Quick Comments/What We’re Reading

Posted By Greg Blaha

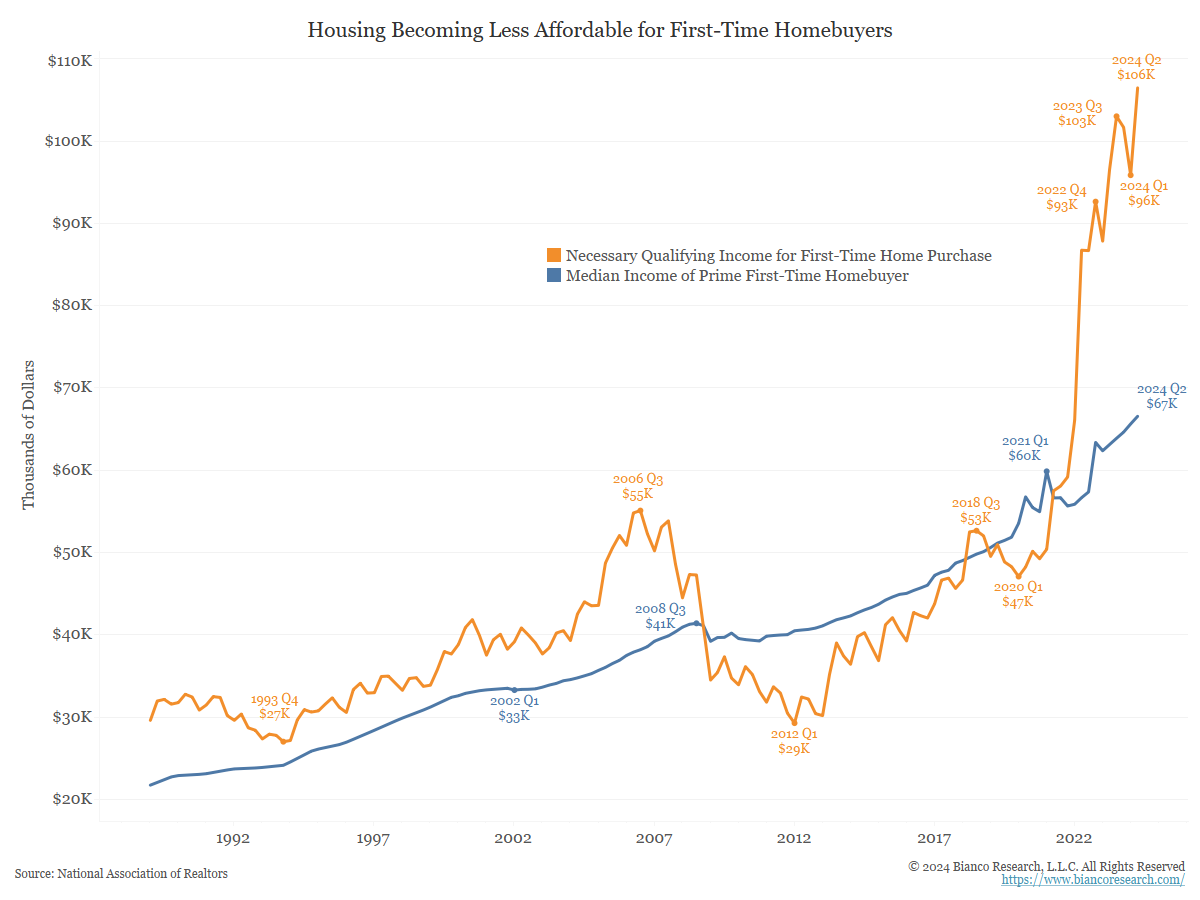

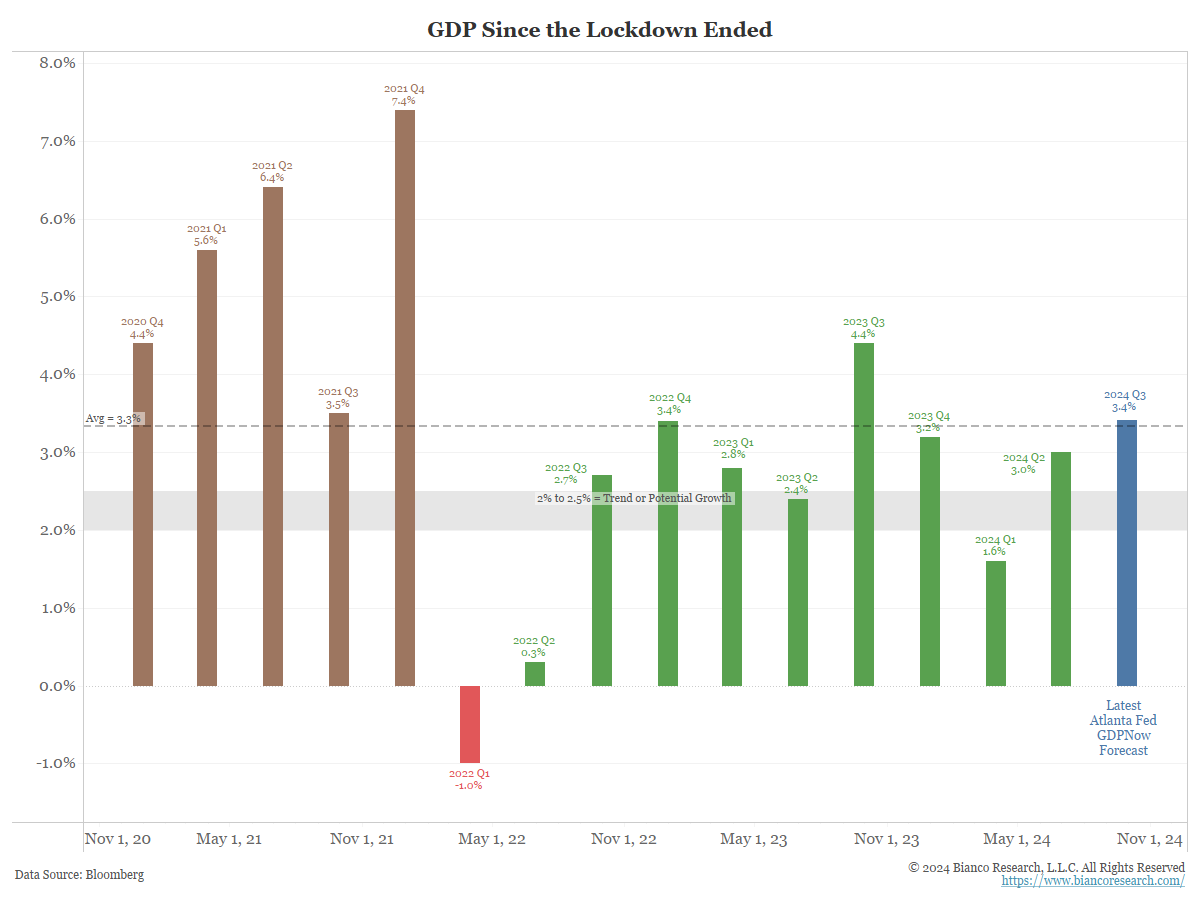

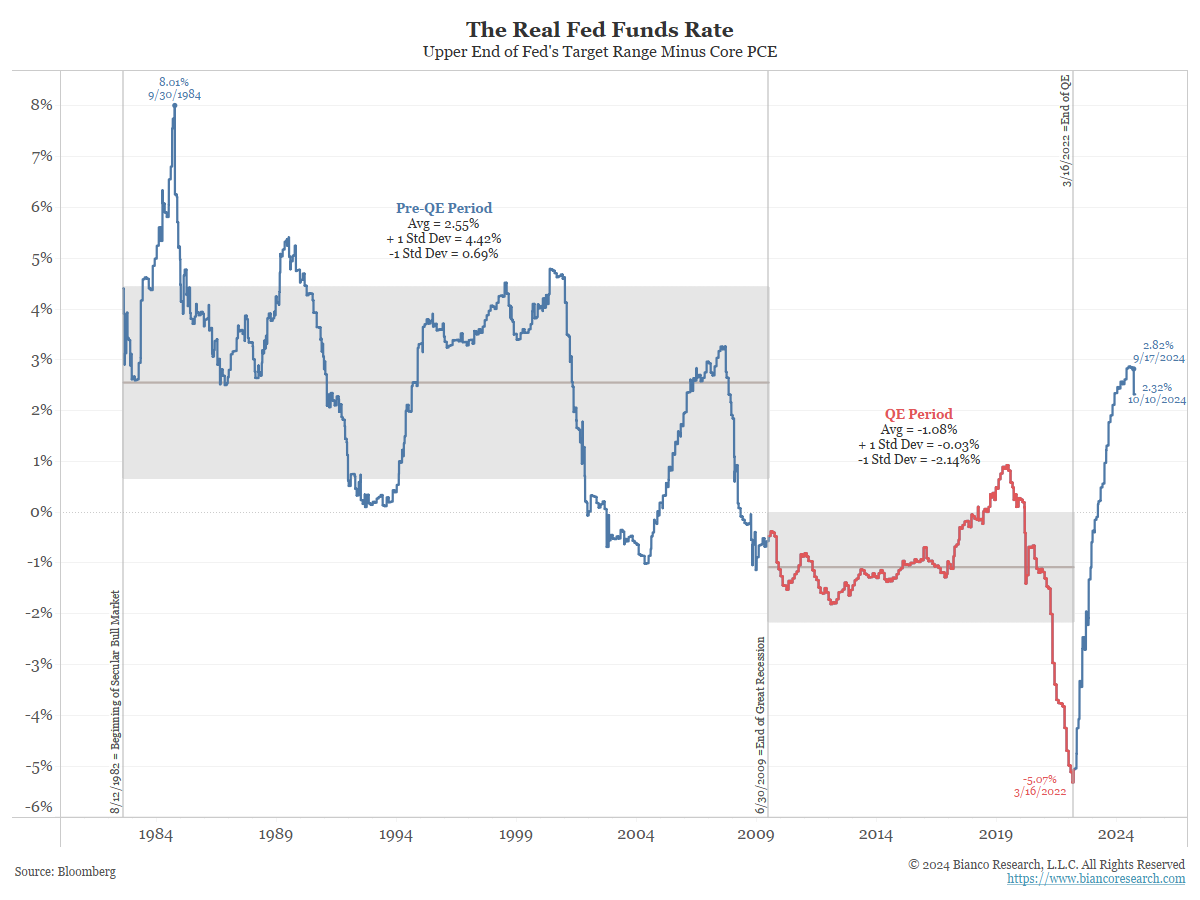

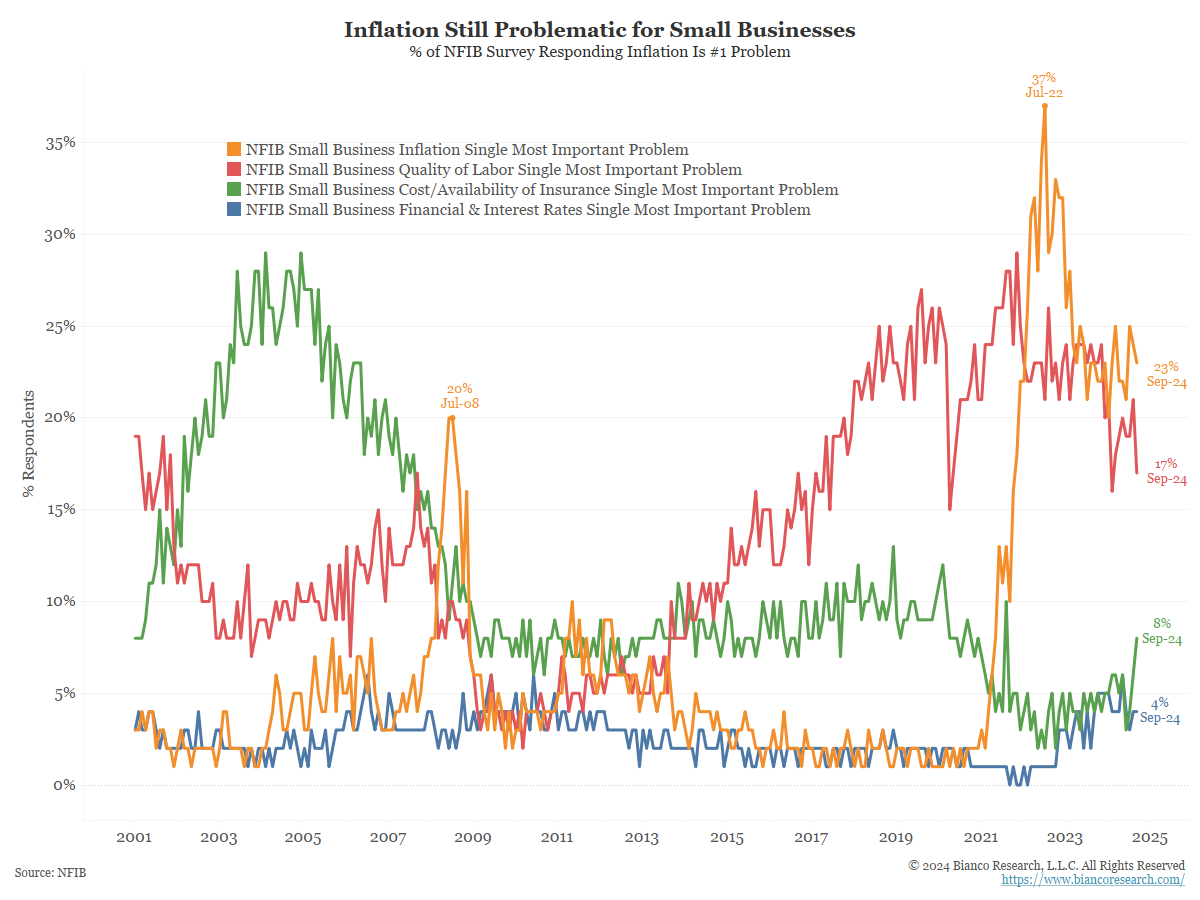

Today's topics include housing affordability, more Fedspeak favoring slower pace of cuts, rising rates, the short-term case against stocks, the long-term case against stocks, Covid broke many economic relationships, zombie companies in Japan at risk, and politics & stocks... Read More