Measuring the Size and Scope of Negative Interest Rates

Posted By Jim Bianco

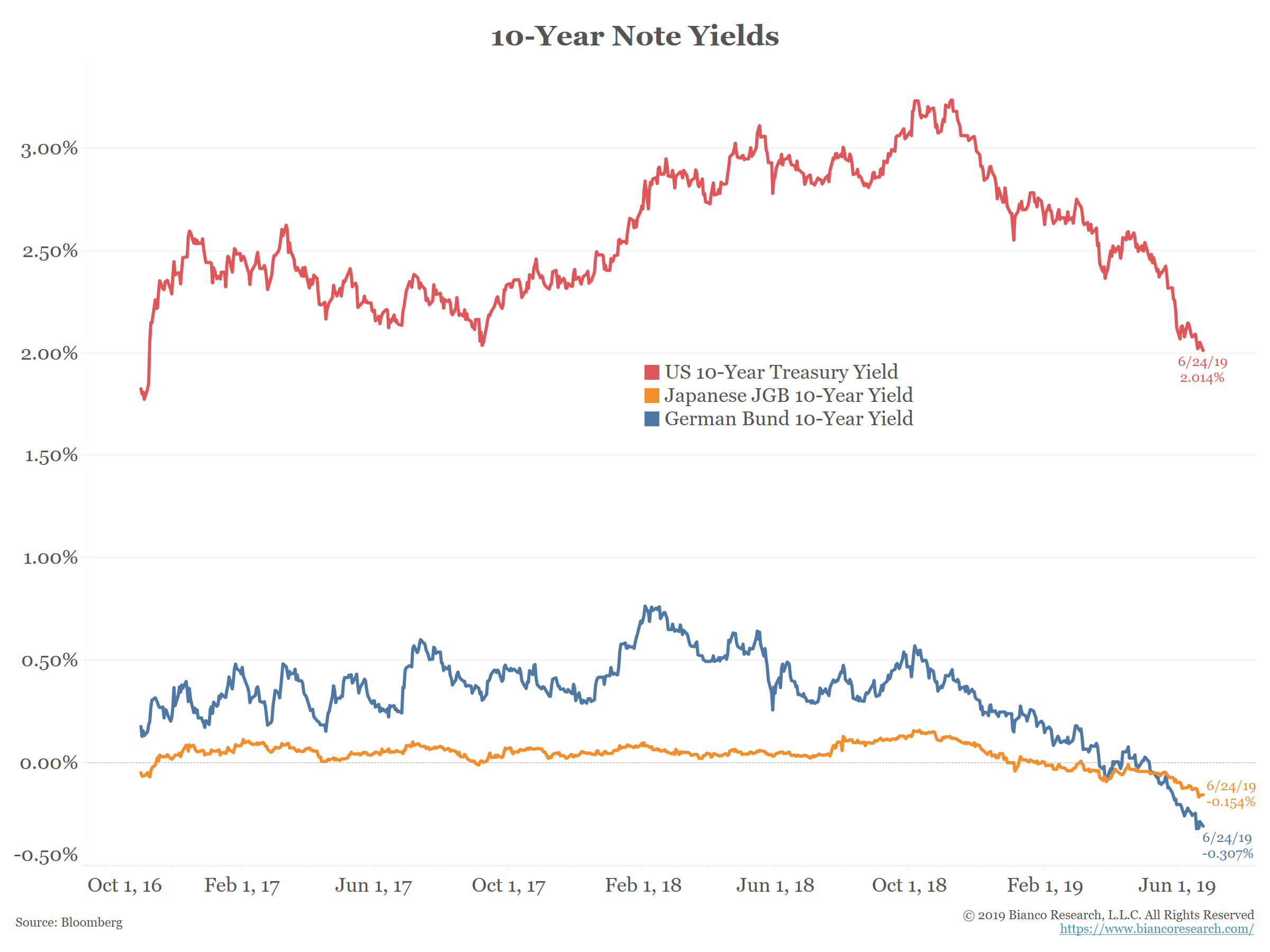

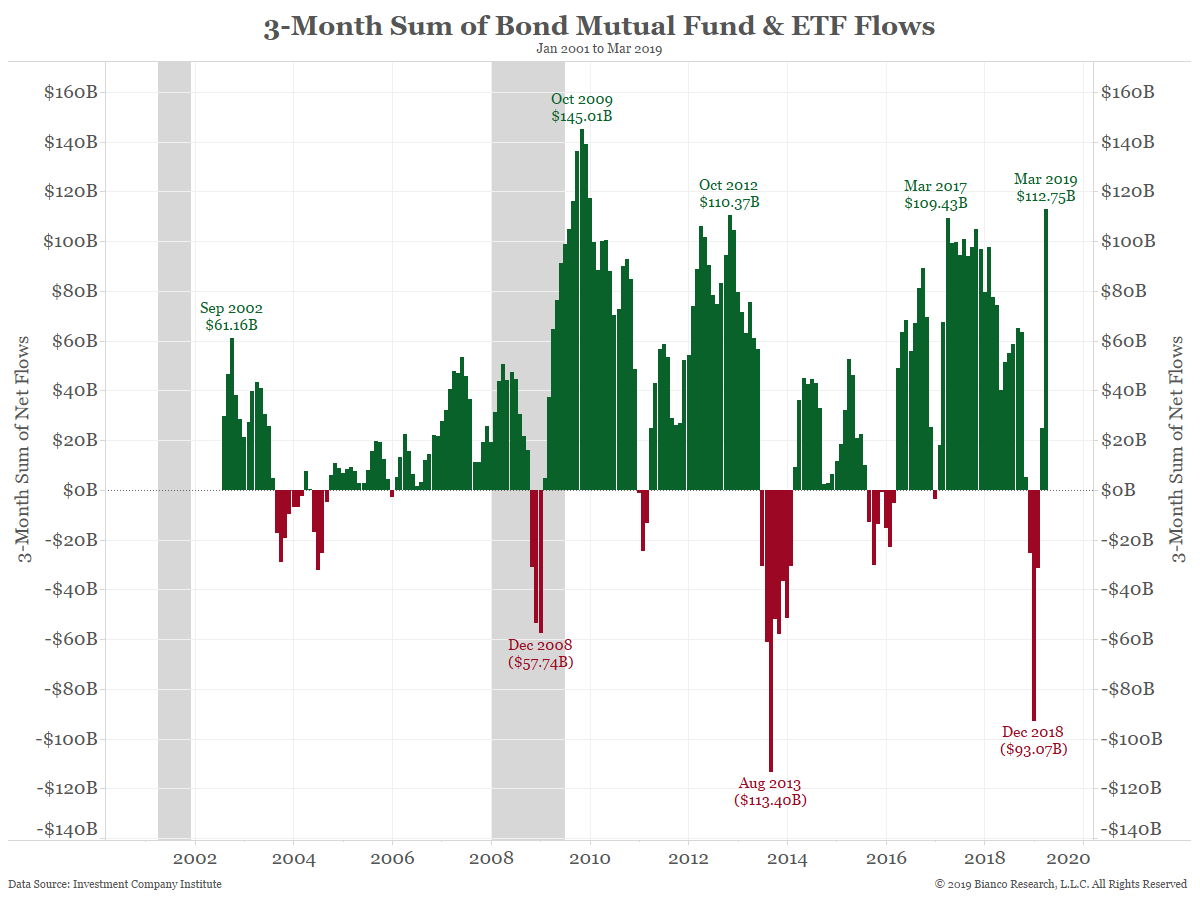

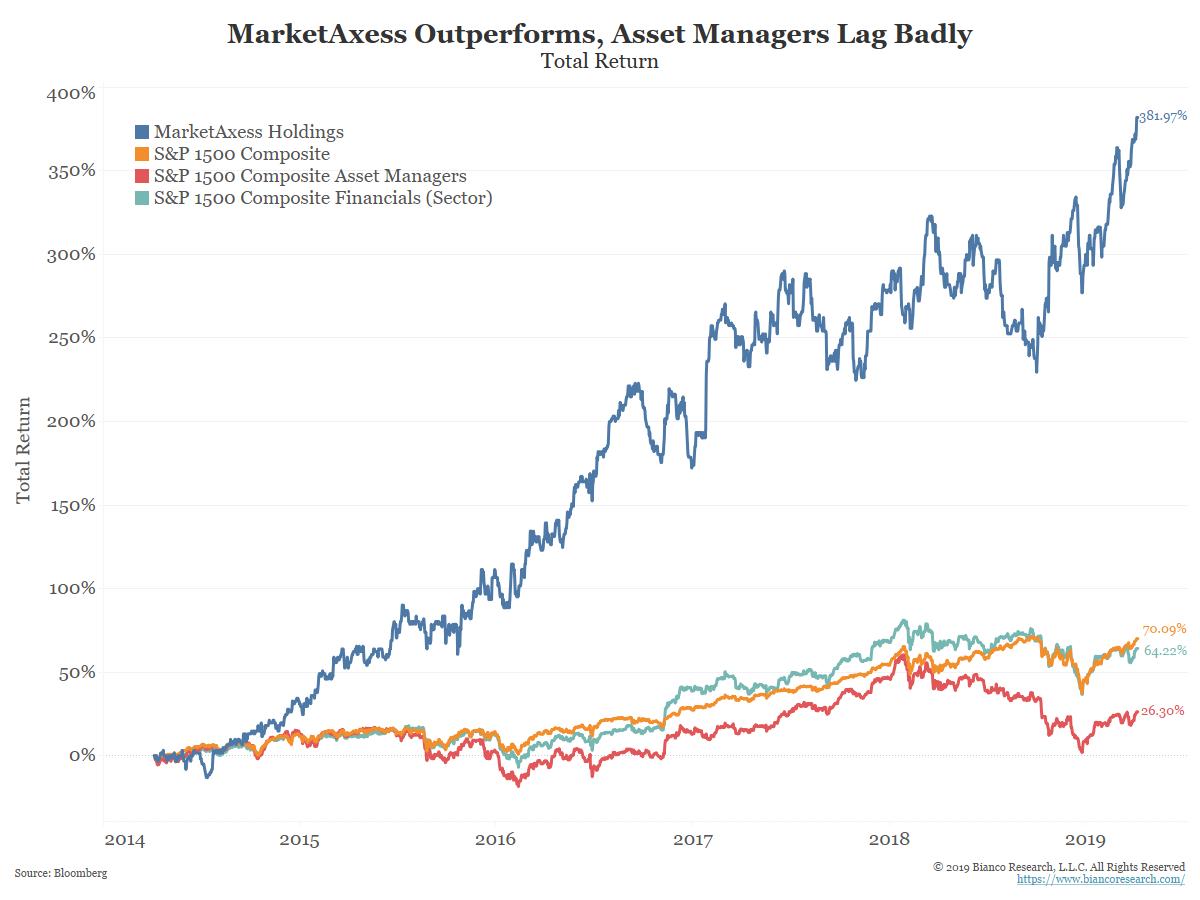

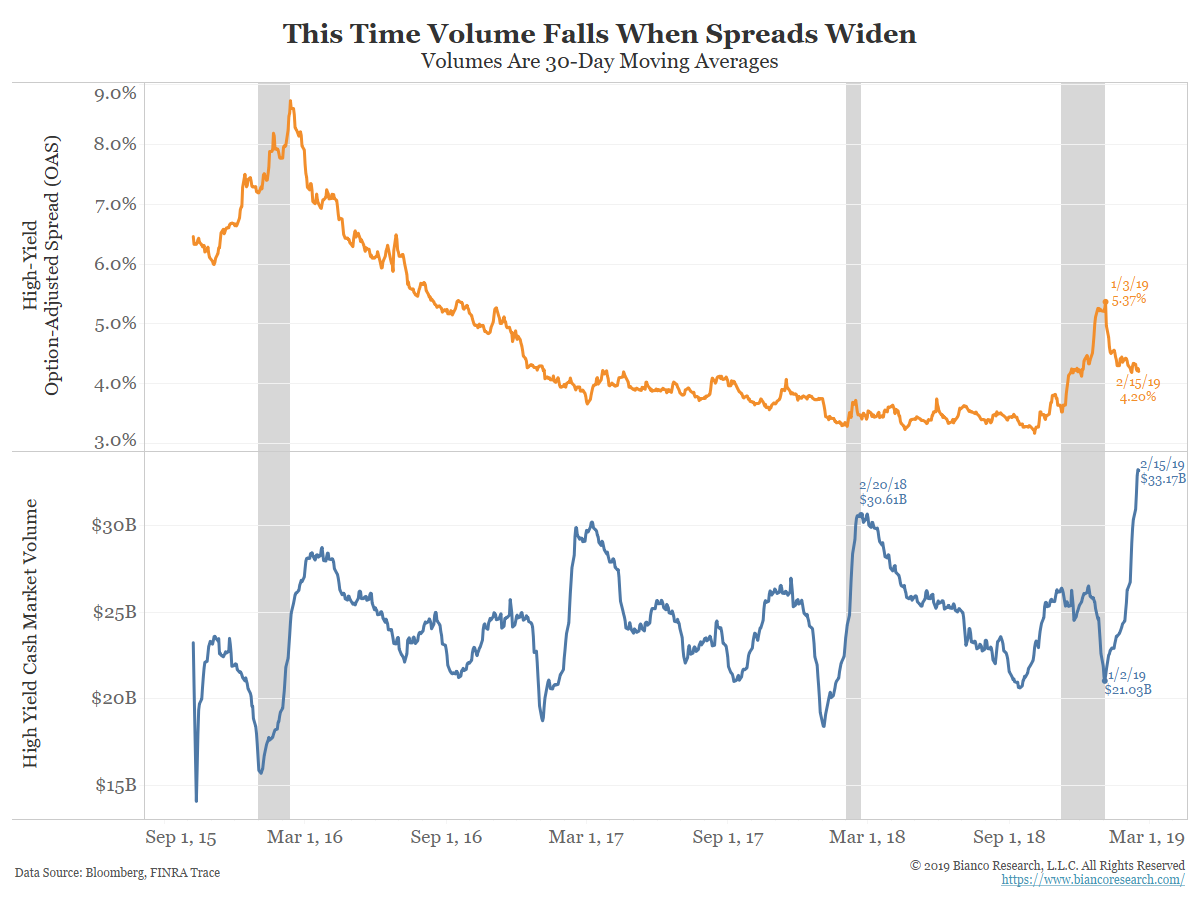

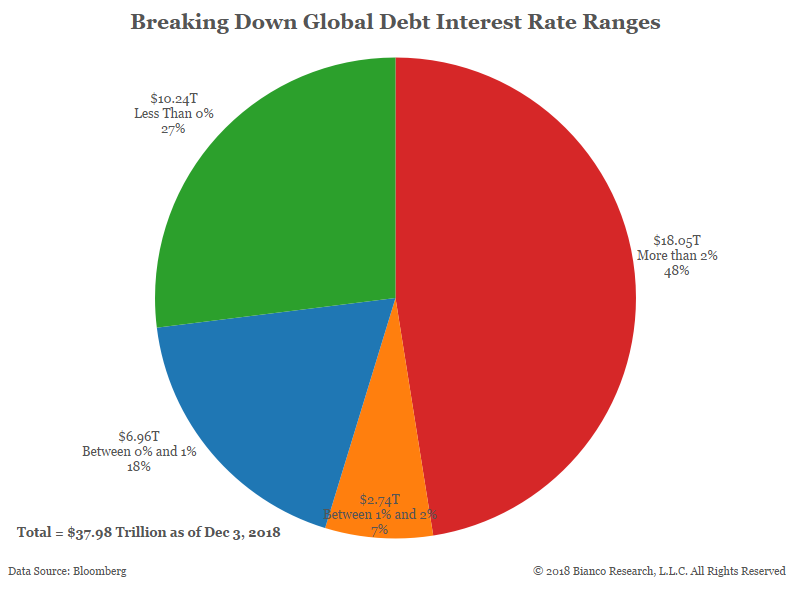

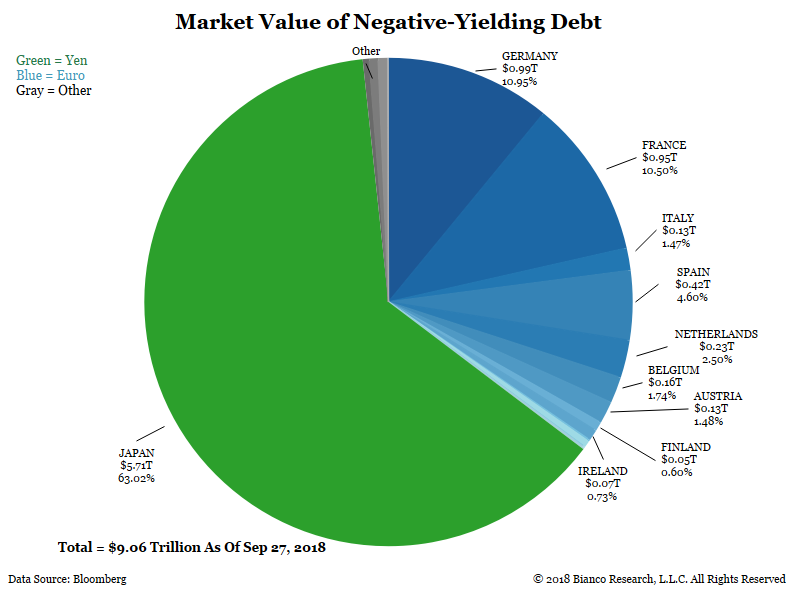

The market value of negative-yielding bonds across the globe recently hit a new record of $12.75 trillion. This is 23% of the total amount of sovereign debt outstanding.... Read More