-

- Bloomberg – Tim Duy: The Fed Will Look Past This Turmoil in Markets

Friday’s jobs report is more important for the path of interest rates than the recent drop in equities.

The declines in equities so far are unlikely to have much impact on rate policy given the current environment where, according to the Fed, the economy sits near or beyond full employment. More important for the path of monetary policy is this week’s employment report for March. A mix of continued strong job growth, a further decline in the unemployment rate, and stronger wage growth would overshadow recent equity declines and further cement the Fed’s case for additional rate hikes.

- Bloomberg – Tim Duy: The Fed Will Look Past This Turmoil in Markets

Summary

Comment

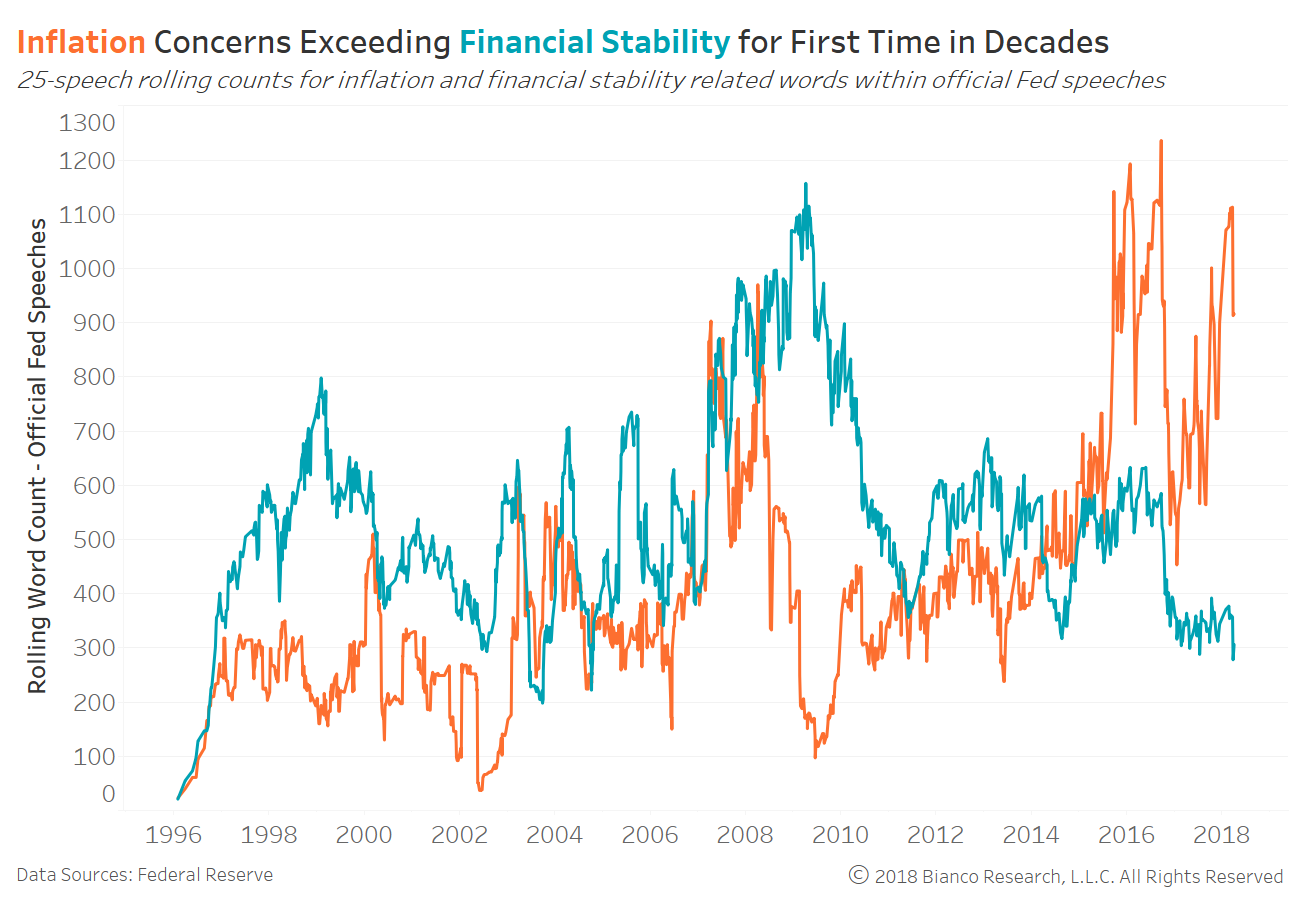

The next chart shows the count of inflation-related words in orange and financial stability-related words in blue. Financial stability, meaning words like ‘equity markets,’ ‘leverage,’ ‘volatility,’ and more, reigned supreme during the modern era of the Federal Reserve. But, inflation captured the attention of Yellen and now Powell et al since late 2015.

Financial stability concerns have dropped considerably since September 2016, while inflation concerns staged a swift rebound.

The inflation versus financial stability race likely impacts the Fed’s reaction function to financial market volatility.

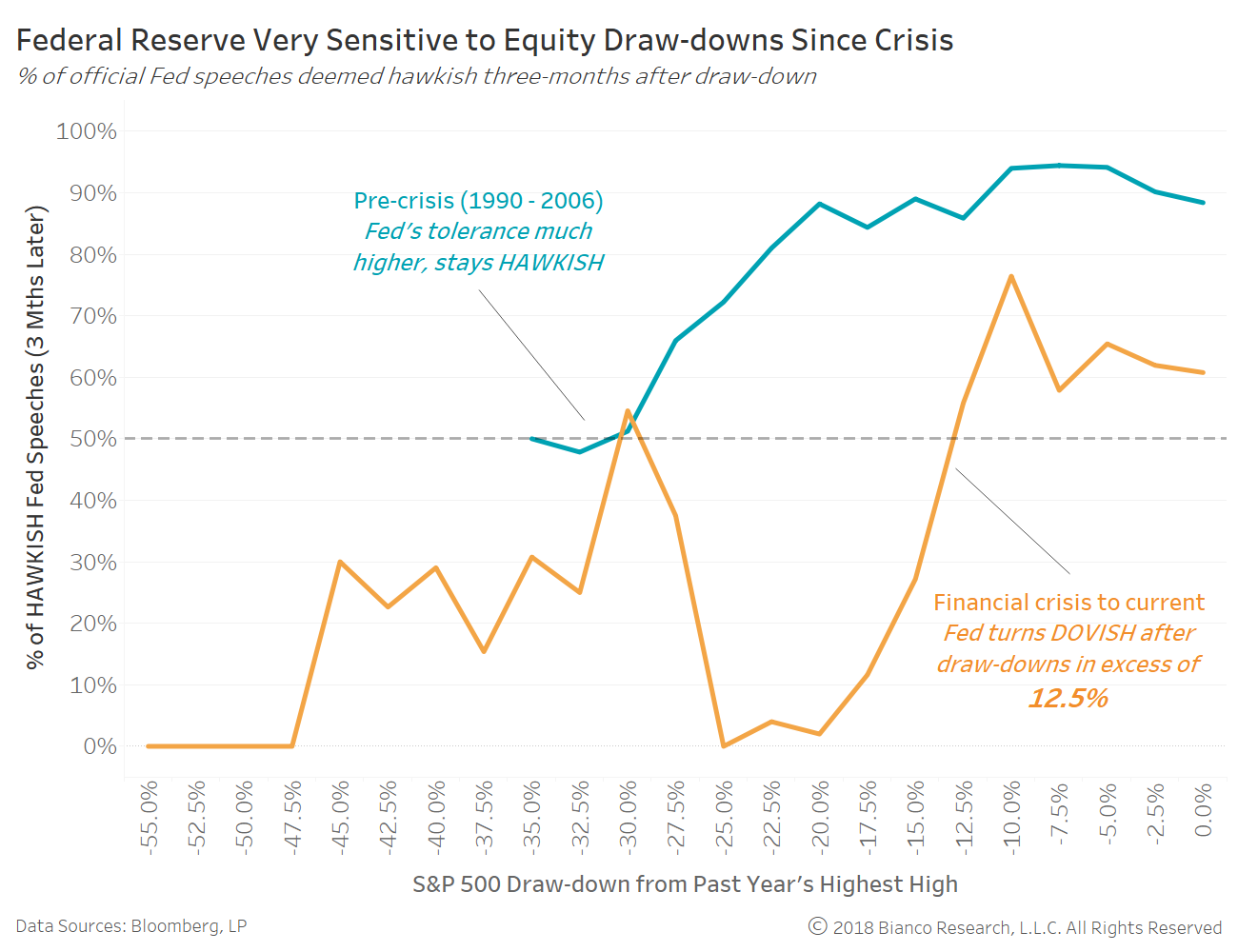

We can measure the Fed’s sensitivity to S&P 500 drawdowns using their reactions (i.e. hawkish-to-dovish leaning) found within these official speeches. The chart below shows the S&P 500’s drawdown from its highest high over the preceding 12 months on the x-axis. The percentage of Fed speeches offering hawkish rhetoric over the following three months are shown on the y-axis for the 1990 – 2006 (blue) and 2007 – current (orange) periods.

The Fed proved significantly less sensitive to equity turmoil before the financial crisis (1990-2006), reaching an overall dovish tone only after ~30% drawdowns. Conversely, the Fed during and after the financial crisis have shown a strong tendency to calm markets with soothing dovish speeches after a mere drawdown of ~12.5%.

We believe investors should prepare for a return to pre-crisis sensitivities, meaning the Fed will not react so quickly to equity jitters as long as growth and inflation fears brew. The post-crisis threshold of ~12.5% (or S&P 500 at 2514) could easily come and go.