The Fed: Everyone Has a Plan Until They Are Punched in the Mouth

Posted By Jim Bianco

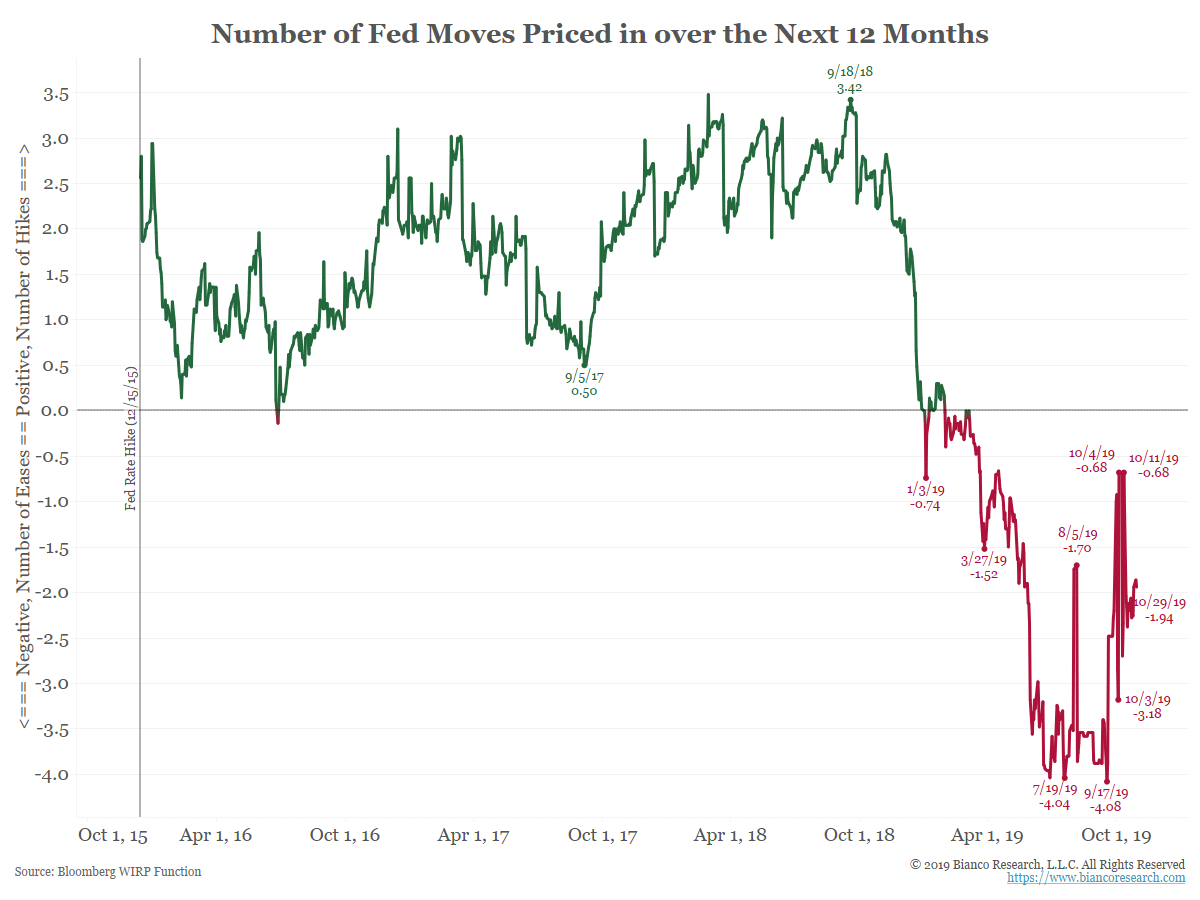

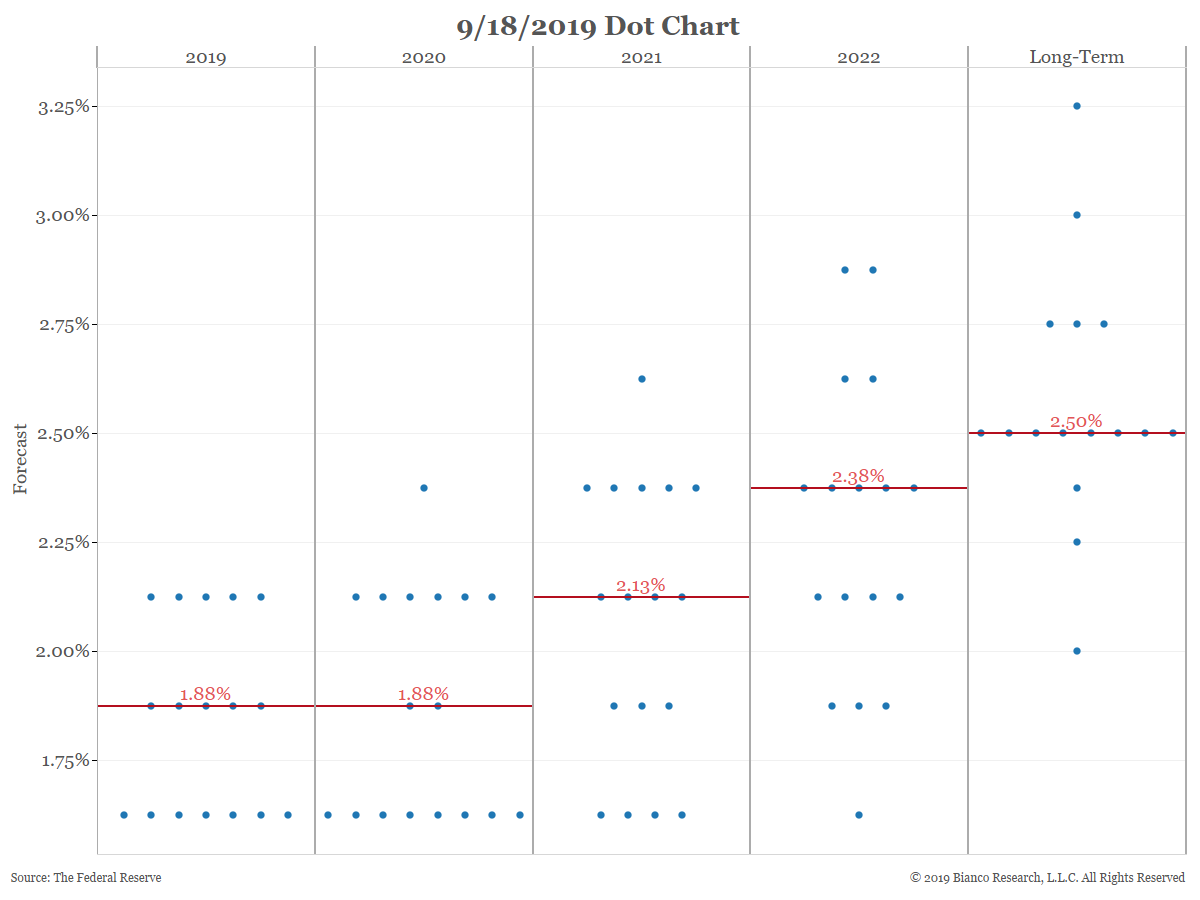

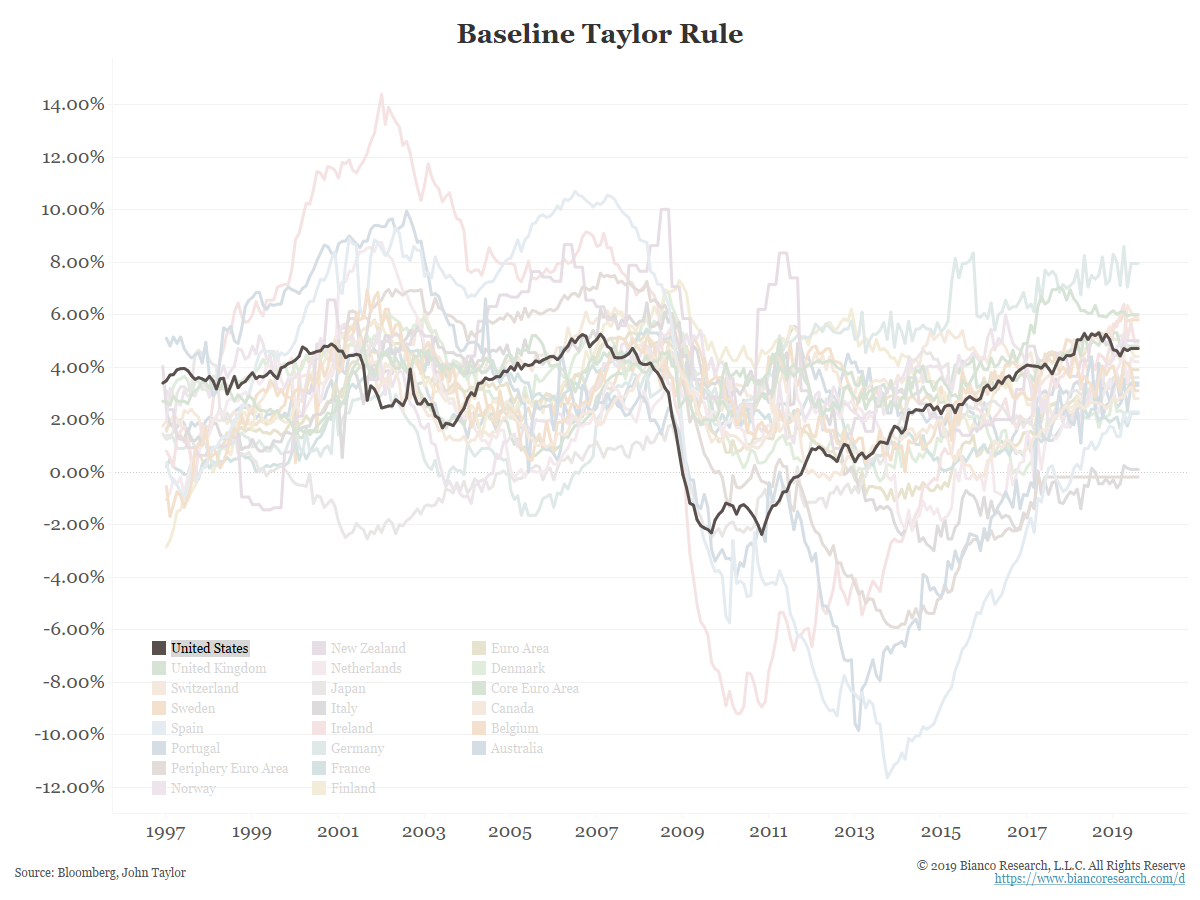

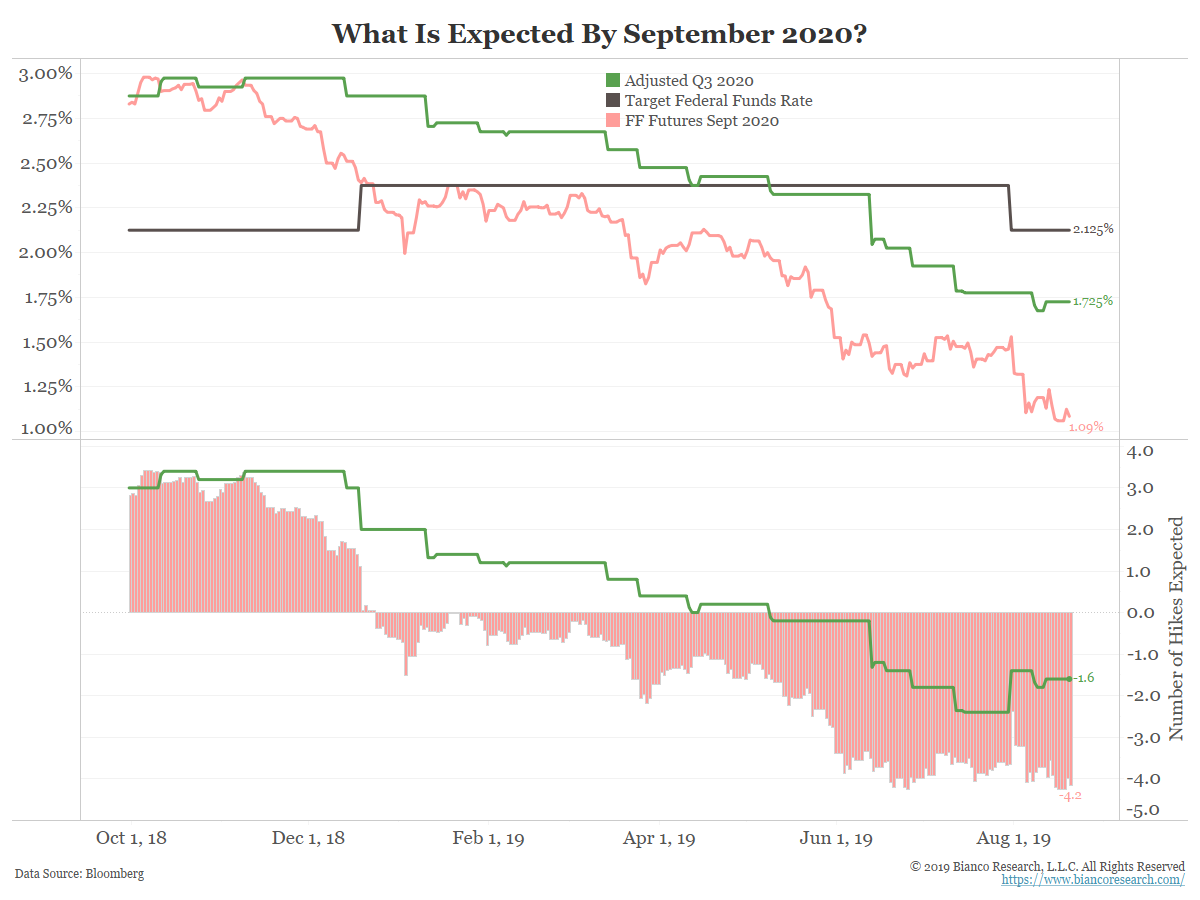

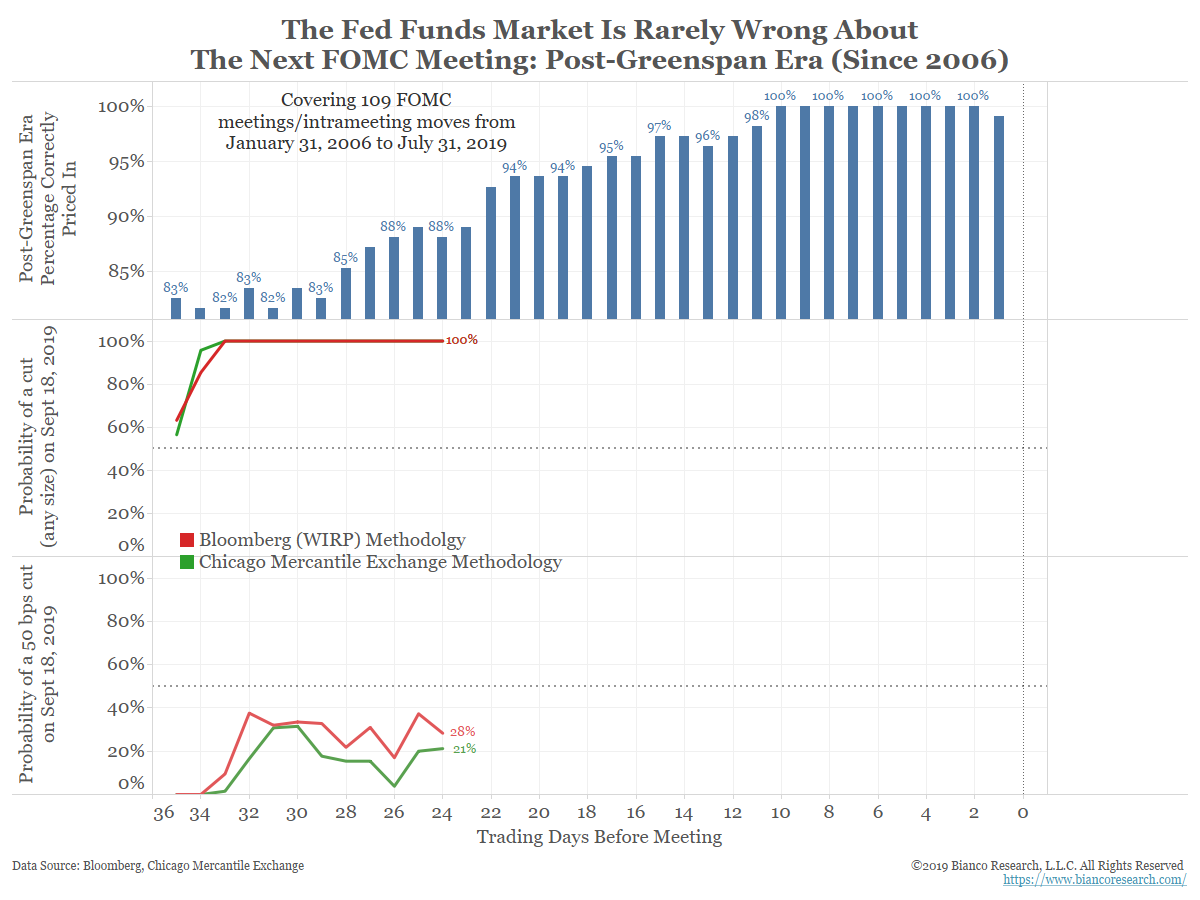

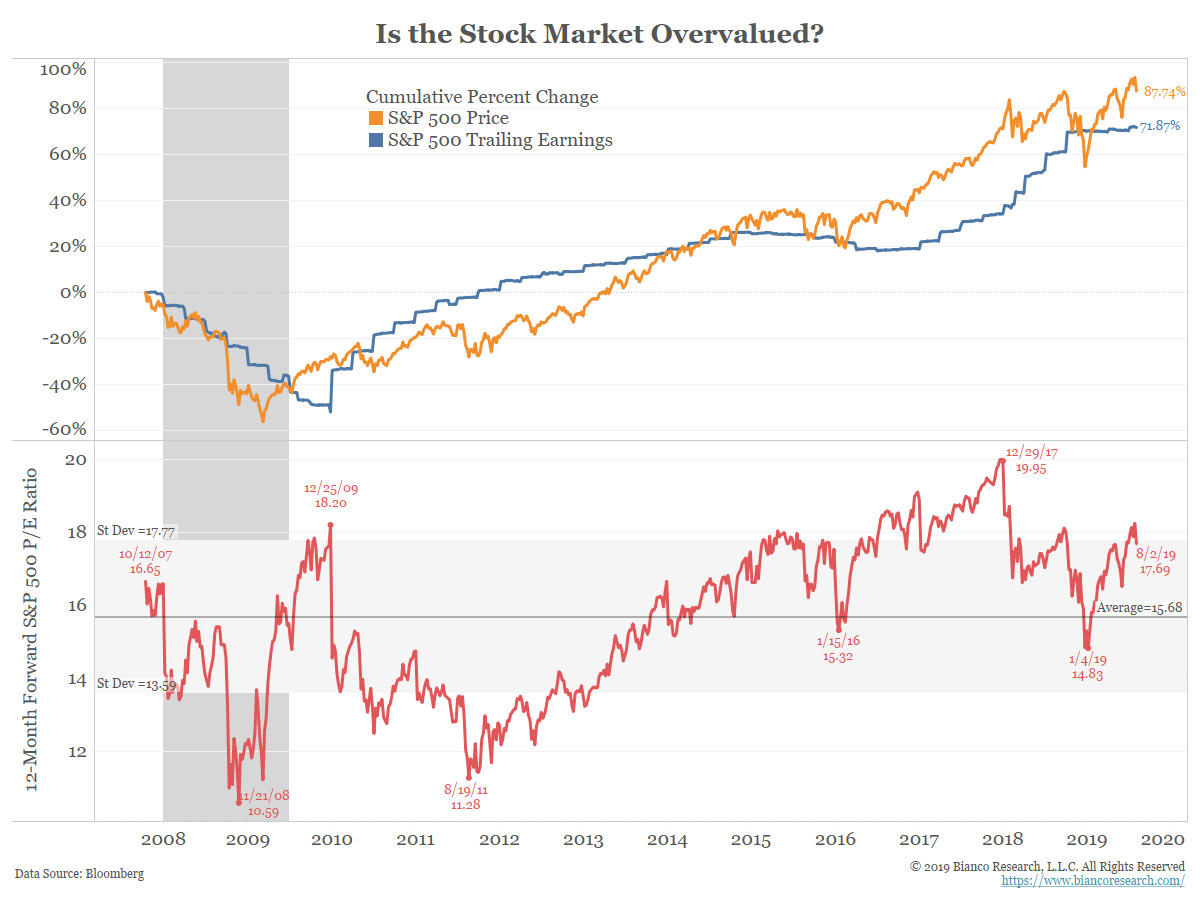

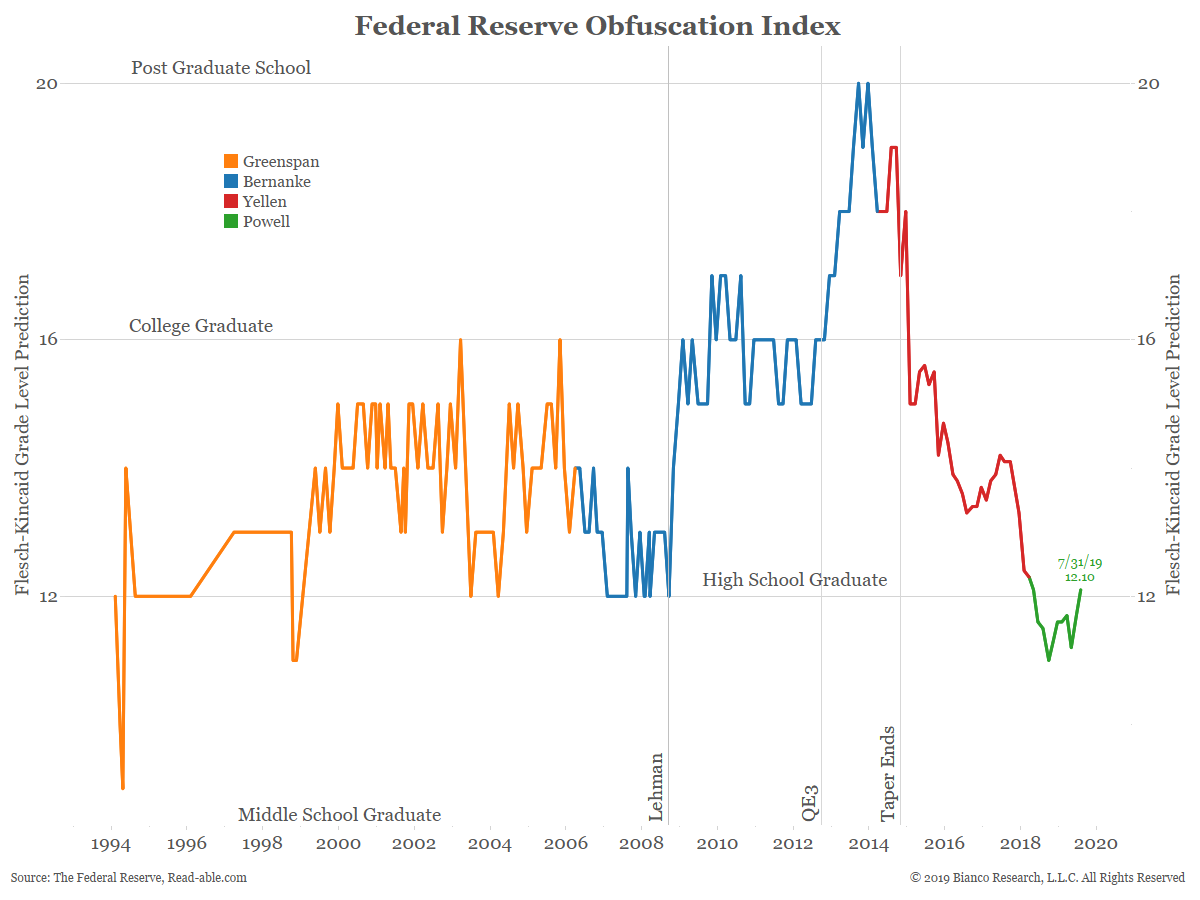

Jim was on CNBC's Trading Nation yesterday talking about the outlook for the Fed going into 2020. The Fed has a plan to keep rates steady for the foreseeable future, but as Jim quipped, "everyone has a plan until they get punched in the mouth." He believes a 5% to 7% correction in stocks in 2020 could force the Fed to revisit talks of rate cuts.... Read More