- Bloomberg – Global Growth Is Peaking—But Not Petering Out

World growth peaking, not petering out, economists say

What’s happening, economists say, is that the broadest period of world growth since 2010 is peaking at an elevated level, not petering out. And the driver of the expansion is shifting to a fiscally juiced U.S. economy from a slowing Europe and Japan. But they acknowledge that their forecasts of another year or more of solid economic activity have become more uncertain after a soggy start to 2018, an outbreak of trade tensions and a ratcheting up of concern over Syria. “If you had talked to me two months ago, I would have said there are upside risks,” to global growth, said Ethan Harris, head of global economics research at Bank of America Merrill Lynch in New York. “Now I’m seeing downside risks.” - Bloomberg – Goldman Sachs Says You Must Own Commodities in These Tense Times

Geopolitical conflicts seen raising risk of supply disruptions

The case for owning commodities has rarely been stronger, according to Goldman Sachs Group Inc. With raw materials rallying on escalating political tensions across the globe and economic growth remaining strong, the bank’s analysts including Jeffrey Currie doubled down on their “overweight” recommendation. They reiterated a view that commodities will yield returns of 10 percent over the next 12 months, according to an April 12 note. The Bloomberg Commodity Index is up more than 2.5 percent this week, the most in two months. Another raw materials gauge, the S&P GSCI Index, has rallied over 5 percent this week to levels last seen in 2014.

Summary

Comment

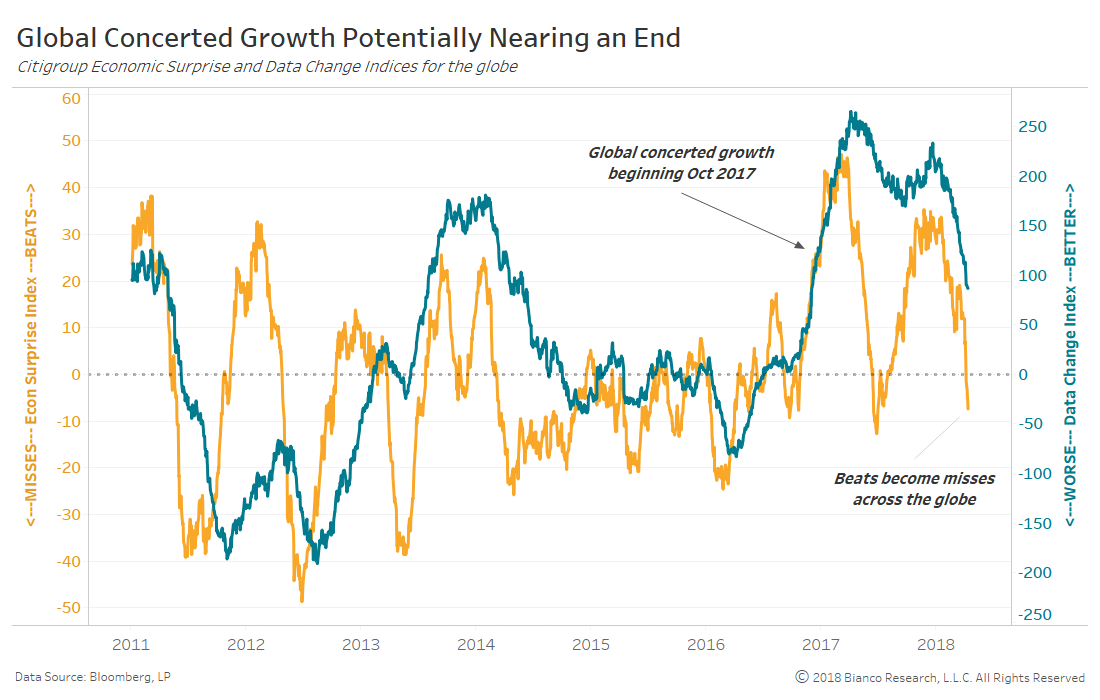

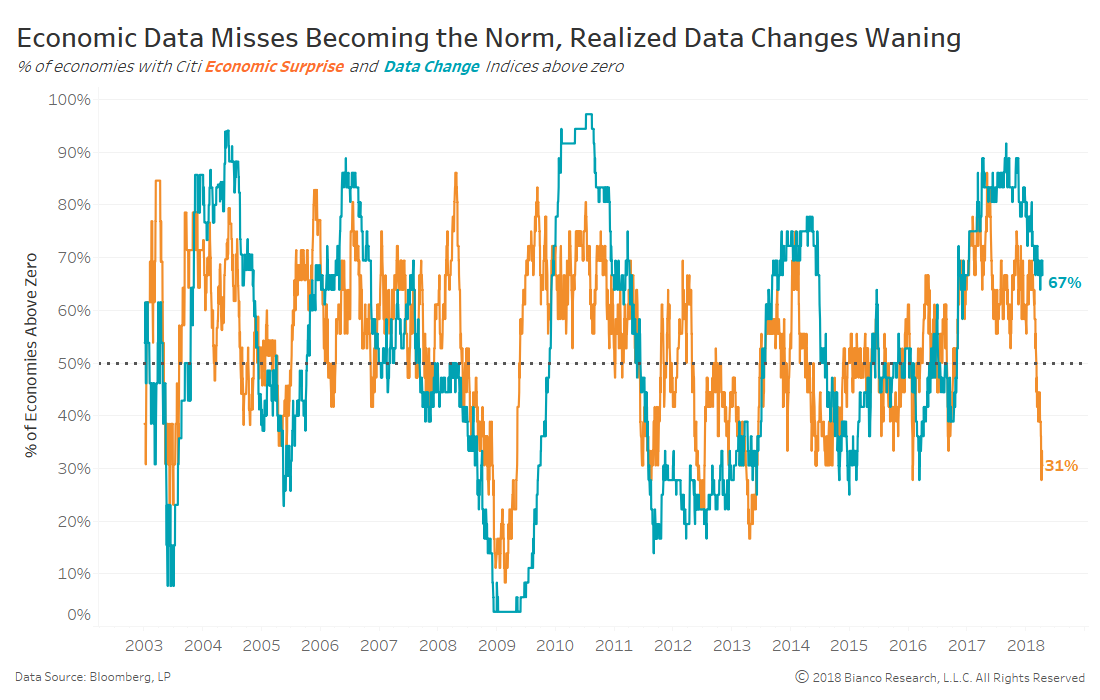

The Global Citigroup Economic Surprise Index (orange line) has dropped below zero, telegraphing a continued drop by realized data changes (green line). Concerted economic growth was in its greatest form October 2016 through April 2017.

The bursts in economic data beats (orange line) from October 2016 through March 2017 and then again from July 2017 through December 2017 coincided with some of the strongest returns produced by developed and emerging equities, industrial metals, and energy.

Equities have recently run into trouble while both surprises and data changes come off their fervent pace of improvement. U.S.Treasuries have stalled with the U.S. 10-year note refusing to push toward the most-discussed 3.0% threshold.

All in all, whether economic data changes remain above one-year averages or not will dictate returns through the end of 2018.

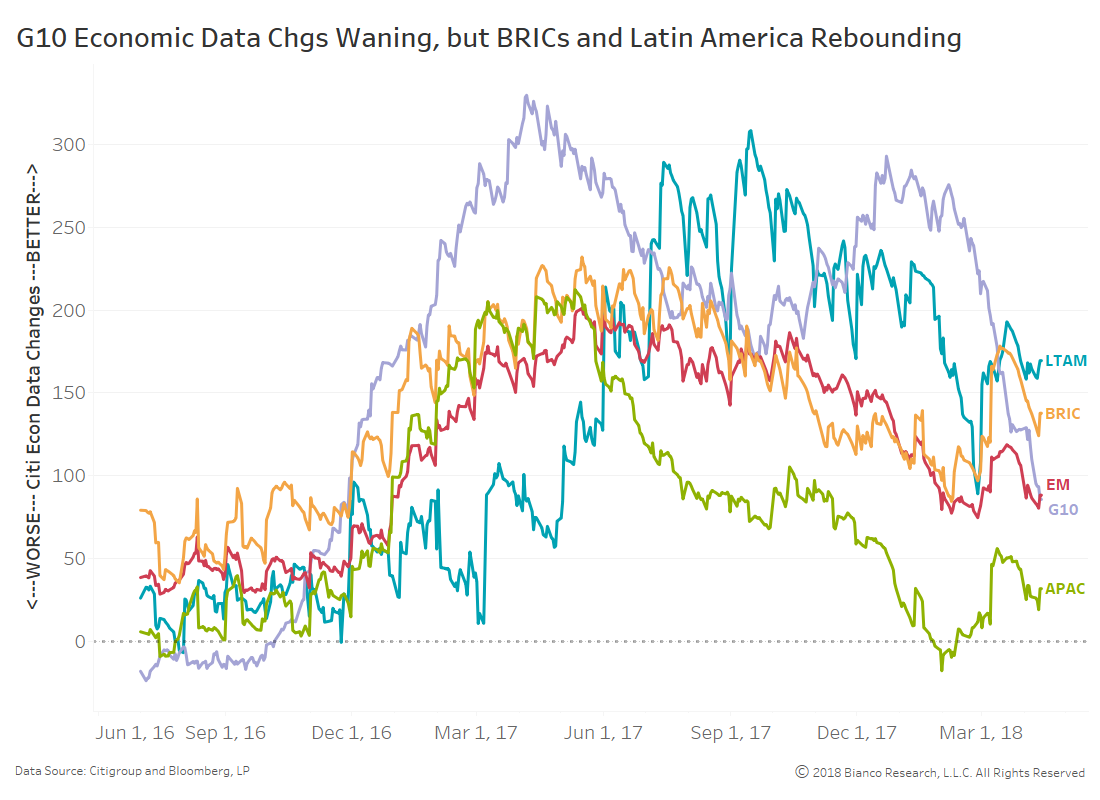

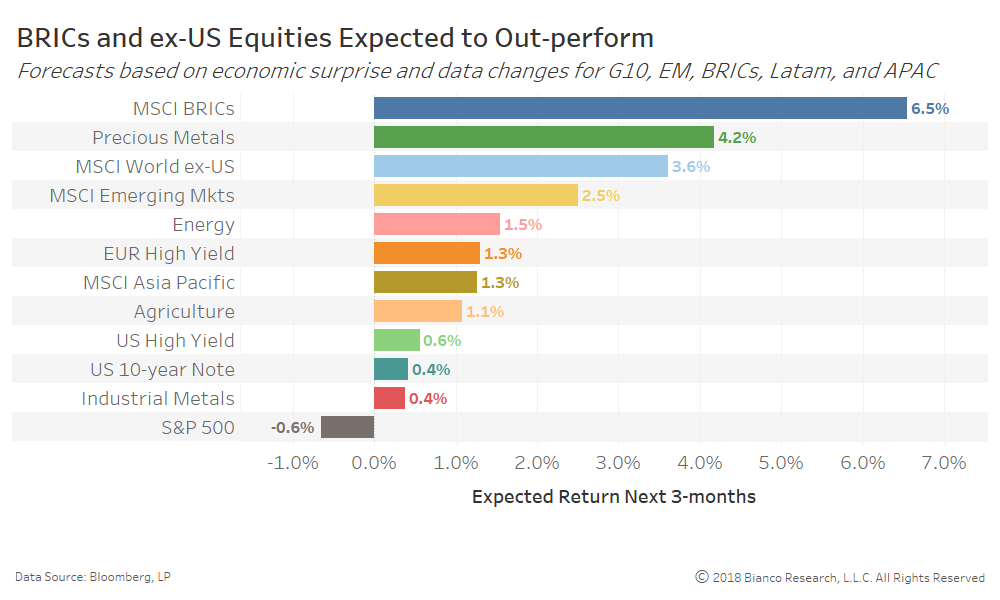

We use the economic surprise and data changes above for the G10, EM, BRICs, APAC, and Latin America to forecast asset returns for the next three months. Not surprisingly, BRICs (6.5%) and emerging market (2.5%) equities are expected to produce healthy returns. The S&P 500 is expected to move sideways to modestly lower (-0.6%).

Commodity markets are expected to offer positive returns, but not likely to the degree expected by Goldman Sachs in the article above. Precious metals and energy top the list, followed by tepid returns by agriculture and industrial metals.

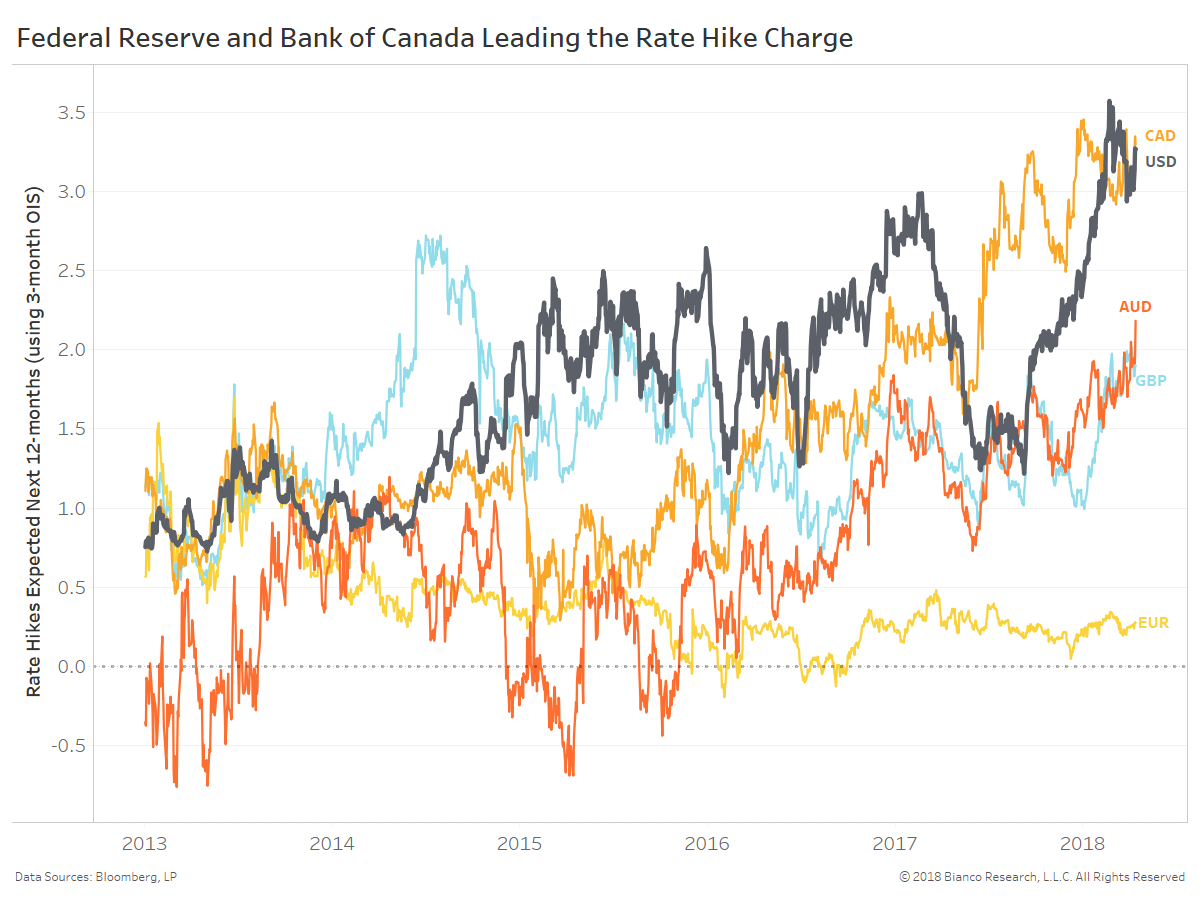

Sovereigns like U.S. Treasuries will remain a frustrating investment as the risk-on/off dynamic continues to break down. The Federal Reserve’s heavy inflation focus (over and beyond financial stability) does not look ready to fade.