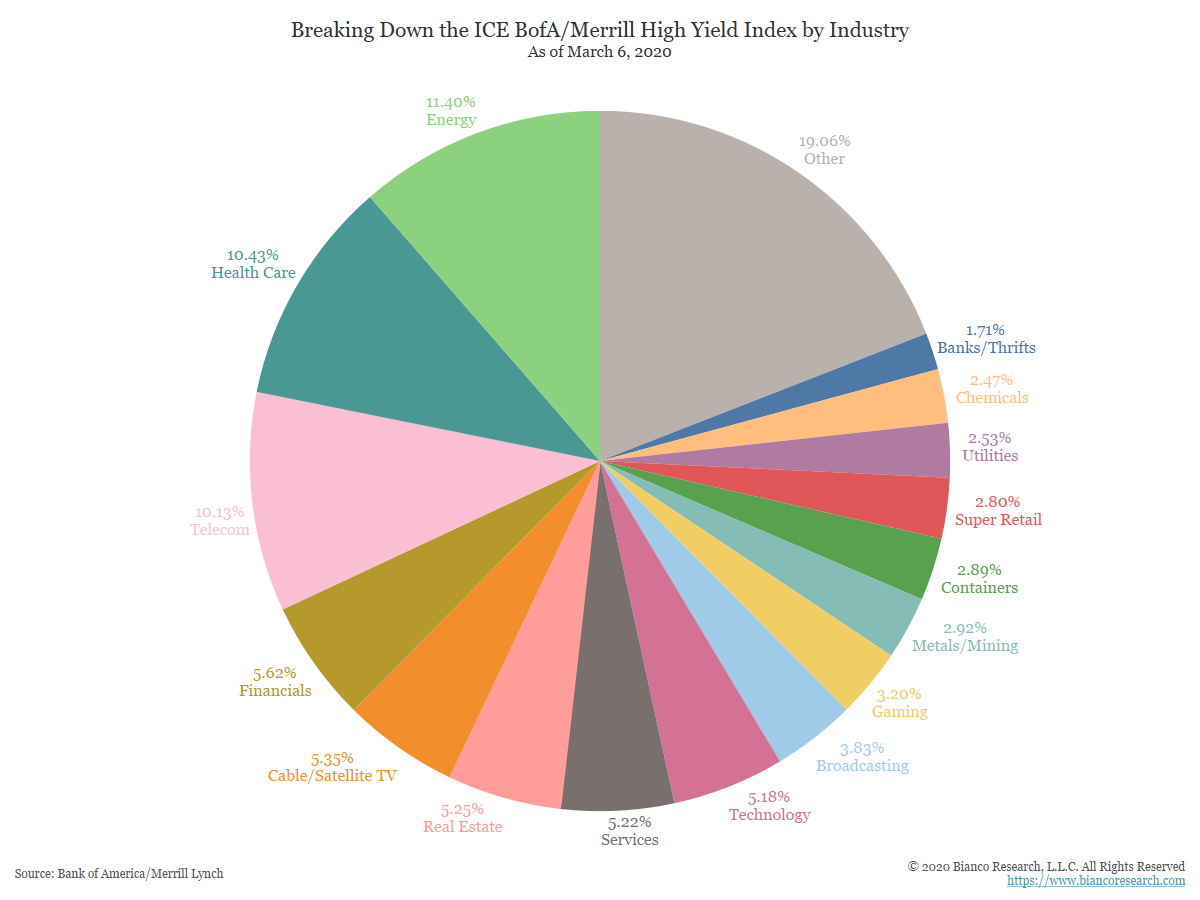

Breaking Down the High Yield Market by Industry

Posted By Greg Blaha

For a long time, bonds from the energy industry made up the largest component of the BofA/Merrill High Yield Index. After this week's carnage, they now rank third behind health care and telecom.... Read More