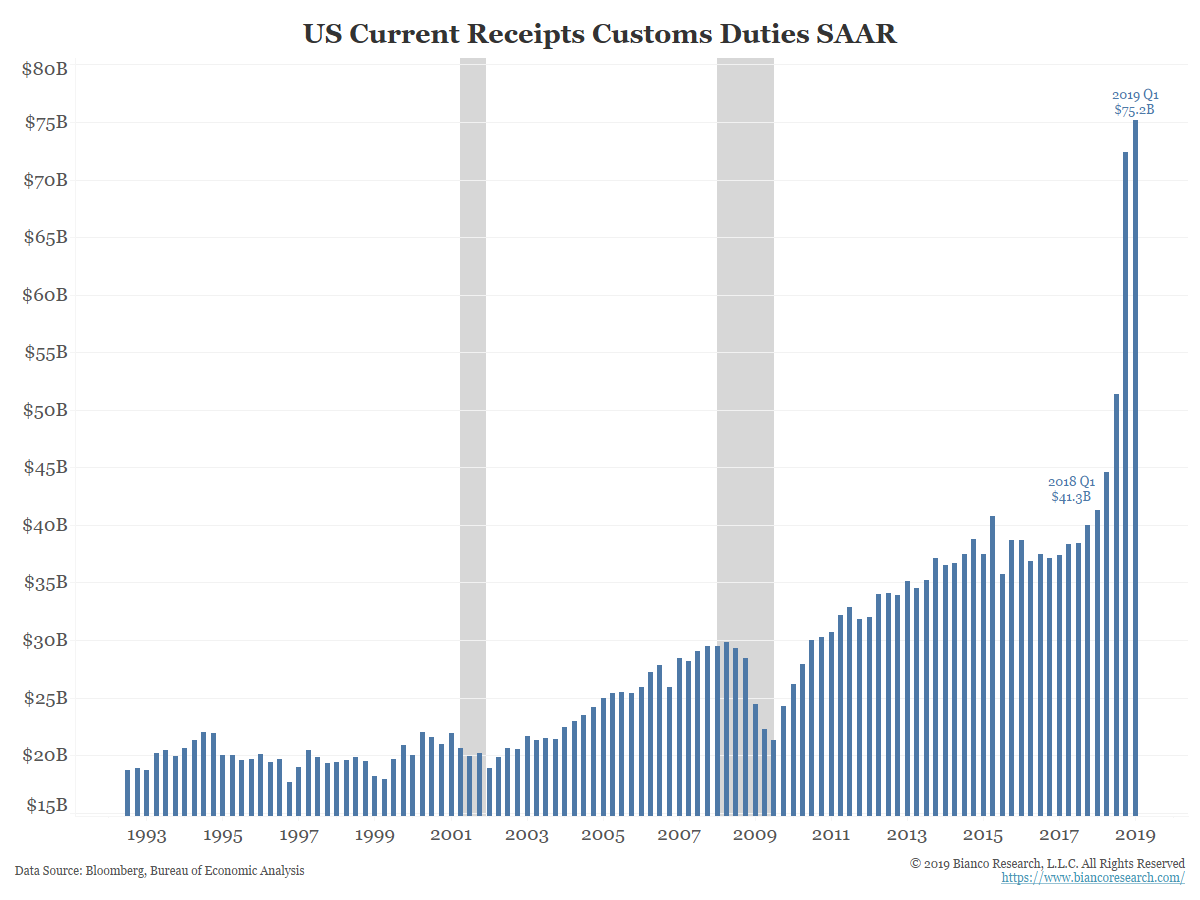

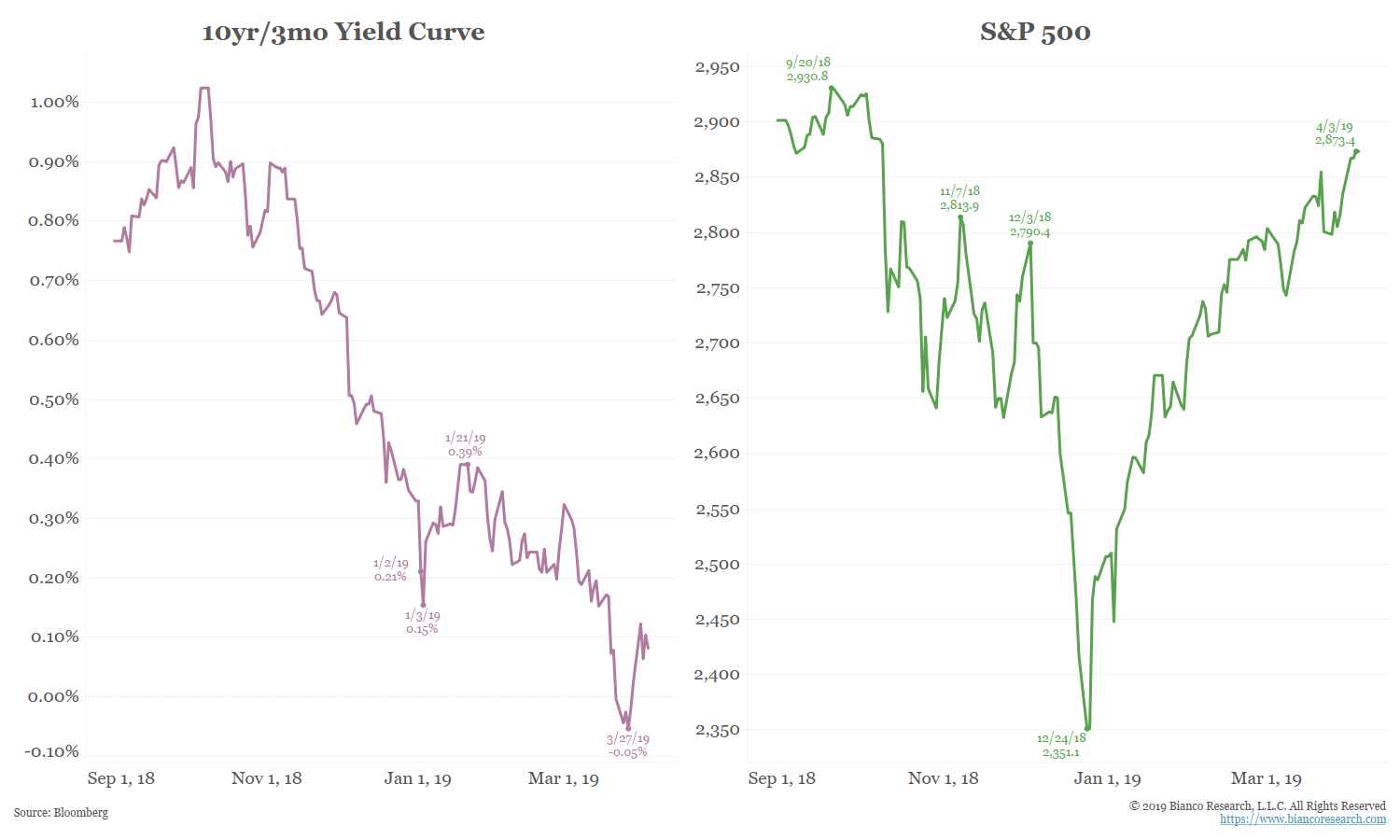

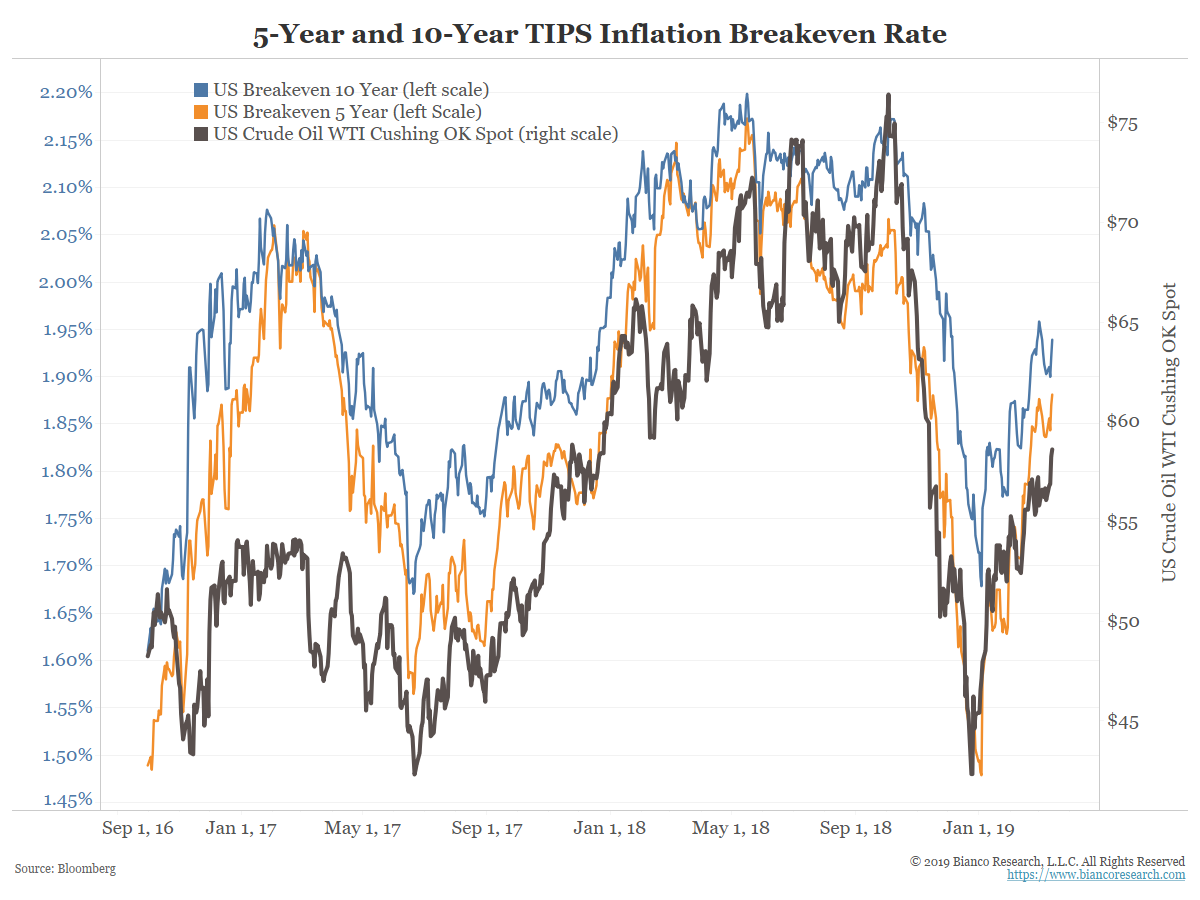

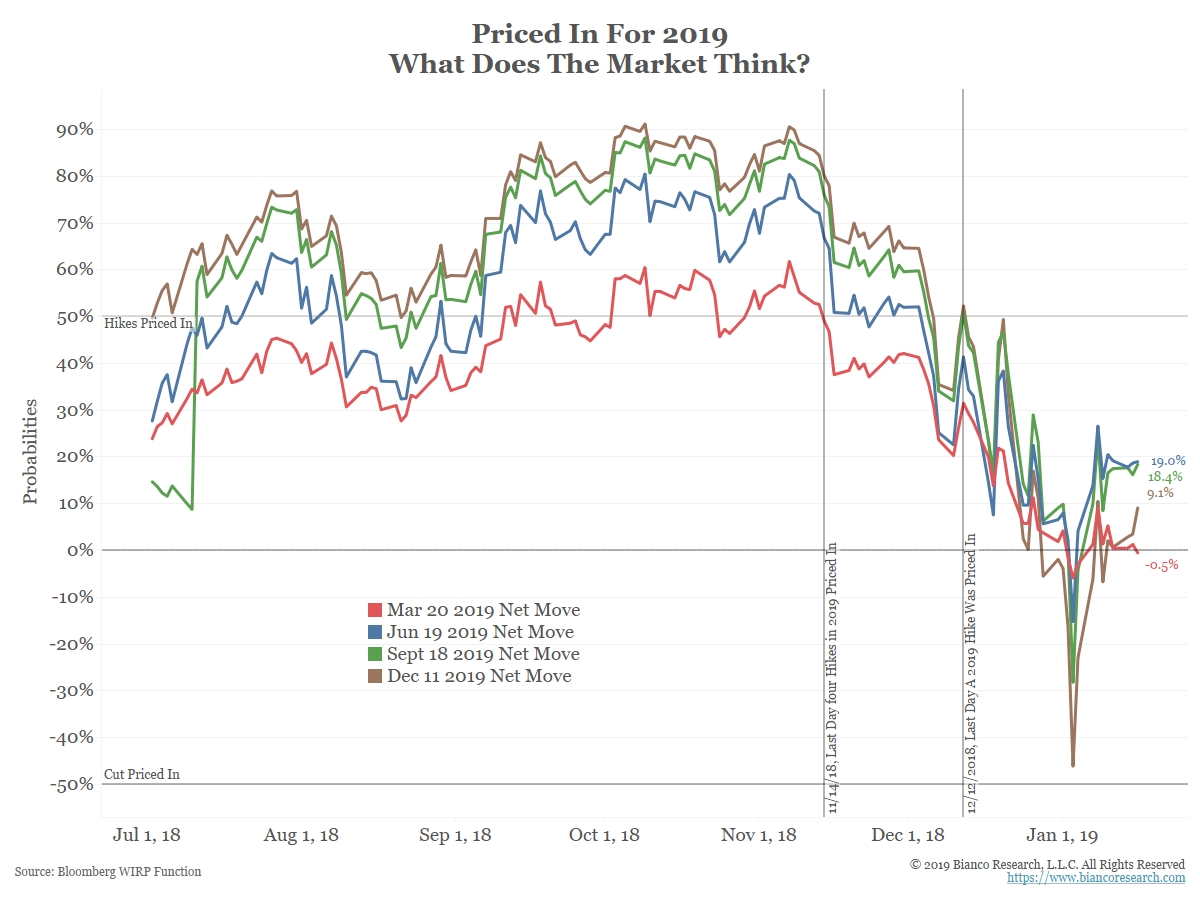

Debt, deficits, and borrowing are exploding higher. Taxes finance less government spending than any time in the past 75 years, yet none of this is impacting bond yields. That leaves inflation.... Read More